TIDMNWF

RNS Number : 3326O

NWF Group PLC

29 January 2019

NWF Group plc

For release 7.00 a.m. 29 January 2019

NWF Group plc

NWF Group plc: Half Year results for the period ended 30

November 2018

NWF Group plc ('NWF' or the Group), the specialist distributor

of fuel, food and feed across the UK, today announces its half year

results for the period ended 30 November 2018.

Financial highlights H1 2018 H1 2017 %

------------------------------ ------------ ------------ --------

Revenue GBP330.5m GBP295.8m +11.7%

Headline operating profit* GBP2.6m GBP2.4m +8.3%

Headline profit before

taxation* GBP2.4m GBP2.2m +9.1%

Fully diluted headline

earnings per share* 3.8p 3.6p +5.6%

Interim dividend per share 1.0p 1.0p -

Net debt GBP14.8m GBP16.3m

Net debt to EBITDA 1.0x 1.2x

Statutory results

Operating profit GBP2.3m GBP2.4m (4.2%)

Profit before taxation GBP1.9m GBP1.9m -

Fully diluted earnings

per share 2.8p 3.1p (9.7%)

* Headline operating profit excludes exceptional items (see note

4). Headline profit before taxation excludes exceptional items and

the net finance cost in respect of the Group's defined benefit

pension scheme. Diluted headline earnings per share also takes into

account the taxation effect thereon.

Operational highlights:

-- Revenue growth from increased activity in Food and Feeds and higher commodity prices

-- Delivery of planned profit improvements in Food

-- Acquisition in the Fuels market in December 2018 in line with strategy

-- Board's full year expectations for trading performance and net debt levels unchanged

Divisional highlights:

-- Fuels - headline operating profit of GBP0.9 million (H1 2017:

GBP1.1 million). A warm summer reduced demand for heating oil with

performance in the autumn months as planned.

-- Food - headline operating profit of GBP1.0 million (H1 2017:

GBP0.9 million). Profit in line with our expectations,

demonstrating a strong recovery as planned from the second half of

FY18, benefiting from new business won in the last 12 months.

-- Feeds - headline operating profit of GBP0.7 million (H1 2017:

GBP0.4 million). Benefits delivered from strong demand over the

summer months, when grazing conditions were poor, and the

investment made in prior years.

Richard Whiting, Chief Executive, NWF Group plc, commented:

"NWF has delivered profit improvement in line with our

expectations in the first half year with each of the divisions

performing as planned. The profit recovery in Food and the strong

performance of Feeds over the summer are of particular note. It was

pleasing to report delivery on our strategy with the acquisition of

Midland Fuel Oil Supplies after the period end. Current trading is

in line with the Board's expectations for the full financial

year."

To view a short video of the results presentation please follow

this link: http://bit.ly/NWF_H1_19

Information for investors, including analyst consensus

forecasts, can be found on the Group's website at www.nwf.co.uk

Richard Whiting, Chief Reg Hoare / Justin Jones /

Executive Patrick Hanrahan Mike Bell

Chris Belsham, Finance MHP Communications Peel Hunt LLP (Nominated adviser)

Director Tel: 020 3128 Tel:0 020 7418 8900

NWF Group plc 8100

Tel: 01829 260 260

CHAIRMAN'S STATEMENT

NWF has continued its development as planned in the first half

year. Fuels delivered in line with expectations with a weaker

summer market offset by stronger results in the autumn. The

acquisition in December 2018 of Midland Fuel Oil Supplies

demonstrates our strategic ambitions in that market. Food has

increased profits significantly from the end of the prior year with

higher activity levels from new customers won in the last 12

months. Feeds benefited from meeting the increased demand from our

customers over the summer months to support the nutrition of dairy

herds when grazing conditions were poor.

Results

Revenue for the half year ended 30 November 2018 was 11.7%

higher at GBP330.5 million (H1 2017: GBP295.8 million) as a result

of increased activity in Food and Feeds and higher commodity prices

in the period. Headline operating profit(1) was higher at GBP2.6

million (H1 2017: GBP2.4 million), with the increases in Food and

Feeds more than offsetting the reduction in Fuels. Headline profit

before taxation(1) was GBP2.4 million (H1 2017: GBP2.2

million).

Headline basic earnings per share(1) was 3.8p (H1 2017: 3.6p)

and headline diluted earnings per share(1) was 3.8p (H1 2017:

3.6p).

Net cash absorbed by operations for the period amounted to

GBP4.9 million (H1 2017: net cash absorbed of GBP0.6 million). The

normal seasonal trading pattern results in a cash outflow in the

first half with increased activity in Feeds absorbing cash in

working capital in the first half.

Net capital expenditure in the period was GBP1.4 million (H1

2017: GBP1.6 million) reflecting normal replacement capex as

planned.

Net debt at the period end was lower at GBP14.8 million (H1

2017: GBP16.3 million), reflecting profit improvement and effective

management of working capital in spite of increased demand in Feeds

over the period. Net debt to EBITDA reduced to 1.0x (H1 2017:

1.2x). The Group's banking facilities of GBP65.0 million are

committed to October 2023 and NWF continues to operate with

substantial headroom.

Net assets at 30 November 2018 increased to GBP46.9 million (30

November 2017: GBP39.6 million) largely due to the decrease in the

accounting valuation of the pension scheme deficit. The IAS 19R

valuation has decreased from GBP19.0 million to GBP15.4 million

primarily as a result of an increase in the discount rate from

2.70% to 3.25%.

1 Headline operating profit excludes exceptional items (see note

4). Headline profit before taxation excludes exceptional items and

the net finance cost in respect of the Group's defined benefit

pension scheme. Diluted headline earnings per share also takes into

account the taxation effect thereon.

Dividend

The Board has approved an interim dividend per share of 1.0p (H1

2017: 1.0p). This will be paid on 1 May 2019 to shareholders on the

register as at 22 March 2019. The shares will trade ex-dividend on

21 March 2019. The Group has a progressive dividend policy and has

increased the annual dividend by c. 5% in nine of the last ten

years.

Operations

Fuels

Revenue increased by 12.0% to GBP222.4 million (H1 2017:

GBP198.5 million) as a result of higher oil prices. Headline

operating profit was GBP0.9 million (H1 2017: GBP1.1 million).

Volumes reduced by 2.2% to 263 million litres (H1 2017: 269

million litres) with lower heating oil and diesel sales,

particularly in the summer months, partially offset by increased

gas oil sales. Brent Crude increased during the first half to an

average of $75.04 per barrel (H1 2017: $54.11 per barrel) and ended

the reporting period at $58.71 per barrel.

In line with our strategy we acquired Midland Fuel Oil Supplies

in December 2018, a 12 million litres fuel distributor which

consolidates our market position to the South and East of

Birmingham.

Food

Revenue increased by 22.1% to GBP23.8 million (H1 2017: GBP19.5

million). Headline operating profit was GBP1.0 million (H1 2017:

GBP0.9 million).

As anticipated, storage volumes increased to 96,000 pallet

spaces (H1 2017: 89,000). This increase results from the new

business won in the last 12 months to support the long-term future

of the Wardle site.

Activity measured in the number of loads was significantly

higher than prior year as the new customers have a greater stock

turn which increases outload requirements. We have completed a

successful trial as an Aldi platform provider and continue to

develop this business opportunity.

The Palletline operation continued its planned development and

we now have four customers utilising our e-fulfilment operations

which continue to expand.

Feeds

Revenue increased by 8.4% to GBP84.3 million (H1 2017: GBP77.8

million) as a result of increased volumes and higher commodity

prices. Headline operating profit was GBP0.7 million (H1 2017:

GBP0.4 million) benefiting from increased volumes.

Volumes were 5.3% higher at 279,000 tonnes (H1 2017: 265,000

tonnes) as farmers utilised more feed, particularly over the summer

months when grazing conditions were poor and our nutritionists

advised higher feed rates to maintain milk output. Fodder stocks

are now at broadly normal levels across the country following a

positive autumn period.

The market experienced inflationary pressures during the period

with increased commodity prices being passed through to farmers.

Whilst milk prices increased over the summer months to over 30p per

litre, with increased feed usage and prices this broadly offset the

revenue gains for farmers. Milk price cuts have subsequently been

announced by a number of dairies which increases pressure on farm

incomes going forward. Average milk prices at the end of November

were 31.8p per litre (November 2017: 31.7p per litre).

Our operational platform, with key mills close to customers in

the North, Central and Southern regions, delivered the expected

efficiencies and provides an effective base for future

development.

Outlook and future prospects

The Group has continued to perform as planned since the period

end. In Fuels, the normal seasonal increase in heating and gas oil

has been delivered successfully in a market with increased oil

price volatility. The acquisition of Midland Fuel Oil Supplies was

completed in December 2018. In Food, activity levels continue at

their higher rates and customers are considering their options for

storing additional stock as a contingency against a hard Brexit.

This is against a backdrop of limited warehouse capacity available

in the market. In Feeds, following outperformance in the first

half, volumes have been a little lower in the ruminant market as

farmers look to reduce feed bills.

We continue to focus on growth initiatives, both organic and

through targeted acquisitions. We also continue to monitor the

various Brexit scenarios and make plans as necessary.

Overall the Group continues to trade in line with the Board's

expectations for the full financial year and I look forward to

updating shareholders later this year.

Philip Acton

Chairman

29 January 2019

Condensed consolidated income statement

for the half year ended 30 November 2018 (unaudited)

Half year Half year Year

ended ended ended

30 November 30 November 31 May

2018 2017 2018

Note GBPm GBPm GBPm

------------------------------------ ------- ------------- ------------- --------

Revenue 3 330.5 295.8 611.0

Cost of sales and administrative

expenses (327.9) (293.4) (600.4)

------------------------------------ ------- ------------- ------------- --------

Headline operating profit(1) 2.6 2.4 10.6

Exceptional items 4 (0.3) - -

------------------------------------ ------- ------------- ------------- --------

Operating profit 3 2.3 2.4 10.6

Finance costs 5 (0.4) (0.5) (0.9)

------------------------------------ ------- ------------- ------------- --------

Headline profit before taxation(1) 2.4 2.2 10.2

Exceptional items 4 (0.3) - -

Net finance cost in respect

of the defined benefit pension

scheme (0.2) (0.3) (0.5)

Profit before taxation 1.9 1.9 9.7

Income tax expense(2) 6 (0.5) (0.4) (1.9)

------------------------------------ ------- ------------- ------------- --------

Profit for the period attributable

to equity shareholders 1.4 1.5 7.8

------------------------------------ ------- ------------- ------------- --------

Earnings per share (pence)

Basic 7 2.8 3.1 16.0

Diluted 7 2.8 3.1 15.9

------------------------------------ ------- ------------- ------------- --------

Headline earnings per share

(pence)(1)

Basic 7 3.8 3.6 16.8

Diluted 7 3.8 3.6 16.7

------------------------------------ ------- ------------- ------------- --------

1 Headline operating profit is statutory operating profit of

GBP2.3 million (H1 2017: GBP2.4 million) before exceptional items

of GBP0.3 million (H1 2017: GBPNil). Headline profit before

taxation is statutory profit before taxation of GBP1.9 million (H1

2017: GBP1.9 million), after adding back the net finance cost in

respect of the Group's defined benefit pension scheme of GBP0.2

million (H1 2017: GBP0.3 million), and the exceptional items.

Headline earnings per share also takes into account the taxation

effect thereon.

2 Taxation on exceptional items in the current period has

reduced the charge by GBPNil (H1 2017: GBPNil).

Condensed consolidated statement of comprehensive income

for the half year ended 30 November 2018 (unaudited)

Half year Half year Year

ended ended ended

30 November 30 November 31 May

2018 2017 2018

GBPm GBPm GBPm

--------------------------------------- ------------- ------------- --------

Profit for the period attributable

to equity shareholders 1.4 1.5 7.8

Items that will never be reclassified

to profit or loss:

Re-measurement gain on the defined

benefit pension scheme 1.5 0.5 2.0

Tax on items that will never be

reclassified to profit or loss (0.3) (0.1) (0.4)

--------------------------------------- ------------- ------------- --------

Total comprehensive income for

the period 2.6 1.9 9.4

--------------------------------------- ------------- ------------- --------

The notes form an integral part of this condensed consolidated

half year report.

Condensed consolidated balance sheet

as at 30 November 2018 (unaudited)

30 November 30 November 31 May

2018 2017 2018

Note GBPm GBPm GBPm

----------------------------------- ----- ------------ ------------ -------

Non-current assets

Property, plant and equipment 44.8 45.8 45.7

Intangible assets 22.1 22.8 22.2

Deferred income tax assets 2.8 3.2 3.1

----------------------------------- ----- ------------ ------------ -------

69.7 71.8 71.0

----------------------------------- ----- ------------ ------------ -------

Current assets

Inventories 5.3 4.6 5.7

Trade and other receivables 80.0 68.6 64.1

Cash and cash equivalents 1.0 0.6 0.5

Derivative financial instruments 8 0.2 0.2 0.2

----------------------------------- ----- ------------ ------------ -------

86.5 74.0 70.5

----------------------------------- ----- ------------ ------------ -------

Total assets 156.2 145.8 141.5

----------------------------------- ----- ------------ ------------ -------

Current liabilities

Trade and other payables (74.1) (65.2) (67.5)

Current income tax liabilities (0.4) (0.6) (1.1)

Borrowings 8 - (0.1) (0.1)

Contingent deferred consideration - (0.9) (0.8)

(74.5) (66.8) (69.5)

----------------------------------- ----- ------------ ------------ -------

Non-current liabilities

Borrowings 8 (15.8) (16.8) (6.8)

Deferred income tax liabilities (3.5) (3.3) (3.6)

Retirement benefit obligations (15.4) (19.0) (17.1)

Provisions (0.1) (0.3) (0.1)

----------------------------------- ----- ------------ ------------ -------

(34.8) (39.4) (27.6)

----------------------------------- ----- ------------ ------------ -------

Total liabilities (109.3) (106.2) (97.1)

----------------------------------- ----- ------------ ------------ -------

Net assets 46.9 39.6 44.4

----------------------------------- ----- ------------ ------------ -------

Equity

Share capital 9 12.2 12.2 12.2

Share premium 0.9 0.9 0.9

Retained earnings 33.8 26.5 31.3

----------------------------------- ----- ------------ ------------ -------

Total equity 46.9 39.6 44.4

----------------------------------- ----- ------------ ------------ -------

The notes form an integral part of this condensed consolidated

half year report.

Condensed consolidated statement of changes in equity

for the half year ended 30 November 2018 (unaudited)

Share Share Retained Total

capital premium earnings equity

GBPm GBPm GBPm GBPm

---------------------------------------------- --------- --------- ---------- --------

Balance at 1 June 2017 12.1 0.9 24.7 37.7

---------------------------------------------- --------- --------- ---------- --------

Profit for the period - - 1.5 1.5

Items that will never be reclassified

to profit or loss:

Re-measurement gain on the defined

benefit pension scheme - - 0.5 0.5

Tax on items that will never be reclassified

to profit or loss - - (0.1) (0.1)

---------------------------------------------- --------- --------- ---------- --------

Total comprehensive income for the

period - - 1.9 1.9

---------------------------------------------- --------- --------- ---------- --------

Transactions with owners:

Issue of shares 0.1 - (0.1) -

Value of employee services - - - -

---------------------------------------------- --------- --------- ---------- --------

0.1 - (0.1) -

---------------------------------------------- --------- --------- ---------- --------

Balance at 30 November 2017 12.2 0.9 26.5 39.6

---------------------------------------------- --------- --------- ---------- --------

Profit for the period - - 6.3 6.3

Items that will never be reclassified

to profit or loss:

Re-measurement gain on the defined

benefit pension scheme - - 1.5 1.5

Tax on items that will never be reclassified

to profit or loss - - (0.3) (0.3)

---------------------------------------------- --------- --------- ---------- --------

Total comprehensive income for the

period - - 7.5 7.5

---------------------------------------------- --------- --------- ---------- --------

Transactions with owners:

Dividend paid - - (2.9) (2.9)

Issue of shares - - - -

Value of employee services - - 0.2 0.2

---------------------------------------------- --------- --------- ---------- --------

- - (2.7) (2.7)

---------------------------------------------- --------- --------- ---------- --------

Balance at 31 May 2018 12.2 0.9 31.3 44.4

---------------------------------------------- --------- --------- ---------- --------

Profit for the period - - 1.4 1.4

Items that will never be reclassified

to profit or loss:

Re-measurement gain on the defined

benefit pension scheme - - 1.5 1.5

Tax on items that will never be reclassified

to profit or loss - - (0.3) (0.3)

---------------------------------------------- --------- --------- ---------- --------

Total comprehensive income for the

period - - 2.6 2.6

---------------------------------------------- --------- --------- ---------- --------

Transactions with owners:

Issue of shares - - - -

Value of employee services - - (0.1) (0.1)

---------------------------------------------- --------- --------- ---------- --------

- - (0.1) (0.1)

---------------------------------------------- --------- --------- ---------- --------

Balance at 30 November 2018 12.2 0.9 33.8 46.9

---------------------------------------------- --------- --------- ---------- --------

The notes form an integral part of this condensed consolidated

half year report.

Condensed consolidated cash flow statement

for the half year ended 30 November 2018 (unaudited)

Half year Half year Year

ended ended ended

30 November 30 November 31 May

2018 2017 2018

GBPm GBPm GBPm

------------------------------------------------ ------------- ------------- --------

Cash flows from operating activities

Headline operating profit 2.6 2.4 10.6

Adjustments for:

Depreciation and amortisation 2.3 2.3 4.5

Contributions to pension scheme not recognised

in income statement (0.8) (0.5) (1.3)

Other (0.1) (0.1) 0.1

------------------------------------------------ ------------- ------------- --------

Operating cash flows before movements

in working capital 4.0 4.1 13.9

Movements in working capital:

Decrease/(increase) in inventories 0.4 (0.4) (1.5)

Increase in receivables (15.9) (7.3) (2.8)

Increase in payables 6.6 3.0 5.3

Utilisation of provision - - (0.2)

------------------------------------------------ ------------- ------------- --------

Net cash (absorbed by)/generated from

operations (4.9) (0.6) 14.7

Interest paid (0.2) (0.2) (0.4)

Income tax paid (1.1) (0.4) (1.4)

------------------------------------------------ ------------- ------------- --------

Net cash (absorbed by)/generated from

operating activities (6.2) (1.2) 12.9

------------------------------------------------ ------------- ------------- --------

Cash flows from investing activities

Purchase of intangible assets (0.1) (0.1) (0.2)

Purchase of property, plant and equipment (1.3) (1.5) (2.9)

Payment of contingent consideration (0.8) (0.5) (0.5)

Proceeds on sale of property, plant and

equipment - - 0.2

Net cash absorbed by investing activities (2.2) (2.1) (3.4)

------------------------------------------------ ------------- ------------- --------

Cash flows from financing activities

Increase in bank borrowings 9.0 3.0 (7.0)

Capital element of finance lease and

hire purchase payments (0.1) (0.1) (0.1)

Dividends paid - - (2.9)

------------------------------------------------ ------------- ------------- --------

Net cash generated from/(absorbed by)

financing activities 8.9 2.9 (10.0)

------------------------------------------------ ------------- ------------- --------

Net movement in cash and cash equivalents 0.5 (0.4) (0.5)

Cash and cash equivalents at beginning

of period 0.5 1.0 1.0

------------------------------------------------ ------------- ------------- --------

Cash and cash equivalents at end of period 1.0 0.6 0.5

------------------------------------------------ ------------- ------------- --------

The notes form an integral part of this condensed consolidated

half year report.

Notes to the condensed consolidated half year report

for the half year ended 30 November 2018 (unaudited)

1. General information

NWF Group plc ('the Company') is a public limited company

incorporated and domiciled in the UK under the Companies Act 2006.

The address of its registered office is NWF Group plc, Wardle,

Nantwich, Cheshire CW5 6BP.

The Company has its primary listing on AIM, part of the London

Stock Exchange.

These condensed consolidated interim financial statements

('interim financial statements') were approved by the Board for

issue on 29 January 2019.

These interim financial statements do not constitute statutory

accounts within the meaning of Section 434 of the Companies Act

2006. The interim financial statements for the half years ended 30

November 2018 and 30 November 2017 are neither audited nor reviewed

by the Company's auditors. Statutory accounts for the year ended 31

May 2018 were approved by the Board of Directors on 31 July 2018

and delivered to the Registrar of Companies. The report of the

auditors on those accounts was unqualified, did not contain an

emphasis of matter paragraph and did not contain any statement

under Section 498 of the Companies Act 2006.

2. Basis of preparation and accounting policies

Except as described below, these interim financial statements

have been prepared in accordance with the principal accounting

policies used in the Company's consolidated financial statements

for the year ended 31 May 2018. These interim financial statements

should be read in conjunction with those consolidated financial

statements, which have been prepared in accordance with

International Financial Reporting Standards ("IFRS") as endorsed by

the European Union.

These interim financial statements do not fully comply with IAS

34 'Interim Financial Reporting', as is currently permissible under

the rules of AIM.

Taxes on income in the interim periods are accrued using the tax

rate that would be applicable to expected total annual

earnings.

The triennial actuarial valuation of the Group's defined benefit

pension scheme was completed in the half year ended 30 November

2017, with a deficit of GBP19.1 million at the valuation date of 31

December 2016. In these interim financial statements, this

liability has been updated in order to derive the IAS 19R valuation

as of 30 November 2018. The triennial valuation resulted in Group

contributions of GBP2.1 million per annum, including recovery plan

payments of GBP1.8 million per annum for 11 years from 1 January

2018.

The Directors consider that headline operating profit, headline

profit before taxation and headline earnings per share measures,

referred to in these interim financial statements, provide useful

information for shareholders on underlying trends and performance.

Headline profit before taxation is reported profit before taxation,

after adding back the net finance cost in respect of the Group's

defined benefit pension scheme, and the exceptional items and the

taxation effect thereon where relevant. The calculations of basic

and diluted headline earnings per share are shown in note 7 of

these interim financial statements.

Certain statements in these interim financial statements are

forward looking. The terms 'expect', 'anticipate', 'should be',

'will be' and similar expressions identify forward looking

statements. Although the Board of Directors believes that the

expectations reflected in these forward looking statements are

reasonable, such statements are subject to a number of risks and

uncertainties and actual results and events could differ materially

from those expressed or implied by these forward looking

statements.

The Group has adopted IFRS 9 (Financial Instruments:

Classification and Measurement) and IFRS 15 (Revenue from Contracts

with Customers) in the financial period beginning on 1 June 2018.

IFRS 9 has introduced an expected credit loss model for recognising

impairment of financial assets held at amortised cost. IFRS 15

requires revenue to be recognised when the performance obligations

are satisfied. There were no material changes as a result of

adopting these new standards.

IFRS 16 'Leases' is effective for periods beginning on or after

1 January 2019. For the Group, transition to IFRS 16 will take

place on 1 June 2019. The standard requires lessees to recognise

assets and liabilities for all leases unless the lease term is less

than 12 months, or the asset value is low. The Group has material

operating leases and therefore the adoption of the standard is

expected to have a material impact on the financial statements of

the Group. On adoption of IFRS 16, the Group will recognise a right

of use asset and a lease liability on the balance sheet for all

applicable leases. As a result, there will be a material increase

in gross assets and a corresponding increase in gross liabilities.

Within the income statement, depreciation and interest expense will

increase and operating lease costs will decrease. The net impact on

the income statement has not yet been quantified. The impact of

IFRS 16 will continue to be reviewed to the date of adoption.

3. Segment information

The chief operating decision-maker has been identified as the

Board of Directors ('the Board'). The Board reviews the Group's

internal reporting in order to assess performance and allocate

resources. The Board has determined that the operating segments,

based on these reports, are Fuels, Food and Feeds.

The Board considers the business from a product/services

perspective. In the Board's opinion, all of the Group's operations

are carried out in the same geographical segment, namely the

UK.

The nature of the products/services provided by the operating

segments are summarised below:

Fuels - sale and distribution of domestic heating, industrial and road fuels

Food - warehousing and distribution of customers' ambient

grocery and other products to supermarket and other retail

distribution centres

Feeds - manufacture and sale of animal feeds and other agricultural products

Segment information about the above businesses is presented

below.

The Board assesses the performance of the operating segments

based on a measure of headline operating profit. Finance income and

costs are not included in the segment results which are assessed by

the Board. Other information provided to the Board is measured in a

manner consistent with that in the financial statements.

Inter-segment transactions are entered into under the normal

commercial terms and conditions that would also be available to

unrelated third parties.

Segment assets exclude deferred income tax assets and cash and

cash equivalents. Segment liabilities exclude taxation, contingent

deferred consideration, borrowings and retirement benefit

obligations. Excluded items are part of the reconciliation to

consolidated total assets and liabilities.

Half year ended 30 Fuels Food Feeds Group

November 2018 Note GBPm GBPm GBPm GBPm

------------------------------- ----- ------ ------ ------ ------

Revenue

Total revenue 225.5 24.2 84.3 334.0

Inter-segment revenue (3.1) (0.4) - (3.5)

------------------------------- ----- ------ ------ ------ ------

Revenue 222.4 23.8 84.3 330.5

------------------------------- ----- ------ ------ ------ ------

Result

Headline operating

profit 0.9 1.0 0.7 2.6

Group exceptional item 4 (0.3)

Operating profit as

reported 2.3

Finance costs 5 (0.4)

------

Profit before taxation 1.9

Income tax expense 6 (0.5)

------------------------------- ----- ------ ------ ------ ------

Profit for the period 1.4

------------------------------- ----- ------ ------ ------ ------

Other information

Depreciation and amortisation 0.7 0.8 0.8 2.3

------------------------------- ----- ------ ------ ------ ------

Fuels Food Feeds Group

As at 30 November 2018 GBPm GBPm GBPm GBPm

--------------------------------- ------- ------ ------- --------

Balance sheet

Assets

Segment assets 64.6 32.4 55.4 152.4

--------------------------------- ------- ------ -------

Deferred income tax assets 2.8

Cash and cash equivalents 1.0

--------------------------------- ------- ------ ------- --------

Consolidated total assets 156.2

--------------------------------- ------- ------ ------- --------

Liabilities

Segment liabilities (53.2) (5.3) (15.7) (74.2)

--------------------------------- ------- ------ -------

Current income tax liabilities (0.4)

Deferred income tax liabilities (3.5)

Borrowings (15.8)

Retirement benefit obligations (15.4)

--------------------------------- ------- ------ ------- --------

Consolidated total liabilities (109.3)

--------------------------------- ------- ------ ------- --------

Half year ended 30 Fuels Food Feeds Group

November 2017 Note GBPm GBPm GBPm GBPm

------------------------------- ----- ------ ------ ------ ------

Revenue

Total revenue 201.0 19.8 77.8 298.6

Inter-segment revenue (2.5) (0.3) - (2.8)

------------------------------- ----- ------ ------ ------ ------

Revenue 198.5 19.5 77.8 295.8

------------------------------- ----- ------ ------ ------ ------

Result

Headline operating

profit 1.1 0.9 0.4 2.4

------------------------------- ----- ------ ------ ------

Operating profit as

reported 1.1 0.9 0.4 2.4

Finance costs 5 (0.5)

------

Profit before taxation 1.9

Income tax expense 6 (0.4)

------------------------------- ----- ------ ------ ------ ------

Profit for the period 1.5

------------------------------- ----- ------ ------ ------ ------

Other information

Depreciation and amortisation 0.8 0.7 0.8 2.3

------------------------------- ----- ------ ------ ------ ------

Fuels Food Feeds Group

As at 30 November 2017 GBPm GBPm GBPm GBPm

----------------------------------- ------- ------ ------- --------

Balance sheet

Assets

Segment assets 58.4 31.0 52.6 142.0

----------------------------------- ------- ------ -------

Deferred income tax assets 3.2

Cash and cash equivalents 0.6

----------------------------------- ------- ------ ------- --------

Consolidated total assets 145.8

----------------------------------- ------- ------ ------- --------

Liabilities

Segment liabilities (46.3) (4.2) (15.0) (65.5)

----------------------------------- ------- ------ -------

Current income tax liabilities (0.6)

Deferred income tax liabilities (3.3)

Borrowings (16.9)

Contingent deferred consideration (0.9)

Retirement benefit obligations (19.0)

----------------------------------- ------- ------ ------- --------

Consolidated total liabilities (106.2)

----------------------------------- ------- ------ ------- --------

Fuels Food Feeds Group

Year ended 31 May 2018 Note GBPm GBPm GBPm GBPm

------------------------------- ------- ------ ------ ------ ------

Revenue

Total revenue 406.2 41.0 169.9 617.1

Inter-segment revenue (5.5) (0.6) - (6.1)

------------------------------- ------- ------ ------ ------ ------

Revenue 400.7 40.4 169.9 611.0

------------------------------- ------- ------ ------ ------ ------

Result

Headline operating

profit 6.9 0.7 3.0 10.6

------------------------------- ------- ------ ------ ------

Operating profit as

reported 6.9 0.7 3.0 10.6

Finance costs 5 (0.9)

------

Profit before taxation 9.7

Income tax expense 6 (1.9)

------------------------------- ------- ------ ------ ------ ------

Profit for the year 7.8

------------------------------- ------- ------ ------ ------ ------

Other information

Depreciation and amortisation 1.4 1.6 1.5 4.5

------------------------------- ------- ------ ------ ------ ------

Fuels Food Feeds Group

As at 31 May 2018 GBPm GBPm GBPm GBPm

----------------------------------- ------- ------ ------- -------

Balance sheet

Assets

Segment assets 54.3 30.9 52.7 137.9

Deferred income tax assets 3.1

Cash at bank and in hand 0.5

----------------------------------- ------- ------ ------- -------

Consolidated total assets 141.5

----------------------------------- ------- ------ ------- -------

Liabilities

Segment liabilities (44.7) (4.6) (18.3) (67.6)

----------------------------------- ------- ------ -------

Current income tax liabilities (1.1)

Deferred income tax liabilities (3.6)

Borrowings (6.9)

Contingent deferred consideration (0.8)

Retirement benefit obligations (17.1)

----------------------------------- ------- ------ ------- -------

Consolidated total liabilities (97.1)

----------------------------------- ------- ------ ----------------

4. Profit before taxation - exceptional items

Half year Half year Year

ended ended ended

30 November 30 November 31 May

2018 2017 2018

GBPm GBPm GBPm

------------------ ------------- ------------- --------

GMP equalisation 0.3 - -

Exceptional costs 0.3 - -

------------------ ------------- ------------- --------

On 26 October 2018, the High Court issued a judgement involving

the Lloyds Banking Group defined benefit pension schemes. The

judgement concluded that the schemes should equalise pension

benefits for men and women in relation to guaranteed minimum

pension ("GMP") benefits. The judgement has implications for many

defined benefit schemes, including the NWF Group Benefits

Scheme.

We have worked with our actuarial advisors to understand the

implications of the High Court judgement for the NWF Group Benefits

Scheme and as a result, have recorded a GBP0.3 million pre-tax

exceptional expense to reflect our best estimate of the effect on

our reported pension liabilities.

The change in pension liabilities recognised in relation to GMP

equalisation involves estimation uncertainty. It is expected that

there will be further court hearings to further clarify the

application of GMP equalisation in practice. Also, it is not yet

known whether Lloyds Banking Group will appeal the High Court

judgement. Whilst the financial statements reflect the best

estimate of the impact on pension liabilities reflecting the

information currently available, that estimate reflects several

assumptions. The Directors will continue to monitor any further

clarifications or court hearings arising from the Lloyds Banking

Group case and consider the impact on pension liabilities

accordingly.

The Directors have made the judgement that the estimated effect

of GMP equalisation on the Group's pension liabilities is a past

service cost that should be reflected through the consolidated

income statement and that any subsequent change in the estimate of

that should be recognised in other comprehensive income. The

judgement is based on the fact that the reported pension

liabilities for the NWF Group Benefits Scheme did not previously

include any amount in respect of GMP equalisation.

5. Finance costs

Half year Half year Year

ended ended ended

30 November 30 November 31 May

2018 2017 2018

GBPm GBPm GBPm

--------------------------------------- ------------- ------------- --------

Interest on bank loans and overdrafts 0.2 0.2 0.4

Net finance cost in respect of the

defined benefit pension scheme 0.2 0.3 0.5

--------------------------------------- ------------- ------------- --------

Total finance costs 0.4 0.5 0.9

--------------------------------------- ------------- ------------- --------

6. Income tax expense

The income tax expense for the half year ended 30 November 2018

is based upon management's best estimate of the weighted average

annual tax rate expected for the full financial year ending 31 May

2019 of 20.8% (H1 2017: 20.9%). The exceptional item in respect of

GMP equalisation has not been treated as a tax-deductible expense

as relief will be on a cash paid basis. As a consequence, there

will be a deferred tax impact.

7. Earnings per share

The calculation of basic and diluted earnings per share is based

on the following data:

Half year Half year Year

ended ended ended

30 November 30 November 31 May

2018 2017 2018

GBPm GBPm GBPm

---------------------------------------- -------------- ------------- --------

Earnings

Earnings for the purposes of basic

and diluted earnings per share, being

profit for the period attributable

to equity shareholders 1.4 1.5 7.8

----------------------------------------- ------------- ------------- --------

Half year Half year Year

ended ended ended

30 November 30 November 31 May

2018 2017 2018

000s 000s 000s

--------------------------------------- ------------- ------------- --------

Number of shares

Weighted average number of shares

for the purposes of basic earnings

per share 48,720 48,646 48,658

Weighted average dilutive effect

of conditional share awards (note

9) 30 14 173

--------------------------------------- ------------- ------------- --------

Weighted average number of shares

for the purposes of diluted earnings

per share 48,750 48,660 48,831

--------------------------------------- ------------- ------------- --------

The calculation of basic and diluted headline earnings per share

is based on the following data:

Half year Half year Year

ended ended ended

30 November 30 November 31 May

2018 2017 2018

GBPm GBPm GBPm

------------------------------------ ------------- ------------- --------

Profit for the period attributable

to equity shareholders 1.4 1.5 7.8

Add back:

Net finance cost in respect of the

defined benefit pension scheme 0.2 0.3 0.5

Exceptional items 0.3 - -

Tax effect of the above - (0.1) (0.1)

------------------------------------ ------------- ------------- --------

Headline earnings 1.9 1.7 8.2

------------------------------------ ------------- ------------- --------

8. Financial instruments

The Group's financial instruments comprise cash, bank

overdrafts, invoice discounting advances, obligations under hire

purchase agreements, derivatives and various items such as

receivables and payables, which arise from its operations. There is

no significant foreign exchange risk in respect of these

instruments.

The carrying amounts of all of the Group's financial instruments

are measured at amortised cost in the financial statements, with

the exception of derivative financial instruments being forward

supply contracts. Derivative financial instruments are measured at

fair value subsequent to initial recognition.

The Group classifies fair value measurement using a fair value

hierarchy that reflects the significance of inputs used in making

measurements of fair value. The fair value hierarchy has the

following levels:

-- Level 1 fair value measurements are those derived from

unadjusted quoted prices in active markets for identical assets or

liabilities;

-- Level 2 fair value measurements are those derived from

inputs, other than quoted prices included within Level 1 above,

that are observable for the asset or liability, either directly

(i.e. as prices) or indirectly (i.e. derived from prices); and

-- Level 3 fair value measurements are those derived from

valuation techniques that include inputs for the asset or liability

that are not based on observable market data (unobservable

inputs).

All of the Group's derivative financial instruments were

classified as Level 2 in the current and prior periods. There were

no transfers between levels in both the current and prior

periods.

The book and fair values of financial assets at 30 November 2018

are as follows:

30 November 30 November 31 May

2018 2017 2018

Total book and fair value GBPm GBPm GBPm

--------------------------------------- ------------ ------------ -------

Trade and other receivables 74.5 64.0 61.1

Financial assets carried at amortised

cost: cash and cash equivalents 1.0 0.6 0.5

Financial assets carried at fair

value: derivatives 0.2 0.2 0.2

--------------------------------------- ------------ ------------ -------

Financial assets 75.7 64.8 61.8

--------------------------------------- ------------ ------------ -------

The book and fair values of financial liabilities at 30 November

2018 are as follows:

30 November 30 November 31 May

2018 2017 2018

Total book and fair value GBPm GBPm GBPm

------------------------------------- ------------ ------------ -------

Trade and other payables 74.1 65.2 67.5

Financial liabilities carried

at amortised cost:

Hire purchase obligations repayable

within one year - 0.1 0.1

74.1 65.3 67.6

------------------------------------- ------------ ------------ -------

Floating rate invoice discounting

advances 11.8 12.8 2.8

Revolving credit facility 4.0 4.0 4.0

15.8 16.8 6.8

------------------------------------- ------------ ------------ -------

Financial liabilities 89.9 82.1 74.4

------------------------------------- ------------ ------------ -------

9. Share capital

Number

of shares Total

000s GBPm

----------------------------------- ----------- ------

Allotted and fully paid: ordinary

shares of 25p each

Balance at 31 May 2017 48,644 12.1

Issue of shares (see below) 16 0.1

----------------------------------- ----------- ------

Balance at 30 November 2017 48,660 12.2

Issue of shares - -

----------------------------------- ----------- ------

Balance at 31 May 2018 48,660 12.2

Issue of shares (see below) 90 -

----------------------------------- ----------- ------

Balance at 30 November 2018 48,750 12.2

----------------------------------- ----------- ------

During the half year ended 30 November 2018, 89,920 (H1 2017:

15,900) shares with an aggregate nominal value of GBP22,480 (H1

2017: GBP3,975) were issued under the Company's conditional

Performance Share Plan.

The maximum total number of ordinary shares that may vest in the

future in respect of conditional Performance Share Plan awards

outstanding at 30 November 2018 amounted to 1,216,945 (H1 2017:

1,124,619) shares. These shares will only be issued subject to

satisfying certain performance criteria.

10. Half Year Report

Copies of this Half Year Report are due to be sent to

shareholders on 7 February 2019. Further copies may be obtained

from the Company Secretary at NWF Group plc, Wardle, Nantwich,

Cheshire CW5 6BP, or from the Company's website at

www.nwf.co.uk.

11. 2019 financial calendar

Interim dividend paid 1 May 2019

Financial year end 31 May 2019

Full year results announcement Early August 2019

Publication of Annual Report and Accounts Late August 2019

Annual General Meeting 26 September 2019

Final dividend paid Early December 2019

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR UWVWRKAAAUAR

(END) Dow Jones Newswires

January 29, 2019 02:00 ET (07:00 GMT)

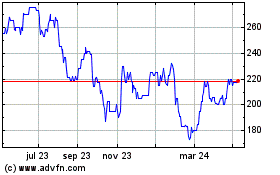

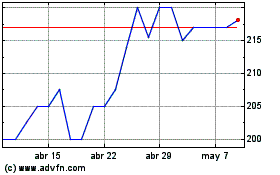

Nwf (LSE:NWF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Nwf (LSE:NWF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024