TIDMLSE

RNS Number : 7733N

London Stock Exchange Group PLC

22 January 2019

22 January 2019

Information Services Division Leadership Appointments

-- Waqas Samad Appointed Group Director, Information Services Division

-- Mark Makepeace Appointed Non-Executive Chairman, Information Services Division

London Stock Exchange Group ("LSEG", "the Group") today

announces that Waqas Samad is appointed Group Director of the

Information Services Division ("ISD") and a member of the LSEG

Executive Committee, effective immediately. He will report to David

Schwimmer, CEO, LSEG.

As part of this planned succession and transition, Mark

Makepeace will remain with the Group during 2019 and assume the

role of Non-Executive Chairman, Information Services, in addition

to his existing role as Non-Executive Chairman of LSEG in the

Americas region. He will continue to report to David.

Donald Brydon, Chairman, LSEG said:

"In addition to his contribution to LSEG, Mark has made a huge

contribution to the evolution of indices and the development of the

asset management industry. Having been chairman of FTSE in the

1980s and a party to his initial CEO appointment, I can truly say

that he has more than exceeded everyone's expectations at the

time."

David Schwimmer, CEO, LSEG said:

"As the founder of FTSE and a founder and inaugural Chairman of

the Index Industry Association, Mark has been a pioneer in the

development of the global index industry. Mark has successfully

built a world class global business with more than $16 trillion

assets under benchmark to FTSE Russell Indexes. Under his

leadership, the acquisition and integration of Russell Indexes,

Mergent, TMX and Citi Fixed Income Indexes and The Yield Book have

been transformative in expanding the global customer base and

multi-asset capabilities of the business."

"Mark also developed a strong bench of talent and Waqas Samad,

who was recruited by Mark in 2016, is a natural successor to lead

ISD, including FTSE Russell. Waqas will build on the existing

strong business and proven strategy to continue to deliver on our

growth expectations for this business. He will also bring his

industry experience in indices and analytics across all asset

classes to further develop the multi-asset and data analytics

capabilities, as well as continue to deepen our customer

partnership approach."

Mark Makepeace, Group Director of Information Services; CEO,

FTSE Russell and Non-Executive Chairman, LSEG Americas said:

"Over the past thirty years, the index industry has gone through

a period of transformative growth, playing an important role in the

investment management process. I'm proud to have developed FTSE

from a start-up to a global player active in more than 70

countries. FTSE Russell has been a pioneer in facilitating

investment in emerging markets, including among the first to

benchmark China A Shares, and has played a key part supporting

investors' increasing interest in Environmental, Social and

Governance factors. I'm pleased to hand over the leadership of

Information Services to Waqas to further develop it."

Waqas Samad, CEO Benchmarks, FTSE Russell said:

"I'm honoured to be asked to lead this important business area

for the Group. Mark has built a fantastic franchise in FTSE Russell

and it is well positioned to continue to benefit from the

underlying global trends driving both passive and active investment

management strategies globally. More broadly, the Information

Services Division is a great platform and I look forward to further

developing the Group's customer partnership approach and delivering

even greater value and analytical insights for our customers."

For Further Information:

Media: Gavin Sullivan/ Lucie Holloway/ Ramesh

Chhabra +44 (0)20 7797 1222

Investor Relations: Paul Froud +44 (0)20 7797 3322

Notes to Editors:

About Waqas Samad:

Waqas has spent almost 25 years in the financial services

industry, the last 15 of which were in leadership roles in the

index and portfolio analytics industry. As CEO of Benchmarks at

FTSE Russell, Waqas Samad is currently responsible for leading FTSE

Russell's continued global growth into indexes across all asset

classes. He led the firm's expansion in fixed income through the

acquisition of the Citi Fixed Income Indexes and The Yield Book

businesses. He is also responsible for the FTSE Canada business in

North America.

Waqas joined LSEG from Barclays in 2016, where he was CEO of

Barclays Risk Analytics & Index Solutions (BRAIS). Prior to

joining Barclays in 2007, he spent three years at Deutsche Bank as

Head of the Index Research Group in Europe and Asia and he spent

five years at Credit Suisse in a variety of quantitative and

technology roles. Waqas holds a Bachelors' degree in Electrical and

Electronic Engineering from Imperial College and has completed the

Investment Management Programme at London Business School.

Waqas is Chairman of the Index Industry Association.

About FTSE Russell:

FTSE Russell is a global index leader that provides innovative

benchmarking, analytics and data solutions for investors worldwide.

FTSE Russell calculates thousands of indexes that measure and

benchmark markets and asset classes in more than 70 countries,

covering 98% of the investable market globally.

FTSE Russell index expertise and products are used extensively

by institutional and retail investors globally. Approximately $16

trillion is currently benchmarked to FTSE Russell indexes. For over

30 years, leading asset owners, asset managers, ETF providers and

investment banks have chosen FTSE Russell indexes to benchmark

their investment performance and create ETFs, structured products

and index-based derivatives.

A core set of universal principles guides FTSE Russell index

design and management: a transparent rules-based methodology is

informed by independent committees of leading market participants.

FTSE Russell is focused on applying the highest industry standards

in index design and governance and embraces the IOSCO Principles.

FTSE Russell is also focused on index innovation and customer

partnerships as it seeks to enhance the breadth, depth and reach of

its offering.

FTSE Russell is wholly owned by London Stock Exchange Group.

For more information, visit www.ftserussell.com

About London Stock Exchange Group:

London Stock Exchange Group (LSEG) is an international markets

infrastructure business. Its diversified global business focuses on

capital formation, intellectual property and risk and balance sheet

management. LSEG operates an open access model, offering choice and

partnership to customers across all of its businesses. The Group

can trace its history back to 1698.

The Group operates a broad range of international equity, ETF,

bond and derivatives markets, including London Stock Exchange;

Borsa Italiana; MTS (a European fixed income market); and Turquoise

(a pan-European equities MTF). Through its platforms, LSEG offers

market participants, unrivalled access to Europe's capital markets.

The Group also plays a vital economic and social role, enabling

companies, including SMEs, to access funds for growth and

development.

Through FTSE Russell, the Group is a global leader in financial

indexing, benchmarking and analytic services with approximately $16

trillion benchmarked to its indexes. The Group also provides

customers with an extensive range of data services, research and

analytics through The Yield Book, Mergent, SEDOL, UnaVista, XTF and

RNS.

Post trade and risk management services are a significant part

of the Group's business operations. In addition to majority

ownership of LCH, a multi-asset global CCP operator, LSEG owns

CC&G, the Italian clearing house and Monte Titoli, a leading

European custody and settlement business.

LSEG Technology develops and operates high performance

technology solutions, including trading, market surveillance and

post trade systems for over 40 organisations and exchanges,

including the Group's own markets.

Headquartered in the United Kingdom, with significant operations

in North America, Italy, France and Sri Lanka, the Group employs

approximately 4,500 people.

Further information on London Stock Exchange Group can be found

at www.lseg.com. The Group's ticker symbol is LSE.L

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

BOABGGDBGXDBGCD

(END) Dow Jones Newswires

January 22, 2019 05:37 ET (10:37 GMT)

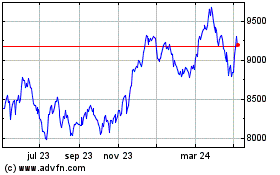

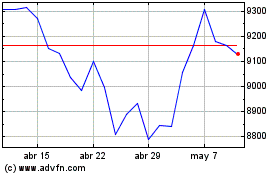

London Stock Exchange (LSE:LSEG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

London Stock Exchange (LSE:LSEG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024