ADRs End Slightly Higher; AstraZeneca, BT Group and Diageo Trade Actively

26 Febrero 2019 - 4:59PM

Noticias Dow Jones

International stocks trading in New York closed slightly higher

Tuesday.

The BNY Mellon index of American depositary receipts rose 0.2%

to 141.14. The European index increased 0.4% to 129.40. The Asian

index was nearly flat at 166.51. The Latin American index rose 0.3%

to 252.51. And the emerging-markets index remained flat at

313.42.

AstraZeneca PLC (AZN), BT Group PLC (BT) and Diageo PLC (DEO)

were among those with ADRs that traded actively.

AstraZeneca's Chief Executive Pascal Soriot told senators that

the company would be prepared to reduce its list prices by an

equivalent amount to the behind-the-scenes discounts that it offers

insurers and other middlemen, less the fees attached to them. That

move would be an extraordinary cut in prices; these discounts,

known as rebates, averaged around 50% of gross revenue, Dr. Soriot

said in his testimony. Still, that promise only would hold under a

sweeping overhaul of the drug-pricing system, according to the

AstraZeneca chief. ADRs of AstraZeneca rose 1.2% to $41.98.

BT Group shareholders risk a dividend cut when CEO Philip Jansen

unveils in May his strategy for the British telecommunications

company, Berenberg says. "We believe he will outline a

pro-investment, pro-growth vision and repair political and

regulatory relations at the start of his tenure. We do not think BT

has the cash flow to be able to do this without risk to the

dividend," analysts at the investment bank say. Prioritizing

investment over the dividend may be right for the company's

long-term interests, but its share price is too expensive to be

patient, the bank says. Berenberg cuts the stock to hold from buy.

ADRs of BT Group fell 1.7% to $14.79.

Diageo said Tuesday that it approached China's Sichuan

Shuijingfang Company Ltd. with a proposal to increase its stake in

the company to 70% from 60%. The stake increase would be achieved

through a partial tender offer at 45.00 Chinese yuan ($6.72) a

share, the FTSE 100 beverage company said. Diageo said the outlined

proposal doesn't constitute an offer and creates no obligation to

make an offer. The proposal is still under discussion and there is

no certainty any offer will be made, the owner of Johnnie Walker

whisky and Tanqueray gin brands said. ADRs of Diageo rose 0.4% to

$157.01.

(END) Dow Jones Newswires

February 26, 2019 17:44 ET (22:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

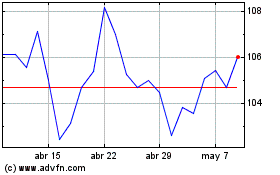

Bt (LSE:BT.A)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

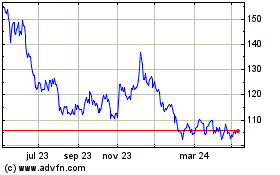

Bt (LSE:BT.A)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024