Barclays' Investment Bank Struggles

25 Abril 2019 - 6:19AM

Noticias Dow Jones

By WSJ City

Barclays reported weak first-quarter earnings in its investment

bank, days before shareholders are due to vote on a board

appointment for an activist investor who wants to shrink the

unit.

KEY FACTS

-- Net profit in Barclays's corporate and investment bank fell 30% from a

year ago to GBP582m.

-- The reasons: reduced client activity, lower volatility and fewer

corporate deals.

-- Overall net profit was GBP1.04bn, up from a GBP764m net loss last year

which stemmed from regulatory settlements.

Why This Matters

The results ramp up pressure on Chief Executive Jes Staley to

prove the bank's strategic mix of consumer, business and investment

banking can work. Sherborne Investors is asking shareholders to

vote its founder, Edward Bramson, onto the board at an annual

meeting May 2 to trigger a change in strategy.

This story first appeared on Dow Jones Newswires.

WSJ City: The news, the key facts and why it matters. Be deeply

informed in less than five minutes. You can find more concise

stories like this on the WSJ City app. Download now from the App

Store or Google Play, or sign up to newsletters here

http://www.wsj.com/newsletters?sub=356&mod=djemwsjcity

(END) Dow Jones Newswires

April 25, 2019 07:04 ET (11:04 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

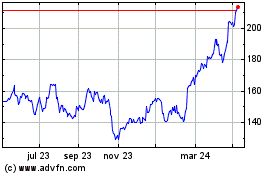

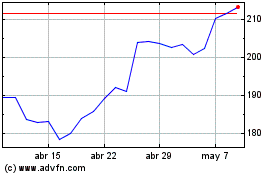

Barclays (LSE:BARC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Barclays (LSE:BARC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024