TIDMPOS

RNS Number : 9389M

Plexus Holdings Plc

14 January 2019

Plexus Holdings PLC / Index: AIM / Epic: POS / Sector: Oil

Equipment & Services

This announcement contains inside information

Plexus Holdings PLC ('Plexus' or 'the Company')

Proposed Buyback of Ordinary Shares held by Gusar

Plexus Holdings PLC, the AIM quoted oil and gas engineering

services business and owner of the proprietary POS-GRIP(R)

friction-grip method of wellhead engineering, is pleased to

announce that it has conditionally agreed to acquire 4,950,495

Ordinary Shares (the "Buyback Shares") beneficially held by LLC

Gusar (OOO Gusar) Ltd ("Gusar"), by way of an off-market buyback at

an aggregate price of GBP2,500,000 representing a price of 50.5

pence per Ordinary Share (the "Buyback").

The proposed Buyback will enable Gusar, inter alia, to finance

the purchase of two POS-GRIP jack-up exploration wellhead systems

and associated equipment and tooling from the Company (the sale of

which was originally announced by the Company on 14 February 2018)

via its preferred mechanism and will expedite the establishment of

Plexus' POS-GRIP(R) equipment in Russia and the CIS (the "Region"),

one of the top three hydrocarbon producers in the world with

significant gas reserves.

The acquisition of the Buyback Shares constitutes an off-market

purchase and, pursuant to s.693(1)(a) of the Companies Act 2006,

may only be made pursuant to a buyback contract which has been

approved by shareholders prior to the acquisition of the Buyback

Shares.

Accordingly, the Company is convening the General Meeting, to be

held at the offices of Fox Williams LLP at 10 Finsbury Square,

London EC2A 1AF on 1 February 2019 at 2.30p.m., at which the

Company will seek Shareholder approval of the Buyback

Agreement.

In order to convene the General Meeting, a circular containing a

notice of the General Meeting and form of proxy (the "Circular")

will be despatched to Shareholders of the Company shortly. The

Circular will set out further details of the Buyback, the

Resolution and a recommendation from the Directors of the Company

that Shareholders vote in favour of the Resolution.

Plexus' CEO Ben Van Bilderbeek said, "Plexus sees the share

buyback as a practical and positive move that enables the

acceleration of the delivery of the equipment into Russia, and

positions Gusar ready to fulfill anticipated rental wellhead

exploration orders in Russia, one of the world's three major

hydrocarbon producers."

Gusar's General Director Alexander Beryozkin said, "We are

delighted that after a period of intense work with Gazprom and

other customers, we are preparing to enter the stage of

participation in exploration drilling in the Russian Federation as

soon as the 2019 drilling season. As we have previously indicated,

we have reached an agreement with Gazprom for the supply of Mudline

suspension systems localized for manufacturing in Gusar's

facilities in Russia further to our License Agreement with Plexus.

With the use of POS-GRIP technology, we look forward to delivering

to our customers reduced drilling time and costs, while increasing

safety by not having to remove the BOP. The Plexus - Gusar alliance

gives us an opportunity for the first time to bring localized

products to the Russian market using advanced superior technology,

which positions us for further participation in the Russian

exploration drilling market."

**S**

For further information please visit www.posgrip.com or

contact:

Ben van Bilderbeek Plexus Holdings PLC Tel: 020 7795 6890

Graham Stevens Plexus Holdings PLC Tel: 020 7795 6890

Derrick Lee Cenkos Securities PLC Tel: 0131 220 9100

Frank Buhagiar St Brides Partners Ltd Tel: 020 7236 1177

Isabel de Salis St Brides Partners Ltd Tel: 020 7236 1177

Proposed Buyback of Ordinary Shares held by Gusar

and

Notice of General meeting

INTRODUCTION

The Company has today announced that it has conditionally agreed

to acquire 4,950,495 Ordinary Shares beneficially held by Gusar, by

way of an off-market buyback at an aggregate price of GBP2,500,000

representing a price of 50.5 pence per Ordinary Share.

The acquisition of the Buyback Shares beneficially held by Gusar

constitutes an off-market purchase and, pursuant to s.693(1)(a) of

the Companies Act 2006, may only be made pursuant to a buyback

contract which has been approved by shareholders prior to the

acquisition of the Buyback Shares.

Accordingly, the Company is convening the General Meeting, to be

held at 2.30 p.m. on 1 February 2019, at which it will seek

Shareholder approval of the Buyback Agreement. The Resolution to be

proposed at the General Meeting is set out in the Notice of General

Meeting at the end of the Circular.

The purpose of the Circular is to provide you with information

on and the reasons for the Buyback, to explain why the Board

considers the Buyback to be in the best interests of the Company

and its Shareholders as a whole and why the Directors recommend

that you vote in favour of the Resolution to be proposed at the

General Meeting.

You will find set out at the end of the Circular a notice of the

General Meeting and a Form of Proxy is also enclosed with the

Circular. Completion of the Form of Proxy will not preclude you

from attending the General Meeting and voting in person.

REASONS FOR THE BUYBACK

Background

Following the sale of the jack-up exploration business of the

Company to FMC Technologies Limited ("TFMC") which completed on 7

February 2018, the Company has been working on expanding its

presence in the Region, one of the top three hydrocarbon producers

in the world, initially in the jack-up exploration drilling

sector.

This is possible as it was a condition of the sale to TFMC that

the Company retained the Existing IP Licence Agreement with Gusar

in the Region as a "carve out" from the general exclusivity which

was granted to TFMC in relation to the jack-up exploration business

which was sold.

The Existing IP Licence Agreement permits Gusar to, amongst

other things, manufacture, market, supply and service POS-GRIP

jack-up exploration wellhead systems in the Region.

The Region has significant gas reserves which is an area in

which the technology of the Company excels. The Company believes

there is a sizeable commercial opportunity in the Region for its

jack-up exploration drilling equipment and it is possible that

further applications of the Company's technology may also be able

to be introduced in the Region in the future. The Directors believe

this will enhance its prospects of further establishing the

reputation and market position of its POS-GRIP equipment beyond

jack-up exploration.

As a consequence of this strategy, the Company has been working

hard with Gusar over the past three years to win a first major

contract in the Region. On 14 February 2018, the Company announced

the sale of two POS-GRIP rental wellhead sets and associated

mudline equipment and tooling to Gusar for c.GBP1.4 million which

at the time was the equipment which had been agreed to be purchased

by Gusar. On 27 September 2018, the Company announced that Gusar

had entered into an initial agreement to supply Gazprom with two

sets of Plexus' Tersus(TM) - TRT Mudline Suspension System in

relation to Gazprom activity on the Kara Sea Shelf in 2019.

In addition, Gusar has indicated that it is in advanced

discussions with customers in the Region regarding the potential

provision of the Company's wellhead equipment for the construction

of exploration gas wells in the Region. The two wellheads which

form the main part of the Equipment which is proposed to be

purchased by Gusar under the Equipment Supply Agreement were

retained from the existing stock which the Company held prior to

the sale of the majority of the wellheads and jack up exploration

equipment pursuant to the TFMC transaction.

In order to fulfil its anticipated and future commitments with

customers, Gusar needs to complete the purchase of the Equipment

from the Company. The Equipment is intended to act as a "kick off"

set of equipment for Gusar's jack-up rental equipment inventory and

the Directors believe this should facilitate and accelerate the

generation of further ongoing contract opportunities in the

Region.

Gusar needs to finance the purchase of the Equipment prior to

shipping and wishes to do so by selling some of the Ordinary Shares

which it holds in the capital of the Company. The Company has,

subject to shareholder approval, agreed to purchase such Ordinary

Shares on the terms of the Buyback Agreement.

As part of the Buyback it is agreed that the existing equipment

supply agreement, which was in place at the time of the

announcement by the Company on 14 February 2018, will be superseded

and replaced by the updated Equipment Supply Agreement which

reflects the new terms and list of Equipment which it is agreed is

being sold and purchased.

Key Deal Terms

The Company has agreed, subject to shareholder approval, a deal

with Gusar which encompasses a number of different aspects, each of

which the Board believes is in the best interests of the Company

and furthers the commercial objectives of the Company in the

Region. The relevant aspects of the proposed deal are as

follows:

-- pursuant to the Buyback Agreement, the Company will buy back

4,950,495 Ordinary shares from Gusar for an aggregate price of

GBP2,500,000 representing a price of 50.5 pence per Ordinary Share,

being the closing market bid price on the business day before the

date on which the Buyback Agreement was signed;

-- of the GBP2,500,000 paid by the Company for the Buyback

Shares, GBP1,727,376.08 will be immediately paid back to the

Company to satisfy the obligations of Gusar to make the Agreed

Gusar Payments, which include the agreed payments in respect of the

Equipment Supply Agreement, the sum of GBP76,389.13 owed by Gusar

to POSL under an existing invoice and the sum of GBP50,000 as a

contribution to the legal costs of the Buyback; and the balance of

GBP772,623.92 will be paid to Gusar in cash following receipt of

the shares being purchased;

-- as a condition to the Buyback, the Company and Gusar will

also enter into the Royalty Agreement under which Gusar has agreed

that it will pay a royalty to the Company of 20% in relation to any

revenue generated by Gusar in relation to the rental of POS-GRIP

wellhead systems (other than mudline systems), this royalty being

in addition to the 20% royalties already payable by Gusar to the

Company under the Existing IP Licence Agreement;

-- subject to the Buyback being approved by the shareholders,

the Company and Gusar will enter into the Equipment Supply

Agreement under which Gusar will purchase the following items from

the Company for the aggregate amount of GBP1,600,986.95:

a. GBP311,146.48 for the purchase of mudline equipment;

b. GBP1,048,125.47 for the purchase of two wellhead systems; and

c. GBP241,715.00 for the purchase of other agreed items of equipment.

-- the additional royalty under the Royalty Agreement is payable

for one of the following periods:

- if the minimum licence fee of US$5,000,000 under the Existing

IP Licence Agreement has been paid in full to the Company by Gusar

prior to the expiry of the Equipment Rental Agreement, the duration

of the Equipment Rental Agreement; or

- if the minimum licence fee of US$5,000,000 has not been paid

in full prior to the expiry of the Equipment Rental Agreement,

until the minimum licence fee of US$5,000,000 has been paid.

There are a number of reasons why the Board believes the Buyback

is in the best interests of the Company as follows:

Reasons for the Buyback

-- The Buyback will enable Gusar to finance the purchase of the

two POS-GRIP wellhead systems and associated equipment and tooling

from the Company which it is anticipated will be rented to

customers of Gusar in the Region. Following the purchase of the

equipment, Gusar should be well placed to promote Plexus' products

to its clients which should enable the Company to establish an

increased presence in the Region;

-- Gusar has indicated to the executive directors of the Company

that it intends to use the balance of the consideration for the

Buyback, after payment of the Agreed Gusar Payments, on essential

items of equipment which should accelerate the ability of Gusar to

service and supply the market in the Region with the products of

the Company. Gusar is considering using the balance of the

consideration on the purchase of further associated equipment from

the Company, the purchase of connectors from a third party and

towards the cost of building a testing facility;

-- The Buyback Agreement arrangements enable Gusar to fund the

purchase of the equipment by its preferred route - monetizing a

non-core asset, which is intended to expedite the process of Plexus

establishing a presence in the Region; and

-- The execution of the Royalty Agreement means that the

royalties due to the Company for the sale or rental of POS-GRIP

wellhead systems in the Russian Federation by Gusar will increase

from 20% to 40% of revenue generated (being 20% under the Existing

IP Licence Agreement and 20% under the Royalty Agreement) for an

agreed period (as described above) and this increased royalty

percentage should enhance the margins of the Company.

PRINCIPAL TERMS AND CONDITIONS OF THE BUYBACK AGREEMENT

The Company has signed the Buyback Agreement with Gusar, which,

subject to shareholder approval, sets out the terms on which the

Company will purchase the Buyback Shares beneficially held by

Gusar.

Buyback Agreement

Pursuant to the Buyback Agreement, the Company has agreed to

purchase the Buyback Shares beneficially held by Gusar at an

aggregate price of GBP2,500,000 representing a price of 50.5 pence

per Buyback Share, being the closing market bid price of the

Ordinary Shares on 10 January 2019 (the last trading day prior to

the announcement of the Buyback), subject to (inter alia):

(i) the Company obtaining shareholder approval, such approval to

be sought at the General Meeting convened pursuant to the Notice of

General Meeting set out at the end of the Circular; and

(ii) the Royalty Agreement being executed, dated and delivered; and

(iii) the Equipment Supply Agreement being executed, dated and delivered.

It is intended that, subject to the conditions being satisfied

including receipt of the Buyback Shares by the Company, settlement

of the Buyback will occur within two business days after all the

conditions in the Buyback Agreement are satisfied. On this date,

the Company will pay the GBP2,500,000 of consideration payable in

respect of the Buyback Shares to Gusar by making such payment into

an escrow account operated by Fox Williams LLP, the solicitors to

the Company.

Once Fox Williams LLP has received such payment on behalf of

Gusar, it has the authority to pay the Agreed Gusar Payments to the

Company and to pay the balance in cash to Gusar.

Once the Buyback Shares have been transferred to the CREST

account of the Company, the equipment will be shipped to Gusar

pursuant to the terms of the Equipment Supply Agreement.

Any Ordinary Shares purchased by the Company pursuant to the

Buyback Agreement will be held in treasury and will not rank for

any future dividends and no voting rights will be exercised in

respect of such Ordinary Shares.

FINANCING OF THE BUYBACK

The Company will fund the consideration of GBP2,500,000 payable

under the Buyback Agreement from the Plexus Group's existing cash

reserves.

It is a requirement of the Companies Act 2006 that the Company

must finance the Buyback out of distributable profits and the

Company shall have sufficient distributable profits to comply with

the Companies Act in relation to the Buyback. The Directors have

confirmed that the Company will have sufficient distributable

profits at the anticipated date of the Buyback.

EFFECT OF THE BUYBACK

Following the Buyback there will be 100,435,744 Ordinary Shares

of the Company in issue (not including the 4,950,495 Buyback Shares

which will be placed into treasury).

As at 11 January 2019 (being the latest practicable date prior

to the date of publication of the Circular), so far as the

Directors are aware, the Buyback will not immediately result in any

Shareholder becoming a substantial shareholder of the Company,

holding 10 per cent. or more of the Company's issued share

capital.

A summary of the principal terms of the Buyback Agreement is set

out in the Circular.

Once the Buyback is complete the Ordinary Shares which have been

bought back will be placed into treasury.

RECOMMATION

The Directors believe that the Buyback will help promote the

success of the Company for the benefit of its Shareholders as a

whole.

The Directors unanimously recommend Shareholders to vote in

favour of the Resolution to be proposed at the General Meeting as

they intend to do so in respect of their own beneficial holdings*

amounting, in aggregate, to 59,700,673 Ordinary Shares,

representing approximately 56.65 per cent. of the Existing Ordinary

Shares.

* J. Jeffrey Thrall, has an indirect beneficial interest in a

company which controls 32.477% of Mutual Holdings Limited. The

number of Ordinary shares held by Mutual Holdings Limited in the

Company at the date of this circular is 42,700,001. Additionally,

J. Jeffrey Thrall has an indirect beneficial interest in Nazdar

Limited, a company which holds 1,591,512 Ordinary shares in the

Company and he holds 4,000 Ordinary shares through Thrall

Enterprises Inc.

Ben van Bilderbeek is settlor of a trust which controls 59.962%

of the shares of Mutual Holdings Limited and the entire issued

share capital of OFM Investment Limited. At the date of this

circular, Mutual Holdings Limited holds 42,700,001 shares and OFM

Investment Limited holds 15,069,767.

Additionally, Ben van Bilderbeek holds 307,693 Ordinary shares

directly, Graham Stevens holds 15,100 Ordinary Shares directly and

Craig Hendrie holds 12,600 Ordinary Shares directly.

Capitalised terms in this announcement have the same meaning as

in the Circular published by the Company in connection with the

proposed Buyback

NOTES:

AIM-traded oil and gas engineering services company Plexus (AIM:

POS) is an IP-led company that has developed a range of products

and applications based on its patent-protected POS-GRIP

friction-grip technology. Having proved the superior qualities of

POS-GRIP within the jack-up wellhead exploration market through the

sale of this business to FMC Technologies Limited ("FMCT"), a

subsidiary of TechnipFMC (Paris:FTI, NYSE:FTI), in early 2018, the

Company is now focused on establishing its technology and equipment

in other markets including surface production, subsea and

de-commissioning.

Its suite of new products and applications includes: the

Python(TM) Subsea Wellhead (a new standard for subsea wellheads -

supported by BG, Royal Dutch Shell, Wintershall, Maersk, Total,

Tullow Oil, eni, Senergy, and Oil States Industries Inc); the

POS-SET(TM) Connector for the growing de-commissioning and

abandonment market; HP/HT dual marine barrier risers which provide

an efficient, safe and cost effective solution for use on jack-up

rigs; an innovative HP/HT Tie-Back connector product; and a new

Well Tree product. Importantly, the Company has a Collaboration

Agreement with TFMC, which provides a platform to seek to further

develop and commercialise these and other applications utilising

POS-GRIP technology.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

POSGGUAUGUPBGUW

(END) Dow Jones Newswires

January 14, 2019 02:00 ET (07:00 GMT)

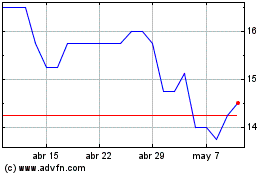

Plexus (LSE:POS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Plexus (LSE:POS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024