TIDMPRIM

RNS Number : 0597T

Primorus Investments PLC

15 March 2019

Primorus Investments plc

("Primorus" or the "Company")

Update on WeShop Limited

The Board of Primorus is pleased to provide an update to

shareholders on its investee company WeShop Limited ("WeShop"),

following receipt of a shareholder update.

Primorus has invested a total of GBP875,000 in WeShop

representing approximately 3.5 per cent. of the issued share

capital of WeShop.

A summary of the update from WeShop is set out below:

Introduction

WeShop has informed its shareholders some significant

developments in its ambition to unlock the true potential of social

commerce, including:

-- Product and proposition enhancements

-- Strengthening the senior management team and the business's executional capability

-- New branding with more relevancy and specific user group focus

-- The agreement of key commercial deals as part of the plan to

develop a true social retail ecosystem

WeShop has strengthened its user proposition by agreeing access

to an online product inventory which it believes will:

-- Increase WeShop retailer count from 3,000 to 9,000+

-- Increase UK product count from circa 5m to 150m+

-- Provide access to a global product feed of circa 1.6bn products in 12 countries

-- Provide access to a global retailer count of over 20,000 merchants

WeShop has announced that it has agreed a three year licensing

agreement with a technology partner, giving consumers the

fundamental choice of which merchant they buy a product from, and

at what price point. The directors of WeShop believe this is a key

milestone in delivering the best possible experience and

proposition to its users.

WeShop has been working to ensure it can deliver the core

elements of a best-in-class retail experience for consumers

across:

-- Choice of products

-- Best price

-- Social recommendations

-- Strong AI and personalisation

-- Mobile experience

-- Trusted supply of goods and delivery

By the end of H1 2019, WeShop aims to fulfil all these criteria,

ensuring that the business is ready to begin user acquisition in Q2

2019, and drive engagement and transactions at scale.

Strengthening the senior management team and the business's

executional capability

WeShop also announces some additions to the senior team, tasked

with executing and delivering its ambitious growth plans.

James Sowerby joins as Chief Executive Officer, from Avon

Cosmetics, one of the world's largest social selling companies,

where he headed up global business development, and previously

Strategy. He brings with him deep experience in social selling,

retailer partnerships, and executing global growth plans.

Paul Ellerbeck joins as Chief Technology Officer, with an

excellent track record as a commercially-minded C.T.O in growth

tech businesses including Easy Property Group, a disruptor in the

online property market, and The Digital Property Group, one of the

UK's largest property groups that merged with Zoopla.

Martin Best joins as Chief Marketing Officer, from World Remit,

a major disruptive player in the money transfer market, having

previously held various global Marketing and Commercial Director

roles at Carlsberg. Martin has deep experience of practical

execution of growth plans in disruptive industries.

Lisa Heidemanns joins as Chief Operating Office in Q2 2019, from

LVMH where she has held a variety of senior management positions

across the LVMH portfolio of brands, including most recently as

Chief Client Officer of Rimowa. Lisa brings with her strong

expertise in developing insight-led consumer propositions and

experiences.

New branding with more relevance and focus

As part of WeShop's efforts to develop a compelling proposition

and user experience, its proposition has been refocussed

considerably on Gen-Z and Millennials (18-34 year olds), as they

have the highest levels of engagement on social media, and

penetration of online shopping, enabling the business to leverage

existing behaviours. Considerable insight, testing and research has

been carried out to ensure that the positioning, branding and

messaging is as relevant and targeted as possible.

The agreement of key commercial deals as part of the plan to

develop a true social retail ecosystem

Direct Integration: WeShop has announced that it has completed

its first commercial agreement with a retailer to directly

integrate onto the WeShop platform, allowing users to checkout on

site. The retailer provides over 100 top brand names in the world

of fashion. Not only will this lead to a frictionless checkout

experience, but the commercial rates agreed are 300% higher than

the current average affiliate.

Brand Relationships: WeShop has also announced that, over the

past 3 months, it has developed several direct relationships with

world leading brands and retailers, with signed Letters of Intent

secured. These relationships will be progressed over the coming

year with the ultimate view of directly integrating with their

distribution centres. These will be formally announced to

shareholders in the coming months.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information, please contact:

Primorus Investments plc: +44 (0) 20 7440 0640

Alastair Clayton

Nominated Adviser: +44 (0) 20 7213 0880

Cairn Financial Advisers LLP

James Caithie / Sandy Jamieson

Broker: +44 (0) 20 3621 4120

Turner Pope Investments

Andy Thacker

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDXELFFKXFBBBX

(END) Dow Jones Newswires

March 15, 2019 09:06 ET (13:06 GMT)

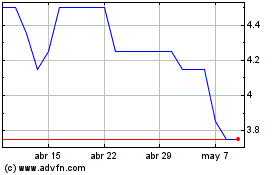

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024