TIDMPTY

RNS Number : 2676W

Parity Group PLC

16 April 2019

16 April 2019

PARITY GROUP PLC

FULL YEAR RESULTS FOR THE YEAR TO 31 DECEMBER 2018

Parity Group plc ("Parity" or the "Group"), the data and

technology focussed professional services business, announces its

full year results for the year ended 31 December 2018.

Financial Headlines:

-- Group revenues(1) up by 2.7% to GBP86.1m (2017: GBP83.8m)

-- Adjusted profit before tax(2) declined by 48.7% to GBP0.85m

(2017: GBP1.66m) primarily due to non-renewal of large consultancy

contract

-- Continued positive cash flow from operations of GBP0.6m (2017: GBP3.0m)

-- Further reduction in net debt to GBP1.1m (2017: GBP1.6m)

1. On a continuing basis

2. Profit before tax and non-recurring items from continuing operations

Strategic and Operational Headlines:

-- Revenue growth strongest in lower margin business

-- Strong performance with our public sector framework contracts during 2018

-- Increasing repeat business from long standing clients

-- Wins in private sector complement historic government strengths

-- Changes to consulting business begin

-- Appointment of Antonio Acuna to lead consulting division

-- New projects in data analysis and management for private and public sector clients

-- Restructuring of consulting team to optimise margin and reflect client demand

-- Cross-selling between divisions

-- Clients buying support from both sides of the business - recruitment and consultancy

-- Disposal

-- Exit from loss-making, non-core activity Inition.

John Conoley, Non-Executive Chairman of Parity Group, said:

"2018 was the year when Parity revisited its long-term strategy.

We set in place the foundations for growth in a market that has

continued to evolve. We invested in senior talent and marketing.

Reorganising and reshaping of our proposition will build on our

strengths as trusted partners with deep and lasting relationships

that empower clients to make bold data-led business decisions."

"Trading remains in line with expectations and the Board's

confidence in the refreshed strategy is reflected in its continuing

investment. Alongside a strengthening of senior talent, we have the

foundations for growth in the coming years."

Matthew Bayfield, Chief Executive, said:

"This has been a year of reflection and change for Parity."

"As client and market needs changed, we experienced real

challenges that questioned our approach. We responded with a

roadmap for a new operating model that includes new service lines,

a clearer emphasis on consistent and integrated relationship

management and a stronger brand and communication to the market.

Our strengths in financial management have enabled us to reduce

debt and continue to generate cash and, together with a positive

initial response from clients to our new offer, this gives us

confidence for the future."

For further information, contact:

Matthew Bayfield, CEO

Roger Antony, GFD Parity Group 020 8543

David Beck, PR & Communications plc 5353

Mike Coe 020 7220

Chris Savidge WH Ireland 1666

This announcement contains certain statements that are or may be

forward-looking with respect to the financial condition, results or

operations and business of Parity Group plc. By their nature

forward-looking statements involve risk and uncertainty because

they relate to events and depend on circumstances that will occur

in the future. There are a number of factors that could cause

actual results and developments to differ materially from those

expressed or implied by such forward-looking statements. These

factors include, but are not limited to (i) adverse changes to the

current outlook for the UK IT recruitment and solutions market,

(ii) adverse changes in tax laws and regulations, (iii) the risks

associated with the introduction of new products and services, (iv)

pricing and product initiatives of competitors, (v) changes in

technology or consumer demand, (vi) the termination or delay of key

contracts and (vii) volatility in financial markets.

Chairman's Report

2018 - a year of strategic realignment for Parity

This year has been very significant for Parity.

After a period of consolidation and reflection we have embarked

on a course for long term growth that will capitalise on our

strengths and develop a proposition that meets client need.

Our experience has increasingly told us that we have two

opportunities. We have a strong story to tell about how data is

used by organisations which should bring us higher margin

consulting projects. We are also seeing increasing success when

introducing clients to the breadth of our services. The board

decided that it is time for a more co-ordinated offer and

structure.

Results

Revenue grew at 2.7% across the Group increasing to GBP86.1m for

the full year (2017: GBP83.8m). The Group continues to be cash

generative and has maintained strong working capital management

with debtor days reduced to 18 days (2017: 20 days), resulting in a

further reduction of net debt to GBP1.1m (2017: GBP1.6m),

underpinning our solid platform for future investment and

development of the Group strategy.

Despite this, our strong first-half was followed by a

significant delay and subsequent non-renewal of a major project for

our Consultancy Services business. This reversed the trend of

growing contribution from this side of the business and prompted us

to accelerate a restructuring which we had planned to manage more

progressively.

Board changes and people

The existing management team had made consistent progress in

simplifying the structure of the business and aligning services

better to support our clients in the growth markets we had

identified. The recruitment of Matthew Bayfield in May 2018 was

another significant step in ensuring the development of services to

meet the demand for data driven solutions. Every company is

investing to exploit the opportunities available to make better

decisions through the mining and deciphering of information. With

his recognised industry expertise, Matthew has quickly been able to

develop services that have been well received by our clients and

are leading to further opportunities.

As announced in February 2019, Matthew Bayfield joined the Board

on 5 February as Chief Executive Officer, replacing Alan Rommel.

Subsequently, on 8 April, we announced that Alan Rommel had stepped

down from his Board role as Chief Operating Officer in order to

pursue other interests. The Board acknowledges and thanks Alan for

his significant contribution and commitment to the Group over the

last 25 years.

We are lucky in being supported by a strong team of committed

professionals at every level of the business and see investment in

skills as a key plank of our future plans.

Strategy

Having been greatly encouraged by the opportunities identified

in higher-margin data consultancy services, the Board has

restructured the Consultancy Services division to focus more

closely on this market. In addition to the promotion of Matthew, we

are investing significantly in senior talent to drive thought

leadership and engage with clients at the earliest stages of their

data policy development leading on to delivering their data

projects.

Better alignment between our consulting and recruitment

businesses offers Parity a competitive advantage as we widen the

client base to which we offer the full portfolio of our services.

Our aim is to drive further operating margin improvement and

deliver consistent growth in earnings and sustainable shareholder

value in the medium and long-term.

This will be supported by the forthcoming developments in

marketing and branding which we have initiated for roll-out in

2019. Additionally, changes to our internal operating model will

assure consistent quality in our relationship and account

management whilst maintaining our strength in financial

management.

Financing and dividend

Banking arrangements with PNC have been in place since 2010. PNC

has confirmed internal credit approval to extend the facility for a

further two years on improved terms. The renewal will result in a

GBP10m facility with interest charged at 2.00% above base

(previously 2.35%).

The Board is not proposing to declare a dividend at this time

but will keep this policy under review.

Current trading and outlook

Trading in the current financial year remains in line with

expectations. The Board remains confident in its strategy and

continues to invest to improve the operational efficiencies in the

core recruitment service offering, the alignment of the service

offerings from both a sales and delivery capability, and the

strengthening of the senior talent within the firm to deliver an

improved trajectory through 2019 and beyond.

Chief Executive's statement

Since my appointment as Chief Executive two months ago I have

spent considerable time with our clients. I have been seeking to

better understand our clients' data and technology needs and to

review our ability to fully service those needs. The explosion of

data analytic software and the value potential that is created from

a better understanding of customer behaviour is well known.

The new and ever-growing challenges facing corporates and

government organisations in data have become:

-- acquiring the human skills to interpret the vast quantity of data being generated;

-- attracting the people who can adapt operating systems in

light of learnings from that data; and

-- inspire confident decision making based upon reliable data and advice.

Parity, as a specialist in the people who know and understand

the value of data, is ideally placed to benefit from this next

stage in the data growth story.

Parity has great strengths in recruitment and resourcing and in

providing our clients with data and technology experts who are

focused on delivery. Alongside our resourcing business we have

built a smaller but higher margin consultancy business that

delivers data and technology solutions to a small number of large

clients.

However, we have not been as successful as we would like in

leveraging our strengths and skills in resourcing to help us to

grow our consultancy business. Our operating model is set up to

support a relatively low margin recruitment business which is very

focussed on delivery but is less well suited to selling higher

margin consultancy; the business has operated within silos and has

failed to transfer clients between the two service lines at

scale.

The new Parity business model

In future the Parity business model will change, we will have

three distinct propositions to take to clients; recruitment,

learning and development and consultancy, all delivered through a

single account management team working to deliver a single P&L.

They will be supported by a single and enhanced sales and marketing

function.

The three service lines will complement each other and encourage

cross referrals and integrated solutions, delivering what our

clients have asked for, being the support of a collaborative

partner, that enables confident decision making based on reliable

data.

Recruitment

Our recruitment proposition represents the heritage of our

business, it has an enviable list of blue-chip clients in both the

public and private sector. Clients like the excellent level of

service we provide and its specialism in the field of data and

technology. However, the market for these services operates on

relatively low margins, is increasingly commoditised and is highly

price sensitive. We will continue to be active in this field but

will increasingly focus on the higher value recruitment that fits

alongside our other service lines of learning and development and

consultancy.

Consultancy

We are also in the market offering data and technology

consulting and whilst we have enjoyed some successes, we have also

had challenges and they have largely been of our own making. We

have lacked sufficient account management skills and are failing to

fully capitalise on our proven knowledge of the data and IT

markets. We regard this as a significant opportunity and are

investing in senior management to lead this effort. We announced

today that Antonio Acuna MBE, formerly Head of the UK Government's

open data initiative data.gov.uk, has joined us to lead our

consultancy services. Working more closely with the established

account management teams in recruitment we will be able to offer

integrated recruitment and advisory packages to help solve clients'

need for effective data management and analysis.

Learning & Development

We will launch a new service line in learning and development.

Clients who engage with us and buy our recruitment and advice

services are also looking to develop their existing people. With

our proven knowledge of the skills required of people in data and

technology we are ideally placed to diagnose clients' learning and

development needs. We will design and deliver programs to upskill

our clients' existing people resources in data management and

analysis, whilst identifying gaps that can be filled through

recruitment as well as data and IT projects that require our

consultancy service.

One Parity business

All three service offerings will operate as one business

reported as such without divisional breakdowns. We will be

completely re-engineering our sales and marketing function and are

in the process of recruiting a new leader for this critical

function. In the past we have tended to rely on our existing

relationships and been reactive to clients' requests; in the future

we will be much more proactive in leading thinking in the area of

data management and analysis. With three integrated market

propositions that are relevant to companies across all sectors and

almost regardless of size there is a huge addressable market.

We will be relaunching the Parity brand in the very near future

with a new more modern identity and clearer messaging. We have a

large network of employees, consultants and people who we have

placed within organisations all of whom can become ambassadors and

advocates for the new Parity way of working.

Parity is a professional services business with unrivalled

skills and expertise in a hugely important and fast-growing market,

which gives us great confidence in our future prospects.

Operational and Financial Review

-- An increase in revenue but weighted towards lower margin recruitment work

-- Delay and subsequent loss of the MoD account impacted operating profit substantially

-- Continued strong working capital management resulted in a decrease in net debt

Continuing Operations 2018 2017 Incr./(Decr.)

GBP000's GBP000's %

---------------------------------- ---------- ---------- --------------

Key Financials

Revenue 86,112 83,815 2.7%

Adjusted profit before tax(1) 853 1,662 (48.7%)

Net debt (1,090) (1,632) (33.2%)

---------------------------------- ---------- ---------- --------------

Ratios

Adjusted PBT margin % 1.0% 2.0%

Net debt / Adjusted EBITDA ratio 0.8 0.7

---------------------------------- ---------- ---------- --------------

1 Adjusted profit before tax is defined as profit before tax and non-recurring items

Despite growth in its revenues, the Group experienced a

reduction in adjusted profit before tax during the year ended 31

December 2018. The decline in profit derived mainly from the mix

impact of revenue growth in the lower margin Professionals

division, and a reduction in both revenue and contribution from the

Consultancy Services division. The trading challenges in the

Consultancy Services division prompted a restructure of the

division with the associated one-off costs treated as non-recurring

items. The Group was cash generative during the year resulting in a

further reduction to net debt.

Revenue for the year ended 31 December 2018 increased by 2.7%

from GBP83.8m to GBP86.1m driven by growth in the Professionals

division. The division's contractor volumes recovered from the

impact of IR35 reforms introduced in the public sector in 2017. The

trading issues in the Consultancy Services division led to a weaker

revenue mix. Consequently, adjusted profit before tax fell by 48.7%

from GBP1.66m to GBP0.85m with the Group adjusted PBT margin

tightening from 2.0% to 1.0%. Non-recurring items incurred in the

year were predominately related to restructuring and totalled

GBP495,000. Profit before tax after deducting non-recurring items

was GBP358,000. Net cash generated from operations was GBP604,000

enabling us to reduce net debt from GBP1.6m to GBP1.1m at the end

of 2018, with the Net Debt/Adjusted EBITDA ratio at the end of year

0.8x (2017: 0.7x).

Divisional performance

2018 2017 Incr./(Decr.)

GBP000's GBP000's %

------------------------------- ---------- ---------- --------------

Revenue

Parity Professionals 84,025 80,036 5.0%

Parity Consultancy Services 8,496 9,543 (11.0%)

Less inter-segment revenue (6,409) (5,764) -

------------------------------- ---------- ---------- --------------

Group revenue 86,112 83,815 2.7%

------------------------------- ---------- ---------- --------------

Divisional contribution

Parity Professionals 2,314 2,307 0.3%

Parity Consultancy Services 320 1,148 (72.1%)

------------------------------- ---------- ---------- --------------

Total divisional contribution 2,634 3,455 (23.8%)

------------------------------- ---------- ---------- --------------

Reconciliation of divisional contribution and adjusted EBITDA to

operating profit from continuing operations

2018 2017

GBP'000 GBP'000

--------------------------------------------- --------- ---------

Divisional contribution 2,634 3,455

Group costs (1,093) (1,045)

Share-based payment charges (129) (68)

--------------------------------------------- --------- ---------

Adjusted EBITDA 1,412 2,342

Depreciation and amortisation (194) (286)

Operating profit before non-recurring

items 1,218 2,056

Non-recurring items (continuing operations) (495) -

Operating profit from continuing operations 723 2,056

--------------------------------------------- --------- ---------

Divisional contribution is reconciled to the income statement as

part of segmental information presented in note 2.

Parity Consultancy Services

During 2018 the Consultancy Services business was focused on

delivering data and technology solutions to its clients. Whilst

trading was in line with our expectations in the first half of the

year, the division was impacted by challenges in the second half

which resulted in a 72% drop in full year divisional contribution

to GBP0.3m (2017: GBP1.1m). Nevertheless, we remain convinced by

the opportunity that the data consultancy market provides to the

Group and have invested in senior management and marketing during

the year. The difficult second half prompted a restructuring of the

division, to align the cost base towards the more profitable

opportunities available to the Group.

The most significant challenge related to the long-standing

MCOCS contract with the MoD. Whilst the division maintained the

quality of its delivery to the client during the year, an expected

extension in Q3 to the contract was delayed due to a protracted

client decision-making process, and subsequently not renewed. As a

result of the delay the division incurred losses associated with

its fixed cost delivery base. To a lesser extent the division was

also impacted in H2 by a reduction in spend for our Application

Management Support services in comparison to previous years.

In Q4 the division acted to address its losses, taking the

decision to restructure its delivery function. We have excluded

further work on the MCOCS project from our financial projections,

and right-sized our delivery model for Application Management

Support. Inevitably this resulted in some redundancies. The

associated one-off costs have been treated as non-recurring

items.

Good progress has been made with other clients including the

Education and Skills Funding Agency where we are supporting our

client with its digital projects. Most pleasingly, we have seen

early signs of success from the investments made to focus efforts

on data consultancy services. These investments have been

instrumental in winning work with a leading contract catering and

facilities group.

Parity Professionals

Parity Professionals provides targeted recruitment of temporary

and permanent professionals with the staff to deliver business

change programmes. We supply a broad range of skills from project

management through to the niche skills in digital, data and

information security required to ensure our clients can deliver

their projects.

Parity Professionals generated revenue growth of 5% at GBP84.0m

(2017: GBP80.0m), building on a well-established client base in the

Public Sector with 15 framework wins and over 100 new clients in

the year. Over 50% of the new client wins were in the Private

Sector including household names such as Primark, not-for profit

organisations such as the British Standards Institute and a number

of housing associations.

Revenue growth was supported by a higher number of new interim

candidate placements in the period. Contractor volumes recovered

from the impact of the IR35 reforms which were introduced in April

2017 and applied to contractors working at our public sector

clients. At the end of 2018 the number of contractors on billing

was 995 (end 2017: 940). The total margin value on new sales in the

period grew by 8% compared to 2017, and this momentum has improved

through the year, resulting in a forward order book at year end of

GBP32.7m (2017: GBP27.5m). Revenue from permanent recruitment was

broadly flat at GBP638,000 (2017: GBP657,000) partly due to supply

side shortages, though average fee rates per placement increased

significantly as we targeted more senior roles and niche skills in

the digital and cyber security markets.

One challenge created by the IR35 reforms and affecting the

divisions contribution is a higher contractor churn rate, partly

due to the lure of roles in the Private Sector, where the reforms

will not apply until 2020. The divisional contribution margin was

also affected by the managed service win at Primark, with lower

than average contractor gross margins initially, but with the

opportunity to improve profitability in the future, by placing

contractors that we have sourced.

We continue to deliver the service-wrap for the Public Sector

FastStream Graduate intake and this contract has been extended

through to September 2019, though it is expected that the client

will in-house the service provision, TUPEing Parity staff from this

point with no stranded costs to the business. Parity Professionals

successfully retendered for G-Cloud 10 framework with the Crown

Commercial Service and has been awarded a managed service for the

provision of project and programme management services for the

Scottish Government Digital Superfast Broadband programme

underwriting our dominant position for trusted delivery on key

Public Sector contracts.

After the year end we were informed that a significant framework

contract for the placement of staff with the Scottish Government

would not be renewed. Our incumbent contractors placed through the

framework will continue their contracts until their assignments end

but we will not be able to make any new placements. This will

result in revenues from the framework contract gradually winding

down over the next two financial years. While this legacy type of

contract has been significant in revenue terms it has provided

relatively low levels of margin, the loss of which will be largely

offset by costs savings mainly related to serving this specific

contract during the period of contract run off.

In the longer term the end of this contract will improve the

Group's net margin performance albeit from a lower level of

revenue, consistent with the longer term direction of travel for

Parity.

Non-recurring items

Non-recurring items of GBP0.50m (2017: GBPnil) were incurred

during the year, primarily as a result of restructuring the

Consultancy Services division.

Taxation

The tax credit on continuing profit before tax was GBP63,000

(2017: tax credit of GBP534,000), mainly representing a deferred

tax adjustment in respect of prior periods. Whilst the Consultancy

Services division generated a lower contribution than the previous

year, its outlook remains positive. Therefore, we continue to take

a prudent view on the division's carried forward tax losses which

remain unrecognised but will keep this under review.

The Group did not provide for corporation tax payable in 2018

due to the utilisation of Group relief and the availability of

carried forward deductible timing differences and tax losses.

Discontinued operations

We disposed of the non-core Inition subsidiary in April 2018 for

consideration of GBP0.2m and recorded a loss on disposal of

GBP0.3m. Inition was held for sale at the start of the year and

accordingly its results to the point of disposal are presented as

discontinued. During the portion of 2018 that Inition was owned by

the Group, it incurred an operating loss before tax of GBP0.3m

(2017: GBP1.1m).

Earnings per share and dividend

The basic earnings per share from continuing operations were

0.41 pence (2017: 2.15 pence). The decrease stems from lower

profitability and the deferred tax credit recognised in 2017.

The Board does not propose a dividend for 2018 (2017: nil).

During the year the Board sought external advice in respect of the

steps needed to restore a dividend. The Board suspended the

exercise when it became clear that profits before tax would be

lower than in 2017 but will keep the position under review.

Statement of Financial Position

Trade and other receivables

Trade and other receivables remained at a consistent level in

comparison to the previous year at GBP12.0m (2017: GBP12.0m).

Ordinarily we would expect the increased contractor volumes in the

Professionals division to carry a higher working capital

requirement. However, the working capital requirement has been

offset by a further improvement in debtor collections in the

Professionals division. Group debtor days, calculated on billings

on a countback basis, decreased to a record low of 18 days (2017:

20 days).

Trade and other payables

Trade and other payables also remained at similar levels to the

previous year at GBP8.3m (2017: GBP8.3m). At the year end, creditor

days were 28 days (2017: 28 days).

Loans and borrowings

Loans and borrowings represent the Group's debt under the

asset-based lending facility. This is a working capital facility

and is consequently linked to the same cycle as the trade

receivables. The asset-based lending facility with PNC Business

Credit ("PNC"), a leading secured finance lender, allows for

borrowing of up to GBP15m depending on the availability of

appropriate assets as security. The current facility which has been

in place since 2010 is in the final stages of being renewed on

improved terms including a reduction in the interest rate to 2.00%

above base rate from 2.35% previously. The terms of the agreement

have been sanctioned by PNC's credit committee with just the legal

paperwork to tie up to complete the renewal.

Cash flow and net debt

The Group generated positive net cash flows from operating

activities of GBP0.6m (2017: GBP3.0m), driven by EBITDA and a

positive working capital swing with a reduction in debtor days to

18 (2017: 20 days). The GBP0.6m cash generated was after cash flows

of GBP0.4m outflow and GBP0.1m inflow in respect of non-recurring

items and discontinued operations respectively.

As a result of the positive cash flow, net debt reduced to

GBP1.1m (2017: GBP1.6m).

Defined benefit pension deficit

During the year the pension scheme was subject to a triennial

actuarial review, the outcome of which is in the process of being

agreed between the Trustees and the Group.

At the year end the deficit had increased to GBP1.9m (2017:

GBP1.1m), primarily due to a fall in the value of the scheme's

investments, reflecting weaker global equity markets.

Assets and liabilities held for sale

The assets and liabilities held for sale on the 2017 balance

sheet related entirely to the Inition subsidiary which was disposed

of in April 2018.

Consolidated Income Statement for the year ended 31 December

2018

Before non-

recurring Non-recurring

items (note

5)

items 2018 Total Total

2018 GBP'000 2018 2017

Notes GBP'000 GBP'000 GBP'000

------------------------------- ------- ------------- --------------- ----------- --------------

Continuing operations

Revenue 2,3 86,112 - 86,112 83,815

Employee benefit costs 4 (5,976) (299) (6,275) (5,939)

Depreciation and amortisation 4 (194) - (194) (286)

All other operating expenses 4 (78,724) (196) (78,920) (75,534)

------------------------------- ------- ------------- --------------- ----------- --------------

Total operating expenses (84,894) (495) (85,389) (81,759)

------------------------------- ------- ------------- --------------- ----------- --------------

Operating profit/(loss) 1,218 (495) 723 2,056

Finance costs 7 (365) - (365) (394)

------------------------------- ------- ------------- --------------- ----------- --------------

Profit/(loss) before

tax 853 (495) 358 1,662

Tax (charge)/credit 9 (16) 79 63 534

------------------------------- ------- ------------- --------------- ----------- --------------

Profit/(loss) for the

year from continuing

operations 837 (416) 421 2,196

------------------------------- ------- ------------- --------------- ----------- --------------

Discontinued operations

Loss from discontinued

operations after tax 8 (381) - (381) (2,182)

------------------------------- ------- ------------- --------------- ----------- --------------

Profit/(loss) for the

year attributable to

owners of the parent 456 (416) 40 14

------------------------------- ------- ------------- --------------- ----------- --------------

Earnings per share - Continuing operations

Basic earnings per share 10 0.41p 2.15p

Diluted earnings per

share 10 0.41p 2.12p

Earnings per share - Continuing and discontinued operations

Basic earnings per share 10 0.04p 0.01p

Diluted earnings per

share 10 0.04p 0.01p

------------------------------- ------- ------------- --------------- ----------- --------------

Consolidated Statement of Comprehensive Income for the year

ended 31 December 2018

2018 2017

Notes GBP'000 GBP'000

------------------------------------------------- -------- --------- ---------

Profit for the year 40 14

Other comprehensive income

Items that may be reclassified to profit or

loss

Exchange differences on translation of foreign

operations (3) (39)

Items that will never be reclassified to profit

or loss

Remeasurement of defined benefit pension scheme (1,005) 800

Deferred taxation on remeasurement of defined

pension scheme 12 171 (136)

Other comprehensive (expense)/income for the

year after tax (837) 625

------------------------------------------------- -------- --------- ---------

Total comprehensive (expense)/income for the

year attributable to owners of the parent (797) 639

------------------------------------------------- -------- --------- ---------

Consolidated Statement of Changes in Equity for the year ended

31 December 2018

Share Capital

Share Deferred premium redemption Other Retained

capital shares reserve reserve reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ --------- --------- ---------- ------------ ---------- ---------- ---------

At 1 January 2018 2,043 - 33,211 14,319 44,160 (86,544) 7,189

------------------------ --------- --------- ---------- ------------ ---------- ---------- ---------

Issue of new ordinary

shares 10 - 33 - - - 43

Share options -

value of employee

services - - - - - 129 129

------------------------ --------- --------- ---------- ------------ ---------- ---------- ---------

Transactions with

owners 10 - 33 - - 129 172

------------------------ --------- --------- ---------- ------------ ---------- ---------- ---------

Profit for the year - - - - - 40 40

Exchange differences

on translation of

foreign operations - - - - - (3) (3)

Remeasurement of

defined benefit

pension scheme - - - - - (1,005) (1,005)

Deferred taxation

on remeasurement

of defined pension

scheme taken directly

to equity - - - - - 171 171

Reallocation of

impairment charge - - - - (9,600) 9,600 -

------------------------ --------- --------- ---------- ------------ ---------- ---------- ---------

At 31 December 2018 2,053 - 33,244 14,319 34,560 (77,612) 6,564

------------------------ --------- --------- ---------- ------------ ---------- ---------- ---------

Share Capital

Share Deferred premium redemption Other Retained

capital shares reserve reserve reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ --------- --------- ---------- ------------ ---------- ---------- ---------

At 1 January 2017 2,037 14,319 33,195 - 44,160 (87,251) 6,460

------------------------ --------- --------- ---------- ------------ ---------- ---------- ---------

Issue of new ordinary

shares 6 - 16 - - - 22

Share options -

value of employee

services - - - - - 68 68

Cancellation of

deferred shares - (14,319) - 14,319 - - -

------------------------ --------- --------- ---------- ------------ ---------- ---------- ---------

Transactions with

owners 6 (14,319) - 14,319 - 68 90

------------------------ --------- --------- ---------- ------------ ---------- ---------- ---------

Profit for the year - - - - - 14 14

Exchange differences

on translation of

foreign operations - - - - - (39) (39)

Remeasurement of

defined benefit

pension scheme - - - - - 800 800

Deferred taxation

on remeasurement

of defined pension

scheme taken directly

to equity - - - - - (136) (136)

At 31 December 2017 2,043 - 33,211 14,319 44,160 (86,544) 7,189

------------------------ --------- --------- ---------- ------------ ---------- ---------- ---------

Consolidated Statement of Financial Position as at 31 December

2018

2018 2017

Notes GBP'000 GBP'000

----------------------------------------- -------- --------- ---------

Assets

Non-current assets

Goodwill 11 4,594 4,594

Other intangible assets 86 227

Property, plant and equipment 69 78

Deferred tax assets 12 1,153 919

Total non-current assets 5,902 5,818

----------------------------------------- -------- --------- ---------

Current assets

Trade and other receivables 12,018 12,033

Cash and cash equivalents 5,829 4,968

Assets classified as held for sale - 791

Total current assets 17,847 17,792

----------------------------------------- -------- --------- ---------

Total assets 23,749 23,610

----------------------------------------- -------- --------- ---------

Liabilities

Current liabilities

Loans and borrowings (6,919) (6,592)

Trade and other payables (8,261) (8,349)

Provisions (43) -

Liabilities classified as held for sale - (395)

Total current liabilities (15,223) (15,336)

----------------------------------------- -------- --------- ---------

Non-current liabilities

Loans and borrowings - (8)

Provisions (20) (18)

Retirement benefit liability (1,942) (1,059)

Total non-current liabilities (1,962) (1,085)

----------------------------------------- -------- ---------

Total liabilities (17,185) (16,421)

----------------------------------------- -------- --------- ---------

Net assets 6,564 7,189

----------------------------------------- -------- --------- ---------

Shareholders' equity

Called up share capital 2,053 2,043

Share premium reserve 33,244 33,211

Capital redemption reserve 14,319 14,319

Other reserves 34,560 44,160

Retained earnings (77,612) (86,544)

----------------------------------------- -------- ---------

Total shareholders' equity 6,564 7,189

----------------------------------------- -------- --------- ---------

Consolidated Statement of Cash Flows for the year ended 31

December 2018

2018 2017

Notes GBP'000 GBP'000

---------------------------------------------------- ------ --------- ---------

Cash flows from operating activities

Profit for the year 40 14

Adjustments for:

Net finance expense 7 365 394

Share-based payment expense 129 68

Income tax credit 8,9 (236) (619)

Amortisation of intangible assets 165 341

Depreciation of property, plant and equipment 53 106

Impairment of goodwill 8 - 1,165

Loss on write down of intangible assets 8 - 3

Loss on disposal of subsidiary 8 306 -

822 1,472

Working capital movements

Decrease in work in progress - 3

Decrease in trade and other receivables 204 2,619

Decrease in trade and other payables (141) (910)

Increase in provisions 45 1

Payments to retirement benefit plan (326) (184)

---------------------------------------------------- ------ --------- ---------

Net cash flows from operating activities 604 3,001

---------------------------------------------------- ------ --------- ---------

Investing activities

Purchase of intangible assets (14) (5)

Purchase of property, plant and equipment (35) (91)

Net proceeds from disposal of subsidiary 8 114 -

---------------------------------------------------- ------ --------- ---------

Net cash flows from/(used in) investing activities 65 (96)

---------------------------------------------------- ------ --------- ---------

Financing activities

Issue of ordinary shares 43 22

Drawdown/(repayment) of finance facility 330 (2,032)

Interest paid 7 (181) (199)

---------------------------------------------------- ------ --------- ---------

Net cash flows from/(used in) financing activities 192 (2,209)

---------------------------------------------------- ------ --------- ---------

Net increase in cash and cash equivalents 861 696

---------------------------------------------------- ------ --------- ---------

Cash and cash equivalents at the beginning

of the year 4,968 4,272

---------------------------------------------------- ------ --------- ---------

Cash and cash equivalents at the end of the

year 5,829 4,968

---------------------------------------------------- ------ --------- ---------

Notes to the audited preliminary results

1 Accounting policies

Basis of preparation

Parity Group plc (the "Company") is a company incorporated and

domiciled in the UK.

The financial information set out in these audited preliminary

results constitutes the Group's audited consolidated accounts for

2018 and 2017. The notes in these audited preliminary results have

been extracted from the Group's audited consolidated accounts for

the year ended 31 December 2018.

The financial information set out in these audited preliminary

results has been prepared in accordance with International

Financial Reporting Standards as adopted by the EU ("Adopted

IFRSs"). The policies have been consistently applied to all the

years presented unless otherwise stated.

The Group has adopted IFRS 15 'Revenue from Contracts with

Customers' effective 1 January 2018 and applied it retrospectively.

The Group has assessed its contracts against principal vs agent

considerations and determines that revenue of GBP2,049,000 (2017:

GBPnil), relating to contracts where the Group acts as a managed

service provider, falls under recognition as agent under IFRS 15

that would have fallen under recognition as principal under IAS 18.

Accordingly, if IAS 18 still applied, revenue and operating

expenses would both be higher by GBP2,049,000 (2017: GBPnil)

compared to IFRS 15. These affected contracts however were not in

place prior to 2018 therefore there is no impact to periods prior

to 2018. The implementation of IFRS 15 did not have an impact on

the timing or amount of revenue recognised by the Group on its

other contracts.

The Group has adopted IFRS 9 'Financial Instruments' effective 1

January 2018 and applied transitional relief and opted not to

restate prior periods. The implementation of IFRS 9 did not have a

significant impact on the value or classification of the Group's

financial assets and liabilities.

2 Segmental information

In accordance with IFRS 8 'Operating Segments' the Group's

management structure, and the reporting of financial information to

the Chief Operating Decision Maker (the Group Board), have been

used as the basis to define reporting segments. The Group has two

continuing defined cash generating units (see note 11) which form

the basis of each operating segment. The components of each segment

are described below.

The internal financial information prepared for the Group Board

includes contribution at a segmental level, and the Group Board

allocates resources on the basis of this information.

Segment contribution, defined as divisional revenue less

attributable costs, profit before tax, and assets and liabilities

are internally reported at a Group level.

The Group has two segments:

-- Parity Professionals - provides targeted recruitment of

temporary and permanent professionals to support IT and business

change programmes. Parity Professionals provides 90% (2017: 89%) of

the continuing Group's revenues.

-- Parity Consultancy Services - provides business and IT

consultancy services focusing on the provision of data solutions

and delivery of IT projects. Parity Consultancy Services provides

10% (2017: 11%) of the continuing Group's revenues.

Group costs include Directors' salaries and costs relating to

Group activities and are not allocated to reporting segments for

internal reporting purposes.

The Group evaluates performance on the basis of contribution

from operations before tax not including non-recurring items, such

as restructuring costs.

Inter-segment sales are priced on the same basis as sales to

external customers, with a discount applied to encourage the use of

Group resources at a rate acceptable to the tax authorities.

Inter-segment revenue in the year is a result of Parity

Professionals selling IT recruitment services to Parity Consultancy

Services.

Parity Consultancy Before

Parity Services non-recurring Non-recurring

Professionals 2018 Items Items Total

2018 GBP'000 2018 2018 2018

Continuing operations GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- --------------- ------------------- --------------- -------------- ---------

Revenue from external

customers 77,616 8,496 86,112 - 86,112

Inter-segment revenue 6,409 - 6,409 - 6,409

------------------------------- --------------- ------------------- --------------- -------------- ---------

Segment revenue 84,025 8,496 92,521 - 92,521

Attributable costs (81,711) (8,176) (89,887) - (89,887)

------------------------------- --------------- ------------------- --------------- -------------- ---------

Segment contribution 2,314 320 2,634 - 2,634

Group costs (1,093) - (1,093)

Depreciation and amortisation (194) - (194)

Share-based payment (129) - (129)

Non-recurring items - (495) (495)

Operating profit/(loss) 1,218 (495) 723

Finance costs (365) - (365)

------------------------------- --------------- ------------------- --------------- -------------- ---------

Profit/(loss) before

tax 853 (495) 358

------------------------------- --------------- ------------------- --------------- -------------- ---------

Parity Consultancy Before

Parity Services non-recurring Non-recurring

Professionals 2017 Items Items Total

2017 GBP'000 2017 2017 2017

Continuing operations GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- --------------- ------------------- --------------- -------------- ---------

Revenue from external

customers 74,272 9,543 83,815 - 83,815

Inter-segment revenue 5,764 - 5,764 - 5,764

------------------------------- --------------- ------------------- --------------- -------------- ---------

Segment revenue 80,036 9,543 89,579 - 89,579

Attributable costs (77,729) (8,395) (86,124) - (86,124)

------------------------------- --------------- ------------------- --------------- -------------- ---------

Segment contribution 2,307 1,148 3,455 - 3,455

Group costs (1,045) - (1,045)

Depreciation and amortisation (286) - (286)

Share-based payment (68) - (68)

Non-recurring items - - -

Operating profit 2,056 - 2,056

Finance costs (394) - (394)

------------------------------- --------------- ------------------- --------------- -------------- ---------

Profit before tax 1,662 - 1,662

------------------------------- --------------- ------------------- --------------- -------------- ---------

All segment assets and liabilities are based

in the UK.

3 Revenue

All of the Group's revenue derives from contracts with

customers. Trade receivables, amounts recoverable on contracts and

accrued income arise from contracts with customers. Changes to the

Group's contract assets are attributable solely to the satisfaction

of performance obligations.

The Group's revenue from external customers disaggregated by

pattern of revenue recognition is as follows:

Parity Parity

Parity Consultancy Parity Consultancy

Professionals Services Professionals Services

2018 2018 2017 2017

Continuing operations GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- ---------------- ------------- ---------------- -------------

Services transferred over

time 76,978 8,496 73,615 9,543

Services transferred at a

point in time 638 - 657 -

--------------------------------- ---------------- ------------- ---------------- -------------

Revenue from external customers 77,616 8,496 74,272 9,543

--------------------------------- ---------------- ------------- ---------------- -------------

The Group's revenue from external customers disaggregated by

primary geographical market is as follows:

Parity Parity

Parity Consultancy Parity Consultancy

Professionals Services Professionals Services

2018 2018 2017 2017

Continuing operations GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- ---------------- ------------- ---------------- -------------

UK 76,033 8,496 74,272 9,543

Rest of EU 1,583 - - -

--------------------------------- ---------------- ------------- ---------------- -------------

Revenue from external customers 77,616 8,496 74,272 9,543

--------------------------------- ---------------- ------------- ---------------- -------------

72% (2017: 68%) or GBP56.0m (2017: GBP50.4m) of the Parity

Professionals revenue from external customers was generated in the

public sector. 83% (2017: 82%) or GBP7.0m (2017: GBP7.8m) of the

Parity Consultancy Services revenue was generated in the public

sector.

The largest single customer in Parity Professionals contributed

revenue of 14% or GBP11.7m and was in the public sector (2017: 11%

or GBP8.8m and in the public sector). The largest single customer

in Parity Consultancy Services contributed revenue of 64% or

GBP5.4m and was in the public sector (2017: 46% or GBP4.4m and in

the public sector).

4 Operating expenses

2018 2017

Continuing operations GBP'000 GBP'000

------------------------------------------------------------------------- ---- ---- --------- ---------

Employee benefit costs

- wages and salaries 5,478 5,138

- social security costs 623 609

- other pension costs 174 192

------------------------------------------------------------------------------------- --------- ---------

6,275 5,939

----------------------------------------------------------------------------------- --------- ---------

Depreciation and amortisation

Amortisation of intangible assets -

software 155 239

Depreciation of leased property, plant

and equipment 11 9

Depreciation of owned property, plant

and equipment 28 38

------------------------------------------------------------------------------------- --------- ---------

194 286

----------------------------------------------------------------------------------- --------- ---------

All other operating expenses

Contractor costs 76,067 73,088

Sub-contracted direct costs 363 228

Operating lease rentals - plant and

machinery 8 17

- land and buildings 661 659

Other occupancy costs 156 98

IT costs 326 278

Net exchange gain (6) -

Equity settled share-based payment

charge 129 68

Other operating costs 1,216 1,098

------------------------------------------------------------------------------------- --------- ---------

78,920 75,534

----------------------------------------------------------------------------------- --------- ---------

Total operating expenses 85,389 81,759

------------------------------------------------------------------------------------- --------- ---------

During the year the Group obtained the following services from

the Group's auditors:

Grant Thornton KPMG LLP

UK LLP

2018 2017 2018 2017

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------- ----------------- --------- --------- ---------

Audit of the Group, Company

and subsidiary financial statements 65 - - 77

Interim review - - - 6

Tax compliance 14 - - 27

Other - - 20 26

-------------------------------------- ----------------- --------- --------- ---------

Other services 14 - 20 59

-------------------------------------- ----------------- --------- --------- ---------

Total fees 79 - 20 136

-------------------------------------- ----------------- --------- --------- ---------

All other services have been performed in the UK. 'Other' refers

to services provided in relation to advice relating to the

Retirement Benefit Plan, transaction costs and assistance provided

with research and development tax credit applications.

5 Non-recurring items

2018 2017

Continuing operations GBP'000 GBP'000

-------------------------------------- --------- ---------

Restructuring

279 -

* Employee benefit costs

122 -

* Other operating costs

Legal costs 74 -

Past service cost for defined benefit 20 -

pension scheme

495 -

-------------------------------------- --------- ---------

Non-recurring items during 2018 in respect of continuing

operations included:

-- Costs related to restructuring of Parity Consultancy Services

to align to the Group's strategy of focusing on the data

consultancy market. Costs include employee termination payments,

fees for professional services and costs of changes in management

structure

-- Legal costs for professional services fees in respect of

one-off cases with no significant further related costs

anticipated

-- Past service cost for the Group's defined benefit pension

scheme in respect of GMP equalisation

There were no non-recurring items during 2017.

6 Average staff numbers

2018 2017

Number Number

---------------------------------------- -------- --------

Continuing operations

Professionals - United Kingdom(1) 86 85

Consultancy Services - United Kingdom,

including corporate office 23 25

109 110

---------------------------------------- -------- --------

Discontinued operations

Consultancy Services(2) 15 22

----------------------------------------- -------- --------

(1) Includes 20 (2017: 22) employees providing shared services

across the Group

(2) Average for 4 months (2017: 12 months)

At 31 December 2018, the Group had 101 continuing employees

(2017: 105).

7 Finance costs

2018 2017

GBP'000 GBP'000

--------------------------------- --------- ---------

Finance costs

Interest expense on financial

liabilities 181 199

Net finance costs in respect of

post-retirement benefits 184 195

----------------------------------- --------- ---------

365 394

--------------------------------- --------- ---------

The interest expense on financial liabilities represents

interest paid on the Group's asset-based financing facilities. A 1%

increase in the base rate would have increased annual borrowing

costs by approximately GBP37,000 (2017: GBP53,000).

8 Discontinued operations

In April 2018 the Group sold Inition Limited following the

strategic decision made to place greater focus on the Group's core

business. As such, Inition Limited's operating result for the

current and comparative year, the loss on disposal and the

impairment of goodwill associated with the Inition cash generating

unit is presented as discontinued.

The loss on disposal of Inition Limited was determined as

follows:

2018 2017

GBP'000 GBP'000

--------------------------------- --------- ---------

Consideration 200 -

Net assets disposed of

Intangible assets 33 -

Property, plant and equipment 62 -

Cash and cash equivalents 86 -

Trade and other receivables 695 -

Trade and other payables (485) -

--------------------------------- --------- ---------

Total net assets disposed of 391 -

Loss on disposal before disposal (191) -

expenses

Disposal expenses (115) -

--------------------------------- --------- ---------

Loss on disposal of Inition (306) -

Limited

--------------------------------- --------- ---------

Net proceeds received on disposal of Inition Limited were as

follows:

2018 2017

GBP'000 GBP'000

------------------------------ --------- ---------

Cash consideration received 200 -

Cash disposed of (86) -

------------------------------ --------- ---------

Net proceeds from disposal of 114 -

Inition Limited

------------------------------ --------- ---------

The post-tax result of discontinued operations was determined as

follows:

Note 2018 2017

GBP'000 GBP'000

----------------------------------- ----- --------- ---------

Revenue 523 2,324

Depreciation and amortisation (24) (161)

Loss on write down of intangible

assets - (3)

All other operating expenses (787) (3,262)

----------------------------------- ----- --------- ---------

Operating loss (288) (1,102)

Impairment of goodwill - (1,165)

Loss on disposal of Inition (306) -

Limited

Debtor insolvency dividend 40 -

----------------------------------- ----- --------- ---------

Loss from discontinued operations

before tax (554) (2,267)

Tax credit 173 85

----------------------------------- ----- --------- ---------

Loss from discontinued operations

after tax (381) (2,182)

----------------------------------- ----- --------- ---------

Basic loss per share 10 (0.37p) (2.14p)

Diluted loss per share 10 (0.37p) (2.14p)

----------------------------------- ----- --------- ---------

The discontinued operations operating loss relates entirely to

Inition Limited. The debtor insolvency dividend of GBP40,000 (2017:

GBPnil) represents a one-off payment received from the

administrators of Atraxis AG and relates to a bad debt previously

written off by a former Group subsidiary registered in Switzerland.

The discontinued operations tax credit of GBP173,000 in 2018

relates to a research and development tax credit claimed by Inition

Limited.

Cash flows from/(used in) discontinued operations are as

follows:

2018 2017

GBP'000 GBP'000

---------------------------------------------- --------- ---------

Net cash from/(used in) operating activities 105 (674)

Net cash used in investing activities (5) (38)

---------------------------------------------- --------- ---------

Net cash flows for the year from/(used

in) discontinued operations 100 (712)

---------------------------------------------- --------- ---------

9 Taxation

2018 2017

GBP'000 GBP'000

------------------------------------------ ---- ---- --------- ---------

Current tax expense

Current tax on profit for the year - 112

Total current tax expense - 112

------------------------------------------------------ --------- ---------

Deferred tax credit

Accelerated capital allowances 15 68

Origination and reversal of other

temporary differences 72 -

Recognition of deferred tax previously

unprovided - (675)

Adjustments in respect of prior periods (150) (39)

------------------------------------------------------ --------- ---------

Total deferred tax credit (63) (646)

------------------------------------------------------ --------- ---------

Tax credit on continuing operations (63) (534)

------------------------------------------------------ --------- ---------

The tax credit on continuing operations excludes the tax credit

from discontinued operations of GBP173,000 (2016: GBP85,000). This

comprises a current tax credit of GBP173,000 (2017: GBP112,000) and

a deferred tax expense of GBPnil (2017: GBP27,000). This has been

included in loss from discontinued operations after tax (see note

8). The adjustment in respect of prior periods of GBP150,000 (2017:

GBP39,000) largely relates to capital allowances that had been

expected to be claimed that were subsequently not claimed.

There is no current tax payable by the Group for 2018 (2017:

GBPnil).

The standard rate of corporation tax in the United Kingdom

changed from 20% to 19% with effect from 1 April 2017 and remained

at 19% during 2018. Accordingly, the Group's profits for this

accounting period are subject to tax at a rate of 19% (2017:

19.25%). A reduction to 17% effective 1 April 2020 was

substantively enacted on 15 September 2016. As such, the tax rate

of 17% (2017: 17%) has been applied in calculating the UK deferred

tax position of the Group.

The reasons for the difference between the actual tax credit for

the year and the standard rate of corporation tax in the UK applied

to profit for the year are as follows:

2018 2017

GBP'000 GBP'000

Profit before tax from continuing operations 358 1,662

----------------------------------------------------------- ------- -------

Expected tax charge based on the standard

rate of UK

corporation tax of 19% (2017: 19.25%) 68 320

Expenses not allowable for tax purposes 29 10

Adjustments in respect of prior periods (150) (39)

Utilisation of unprovided tax losses carried

forward - (141)

Recognition of deferred tax asset previously

unprovided - (675)

Other (10) (9)

----------------------------------------------------------- ------- -------

Tax credit on continuing operations (63) (534)

----------------------------------------------------------- ------- -------

Tax on each component of other comprehensive income is as

follows:

2018 2017

Before After Before After

tax Tax tax tax Tax tax

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------- --------- ---------- --------- --------- ---------- ---------

Exchange differences on translation

of foreign operations (3) - (3) (39) - (39)

Remeasurement of defined benefit

pension scheme (1,005) 171 (834) 800 (136) 664

------------------------------------- --------- ---------- --------- --------- ---------- ---------

(1,008) 171 (837) 761 (136) 625

------------------------------------- --------- ---------- --------- --------- ---------- ---------

10 Earnings per ordinary share

Basic earnings per share is calculated by dividing the basic

earnings for the year by the weighted average number of fully paid

ordinary shares in issue during the year.

Diluted earnings per share is calculated on the same basis as

the basic earnings per share with a further adjustment to the

weighted average number of fully paid ordinary shares to reflect

the effect of all dilutive potential ordinary shares.

Weighted Weighted

average average

number Earnings/ number Earnings/

of (loss) of (loss)

Earnings/ Earnings/

(loss) shares per share (loss) shares per share

2018 2018 2018 2017 2017 2017

GBP'000 '000 Pence GBP'000 '000 Pence

-------------------------- ----------- --------- ------------ ----------- --------- ------------

Continuing operations

Basic earnings per share 421 102,464 0.41 2,196 102,087 2.15

Effect of dilutive

options - 1,126 - - 1,292 -

Diluted earnings per

share 421 103,590 0.41 2,196 103,379 2.12

Discontinued operations

Basic loss per share (381) 102,464 (0.37) (2,182) 102,087 (2.14)

Effect of dilutive - - - - - -

options

Diluted loss per share (381) 102,464 (0.37) (2,182) 102,087 (2.14)

Continuing and discontinued

operations

Basic earnings per share 40 102,464 0.04 14 102,087 0.01

Effect of dilutive

options - 1,126 - - 1,292 -

Diluted earnings per

share 40 103,590 0.04 14 103,379 0.01

-------------------------- ----------- --------- ------------ ----------- --------- ------------

As at 31 December 2018 the number of ordinary shares in issue

was 102,624,020 (2017: 102,124,020).

11 Goodwill

The carrying amount of goodwill is allocated to the Group's two

separate continuing cash generating units (CGUs), being Parity

Professionals and Parity Consultancy Services.

Carrying amounts are as follows:

Parity

Parity Consultancy

Professionals Services Total

GBP'000 GBP'000 GBP'000

------------------------------- ---------------- ------------- ----------

Carrying value

Balance at 1 January 2017 and

31 December 2017 2,642 1,952 4,594

------------------------------- ---------------- ------------- ----------

Balance at 1 January 2018 and

31 December 2018 2,642 1,952 4,594

------------------------------- ---------------- ------------- ----------

Goodwill was tested for impairment in accordance with IAS 36 at

the year end and no impairment charge was recognised.

The recoverable amounts of the CGUs are based on value in use

calculations using the pre-tax cash flows based on budgets approved

by management for 2019. Years from 2020 to 2022 are based on the

budget for 2019 projected forward at expected growth rates. Years

from 2023 onward assume no further growth. This approach is

considered prudent based on current expectations of the 2019

long-term growth rate.

Major assumptions are as follows:

Parity Professionals Parity Consultancy

% Services

%

2018

Discount rate 13.0 11.5

Forecast revenue growth

(years 1 to 4) 2.0 10.0

Operating margin 2019 1.9 6.1

Operating margin 2020 2.0-2.3 7.8-10.5

onward

2017

Discount rate 13.0 11.5

Forecast revenue growth

(years 1 to 4) 5.0 10.0

Operating margin 2018 2.6 10.0

Operating margin 2019 3.0-3.6 10.7-12.9

onward

Discount rates are based on the Group's weighted average cost of

capital adjusted for the specific risks of each cash generating

unit.

Forecast revenue growth is expressed as the compound growth rate

over the next 4 years from 2019 to 2022. Growth for the Parity

Professionals CGU is based upon the long-term growth rate for the

UK economy. Growth for the Parity Consultancy Services is assumed

to be higher than the long-term growth rate due to the following

factors:

-- The CGU is the focal point of the Group's strategy and growth plans;

-- The CGU is relatively small so higher rates of growth are

achievable from a small base. For instance, the CGU achieved an

average growth of 47% in the financial years 2016 and 2017;

-- In 2018 the CGU was hit by issue on a significant contract

resulting in reduced year on year revenue for the CGU. The

Directors expect this to be a one-off rather than a trend; and

-- New client wins in 2018 and an extension to the ESFA contract

in 2019 help to underwrite the growth forecasts.

For all CGUs the rates are based on past experience of growth in

revenues and future expectations of economic conditions. Operating

margins are based on past experience.

A 10% change in any of the underlying assumptions used in the

discounted cash flow forecasts would not lead to the carrying value

of goodwill being in excess of their recoverable amount.

12 Deferred tax

2018 2017

GBP'000 GBP'000

--------------------------------------------------- -------- --------

At 1 January 919 409

Recognised in other comprehensive income

Remeasurement of defined benefit pension scheme 171 (136)

Recognised in the income statement

Adjustments in relation to prior periods 150 39

Capital allowances in excess of depreciation (15) (68)

Other short-term timing differences (72) -

Recognition of deferred tax previously unprovided - 675

At 31 December 1,153 919

--------------------------------------------------- -------- --------

The deferred tax asset of GBP1,153,000 (2017: GBP919,000)

comprises:

2018 2017

GBP'000 GBP'000

---------------------------------------------- --------- ---------

Depreciation in excess of capital allowances 820 685

Short term and other timing differences 3 54

Retirement benefit liability 330 180

---------------------------------------------- --------- ---------

1,153 919

---------------------------------------------- --------- ---------

A deferred tax asset for deductible temporary differences is not

recognised unless it is more likely than not that there will be

taxable profits in the foreseeable future against which the

deferred tax asset can be utilised. At the balance sheet date, the

Directors assessed the probability of future taxable profits being

available against which Parity Consultancy Services could recognise

a deferred tax asset for previously unrecognised deductible

temporary differences. The review concluded that it is probable

that future taxable profits will be available. As such, the

Directors have recognised a deferred tax asset for all deductible

temporary differences available to Parity Consultancy Services.

A deferred tax asset for unused tax losses carried forward is

normally recognised on the same basis as for deductible temporary

differences. However, the existence of the unused tax losses is

itself strong evidence that future taxable profit may not be

available. Therefore, when an entity has a history of recent

losses, the entity recognises a deferred tax asset arising from

unused tax losses only to the extent that there is convincing

evidence that sufficient taxable profit will be available against

which the unused tax losses can be utilised. At the balance sheet

date, the Directors considered recognising a deferred tax asset for

previously unrecognised unused tax losses carried forward by Parity

Consultancy Services. The review concluded that given the

division's history of relatively recent tax losses and the

additional requirement of providing convincing evidence that

sufficient taxable profit will be available, a prudent approach

would be taken and deferred tax would remain unrecognised for tax

losses carried forward by the division.

The Directors believe that the deferred tax asset recognised is

recoverable based on the future earning potential of the Group and

the individual cash generating divisions. The forecasts for Parity

Professionals comfortably support the unwinding of the deferred tax

asset held by this division of GBP404,000 (2017: GBP380,000) and

the forecasts for Parity Consultancy Services comfortably support

the unwinding of the deferred tax asset held by this division of

GBP749,000 (2017: GBP539,000).

The deferred tax asset at 31 December 2018 has been calculated

on the rate of 17% substantively enacted at the balance sheet

date.

The movements in deferred tax assets during the period are shown

below:

(Charge)/credit Credit to

to other comprehensive

Asset income income

2018 statement 2018

GBP'000 2018 GBP'000

GBP'000

------------------------------ ---------- ------------------- ----------------------

Depreciation in excess of

capital allowances 820 135 -

Other short-term timing

differences 3 (51) -

Retirement benefit liability 330 (21) 171

------------------------------ ---------- ------------------- ----------------------

At 31 December 2018 1,153 63 171

------------------------------ ---------- ------------------- ----------------------

Charge to

Credit to other comprehensive

Asset income statement income

2017 2017 2017

GBP'000 GBP'000 GBP'000

------------------------------ ---------- ------------------- ----------------------

Depreciation in excess of

capital allowances 685 330 -

Other short-term timing 54 - -

differences

Retirement benefit liability 180 316 (136)

At 31 December 2017 919 646 (136)

------------------------------ ---------- ------------------- ----------------------

The Group has unrecognised carried forward tax losses of

GBP30,187,000 (2017: GBP29,485,000). The Group has unrecognised

capital losses carried forward of GBP282,068,000 (2017:

GBP281,937,000). These losses may be carried forward

indefinitely.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR EAPLSFFANEFF

(END) Dow Jones Newswires

April 16, 2019 02:00 ET (06:00 GMT)

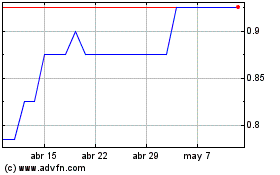

Partway (LSE:PTY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Partway (LSE:PTY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024