Princess Private Equity Holding Ltd Princess publishes November NAV (3421L)

21 Diciembre 2018 - 10:45AM

UK Regulatory

TIDMPEY TIDMPEYS

RNS Number : 3421L

Princess Private Equity Holding Ltd

21 December 2018

News Release

Guernsey, 21 December 2018

Princess publishes November NAV

-- Princess Private Equity Holding Limited's (Princess) net

asset value decreased by 0.2% to EUR 11.07 per share, net of the

interim dividend of EUR 0.28 per share

-- Portfolio developments (+0.1%) were positive and currency movements negative (-0.1%)

-- Princess received distributions of EUR 5.8 million and

invested EUR 18.4 million over the month

Princess received distributions of EUR 5.8 million during the

month, of which EUR 1.5 million came predominantly from Princess'

mature legacy fund portfolio.

Princess invested a total of EUR 18.4 million during the month,

of which EUR 13.8 million was invested in Vishal Mega Mart, one of

India's largest value retail brands. Vishal is the franchisor of

the Vishal Mega Mart brand and wholesale supplier to a franchisee

network of over 250 hypermarket stores in India. These stores

combine a private label, fast-fashion offering with a variety of

general merchandise and food & grocery products. Partners Group

was attracted to Vishal as it serves the organized retail market

segment, which makes up only 9% of India's retail industry and is

expected to significantly expand over the coming years. Partners

Group believes that Vishal offers a unique value proposition to an

underserved customer segment and will continue to experience strong

industry tailwinds. In addition, Vishal is led by a strong

execution focused team and has developed a highly replicable and

scalable model offering consumers an aspirational product

assortment at compelling value. Going forward, Partners Group will

work closely with Vishal to further expand the company's presence,

maximize supply chain efficiency and increase product

assortment.

EUR 4.5 million was invested to fund Hearthside Food Solutions'

acquisition of Greencore USA, a leading producer of fresh foods to

go, frozen breakfast sandwiches, salad kits, prepared meal kits and

snacks. The company is the US unit of Greencore Group, an

Ireland-based convenience food provider listed on the London Stock

Exchange. Operating in 13 locations across North America, Greencore

USA employs around 3'300 people and recorded revenues of USD 1.4

billion in 2017. Prior to being purchased by Greencore Group, the

company was known as Peacock Foods and was owned by Charlesbank

from 2010 to 2016. Charlesbank and Partners Group, which jointly

acquired Hearthside earlier in May 2018, will fund the acquisition

with additional equity. The add-on investment in Greencore USA is

in line with one of the core value creation initiatives of

expanding Hearthside's platform. Subject to regulatory approval and

customary closing conditions, the transaction marks a significant

step in the further growth and development of Hearthside's network,

which has now grown to 38 production facilities across the US and

Europe. Greencore USA is an attractive investment, given its

leadership position within the packaged fresh and frozen foods

categories, market segments with strong tailwinds and increasing

consumer demand. The acquisition is expected to bolster

Hearthside's position in these high-growth categories and generate

synergies in the company's production, innovation and R&D

capabilities. The complementary nature of Greencore's products and

services will also enable Hearthside to broaden its customer base,

expand its current product and service offerings and further scale

up its operations.

Further information is available in the monthly report, which

can be accessed via:

http://www.princess-privateequity.net/financialreports.

Ends.

About Princess

Princess is an investment holding company founded in 1999 and

domiciled in Guernsey. It invests, inter alia, in private equity

and private debt investments. Princess is advised in its investment

activities by Partners Group, a global private markets investment

management firm with EUR 67 billion in investment programs under

management in private equity, private debt, private real estate and

private infrastructure. Princess aims to provide shareholders with

long-term capital growth and an attractive dividend yield. Princess

is traded on the Main Market of the London Stock Exchange (ticker:

PEY for the Euro Quote; PEYS for the Sterling Quote).

Contacts

Princess Private Equity Holding Limited:

princess@partnersgroup.com

www.princess-privateequity.net

Registered Number: 35241

LEI: 54930038LU8RDPFFVJ57

Investor relations contact

George Crowe

Phone: +44 (0)20 7575 2771

Email: george.crowe@partnersgroup.com

Media relations contact

Jenny Blinch

Phone: +44 207 575 2571

Email: jenny.blinch@partnersgroup.com

www.partnersgroup.com

This document does not constitute an offer to sell or a

solicitation of an offer to buy or subscribe for any securities and

neither is it intended to be an investment advertisement or sales

instrument of Princess. The distribution of this document may be

restricted by law in certain jurisdictions. Persons into whose

possession this document comes must inform themselves about, and

observe any such restrictions on the distribution of this document.

In particular, this document and the information contained therein

are not for distribution or publication, neither directly nor

indirectly, in or into the United States of America, Canada,

Australia or Japan.

This document may have been prepared using financial information

contained in the books and records of the product described herein

as of the reporting date. This information is believed to be

accurate but has not been audited by any third party. This document

may describe past performance, which may not be indicative of

future results. No liability is accepted for any actions taken on

the basis of the information provided in this document. Neither the

contents of Princess' website nor the contents of any website

accessible from hyperlinks on Princess' website (or any other

website) is incorporated into, or forms part of, this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

STRUAONRWRAUUAA

(END) Dow Jones Newswires

December 21, 2018 11:45 ET (16:45 GMT)

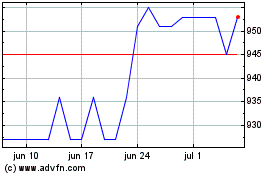

Princess Private Equity (LSE:PEYS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

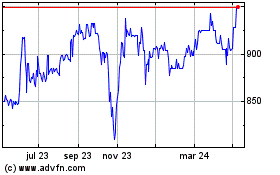

Princess Private Equity (LSE:PEYS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024