TIDMPRV

RNS Number : 2029O

Porvair PLC

28 January 2019

For immediate release 28 January 2019

Results for the year ended 30 November 2018

Record revenue, profit before tax and strong cash generation

Porvair plc ("Porvair" or "the Group"), the specialist

filtration and environmental technology group, today announces its

results for the year ended 30 November 2018.

Highlights

Strong financial performance:

-- Record revenue of GBP128.8 million (2017: GBP116.4 million), up 11%.

-- Profit before tax up to a record GBP12.0 million (2017: GBP11.7 million).

-- Adjusted profit before tax* increased to GBP13.5 million (2017: GBP12.4 million).

-- Basic earnings per share up 13% to 22.1 pence (2017: 19.5 pence).

-- Adjusted basic earnings per share* up 11% to 22.9 pence (2017: 20.7 pence).

-- Net cash was GBP6.6 million at 30 November 2018 (2017: GBP9.8

million) after GBP13.5 million (2017: GBP11.4 million) invested in

capital expenditure and acquisitions.

-- Recommended final dividend of 3.0 pence per share (2017: 2.7

pence per share), an increase of 11%.

-- Rohasys BV acquired and traded in line with expectations in its first year.

-- Keystone Filter acquired and integrated into the Aerospace & Industrial division.

-- Order books for 2019 are healthy, ahead of the prior year.

Commenting on the outlook, Ben Stocks, Chief Executive,

said:

"The Group has started 2019 with a healthy order book and is

trading well. The acquisitions made during the year have expanded

the Group's capabilities in industrial and laboratory markets and

are performing as expected. Porvair remains in a strong financial

position."

*See note 1 for definition of alternative performance

measures.

For further information please contact:

Porvair plc 020 7466 5000 today

Ben Stocks, Chief Executive 01553 765 500 thereafter

Chris Tyler, Group Finance Director

Buchanan Communications 020 7466 5000

Charles Ryland / Steph Watson

An analyst briefing will take place at 9:30 a.m. on Monday 28

January 2019 at Buchanan. An audio webcast and a copy of the

presentation will be available at www.porvair.com on the day.

Operating review

Overview of 2018

2018 2017 Growth

GBPm GBPm %

Revenue 128.8 116.4 11

------ ------ -------

Adjusted profit before tax 13.5 12.4 9

------ ------ -------

Profit before tax 12.0 11.7 3

------ ------ -------

Adjusted earnings per share 22.9p 20.7p 11

------ ------ -------

Earnings per share 22.1p 19.5p 13

------ ------ -------

Cash generated from operations 15.3 12.3

------ ------

Net cash 6.6 9.8

------ ------

Revenue was GBP128.8 million, an increase of 11%. Demand across

the Group's three divisions was generally robust, notably so in US

industrial, nuclear, laboratory consumables, aluminium and

specialist metal filtration.

Profit before tax was GBP12.0 million (2017: GBP11.7 million).

Adjusted profit before tax in the year ended 30 November 2018,

excluding the items disclosed in note 1, was up 9% to a record

GBP13.5 million. Adjusted earnings per share increased 11% to 22.9

pence. After investing GBP13.5 million in capital expenditure and

acquisitions, the Group finished the year with net cash of GBP6.6

million.

Over the last five years the Group has delivered revenue growth

of 53% (9% CAGR) and cash from operations of GBP68 million.

Adjusted profit before tax has increased 66% (11% CAGR). Over the

same period, GBP42 million has been invested in capital projects

and acquisitions. In 2018, the Group's after tax adjusted operating

profit return on operating capital was 43% (2017: 48%).

Strategic statement

Porvair's strategy is to generate shareholder value through the

development of specialist filtration and associated environmental

technology businesses, both organically and by acquisition. Such

businesses have certain key characteristics in common:

-- Specialist design or engineering skills are required;

-- Product use and replacement is mandated by regulation,

quality accreditation or a maintenance cycle; and

-- Products are typically designed into a system that will have a long life-cycle.

This strategy continues to work for the Group, which moves into

2019 in a position of financial strength, able to invest in both

organic and acquired growth as appropriate.

Business model outline

Our customers require filtration or emission control products

that perform to a given specification. Orders are won by offering

the best technical solutions for these requirements at an

acceptable commercial cost. Filtration expertise is applicable

across all markets served with new products generally being

adaptations of existing designs. Experience in specific markets or

applications is valuable in building customer confidence. Domain

knowledge is important, as is deciding where to direct

resources.

This leads us to:

1. Focus on regulated markets where we see long term growth potential.

2. Look for applications where product use is mandated and

replacement demand is therefore regular.

3. Make new product development a core business activity.

4. Establish geographic presence where end-markets require.

5. Invest in both organic and acquired growth.

Therefore:

-- We focus on three operating segments: Aerospace &

Industrial; Laboratory; and Metal Melt Quality. All have clear

structural growth drivers.

-- Our products typically protect complex downstream systems and

as a result are replaced regularly. A high proportion of our annual

revenue is from repeat orders.

-- Through new product development the Group aims to generate

growth rates in excess of the underlying market. Where possible we

build robust intellectual property around our product

developments.

-- Our geographic presence follows the markets we serve. 52% of

revenue is in the Americas; 19% in Asia; 15% in the EU and 13% in

the UK. We aim to meet dividend and investment needs from free cash

flow and modest borrowing facilities. All investments are subject

to a hurdle rate analysis based on strategic and financial

priorities.

Operating structure

-- The Group operates with three divisions. Each division

addresses a core market: Aerospace & Industrial (approximately

40% of Group revenue); Laboratory (approximately 30% of Group

revenue); and Metal Melt Quality (approximately 30% of Group

revenue).

-- The Group has plants in the US, UK, Germany, Netherlands and

China. In 2018, 57% of revenue was manufactured in the US, 30% in

the UK, 9% in Continental Europe and 4% in China.

Investment and future development

The main investments during 2018 were:

-- The acquisition of Rohasys BV on 7 December 2017, bringing

complementary instruments and automation expertise to Seal

Analytical.

-- The acquisition of Keystone Filter on 28 February 2018,

adding the manufacture of filter cartridges for the food, beverage

and nuclear markets to our US Aerospace & Industrial

division.

-- The expansion of our facility in Vineland, NJ, to provide

increased manufacturing capacity, clean room capabilities and

better plant layout.

-- Expansion and refurbishment of our microelectronics facility in Boise, ID.

-- A new manufacturing line for nuclear containment filters in Ashland, VA.

-- The commissioning of a new manufacturing line for bioscience filters in Wrexham, UK.

New product development remains core to Porvair's strategy, with

incremental range extensions and increasing product differentiation

being priorities. Our biggest project in 2018 was the overhaul and

upgrade of Seal Analytical's core product, a segmented flow

analyser. Our new AA500 analyser is smaller, faster, quieter and

more accurate than any other on the market.

Divisional review

Aerospace & Industrial

2018 2017 Growth

GBPm GBPm %

Revenue 50.5 43.4 16

Inter segment revenue - (0.2)

----- ------ -------

External revenue 50.5 43.2 17

----- ------ -------

Operating profit 7.7 6.8 14

----- ------ -------

Adjusted operating profit 8.0 6.8 18

----- ------ -------

Reported revenue growth was 17%, but this includes sales

transferred in from the Laboratory division and acquired growth.

Underlying sales growth was 10% (note 1). Adjusted operating

profits in the division were up 18% to GBP8.0 million.

The division designs and manufactures a wide range of specialist

filtration products, demand for which grows as aerospace and

industrial customers seek cleaner, safer or more efficient

operations. Differentiation is achieved through design engineering,

with notable new products introduced this year for the US nuclear

market and aerospace inerting applications.

Demand in 2018 was good across industrial markets, notably in

the US, where the Keystone acquisition contributed to growth in the

second half. The US had another record year for revenues and

profits with nuclear and industrial orders robust. After a quiet

first half, aerospace orders increased in the second half and

finished the year strongly.

Commissioning of the large gasification projects continued.

These are complex power plants using new technology for which our

filter systems are a relatively small but critical component. All

three facilities - in Korea, India and China - experienced

commissioning challenges during the year due to variations in

feedstocks and operating conditions, but successful run time is

accumulating. At this stage our filters are performing as expected,

with spares orders delivered in the final quarter and scheduled for

further deliveries in the first half of 2019.

Laboratory

2018 2017 Growth

GBPm GBPm %

Revenue 41.2 36.8 12

Inter segment revenue (2.5) (1.5)

------ ------ -------

External revenue 38.7 35.3 9

------ ------ -------

Operating profit 6.2 6.1 3

------ ------ -------

Adjusted operating profit 6.5 6.3 4

------ ------ -------

Revenue growth in the Laboratory division was 9%, including a

full year of revenue from JG Finneran and the first year from

Rohasys. Adjusted operating profit grew 4%, Rohasys having

contributed revenue but minimal profits in its first year of

ownership.

The division serves the analytical laboratory market, where

increasing availability of smaller automated instruments and the

growing requirement for ever improving detection limits is driving

demand for sample preparation and testing. The Group addresses this

market with analytical instruments and robotic systems supplied by

Seal Analytical and a range of sample preparation and

chromatography consumables supplied by Porvair Sciences and JG

Finneran.

Seal Analytical had a good year, compensating for slower

instrument sales into China with increased demand in the US. Seal

is a leading supplier of instruments and consumables to

environmental laboratories and specialises in equipment for the

detection of inorganic contamination in water. This market grows as

water quality standards improve. Seal differentiates itself with an

active new product development programme which will be boosted in

2019 by the roll out of the new AA500, a product that offers

significant benefits to Seal's extensive installed base. Rohasys

finished its first year with sales and profits in line with the

targets set at the time of the acquisition. Its automation

expertise is accelerating our new product development programme.

Seal's five-year CAGR revenue growth is 10%.

Porvair Sciences manufactures laboratory filters and associated

consumables, with a focus on chromatography and laboratory sample

preparation products. Differentiation is through proprietary

filtration media and manufacturing capabilities, with both

benefitting from continued investment in 2018. During the year we

acquired some filter coating intellectual property which we expect

will add to our sample preparation capabilities. Sales of

bioscience filtration media increased 26%. JG Finneran performed

strongly in its first full year and will further benefit in 2019

from its improved and enlarged facilities.

Metal Melt Quality

2018 2017 Growth

GBPm GBPm %

Revenue 39.6 37.8 5%

----- ----- -------

Operating profit 2.4 1.7 37%

----- ----- -------

Revenue was up 5% (9% in constant currency (note 1)) to a record

GBP39.6 million. Operating profit increased 37%. Much improved US

operational efficiencies were balanced by continuing losses in

China.

This division serves three market segments and has a well

differentiated and patented product range:

-- Selee CSX(TM) and Selee CSW(TM) for aluminium cast house

filtration. These products are free of phosphates and ceramic

fibres, giving them a unique environmental footprint.

-- Selee IC(TM) for grey and ductile iron filtration. This range

is sold principally in the US and offers excellent filtration

efficiency.

-- Selee SA(TM) for the filtration of nickel-cobalt alloys. This

niche application requires exceptional filtration performance and

uses proprietary manufacturing techniques.

In the US, market share gains resulted in a fifth record year

for sales of Selee CSX(TM) aluminium cast house filters. Demand for

super alloy filters grew and the range and volume of ceramic 3D

manufactured products again increased. Plant efficiencies in the US

were excellent. This allowed the US business to report record

margins.

Revenue in China grew by over 30%, but our Chinese plant is not

yet at break even volumes and costs. As the Chinese aluminium

market develops, we expect demand for our proprietary filters to

grow, based on their demonstrably better quality and environmental

performance. Higher grades of metal require better filtration and,

in line with the Chinese Government's 'China 2025' initiative,

Chinese producers are moving to higher grade alloys. We continue to

sell on value rather than price. This can initially hold back

growth, but our experience in other parts of the world gives us

confidence that this remains the right strategy.

Dividends

The Board re-affirms its preference for a progressive dividend

policy and recommends an increased final dividend of 3.0 pence per

share, a cost of GBP1.4 million (2017: 2.7 pence per share, a cost

of GBP1.2 million). This makes the full year dividend increase by

10% to 4.6 pence per share, a cost of GBP2.1 million (2017: 4.2

pence, a cost of GBP1.9 million).

Staff

The Board recognises that Porvair's success is largely due to

the skill and commitment of its staff, to whom we offer our sincere

thanks. During the year we welcomed new members of staff to the

Group from both Keystone and Rohasys.

Charles Matthews stepped down from the Board at the 2018 AGM, at

which time we expressed our gratitude and best wishes.

Current trading and outlook

The Group has started 2019 with a healthy order book and is

trading well. The acquisitions made during the year have expanded

the Group's capabilities in industrial and laboratory markets and

are performing as expected. Porvair remains in a strong financial

position.

Ben Stocks

Group Chief Executive

25 January 2019

Financial review

Group results

2018 2017 Growth

GBPm GBPm %

Revenue 128.8 116.4 11

------ ------ -------

Operating profit 12.9 12.3 4

------ ------ -------

Profit before tax 12.0 11.7 3

------ ------ -------

Profit for the year 10.0 8.8 13

------ ------ -------

Reported revenue growth was 11%, 13% at constant currency. 7%

was from organic growth and 6% from acquisitions. Operating profit

was GBP12.9 million (2017: GBP12.3 million) and profit before tax

was GBP12.0 million (2017: GBP11.7 million). Profit for the year

increased by 13% to GBP10.0 million.

Alternative performance measures

2018 2017 Growth

GBPm GBPm %

Adjusted operating profit 14.3 13.0 10

----- ----- -------

Adjusted profit before tax 13.5 12.4 9

----- ----- -------

Adjusted profit for the year 10.4 9.4 11

----- ----- -------

In addition to the constant currency revenue measures disclosed

in previous years, the Group has presented other alternative

performance measures for the first time this year to enable a

better understanding of the Group's trading performance. Adjusted

operating profit and adjusted profit before tax exclude:

-- the impact of acquiring businesses:

o the amortisation of acquired intangible assets of GBP0.6

million (2017: GBP0.2 million);

o other adjustments to profit and loss related to acquiring

businesses of GBP0.1 million (2017: GBP0.4 million).

-- other items that are considered significant and where

treatment as an adjusted item provides a more consistent assessment

of the Group's trading:

o an exceptional charge of GBP773,000 (2017: GBPnil), following

recent legal guidance, to enhance the benefits provided by the

Group's defined benefit pension plan to equalise its guaranteed

minimum pensions for men and women on benefits earned between 17

May 1990 and 6 April 1997.

Adjusted profit for the year excludes the adjustments to profit

before tax above together with their tax effect and an exceptional

one off tax credit of GBP778,000 (2017: GBPnil), reflecting a

reduction in the Group's deferred tax liability from the change in

US tax rates from December 2017 enacted in the US Tax Cuts and Jobs

Act.

Group operating performance

The two recent acquisitions, Rohasys BV ("Rohasys") and Keystone

Filter ("Keystone") contributed to revenue growth in the year but,

as expected, neither contributed significantly to operating profit,

consequently adjusted operating profit margins reduced slightly to

11.1% (2017: 11.2%). Adjusted operating margins increased in the

Aerospace & Industrial division to 15.9% (2017: 15.7%). In the

Laboratory division adjusted operating margins reduced to 15.8%

(2017: 17.0%), as a result of the acquisition of Rohasys and margin

sharing with Aerospace & Industrial on the transfer of

customers between divisions. Metal Melt Quality operating margins

increased to 6.0% (2017: 4.6%), a better performance in the US more

than offsetting the increased losses in China. Adjusted Central

costs increased to GBP2.6 million (2017: GBP1.8 million). The

result in 2017 included the release of GBP1.0 million currency

contract mark-to-market provisions.

Impact of exchange rate movements on performance

The international nature of the Group's business means that

relative movements in exchange rates can affect reported

performance. The rate used for translating the results of overseas

operations were:

2018 2017

Average rate for translating the results:

US $ denominated operations $1.34:GBP $1.29:GBP

Euro denominated operations EUR1.13:GBP EUR1.15:GBP

Closing rate for translating the balance

sheet:

US $ denominated operations $1.28:GBP $1.35:GBP

Euro denominated operations EUR1.13:GBP EUR1.14:GBP

A stronger Sterling average rate against the US dollar offset by

a weaker Sterling average rate against the Euro over the year

reduced reported revenues on translation by 2%.

In the year, the Group sold $17.8 million (2017: $16.0 million)

at an average rate of $1.33:GBP1 (2017: $1.29:GBP1) and EUR3.9

million (2017: EUR5.5 million) at an average rate of EUR1.13:GBP1

(2017: EUR1.12:GBP1).

At 30 November 2018, the Group had no outstanding forward

foreign exchange contracts (2017: $2.0 million). It had $6.2

million (2017: $3.9 million) of net current assets on the UK

operations' balance sheet.

Finance costs

Net interest payable comprises bank borrowing costs, interest on

the Group's pension deficit and the cost of unwinding discounts on

provisions. Overall, it remained stable at GBP0.8 million (2017:

GBP0.7 million). The defined benefit pension scheme interest cost

was GBP0.4 million (2017: GBP0.4 million), bank interest and

borrowing facilities non-utilisation fees were GBP0.3 million

(2017: GBP0.3 million) and there was a charge of GBP0.1 million

(2017: GBPnil) for unwinding discounted provisions.

Interest cover was 17 times (2017: 20 times). Interest cover on

bank finance costs was 44 times (2017: 62 times).

Tax

The Group tax charge was GBP2.0 million (2017: GBP2.8 million).

After removing the adjusting items described in note 1 to the

accounts, the Group's underlying tax charge was GBP3.1 million

(2017: GBP3.0 million). This is an effective rate of 23.0% (2017:

24.4%), which is higher than the UK standard corporate tax rate of

19.0% (2017: 19.3%). The tax rate in the UK compared with the

standard rate was reduced by the benefit of tax relief on the

exercise of share options. The tax rate was pushed up by profits

made in Germany, which attract a higher tax rate. The Group has not

taken a tax credit relating to the losses arising in China because

it could not be certain that the asset would be recovered, this has

increased the tax rate by 3.2% (2017: 2.5%).

The US tax rate reduced to an effective rate of 23% (2017: 31%)

as a result of changes enacted in the US Tax Cuts and Jobs Act.

This has reduced the effective tax rate on Group trading profits by

3% compared with the prior year.

The tax charge comprises current tax of GBP2.7 million (2017:

GBP2.1 million) and a deferred tax credit of GBP0.7 million (2017:

charge of GBP0.8 million).

The Group carries a deferred tax asset of GBP2.3 million (2017:

GBP2.9 million) and a deferred tax liability of GBP2.0 million

(2017: GBP2.2 million). The deferred tax asset relates principally

to the deficit on the pension fund and share-based payments. The

deferred tax liability relates to accelerated capital allowances,

capitalised development costs and other timing differences,

predominantly arising in the US.

Total equity and distributable reserves

Total equity at 30 November 2018 was GBP89.5 million (2017:

GBP74.9 million), an increase of 19% over the prior year.

Increases in total equity arose from: profit after tax of

GBP10.5 million (2017: GBP9.2 million) with the charge for employee

share option schemes net of tax (2018: GBP0.4 million; 2017: GBP0.4

million) added back; GBP0.1 million (2017: GBP0.3 million) arising

on the proceeds of the issue of shares on share option exercises; a

pension scheme actuarial gain (net of tax) of GBP2.9 million (2017:

nil); and exchange gains (net of tax) on translation of GBP3.5

million (2017: loss of GBP4.0 million). In 2018 there was no impact

of hedge accounting instruments (2017: gain of GBP0.2 million).

Reductions in total equity arose from dividends paid of GBP2.0

million (2017: GBP1.8 million) and purchases by the Employee

Benefit Trust of the Company's own shares charged directly to

equity of GBP0.4 million (2017: GBP0.5 million).

The Company had GBP19.5 million (2017: GBP12.6 million) of

distributable reserves at 30 November 2018. The Company's

distributable reserves increased in the year as a result of

dividends received from other Group companies and an actuarial gain

offset by head office costs and dividends paid to shareholders.

Return on capital employed

The Group's return on capital employed was 15% (2017: 16%).

Excluding the impact of goodwill and the net pension liability, the

return on operating capital employed was 43% (2017: 48%). The

Group's divisions have pre-tax weighted average costs of capital of

between 9% and 11%.

Cash flow

The table below summarises the key elements of the cash flow for

the year:

2018 2017

GBPm GBPm

Operating cash flow before working capital 17.0 13.7

Working capital movement (1.7) (1.4)

------ ------

Cash generated from operating activities 15.3 12.3

Interest (0.3) (0.2)

Tax (2.4) (2.7)

Capital expenditure net of disposals (4.5) (5.4)

------ ------

8.1 4.0

Acquisitions (9.0) (5.9)

Dividends (2.0) (1.8)

Share issue proceeds 0.1 0.3

Purchase of EBT shares (0.4) (0.5)

------ ------

Net cash decrease in the year (3.2) (3.9)

Exchange gains - 0.1

Net cash at 1 December 9.8 13.6

------ ------

Net cash at 30 November 6.6 9.8

------ ------

Generating free cash flow is key to the Group's business model

and operating cashflow of GBP15.3 million, represented an 88%

(2017: 80%) conversion rate of operating profit before depreciation

and amortisation. Net working capital increased by GBP1.7 million

(2017: GBP1.4 million), mainly arising in the Aerospace &

Industrial division. A particularly strong final month and

purchases made for manufacture and delivery of the strong order

book meant that receivables increased by GBP1.6 million (2017:

GBP0.3 million) and inventories increased by GBP2.5 million (2017:

GBP0.5 million). Payables increased by GBP3.2 million (2017: GBP0.5

million).

Construction contracts and performance bonds

During the year a nuclear and a gasification contract were

completed. Progress on a further nuclear contract and two

gasification contracts is described in the Aerospace &

Industrial section of Operating Review. At 30 November 2018, the

Group had GBP0.3 million (2017: GBP0.8 million) due from contract

customers and net amounts due to contract customers of GBP7.3

million (2017: GBP8.0 million), representing the net amount by

which progress billings at 30 November 2018 exceeded revenue

recognised to date on these contracts. The deferred revenue will be

recognised as costs are incurred and/or profits recognised.

Contract customers generally provide advance payments to fund

the initial stages of the contracts and the Group provides advance

payment bonds to the customer as security. The bonds are

cancellable after up to six months following the shipment of goods.

At 30 November 2018 there were $2.4 million advance payment bonds

outstanding (2017: GBPnil).

Contract customers also generally require performance bonds to

cover risks arising during the contract warranty periods. At 30

November 2018, the Group had $7.5 million (2017: $6.2 million) of

performance bonds outstanding.

Capital expenditure

Capital expenditure was GBP4.5 million (2017: GBP5.4 million) in

the year. The principal investments in 2018 are described in the

Investment section of the Operating review.

Acquisitions

On 7 December 2017 the Group purchased 100% of the share capital

of Rohasys B.V. ("Rohasys") to increase the Group's offering in the

laboratory market. Rohasys manufactures robotic sample handling

systems in the Netherlands. The total maximum consideration is

EUR3,548,000 (GBP3,118,000); EUR896,000 (GBP787,000) was paid in

cash on the acquisition date, together with EUR502,000 (GBP441,000)

to settle the outstanding loan. The balance is contingent on

financial performance and due for payment in cash over four years.

The contingent consideration is dependent on Rohasys meeting sales

and profit targets and will be settled in cash. EUR250,000

(GBP226,000) was paid in the year and, at 30 November 2018, EUR1.7

million (GBP1.5 million) was held in other payables.

On 28 February 2018 the Group purchased the net assets of

Keystone Filter ("Keystone"), a division of CECO Environmental

Corp. Keystone designs and manufactures a range of filter

cartridges and housings for the food and beverage, drinking water,

and chemical process markets and is based in the USA. The total

consideration of $7,190,000 (GBP5,219,000) was paid in full in the

year.

Pension schemes

The Group supports its defined benefit pension scheme in the UK

("The Plan"), which is closed to new members, and provides access

to defined contribution schemes for its US employees and other UK

employees.

The Group's total pension cost was GBP3.7 million (2017: GBP2.7

million). GBP3.3 million (2017: GBP2.3 million) was recorded as an

operating cost: GBP1.7 million (2017: GBP1.6 million) related to

funding defined contributions schemes; GBP1.5 million (2017: GBP0.6

million) related to the charge for The Plan and GBP0.1 million

(2017: GBP0.1 million) related to the pension protection levy.

GBP0.4 million (2017: GBP0.4 million) was charged as a finance cost

in relation to The Plan.

The Group's cash contributions paid to The Plan were GBP1.6

million (2017: GBP1.6 million).

The Group's net retirement benefit obligation was GBP12.4

million (2017: GBP15.7 million). The Plan's liabilities reduced to

GBP39.2 million (2017: GBP43.8 million). The Plan's assets reduced

to GBP27.0 million (2017: GBP28.3 million). There were a further

GBP0.2 million (2017 GBP0.2 million) of non-Plan liabilities.

The actuarial gain in the year was GBP3.6 million (2017: loss of

GBP0.1 million). The Plan's assets suffered an actuarial loss of

GBP1.4 million. The actuarial gain on the liabilities of GBP5

million arose principally from changes to the discount rate used to

value The Plan's liabilities and a change in the mortality

assumption:

-- The discount rate increased from 2.5% to 3.0%, as a result of

higher AA bond yields, which accounted for most of the reduction of

GBP3.2 million in liabilities arising on changes in financial

assumptions.

-- During 2018, as a precursor to the triennial valuation, the

Group reviewed the demographic assumptions used by The Plan. To

assess the most appropriate mortality assumption for The Plan, the

Group commissioned a Medically Underwritten Mortality Study and a

postcode mortality analysis from its actuarial advisers, KPMG. The

Company wrote to members of The Plan aged between 55 and 80

representing approximately 95% of the value of liabilities in that

age range and 61% of the liabilities in total. 134 members

completed the survey representing 63% of the liabilities in the 55

to 80 age range and 40% of the liabilities in total. The medical

underwriter's results were analysed by KPMG and combined with the

findings of a postcode mortality analysis to arrive at an overall

blended mortality assumption for The Plan.

This resulted in a multiplier applied to the SAPS series 2 base

tables of 122% (2017: 106%) for the IAS 19 accounting valuation.

The allowance for future improvements used the 2017 CMI Core

Projection (2017: 2016 CMI Core Projections) with a long term trend

of 1.25% per annum. The change in demographic assumptions modestly

reduced the life expectancy assumed for the members and reduced the

Group's defined pension scheme liabilities by GBP1.8 million.

The Plan's liabilities increased by GBP773,000 to amend the

benefits provided by The Plan to equalise its guaranteed minimum

pensions for men and women on benefits earned between 17 May 1990

and 6 April 1997. This additional liability was charged to the

income statement.

The triennial actuarial valuation of The Plan determines the

cash contributions that the Group makes to The Plan. The next full

actuarial valuation will be based on The Plan's position at 31

March 2018 and is expected to be completed before 30 June 2019. For

the previous valuation, based on data at 31 March 2015, the Group

agreed to set the employer's contributions at 18.9% of salary.

Additionally, the Group committed to making a GBP0.2 million annual

contribution towards the running costs of The Plan from April 2016,

which will increase by 3.5% per annum thereafter. The Group also

committed to make additional annual contributions, to cover the

past service deficit of GBP1.0 million per annum.

Borrowings and bank finance

At the year end, the Group had cash balances of GBP11.5 million

(2017: GBP12.5 million) and borrowings of GBP4.9 million (2017:

GBP2.7 million).

In 2017, the Group secured a five year revolving credit facility

of EUR23 million (GBP20.4 million) with Barclays Bank plc and

Handelsbanken plc. The facility has a margin over LIBOR of 1.5% and

a non-utilisation fee of 0.4375%. The Group also has a GBP2.5

million overdraft facility provided by Barclays Bank plc. The

financial covenants require the Group to maintain interest cover of

3.5 times and net debt to be less than 2.5 times EBITDA.

At 30 November 2018, the Group had net cash of GBP6.6 million

(2017: GBP9.8 million), EUR17.3 million (GBP15.3 million) of unused

facilities (2017: EUR19.6 million of unused facilities (GBP17.2

million)) and an unutilised overdraft facility of GBP2.5 million

(2017: GBP2.5 million).

Finance and treasury policy

The treasury function at Porvair is managed centrally, under

Board supervision. It seeks to limit the Group's trading exposure

to currency movements. The Group does not hedge against the impact

of exchange rate movements on the translation of profits and losses

of overseas operations.

The Group finances its operations through share capital,

retained profits and, when required, bank debt. It has adequate

facilities to finance its current operations and capital plans for

the foreseeable future.

Adoption of new accounting standards

The Group will adopt IFRS 9 and 15 in its accounts for the year

ending 30 November 2019 and will adopt IFRS 16 in its accounts for

the year ending 30 November 2020. The impact of the changes arising

from the adoption of these new standards is expected to be

immaterial to the opening reserves and performance of the Group.

Adopting IFRS 16 will result in the gross up of fixed assets and

liabilities in the opening balance sheet of the 2020 accounts and

adopting IFRS 15 will result in substantially all of the amounts

due to contract customers included in accruals and deferred income

in the 2018 accounts being converted to accruals for future costs

in the opening balance sheet of the 2019 accounts.

International Trade

Over 50% of Group revenues are manufactured in the US and

changes to US tariff arrangements have had a modest effect on

trading. A few customers in both the US and China have switched

back to domestic suppliers, and the Group has both won and lost

accounts as a result. The net effect has been small. Trading

activity between the UK and the EU is less than 10% of Group

revenues, so a significant perturbation due to Brexit is unlikely,

nevertheless the implications of either a short term disturbance in

the movement of goods or longer term tariff changes have been taken

into account in the Group's planning for 2019.

Chris Tyler

Group Finance Director

25 January 2019

Consolidated income statement

For the year ended 30 November

Note 2018 2017

Continuing operations GBP'000 GBP'000

Revenue 1,2 128,823 116,423

Cost of sales (84,444) (78,091)

--------- ---------

Gross profit 44,379 38,332

Distribution costs (2,172) (1,645)

Administrative expenses (29,339) (24,348)

------------------------------------------ ----- --------- ---------

Adjusted operating profit 1,2 14,343 13,021

Adjustments

Equalisation of guaranteed minimum

pension 1 (773) -

Amortisation of acquired intangibles 1 (564) (244)

Other acquisition related adjustments 1 (138) (438)

------------------------------------------ ----- --------- ---------

Operating profit 1,2 12,868 12,339

Finance income 6 4

Finance costs (836) (661)

Profit before income tax 1,2 12,038 11,682

------------------------------------------ ----- --------- ---------

Adjusted income tax expense (3,113) (3,011)

Adjustments

Tax effect of adjustments to

operating profit 1 325 171

Exceptional reduction of US

deferred tax liability 1 778 -

------------------------------------------ ----- --------- ---------

Income tax expense (2,010) (2,840)

Profit for the year 10,028 8,842

--------- ---------

Profit attributable to:

Owners of the parent 10,045 8,861

Non-controlling interests (17) (19)

--------- ---------

Profit for the year 10,028 8,842

--------- ---------

Earnings per share (basic) 3 22.1p 19.5p

Adjusted earnings per share

(basic) 3 22.9p 20.7p

Earnings per share (diluted) 3 22.0p 19.4p

Adjusted earnings per share

(diluted) 3 22.8p 20.5p

Consolidated statement of comprehensive income

For the year ended 30 November

2018 2017

GBP'000 GBP'000

Profit for the year 10,028 8,842

--------- ---------

Other comprehensive income/(expense):

Items that will not be reclassified to

profit and loss

Actuarial gains/(losses) in defined benefit

pension plans net of tax 2,948 (66)

--------- ---------

Items that may subsequently be classified

to profit and loss

Exchange differences on translation of

foreign subsidiaries 3,606 (3,985)

Tax relating to components of other comprehensive (149) -

income

Changes in fair value of forex contracts

held as a cash flow hedge - 157

--------- ---------

3,457 (3,828)

--------- ---------

Net other comprehensive income/(expense) 6,405 (3,894)

--------- ---------

Total comprehensive income for the year 16,433 4,948

--------- ---------

Comprehensive income attributable to:

Owners of the parent 16,450 4,967

Non-controlling interests (17) (19)

--------- ---------

Total comprehensive income for the year 16,433 4,948

--------- ---------

Consolidated balance sheet

As at 30 November

Note 2018 2017

GBP'000 GBP'000

Non-current assets

Property, plant and equipment 5 21,827 19,997

Goodwill and other intangible assets 6 67,001 57,227

Deferred tax asset 2,304 2,933

91,132 80,157

Current assets

Inventories 19,856 16,067

Trade and other receivables 22,336 19,186

Derivative financial instruments - 40

Cash and cash equivalents 11,492 12,497

--------- -----------

53,684 47,790

Current liabilities

Trade and other payables 7 (32,826) (27,736)

Current tax liabilities (1,530) (1,164)

Provisions for other liabilities and

charges 10 (506) (1,217)

(34,862) (30,117)

Net current assets 18,822 17,673

--------- -----------

Non-current liabilities

Borrowings 9 (4,867) (2,711)

Deferred tax liability (2,032) (2,166)

Retirement benefit obligations (12,356) (15,670)

Other payables (1,008) (2,216)

Provisions for other liabilities and

charges 10 (219) (178)

--------- -----------

(20,482) (22,941)

--------- -----------

Net assets 89,472 74,889

--------- -----------

Capital and reserves

Share capital 11 917 913

Share premium account 11 35,958 35,831

Cumulative translation reserve 10,570 6,964

Retained earnings 42,024 31,161

--------- -----------

Equity attributable to owners of the

parent 89,469 74,869

Non-controlling interests 3 20

--------- -----------

Total equity 89,472 74,889

--------- -----------

Consolidated cash flow statement

For the year ended 30 November

Note 2018 2017

GBP'000 GBP'000

Cash flows from operating activities

Cash generated from operations 14 15,335 12,257

Interest paid (345) (220)

Tax paid (2,419) (2,741)

--------- ---------

Net cash generated from operating

activities 12,571 9,296

--------- ---------

Cash flows from investing activities

Interest received 6 4

Acquisition of subsidiaries (net of

cash acquired) 13 (9,007) (5,932)

Purchase of property, plant and equipment 5 (3,796) (5,248)

Purchase of intangible assets 6 (656) (177)

Share capital from non-controlling

interests - 39

Net cash used in investing activities (13,453) (11,314)

--------- ---------

Cash flows from financing activities

Proceeds from issue of ordinary share

capital 11 131 325

Purchase of Employee Benefit Trust

shares (416) (475)

Increase in borrowings 1,913 3,021

Dividends paid to shareholders 4 (1,957) (1,769)

Net cash (used in)/from financing

activities (329) 1,102

--------- ---------

Net decrease in cash and cash equivalents (1,211) (916)

Exchange gains/(losses) on cash and

cash equivalents 206 (220)

--------- ---------

(1,005) (1,136)

Cash and cash equivalents at 1 December 12,497 13,633

--------- ---------

Cash and cash equivalents at 30 November 11,492 12,497

--------- ---------

Reconciliation of net cash flow to movement in net cash

2018 2017

GBP'000 GBP'000

Net decrease in cash and cash equivalents (1,211) (916)

Effects of exchange rate changes (37) 90

Increase in borrowings (1,913) (3,021)

Net cash at 1 December 9,786 13,633

--------- ---------

Net cash at 30 November 6,625 9,786

--------- ---------

Consolidated statement of changes in equity

Share Cumulative Non-controlling

Share premium translation Retained interest

capital account reserve earnings Total GBP'000 Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------- -------- ------------ ---------- ---------- ---------------- ----------

Balance at 1 December

2016 906 35,513 10,949 24,078 71,446 - 71,446

--------- -------- ------------ ---------- ---------- ---------------- ----------

Profit for the year - - - 8,861 8,861 - 8,861

Other comprehensive

income/(expense): - - (3,985) 91 (3,894) - (3,894)

Total comprehensive

income for the year - - (3,985) 8,952 4,967 - 4,967

--------- -------- ------------ ---------- ---------- ---------------- ----------

Transactions with owners:

Consideration paid

for purchase of own

shares (held in trust) - - - (475) (475) - (475)

Employee share option

schemes:

* value of employee services net of tax - - - 375 375 - 375

Proceeds from shares

issued 7 318 - - 325 - 325

Dividends paid - - - (1,769) (1,769) - (1,769)

--------- -------- ------------ ---------- ---------- ---------------- ----------

Total transactions

with owners recognised

directly in equity 7 318 - (1,869) (1,544) - (1,544)

--------- -------- ------------ ---------- ---------- ---------------- ----------

Adjustment arising

from change in non-controlling

interest - - - - - 20 20

--------- -------- ------------ ---------- ---------- ---------------- ----------

Balance at 30 November

2017 913 35,831 6,964 31,161 74,869 20 74,889

--------- -------- ------------ ---------- ---------- ---------------- ----------

Balance at 1 December

2017 913 35,831 6,964 31,161 74,869 20 74,889

--------- -------- ------------ ---------- ---------- ---------------- ----------

Profit for the year - - - 10,045 10,045 - 10,045

Other comprehensive

income: - - 3,606 2,799 6,405 - 6,405

Total comprehensive

income for the year - - 3,606 12,844 16,450 - 16,450

--------- -------- ------------ ---------- ---------- ---------------- ----------

Transactions with owners:

Consideration paid

for purchase of own

shares (held in trust) - - - (416) (416) - (416)

Employee share option

schemes:

* value of employee services net of tax - - - 392 392 - 392

Proceeds from shares

issued 4 127 - - 131 - 131

Dividends paid - - - (1,957) (1,957) - (1,957)

--------- -------- ------------ ---------- ---------- ---------------- ----------

Total transactions

with owners recognised

directly in equity 4 127 - (1,981) (1,850) - (1,850)

--------- -------- ------------ ---------- ---------- ---------------- ----------

Adjustment arising

from change in non-controlling

interest - - - - - (17) (17)

--------- -------- ------------ ---------- ---------- ---------------- ----------

Balance at 30 November

2018 917 35,958 10,570 42,024 89,469 3 89,472

--------- -------- ------------ ---------- ---------- ---------------- ----------

Notes

1. Alternative performance measures

The Group uses adjusted figures as alternative performance

measures in addition to those reported under IFRS, as management

believe that these measures provide a useful analysis of trends in

underlying performance compared with prior periods.

Alternative revenue measures

2018 2017 Growth

Aerospace & Industrial GBP'000 GBP'000 %

Underlying revenue 47,916 43,651 10

Divisional adjustment - (1,955)

Acquisitions 1,671 -

-------- -------- -------

Revenue at constant currency 49,587 41,696 19

Exchange 949 1,553

Revenue as reported 50,536 43,249 17

-------- -------- -------

Laboratory

Underlying revenue 25,970 26,075 0

Divisional adjustment - 1,955

Acquisitions 11,291 5,866

-------- -------- -------

Revenue at constant currency 37,261 33,896 10

Exchange 1,398 1,430

-------- -------- -------

Revenue as reported 38,659 35,326 9

-------- -------- -------

Metal Melt Quality

Revenue at constant currency 37,678 34,707 9

Exchange 1,950 3,141

-------- -------- -------

Revenue as reported 39,628 37,848 5

-------- -------- -------

Group

Underlying revenue 111,564 104,433 7

Acquisitions 12,962 5,866

-------- -------- -------

Revenue at constant currency 124,526 110,299 13

Exchange 4,297 6,124

-------- -------- -------

Revenue as reported 128,823 116,423 11

-------- -------- -------

Revenue at constant currency is derived from translating

overseas subsidiaries at budgeted fixed exchange rates. In 2018 and

2017 the rates used were $1.4:GBP and EUR1.2:GBP.

Underlying revenue is revenue at constant currency adjusted for

the impact of acquisitions made in the current and prior year and,

in the case of 2017, the impact of accounts that were managed by

the Laboratory division in 2017 but transferred to Aerospace &

Industrial in 2018.

1. Alternative performance measures continued

Alternative profit measures

A reconciliation of the Group's adjusted performance measures to

the reported IFRS measures is presented below:

2018 2017

Adjusted Adjustments Total Adjusted Adjustments Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Operating profit 14,343 (1,475) 12,868 13,021 (682) 12,339

Finance income 6 - 6 4 - 4

Finance costs: (836) - (836) (661) - (661)

Profit before

income tax 13,513 (1,475) 12,038 12,364 (682) 11,682

Income tax expense (3,113) 1,103 (2,010) (3,011) 171 (2,840)

--------- ------------ -------- ---------- ---------- -------------

Profit for the

year 10,400 (372) 10,028 9,353 (511) 8,842

--------- ------------ -------- ---------- ---------- -------------

2018 2017

GBP'000 GBP'000

Equalisation of guaranteed minimum pension (773) -

Amortisation of intangible assets acquired through

acquisitions (564) (244)

Release of contingent consideration - 20

Acquisition expenses (138) (458)

Adjustments affecting operating profit (1,475) (682)

----------- --------

Tax effect of adjustments 325 171

Tax - exceptional item 778 -

Adjustments affecting tax 1,103 171

----------- --------

Total adjusting items (372) (511)

----------- --------

Adjusted operating profit and adjusted profit before tax

exclude:

-- the impact of acquiring businesses:

o the amortisation of acquired intangible assets of GBP0.6

million (2017: GBP0.2 million); and

o acquisition expenses and other adjustments to the income

statement related to acquiring businesses of GBP0.1 million (2017:

GBP0.4 million).

-- other items that are considered significant and where

treatment as an adjusted item provides a more consistent assessment

of the Group's trading:

o an exceptional charge of GBP773,000 (2017: GBPnil), following

recent legal precedent, to enhance the benefits provided by the

Group's defined benefit pension plan to equalise its guaranteed

minimum pensions for men and women on benefits earned between 17

May 1990 and 6 April 1997.

Adjusted profit for the year excludes the adjustments to profit

before tax together with their tax effect and an exceptional one

off tax credit of GBP778,000 (2017: GBPnil) reflecting a reduction

in the Group's deferred tax liability from the change in US tax

rates from December 2017 enacted in the US Tax Cuts and Jobs

Act.

2. Segment information

The segmental analyses of revenue, operating profit/(loss),

segment assets and liabilities and geographical analyses of revenue

are set out below:

2018 Aerospace Laboratory Metal Melt Central Group

& Industrial Quality

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Total segment

revenue 50,546 41,181 39,628 - 131,355

Inter-segment

revenue (10) (2,522) - - (2,532)

-------------- ----------- ----------- ---------- ---------

Revenue 50,536 38,659 39,628 - 128,823

-------------- ----------- ----------- ---------- ---------

Adjusted operating

profit/(loss) 8,043 6,494 2,373 (2,567) 14,343

Equalisation of

guaranteed minimum

pension - - - (773) (773)

Amortisation of

acquired intangibles (302) (255) (7) - (564)

Other acquisition

related adjustments - - - (138) (138)

------------------------- -------------- ----------- ----------- ---------- ---------

Operating profit/(loss) 7,741 6,239 2,366 (3,478) 12,868

Interest payable

and similar charges - - - (830) (830)

-------------- ----------- ----------- ---------- ---------

Profit/(loss)

before income

tax 7,741 6,239 2,366 (4,308) 12,038

Income tax expense - - - (2,010) (2,010)

Profit/(loss)

for the year 7,741 6,239 2,366 (6,318) 10,028

-------------- ----------- ----------- ---------- ---------

2017 Aerospace Laboratory Metal Melt Central Group

& Industrial Quality

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Total segment

revenue 43,407 36,774 37,848 - 118,029

Inter-segment

revenue (158) (1,448) - - (1,606)

-------------- ----------- ----------- ---------- ---------

Revenue 43,249 35,326 37,848 - 116,423

-------------- ----------- ----------- ---------- ---------

Adjusted operating

profit/(loss) 6,825 6,255 1,745 (1,804) 13,021

Amortisation of

acquired intangibles (42) (189) (13) - (244)

Other acquisition

related adjustments - - - (438) (438)

------------------------- -------------- ----------- ----------- ---------- ---------

Operating profit/(loss) 6,783 6,066 1,732 (2,242) 12,339

Interest payable

and similar charges - - - (657) (657)

-------------- ----------- ----------- ---------- ---------

Profit/(loss)

before income

tax 6,783 6,066 1,732 (2,899) 11,682

Income tax expense - - - (2,840) (2,840)

-------------- ----------- ----------- ---------- ---------

Profit/(loss)

for the year 6,783 6,066 1,732 (5,739) 8,842

-------------- ----------- ----------- ---------- ---------

Other Group operations are included in "Central". These mainly

comprise Group corporate expenditure such as head office and Board

costs, new business development and general financial costs.

2. Segment information continued

Segment assets and liabilities

At 30 Nov 2018 Aerospace Laboratory Metal Melt Central Group

& Industrial Quality

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Segmental assets 59,655 37,608 33,869 2,192 133,324

Cash and cash

equivalents - - - 11,492 11,492

-------------- ----------- ----------- ----------- -----------

Total assets 59,655 37,608 33,869 13,684 144,816

-------------- ----------- ----------- ----------- -----------

Segmental liabilities (18,610) (11,365) (3,999) (4,147) (38,121)

Retirement

benefit obligations - - - (12,356) (12,356)

Bank overdraft

and loans - - - (4,867) (4,867)

-------------- ----------- ----------- ----------- -----------

Total liabilities (18,610) (11,365) (3,999) (21,370) (55,344)

-------------- ----------- ----------- ----------- -----------

At 30 Nov 2017 Aerospace Laboratory Metal Melt Central Group

& Industrial Quality

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Segmental assets 46,985 30,250 35,222 2,993 115,450

Cash and cash

equivalents - - - 12,497 12,497

-------------- ----------- ----------- ----------- -----------

Total assets 46,985 30,250 35,222 15,490 127,947

-------------- ----------- ----------- ----------- -----------

Segmental liabilities (15,979) (7,690) (3,917) (7,091) (34,677)

Retirement

benefit obligations - - - (15,670) (15,670)

Bank overdraft

and loans - - - (2,711) (2,711)

-------------- ----------- ----------- ----------- -----------

Total liabilities (15,979) (7,690) (3,917) (25,472) (53,058)

-------------- ----------- ----------- ----------- -----------

Geographical analysis

2018 2017

By destination By origin By destination By origin

GBP'000 GBP'000 GBP'000 GBP'000

Revenue

United Kingdom 16,494 38,984 15,529 37,122

Continental Europe 19,322 10,949 15,156 10,120

United States of America 56,159 73,979 51,989 66,187

Other NAFTA 8,304 - 8,793 -

South America 2,206 - 1,658 -

Asia 24,914 4,911 22,004 2,994

Africa 1,424 - 1,294 -

--------------- ---------- --------------- ----------

128,823 128,823 116,423 116,423

--------------- ---------- --------------- ----------

3. Earnings per share

2018 2017

Total Earnings Weighted Per share Earnings Weighted Per share

average amount average amount

number number of

GBP'000 of shares (pence) GBP'000 shares (pence)

Earnings attributable

to ordinary shareholders 10,045 8,861

Shares in issue 45,705,419 45,429,715

Shares owned by

the Employee Benefit

Trust (156,552) (63,618)

--------- ------------ ---------- --------- ----------- ----------

Basic earnings 10,045 45,548,867 22.1 8,861 45,366,097 19.5

Effect of dilutive

securities - share

options 102,380 (0.1) 262,585 (0.1)

--------- ------------ ---------- --------- ----------- ----------

Diluted earnings 10,045 45,651,247 22.0 8,861 45,628,682 19.4

--------- ------------ ---------- --------- ----------- ----------

2018 2017

Adjusted Earnings Weighted Per share Earnings Weighted Per share

average amount average amount

number number of

GBP'000 of shares (pence) GBP'000 shares (pence)

Earnings attributable

to ordinary shareholders 10,045 8,861

Adjusting items

(note 1) 372 511

--------- ----------- ---------- --------- ----------- ----------

Adjusted earnings

attributable to

ordinary shareholders 10,417 9,372

--------- ----------- ---------- --------- ----------- ----------

Adjusted basic

earnings 10,417 45,548,867 22.9 9,372 45,366,097 20.7

Adjusted diluted

earnings 10,417 45,651,247 22.8 9,372 45,628,682 20.5

--------- ----------- ---------- --------- ----------- ----------

4. Dividends per share

2018 2017

Per share GBP'000 Per share GBP'000

Final dividend paid 2.7p 1,229 2.4p 1,088

Interim dividend paid 1.6p 728 1.5p 681

---------- -------- ---------- --------

4.3p 1,957 3.9p 1,769

---------- -------- ---------- --------

The Directors recommend the payment of a final dividend of 3.0

pence per share (2017: 2.7 pence per share) on 7 June 2019 to

shareholders on the register on 3 May 2019; the ex-dividend date is

2 May 2019. This makes a total dividend for the year of 4.6 pence

per share (2017: 4.2 pence per share).

5. Property, plant and equipment

Land and Assets in Plant, Total

buildings the course machinery

of construction and equipment

Cost GBP'000 GBP'000 GBP'000 GBP'000

At 1 December 2017 9,939 1,280 35,539 46,758

Reclassification 173 (975) 802 -

Additions 704 1,827 1,265 3,796

Acquisitions - - 192 192

Disposals (4) - (156) (160)

Exchange differences 394 46 1,165 1,605

At 30 November 2018 11,206 2,178 38,807 52,191

----------- ----------------- --------------- --------

Depreciation

At 1 December 2017 (2,964) - (23,797) (26,761)

Charge for the year (318) - (2,522) (2,840)

Disposals 4 - 156 160

Exchange differences (127) - (796) (923)

At 30 November 2018 (3,405) - (26,959) (30,364)

-------- --------- ---------

Net book value

At 30 November 2018 7,801 2,178 11,848 21,827

------ ------ ------- -------

At 30 November 2017 6,975 1,280 11,742 19,997

------ ------ ------- -------

6. Goodwill and other intangible assets

Trademarks,

Development knowhow

expenditure Software and other

Goodwill capitalised capitalised intangibles Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Net book amount

at 1 December

2017 56,309 158 232 528 57,227

Additions - 115 541 - 656

Acquisitions 4,036 - 2 3,218 7,256

Amortisation

charges - (76) (54) (637) (767)

Exchange differences 2,416 11 18 184 2,629

-----------

Net book amount

at 30 November

2018 62,761 208 739 3,293 67,001

----------- -------------- -------------- ------------- ---------

At 30 November Trademarks,

2018 Development knowhow

expenditure Software and other

Goodwill capitalised capitalised intangibles Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost 81,429 890 1,882 5,324 89,525

Accumulated

amortisation

and impairment (18,668) (682) (1,143) (2,031) (22,524)

Net book amount 62,761 208 739 3,293 67,001

----------- -------------- -------------- ------------- -----------

7. Trade and other payables

2018 2017

Amounts falling due within one year: GBP'000 GBP'000

Trade payables 12,046 9,503

Taxation and social security 628 814

Other payables 2,884 2,318

Accruals and deferred income 17,268 15,101

At 30 November 32,826 27,736

--------- ---------

8. Construction contracts

2018 2017

GBP'000 GBP'000

Amounts due from contract customers included

in trade receivables 329 834

--------- ---------

Contracts in progress at 30 November:

Amounts due from contract customers included

in other receivables 460 211

Amounts due to contract customers included in

accruals and deferred income (7,728) (8,210)

--------- ---------

Net amounts due to contract customers (7,268) (7,999)

--------- ---------

Contract costs incurred plus recognised profits

less recognised losses to date 32,805 45,165

Less: progress billings (40,073) (53,164)

Contracts in progress at 30 November (7,268) (7,999)

--------- ---------

The amount of construction contract revenue recognised in the

year is GBP2,640,000 (2017: GBP910,000).

9. Borrowings

On 24 May 2017, the Group agreed a five year revolving credit

facility of EUR23 million (GBP20 million) with Barclays Bank plc

and Handelsbanken plc. The Group also has a GBP2.5 million

overdraft facility provided by Barclays Bank plc.

At 30 November 2018, the Group had EUR17.3 million of unused

facilities (2017: EUR19.6 million of unused facilities) and an

unutilised overdraft facility of GBP2.5 million (2017: GBP2.5

million).

10. Provisions

Dilapidations Warranty Total

GBP'000 GBP'000 GBP'000

At 1 December 2017 178 1,217 1,395

Released in the year - (711) (711)

Charged to the consolidated income

statement:

Unwinding of discount 41 - 41

At 30 November 2018 219 506 725

-------------- --------- --------

2018 2017

Analysis of total provisions: GBP'000 GBP'000

Current 506 1,217

Non-current 219 178

At 30 November 725 1,395

--------- ---------

Provisions arise from a discounted dilapidations provision for

leased property, which is expected to be required in 2023 and sale

warranties which expire by 2020. The amount released in the year of

GBP711,000 arose on the completion of contracts.

11. Share capital and premium

Number Ordinary Share premium Total

of shares shares account

Thousands GBP'000 GBP'000 GBP'000

At 1 December 2017 45,641 913 35,831 36,744

Issue of shares on

exercise of share

options 202 4 127 131

At 30 November 2018 45,843 917 35,958 36,875

----------- --------- -------------- --------

In February, March, April, June, July and September 2018, 51,049

ordinary shares of 2 pence each were issued on the exercise of Save

As You Earn share options for cash consideration of GBP128,000. In

September 2018, 151,375 ordinary shares of 2 pence each were issued

on the exercise of Long Term Share Plan share options for cash

consideration of GBP3,000.

The Group uses an Employee Benefit Trust (EBT) to purchase

shares in the Company to satisfy entitlements, granted since the

Company's AGM in 2015, under the Group's Long Term Incentive Plan.

During the year the Group purchased 84,000 ordinary shares of 2

pence each (2017: 92,000) for a total consideration of GBP416,000

(2017: GBP475,000). The cost of the shares held by the EBT is

deducted from retained earnings. The EBT is financed by a

repayable-on-demand loan from the Group of GBP968,000 (2017:

GBP552,000). As at 30 November 2018 the EBT held a total of 196,000

ordinary shares of 2 pence each (2017: 112,000) at a cost of

GBP968,000 (2017: GBP552,000) and a market value of GBP833,000

(2017: GBP521,000).

12. Acquisitions

On 7 December 2017 the Group, through its subsidiary Seal

Analytical Limited, purchased 100% of the share capital of Rohasys

B.V. ("Rohasys") in order to increase the Group's offering in the

laboratory market. The trade is the manufacture of robotic sample

handling systems and is based in the Netherlands. The total maximum

consideration is EUR3,548,000 (GBP3,118,000); EUR896,000

(GBP787,000) of this was paid in cash on the acquisition date,

together with EUR502,000 (GBP441,000) to settle the outstanding

loan. The balance is contingent on financial performance and

payable in instalments until 2021; the first EUR250,000

(GBP226,000) instalment of contingent consideration was paid in

March 2018.

The contingent consideration is dependent on Rohasys meeting

sales and profit targets, and will be settled in cash. Management

has forecast that payment of 99% of the maximum contingent

consideration, EUR2,136,000 (GBP1,877,000), is the most probable

outcome. This was discounted to EUR1,878,000 (GBP1,650,000) using

the discount rate of 14.5%, calculated for Rohasys. A reduction in

the annual sales by EUR200,000 (GBP177,000), which is considered a

reasonable possible alternative, would reduce the future contingent

liability by EUR30,000 (GBP27,000). In the period since

acquisition, the business has contributed EUR2,378,000

(GBP2,101,000) sales and EUR83,000 (GBP73,000) operating profit to

the Group results. The direct costs of acquisition charged to the

income statement were GBP35,000. If Rohasys had been consolidated

from 1 December 2017, the consolidated statement of income would

show pro-forma revenue of GBP128,823,000 and underlying operating

profit of GBP12,886,000.

Total

GBP'000

Purchase consideration:

Cash paid 787

Loan repaid 441

Contingent consideration 1,650

Total purchase consideration 2,878

Fair value of net

assets acquired (1,070)

Goodwill 1,808

--------

12. Acquisitions continued

Provisional recognised amounts of identifiable

assets acquired and liabilities assumed Fair value

GBP'000

Property, plant and equipment 22

Software 2

Trade name 72

Knowhow 318

Customer list 528

Inventory 393

Trade receivables 369

Trade payables (425)

Deferred tax liabilities (229)

Other working capital

(net) 20

Net assets acquired 1,070

-------------

Purchase consideration

settled in cash 787

-------------

Cash outflow on acquisition 787

-------------

An independent valuation of the identifiable intangible assets

has been carried out in the period. The goodwill is attributable to

the non-contractual relationships, the synergies between the

business acquired and the existing operations of the Group and the

potential to develop the technologies acquired. The goodwill

recognised is attributable to the Laboratory division and is not

expected to be deductible for income tax purposes. The purchase has

been accounted for as an acquisition. The intangible assets arising

on the acquisition are to be written off between three and ten

years.

On 28 February 2018 the Group, through its subsidiary Porvair

Filtration Group Inc., purchased the net assets of Keystone Filter

("Keystone"), a division of CECO Environmental Corp. The trade is

the design and manufacture of a range of filter cartridges and

housings for the food and beverage, drinking water, and chemical

process markets and is based in the USA. The total consideration is

$7,190,000 (GBP5,219,000); $5,290,000 (GBP3,840,000) of this was

paid on 28 February 2018, with the balance deferred and paid in

August 2018. In the period since acquisition, the business has

contributed $2,342,000 (GBP1,747,000) sales and $133,000

(GBP99,000) of underlying operating profit to the Group results.

The direct costs of acquisition charged to the income statement

were $77,000 (GBP56,000). If Keystone had been consolidated from 1

December 2017, the consolidated statement of income would show

pro-forma revenue of GBP129,463,000 and underlying operating profit

of GBP12,999,000

Total

GBP'000

Purchase consideration:

Cash paid 3,840

Deferred consideration 1,379

Total purchase consideration 5,219

Fair value of net

assets acquired (2,991)

Goodwill 2,228

--------

12. Acquisitions continued

Provisional recognised amounts of identifiable

assets acquired and liabilities assumed Fair value

GBP'000

Property, plant and equipment 170

Trade name 208

Order backlog 73

Customer list 2,019

Inventory 372

Trade receivables 325

Trade payables (171)

Other working capital

(net) (5)

Net assets acquired 2,991

-------------

Purchase consideration

settled in cash 3,840

-------------

Cash outflow on acquisition 3,840

-------------

An independent valuation of the identifiable intangible assets

has been carried out in the period. The goodwill is attributable to

the non-contractual relationships, the synergies between the

business acquired and the existing operations of the Group and the

potential to develop the technologies acquired. The goodwill

recognised is attributable to the Aerospace & Industrial

division and is expected to be deductible for income tax purposes.

The purchase has been accounted for as an acquisition. The

intangible assets arising on the acquisition are to be written off

between three and ten years.

13. Deferred and contingent consideration on acquisitions

Rohasys Keystone JG Finneran Total

Associates

Inc.

GBP'000 GBP'000 GBP'000 GBP'000

At 1 December 2017 - - 4,432 4,432

Purchase consideration

in the year 2,878 5,219 - 8,097

Cash paid in the year (1,454) (5,302) (2,251) (9,007)

Recognised in the income

statement 95 - - 95

Exchange movements 22 83 170 275

-------- --------- ------------ --------

At 30 November 2018 1,541 - 2,351 3,892

-------- --------- ------------ --------

Included within other payables 2018 2017

GBP'000 GBP'000

Deferred and contingent consideration - current 2,884 2,216

Deferred and contingent consideration - non-current 1,008 2,216

At 30 November 3,892 4,432

--------- ---------

14. Cash generated from operations

2018 2017

GBP'000 GBP'000

Operating profit 12,868 12,339

Post-employment benefits (136) (963)

Fair value movement of derivatives through

profit and loss 40 (1,461)

Share based payments 610 508

Depreciation, amortisation and impairment 3,607 3,228

Operating cash flows before movement in

working capital 16,989 13,651

--------- ---------

Increase in inventories (2,494) (523)

Increase in trade and other receivables (1,570) (287)

Increase in payables 3,216 545

Decrease in provisions (806) (1,129)

Increase in working capital (1,654) (1,394)

--------- ---------

Cash generated from operations 15,335 12,257

--------- ---------

15. Basis of preparation

The results for the year ended 30 November 2018 have been

prepared in accordance with International Financial Reporting

Standards (IFRSs) as adopted by the European Union as at 30

November 2018. The financial information contained in this

announcement does not constitute statutory accounts as defined in

Section 434 of the Companies Act 2006. The financial information

has been extracted from the financial statements for the year ended

30 November 2018, which have been approved by the Board of

Directors and on which the auditors have reported without

qualification. The financial statements will be delivered to the

Registrar of Companies after the Annual General Meeting. The

financial statements for the year ended 30 November 2017, upon

which the auditors reported without qualification, have been

delivered to the Registrar of Companies.

16. Annual general meeting

The Company's Annual General Meeting will be held at 11.00 a.m.

on Thursday 11 April 2019 at the offices of Porvair Sciences

Limited(,) Clywedog Road South, Wrexham Industrial Estate, Wrexham,

LL13 9XS.

17. Related parties

There were no related party transactions in the year ended 30

November 2018.

18. Responsibility Statement

Each of the Directors confirms, to the best of their knowledge,

that:

-- the financial statements, on which this announcement is

based, have been prepared in accordance with the applicable law and

International Financial Reporting Standards as adopted by the EU

and give a true and fair view of the assets, liabilities, financial

position, and profit or loss of the Company and the undertakings

included in the consolidation taken as a whole; and

-- the review of the business includes a fair review of the

development and performance of the business and the position of the

Company and the undertakings included in the consolidation taken as

a whole, together with a description of the principal risks and

uncertainties that they face.

The Directors of Porvair are listed in the Porvair Annual Report

for the year ended 30 November 2017. Charles Matthews resigned from

the Board on 17 April 2018. A list of current Directors is

maintained on the Porvair website www.porvair.com.

Copies of full accounts will be sent to shareholders in March

2019. Additional copies will be available from www.porvair.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR LLFLALRIDFIA

(END) Dow Jones Newswires

January 28, 2019 02:00 ET (07:00 GMT)

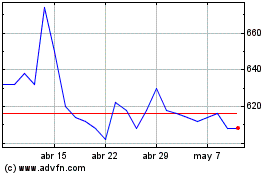

Porvair (LSE:PRV)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Porvair (LSE:PRV)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024