Vodafone CEO Vows to Maintain Control of European Tower Assets

14 Noviembre 2018 - 12:29PM

Noticias Dow Jones

By Adria Calatayud

BARCELONA--Vodafone Group PLC's (VOD.LN) Chief Executive Nick

Read said Wednesday that it is important for the company to

maintain control of its European towers, as the review of those

assets isn't aimed at deleveraging.

The British telecommunications giant said Tuesday it would

separate its tower assets into a differentiated legal entity within

the group and review options, as it set out plans to reduce 1.2

billion euros ($1.35 billion) in operating expenses over three

years.

"I think it's important to maintain strategic control. These are

important assets to us," Mr. Read said at a Morgan Stanley

conference in Barcelona, Spain.

The company's CEO said reducing its debt load wasn't a big

factor in the decision to separate its tower assets.

"If we get a fantastic value for shareholders, we will do that,

but [the motive] is not deleveraging," Mr. Read said.

The review will take six to nine months, Mr. Read said.

Mr. Read said Vodafone's experience in the U.K. shows that

active sharing of tower assets doesn't work in big cities, as data

management can be complex if competing operators have different

demands. However, the company is open to passive sharing across

Europe, the CEO said.

Vodafone owns around 58,000 communication towers in Europe.

Write to Adria Calatayud at

adria.calatayudvaello@dowjones.com

(END) Dow Jones Newswires

November 14, 2018 13:14 ET (18:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

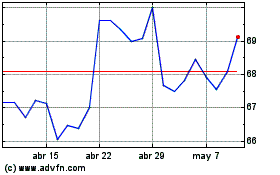

Vodafone (LSE:VOD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

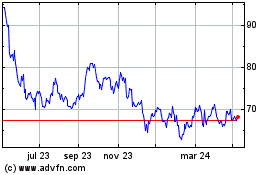

Vodafone (LSE:VOD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024