TIDMPFP

RNS Number : 8108V

Pathfinder Minerals Plc

10 April 2019

10 April 2019

Pathfinder Minerals Plc

("Pathfinder" or the "Company")

Corporate Update, Scoping Study

&

Subscription & Further Issue of Equity

Pathfinder provides an update on progress towards restoring an

interest in Mining Concession 4623C (the "Licence") in Mozambique

and settling all current and pending legal disputes associated

directly and indirectly with the Licence (the "Proposed

Transaction").

The Board is evaluating multiple transaction structures, taking

into account commercial and regulatory factors, through which the

Company could hold its interest in the Licence and deliver value

for shareholders. While the optimal structure of the Proposed

Transaction remains under evaluation, the Board is pleased to relay

that the principle of a Proposed Transaction has been agreed

between Pathfinder and General Jacinto Veloso who, with his family

interests, is a 50 per cent shareholder in the entity to which the

Licence is currently registered. In parallel, the Board is

evaluating, and is in active discussions with regards to, potential

funding strategies (including both partnerships and debt provision)

to facilitate the Proposed Transaction and finance subsequent

development of the Licence. The Board's objective is to deliver

meaningful value to current shareholders and minimise future

dilution. Further updates will be provided as and when

appropriate.

The Licence contains the Moebase and Naburi heavy mineral sands

deposits previously licensed to the Company under Mining

Concessions 760C and 4623C. The amalgamated Licence covers

approximately 32000 hectares of land on the Indian Ocean coast of

the Zambezia province of Mozambique, containing ilmenite, rutile

and zircon.

Updated Scoping Study

The Board commissioned an independent technical consultant, 2M

Mineral Services Limited, to prepare a revised Scoping Study on the

Licence (the "2019 Report"), which includes a revision of the

capital and operating costs and pricing assumptions that were

presented in the URS/Scott Wilson 2011 scoping study report (the

"2011 Report"). This revision has resulted in an estimated pre-tax

net present value ("NPV") at a 10 per cent discount rate of US$1.05

billion; with projected annual revenues of US$323 million over a

mine life of 30 years. The project internal rate of return ("IRR")

is expected to be approximately 25 per cent. The revised findings

represent a near doubling of the previously reported equivalent NPV

and an increase of 6.1 per cent in the project IRR. A summary of

the key differences in scoping study outcomes between the 2011

Report and the 2019 Report is set out below.

Key Differences in Scoping Study Outcomes between 2011 and 2019 Scoping

Study Reports:

2011 2019 Change

%

------------ ------------- ------------ --------

Estimated Run of Mine production Mtpa 47.7 47.7 0%

------------ ------------- ------------ --------

Estimated Life of Mine Years 30 30 0%

------------ ------------- ------------ --------

Estimated Mineral Content Split

of Final Product Ilmenite 93.4% 93.4% 0%

------------ ------------- ------------ --------

Rutile 1.8% 1.8% 0%

-------------------------------------------------- ------------- ------------ --------

Zircon 4.8% 4.8% 0%

-------------------------------------------------- ------------- ------------ --------

Estimated Annual Production ('000

tonnes) Ilmenite 1,245 1,245 0%

------------ ------------- ------------ --------

Rutile 24 24 0%

-------------------------------------------------- ------------- ------------ --------

Zircon 65 65 0%

-------------------------------------------------- ------------- ------------ --------

Projected Annual Revenues US$ m 247 323 +19.4%

------------ ------------- ------------ --------

Initial Capital Cost US$ m 686 742 +7.5%

------------ ------------- ------------ --------

Estimated Pre-tax IRR % 18.8% 24.9% +6.1%*

------------ ------------- ------------ --------

Estimated Pre-tax NPV @ 10% discount

rate US$ m 529 1,046 +97.7%

------------ ------------- ------------ --------

Pricing Assumptions (USD/tonne) Ilmenite 125 173 +38.4%

------------ ------------- ------------ --------

Rutile 677 908 +34.1%

-------------------------------------------------- ------------- ------------ --------

Zircon 1,148 1,320 +15.0%

-------------------------------------------------- ------------- ------------ --------

* On an absolute basis

The 2019 Report is based on the previously estimated historical

mineral resource of the Licence of 2.02 billion tonnes, with a

total heavy mineral content of approximately 3.55 per cent -

equivalent to approximately 71.7 million tonnes of contained heavy

minerals - which will be the subject of confirmation drilling and

re-estimation in the next stage of study.

Issue of Equity

Cash Subscription

The Company has conditionally raised GBP200,000 via a

subscription for 10,000,000 new ordinary shares of 0.1p each in the

capital of Company ("Ordinary Shares") (the "Subscription Shares")

at a price of 2.0p per share (the "Subscription Price") with new

and existing investors, including a director of the Company (the

"Subscription"). The Subscription is conditional only on admission

of the Subscription Shares to trading on AIM.

The Subscription Price represents a premium of approximately 48

per cent over the middle market closing price of the Company's

Ordinary Shares on 9 April 2019 (the latest practicable date prior

to the publication of this announcement), which was 1.35p.

The proceeds from the Subscription are to be utilised for

general working capital purposes.

Settlement Share Issue

In addition, the Company has agreed to issue, in aggregate,

7,500,000 new Ordinary Shares at 2.0p per share to a current

director and certain former directors (the "Participating

Directors") in satisfaction of deferred salary that has been

accrued (the "Settlement Shares"). The Settlement Share issue has

the positive effect of reducing the Company's accrued cash

liabilities by an aggregate GBP150,000.

Details of the Subscription Shares and Settlement Shares to be

issued to the Participating Directors are set out below:

Director/Former Number of Number of Total Ordinary Ordinary

Director Ordinary Ordinary Shares Shares held Share holding

Shares subscribed issued in immediately as a percentage

for pursuant settlement following of enlarged

to the Subscription of accrued admission share capital

directors' of the Subscription immediately

fees pursuant Shares and following

to the Settlement the Settlement admission

Share issue Shares of the Subscription

Shares and

the Settlement

Shares

Scott Richardson

Brown 1,250,000 - 3,101,851 1.07%

--------------------- ------------------ --------------------- ---------------------

Sir Henry Bellingham - 1,250,000 1,250,000 0.43%

--------------------- ------------------ --------------------- ---------------------

Nicholas Trew* - 3,608,350 n/a n/a

--------------------- ------------------ --------------------- ---------------------

Robert Easby* - 2,641,650 n/a n/a

--------------------- ------------------ --------------------- ---------------------

* directors within the past 12 months

Participating Director (as defined above)

Related Party Transactions

As a director of the Company, the participation in the

Subscription by Scott Richardson Brown is treated as a related

party transaction.

As a director and former directors of the Company within the

past 12 months, the participation of the Participating Directors in

the Settlement Share issue is treated as a related party

transaction.

Accordingly, Simon Farrell, being the only independent director

in relation to Scott Richardson Brown's participation in the

Subscription and the Participating Directors' participation in the

Settlement Share issue, considers, having consulted with the

Company's Nominated Adviser, Strand Hanson Limited, that the terms

of the respective participations are fair and reasonable insofar as

the Company's shareholders are concerned.

Issue of Share Options

The Company has today also granted a total of 7,500,000 share

options over 7,500,000 Ordinary Shares to Scott Richardson Brown.

Further details of the share option grant are set out below:

Director No. of share Exercise Expiry date Total no. of

options granted Price share options

held

================== ================= ========= ============ ==============

Scott Richardson

Brown 7,500,000 2.50p 10/04/2021 13,500,000

================== ================= ========= ============ ==============

Admission and Total Voting Rights

The Company will apply to the London Stock Exchange for

admission of the Subscription Shares and the Settlement Shares to

AIM ("Admission"). Admission is expected to take place on or around

30 April 2019. Following Admission, the Company's issued share

capital will consist of 290,430,288 Ordinary Shares with no

Ordinary Shares held in treasury. Therefore, this figure may be

used by shareholders as the denominator for the calculations by

which they will determine if they are required to notify their

interest in, or a change to their interest in, Pathfinder under the

FCA's Disclosure Guidance and Transparency Rules.

Scott Richardson Brown, Chief Executive Officer of Pathfinder,

commented:

"The agreement between General Veloso and Pathfinder, subject to

the further work to firm up the optimal transaction structure for

Pathfinder shareholders to bring this to completion, should give

shareholders confidence that the return of this asset is now,

finally, on the near horizon. It reflects the considerable efforts

of the parties to work together towards a resolution in the

interests of all stakeholders. The Board's confidence in the

deliverability of a resolution is further reflected in the

directors' participation in the Subscription and Settlement Share

issue today at a 48 per cent premium to the closing mid market

price yesterday.

"The results of the revised scoping study report are compelling

and serve as a reminder of the opportunity for value creation from

the Licence."

Enquiries:

Pathfinder Minerals Plc

Scott Richardson Brown, Chief Executive Officer

Tel. +44 (0)20 3440 7775

Strand Hanson Limited (Nominated & Financial Adviser and

Broker)

James Spinney / Ritchie Balmer / Jack Botros

Tel. +44 (0)20 7409 3494

Vigo Communications (Public Relations)

Ben Simons / Simon Woods

Tel. +44 (0)20 7390 0234

Email. pathfinderminerals@vigocomms.com

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR").

PDMR Notification Forms

The notifications below are made in accordance with the

requirements of MAR.

1. Details of the persons discharging managerial responsibilities

/ person closely associated

a) Name Scott Richardson Brown

-------------------------- ---------------------------------------

2. Reason for the notification

-------------------------------------------------------------------

a) Position/status Chief Executive Officer

-------------------------- ---------------------------------------

b) Initial notification Initial notification

/ amendment

-------------------------- ---------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name Pathfinder Minerals PLC

-------------------------- ---------------------------------------

b) LEI 2138009YG6AG3K86TN77

-------------------------- ---------------------------------------

4. Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------

a) Description of the Ordinary Shares of 0.1 pence per share

financial instrument,

type of instrument

-------------------------- ---------------------------------------

Identification code GB00BYY0JQ23

-------------------------- ---------------------------------------

b) Nature of the transaction Participation in subcription

-------------------------- ---------------------------------------

c) Price(s) and volume(s) Share Price (GBX) Volume(s)

2.0 pence per share 1,250,000

----------

-------------------------- ---------------------------------------

d) Aggregated information N/A

- Aggregated volume

- Price

-------------------------- ---------------------------------------

e) Date of the transaction 10 April 2019

-------------------------- ---------------------------------------

f) Place of the transaction AIM, London Stock Exchange

-------------------------- ---------------------------------------

1. Details of the persons discharging managerial responsibilities

/ person closely associated

a) Name Scott Richardson Brown

-------------------------- ---------------------------------------

2. Reason for the notification

-------------------------------------------------------------------

a) Position/status Chief Executive Officer

-------------------------- ---------------------------------------

b) Initial notification Initial notification

/ amendment

-------------------------- ---------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-------------------------------------------------------------------

a) Name Pathfinder Minerals PLC

-------------------------- ---------------------------------------

b) LEI 2138009YG6AG3K86TN77

-------------------------- ---------------------------------------

4. Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

-------------------------------------------------------------------

a) Description of the Ordinary Shares of 0.1 pence per share

financial instrument,

type of instrument

-------------------------- ---------------------------------------

Identification code GB00BYY0JQ23

-------------------------- ---------------------------------------

b) Nature of the transaction Issue of Options

-------------------------- ---------------------------------------

c) Price(s) and volume(s) Share Price (GBX) Volume(s)

2.50 pence per share 7,500,000

----------

-------------------------- ---------------------------------------

d) Aggregated information N/A

- Aggregated volume

- Price

-------------------------- ---------------------------------------

e) Date of the transaction 10 April 2019

-------------------------- ---------------------------------------

f) Place of the transaction AIM, London Stock Exchange

-------------------------- ---------------------------------------

1. Details of the persons discharging managerial responsibilities

/ person closely associated

a) Name Sir Henry Bellingham

-------------------------- -----------------------------------------

2. Reason for the notification

---------------------------------------------------------------------

a) Position/status Non-Executive Co-Chairman

-------------------------- -----------------------------------------

b) Initial notification Initial notification

/ amendment

-------------------------- -----------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

---------------------------------------------------------------------

a) Name Pathfinder Minerals PLC

-------------------------- -----------------------------------------

b) LEI 2138009YG6AG3K86TN77

-------------------------- -----------------------------------------

4. Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

---------------------------------------------------------------------

a) Description of the Ordinary Shares of 0.1 pence per share

financial instrument,

type of instrument

-------------------------- -----------------------------------------

Identification code GB00BYY0JQ23

-------------------------- -----------------------------------------

b) Nature of the transaction Issue of shares in settlement of accrued

fees

-------------------------- -----------------------------------------

c) Price(s) and volume(s) Share Price (GBX) Volume(s)

2.0 pence per share 1,250,000

---------------

-------------------------- -----------------------------------------

d) Aggregated information N/A

- Aggregated volume

- Price

-------------------------- -----------------------------------------

e) Date of the transaction 10 April 2019

-------------------------- -----------------------------------------

f) Place of the transaction AIM, London Stock Exchange

-------------------------- -----------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCGGUQCCUPBGCU

(END) Dow Jones Newswires

April 10, 2019 10:49 ET (14:49 GMT)

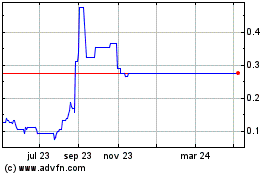

Pathfinder Minerals (LSE:PFP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Pathfinder Minerals (LSE:PFP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024