TIDMPPC

RNS Number : 0823Q

President Energy PLC

15 February 2019

15 February 2019

PRESIDENT ENERGY PLC

("President", "the Company" or "the Group")

New Argentina independently certified reserves report

1P and 2P Neuquen Basin high value reserves increase by 90% and

40% respectively

Substantial increase in Group economic value of 2P reserves to

nearly US$300 million

President Energy (AIM: PPC), the upstream oil and gas company

with a diverse portfolio of production and exploration assets

focused primarily South America, announces its new independently

certified hydrocarbon reserves report on its assets in Argentina

("the Report") calculated as at 31 December 2018.

Report Highlights

-- President's net 1P and 2P reserves in the Neuquén Basin

increased over the previous year by 82% and 41% respectively to

8.1MMboe and 11.4MMboe (y/e 2017 4.5MMboe and 8.0MMboe).

-- Overall Group net 1P reserves in Argentina increased by 6% to

15.4MMboe (y/e 2017 14.5MMboe).

-- The Group's overall net 2P reserves in Argentina show a

decrease to 24.9MMboe (y/e 2017 26.5MMboe). The 2P differences are

due to the reserves in the Salta Province being prudently adjusted

due to deliberately reduced capex activity as the Company focused

on the higher value, value added Rio Negro fields.

-- President's net Argentina 3P reserves increased by 14% to 30.5MMboe (y/e 2017 26.8MMboe)

-- The Neuquen Basin 1P and 2P reserves comprise 81% oil with

the balance being gas but with gas representing only some 3% of

President's current production. Only a limited amount of reserves

are currently attributed to the Las Bases and Puesto Prado

Concessions acquired in December 2018. The reserves in these areas

are expected to grow in 2019 as President implements its capex

plans and, inter alia, significantly increases gas production.

-- The beneficial effect of such emphasis is demonstrated by the

NPV10 value of President's net 1P and 2P Neuquen Basin reserves

increasing by 44% and 22% respectively to US$133 million and US$192

million (y/e 2017 US$92million and US$158 million), the Group's

entire Argentina 2P reserves NPV 10 value increasing by 15% to

US$291 million (y/e 2017 US$253 million) and the 3P Argentina

reserves value increasing by 40% to US361 million (y/w 2017 US$258

million).

-- Combined with Management estimates of value for Louisiana

reserves, the Group's net 2P reserves value calculated on an NPV10

basis ignoring all exploration resources is now nearly US$300

million as at 31 December 2018, representing an approximate 200%

premium to the Company's total enterprise value taking into account

its current market capitalisation and total gross debt of

approximately US$30 million.

Commentary

President has now received from its independent Argentine

regulated reserves auditor the Report over its producing areas in

Argentina including those in the Rio Negro Province, Neuquén Basin

and the Salta Province, North West Basin.

The Report focuses only on producing assets in Argentina and

does not take account of (1) the significant prospective resources

of President's exploration areas in Argentina (2) the Company's

producing hydrocarbon reserves and prospective resources in

Louisiana nor (3) the extensive prospective resources in

President's Paraguay exploration areas.

A table showing the independently certified reserves in

Argentina by Province as well as management estimates of the

Louisiana reserves is set out below.

NET RESERVES TABLE

(MMboe)

1P 2P 3P

Puesto Guardian, Salta 7.3 13.6 16.7

Rio Negro, Neuquen

Basin 8.1 11.4 13.8

Total Argentina 15.4 25 30.5

Louisiana 0.6 0.6 0.6

Group Net reserves 16 25.6 31.1

Note- for the purposes of this table and the reserve figures,

fraction numbers are rounded up if 0.05 or more or down if less

than 0.05.

Peter Levine, Chairman and Group CEO commented:

"The increases in key producing reserves and value in the

Neuquén Basin in Argentina and its higher contribution to entire

Group reserves reflect our successful and continued focus on that

area. The report and our continued cash generation is a clear

vindication of our philosophy of value over volume underpinned by

the success of President's acquisitions policy in the last 18

months and our concentration on margins.

"Accordingly, we remain focused on materially increasing

profitable hydrocarbon production combined with reserves

growth.

"With the benefit of the latest acquisitions made in December,

including the strategic gas pipeline and infrastructure, we are

working diligently towards significantly growing our gas production

this year as well as oil, thereby providing a more balanced energy

portfolio."

Glossary of terms

MMboe millions of barrels of oil equivalent

1P - Proven hydrocarbon reserves

2P - Proven plus Probable hydrocarbon reserves

3P - Proven plus probable plus possible hydrocarbon reserves

NPV10 - Net present value discounted at 10 per cent through the

life of each concession calculated at a flat US$68 per barrel

Reserves use a value of flat US$68 per barrel during the life of

each Concession

Victor Linari, Master in Geology and Member of the Society of

Exploration Geophysicists, who meets the criteria for qualified

persons under the AIM guidance note for mining and gas companies,

has reviewed and approved the technical information contained in

this announcement.

Contact:

President Energy PLC

Peter Levine, Chairman, Chief Executive

Rob Shepherd, Group FD +44 (0) 207 016 7950

finnCap (Nominated Advisor & Joint

Broker)

Christopher Raggett, Scott Mathieson +44 (0) 207 220 0573

Panmure Gordon (Joint Broker)

Charles Lesser, Dominic Morley +44 (0) 207 886 2500

Tavistock (Financial PR)

Nick Elwes, Simon Hudson +44 (0) 207 920 3150

Notes to Editors

President Energy is an oil and gas company listed on the AIM

market of the London Stock Exchange (PPC.L) primarily focused in

Argentina, with a diverse portfolio of operated onshore producing

and exploration assets.

The Company has operated interests in the Puesto Flores,

Estancia Vieja, Puesto Prado and Las Bases Concessions, Rio Negro

Province as well as in the Neuquén Basin of Argentina and in the

Puesto Guardian Concession, in the Noroeste Basin in NW Argentina.

Alongside this, President Energy has cash generative production

assets in Louisiana, USA and further significant exploration and

development opportunities through its acreage in Paraguay and

Argentina.

The Group is also actively pursuing value accretive acquisitions

of high-quality production and development assets in Argentina

capable of delivering positive cash flows and shareholder returns.

With a strong institutional base of support, including the IFC,

part of the World Bank Group, an in-country management team as well

as a Board whose interests are aligned to those of its

shareholders, President Energy gives UK investors rare access to

the Argentinian growth story combined with world class standards of

corporate governance, environmental and social responsibility.

This announcement contains inside information for the purposes

of article 7 of Regulation 596/2014

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCLLFIAFTISLIA

(END) Dow Jones Newswires

February 15, 2019 02:00 ET (07:00 GMT)

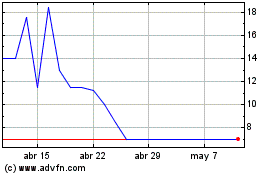

Molecular Energies (LSE:MEN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Molecular Energies (LSE:MEN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024