Network International Holdings PLC TR-1: Notification of major holdings (6314W)

18 Abril 2019 - 4:15AM

UK Regulatory

TIDMNETW

RNS Number : 6314W

Network International Holdings PLC

18 April 2019

TR-1: Standard form for notification of major holdings

NOTIFICATION OF MAJOR HOLDINGS (to be sent to the relevant issuer and

to the FCA in Microsoft Word format if possible)(i)

1a. Identity of the issuer or the Network International Holdings plc

underlying issuer of existing shares

to which voting rights are attached(ii)

:

------------------------------------------------------------

1b. Please indicate if the issuer is a non-UK issuer (please mark with

an "X" if appropriate)

Non-UK issuer

------------------

2. Reason for the notification (please mark the appropriate box or boxes

with an "X")

An acquisition or disposal of voting rights X

------------------

An acquisition or disposal of financial instruments

------------------

An event changing the breakdown of voting rights

------------------

Other (please specify)(iii) :

------------------

3. Details of person subject to the notification obligation(iv)

Name General Atlantic Service Company,

L.P.

GAP (Bermuda) Limited

General Atlantic GenPar (Bermuda),

L.P.

General Atlantic Cooperatief U.A.

General Atlantic Borneo B.V.

General Atlantic Borneo II B.V.

Charles R. Kaye and Joseph P. Landy[1]

Warburg Pincus LLC

Warburg Pincus (Bermuda) Private

Equity GP Ltd.

Warburg Pincus Partners II (Cayman),

L.P.

Warburg Pincus XI-C, LLC

Warburg Pincus (Cayman) XI, L.P.

WP Mercury Holdings Coöperatief

U.A.

WP Mercury Holdings B.V.

WP/GA Dubai Holding B.V.

WP/GA Dubai Holding II B.V.

WP/GA Dubai I B.V.

WP/GA Dubai II B.V.

WP/GA Dubai III B.V.

WP/GA Dubai IV B.V.

City and country of registered office

(if applicable)

4. Full name of shareholder(s) (if different from 3.)(v)

Name WP/GA Dubai IV B.V.

------------------------------------------------------------

City and country of registered office Amsterdam, the Netherlands

(if applicable)

------------------------------------------------------------

5. Date on which the threshold was 15 April 2019

crossed or reached(vi) :

------------------------------------------------------------

6. Date on which issuer notified (DD/MM/YYYY): 17 April 2019

------------------------------------------------------------

7. Total positions of person(s) subject to the notification obligation

% of voting % of voting rights Total of both Total number

rights attached through financial in % (8.A + of voting rights

to shares (total instruments 8.B) of issuer(vii)

of 8. A) (total of 8.B

1 + 8.B 2)

----------------------- --------------------- ----------------- ------------------

Resulting situation

on the date

on which threshold

was crossed

or reached 21.56% 0% 21.56% 500,000,000

----------------------- --------------------- ----------------- ------------------

Position of N/A N/A N/A

previous notification

(if

applicable)

----------------------- --------------------- ----------------- ------------------

8. Notified details of the resulting situation on the date on which the

threshold was crossed or reached(viii)

A: Voting rights attached to shares

Class/type of Number of voting rights(ix) % of voting rights

shares

ISIN code (if

possible)

Direct Indirect Direct Indirect

(Art 9 of Directive (Art 10 of Directive (Art 9 of Directive (Art 10 of Directive

2004/109/EC) 2004/109/EC) 2004/109/EC) (DTR5.1) 2004/109/EC)

(DTR5.1) (DTR5.2.1) (DTR5.2.1)

---------------------

Ordinary Shares

of 10 pence

each

GB00BH3VJ782 107,824,500 0 21.56% 0

-------------------- --------------------- ----------------------------------- ---------------------

SUBTOTAL 8. A 107,824,500 21.56%

------------------------------------------- ----------------------------------------------------------

B 1: Financial Instruments according to Art. 13(1)(a) of Directive 2004/109/EC

(DTR5.3.1.1 (a))

Type of Expiration Exercise/ Number of voting % of voting

financial date(x) Conversion rights that may rights

instrument Period(xi) be acquired if

the instrument

is

exercised/converted.

-------------------- --------------------- ----------------------------------- ---------------------

N/A N/A N/A N/A N/A

-------------------- --------------------- ----------------------------------- ---------------------

SUBTOTAL 8. B 1 N/A N/A

--------------------- ----------------------------------- ---------------------

B 2: Financial Instruments with similar economic effect according to

Art. 13(1)(b) of Directive 2004/109/EC (DTR5.3.1.1 (b))

Type of Expiration Exercise/ Physical or Number of % of voting

financial date(x) Conversion cash voting rights rights

instrument Period (xi) settlement(xii)

--------------------- --------------------- ---------------- -----------------

N/A N/A N/A N/A N/A N/A

--------------------- --------------------- ---------------- -----------------

SUBTOTAL 8.B.2 N/A N/A

---------------- -----------------

9. Information in relation to the person subject to the notification

obligation (please mark the

applicable box with an "X")

Person subject to the notification obligation is not controlled

by any natural person or legal entity and does not control any other

undertaking(s) holding directly or indirectly an interest in the

(underlying) issuer(xiii)

Full chain of controlled undertakings through which the voting rights X

and/or the

financial instruments are effectively held starting with the ultimate

controlling natural person or legal entity(xiv) (please add additional

rows as necessary)

Name(xv) % of voting rights % of voting rights Total of both if

if it equals or through financial it equals or is

is higher than the instruments if it higher than the

notifiable threshold equals or is higher notifiable threshold

than the notifiable

threshold

------------------------------------ --------------------------- ------------------------

WP/GA Dubai IV B.V. is 100% owned by WP/GA Dubai III B.V., which in turn

is 100% owned by WP/GA Dubai II B.V., which in turn is 100% owned by

WP/GA Dubai I B.V., which in turn is 100% owned by WP/GA Dubai Holding

II B.V., which in turn is 100% owned by WP/GA Dubai Holding B.V., which

in turn is 50% owned by WP Mercury Holdings B.V. and 50% owned by General

Atlantic Borneo II B.V.

WP Mercury Holdings B.V. is 77.65% owned by WP Mercury Holdings Coöperatief

U.A., with the remainder held by non-voting minority shareholders. WP

Mercury Holdings Coöperatief U.A. is controlled by certain limited

partnerships of which Warburg Pincus (Cayman) XI, L.P. is the general

partner, and the fund manager is Warburg Pincus LLC.

The general partner of Warburg Pincus (Cayman) XI, L.P. is Warburg Pincus

XI-C, LLC, which is represented by its managing member Warburg Pincus

Partners II (Cayman), L.P., which in turn is represented by it general

partner Warburg Pincus (Bermuda) Private Equity GP Ltd.

Each of Charles R. Kaye and Joseph P. Landy, as the Managing Members

and Co-Chief Executive Officers of Warburg Pincus LLC, may be deemed

to control the management of Warburg Pincus LLC.

General Atlantic Borneo II B.V. is 93.91% owned by General Atlantic Borneo

B.V., with the remaining held by non-voting minority shareholders. General

Atlantic Borneo B.V. is 100% owned by General Atlantic Cooperatief U.A.

General Atlantic Cooperatief U.A. is controlled by certain limited partnerships

of which General Atlantic GenPar (Bermuda), L.P. and GAP (Bermuda) Limited

are the general partners, and the fund manager is General Atlantic Service

Company, L.P.

10. In case of proxy voting, please identify:

Name of the proxy holder N/A

-----------------------------------------------------

The number and % of voting rights N/A

held

-----------------------------------------------------

The date until which the voting rights N/A

will be held

-----------------------------------------------------

11. Additional information(xvi)

The change in the percentage of shares held is due to participation in

the IPO of Network International Holdings plc, the shares of which were

admitted to the London Stock Exchange on 15 April 2019.

Place of completion London

Date of completion 17 April 2019

--------------

[1] Each of Charles R. Kaye and Joseph P. Landy, as the Managing

Members and Co-Chief Executive Officers of Warburg Pincus LLC, may

be deemed to control the management of Warburg Pincus LLC.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

HOLKVLBFKZFFBBX

(END) Dow Jones Newswires

April 18, 2019 05:15 ET (09:15 GMT)

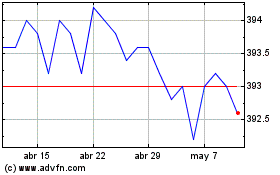

Network (LSE:NETW)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Network (LSE:NETW)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024