TIDMPOS

RNS Number : 6625S

Plexus Holdings Plc

13 March 2019

Plexus Holdings PLC / Index: AIM / Epic: POS / Sector: Oil

Equipment & Services

This announcement contains inside information

Plexus Holdings PLC ('Plexus' or 'the Company')

Declaration of Interim Dividend,

Proposed Cancellation of Share Premium Account

and Notice of General Meeting

Plexus Holdings PLC, the AIM quoted oil and gas engineering

services business and owner of the proprietary POS-GRIP(R)

friction-grip method of wellhead engineering, is pleased to

announce an interim dividend and a proposed reduction of

capital.

Interim Dividend

The Board considers the payment of dividends as an important

means of returning value to Shareholders. Following the sale of the

Company's jack-up exploration rental wellhead business and related

assets to FMC Technologies Limited ("TFMC") in February 2018, the

Board indicated that it would consider returning some of the cash

arising from the TFMC transaction to Shareholders by way of a

dividend, subject to the financial position and prospects of the

Company. Accordingly, the Board is pleased to declare an interim

dividend in an aggregate amount of GBP1,000,000 (equivalent to

approximately 0.99566 pence per Ordinary Share (excluding the

4,950,495 Existing Ordinary Shares held in treasury)) (the "Interim

Dividend") to all Shareholders showing on the Company's register of

members as at the close of business on 22 March 2019, which is

payable on 8 April 2019, subject to the requirements of the

Act.

The Company's abridged and unaudited interim accounts for the

8-month period to 28 February 2019, which have been prepared only

for the purposes of sections 836 and 838 of the Companies Act 2006

in order to justify payment of the Interim Dividend can be viewed

at the link below and will be available on the Company's website

shortly at www.plexusplc.com.

http://www.rns-pdf.londonstockexchange.com/rns/6625S_1-2019-3-12.pdf

The Company's interim results for the six months to 31 December

2018 will be notified via RNS by 29 March.

Reduction of Capital

The Board intends to undertake a court approved Reduction of

Capital by way of the cancellation of its share premium account in

order to increase its distributable reserves.

The Company's ability to return value to its Shareholders and

pay dividends is restricted by company law and applicable

accounting standards. Under the Act, companies are only permitted

to make distributions to shareholders from distributable reserves.

The purpose of the Reduction of Capital is therefore to increase

the distributable reserves in the Company by cancelling the amount

standing to the credit of the Share Premium Account.

The principal benefit of the Reduction of Capital will be to

increase the Company's flexibility to pay dividends, to facilitate

any prospective buyback of shares (including by way of tender

offer) or to provide flexibility for any other general corporate

purposes should the Company so determine at a future date, subject

always to the financial position and prospects of the Company. The

Reduction of Capital will not affect the voting or dividend rights

of any Shareholder, or the rights of any Shareholder on a return of

capital.

The Reduction of Capital is conditional upon the passing of the

Resolution, as well as Court approval being obtained. Accordingly,

the Company is convening the General Meeting, to be held at the

offices of Fox Williams LLP at 10 Finsbury Square, London EC2A 1AF

on 9 April 2019 at 11.00 a.m., at which the Company will seek

Shareholder approval for the Reduction of Capital.

To convene the General Meeting, a circular containing a notice

of the General Meeting and form of proxy (the "Circular") will be

despatched to Shareholders of the Company. The Circular will set

out further details of the Reduction of Capital, the Resolution and

a recommendation from the Directors of the Company that

Shareholders vote in favour of the proposals.

The Circular and Notice of General Meeting will be available on

the Company's website shortly at www.plexusplc.com.

**S**

For further information please visit www.posgrip.com or

contact:

Ben van Bilderbeek Plexus Holdings PLC Tel: 020 7795 6890

Graham Stevens Plexus Holdings PLC Tel: 020 7795 6890

Derrick Lee Cenkos Securities PLC Tel: 0131 220 9100

Frank Buhagiar St Brides Partners Ltd Tel: 020 7236 1177

Isabel de Salis St Brides Partners Ltd Tel: 020 7236 1177

Proposed Cancellation of Share Premium Account

and

Notice of General Meeting

INTRODUCTION

The Company has today announced that it intends to undertake a

court approved reduction of capital by way of the cancellation of

its share premium account in order to generate additional

distributable reserves.

Accordingly, the Company is convening the General Meeting, to be

held at 11.00 am on 9 April 2019, at which it will seek Shareholder

approval of the Reduction of Capital. The Resolution to be proposed

at the General Meeting is set out in the Notice of General Meeting

at the end of the Circular.

The purpose of the Circular is to:

-- provide you with information about the background to, and the

reasons for, the Reduction of Capital;

-- to explain why the Board considers the Reduction of Capital

to be in the best interests of the Company and its Shareholders as

a whole and, accordingly, why the Directors recommend that you vote

in favour of the Resolution to be proposed at the General Meeting;

and

-- give notice of the General Meeting for Shareholders to vote on the Resolution.

If the Resolution is passed at the General Meeting, subject to

the satisfaction of the other conditions to the Reduction of

Capital, the Reduction of Capital is expected to take effect on or

around 8 May 2019.

REASONS FOR THE REDUCTION OF CAPITAL

Background

The Board considers the payment of dividends as an important

means of returning value to Shareholders. Following the sale of the

Company's jack-up exploration rental wellhead business and related

assets to FMC Technologies Limited ("TFMC") in February 2018, the

Board indicated that it would consider returning some of the cash

arising from the TFMC transaction to Shareholders by way of a

dividend, subject to the financial position and prospects of the

Company. Accordingly, the Board on 12 March 2019 approved and

declared an interim dividend in an aggregate amount of GBP1,000,000

(equivalent to approximately 0.99566 pence per Ordinary Share

(excluding the 4,950,495 Existing Ordinary Shares held in treasury

at the date of the Circular)) (the "Interim Dividend") to all

Shareholders showing on the Company's register of members as at the

close of business on 22 March 2019, which is payable on 8 April

2019, subject to the requirements of the Act.

The Company's balance sheet as at 28 February 2019 showed

distributable reserves of approximately GBP1.5 million. The payment

by the Company of the Interim Dividend will reduce such

distributable reserves by the aggregate amount of the Interim

Dividend.

Company law and applicable accounting standards place technical

restrictions on the ability of the Company to return value to its

Shareholders and pay dividends. Under the Act, companies are only

permitted to make distributions to shareholders from distributable

reserves. The purpose of the Reduction of Capital is therefore to

increase the distributable reserves in the Company by cancelling

the amount standing to the credit of the Share Premium Account.

The principal benefit of the Reduction of Capital will be to

increase the Company's flexibility to pay dividends, to facilitate

any prospective buyback of shares (including by way of tender

offer) or to provide flexibility for any other general corporate

purposes should the Company so determine at a future date, subject

always to the financial position and prospects of the Company.

The proposal is conditional upon the passing of the Resolution

set out in the Notice of General Meeting, as well as Court approval

being obtained, further details of which are set out below. Subject

to the same, the Reduction of Capital is expected to take effect

upon registration of the Court's confirmation order by the UK

Registrar of Companies on or around 8 May 2019.

The Reduction of Capital will not result in any change in the

nominal value of the Ordinary Shares or the number of Ordinary

Shares in issue. No new share certificates will be issued as a

result of the Reduction of Capital.

Furthermore, the Reduction of Capital per se will not involve

any distribution or repayment of share premium by the Company and

will not reduce the underlying net assets of the Company.

The Reduction of Capital will not affect the voting or dividend

rights of any Shareholder, or the rights of any Shareholder on a

return of capital.

Further details on the Share Premium Account

In the audited report and accounts of the Company for the year

ended 30 June 2018, the Company recorded on its balance sheet an

amount standing to the credit of the Share Premium Account of

approximately GBP36,893,000.

In accordance with applicable law and accounting standards, the

Share Premium Account is a non-distributable capital reserve and,

pursuant to relevant provisions of the Act, the Share Premium

Account is treated for most purposes as part of the permanent

capital of the Company. Share premium arises on the issue by the

Company of shares at a premium to their nominal value. The premium

element is credited to the Share Premium Account.

It is proposed that all of the Share Premium Account be

cancelled. This cancellation would create realised profits that

will, subject to any order of the Court, be transferred to the

Company's profit and loss account and applied to the Company's

accumulated profit, such sum representing distributable reserves of

the Company.

Further details on the Reduction of Capital Procedure

Under the Act, a company limited by shares may reduce its share

premium account, as long as it is not restricted from doing so by

its articles of association, by obtaining the approval of its

shareholders by special resolution and the confirmation of the

Court. Similarly, pursuant to article 13 of the Company's Articles,

subject to the Act and to any rights attached to any shares, the

Company may by special resolution reduce its share capital or any

capital redemption reserve, share premium account or other

undistributable reserve in any way.

The Company is therefore seeking approval of its Shareholders to

the Reduction of Capital. The Notice of General Meeting, which

contains the Resolution, is set out at the end of the Circular. The

Resolution is proposed in this regard to cancel the Share Premium

Account to enable such reserves to be treated as distributable.

The Reduction of Capital must be confirmed by the Court, to

which the Company will make an application if the Resolution is

passed.

Provisional dates have been obtained for the required Court

hearings of the Company's application, but they are subject to

change and dependent on the Court's timetable. If the hearings go

ahead on the provisional dates, the present timetable provides that

the final hearing, at which it is anticipated that the Court will

make an order confirming the Reduction of Capital, will take place

on 7 May 2019. In any event, the actual dates of the final Court

hearing to confirm the Reduction of Capital will be advertised in a

national newspaper, as directed by the Court, at least seven days

prior to that hearing.

The Reduction of Capital does not take effect until the Court

Order is filed with and registered by the UK Registrar of

Companies. The Board intends to file the required documentation

with the UK Registrar of Companies on the business day following

receipt of the Court Order confirming the Reduction of Capital and,

subject to compliance with all procedural requirements, the UK

Registrar of Companies will usually register the documents on the

same day. On the present timetable, which is subject to change and

dependent on the Court's timetable, this would mean that the

Reduction of Capital would take effect no later than 8 May 2019.

The Company will only be in a position to use the distributable

reserves created by the Reduction of Capital once it becomes

effective.

In order to approve the Reduction of Capital, the Court will

need to be satisfied that the interests of the creditors of the

Company will not be prejudiced as a result thereof. This may

include, inter alia, seeking the consent of the Company's creditors

to the Reduction of Capital or the provision by the Company to the

Court of an undertaking to deposit all or part of the reserve

arising on the Reduction of Capital into a block account (not to be

treated as distributable) created for the purposes of discharging

all current creditors of the Company or the non-consenting

creditors of the Company.

The Board have undertaken a review of the Company's liabilities

(including contingent liabilities) and consider that the Company

will be able to satisfy the Court that, as at the date (if any) on

which the Court Order relating to the Reduction of Capital has been

registered by the UK Registrar of Companies and the Reduction of

Capital therefore becomes effective, the Company's creditors will

be sufficiently protected, and the Company will seek to put in

place any appropriate arrangements in this regard.

The Board reserves the right (where necessary by application to

the Court) to abandon, discontinue or adjourn any application to

the Court for confirmation of the Reduction of Capital, and hence

the Reduction of Capital itself, if the Board believes that the

terms required to obtain confirmation are unsatisfactory to the

Company or if as the result of a material unforeseen event the

Board considers that to continue with the Reduction of Capital is

inappropriate or inadvisable.

GENERAL MEETING

Set out at the end of the Circular is a notice convening the

General Meeting to be held at the offices of Fox Williams LLP, 10

Finsbury Square, London EC2A 1AF, at 11.00 am on 9 April 2019 to

consider the Resolution.

The Resolution (if passed) will approve and authorise the

cancellation of the Share Premium Account.

The Resolution will be passed if 75 per cent. or more of the

votes cast (in person or by proxy) are in favour of it.

RECOMMENDATION

The Directors believe that the Reduction of Capital will help

promote the success of the Company for the benefit of its

Shareholders as a whole.

The Directors unanimously recommend Shareholders to vote in

favour of the Resolution to be proposed at the General Meeting as

they intend to do so in respect of their own beneficial holdings*

amounting, in aggregate, to 59,700,673 Ordinary Shares,

representing approximately 59.44 per cent. of the Existing Ordinary

Shares (excluding 4,950,495 Existing Ordinary Shares held in

treasury at the date of the Circular).

* J. Jeffrey Thrall, has an indirect beneficial interest in a

company which controls 32.477% of Mutual Holdings Limited. The

number of Ordinary shares held by Mutual Holdings Limited in the

Company at the date of this circular is 42,700,001. Additionally,

J. Jeffrey Thrall has an indirect beneficial interest in Nazdar

Limited, a company which holds 1,591,512 Ordinary shares in the

Company and he holds 4,000 Ordinary shares through Thrall

Enterprises Inc.

Ben van Bilderbeek is settlor of a trust which controls 59.962%

of the shares of Mutual Holdings Limited and the entire issued

share capital of OFM Investment Limited. At the date of this

circular, Mutual Holdings Limited holds 42,700,001 shares and OFM

Investment Limited holds 15,069,767.

Additionally, Ben van Bilderbeek holds 307,693 Ordinary shares

directly, Graham Stevens holds 15,100 Ordinary Shares directly and

Craig Hendrie holds 12,600 Ordinary Shares directly.

Capitalised terms in this announcement have the same meaning as

in the Circular published by the Company in connection with the

proposed Reduction of Capital.

NOTES:

AIM-traded oil and gas engineering services company Plexus (AIM:

POS) is an IP-led company that has developed a range of products

and applications based on its patent-protected POS-GRIP

friction-grip technology. Having proved the superior qualities of

POS-GRIP within the jack-up wellhead exploration market through the

sale of this business to FMC Technologies Limited, a subsidiary of

TechnipFMC (Paris:FTI, NYSE:FTI) (jointly "TFMC"), in early 2018,

the Company is now focused on establishing its technology and

equipment in other markets including surface production wellheads,

subsea and de-commissioning.

Its suite of ongoing products and applications include: "HG"(TM)

Wellheads, which combine POS-GRIP Technology with Gas Tight metal

sealing; the Python(R) Subsea Wellhead (a new standard for subsea

wellheads - developed in a JIP supported by Royal Dutch Shell, BG

(now owned by Shell), Wintershall, Total, Maersk (now owned by

Total), Tullow Oil, eni, Senergy (now Lloyds register), and Oil

States Industries Inc); the POS-SET(TM) Connector for the growing

de-commissioning and abandonment market; and Tersus-PCT, an

innovative HP/HT Tie-Back connector product. Importantly, the

Company also has a Collaboration Agreement with TFMC, which

provides a platform to further develop and commercialise these and

other applications based on its POS-GRIP technology.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCEANDAFELNEFF

(END) Dow Jones Newswires

March 13, 2019 03:00 ET (07:00 GMT)

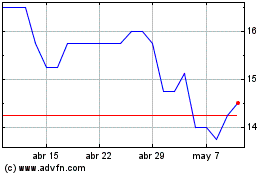

Plexus (LSE:POS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Plexus (LSE:POS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024