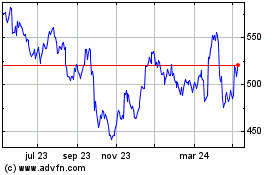

TIDMPHNX

RNS Number : 8542R

Phoenix Group Holdings PLC

05 March 2019

Phoenix Group announces strong results after a transformational

year. New cash generation targets set and synergy target increased

by GBP500 million to GBP1.2 billion

Phoenix Group, Europe's largest life and pensions

consolidator(1) , today announces a strong set of results for the

year ended 31 December 2018.

2018 Highlights

-- GBP664 million of cash generation(2) in 2018 (2017: GBP653

million). The Group has delivered GBP1.3 billion cash generation in

2017 and 2018, exceeding the upper end of its cash generation

target range of GBP1.0 billion - GBP1.2 billion for this

period.

-- Solvency II surplus of GBP3.2 billion(3) as at 31 December

2018 (GBP2.5 billion pro-forma as at 31 December 2017).

-- Shareholder Capital Coverage Ratio of 167%(4) as at 31

December 2018 (147% pro-forma as at 31 December 2017).

-- Proposed final dividend of 23.4p per share, a 3.5% increase

on the 2017 final dividend.

-- Group operating profit of GBP708 million (2017: GBP368

million).

-- Assets under administration of GBP226 billion as at 31

December 2018 (31 December 2017 pro-forma: GBP240 billion). Net

business inflows of GBP3.9 billion on UK Open and European

businesses.

-- New business contribution(5) of GBP154 million (2018

pro-forma) demonstrates value accretive nature of Open new business

in the UK and Europe.

-- Fitch Ratings affirmed the Group's ratings at A+(6) ;

"stable" outlook. Leverage ratio 22%(7) .

New cash generation targets

-- 2019 cash generation target of GBP600 - GBP700 million(8)

.

-- Long-term cash generation target for 2019 - 2023 of GBP3.8

billion.

Acquisition of the Standard Life Assurance businesses

-- Acquisition of the Standard Life Assurance businesses

completed on 31 August 2018.

-- Total synergy target (net of GBP150 million transition costs)

increased by GBP500 million from GBP720 million to GBP1,220

million:

- Capital synergies new target of GBP720 million (increased from

GBP440 million); with GBP500 million delivered to date; and

- Capitalised cost synergies new target of GBP650 million

(increased from GBP415 million); reflecting an increase from GBP50

million to GBP75 million per annum.

Delivering on strategic priorities

-- Successfully entered bulk purchase annuity market contracting

GBP0.8 billion of liabilities in 2018.

-- AXA and Abbey Life integrations completed ahead of plan and

targets, delivering cost synergy benefits of GBP27 million per

annum and cumulative cash generation of GBP968 million.

-- Diligenta selected as Phoenix's partner to deliver a single,

digitally enhanced outsourcer platform to a further 2 million

legacy-Phoenix policies.

-- Brexit preparations complete.

-- On-shoring project completed with UK plc in place.

Commenting on the results, Group CEO, Clive Bannister said:

"2018 was a very successful year for Phoenix in which we

exceeded our cash generation targets, further improved our capital

resilience and transformed the business through the acquisition of

the Standard Life Assurance businesses.

These results show the strength of our Group and have enabled us

to again increase our short and long term cash generation

targets.

The transition of the Standard Life Assurance businesses

continues to progress well and today we increase the total cost and

capital synergy target by 70% from GBP720 million to GBP1.2

billion. Our end state operating model will incorporate the best of

both legacy businesses and our management bench strength and

strategic options as a combined Group have increased

significantly.

Phoenix's substantial new business flows across both our

Heritage and Open businesses through our Strategic Partnership with

Standard Life Aberdeen bring increased sustainability to our long

term cash generation. We are confident about our opportunities to

grow in the future both organically and through BPA and

acquisitions."

Presentation

There will be a presentation for analysts and investors today at

8.30am (GMT) at:

J.P. Morgan, 1 John Carpenter Street, London, EC4Y 0JP

A link to a live webcast of the presentation, with the facility

to raise questions, and a copy of the presentation will be

available at www.thephoenixgroup.com

Participants may also dial in as follows:

Dial-in number: +44 20 3059 5868

Title of call: Phoenix Full Year Results

Please dial in 10 minutes prior to the beginning of the conference

call in order to register.

A replay of the presentation will also be available through the

website.

Dividend

The recommended final dividend of 23.4p per share is expected to

be paid on 7 May 2019, subject to shareholder approval at Phoenix

Group Holdings plc's AGM on 2 May 2019.

The ordinary shares will be quoted ex-dividend on the London

Stock Exchange as of 21 March 2019. The record date for eligibility

for payment will be 22 March 2019.

Enquiries

Investors/analysts:

Claire Hawkins, Head of Investor Relations, Phoenix Group

+44 (0)20 3735 0575

Media:

Andy Donald and Vikki Kosmalska, Maitland + 44 (0) 20 7379

5151

Shellie Wells, Head of Corporate Communications, Phoenix

Group

+44 (0) 203 735 0922/ +44 7872 414137

Notes

1. Phoenix Group is the largest life and pensions consolidator

in Europe with 10.0 million policies and GBP226 billion of assets

under administration.

2. Cash generation is a measure of cash and cash equivalents,

remitted by the Group's operating subsidiaries to the holding

companies and is available to cover dividends, debt interest, debt

repayments and other items.

3. The Solvency II capital position is an estimated position and

includes the impact of a regulator approved recalculation of

transitionals for Standard Life Assurance Limited only. Had a

dynamic recalculation of transitionals been assumed for the Phoenix

Life companies, the Solvency II Surplus and the Shareholder Capital

Coverage ratio would increase by GBP0.1 billion and 3%

respectively.

4. The Shareholder Capital Coverage Ratio of 167% excludes

Solvency II Own Funds and Solvency Capital Requirements of

unsupported with-profit funds and the PGL Pension Scheme.

5. New business contribution is the increase in Solvency II Own

Funds arising from new business written in the period excluding

risk margin and contract boundary restrictions.

6. Insurer Financial Strength rating of Phoenix Life Limited,

Phoenix Life Assurance Limited and Standard Life Assurance

Limited.

7. Current leverage ratio of 22% estimated by management.

8. 2019 cash generation target is net of the GBP250 million cost

of capitalising Standard Life International Designated Activity

Company for Brexit.

9. This announcement in relation to Phoenix Group Holdings plc

and its subsidiaries (the 'Group') contains, and we may make other

statements (verbal or otherwise) containing, forward-looking

statements and other financial and/or statistical data about the

Group's current plans, goals and expectations relating to future

financial conditions, performance, results, strategy and/or

objectives.

10. Statements containing the words: 'believes', 'intends',

'will', 'may', 'should', 'expects', 'plans', 'aims', 'seeks',

'targets', 'continues' and 'anticipates' or other words of similar

meaning are forward-looking. Such forward-looking statements and

other financial and/or statistical data involve risk and

uncertainty because they relate to future events and circumstances

that are beyond the Group's control. For example, certain insurance

risk disclosures are dependent on the Group's choices about

assumptions and models, which by their nature are estimates. As

such, actual future gains and losses could differ materially from

those that the Group has estimated.

11. Other factors which could cause actual results to differ

materially from those estimated by forward-looking statements

include but are not limited to: domestic and global economic and

business conditions; asset prices; market related risks such as

fluctuations in interest rates and exchange rates, the potential

for a sustained low-interest rate environment, and the performance

of financial markets generally; the policies and actions of

governmental and/or regulatory authorities, including, for example,

new government initiatives related to the financial crisis and the

effect of the European Union's "Solvency II" requirements on the

Group's capital maintenance requirements; the impact of inflation

and deflation; the political, legal and economic effects of the

UK's vote to leave the European Union; market competition; changes

in assumptions in pricing and reserving for insurance business

(particularly with regard to mortality and morbidity trends, gender

pricing and lapse rates); the timing, impact and other

uncertainties of future acquisitions or combinations within

relevant industries; risks associated with arrangements with third

parties; inability of reinsurers to meet obligations or

unavailability of reinsurance coverage; the impact of changes in

capital, solvency or accounting standards, and tax and other

legislation and regulations in the jurisdictions in which members

of the Group operate.

12. As a result, the Group's actual future financial condition,

performance and results may differ materially from the plans, goals

and expectations set out in the forward-looking statements and

other financial and/or statistical data within this announcement.

The Group undertakes no obligation to update any of the

forward-looking statements or data contained within this

announcement or any other forward-looking statements or data it may

make or publish. Nothing in this announcement should be construed

as a profit forecast or estimate.

Cash resilience growth

A sustainable phoenix

Annual report and accounts 2018

2018 was transformational for Phoenix as we delivered cash,

resilience and growth.

With the restructuring of the life and pensions industry, we are

in a position to take advantage of further opportunities.

The successful acquisition of the standard life assurance

businesses has allowed us to evolve from being a heritage business

to one that extends to open business and Europe.

This has enhanced the sustainability of the group and will

propel us towards our new vision To become Europe's Leading Life

Consolidator.

More information online at www.thephoenixgroup.com

PHOENIX GROUP AT A GLANCE

OUR VISION

Become Europe's Leading Life Consolidator.

OUR PURPOSE

Inspire confidence in the future.

OUR MISSION

Improve outcomes for customers and deliver value for

shareholders.

WHAT WE DO

As the largest life and pensions consolidator in Europe, Phoenix

specialises in the acquisition and management of closed life

insurance and pension funds. We call this our Heritage

business.

Transactions in the bulk purchase annuity market offer a

complementary source of growth for the Group and the management

actions we deliver help increase and accelerate cash flows.

Alongside this, we have an Open business which manufactures and

underwrites new products and policies to support people saving for

their future in areas such as workplace pensions and self-invested

personal pensions. This Open business is supported by the Strategic

Partnership with Standard Life Aberdeen plc following our

acquisition of Standard Life Assurance Limited in 2018. We also

have a market leading brand - SunLife - which sells a range of

financial products specifically for the over 50's market

Read more on our operating structure and business model on P8

and 14

Read more on our marketplace on P12

OUR LOCATIONS

STRATEGIC REPORT

Phoenix Group at a glance IFC

Chairman's Statement 2

Group Chief Executive Officer's Report 4

Our Operating Structure 8

Our Key Products 9

Our Business Segments 10

The Marketplace 12

Business Model 14

Our Strategy and KPIs 18

Business Review 28

Risk Management 39

Stakeholder Engagement 47

CORPORATE GOVERNANCE

Chairman's Introduction 60

Board Structure 61

Board of Directors 62

Executive Management Team 64

Corporate Governance Report 65

Directors' Remuneration Report 76

Directors' Report 106

Statement of Directors' Responsibilities 110

FINANCIALS

Independent Auditor's Report 112

IFRS Consolidated Financial Statements 122

Notes to the Consolidated Financial

Statements 129

Parent Company Accounts 214

Notes to the Parent Financial Statements 216

Additional Life Company Asset Disclosures 222

Additional Capital Disclosures 228

Alternative Performance Measures 230

Additional information

Stakeholder Information 232

Forward-looking Statements 233

Glossary 234

Key performance indicators

GBP664m

OPERATING COMPANIES' CASH GENERATION

APM REM

GBP3.2bn

PGH Solvency II SURPLUS (ESTIMATED)

167%

PGH Shareholder capital coverage ratio (estimated)

APM

23.4p

Final dividend per share

GBP708m

Operating profit

APM

93%

Customer satisfaction score(1)

OTHER PERFORMANCE INDICATORS

GBP410m

IFRS profit after tax

GBP226bn

ASSETS UNDER ADMINISTRATION

APM

GBP154m

NEW BUSINESS CONTRIBUTION(2) APM

22%

Financial lEVERAGE RATIO(3)

APM

Read more on P28

All amounts throughout the report market with 'REM' are KPI's

linked to Executive Remuneration.

See Directors' Remuneration Report P76

All amounts throughout the report marked with 'APM' are

alternative performance measures.

1 Phoenix Life score only.

2 On a pro forma basis as if the Standard Life Assurance

acquisition took place on 1 Jan 2018

3 As calculated by Phoenix on a Fitch Ratings basis.

OUR STRATEGIC PRIORITIES

01

IMPROVE CUSTOMER OUTCOMES

02

DRIVE VALUE

03

MANAGE CAPITAL

04

ENGAGE People

Read more on our strategic priorities P18

OUR THREE Main BUSINESS SEGMENTS

UK HERITAGE

With-profits

Unit linked

Annuities

Protection

UK OPEN

Unit linked:

Workplace

Retail pension

Wrap

Protection:

SunLife over 50s

EUROPE

Ireland:

Unit linked

With-profits

Annuities

Germany:

With-profit

Unit linked

OUR KEY PRODUCTS*

With-profits GBP56bn

Unit linked GBP145bn

Non-Profit (Annuities) GBP19bn

Non-Profit (Protection) GBP3bn

* Based on assets under administration.

Our main business segments*

UK Heritage GBP118bn

----------- --------

UK Open GBP85bn

Europe GBP23bn

* Based on assets under administration.

OUR BRANDS

All amounts throughout the report marked with 'APM' are

alternative performance measures.

Read more on P230

All amounts throughout the report market with 'REM' are KPIs

linked to Executive Remuneration

See Directors' Remuneration Report P76

CHAIRMAN'S STATEMENT

"The acquisition of the Standard Life Assurance businesses in

2018 was transformational for Phoenix. We are now Europe's largest

life and pensions consolidator."

Nicholas Lyons

CHAIRMAN

DEAR SHAREHOLDERS,

I joined Phoenix as Chairman at a pivotal moment in the Group's

history. 2018 was a defining year for the Group marked by

outstanding strategic delivery and strong financial

performance.

On 31 August, Phoenix completed the GBP2.9 billion acquisition

of the Standard Life Assurance businesses and entered into a

Strategic Partnership with Standard Life Aberdeen. This transaction

established the Group as the largest life and pensions consolidator

in Europe with GBP226 billion of assets under administration and 10

million policies as at 31 December 2018. Not only did the

acquisition bring additional scale to the Group's Heritage

business, but Phoenix also acquired a significant Open business in

the form of Standard Life branded insurance products which the

Group is committed to growing.

Our Strategic Partnership is underpinned by a 19.98% equity

stake taken by Standard Life Aberdeen in Phoenix and our Board has

been strengthened by the appointment of two Standard Life Aberdeen

nominated Non-Executive Directors. We have a close and positive

working relationship with Standard Life Aberdeen which extends

through its management of c. 60% of our assets under administration

and the distribution agreement generating new business. Our

objectives are aligned as we seek to leverage our respective skill

sets to grow our businesses.

Phoenix marked a number of additional significant achievements

this year including the completion of the integration of the AXA

Wealth and Abbey Life businesses ahead of plan and targets and

successfully entering into the Bulk Purchase Annuity market.

Finally, the Group extended its track record of meeting and

exceeding all of its publicly stated financial targets by

surpassing the upper end of its two-year cash generation target

range of GBP1.0 - GBP1.2 billion, delivering GBP1.3 billion of cash

generation over 2017 and 2018.

Capital Markets Day

In November Phoenix held a very well-attended Capital Markets

Day to provide an update on the Standard Life Assurance

acquisition. The presentation illustrated how Phoenix has evolved

from being a 'closed' business to a consolidator of both Open and

Heritage life businesses.

Organic growth through the capital-light new business written as

part of the Strategic Partnership with Standard Life Aberdeen

represents a fundamental strengthening of the Group's business

model, stemming the natural run-off of our Heritage business and

bringing sustainability to the Group's cash generation profile.

Dividend policy

The additional cash flows acquired as part of the acquisition of

the Standard Life Assurance businesses enhance the sustainability

of our dividend. Therefore, in line with previously stated

expectations the Board recommends raising the dividend to an

annualised amount of GBP338 million from the time of the 2018 final

dividend. This corresponds to a final 2018 dividend per share of

23.4p and constitutes a c. 3.5% uplift in dividend per share

(rebased to take into account the bonus element of the rights issue

completed in July 2018), resulting in a new annualised dividend per

share level of 46.8p going forward.

Given the long-term run-off nature of the Group's Heritage

business, the Board continues to consider it prudent to maintain a

stable and sustainable dividend policy.

Recent board changes

Against a backdrop of macroeconomic uncertainty in light of

Brexit, the Board aims to maintain the breadth and depth of

experience required to continue delivering shareholder value and

improving customer outcomes. Therefore, we were delighted to

welcome Campbell Fleming and Barry O'Dwyer from Standard Life

Aberdeen to the Board. Both bring with them substantial experience

and executive skills complementary to those of our existing

Directors and very related to our evolving strategy.

Looking ahead

Despite our expectation that market conditions will remain

turbulent leading up to and beyond Brexit, we look ahead with

optimism as Phoenix's hedging programme brings resilience to the

Group' solvency position and cash generation. Additionally, the

Group's capital-light new business capability brings added

sustainability to Phoenix's cash generation.

Simultaneously, the drivers for consolidation in the life

insurance sector are increasing and we believe institutions will

look to divest their capital intensive closed business to

consolidators such as Phoenix. Phoenix has a proven track record of

delivering value accretive acquisitions and I am confident that the

Group is well placed to take advantage of these growth

opportunities as and when they arise.

Phoenix will enter the FTSE100 Index on 18 March 2019. Entry

into this index is recognition of the progress Phoenix has made as

an organisation.

I would like to take this opportunity to thank all my colleagues

for their hard work and commitment in what has been another hugely

successful year for Phoenix and our investors for their continuing

support. I look forward to working with you all in 2019.

NICHOLAS LYONS

CHAIRMAN

4 March 2019

GBP226bn

Assets under administration

10.0m

Policies

GROUP CHIEF EXECUTIVE OFFICER'S REPORT

"Phoenix's business continues to be resilient. Our open business

brings improved sustainability to cash generation and we are

confident about our growth opportunities."

CLIVE BANNISTER

GROUP CHIEF EXECUTIVE OFFICER

The acquisition of the Standard Life Assurance businesses in

2018 was transformational for Phoenix. It allowed us to evolve from

being a UK closed life consolidator into the largest life and

pensions consolidator in Europe; with Heritage and Open businesses

spanning the UK, Germany and Ireland.

Phoenix delivered strong financial performance during the year,

generating GBP664 million of cash and increasing the resilience of

the Group's capital position through the implementation of our

hedging programme to the Standard Life Assurance businesses. Our

leverage ratio remains below the target range and our credit

ratings were affirmed by Fitch Ratings in September following

completion of the acquisition.

Phoenix's substantial new business capabilities bring improved

sustainability to our long-term cash generation. Our Open business

is growing, driven by the success of the capital-light Standard

Life branded products sold through the Strategic Partnership with

Standard Life Aberdeen. This growth is augmented by our successful

entry into the bulk purchase annuity market which, together with

vesting annuities, keeps scale in our Heritage business.

Whilst the acquisition of the Standard Life Assurance businesses

represents an important milestone in our consolidation journey, it

is not our final destination and we remain confident in our ability

to grow further through additional acquisitions.

ACQUISITION OF the STANDARD LIFE ASSURANCE businesses AND

STRATEGIC PARTNERSHIP WITH STANDARD LIFE ABERDEEN

Phoenix completed the acquisition of the Standard Life Assurance

businesses on 31 August 2018 with 99.98% of voting shareholders

supporting the transaction. The acquisition was funded through a

GBP950 million rights issue completed in July with a take-up rate

of 96.25%, and the issuance of GBP500 million Tier 1 notes in April

and a EUR500 million Tier 2 bond in September. I would like to

thank our investors for their overwhelming support for this

acquisition.

The acquisition has brought additional scale to Phoenix's

pre-existing UK Heritage business which now has GBP118 billion of

assets under administration. It has also brought a significant Open

business to Phoenix in the form of Standard Life branded workplace

pension, retail pension and Wrap products.

These products are predominantly capital-light unit linked

products and will be delivered to the customer through the

Strategic Partnership with Standard Life Aberdeen. Under this

partnership, Standard Life Aberdeen will undertake sales, marketing

and distribution for new business which Phoenix will underwrite and

administer. In this way, both companies continue to provide the

services that align to their key strengths and is built to work

seamlessly for customers with the full proposition being delivered

under the Standard Life Brand.

We also now have a European business which contains both

Heritage and Open business. We are poised to complete our

preparations to ready this business for Brexit with a Part VII

transfer to an Irish domiciled subsidiary, Standard Life

International Designated Activity Company ('SL Intl') due to

complete in March. We have injected GBP250 million of capital into

SL Intl prior to this Part VII and will report our 2019 cash

generation figures net of this injection.

Cost and capital synergies

Upon announcement of the transaction in February 2018, we set a

total cost and capital synergy target for the transition of the

Standard Life Assurance business within Phoenix of GBP720

million.

Upon completion of the acquisition in August, we worked with our

new colleagues from Standard Life Assurance to design the operating

model of our combined organisation.

It is clear to me that Phoenix will be forever strengthened by

the breadth of skills that our new colleagues bring. I am extremely

grateful for the hard work across all locations in the Group that

has ensured that our transition programme has 'the best of both'.

As a result of this collaboration, I am pleased to announce an

increase of 70% to a new total synergy target of GBP1,220

million.

Transition programme

Our transition programme is making good progress and will

deliver an end state operating model over three phases. We are now

targeting savings of GBP75 million per annum from our 2018 business

as usual combined cost base of GBP600 million and have also set a

GBP30 million target for one-off cost savings.

Actuarial harmonisation

In 2018 we delivered GBP500 million of capital synergies in

respect of the Standard Life Assurance businesses. This principally

consists of the benefits from capital synergies from implementing

the Group's equity and currency hedging strategy but also includes

capital synergies by internally restructuring indemnity benefits

within the Group.

We have increased our capital synergy target to GBP720 million

to reflect the estimated impact of moving towards Phoenix's

strategic asset allocation for annuity backing assets and creating

a single life company.

In addition, the programme will also bring together our two

internal models. This has never been done before and the timeline

we outline today targeting PRA approval by the end of 2020 remains

indicative as we work through a number of key decisions and work

with our regulators to assess achievability.

The end state operating model will be delivered in three phases

over three years

Phase 1 Phase 2 Phase 3

------------------------------------ ------------------------------------- -------------------------------------

Focuses on enabling Head Office Covers the Finance and Actuarial Will deliver the end state operating

functions such as HR, Legal and Risk functions. This includes the model for both the UK Heritage and UK

to enhance process efficiency harmonisation of the Group's Open segments.

and remove duplication. This phase capital framework and related The end state operating model will be

will also deliver a single Risk internal model as well as improving designed to respond to an evolving

Management Framework and the alignment of reporting landscape from the

three lines of defence model. processes as a combined business. Open business perspective while also

providing a versatile platform for

future consolidation.

------------------------------------ ------------------------------------- -------------------------------------

Phase 1: Enabling Head Office Functions

Phase 2: Finance and Actuarial

Phase 3: Customer and Technology

2019

2020

2021

FINANCIAL PERFORMANCE

Cash generation is resilient and sustainable

Phoenix delivered GBP664 million cash generation in the year

taking total cash generation in 2017 and 2018 to GBP1.3 billion and

exceeding the upper end of the target range for this period of

GBP1.0-GBP1.2 billion.

The Group has set new short and longer-term cash generation

targets for the enlarged business. In 2019 we expect to generate

GBP600 - GBP700 million of cash net of the cost of capitalising our

Irish subsidiary for Brexit and our target for 2019 to 2023 is

GBP3.8 billion. In addition we expect a further GBP8.2 billion of

cash from 2024 on-wards.

The combined cash guidance of GBP12.0 billion reflects the cash

for our in-force business only and does not include the additional

cash flows that may be generated on new business. As our Open

business grows, it will help to offset the run off of our Heritage

business and bring improved sustainability to our cash generation

which in turn supports our stable and sustainable dividend

policy.

Phoenix Group capital position

During 2018, the Group strengthened the resilience of its

capital position, increasing the Solvency II surplus from a pro

forma of GBP2.5 billion as at 31 December 2017 to GBP3.2 billion as

at 31 December 2018.

The Shareholder Capital coverage ratio also increased to 167% at

31 December 2018 from a 147% pro forma ratio at 31 December 2017,

well within our target range of 140% to 180%.

Operating Profit

The Group delivered total operating profit of GBP708 million and

reports for the first time operating profit across its three main

business segments. The increase compared to the prior year is

primarily driven by the inclusion of Standard Life Assurance for

the four-month period post completion of the acquisition together

with net positive impacts of management actions and experience and

actuarial assumption changes during 2018.

Assets under administration

As at 31 December 2018, the Group had GBP226 billion of assets

under administration, reduced from the GBP240 billion pro forma

position at 31 December 2017. This fall is primarily driven by

market movements experienced in the fourth quarter of 2018 when

markets were particularly negative. During the year, strong net

inflows on our UK Open and European businesses have partially

offset net outflows on our UK Heritage business.

REGULATORY AND LEGISLATIVE CHANGES

In September we were informed by the Financial Conduct Authority

('FCA') that it had closed its investigation into Abbey Life

Assurance Limited following the thematic review into the fair

treatment of long standing customers in the life insurance sector.

The FCA found that the conduct of Abbey Life Assurance Limited did

not warrant enforcement action. Standard Life was referred to the

FCA enforcement division to consider whether any of the issues

identified in the thematic review on non-advised annuities sales

warranted further intervention and we continue to work with the FCA

on the ongoing investigation.

With regard to annuities sales, both Standard Life and Abbey

Life agreed with the FCA to undertake a past business review and

both programmes are well advanced. Both of these reviews were known

issues at the time of acquisition and we expect the costs arising

from these reviews to be covered by the indemnities agreed at the

time of the acquisition.

CUSTOMERS

Phoenix places its customers at the heart of what it does and is

committed to delivering a high level of customer service and to

improving customer outcomes.

Phoenix invests in its online capabilities and we connect

digitally with as many of our customers as possible.

For Phoenix Life, this digital journey is being shaped through

our outsourcing arrangement with Diligenta. 80% of our Diligenta

pension customers can now log on to our digital platform and during

2018 we saw over 40% of eligible customers taking advantage of our

online encashment functionality. In absolute numbers this would be

80% of around 1 million customers.

In 2018, over 14,000 policies moved into drawdown with Standard

Life and digital was the channel of choice for the majority of

these customers. Furthermore, with more than three million logins

last year, our mobile app is now the easiest way for Standard Life

customers to interact with us when they want.

Since auto-enrolment we have supported 11,000 schemes into a

qualifying workplace pension scheme with 1.7 million new joiners

auto-enrolled into them by employers.

In August, I was delighted to announce that we would be

introducing caps on ongoing charges across our Phoenix Life

non-workplace unitised pensions business and removing exit charges

on small unitised pensions policies. This change will benefit c.

250,000 policies and reduce the average Phoenix Life ongoing charge

for unitised non-workplace pension policies to 1.1%.

We recognise the importance of customer service and monitor our

performance through a number of metrics. We have exceeded all of

our customer service targets in 2018.

Colleagues

Corporate responsibility plays a central role in the colleague

experience at Phoenix. The three strands of physical, mental and

financial wellbeing underpin our colleague and community

initiatives, which now extend to the Standard Life Assurance

businesses.

Volunteering is a priority across the Group with over 50% of

Phoenix Group and Phoenix Life colleagues participating in

volunteering activities over the year.

2018 saw Phoenix embark on a significant listening exercise to

re-invigorate our commitment to our corporate values. 'The Big

Conversation' brought these values to life and delivered an agreed

set of behaviours - created by staff and championed by senior

management sponsors.

2019 will see us engage colleagues in the creation of a combined

set of values for the Group, building on previous work conducted at

Standard Life Assurance and Phoenix.

This focus on engagement and colleague empowerment creates a

rich and diverse working environment, reflected in our continued

status as one of the UK's Top Employers.

CONCLUSION

In 2018, Phoenix delivered on its existing strategic priorities

alongside a material acquisition. We completed the integration of

both the AXA Wealth and Abbey Life during the year and to date have

generated cash from both transactions of GBP968 million or over 70%

of consideration. We also completed our on-shoring programme

replacing the previous Cayman Islands registered holding company

with a UK-incorporated one.

We look forward to 2019 with excitement. Whilst we will of

course remain focused on the safe transition of our combined

businesses, we have the management bandwidth to deliver on our

growth strategy.

The drivers of consolidation in the life insurance industry are

numerous: trapped capital, specialist skills shortages, stranded

costs, and an increased regulatory burden. These drivers will

generate future acquisition opportunities for Phoenix.

Phoenix has the skill set, scale and financial strength to be at

the forefront of the UK and European life consolidation market. We

remain optimistic about the opportunities that 2019 will bring and

we are ready to move forward with transactions that add value to

our investors.

I have been delighted to welcome former Standard Life colleagues

to the Phoenix family and thank all of my colleagues throughout the

Group for their hard work during a year that has seen Phoenix

deliver its strategy for the benefit of both shareholders and

policyholders.

CLIVE BANNISTER

GROUP CHIEF EXECUTIVE OFFICER

4 March 2019

"The drivers of consolidation are increasing and Phoenix is well

placed to be the Leading Life Consolidator in Europe during this

process."

CLIVE BANNISTER

GROUP CHIEF EXECUTIVE OFFICER

Illustrative cash generation profile over time

Cash generation

Management Actions

OPEN

Heritage

Management Actions

Management actions increase or accelerate cash generation across

the Heritage and Open businesses.

Open

Growth of Open business at 2018 levels will offset Heritage

run-off.

Heritage

Our Heritage business runs off at 5-7% per annum.

1 Pro forma assuming the acquisition of the Standard Life

businesses took place on 31 December 2017.

2018 timeline

February

Announced proposed acquisition of the Standard Life Assurance

businesses.

April

GBP500 million Tier 1 notes issued.

July

GBP950 million rights issue.

September

FCA closes Abbey Life enforcement investigation.

EUR500 million Tier 2 bond issued.

Fitch Ratings affirms ratings and places Phoenix on 'stable'

outlook

March

Integration of AXA Wealth and Abbey Life complete.

May

First BPA transaction announced.

August

Acquisition of the Standard Life Assurance businesses

completed.

December

New UK holding company in place. On-shoring complete. Abbey Life

Part VII complete.

OUR OPERATING STRUCTURE

Phoenix Group's operating structure is evolving as we transition

to a new end state operating model for the combined group.

Phoenix Group

Group functions

Manage corporate and strategic activity and include the

following:

Group Finance including Tax, Treasury and Investor Relations

Corporate Communications

Group Risk

Group HR

Group Customer

Group Internal Audit

Group Legal

Strategy, Corporate Development and Group Actuarial

Company Secretariat

Phoenix Life

Standard Life

Manage the financial assets for policyholders across our UK

Heritage; UK Open and European business segments

Life companies

Phoenix Life Limited

Phoenix Life Assurance Limited

Life companies

Standard Life Assurance Limited

Standard Life International Designated Activity Company

INVESTMENT MANAGEMENT AND DISTRIBUTION

Management services company

Provides life companies with management services

OUTSOURCE PARTNERS

GROUP FUNCTIONS

The Group operates centralised functions that provide Group-wide

and corporate-level services and manage corporate and strategic

activity. Based in Edinburgh, Wythall near Birmingham and Juxon

House, London, the Group is led by the Group Chief Executive

Officer, Clive Bannister.

PHOENIX LIFE and STANDARD LIFE

Phoenix Life and Standard Life are responsible for the

management of the Group's life funds in the UK, Germany and Ireland

across both Heritage and Open product lines. Phoenix Life is based

in Wythall, Birmingham and is led by its Chief Executive Officer,

Andy Moss. Susan McInnes is the Chief Executive of our Standard

Life business which is primarily based in Edinburgh with

significant operations in Frankfurt and Dublin.

Life companies

The life companies are regulated entities that hold the Group's

policyholder assets. The Group simplifies its business model by

bringing together separate life companies and funds, making more

efficient use of the capital and liquidity in its life

companies.

This results in administrative expense savings and increased

consistency of management practices and principles across the

Group.

Investment management

Investment management services are provided to the life

companies by a number of external asset management companies, with

the main partner being Aberdeen Standard Investments.

Distribution

Distribution of non-workplace Standard Life branded products is

provided by Standard Life Aberdeen under the Client Service and

Proposition Agreement. We have also retained the SunLife

distribution business within the Open business segment of the Group

with a management team based in Bristol focused on their key skills

of marketing and sales.

Management services companies

The Group's management services companies are charged with the

efficient provision of financial and risk management services,

sourcing strategies and delivering all administrative services

required by the Group's life companies. This benefits the life

companies by providing price certainty and transferring some

operational risks.

Outsource partners

The management services companies manage relationships with the

outsource partners for our Phoenix Life business. Without further

acquisitions, the number of policies in our Heritage business

declines over time and the cost of our Heritage operations as a

proportion of policies will increase. This risk is managed by

paying a fixed price per policy to our outsource partners for

policy administration services, which reduces this fixed cost

element of our operations and converts it to a variable cost

structure.

Outsource partners have scale and common processes to benefit

the Group, including reducing investment requirements, improving

technology and reducing our operational risk. Finance, actuarial,

information technology, risk and compliance and oversight of the

outsource partners are retained in-house, ensuring that Phoenix

Life retains full control over the core capabilities necessary to

manage and integrate closed life funds.

OUR KEY PRODUCTS

WE HAVE a wide range of products which are written across

different funds.

The features of each policy influences whether it is the

policyholders and/or the shareholders who are exposed to the risks

and rewards of a policy.

Type of business Typical characteristics Policyholder benefits Shareholder benefits

--------------------------- --- -------------------------- --------------------------- ---------------------------

With-profit 25% These are typically Policyholders benefit from In the 'supported'

GBP56bn savings and investment discretionary annual and/or with-profit funds, the

Assets under administration products. final bonuses. shareholders' capital is

at 31 Dec 2018 They comprise endowments, The bonuses are designed to exposed to all economic

whole of life and pensions distribute to policyholders movements until the estate

products and (some) a fair share of the return is rebuilt to cover the

guaranteed annuity on the required capital, at which

options which guarantee assets in the fund, point the fund

the annuity that a pension together with other becomes 'unsupported'.

pot will be able to buy. elements of experience in In the 'unsupported'

The policyholders and the fund. with-profit funds,

shareholders share in the typically shareholders

risks and rewards of the receive 10% of declared

policy, depending bonuses

on the structure of the (90:10 structure) or nil

fund. (100:0 structure),

Excess assets created over including any estate

time ('estate') provide a distributed.

buffer to absorb cost of

guarantees and

capital requirements.

In the 'supported'

with-profit funds, the

shareholders provide

capital support to the

fund.

--------------------------- --- -------------------------- --------------------------- ---------------------------

Unit linked 65% These are insurance or Policyholders' benefits are Shareholders benefit from

GBP145bn investment contracts in the form of unit price fees earned through

Assets under administration (savings and pensions) growth (based on the management charges,

at 31 Dec 2018 without guarantees. investment income bid/offer spreads and/or

The policyholders bear all and gains, but subject to policy fees.

of the investment risk. management charges and

Policyholders buy units investment transaction

with their premiums which costs).

are invested in funds.

Units are sold when a

claim is made.

--------------------------- --- -------------------------- --------------------------- ---------------------------

Non-profit (annuities) 9% Policyholders make fixed Policyholders receive Shareholders earn a spread

GBP19bn or variable payments in regular payments which on the assets supporting

Assets under administration lieu of a future lump sum start immediately the annuity payments.

at 31 Dec 2018 or a future income (immediate annuity) or at The shareholders are

stream until death. some directly exposed to all

time in the future market and demographic

(deferred annuity). risks.

--------------------------- --- -------------------------- --------------------------- ---------------------------

Non-profit (protection) 1% Term assurance policies Policyholders have Profits are generated from

GBP3bn which pay a lump sum on certainty of the benefits investment returns and

Assets under administration death if death occurs they will receive. underwriting margins.

at 31 Dec 2018 within a specified period. Shareholders are exposed to

Whole of life policies the majority of the risks

which cover the entire and benefit from 100% of

life and pay a lump sum on the profits

death, whenever it or losses arising.

occurs.

--------------------------- --- -------------------------- --------------------------- ---------------------------

Total Assets under administration of GBP223 billion analysed by product type excludes GBP3

billion held in shareholder funds.

OUR BUSINESS SEGMENTS

PHOENIX HAS THREE MAIN BUSINESS SEGMENTS FOR ITS LIFE AND

PENSIONS BUSINESS: UK Heritage, UK Open and Europe.

The UK Heritage business segment comprises products that are no

longer marketed to customers, for example with-profits, annuities

and many legacy unit linked life and pension products. UK Open

business comprises products that are actively marketed to new and

existing customers and includes products sold under the Standard

Life and SunLife brands. The European segment comprises both

Heritage and Open business.

UK HERITAGE UK OPEN EUROPE

------------ ------------------------ --------------- -------------

IN FORCE With-profits Unit linked: Ireland:

Unit linked Workplace Unit linked

Annuities Retail pension With-profits

Protection Wrap Annuities

Germany:

With-profit

Unit linked

------------ ------------------------ --------------- -------------

NEW BUSINESS VESTING ANNUITIES UNIT LINKED UNIT LINKED

BULK PURCHASE ANNUITIES

------------ ------------------------ --------------- -------------

UK Heritage

Phoenix specialises in the safe and efficient management of UK

Heritage business and has a strong track record of delivery.

Our UK Heritage business comprises products that are no longer

actively marketed to customers and has GBP118 billion of assets

under administration.

GBP118bn

UK Heritage*

With-profit (unsupported) 34%

With-profit (supported) 4%

Unit linked 42%

Non-profit (annuities) 15%

Non-profit (protection, shareholder funds

and other non-profit) 5%

*Based on assets under administration at 31 December 2018

In Force

The UK Heritage business has been built from two decades of

consolidation and comprises over 100 legacy brands including

Britannic, Pearl,Scottish Mutual, AXA, Abbey Life and Standard

Life. It has a broad range of life and pensions products which

provide Phoenix with natural diversification and includes business

from both Phoenix Life and Standard Life.

The Group's strategy for our UK Heritage Business is simple - to

deliver value to shareholders and customers and to improve customer

outcomes.

Heritage business cash generation runs off at 5-7% per annum

depending on the particular features of each legacy book. Organic

cash emerges naturally from our UK Heritage business as it runs off

over time and we enhance this organic cash generation through the

delivery of management actions which either increase the overall

cash flows from the business or accelerate the timing of these cash

flows.

Integral to our efficient management of the UK Heritage business

is ensuring that our cost base reduces more quickly than our policy

count runs off.

New business

The Group generates new business in the Heritage business

segment through vesting annuities and bulk purchase annuities, or

from incremental contributions from existing pensions.

Vesting annuities

We offer annuities to existing policyholders when their pension

policies vest across both the Phoenix Life and Standard Life

product ranges. The majority of our vesting annuities are from

pension policies which included guaranteed annuity options on

maturity.

Bulk purchase annuities

In 2018 we successfully entered into the bulk purchase annuity

market completing three transactions during the year. The bulk

purchase annuity market is a potential source of value accretive

annuity liabilities and we will continue to participate in this

market in a proportionate and selective manner.

UK Open

Phoenix is committed to growing its capital-light UK Open

business.

Our UK Open business comprises products that are actively

marketed to customers and has GBP85 billion of assets under

administration.

GBP85bn

UK OPEN*

Workplace 44%

---------------- ---

Retail pensions 29%

---------------- ---

Wrap 27%

---------------- ---

*Based on assets under administration at 31 December 2018

In Force

Open business mainly relates to those products being sold under

the Standard Life brand but also includes those aimed at the over

50's market distributed by SunLife.

Assets under administration in our open business are held in

three product lines: Workplace, Retail pensions and Wrap. These are

predominantly unitised products which have no guarantees and where

investment risk sits with the customer. Our Open business therefore

comprises capital-light products.

The Group's strategy for our Open business is shared with our

Heritage book as we aim to deliver value to shareholders and

customers alike. Our Strategic Partnership is important in

supporting that strategy.

New business

Our Open business is growing through new business generated

through the Client Service and Proposition Agreement with Standard

Life Aberdeen and through an increase in pensions

auto-enrolment.

Under this agreement, Standard Life Aberdeen is responsible for

the distribution, branding and marketing of products. They do this

through their existing networks of Retail and Independent Advisors

and for some products using their successful investment platform.

The exception to this are Workplace pensions products where

distribution is performed by the Phoenix Group.

Responsibility for the Wrap Platform, which hosts some of our

investment products such as Wrap SIPP and offshore bond also sits

with Standard Life Aberdeen.

Where a customer needs or wants advice it can be delivered by

Standard Life Aberdeen's in house advice arm.

Phoenix are responsible for providing the insurance product and

the administration once the product is sold - this plays very much

to our strengths given our existing expertise in product

administration for our existing c. 5.5 million Phoenix Life

customers. The relationship is built to work seamlessly for

customers with the full proposition from distribution through to

administration being done under the Standard Life brand.

Under the agreement, Phoenix collects product charges from

customers and remits investment management fees to Standard Life

Aberdeen. Where relevant, Standard Life Aberdeen may also collect a

platform charges directly from the customer.

The SunLife business also generates new business across it's

range of over 50's products.

EUROPE

Our European business provides a platform for potential future

consolidation.

It contains both open and heritage products split across Germany

and Ireland and has GBP23 billion of assets under

administration.

GBP23bn

EUROPE*

Germany 49%

Ireland 24%

International Bond 27%

*Based on assets under administration at 31 December 2018

In Force

Germany

Germany closed its with-profits business to new business in 2015

and now distributes only unit linked life assurance products which

have no material guarantees. These products target the over 50's

market and utilise the broker distribution channels through

operations in Frankfurt and Graz, Austria.

International bond

This business is all open business managed from our Dublin

office targeting customers in the UK. The international bonds are

unit linked products distributed by retail advisers, banks and

wealth managers.

Ireland

A unit linked investment proposition for both the pre and post

retirement market, the Irish business is also capital-light in

nature and is distributed through adviser channels.

New business

New business is written across all open product lines of our

European business.

The international bond is sold by Standard Life Aberdeen through

the retail market and the investment platform. All other open

products are sold by the European units themselves.

THE MARKETPLACE

The UK Life and Pensions market remains competitive and a strong

brand is the key to success in winning market share. THE PHOENIX

BRAND IS DOMINANT IN the CONSOLIDATION OF THE LIFE AND PENSIONS

INDUSTRY AND IS TAKING A FOOTHOLD IN THE BULK PURCHASE ANNUITY

MARKET. Phoenix's open business is delivered under the brands of

Standard Life and sunlife.

Phoenix has been a brand in the insurance industry since 1782.

From its beginnings, more than 200 years ago, Phoenix has grown to

become the largest life and pensions consolidator in Europe.

Closed life funds market

Phoenix estimates the size of the closed life funds market to be

approximately GBP380 billion in the UK, increasing to GBP540

billion including Germany and Ireland.

Changes in customer behaviour, market dynamics and the

regulatory environment resulted in insurers closing their old style

capital-heavy insurance product lines to new business, replacing

them with capital-light investment style products.

Opportunities and outlook

The Group expects to see continued consolidation in the closed

life funds market in the future. This will be driven by the

significant capital held within closed funds that owners may wish

to redeploy, more intrusive regulation leading to pressure on

owners and fixed cost pressures as closed funds decline in size

over time.

Phoenix continues to seek opportunities to acquire and manage

closed life funds. The Group's scale allows the generation of

capital efficiencies through the diversification of risks and the

wide range of product types that Phoenix currently manages provides

a scalable platform for integrating further closed funds. In

addition, Phoenix benefits from a variable cost model given the

Group's outsourcing model and an approved Solvency II Internal

Model which provides greater clarity over capital requirements.

Bulk purchase annuities market

Many Defined Benefit pension schemes are now closed to new

members but have liabilities that will continue for many decades

into the future. The BPA market offers employers the ability to

mitigate the risk of their Defined Benefit pension liabilities

whilst allowing the pension scheme trustees the ability to secure

and protect their members' benefits.

The size of the BPA market is significant, with in excess of

GBP20 billion of transactions completed in 2018 and a similar

volume of transactions expected in 2019.

Opportunities and outlook

Having successfully completed three bulk purchase annuity

transactions in 2018, Phoenix has the acquisition experience and

proven skills set to compete in this market and is targeting

winning BPA liabilities of GBP0.5 - 1.0 billion per annum.

Standard life

Phoenix will continue to write new business under the Standard

Life Brand through the Strategic Partnership with Standard Life

Aberdeen. Phoenix is committed to the development of the Standard

Life proposition which holds a strong position across the following

markets:

Workplace pensions

The introduction of auto-enrolment, which obliges employers to

provide and contribute to a workplace scheme for all eligible

members, has resulted in strong growth in the workplace pensions

market with more than 9.5 million people automatically enrolled

through the scheme since 2012. (Source ONS)

Recent trends have included scheme reviews and employers

shifting from unbundled to bundled arrangements.

Opportunities and outlook

Continued growth is expected in the workplace pensions market.

280,000 policies joined existing employer schemes in 2018 and the

increase in mandatory contribution rates from 5% to 8% from April

2019 will contribute to the growth of this business in the

future.

Standard Life has built a strong proposition to compete in this

market with 15,000 active schemes serving 1.9 million customers and

harnessing the benefit of strong relationships with large employer

benefit consultants and employers.

Retail pensions

The retail pensions book is in part built up by the Strategic

Partnership with Standard Life Aberdeen selling retail pensions

products via independent advisers and has 750,000 customers with

14,000 new drawdown customers in 2018.

Opportunities and outlook

The retail pensions products offering has a strong digital and

service offering which is critically important in this

marketplace.

By offering a solution for both accumulation and decumulation,

customers can keep their assets in the decumulation phase of their

life and consolidate pension pots with other providers into one

vehicle.

This flexibility enables us to keep our customers in the longer

term and retain assets under administration with the Group

evidenced by the steady flow of customers moving from our workplace

schemes to retail pensions when they change employer.

We support the introduction of the Pensions Dashboard and are

engaging with the Department of Workplace Pensions with the rest of

the industry. We believe our business will benefit from customers

greater visibility of their retirement savings and increased

engagement.

Wrap

The Wrap platform is owned and operated by Standard Life

Aberdeen offering a range of Standard Life branded products

provided by Phoenix to circa 100,000 customers. The Wrap platform

offers a high level of functionality which differentiates it from

other platforms and the strong and integrated relationship with

advisers gives it a market-leading position.

Opportunities and outlook

Whilst the platform market is very crowded and highly

competitive, the Wrap platform remains number one in the market

based on both advised gross and net volumes and is well placed to

grow in the future.

Europe

Our European businesses in Germany and Ireland sell unit linked

investment style business and the International bond is sold by

Standard Life Aberdeen through the retail market and investment

platform.

Our European business is specifically targeted to the more

affluent population via broker distribution channels.

Opportunities and outlook

The strong Standard Life brand recognition and a financially

strong parent support new business growth.

Sunlife

Over 50s market

SunLife specialises in the distribution of insurance products to

the over 50s. Phoenix underwrites and administers the life and

pensions products within their range including life cover, equity

release and funeral plans.

Opportunities and outlook

The SunLife brand holds a dominant position in the over 50s

market with a 57.8% market share of all whole of life guaranteed

acceptance plans bought directly. (Source: ABI statistics issued in

November 2018 for 12 month period to 30 September 2018 based on new

Phoenix Life policy sales trading as SunLife).

We will continue to invest in the SunLife brand and its service

offering which was awarded the 2018 Feefo Gold Trusted Service

Provider for the third year running.

UK MARKET OPPORTUNITIES BY OWNER

UK Life companies 58%

Foreign owned 30%

Bank owned 12%

UK MARKET

OPPORTUNITIES BY PRODUCT TYPE

With-profit 37%

Unit linked 40%

Non-profit 23%

BUSINESS MODEL

HOW WE CREATE VALUE

OUR STRATEGIC PRIORITIES HELP ENHANCE THE VALUE WE CREATE

THROUGH OUR BUSINESS MODEL.

01

IMPROVE CUSTOMER OUTCOMES

Improving customer outcomes is central to our vision of being

Europe's Leading Life Consolidator, and to inspire confidence in

the future.

Read more on P18

02

DRIVE VALUE

In order to drive value, the Group looks to identify and

undertake management actions, which increase and accelerate cash

flow.

Read more on P22

03

MANAGE CAPITAL

We continue to focus on the effective management of our risks

and the efficient allocation of capital against those risks.

Read more on P24

04

ENGAGE PEOPLE

Our people are at the heart of our business and key to the

successful growth of Phoenix Group.

Read more on P26

WE ARE SET APART BY OUR STRENGTHS WHICH UNDERPIN OUR BUSINESS

MODEL

SCALE OF OUR PLATFORM

Largest Life and Pensions Consolidator in Europe

SECURITY

Strong balance sheet which generates long term cash flows and

provides security for all stakeholders

SPECIALIST OPERATING MODEL

Specialist operating model enabling us to efficiently manage and

integrate heritage books

Read more on P8

SERVICE

Quality service to our customers and their intermediaries is

critical to our strategy

Read more from P18 to P21

Skills

Talented and experienced team. We will continue to invest in

this expertise

Read more on P26

SIGNIFICANT GROWTH

A wealth of acquisitions opportunities across the UK and Europe

and organic growth through new business is available to us

Read more on P12

OUR CASH GENERATION HELPS US REALISE OPPORTUNITIES FOR

GROWTH

IN-FORCE BOOK CASH EMERGENCE

Capital requirements of operating life companies decline as

policies mature, releasing capital in the form of cash

MANAGEMENT ACTIONS

Management track record of delivering incremental value

New BUSINESS

Capital-light new business under the Strategic Partnership with

Standard Life Aberdeen

Vesting annuities

Mergers and acquisitions

Value accretive acquisitions generate increased cash flows and

synergy opportunities through scale advantages

BULK PURCHASE ANNUITY TRANSACTIONS

The bulk purchase annuity market offers a complementary source

of assets and growth

Resulting outcomes delivered are positive for all

stakeholders

CUSTOMERS

Optimised customer outcomes

Read more on P48

93%

CUSTOMER SATISFACTION

REM

SHAREHOLDERS

Shareholder value created and stable and sustainable dividends

delivered

Read more on P58

GBP664m

CASH GENERATION

APM

3.5%

INCREASE IN 2018 FINAL DIVID

Colleagues

Challenged, motivated and rewarded colleagues

Read more on P51

COMMUNITY & ENVIRONMENT

Support for local communities and charity partners and reduced

environmental impact

Read more on P54

GBP770k

DONATED TO MIDLANDS AND LONDON AIR AMBULANCE CHARITY

PARTNERS

Read more about our cash generation on P16

OUR CASH GENERATION PROCESS

Any assets which the life companies hold in excess of overall

capital buffers required is known as Free Surplus

Opening free surplus

Surplus generated in life companies

Reduction in capital requirements

Management actions

Cash remitted to holding companies

Closing free surplus

Opening cash at holding company level

Cash remitted from the life companies

Head office costs

Pensions

Debt interest and repayments

Dividends

Remaining cash at holding company level

Cash at the holding company level provides resources and

resilience for the Group

Opening Free Surplus

What is the opening free surplus?

Life Company Own Funds

Life companies hold capital in accordance with Solvency II

regulations, providing appropriate security for policyholders. This

capital is known as Solvency II Own Funds.

Less Solvency Capital Requirement

The level of regulatory capital required is known as the

Solvency Capital Requirement.

Less Capital Policy

The life companies hold additional internal capital buffers

above the regulatory capital requirement for prudence.

sources of life company cash generation

How is Free Surplus generated?

Margins earned

Life companies earn margins on different types of life and

pensions products increasing Own Funds.

Reduced capital requirements

As our heritage business runs off, the Solvency Capital

Requirements reduce.

Management actions

These can either increase Own Funds or reduce capital

requirements.

IMPACT OF NEW BUSINESS?

Capital light open business

New business written across our open product range is capital

light.

uses of holding company cash generation

What is the cash remitted from the life companies used for?

Head office costs

Including salaries and other administration costs.

Pensions contributions

To Group's employee Defined Benefit schemes.

Debt interest and repayments

On outstanding Group shareholder debt.

Dividends

The Group maintains a stable and sustainable dividend.

Uses of remaining cash - GROWTH OPPORTUNITIES

What is the remaining cash used for?

Mergers and acquisitions

Transactions must be value accretive and cash flow generative

and need to support the dividend level.

Bulk purchase annuity transactions

Generate increased cash flows over the longer term and are value

accretive.

OUR STRATEGY AND KPIs

WE HAVE FOUR AREAS OF STRATEGIC FOCUS. OUR INITIATIVES AND KEY

PERFORMANCE INDICATORS DEMONSTRATE HOW WE HAVE DELIVERED AGAINST

THESE STRATEGIC AREAS.

01

Improve customer outcomes Phoenix Life

Improving customer outcomes is central to our vision of being

Europe's Leading Life Consolidator.

We have seven key areas of focus related to our customer

offering:

-- Product Offering - Offering products based on customer needs

using best solutions and value for money, from in-house or through

external sourcing.

-- Financial Security - Providing security to our customers

including continuing to honour all policy guarantees.

-- Improving Value and Effective With Profit fund run-off -

Delivering improved value to customers and effectively managing

With-Profit fund run-off.

-- Effective Service Delivery - Delivering a fair, effective and

value for money service to customers in a cost effective manner and

having appropriate processes for identifying potential customer

detriment.

-- Clear and Effective Communications - Providing customers with

clear, accurate and unbiased information and access to advice and

guidance to support them in making informed choices.

-- Product Outcomes - Ensuring that Phoenix product terms

continue to deliver appropriate outcomes for customers and

Phoenix.

-- Customer Journey - Delivery of fair outcomes, appropriate

quality and improvements in the customer journey

KEY INITIATIVES AND PROGRESS IN 2018 - PHOENIX LIFE

-- Customers can now digitally access an annuity shopping around

service which can shape and save their annuity quotes and options

and provide marketplace comparisons. A full Customer Dashboard has

been delivered and allows some customers to access their full

policy details, view online documents and self-serve.

-- In August we announced a cap on ongoing charges of our

non-workplace pension contracts at 1.5% for funds in excess of

GBP5,000 and at 3% for smaller pension pots. All exit charges will

be removed on pension pots of less than GBP5,000. This ensures that

our pension contracts offer good value for money and there is no

perceived barrier to exit for customers with small pension pots

wishing to consolidate their savings.

-- We have refined the requirements under our death claims

payment process for benefits valued at GBP10,000 or less, ensuring

a more simplified customer journey.

-- Our service offering has been aligned across Phoenix Wealth

and Abbey Life, ensuring that all customers receive the same fair

service.

-- Good progress has been made to improve our key point and

regular communications, ensuring letters are engaging, clear and

provide all required information for customer.

-- Our performance on complaint handling, as measured by the

independent complaints adjudicator, the Financial Ombudsman Service

('FOS'), once again shows our commitment and focus on our complaint

handling. For FOS decisions during this reporting period, the

overturn rate of 17% is significantly below the industry average

rate of 30%.1

-- A positive customer satisfaction score based on the results

of the satisfaction survey managed by Ipsos MORI (an external

research firm) has been received. Customers surveyed were asked to

give a satisfaction rating of between 1 and 5 to a number of

questions asked (with a rating of 4 or 5 regarded as satisfied) and

93% of all questions scored a rating of 4 or above.

Read more about customer engagement activities undertaken during

the year on P48

Note:

1 The most recent published industry average overturn rate

across the industry in the Life and Pensions and Decumulation'

category, in which the majority of our business sits was 22%.

PRIORITIES FOR 2019

-- Progress work on our Digital Operating Model for Customer

Services, which will give full digital self-serve capability and

increase the ability of customers to interact with us digitally.

This will deliver straight through customer journeys for Pension

Transfers, Policy Enquiries, Life Surrenders (Quotes and Payments)

and Maturities and further strengthens our commitment to a

continued positive customer experience. We will also be extending

our digital operating model to IFAs allowing them to engage and

interact through our on-line channels.

-- Complete the implementation of our charge reductions on

non-workplace pensions contracts.

HOW WE MEASURE DELIVERY - PHOENIX LIFE

CUSTOMER SATISFACTION SCORE(1)

(%)

2015 91.1

----- ----

2016 91.2

2017 92.4

2018 93.0

Why is it important?

This is an externally calculated measure of how satisfied

customers are with Phoenix's servicing proposition.

Analysis

The Group achieved a satisfaction score of 93% reflecting our

commitment to ensuring customers are satisfied with our products

and services.

Target

To maintain a customer satisfaction score of 90%%.

FINANCIAL OMBUDSMAN SERVICE ('FOS') OVERTURN RATE

(%)

2015 18

2016 18

2017 17

2018 17

Why is it important?

This is an independent view of how firms are handling

complaints. It provides us with an opportunity to review and adjust

our complaint handling proposition in line with best industry

practice.

Analysis

The FOS overturn rate of 17% is significantly below the industry

average of 34% and the 'Decumulation, Life and Pensions' category

average of 27%.

Target

To maintain a FOS overturn target of less than the industry

average of 30%.

SPEED OF PENSION TRANSFER PAYOUTS - ORIGO (DAYS)(2)

2015 10.97

2016 11.31

2017 11.03

2018 10.73

Why is it important?

This is a recognised industry measure for the speed of

processing Pension Transfers, Open Market Options and Immediate

Vesting Personal Pensions. It allows us to benchmark performance

and our overall servicing and claims proposition against our

peers.

Analysis

The Group's pension transfer times are better than the industry

target.

Target

12 days in line with the industry stated target for Origo

Pension Transfers.

93%

2017: 92%

REM

17.0%

2017: 17.0%

REM

11.00 days

2017: 11.03 days

REM

Notes:

1 The customer satisfaction score relates to Phoenix only.

2 Origo Timescales are Phoenix, Phoenix Wealth and Abbey - the

overall timescale has been applied based on the way that timescales

are calculated for each individual entity. These will be aligned

from 2018.

01

IMPROVE CUSTOMER OUTCOMES STANDARD LIFE

KEY INITIATIVES AND PROGRESS IN 2018 - STANDARD LIFE

-- Significant changes have been made to our online, app and

telephony services in 2018 including extending our opening hours,

implementing a new voice recognition system and extending our

secure messaging facility which enables contact with us out of

hours. We have implemented a new online registration process,

making it easier to get registered, fingerprint, pin and facial

recognition access to our mobile app and improvements to the

investment switching journey online for trust schemes.

-- Since Auto enrolment we have supported 11,000 schemes into a

qualifying workplace pension scheme with 1.7 million new joiners

auto enrolled into them by employers. We are continuing to enhance

the administration experience we offer via our Workplace Hub

platform.

-- In 2018, we had 14,000 policies moving into drawdown with the

majority using our digital platform, followed by our Telephony

Guidance service. Of all cases processed via our retirement

application we anticipate that we were able to process 60%

'straight-through'.

-- Furthermore, with more than 3 million logins last year, our

24/7 mobile app is now the easiest way for our customers to

interact with us when they want, time and time again.

-- For customers in our non-advised Active Money Personal

Pension drawdown plan, we have developed an online retirement

review to help them assess if they are still on track and in the

right investment based on their objectives. The timing of our

pre-retirement communications has also been changed as feedback has

shown that people start to think about major decisions in the

run-up to milestone birthdays. Our communications now trigger at