TIDMPYC

RNS Number : 6587Q

Physiomics PLC

21 February 2019

Physiomics Plc

("Physiomics" or "the Company")

Interim Results Statement

for the six-month period ended 31 December 2018

Oxford, UK, 21 February 2019: The Board of Physiomics Plc, a

provider of technology-based solutions to predict the effects of

cancer treatment regimens for the biopharma industry (AIM: PYC),

today announces its financial results for the six months ended 31

December 2018.

Physiomics' Virtual Tumour(TM) is a sophisticated computer model

that simulates tumour cell division and predicts the effect of

different anti-cancer regimes to support pre-clinical and clinical

oncology development programs. Virtual Tumour(TM) helps customers

to balance efficacy and toxicity and to prioritise the most

effective drug combinations while reducing time and cost.

Summary financial results

-- Total income* GBP372k (H1 2017: GBP142k)

-- Operating loss GBP113k (H1 2017: GBP220k)

-- Cash and cash equivalents of GBP552k at 31 December 2018 (31 December 2017: GBP166k)

-- Shareholders' funds of GBP639k at 31 December 2018 (31 December 2017: GBP190k)

* Total income for the six months ended 31 December 2018

includes other operating income which is grant income of GBP48k (H1

2017: GBP68k)

Operational highlights

Key events in the period include:

-- Announcement that the Company had increased its capacity to

deliver client projects with the addition of a new member of its

technical project team;

-- Announcement of a contract award expected to be worth

approximately GBP55,000 with a new European biotech client; and

-- Announcement that Merck had signed contracts with Physiomics

for services to the value of GBP435,000 expected to be completed

during calendar year 2019.

Chairman and CEO's statement

Introduction

The Company is pleased to report a strong first half year

culminating with the announcement in December 2018 of the renewal

of its deal with long-term client Merck. The Company continues to

focus on increasing awareness amongst potential clients and

building its pipeline of new business.

The total income for the period increased 162% to GBP372k

compared with GBP142k in the comparable prior period. Total income

for the period comprised the second half of the 2018 Merck

projects, revenues from new clients announced during the calendar

year and grant income from Innovate UK.

Expenses for the half year increased to GBP485k compared with

GBP362k for the comparable prior period, mainly due to the cost of

new staff, increased use of consultants and increased spend on

marketing and conferences. Total expenses were in line with

internal forecasts and with the use of funds stated during the

Company's placing in May 2018. The investments in staff and

consultants increases the Company's capacity to service client

business and the investment in marketing is helping to build our

pipeline of future business. Despite this increased spend, the

operating loss for the half year narrowed by 49% to GBP113k

compared with GBP220k in the comparable prior period and the loss

after tax narrowed 67% to GBP64k compared with GBP192k in the

comparable prior period. Cash and equivalents increased

significantly to GBP552k at 31 December 2018, compared with GBP166k

at 31 December 2017 and are relatively unchanged from GBP572k at 30

June 2018.

Business strategy

The Company continues to work in two distinct areas. Our core

business remains the provision of services to companies developing

cancer drugs, where Physiomics can bring decades of experience to

bear on clients' challenges. Our work using Virtual Tumour(TM) has

been used by clients in discussions with regulators and to help

them design their early clinical trials.

During the second half of its financial year the Company plans

to engage additional business development support, strengthen its

online and social media presence and develop collateral such as

publications and case studies that can be leveraged across all

these channels. The Company will attend key conferences, including

the American Association for Cancer Research annual conference (29

March 2019 to 3 April 2019 in Atlanta, Georgia) where we will once

again be presenting. We hope to see these marketing activities bear

fruit in the form of new clients during this period. The Directors

believe that a combination of our new hire in July 2018 and

increased use of our flexible consultants will enable us to manage

the expected workload. The Company, at the current time, stands

ready to recruit new team members if required.

In parallel with our core commercial activities we are close to

completing our most recent Innovate UK grant funded project focused

on the personalised treatment of prostate cancer. This feasibility

project involves the use of artificial intelligence techniques

(such as neural networks and other machine learning techniques) to

develop an online tool that could, if approved, be used in

hospitals and clinics to support personalised dosing of the

commonly used chemotherapy drug docetaxel and improve outcomes for

prostate cancer patients. Physiomics is in discussions with a

number of organisations about how it might validate and seek

regulatory approval for this tool, with a view to either partnering

the technology or developing it further in-house.

Outlook

Building on the momentum generated by existing and new contracts

as well as success in attracting grant funding in calendar year

2018, we are looking forward to what the Directors believe will be

a strong second half, underpinned by contracts already secured, and

look forward to providing further updates on business activities to

the market going forwards.

For further information please contact:

Physiomics Plc

Dr Jim Millen

+44 (0)1865 784980

WH Ireland Limited (nomad)

Katy Mitchell

James Sinclair-Ford

+44 (0) 161 832 2174

Hybridan LLP (broker)

Claire Louise Noyce

+44 (0) 203 764 2341

Physiomics Plc

Unaudited Statement of Comprehensive Income for the half year ended 31 December 2018

Unaudited Unaudited Audited

Half year to Half year to Year ended

31-Dec-18 31-Dec-17 30-Jun-18

GBP'000 GBP'000 GBP'000

Revenue 324 74 428

Other operating income 48 68 85

Total income 372 142 513

Operating expenses (485) (362) (773)

Operating loss and loss before taxation (113) (220) (260)

UK corporation tax 49 28 77

Loss for the period attributable to equity shareholders (64) (192) (183)

------------- ------------- -------------

Loss per share (pence)

Basic and diluted (0.09) p (0.34) p (0.31) p

Physiomics Plc

Unaudited Statement of financial position as at 31 December 2018

Unaudited Unaudited Audited

As at As at As at

31-Dec-18 31-Dec-17 30-Jun-18

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 19 5 5

19 5 5

Current assets

Trade and other receivables 269 236 241

Cash and cash equivalents 552 166 572

821 402 813

Total assets 840 407 818

---------- ------------- -------------

Current liabilities

Trade and other payables (61) (217) (60)

Deferred revenue (140) - (68)

---------- ------------- -------------

Total liabilities (201) (217) (128)

---------- ------------- -------------

Net assets 639 190 690

---------- ------------- -------------

Capital and reserves

Share capital 1,181 1,128 1,181

Capital reserves 5,411 4,959 5,398

Profit & loss account (5,953) (5,897) (5,889)

Equity shareholders' funds 639 190 690

---------- ------------- -------------

Physiomics Plc

Unaudited Statement of changes in equity for the half year ended 31 December 2018

Share Share-based Total

Share premium compensation Retained shareholders'

capital account reserve earnings funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July 2017 1,121 4,753 159 (5,705) 328

Share issue (net of costs) 7 47 - - 54

Loss for the period - - - (192) (192)

At 31 December 2017 1,128 4,800 159 (5,897) 190

Share issue (net of costs) 53 428 - - 481

Transfer to other reserves - - 11 - 11

Profit for the period - - - 8 8

At 30 June 2018 1,181 5,228 170 (5,889) 690

Transfer to other reserves - - 13 - 13

Loss for the period - - - (64) (64)

At 31 December 2018 1,181 5,228 183 (5,953) 639

Physiomics Plc

Unaudited Cash Flow Statement for the half year ended 31 December 2018

Unaudited Unaudited Audited

Half year to Half year to Year ended

31-Dec-18 31-Dec-17 30-Jun-18

GBP'000 GBP'000 GBP'000

Cash flows from operating activities:

Operating loss (113) (220) (260)

Amortisation and depreciation 3 2 3

Share-based compensation 13 0 11

(Increase) decrease in receivables (30) (84) (40)

Increase / (decrease) in payables 5 (3) (27)

Increase / (decrease) in deferred revenue 72 133 68

Cash generated from operations (50) (172) (245)

UK corporation tax received 47 75 75

Net cash generated from operating activities (3) (97) (170)

Cash flows from investing activities:

Purchase of non-current assets, net of grants received (17) (1) (2)

Net cash used by investing activities (17) (1) (2)

------------- ------------- -----------

Cash outflow before financing (20) (98) (172)

Cash flows from financing activities:

Issue of ordinary share capital (net of costs) 0 54 534

Net cash from financing activities 0 54 534

------------- ------------- -----------

Net (decrease) / increase in cash and cash equivalents (20) (44) 362

Cash and cash equivalents at beginning of period 572 210 210

Cash and cash equivalents at end of period 552 166 572

------------- ------------- -----------

Physiomics Plc

Notes to the Interim Financial Statements

1. General information

Physiomics Plc is a public limited company ("the Company")

incorporated in England & Wales (registration number 4225086).

The Company is domiciled in the United Kingdom and its registered

address is The Magdalen Centre, Robert Robinson Avenue, The Oxford

Science Park, Oxford, OX4 4GA. The Company's ordinary shares are

traded on the AIM Market of the London Stock Exchange ("AIM").

Copies of the interim report are available from the Company's

website, www.physiomics-plc.com. Further copies of the Interim

Report and Annual Report and Accounts may be obtained from the

address above.

The Company's principal activity is the provision of services to

pharmaceutical companies in the area of outsourced systems and

computational biology.

2. Basis of preparation

The interim financial statements of the Company for the six

months ended 31 December 2018, which are unaudited, have been

prepared in accordance with the accounting policies set out in the

annual report and accounts for the year ended 30 June 2018, which

were prepared under International Financial Reporting Standards

("IFRS").

The financial information contained in the interim report does

not constitute statutory accounts as defined in Section 435 of the

Companies Act 2006. The financial information for the full

preceding year is based on the statutory accounts for the year

ended 30 June 2018. Those accounts, upon which the auditors,

Shipleys LLP, issued a report which was unqualified but contained

an emphasis of matter paragraph, have been delivered to the

Registrar of Companies.

As permitted, this interim report has been prepared in

accordance with the AIM Rules for Companies and not in accordance

with IAS 34 "Interim Financial Reporting" therefore it is not fully

compliant with IFRS.

The interim financial statements are presented in sterling and

all values are rounded to the nearest thousand pounds (GBP'000)

except when otherwise indicated.

3. Loss per share

Basic loss per share is 0.09p (H1 2017: loss per share 0.34p).

The basic loss per ordinary share is calculated by dividing the

loss of GBP63,935 (H1 2017: loss GBP191,934) by 71,910,394 (H1

2017: 57,180,002), the weighted average number of shares in issue

during the period.

The loss attributable to equity holders (holders of ordinary

shares) of the Company for calculating the fully diluted loss per

share is identical to that used for calculating the loss per share.

The exercise of share options would have the effect of reducing the

loss per share and is therefore anti- dilutive.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR EAKAEADPNEFF

(END) Dow Jones Newswires

February 21, 2019 02:00 ET (07:00 GMT)

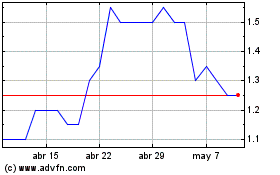

Physiomics (LSE:PYC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Physiomics (LSE:PYC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024