Barclays 1Q Does Little to Settle Investment-Bank Struggle -- Earnings Review

25 Abril 2019 - 5:47AM

Noticias Dow Jones

By Adam Clark

Barclays PLC (BARC.LN) reported its first-quarter results on

Thursday, swinging to a profit due to lower litigation and

regulatory charges despite a drop in income. Shares were down

around 2% in morning trading. Here's what we watched:

PROFIT: Pretax profit of 1.48 billion pounds ($1.91 billion) was

lower than consensus expectations but net profit of GBP1.04 billion

matched analyst forecasts.

REVENUE: Total income fell 2% to GBP5.25 billion and net

operating income dropped 5% to GBP4.80 billion. Both figures were

behind consensus expectations, with U.K. income stalling and a

slump in investment-banking revenue.

WHAT WE WATCHED:

-INVESTMENT BANK: Net profit for the corporate-and-investment

bank fell 28%, likely providing continued ammunition for activist

Edward Bramson's campaign to claim a board seat and scale back the

unit. Chief Executive Jes Staley pointed to Barclays'

outperformance in the markets business against U.S. peers and

falling investment-banking fees across the sector.

-COST-CUTTING: As had widely been predicted, Barclays said it

could look for steeper cost cuts than previously guided in order to

meet its target of a return on tangible equity of over 9% this

year. The lender said it had already cut compensation at its

investment bank and could go further if the "challenging income

environment" continues.

Write to Adam Clark at adam.clark@dowjones.com;

@AdamDowJones

(END) Dow Jones Newswires

April 25, 2019 06:32 ET (10:32 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

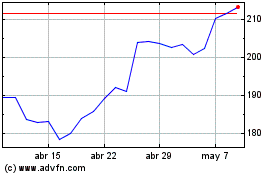

Barclays (LSE:BARC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

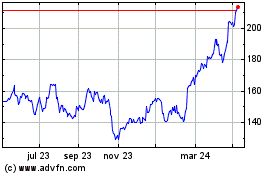

Barclays (LSE:BARC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024