TIDMPOS

RNS Number : 2904Q

Plexus Holdings Plc

18 February 2019

Plexus Holdings PLC / Index: AIM / Epic: POS / Sector: Oil

equipment & services

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulation (EU) No. 596/2014.

Plexus Holdings PLC ('Plexus' or 'the Company')

Trading Update

Plexus Holdings PLC, the AIM quoted oil and gas engineering

services business and owner of the proprietary POS-GRIP(R)

friction-grip method of wellhead engineering, known for its safety,

time and cost saving capabilities, provides the following update on

trading:

Trading Update

Following the sale of the jack-up rental wellhead exploration

business to TFMC last year (with the exception of Russia and the

CIS territories), the Company has now completed the first half of

the current financial year which will be reported on late March.

Ahead of this, the Company now provides the market with a trading

update for the full year to 30 June 2019 ("FY2019").

The Company's revenues for FY2019 are running broadly in line

with expectations, with Plexus encouraged by an increasing level of

incoming enquiries for its POS-GRIP-enabled products during the

last seven months. It is currently anticipated that EBITDA and LBT

for FY2019 will be below market expectations due to a combination

of lower than anticipated gross margins and higher overheads. The

reduced margins are associated with certain key contracts where the

Company has factored in the importance of showcasing Plexus'

technology, raising its profile and proving it in the field. Higher

overheads have been incurred as the baseline costs for the business

have been refined, with the increase partly due to bringing forward

certain investment costs from the next financial year as the

Company prepares for the possibility of having to service a higher

than expected pipeline of opportunities.

In February 2018 the Company announced that it had completed the

disposal of Plexus' wellhead exploration equipment and services

business for jack-up applications (the "Jack-up Business") and the

licencing of certain intellectual property to TFMC. This

transaction repositioned the Company as an IP-led business with a

range of POS-GRIP related products and services to be developed and

deployed within the wider energy sector, with an initial focus on

surface production opportunities. The initial net proceeds from the

sale of the Jack-up Business left the Company with a strong cash

balance, with further cash payments payable to Plexus subject to

the future performance of the Jack-up Business during a three year

earn out period. This has enabled Plexus to finance the acquisition

of a 49% interest in KMS Ltd (a specialist engineering business),

the buyback of Plexus ordinary shares held by LLC Gusar (OOO Gusar)

and provided the flexibility for the Company's accelerated

expenditure for growth in recent months. The Company's cash

position remains strong, although as a result of the lower gross

margin and higher expenses noted previously, together with the KMS

Ltd investment and recent share buyback from Gusar it is expected

that the Company's cash balance at the end of FY2019 will be lower

than previously anticipated.

Strategy

Plexus' long-term goal is to establish POS-GRIP technology as a

new industry standard for wellhead and metal-to-metal sealing

designs, whilst continuing to develop a range of new Plexus

products, which can also offer multiple benefits and advantages to

the industry in terms of improved safety, performance, and

operational cost and time savings.

Having proven the significant advantages of Plexus POS-GRIP

wellheads for jack-up rental wellhead exploration applications to a

wide range of mostly international oil companies and having

completed the sale of the Jack-up Business to TFMC last year,

Plexus is now focused on extending its business activities into the

volume surface production and subsea exploration and production

sectors. An example of product extensions for POS-GRIP technology

is the Company's connector technology which is ideal for high

integrity, low fatigue applications. The Directors believe wellhead

connectors, riser connectors, subsea jumper connectors, pipeline

connectors, tether tensioners and even vessel mooring connectors

can all benefit from the simplicity of POS-GRIP. The simplicity of

Plexus' technology and its ability to deliver unequalled levels of

integrity mean also that target markets can include decommissioning

and abandonment such as with the Company's POS-SET(TM) Connector

product recently supplied to Oceaneering.

The sale of the Jack-up Business to TFMC represented a clear

endorsement of Plexus' proprietary technology and marked a

significant strategic step for the Company, whilst leaving Plexus

in a position to continue to participate in the major Russian

hydrocarbon market through its licensee Gusar where encouraging

progress is being made. At the same time the transaction realigned

Plexus as an IP-led research and development business and enables

greater resources and focus to be directed to the development of

new and existing POS-GRIP applications outside of jack-up

exploration drilling, including through the collaboration agreement

signed with TFMC, which establishes a framework for the two parties

to work together on potential new applications.

Importantly Plexus believes that as the world moves increasingly

towards gas production and consumption, the need for gas-proof

wellhead metal sealing technology (and in due course valve

technology) is more critical than ever, especially in terms of

containing the toxic nature of methane leakage which is coming

under increased scrutiny from oil company investors, as well as the

Green lobby. The Directors believe this lies behind a heightened

level of interest in the Company's surface production technology.

The Saudi Arabian energy minister only recently underlined this

trend when he said that their efforts will be focused on creating a

"global gas" business, as many of the world's energy majors are

increasingly investing in gas, as the growth of demand outpaces

that for oil. The Company is therefore pursuing its strategy of

gaining market share in the mainstream production sector both

organically (as highlighted by the Spirit Energy production

wellhead order in late 2017 which is in the process of being

drilled now) and through licensees and partners.

Plexus' CEO Ben Van Bilderbeek said, "We believe that the

Company's short-term financial performance should not be seen as

the key performance indicator, with the critical strategic goal

being the continued and growing interest in Plexus' POS-GRIP

technology.

The difference between market expectations and the likely

reported full year numbers is in part due to investments that we

have and will be making over the course of the period in support of

the growth strategy we have been working on post the sale of our

jack-up rental wellhead exploration business to TechnipFMC in 2018.

The TFMC transaction has ensured that we have the capital and time

to re-invent our business, particularly in respect of surface

production wellhead opportunities. Our overall objective therefore

is to establish our 'gas proof' POS-GRIP equipment as an enabling

technology for the wider energy industry. Our strategy to achieve

our goal is centred on securing orders for our suite of POS-GRIP

products for applications outside of jack-up exploration, and in

particular surface production and abandonment operations; designing

and developing, both organically and with partners,

POS-GRIP-enabled products for new markets such as geothermal and

renewables; and supporting our Russian partner's efforts to secure

a major order for POS-GRIP equipment in the country.

"In line with the above and in response to a higher level of

enquiries we are receiving from around the world than previously

envisaged at this stage, we have brought forward expenditure from

the next financial year so that we are able to accommodate a

potential uptick in activity levels. Furthermore, we believe the

higher costs than originally anticipated associated with the supply

of the two wellheads and associated equipment sold to Gusar will

prove to be a worthwhile investment, as it has the potential to

bring forward the point at which our partner secures its first

major order for a POS-GRIP wellhead in the major Russian market.

Set against a backdrop of oil prices trading around the US$60 per

barrel level and the resultant higher levels of drilling activity,

the growing importance of natural gas in the hydrocarbon fuel mix,

and increasing calls for the energy industry to tackle gas and in

particular methane leaks, this is an exciting period for Plexus and

I look forward to providing further details in the upcoming half

yearly report."

**S**

For further information please visit www.posgrip.com or

contact:

Ben van Bilderbeek Plexus Holdings PLC Tel: 020 7795 6890

Graham Stevens Plexus Holdings PLC Tel: 020 7795 6890

Derrick Lee Cenkos Securities PLC Tel: 0131 220 9100

Frank Buhagiar St Brides Partners Ltd Tel: 020 7236 1177

Isabel de Salis St Brides Partners Ltd Tel: 020 7236 1177

NOTES:

AIM-traded oil and gas engineering services company Plexus (AIM:

POS) is an IP-led company that has developed a range of products

and applications based on its patent-protected POS-GRIP

friction-grip technology. Having proved the superior qualities of

POS-GRIP within the jack-up wellhead exploration market through the

sale of this business to FMC Technologies Limited, a subsidiary of

TechnipFMC (Paris:FTI, NYSE:FTI) (jointly "TFMC"), in early 2018,

the Company is now focused on establishing its technology and

equipment in other markets including surface production wellheads,

subsea and de-commissioning.

Its suite of ongoing products and applications include: "HG"(TM)

Wellheads, which combine POS-GRIP Technology with Gas Tight metal

sealing; the Python(R) Subsea Wellhead (a new standard for subsea

wellheads - developed in a JIP supported by Royal Dutch Shell, BG

(now owned by Shell), Wintershall, Total, Maersk (now owned by

Total), Tullow Oil, eni, Senergy (now Lloyds register), and Oil

States Industries Inc); the POS-SET(TM) Connector for the growing

de-commissioning and abandonment market; and Tersus-PCT, an

innovative HP/HT Tie-Back connector product. Importantly, the

Company also has a Collaboration Agreement with TFMC, which

provides a platform to further develop and commercialise these and

other applications based on its POS-GRIP technology.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTLFFSVFLIDLIA

(END) Dow Jones Newswires

February 18, 2019 02:00 ET (07:00 GMT)

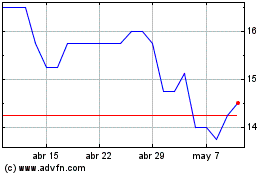

Plexus (LSE:POS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Plexus (LSE:POS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024