German Telcos Bid EUR350 Million for 5G Spectrum as Auction Launches

20 Marzo 2019 - 5:43AM

Noticias Dow Jones

By Patrick Costello

--German telecoms providers have bid EUR350 million for 5G

frequencies in the first two days of the auction

--Analysts expect companies will eventually bid billions of

euros for frequencies

--The auction will run until companies stop submitting bids

German telecoms providers have submitted bids totaling nearly

350 million euros ($397 million) for frequencies on the 5G spectrum

range, Germany's national telecoms regulator, the Federal Network

Agency, said Wednesday.

Telecom providers Deutsche Telekom AG (DTE.XE), Telefonica

Deutschland (O2D.XE), Vodafone Germany and United Internet AG's

1&1 Drillisch AG (DRI.XE) began submitting bids for spectrum on

Tuesday at the regulator's premises in Mainz, the agency said.

Some 41 blocks of spectrum are being auctioned off in the 2 GHz

and 3.4 GHz to 3.7 GHz bands. Companies are bidding for frequencies

on the spectrum to build up 5G networks that will be used by

consumers and industry.

As of 1030 GMT, Vodafone Group PLC's (VOD.LN) German subsidiary

submitted the highest individual bid, offering to pay EUR27.5

million for a block of spectrum on the 2 GHz band in the 13th round

of bidding.

The highest bid made by Deutsche Telekom--Europe's largest

telecoms provider--amounted to EUR23.8 million for spectrum the 3.6

GHz block.

1&1 Drillisch AG submitted the highest set of bids overall,

entering 10 bids exceeding EUR21 million during the first round of

bidding alone. The company would become Germany's fourth

mobile-network operator should it win spectrum at the auction.

Analysts are uncertain as to how much companies will ultimately

pay for these frequencies.

"With four operators taking part, including 1&1 Drillisch

for the first time, the equity market fears an irrational auction,"

Berenberg analyst Usman Ghazi said, noting some forecasts expect

auction costs to exceed EUR8.5 billion.

Still, Berenberg said it believes auction costs could be as low

as EUR3 billion.

"The only reason for high auction prices...will be a senseless

strategy to block 1&1 Drillisch," Mr. Ghazi said.

Federal Network Agency President Jochen Homann said that

"maximizing proceeds" isn't the agency's aim, adding that the

auction allows companies to decide for themselves what these

frequencies are worth.

Because the auction will end only when companies cease

submitting new bids, its duration cannot be predicted, the agency

said.

Write to Patrick Costello at patrick.costello@dowjones.com

(END) Dow Jones Newswires

March 20, 2019 07:28 ET (11:28 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

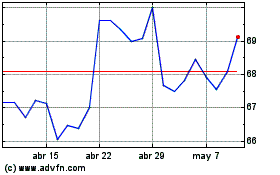

Vodafone (LSE:VOD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

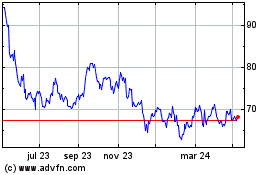

Vodafone (LSE:VOD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024