TIDMPGM

RNS Number : 9349S

Phoenix Global Mining Ltd

14 March 2019

Phoenix Global Mining Ltd / Ticker: AIM:PGM / Sector: Mining

14 March 2019

Phoenix Global Mining Ltd ('Phoenix' or the 'Company')

Director Dealing

Phoenix Global Mining Ltd (AIM:PGM), the AIM quoted North

American-focused base and precious metals exploration and

development company, has been informed that Andre Cohen, a

Non-Executive Director of the Company, purchased 20,000 shares in

the Company on 13 March 2019 at a price of 16.4 pence per

share.

Following completion of the share purchase, Andre Cohen and his

wife hold 272,809 shares in the Company which represents 0.71 per

cent. of the issued share capital and total voting rights of the

Company.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

NOTIFICATION AND PUBLIC DISCLOSURE OF TRANSACTIONS BY PERSONS

DISCHARGING MANAGERIAL RESPONSIBILITIES AND PERSONS CLOSELY

ASSOCIATED WITH THEM:

1. Details of the person discharging managerial responsibilities/person

closely associated

a) Name: Andre Cohen

----------------------------------------- ----------------------------------

2. Reason for the notification

-----------------------------------------------------------------------------

a) Position/status: Non-Executive Director

----------------------------------------- ----------------------------------

b) Initial notification/Amendment: Initial notification

----------------------------------------- ----------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-----------------------------------------------------------------------------

a) Name: Phoenix Global Mining Ltd

----------------------------------------- ----------------------------------

b) LEI: 2138006UWPZAB1A75680

----------------------------------------- ----------------------------------

4. Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-----------------------------------------------------------------------------

a) Description of the financial instrument, Shares of nil par value

type of instrument: each

Identification code:

ISIN: VGG7060R1055

----------------------------------------- ----------------------------------

b) Nature of the transaction: Purchase of shares

----------------------------------------- ----------------------------------

c) Price(s) and volume(s): Price(s) Volume(s)

16.4

pence 20,000

----------

----------------------------------------- ----------------------------------

d) Aggregated information: Single transaction as in

Aggregated volume: 4 c) above Price(s) Volume(s)

Price: 16.4

pence 20,000

----------------------------------------- ----------------------------------

e) Date of the transaction: 13 March 2019

----------------------------------------- ----------------------------------

f) Place of the transaction: AIM

----------------------------------------- ----------------------------------

For further information please visit www.pgmining.com or

contact:

Phoenix Global Mining Dennis Thomas / Richard Wilkins Tel: +44 7827

Ltd 290 849 (Dennis)

/

+44 7590 216 657

(Richard)

SP Angel Lindsay Mair / Caroline Rowe Tel: +44 20 3470

(Nominated Adviser 0470

and Joint Broker)

----------------------------------- ------------------

Brandon Hill Capital Jonathan Evans / Oliver Stansfield Tel: +44 20 3463

(Joint Broker) 5000

----------------------------------- ------------------

Blytheweigh Tim Blythe / Camilla Horsfall Tel: +44 20 7138

(Financial PR) / Megan Ray 3204

----------------------------------- ------------------

RB Milestone Group Trevor Brucato Tel: +1 203 487

(Unites States Consultant) 2981

----------------------------------- ------------------

Notes

Phoenix's flagship project is a brownfield, past producing,

copper, gold, silver, zinc and tungsten underground mine, the

Empire Mine near Mackay in Idaho. Phoenix acquired an 80% interest

in the property in 2015. Based on a total of 315 drill holes a NI

43-101 compliant oxide resource was completed in late 2017. A PEA

(preliminary economic assessment) for an open pit heap leach

solvent extraction and electrowinning ("SX-EW") mine was completed

in April 2018 with a design capacity of 8,000 tonnes of copper

cathode a year. In June 2018 a campaign consisting of RC and

diamond drilling was started. This programme was designed to

upgrade and increase the oxide reserves, provide samples for

ongoing metallurgical testwork, geotechnical and hydrological

studies and condemnation drilling for the heap leach pad site,

waste dump and plant site. At the same time the consultants were

appointed to complete a NI 43-101 compliant Bankable Feasibility

Study ("BFS"). The lead consultant is RPM Global who are supported

by Samuel Engineering, both based in Denver, Colorado. Cascade

Earth Sciences of Pocatello, Idaho have been working on

environmental and permitting issues since 2016 and form part of the

BFS team. Golder Associates are designing the heap leach pad and

ponds, and Call and Nicholas are carrying out the open pit slope

stability studies.

At Empire, it is estimated that only 5% to 7% of the potential

ore system has been explored to date and, accordingly, there is

significant opportunity to increase the resource through phased

exploration; the current resource relates to the oxide resource

only, which remains open along strike and does not include the

deeper, higher grade sulphides. In addition, Phoenix has increased

the claim area from 813 acres at the time of its acquisition to

5,717 acres, mainly to the northwest and west, and in so doing has

increased the potential for additional oxide and sulphide resources

to a total strike length of approximately 5.38-kilometres including

another brownfield mine, the Horseshoe Mine, which is now within

the property boundary and more than 30 historical shafts, adits on

the newly acquired Windy Devil claims.

In 2018 the Company completed 8,604 metres of drilling at

Empire. The analytical and geological data from this 93-hole

drilling program and 106 channel surface sampling programme is

currently being evaluated and modelled in preparation for a Q1 2019

updated resource calculation as part of the ongoing BFS for the

initial open pit mine. Phoenix staff and consultants are

systematically assessing and evaluating the recent data and

incorporating this data into the existing database which includes

all of the information used in the November 2017 resource estimate

and in the April 2018 Preliminary Economic Assessment.

As reported throughout late 2018, mineralised drill hole

intercepts were prevalent in multiple directions outside of the

previously modelled open pit mine, particularly to the north in the

newly discovered Red Star area. The 2018 drilling programme

obtained numerous high-grade interceptions, including grades of

12.05% copper, 20% lead, 5.83% zinc, 2.52 g/t gold and 580 g/t

silver, all of which will be included in an updated resource

estimate expected in Q1 2019. Known mineralisation now covers a

strike length of 5.38 kilometres within the Company's claim block.

The April 2018 pit design covered 1.0 kilometres of this. The

Company continues to believe that the Empire Mine Project and the

surrounding claims holdings represents a major mineralised

system.

The Company also holds two prospective cobalt properties in

Idaho, US, which are located north of the Empire Mine. These are

situated close to the town of Cobalt and are close to projects

being advanced by Canadian junior miners, including eCobalt

Solutions and First Cobalt. Fieldwork, consisting of mapping and

sampling and locating drill holes for the 2019 drilling programme,

has been completed.

With a management team that has successfully constructed,

commissioned and operated mines and low risk, mining-friendly

jurisdictions with excellent infrastructure, Phoenix is looking to

fulfil its ambitions to become a mid-tier base metal, precious

metal and cobalt production company, offering exposure to three

high value and high demand metals with compelling demand/supply

fundamentals.

More details on the Company, its assets and its objectives can

be found on PGM's website at www.pgmining.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DSHKMGMFKDKGLZM

(END) Dow Jones Newswires

March 14, 2019 11:58 ET (15:58 GMT)

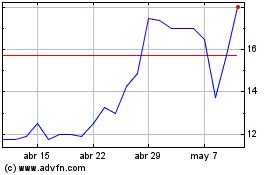

Phoenix Copper (LSE:PXC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Phoenix Copper (LSE:PXC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024