TIDMPSDL

RNS Number : 3156X

Phoenix Spree Deutschland Limited

29 April 2019

Phoenix Spree Deutschland Limited

("Phoenix Spree", or the "Company")

FINANCIAL RESULTS FOR YEARED 31 DECEMBER 2018

STRONG PORTFOLIO PERFORMANCE AND FURTHER GROWTH IN BERLIN

Phoenix Spree Deutschland (LSE: PSDL.LN), the UK listed real

estate company specialising in Berlin residential property, today

announces its full year results for the year ended 31 December

2018.

Robert Hingley, Chairman of Phoenix Spree, commented:

"I am delighted to report that, following an exceptionally

strong year in 2017, we have continued this momentum, delivering

further increases in rental growth and portfolio value. This

performance reflects the active management of our portfolio as well

as the continued positive dynamics that characterise the Berlin

residential market, where we are now fully focused following the

disposal of our Northern German portfolio. Although Berlin

residential yield compression has moderated, following a long

period of declining property yields, we see significant opportunity

to grow the portfolio value through a combination of investment

into our existing properties and the acquisition of assets that

meet our strict acquisition criteria. We are confident that we will

continue to deliver value to shareholders through further rental

growth, condominium sales and densification within the existing

portfolio."

Financial highlights: increases in rental growth, property

values and EPRA NAV

-- IFRS NAV per share up 2.3% to EUR4.05 (GBP3.64) (31 December 2017: EUR3.96 (GBP3.52).

-- EPRA NAV per share up 11.4% to EUR4.58 (GBP4.11) (31 December 2017: EUR4.11 (GBP3.65).

-- Strong like-for-like rental income growth per sqm of 9.0% during the year.

o Contracted net rental income of EUR17.5 million, (31 December

2017 EUR18.1 million), reflecting the sale of the Northern German

portfolio in April 2018.

o Gross rental income including service charges of EUR22.7

million (EUR23.7 million in 2017).

-- EPRA total return per share of 13.2% (year to 31 December 2017: 53.0%).

-- Profit before tax EUR56.4 million (year to 31 December 2017:

EUR138.5 million); year-on-year change reflects lower revaluation

increase in 2018 after exceptionally strong gains in 2017.

-- Earnings per share EUR0.46 (31 December 2017: EUR1.21).

-- Net loan to value of 26.1% as at 31 December 2018 (31 December 2017: 32.0%).

-- New debt of EUR28.8 million signed during 2018. Average debt

maturity of 7.7 years, average interest rate reduced to 2.0%.

-- Final dividend per share of EUR5.15 cents (GBP:4.62p), giving

a total dividend per share of EUR7.50 cents (GBP:6.73p) for year to

31 December 2018 (2017: EUR7.3 cents (GBP: 6.4p)).

Operational highlights: Strong portfolio performance

-- Like-for-like Portfolio valuation increase of 14.0% in year to 31 December 2018.

o Total Portfolio valued at EUR645.7 million, an increase of

6.0% in absolute terms over the twelve-month period (31 December

2017: EUR609.3 million), reflecting the impact of non-Berlin

disposals during year.

o Berlin portfolio valued at EUR641.8 million, an increase of

21.4% year-on-year (31 December 2017: EUR528.5 million).

o Portfolio valuation represents an average value per square

metre of EUR3,527 (31 December 2017: EUR2,853).

-- EPRA Vacancy remains low at 2.8% (31 December 2017 2.9%).

-- Condominium sale completion proceeds up 4.4%, to EUR9.9

million, achieving an average value per sqm of EUR4,566.

-- Continued active management of the Berlin portfolio with

record investment of EUR7.9 million in renovations and

modernisations during 2018.

-- New leases on average signed at a 39.7% premium to passing

rents and condominium sales completed at a 27.8% premium to the

average valuation of Berlin rental properties as at 31 December

2018.

Berlin transition complete: further progress on Berlin

acquisitions

-- Contracts to acquire 222 units notarised during 2018,

representing an aggregate purchase price of EUR36.3 million and an

average value per sqm of EUR2,390.

-- As at 23 April 2019, contracts to acquire a further 14 units

in Berlin have been notarised since the December 2018 year end for

a purchase price of EUR2.4 million, representing a price per sqm of

EUR2,956.

-- Disposal of Central and Northern Germany portfolio completed

in April 2018 for EUR73.0 million, a 26% premium to the Jones Lang

LaSalle valuation pre-notarisation.

-- Since 31 December 2018, all residual non-Berlin assets have

been sold, creating a fully-focussed Berlin fund with potential for

greater economies of scale.

Positive outlook: Significant embedded value remains within

rental Portfolio

-- Berlin residential property prices continue to benefit from

lack of supply and favourable demographics, driven by strong job

creation and population growth.

-- Significant reversionary potential underpins future rental growth.

-- Potential for further valuation creation through condominium projects and sales.

-- Further Berlin acquisitions expected in current financial

year. Acquisition prices remain below construction values.

-- Substantive review of financing structure in progress.

Expected to create further capacity for Portfolio development.

-- Active consideration of densification projects, including

attic conversions and new building construction on land surrounding

buildings already owned by the Company.

For further information, please contact:

Phoenix Spree Deutschland Limited

Stuart Young +44 (0)20 3937 8760

Numis Securities Limited (Corporate Broker)

David Benda +44 (0)20 3100 2222

Tulchan Communications (Financial PR)

Elizabeth Snow

Amber Ahluwalia +44 (0)20 7353 4200

CHAIRMAN'S STATEMENT

I am delighted that the Company has continued its growth over

the last twelve months, delivering further increases in rental

revenues, property values and EPRA NAV after an exceptionally

strong set of results in 2017. This performance is underpinned by

the continued favourable Berlin residential rental market dynamics.

After a long period of rapid property price inflation, yield

compression has moderated, although the strong underlying

demographic trends remain in place. The Berlin residential market

is still characterised by a significant undersupply of available

rental property, as well as positive demographic and employment

trends.

Berlin transition complete: geographically focussed

portfolio

When Phoenix Spree listed on the main market of the London Stock

Exchange in June 2015, 53.5% of the properties in the Portfolio

were located outside of Berlin. Notwithstanding the solid financial

performance of these assets, the Board considered that the Berlin

residential market offered superior medium-term scope for further

growth in rental and property values. The Company therefore

successfully repositioned its geographic focus by divesting

properties outside Berlin through a disciplined disposal process,

all at a premium to trailing book value.

All remaining non-Berlin assets have been successfully divested

following the sale of the Company's remaining Northern Germany

assets in the second quarter of 2018 and one residual asset in

Baden-Wurttemberg in early 2019. We have simultaneously enlarged

our Berlin presence through our strategy of further acquisitions of

attractive assets in central Berlin, enhancing the scope for

further asset management efficiencies and economies of scale.

Acquiring for growth

Phoenix Spree has continued to add to the Portfolio in 2018 and

has completed a further EUR41.6 million of acquisitions in central

Berlin. The Company has a proven record of creating value for

shareholders through property acquisitions, having acquired

buildings with a combined initial value of EUR204.1 million from

2015 up to 31 December 2018, while maintaining its disciplined

approach.

We are well placed to continue to grow the portfolio and we

continue to research attractive acquisition opportunities.

Improving our tenanted accommodation

Some properties acquired can be in a poor state of repair,

depending on the level of historical underinvestment by previous

owners. The Company takes its responsibilities to its tenants

extremely seriously and we have continued to invest in improvements

to our properties.

Through a carefully targeted process of investment, we have

raised the overall standard of accommodation for our tenants and

the environment in areas where our buildings are located. During

2018, the Company invested the highest value yet on improvement

programmes, and it is anticipated that this process will continue

into 2019.

This improvement in the overall quality of our living

accommodation has created significant future embedded value within

the Berlin Portfolio, as evidenced by new leases signed at a

premium to in-place rents and condominium sales completed at a

premium to average rental property valuations.

Partnering with our Property Advisor

Since our introduction to the Stock Exchange in 2015, the

Company has benefitted significantly from the expertise of its

property advisor, PMM Partners (UK) Limited. It has actively

managed and developed the Portfolio, whilst simultaneously sourcing

value-enhancing acquisitions, and achieving disposals at a premium

to book value. PMM Partners has also overseen the capital structure

of the Company as well as its day-to-day interaction with investors

and other key stakeholders in our business. These activities have

been fundamental to the strong financial performance of Phoenix

Spree and its ability to access capital markets.

I am therefore delighted that, following overwhelming

shareholder approval at an Extraordinary General Meeting in

December 2018, the Company entered into a new property advisory and

investor relations agreement with PMM Residential Limited (PMM), a

new company within the PMM Group, which will secure its continued

expertise as property advisor until at least the end of 2022.

The new agreement will provide greater certainty and stability

for shareholders and allow PMM to invest in infrastructure, IT

systems and key personnel dedicated to servicing the Company's

growing requirements. It will also reduce future management and

performance fees paid by the Company and will, therefore, result in

significant cost savings compared with the terms of the old

property advisor agreement. The Board looks forward to building on

our valued relationship with PMM over the coming years to continue

our record of strong performance.

In February 2019, the Company announced it had been informed

that PMM Partners (UK) Limited and its principals had sold a total

of 2,239,361 shares in the Company. The sale of these shares was

principally made to satisfy the tax liabilities arising from the

December 2017 performance fee which was settled in Phoenix Spree

Deutschland (PSD) shares issued to PMM Partners (UK) Limited in May

2018.

Share price and dividend

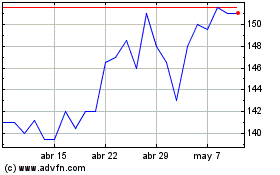

The 2018 financial year proved difficult for global equity

markets in general, as concerns about global growth, the increasing

trend towards trade protectionism and Brexit weighed heavily.

Against this backdrop, 2018 was a year of consolidation for the

Phoenix Spree share price. Notwithstanding this, the shares

outperformed the FTSE All-Share index by 5% and the FTSE 350 Real

Estate Investment Services sector by 12%.

The Board is pleased to recommend a final dividend of EUR5.15

cents per share (GBP 4.62 pence per share), taking the full year

dividend to EUR7.50 cents per share (GBP 6.73 pence per share),

representing a 3% increase on the 2017 full year Euro-denominated

dividend.

Our Better Futures" Corporate Responsibility Plan

The Board recognises the importance of operating with integrity,

transparency and clear accountability towards its shareholders,

tenants and other key stakeholders. We understand that being a

responsible Company, balancing the different interests of our

stakeholders and addressing our environmental and social impacts is

intrinsically linked to the success and sustainability of our

business.

During the past year, the Board and PMM have reviewed how

sustainability is managed within our business and considered

carefully the views of our stakeholders and business priorities to

create our 'Better Futures' Corporate Responsibility ('CR') Plan.

This Plan provides a framework to monitor existing activities

better, while adding new initiatives to improve our overall

sustainability.

Our Corporate Responsibility Plan has four key pillars that have

been integrated throughout our business operations: Protecting our

Environment; Respecting People; Valuing our Customers and Investing

in our Communities. We have established a CR Committee to oversee

the implementation of the Better Futures Plan, reporting to the

Board and advising on any CR related material issues. Our CR

initiatives will be reported in more detail in our 2018 Annual

Report and are available on the Company website.

The Board remains fully committed to high standards of corporate

governance. It has considered the Main Principles and Provisions of

the UK Corporate Governance Code (July 2018) and is pleased to

confirm that the Company has complied with the provisions of the

Code throughout the year, except in certain instances which are set

out in the Corporate Governance Statement within this

announcement.

Outlook

In recent years, Berlin property values have benefited from

significant yield compression. Although this has moderated, the

outlook for the Berlin residential market remains positive.

Residential prices remain on average below the cost of construction

and demand for property continues to grow, due to the continuing

process of urbanisation and population growth. Berlin average

monthly rents per square metre remain among the lowest of all major

European cities.

The Board believes there is scope for further market rental

growth as well as the opportunity to improve rental incomes through

our Property Advisor's active asset management strategies,

particularly on recently acquired buildings. The reversionary

potential that our substantial investment in the Portfolio to date

has created should provide a cushion in the event of any market

slowdown.

The Board remains confident that the Company will continue to

generate growth in rental income and property values during 2019

supported by selected additions to the portfolio and further

condominium projects. This, in turn, should deliver further capital

growth and dividend income to investors in the current financial

year.

REPORT OF THE PROPERTY ADVISOR

Portfolio Regional Overview as at 31 December 2018

Berlin Baden-Wurttemberg Total

(incl. Greater

Area)

% of fund by value 99.4 0.6 100

---------------- ------------------ ------

Number of buildings 95 1 96

---------------- ------------------ ------

Number of residential

units 2,374 18 2,392

---------------- ------------------ ------

Number of commercial

units 142 11 153

---------------- ------------------ ------

Total units 2,516 29 2,545

---------------- ------------------ ------

Total sqm ('000) 179.4 3.7 183.1

---------------- ------------------ ------

Annualised Net Rent (EURm) 17.6 0.4 18.0

---------------- ------------------ ------

Valuation (EURm) 641.8 3.9 645.7

---------------- ------------------ ------

Value per sqm (EUR) 3,576 1,084 3,527

---------------- ------------------ ------

Fully occupied gross

yield % 2.9 12.1 3.0

---------------- ------------------ ------

Vacancy % 4.7 7.7 4.8

---------------- ------------------ ------

EPRA Vacancy % 2.9 0.0 2.8

---------------- ------------------ ------

Like-for-like Portfolio value rises by 14%

On a like-for-like basis, excluding the net impact of

acquisitions and disposals, the Portfolio valuation increased by

14.0% during the year ended 31 December 2018 as it continued to

benefit from the strong market fundamentals in Berlin.

The total Portfolio was valued at EUR645.7 million by Jones Lang

LaSalle GmbH, the Company's external valuers, an absolute increase

of 6.0% over the twelve-month period (31 December 2017: EUR609.3

million), reflecting the impact of non-Berlin disposals during

year. The Portfolio valuation represents an increased average value

per square metre of EUR3,527 (31 December 2017: EUR2,853) and a

gross fully occupied rental yield of 3.0% (31 December 2017:

3.4%).

The Berlin portfolio was valued at EUR641.8 million, an increase

of 21.4% year-on-year (31 December 2017: EUR528.5 million). This

represents an increased average value per square metre of EUR3,576

(31 December 2017: EUR3,220).

The principal drivers behind the like-for-like growth in the

Portfolio value were:

-- a further contraction in market yields, driven by the low interest rate environment;

-- strong growth in like-for-like rental income within the Portfolio;

-- the positive impact of the Property Advisor's active asset management strategy;

-- continued high levels of investor interest in the Berlin property market; and

-- further development of the condominium market, with single

apartment prices in Berlin experiencing another year of

double-digit growth.

Rental income - growth trend continues

Contracted net rental income (excluding service charge revenue)

declined by 3.2% to EUR17.5m (31 December 2017 EUR18.1m),

reflecting the impact of disposal of remaining non-Berlin assets

during the financial year. On a like-for-like basis, excluding the

effect of acquisitions and disposals, rental income across the

Portfolio grew by 9% compared with the prior year. Headline average

in-place rent per sqm was EUR8.6 as at 31 December 2018, compared

with EUR8.1 as at 31 December 2017.

Berlin saw a like-for-like increase in rent per sqm of 6.9%.

Average rent per sqm was EUR8.5, a year-on-year increase of 5.1%

compared with 2017, reflecting strong underlying rental growth in

the existing portfolio, partially offset by the impact of recent

acquisitions, which typically have lower rental values upon

takeover.

As at 31 December 2018 the Company's net contracted annualised

rental income was EUR18.0 million.

Recent letting prices achieve new highs for the Company

The Company enjoyed another strong letting performance in 2018.

A total of 284 new leases were signed, representing 12.0% of the

average units owned during the period. In the Berlin portfolio,

average new letting prices were 5.3% to EUR11.9 per sqm (2017:

EUR11.3 per sqm).

Portfolio reversionary rental potential remains high

Notwithstanding the growth in rental prices, the Portfolio

continues to demonstrate significant reversionary potential, as

shown by the premiums achieved on new letting prices when compared

to in-place rents. New leases signed during the period in Berlin

were agreed, on average, at a 40.4% premium to passing rents.

The Property Advisor believes this reversionary gap should

underpin rental growth in the medium term, providing a buffer

against any potential slow-down in the rental market.

EPRA vacancy remains low

Reported vacancy as at 31 December 2018 was 4.4%, down from 6.8%

as at 31 December 2017. On an EPRA basis, which adjusts for units

undergoing redevelopment or reserved for resale, vacancy was 2.8%

as at 31 December 2018, compared with 2.9% as at 31 December

2017.

The Berlin EPRA vacancy rate also remained low at 2.9% (31

December 2017: 2.7%), with the modest increase reflecting a higher

vacancy rate on buildings acquired during the year. The higher

vacancy rate allows the Company to redevelop and re-let recently

acquired apartments.

Portfolio investment reaches new high

The Company remains committed to improving living standards for

its tenants and fulfilling its environmental obligations in areas

where its properties are located. Depending on the level of

historical underinvestment by previous owners, apartment

improvements can involve redecoration, heating system and heating

plant renewal, new insulation, double glazing, plumbing and

flooring, as well as kitchen and bathroom renewal. Communal areas,

both indoor and outdoor, are also reviewed for potential

improvement where investment has previously been lacking. During

2018, the Company invested EUR7.9m, its highest sum to date, to

further improve the overall quality of its accommodation and

surroundings (year to 31 December 2017: EUR6.7 million).

In the Berlin rental portfolio, EUR4.5 million was invested in

the refurbishment of 189 units representing an average outlay of

EUR354.6 per sqm. The average premium achieved on re-letting these

vacant Berlin units was 68.9%. A further EUR1.9 million was

invested in the infrastructure of properties within the Portfolio

for items such as heating system upgrades and improvements to

indoor and outdoor communal areas. An additional EUR1.5 million was

invested on the development of condominium projects. All these

items are recorded in the accounts as capital expenditure.

A further EUR1.7 million was spent on repairs and maintenance

and expensed through the profit and loss account, compared to

EUR1.4 million in 2017. This results in a total renovation and

repair investment of EUR9.6 million.

Financial Results

EUR million (unless otherwise stated) 31 Dec 2018 31 Dec 2017

Gross rental income (including

service charges) 22.7 23.7

------------ ------------

Like-for-Like annualised rental

income 16.6 15.2

------------ ------------

Net contracted rental income 17.5 18.1

------------ ------------

Profit before tax (PBT) 56.4 138.5

------------ ------------

Reported EPS (EUR) 0.46 1.21

------------ ------------

Investment property value 645.7 609.3

------------ ------------

Net debt 168.4 195.1

------------ ------------

Net LTV 26.1% 32.0%

------------ ------------

EPRA NAV per share (EUR) 4.58 4.11

------------ ------------

EPRA NAV per share (GBP) 4.11 3.65

------------ ------------

Dividend per share (EUR cents) 7.5 7.3

------------ ------------

Dividend per share (GBP pence) 6.7 6.4

------------ ------------

EPRA NAV per share total return

for period (EUR) 13.2% 53.0%

------------ ------------

EPRA NAV per share total return

for period (GBP) 11.4% 57.7%

------------ ------------

Net contracted rental income for the year was 3.2% lower at

EUR17.5 million (year to 31 December 2017: EUR18.1 million). This

decrease reflects the sale of the Northern German Portfolio in

April 2018, effectively offset by strong like-for-like rent per sqm

growth of 7.4%.

The Company has reported a profit before tax for the period to

31 December 2018 of EUR56.4 million (2017: EUR138.5 million) which

was positively affected by a revaluation gain of EUR66.1 million

(2017: EUR157.4 million). The revaluation gain was lower than that

experienced in 2017 and is primarily due to a moderation in the

rate of market yield compression versus the prior year. Reported

earnings per share for the period were EUR0.46 cents (2017: EUR1.21

cents).

EPRA NAV increases by 11.4%

Reported EPRA NAV per share rose by 11.4% in the period to

EUR4.58 (GBP4.11) as at 31 December 2018 (31 December 2017: EUR4.11

(GBP3.65)). After taking into account the dividends paid in 2018 of

EUR7.35 cents (GBP: 6.5p), which were paid in June and October

2018, the Euro EPRA NAV total return in the period was 13.2% (2017:

53.0%).

IFRS NAV per share rose by 2.3% in the period to EUR4.05

(GBP3.54) (31 December 2017: EUR3.96 (GBP3.52).

Dividend

The Company is pleased to have declared a final dividend of

EUR5.15 cents per share (GBP 4.62 pence per share), (2017: EUR5.0

cents; (GBP 4.4 pence per share)), which is expected to be paid on

or around 27 June 2019 to shareholders on the register at close of

business on 7 June 2019, with an ex-dividend date of 6 June 2019.

Taking into account the interim dividend paid in October 2018, the

dividend for the year to 31 December 2018 is EUR7.5 cents per share

(GBP 6.73 pence per share), (2017: EUR7.3 cents per share; (GBP 6.4

pence per share)).

Since listing on the London Stock Market in June 2015, and

including the final dividend for 2018, EUR24.9 million has been

returned to Shareholders. The dividend is paid from operating cash

flows, including the disposal proceeds from condominium projects

and the Company will seek to continue to provide its shareholders

with a secure and progressive dividend over the medium term,

subject to the distribution requirements for Non-Mainstream Pooled

Investments.

Financing

As at 31 December 2018, the Company had gross borrowings of

EUR195.3 million (31 December 2017: EUR222.3 million) and cash

balances of EUR26.9 million (31 December 2017: EUR27.2 million)

equating to a net debt of EUR168.4 million (31 December 2017:

EUR195.1 million) and a net loan to value for the Portfolio of

26.1% (31 December 2017: 32.0%).

Nearly all loans are fixed using an interest rate hedge and, as

at 31 December 2018, the blended interest rate of all loans across

the Portfolio was 2.0%. The average remaining duration of the loan

book at 31 December 2018 was 7.7 years (31 December 2017: 8.4

years). By 31 December 2018, all the Company's debt had been

refinanced within the previous 24 months.

During the course of 2018, the following ten-year loan

facilities were entered into in order to finance newly acquired

properties:

-- April 2018, EUR12.0 million facility;

-- July 2018, EUR1.6 million facility, of which EUR0.3 million remains to be drawn; and

-- December 2018, EUR7.5 million facility of which EUR0.9

million remained to be drawn at 31 December 2018 and was

subsequently drawn in February 2019.

In March 2018, the Company successfully refinanced existing debt

within PSPF Ltd. & Co.KG, against the properties based in

Berlin. An equity release of EUR7.8 million, before costs, was

obtained on the existing property portfolio, all of which was drawn

by 31 December 2018.

Following the disposal of the non-core Central and Northern

Germany assets, EUR40.5 million of the total proceeds of EUR73

million was used to repay debt, with the remainder being reinvested

into the portfolio. Further single property disposals amounting to

EUR4.1 million were also completed during the year with related

debt of EUR3.1 million being repaid.

In November 2018, the Company notarised for disposal the final

non-Berlin property for EUR3.9 million. The transaction completed

in January 2019.There was no debt secured against the asset.

The Company is currently undertaking a substantive review of its

financing requirements to support its future strategy and will

update investors following the conclusion of this exercise.

Acquisitions and disposals

The Company has continued to grow in Berlin with a number of

carefully targeted acquisitions in central locations which fulfil

its strict acquisition criteria. In total, 222 units (210

residential and 12 commercial) were notarised during 2018 for an

aggregate purchase price of EUR36.3 million, at an average price

per sqm of EUR2,390, and annual fully occupied rent of EUR1.3

million.

The Company intends to continue with its strategy of acquiring

in Berlin and, as at 23 April 2019, a further 14 units in Berlin

had been notarised since the December 2018 year end for a purchase

price of EUR2.4 million, representing a value per sqm of EUR2,956.

Acquisitions have been financed using a combination of debt and

cash reserves.

In April 2018 the Company completed the sale of its remaining

Northern Germany assets for a cash consideration of EUR73.0

million, representing a 26% premium to the Jones Lang LaSalle

pre-notarisation valuation. This portfolio, initially acquired in

2006/2007 for an aggregate purchase price of EUR38.7 million,

consisted of 34 properties located in Bremen, Hannover, Hildesheim,

Verden, Delmenhorst, Kiel, Oldenburg, Lüneburg and Lübeck.

Densification projects

Following the significant increase in rental values in recent

years, the Property Advisor is in the process of conducting an

exercise to examine the financial viability of new construction

within the footprint of the existing portfolio. This could involve

both attic conversions and new building construction on land

surrounding buildings that are already owned by the Company.

So far, 26 buildings have been identified for attic conversion

and permission has been granted for 39 new apartments, with a

further 35 in planning. Permission is also being sought for the

first new build project in the courtyard of a building already

owned by the Company with potential to create 23 new units.

Preliminary estimates of the gross development cost for all these

projects are in the region of EUR30 million - EUR35 million. The

Board is committed to ensuring that any decision to proceed with

new construction or investment in existing assets will be based on

the project meeting or exceeding the Company's financial return

targets.

Condominium sales

The Company has continued with its strategy of crystallising the

latent value within the portfolio through selectively reselling

apartment blocks as individual units.

Across the Company's condominium projects, a total of 23 units

were notarised for sale in 2018, with an aggregate sales value of

EUR9.0 million, consistent with the strong sales figures in 2017 of

EUR9.1 million. This represents an average value per sqm of

EUR4,490, or EUR4,466 excluding commercial units and parking.

Condominium sales proceeds during 2018 represented a 24.2%

premium to book value and the average price achieved per sqm for

notarised condominiums was a 25.7% premium to the average valuation

per sqm for properties in the Berlin portfolio as at 31 December

2018, confirming the potential for valuation creation through

apartment privatisation.

These sales constitute a combination of vacant and occupied

units and the Property Advisor expects to identify and prepare

additional condominium projects for sale, either to tenants, or new

buyers during 2019 in order to maintain similar proceeds to

previous years.

Market outlook

The trend towards trade protectionism, slowing global growth and

an uncertain Brexit outcome have impacted negatively on German GDP

forecasts. After averaging 2.1% over the period 2014-2017,

Germany's GDP growth slowed to 1.5% in 2018, and the European

Commission forecasts this will cool further to 1.1% in 2019, before

recovering to 1.7% in 2020. Although headwinds to German economic

growth remain, the inherent strength of the German labour market

continues, with unemployment levels expected to reduce further

(from 5.2% during 2018 to 4.9% in 2019) and employment levels

expected to rise.

Berlin's economic growth prospects remain relatively

uncorrelated given its comparative under-reliance on manufacturing

and skew towards the services sector as a source of job creation.

This positive labour market development has been a key driver of

Berlin's population growth. Between 2011 and 2017, its population

increased by nearly 290,000 and the number of households by almost

200,000. The population is expected to continue to grow. According

to the Senate administration, Berlin will require an additional

194,000 apartments by 2030.

Against a backdrop of strong population growth, medium-term

demand for residential property will continue to outstrip supply,

driven by a combination of high new-build construction costs, lack

of available land and a shortage of new build permits. The net

effect of this supply-demand imbalance should underpin the rental

market and, in turn, create significant future reversionary

potential within the Portfolio. This offers potential to improve

rental incomes in the event that market rental values

stabilise.

With an active market vacancy currently just over 1%, Berlin's

regional government has reacted to supply shortage by implementing

a growing number of regulatory measures such as:

-- the exercise of pre-emptive purchase rights;

-- additional designation of protected residential areas to

restrict the partitioning and resale of rental blocks as

condominiums.

There has recently been a well-documented grass-roots proposal

in Berlin for a referendum which proposes to expropriate properties

of large Berlin landlords with over 3,000 units under management.

The Property Advisor continues to monitor developments in relation

to the proposed referendum, but feels that since the Company owns

2,516 units, the outcome of the referendum is unlikely to affect

the Portfolio.

The Company's strategy will continue to develop to ensure that

it acts in a responsible manner, adhering at all times to relevant

regulatory requirements and property laws.

Notwithstanding the fact that yield compression has moderated,

the Property Advisor remains confident that the favourable Berlin

demographics outlined above offer opportunity to further improve

rental incomes and property values. This, combined with carefully

selected Portfolio acquisitions and a continuation of selective

condominium sales, leaves the Company well placed for the year

ahead.

OUR BUSINESS MODEL

Actively Managing the Portfolio

Underpinning our strategy is a business model that involves our

Property Advisor's active management of the portfolio of assets.

The key stages of this process are; Acquire, Renovate, Optimise,

and Reinvest.

ACQUIRE

The Company focuses on apartment buildings that are sometimes

poorly maintained. Through significant reinvestment, the apartments

are modernised to improve both the standard of accommodation for

tenants and the look of the local neighbourhood. We focus on

carefully selected central Berlin micro-locations which offer the

potential for medium-term value creation through modernisation and

renovation. The Company has historically focussed its acquisitions

on properties built before 1914 (Altbau). Single properties,

packages and portfolios are considered. Since listing on the London

Stock Exchange in June 2015 the Company has notarised on properties

with an aggregate valuation on acquisition of EUR206.3 million.

Acquisitions notarised since 2015 stock market listing

Year Region Purchase Units Sqm Purchase price Fully occupied

price (EUR) Per sqm (EUR) yield

2015 Berlin 35,760,000 227 18,197 1,965 4.3%

------- ------------ ----- ------ -------------- --------------

2016 Berlin 78,305,000 634 41,406 1,891 4.3%

------- ------------ ----- ------ -------------- --------------

2017 Berlin 55,890,000 336 25,135 2,224 3.6%

------- ------------ ----- ------ -------------- --------------

2018 Berlin 36,320,000 222 15,195 2,390 3.5%

------- ------------ ----- ------ -------------- --------------

Total 206,275,000 1,419 99,933 2,064 4.0%

------------ ----- ------ -------------- --------------

RENOVATE

Buildings acquired may require reinvestment to bring them up to

modern standards. It can take several years for the Property

Advisor's disciplined active asset management strategies to be

fully reflected in the valuation of each acquired building.

The scope for value creation is clearly evidenced in buildings

acquired during 2016. Acquisitions that had completed by 31

December 2016 were revalued by Jones Lang LaSalle ("JLL") as at 31

December 2018 at an average 97.2% premium to purchase prices. This

compares with growth in the properties acquired before 2016 over

the same period of 52.4%. This clearly demonstrates the scope for

significant value creation that the Property Advisor can achieve

through the selective acquisition and repositioning of Berlin

properties.

Acquisitions 2016 Value

Number of properties acquired 15

---------

Purchase Price EUR78.3m

---------

Value Growth of 2016 acquisitions (2016 - 31

December 2018) 97.2%

---------

Legacy portfolio valuation growth (2016 - 31

December 2018) 52.4%

---------

Rent per square metre growth of 2016 acquisitions

(2016 - 31 December 2018) 86.5%

---------

Legacy portfolio rent per square metre growth

(2016 - 31 December 2018) 79.0%

---------

Average fully occupied purchase yield of 2016

acquisitions 4.3%

---------

Average fully occupied yield of portfolio in

December 2018 3.0%

---------

We place our tenants' interests at the forefront of everything

we do. Many of the buildings that we acquire are in poor condition,

with a substantial backlog of underinvestment. We therefore seek to

improve the standard of accommodation available to tenants through

modernisation and renovation of apartments and, where appropriate,

their communal areas.

Renovations are carried out sensitively, and we carefully assess

each programme of building improvements to ensure that they are

justified, avoiding excessive investment which might lead to

unaffordable rent increases. Improvements are conducted on a

rolling basis across the Portfolio and vary according to the

condition of each building and its apartments. Refurbishment of

occupied units is only carried out with full agreement from

tenants.

Vacant units in poor condition are considered for full

renovation and vacant attic space is reviewed for conversion to

residential space. Depending on the level of historical

under-investment, apartment improvements can involve heating system

and boiler upgrades, new insulation, double glazing, new plumbing,

kitchen and bathroom renewal, new flooring, and redecoration.

Communal areas, both indoor and outdoor, are also reviewed for

potential improvement. A single apartment generally costs between

EUR20,000 and EUR30,000 to renovate, while an entire building

renovation might cost up to EUR2 million.

OPTIMISE

After acquisition, the Property Advisor looks to realign these

properties to maximise their potential within the Portfolio.

Realigning rents

For properties considered to be core rental buildings, vacant

units are re-let after refurbishment at levels that at all times

comply with relevant regulations. Tenant lists are reviewed

carefully and, only where appropriate, rent increases are applied

for, either where tenants are paying less than the statutory rent

level (Mietspiegel), where modernisation has been undertaken (and

these costs are allowed to be recouped), or where the lease

contains provisions for indexation (Staffel).

Buildings that are re-let typically command a rental premium to

in-place rental values. This "reversionary gap" reflects the

significant investment in these buildings and their surroundings to

bring them up to modern standards.

Berlin reletting premium

Year Berlin portfolio Berlin average new leases

average rent (EUR signed by quarter (EUR

per sqm) per sqm)

2011 6.2 6.7

------------------- --------------------------

2012 6.6 7.9

------------------- --------------------------

2013 7.0 9.1

------------------- --------------------------

2014 7.4 9.8

------------------- --------------------------

2015 8.0 11.2

------------------- --------------------------

2016 7.7 10.6

------------------- --------------------------

2017 8.1 11.9

------------------- --------------------------

2018 8.5 12.0

------------------- --------------------------

Realigning through the creation of new living space

As well as acquiring buildings, the Company is now exploring

ways to realign existing buildings within the existing portfolio by

identifying opportunities to create new residential space. The

substantial increase in rental and property values has created

potential densification opportunities which could involve both

attic conversions and new building construction on land surrounding

buildings already owned by the Company.

REINVEST

The properties within the Portfolio are revalued each year with

historical investment being reflected in revised property values.

To the extent that additional borrowing can be secured on higher

property values, a substantial portion are reinvested by way of

acquisitions and improvements in the existing portfolio of

buildings. For the year ended 2018, 50% of the rental income has

been reinvested into the portfolio.

Buildings that no longer fit the strategic objectives of the

Portfolio are considered for sale, either as blocks, or via the

condominium strategy. Since listing on the Main Market of the

London Stock Exchange in June 2015, the Company has been

progressively selling its non-Berlin assets. In aggregate these

assets have been sold at an average 23.8% premium to trailing book

value and the majority of the proceeds have been reinvested into

further improvements in the Berlin portfolio and Berlin

acquisitions.

Disposals notarised since 2015 stock market listing

Region 2015 2016 2017 2018 Premium to prior

FY book value

(EUR) (EUR) (EUR) (EUR)

Nuremberg & Furth 870,000 77.0%

------- --------- ----------- --------- ----------------

Berlin (including

Greater Area) 3,800,000 19.1%

------- --------- ----------- --------- ----------------

Baden-Wuerttemberg 6,100,000 3,920,000 6.3%

------- --------- ----------- --------- ----------------

Nuremberg & Furth 35,170,000 10.7%

------- --------- ----------- --------- ----------------

Central & North Germany 84,050,000 32.9%

------- --------- ----------- --------- ----------------

Total 870,000 3,800,000 125,320,000 3,920,000 23.8%

------- --------- ----------- --------- ----------------

Creation of condominiums

In addition to its core rental business, the Company also

selectively identifies a small number of condominium projects. The

Company is committed to operating within the relevant regulatory

and planning frameworks at all times during the condominium

realignment process.

This strategy is considered where a significant differential

exists between the market value of a rental unit within an

apartment block and the resale value of a unit as a private

apartment, or where there is limited opportunity to generate

further value as a rental building. The process involves legally

splitting the freeholds in a small number of selected

buildings.

The sales comprise a combination of vacant and occupied units

and can augment returns to reinvest in the Portfolio on further

acquisitions. As at 31 December 2018, 90 units representing

proceeds of EUR26.9 million had completed since condominium sales

commenced in mid-2015.

Year Condominium sales Berlin rental Sales Value Premium to

value EUR/sqm portfolio value (EURm) trailing book

EUR/sqm value (%)

2015 3,899 1,982 4.7 19.4

------------------ ----------------- ------------ ---------------

2016 4,427 2,150 5.5 33.3

------------------ ----------------- ------------ ---------------

2017 4,352 3,220 9.1 23.8

------------------ ----------------- ------------ ---------------

2018 4,566 3,576 9.9 24.2

------------------ ----------------- ------------ ---------------

THE CHANGING FACE OF BERLIN

During the past decade, Berlin has developed into one of

Europe's most vibrant and dynamic cities. Economic and population

growth have substantially outstripped nearly all other European

cities. Today, services account for 85% of Berlin's economic output

and growth in knowledge-based and future-oriented sectors offer a

bright future for Berlin's economy and labour market compared with

other European cities which have relied more heavily on

manufacturing and exports.

Since 2009, employment has increased by more than 30% in

aggregate and this development serves as a solid basis for

residential market demand in Phoenix Spree's core Berlin

residential market.

Whilst manufacturing accounts for one out of four jobs across

Germany as a whole, it plays a subordinated role in Berlin, with

only one out of eight employees employed in this sector. Berlin has

clearly positioned itself as an innovation hub. As its "new world"

economy continues to grow and flourish, the city's inward migration

trends increasingly reflect the new skills demanded by the labour

market. Employment growth has mainly taken place in services, where

more than 200,000 jobs were newly created between 2013 and 2018.

Almost half of these new jobs were in three services sectors only.

First, professional, scientific and technical services; second,

other business services; and third, the information and

communications sector.

The changing population and employment demographics are

reflected in Phoenix Spree's own tenant structure. Analysis of new

tenancies signed during 2018 shows that new tenants attracted to

Phoenix Spree's rental proposition are almost exclusively from the

services sector, over 39% of new leases signed are by tenants that

have relocated either from another German city or from another

country and only 18% are native Berliners.

New leases signed in 2018 by tenant occupation

Employment sector Percentage of tenants

Customer service 23%

----------------------

Other services 20%

----------------------

Students 16%

----------------------

Education service 12%

----------------------

Information Technology 11%

----------------------

Health services 9%

----------------------

Technical services 9%

----------------------

New leases signed in 2018 by place of birth

Nationality Percentage of tenants

Native Berliners 18%

----------------------

Other German locations 42%

----------------------

Other European Union countries 20%

----------------------

Non-European Union but in Europe 6%

----------------------

Other countries 14%

----------------------

Despite the significant rental increases seen in Berlin in

recent years, rental values remain relatively low by European

standards and rent affordability remains high. For Phoenix Spree,

analysis of all new leases signed during 2018 shows that the

average tenant net income after tax is EUR43,200 and that the

percentage of total rent to income stands at only 26%.

Average monthly rents remain among lowest of all major European

cities with the average monthly rent per square metre of EUR9.8

significantly cheaper than other major European cities.

Monthly rents by European City

European City 2018 Monthly Rent (EUR per

sqm)

London 28.2

---------------------------

Edinburgh 19.5

---------------------------

Dublin 19.2

---------------------------

Paris 18.0

---------------------------

Barcelona 17.9

---------------------------

Birmingham 16.2

---------------------------

Amsterdam 16.0

---------------------------

Madrid 15.1

---------------------------

Rome 14.0

---------------------------

Frankfurt 13.3

---------------------------

Milan 12.0

---------------------------

Lisbon 10.6

---------------------------

Berlin 9.8

---------------------------

Vienna 9.4

---------------------------

Source: Knight Frank

Not only are rents comparatively low, but available household

incomes are predicted to rise faster in Berlin than in any other

European city over the next 10 years.

Average household income growth (% change 2018-2028)

European City 10 years Income Growth (%)

Berlin 35.9%

---------------------------

Birmingham 35.1%

---------------------------

Edinburgh 35.2%

---------------------------

Amsterdam 34.0%

---------------------------

London 33.1%

---------------------------

Barcelona 32.7%

---------------------------

Dublin 32.3%

---------------------------

Frankfurt 30.9%

---------------------------

Madrid 30.9%

---------------------------

Milan 29.3%

---------------------------

Lisbon 26.5%

---------------------------

Rome 25.9%

---------------------------

Paris 25.6%

---------------------------

Vienna 21.2%

---------------------------

Source: Knight Frank

CORPORATE RESPONSIBILITY

Phoenix Spree is committed to acting responsibly by balancing

the different interests of all our key stakeholders and capturing

this within our Company Values and business model.

Our Approach to Corporate Responsibility

We strive to strike a meaningful balance between proving a

return to our investors and addressing our social and environmental

impacts. We engage with our stakeholders to ensure we understand

differing viewpoints and take this into consideration when making

business decisions. We believe that this is not only the right way

to approach business, but it will help us maintain a commercial

advantage and enable us to be a sustainable company that delivers

long term success.

Our business focusses on providing homes for people that are

both comfortable and affordable. We often acquire properties that

are in relatively poor condition and, through significant

reinvestment, we modernise the apartments to improve the standard

of accommodation for our tenants and improve the look of the local

neighbourhood. Providing good customer service to our tenants and

improving the sustainability of housing stock through renovation

lies at the core of our business.

In 2018, we reviewed how sustainability is managed within our

business and aligned these with the views of our stakeholders and

business priorities to create our Company Values and our 'Better

Futures' Corporate Responsibility (CR) Plan.

Whilst we are pleased with the progress we are making with the

dedication of our partners; we look forward to further

communication regarding our CR programme in the coming period.

Corporate Responsibility Governance

To ensure the successful delivery of our 'Better Futures' CR

Plan within our business, relevant Policies have been created for

each of the pillars, a measurement framework established to monitor

progress and a structure put in place to ensure robust

oversight.

We share the relevant policies with PMM, who in turn have

created their own policies that are aligned with ours. We request

that PMM periodically verifies that it has acted in accordance with

the policies. Where PMM outsources any key functions to other

business partners, it has likewise shared the policies with them

and requested that they periodically verify that they have acted

within the spirit of the relevant policies.

Structurally, PMM has established a CR Task Force that oversees

the implementation of the plan across the business. This Task Force

reports the progress on the CR Plan, at minimum twice a year, to

Phoenix Spree's CR Sub-Committee, who in turn reports into the

Company's Board.

For further information, please visit the company's website at

www.phoenixspree.com.

PRINCIPAL RISKS AND UNCERTAINTIES

The Board recognises that effective risk evaluation and

management needs to be foremost in the strategic planning and the

decision-making process. In conjunction with the Property Advisor,

key risks and risk mitigation measures are reviewed by the Board on

a regular basis and discussed formally during Board meetings.

RISK IMPACT MITIGATION MOVEMENT

Decline in property Economic, political, The Property Unchanged

valuation fiscal and legal Advisor believes

issues can have German housing

a negative effect affordability

on property valuations. metrics remain

A decline in favourable relative

Group property to other European

valuations could countries and

negatively affect that German residential

the valuation supply-demand

of the Portfolio dynamics are

and the ability supportive, with

of the Group limited supply

to sell properties of rental stock

within the portfolio in urban locations

at valuations putting upward

which satisfy pressure on rents.

the Group's investment

objective.

---------------------------- ---------------------------- -----------

Adverse interest Future interest The Property Unchanged

rate movements rate rises could Advisor has a

increase the record of securing

borrowing cost financing across

to the Group the Portfolio.

which, in turn, The Group mitigates

could negatively its exposure

affect the Group's to adverse interest

financial performance. rate movements

through the use

of interest rate

swaps or by fixing

its interest

rates. All new

debt drawn in

the year was

fixed using interest

rates swaps.

The average blended

interest rate

of the Group's

debt profile

is now 2.0% with

a blended maturity

of 7.7 years.

During the past

24 months, 100%

of the Group's

debt has been

refinanced.

---------------------------- ---------------------------- -----------

Inability to Inability to The Company currently Unchanged

sell condominiums sell condominiums has split over

in the Berlin half the properties

market due to in the German

changing political land registry,

or economic conditions the final step

could affect to allowing the

the Company's sale of properties

cashflows in as individual

the short term, condominiums.

which may affect The Property

the ability of Advisor reviews

the company to the condominium

fund its capital profile of the

expenditure programme Company on a

or fund its annual monthly basis

dividend. and the Company

can onboard new

condominium properties

quickly for sale

if required.

---------------------------- ---------------------------- -----------

Breach of covenant Should any fall The Group has Decreasing

requirements in revenues result no loan to value

in the Group covenants on

breaching financial debt held. The

covenants given group does have

to any lender, debt service

the Group may coverage covenants

be required to on its finance

repay such borrowings with DZ Hyp bank

in whole or in which are assessed

part, together annually in January.

with any related DZ Hyp loan covenant

costs. requirements

have always been

met with significant

headroom, and

were most recently

met in January

2019, again with

significant headroom.

The Property

Advisor regularly

monitors all

debt service

coverage covenants

and would seek

to take remedial

measures in advance

of any covenant

being breached.

---------------------------- ---------------------------- -----------

Insufficient Lack of capital At year end the Increasing

capital to support may restrict Group had cash

expansion the ability of reserves of EUR26.9m

the Group to and has signed

pursue future debt in 2018

investment opportunities of EUR28.9m,

consistent with EUR27.6 of which

the overall investment was drawn. The

objectives. Group always

maintains very

conservative

long-term forecasts

regarding its

cash balances

to ensure a three

year viability

projection. Taking

this into account,

and current and

future spending

commitment on

improving the

portfolio and

returns to shareholders,

without further

debt the Group

has limited capacity

for acquisitions.

It continues

to look for methods

to achieve further

capital on an

ongoing basis.

---------------------------- ---------------------------- -----------

Insufficient Availability The Property Unchanged

investment opportunity of potential Advisor has been

investments which active in the

meet the Group's German residential

investment objective property market

can be negatively since 2006. It

affected by supply has specialised

and demand dynamics acquisition personnel

within the market and an extensive

for German residential network of industry

property and contacts including

the state of property agents,

the German economy industry consultants

and financial and the principals

markets more of other investment

generally. funds. It is

expected that

future acquisitions

will be sourced

from these channels.

---------------------------- ---------------------------- -----------

Changes to property Property laws The Property Increasing

and tenant law remain under Advisor regularly

constant review monitors the

by the new "Red-Red-Green" impact that existing

coalition government and proposed

in Germany and regulation could

future changes have on future

to property regulation rental values

and rent controls and property

for new tenancies planning applications.

could negatively This includes

affect rental the potential

values and property referendum in

valuations. Berlin which

is discussed

on page 11 of

this annual report.

In order to reduce

the dependency

upon statutory

rent increases,

the majority

of the new leases

signed within

the Portfolio

include annual

indexation (or

'Staffel') increases.

---------------------------- ---------------------------- -----------

Occupancy and Unexpected vacancy The Property Decreasing

tenant risk and tenant default Advisor implements

trends across strict vetting

the Portfolio and screening

could lead to processes to

a rental income improve tenant

shortfall which, quality across

in turn, may the Portfolio.

adversely impact Where appropriate,

Group profitability apartments becoming

and investment vacant are renovated

returns. and modernised

and then re-let

at rents which

are at a significant

premium to that

paid by outgoing

tenants.

---------------------------- ---------------------------- -----------

Reliance on the The Group's future Since Listing Unchanged

Property Advisor performance depends on the London

and its key personnel on the success Stock Exchange,

of the Property the Property

Advisor's strategy, Advisor has expanded

skill, judgement headcount through

and reputation. the recruitment

The departure of several additional

of one or more experienced London

key employees and Berlin-based

may have an adverse personnel. Additionally,

effect on the senior Property

performance of Advisor personnel

the Group and and their families

any diminution retain a stake

in the Property in the Group,

Advisor's reputation aligning their

may have an adverse interests with

effect on the other key stakeholders.

Group's performance. In November 2018

the Group announced

that it had signed

a new Property

Advisor agreement

with PMM, committing

the Property

Advisor to the

Fund for the

foreseeable future.

---------------------------- ---------------------------- -----------

Reputational Adverse publicity The Group has Unchanged

risk and inaccurate retained an external

media reporting public relations

could reflect consultancy and

negatively on press releases

stakeholders' are approved

perception of by the Board

the Group, its prior to release.

strategy and The Group maintains

its key personnel. regular communication

with key shareholders

and conducts

presentations

and roadshows

to provide investors

with relevant

information on

the Group, its

strategy and

key personnel.

The Group also

has a dedicated

CSR committee

of the Board

which ensures

the company ethos

is in line with

societal expectations.

---------------------------- ---------------------------- -----------

Macro economic A deterioration Although the Increasing

environment in economic growth Board and Property

and a recessionary Advisor cannot

environment could control external

adversely affect macroeconomic

tenant demand risks, economic

and vacancy, indicators are

leading to a constantly monitored

reduction in by both the Board

rental and property and Property

values. Advisor and Group

strategy is tailored

accordingly.

The Fund is a

Jersey & Guernsey

based entity

operating in

Germany, and

therefore Brexit

should not affect

the fund as it

currently operates

outside the UK.

However, the

uncertainty surrounding

Brexit continues

to affect the

macroeconomic

environment around

Europe and the

situation continues

to be monitored

by both the Board

and Property

Advisor

---------------------------- ---------------------------- -----------

Non- compliance Failure to identify The Group employs Unchanged

with new regulatory and respond to internal compliance

accounting and the introduction and corporate

taxation legislation of new financial governance advisors

regulation in to provide updates

a timely manner. and boardroom

Risk of reputational briefings on

damage, penalties regulatory changes

or fines. likely to impact

the Group. The

Group works closely

with external

accountants and

tax advisors

to keep up to

date with changes

to financial

regulation in

the UK, Channel

Islands and Germany.

---------------------------- ---------------------------- -----------

Loss of data Illegal access Review of IT Increasing

due to cyber of commercially systems and infrastructure

security attack sensitive information in place to ensure

on IT systems and potential these are as

to impact investor, robust as possible.

supplier and Service Providers

tenant confidentiality. are required

to report to

the board on

request on their

financial controls

and procedures.

Service providers

are also required

to hold detailed

risk and controls

registers regarding

their IT systems.

The board is

currently reviewing

its IT procedures

and controls

for the 2019

financial year.

---------------------------- ---------------------------- -----------

Directors' report

The Directors are pleased to present their Annual Report and the

audited consolidated financial statements for the year ended 31

December 2018.

General information

The Company is a public limited company and incorporated in

Jersey, Channel Islands under the Companies (Jersey) Law 1991. The

Company was admitted to the premium segment of the Main Market of

the London Stock Exchange on 15 June 2015.

The Group's objective is to generate an attractive return for

shareholders through the acquisition and active management of

high-quality pre-let properties in Germany. The Group is primarily

invested in the residential market, supplemented with selective

investments in commercial property. The majority of commercial

property within the portfolio is located within residential and

mixed-use properties.

Dividends

The Directors recommend a final dividend of EUR5.15 cents (2017:

EUR5.0 cents) per Ordinary Share to be paid on or around 27 June

2019 to ordinary shareholders on the register on 7 June 2019.

The Directors declared a dividend of EUR5.0 cents per share on

26 April 2018, paid on 29 June 2018 to ordinary shareholders on the

register on 8 June 2018 and a further dividend of EUR2.35 cents per

share on 26 September 2018, paid on 19 October 2018 to ordinary

shareholders on the register on 5 October 2018.

Directors

The Directors who served during 2018 and to date are as

follows:

Name of Director

R Hingley Independent Non-executive director,

Chairman

------------------------------------

R Prosser (resigned 17 April Non-executive director

2018)

------------------------------------

M Northover (resigned 24 January Non-executive director

2018)

------------------------------------

Q Spicer Independent Non-executive director

(Not independent from 7 March

2019)

------------------------------------

A Weaver (resigned 17 April 2018) Non-executive director

------------------------------------

C Valeur (appointed 24 January Independent Non-executive director

2018)

------------------------------------

J Thompson (appointed 24 January Independent Non-executive director

2018)

------------------------------------

M O'Keefe (appointed 17 April Independent Non-executive director

2018)

------------------------------------

Directors' indemnities

The Company has made third party indemnity provisions for the

benefit of its Directors which were in place throughout the year

and remain in force at the date of this report.

Substantial shareholdings

As at 9 April 2019, the Company has received the following

notifications under chapter 5 of the Disclosure and Transparency

Rules of shareholdings of more than 5% of the Company's share

capital:

Name of holder Percentage of voting No. of Ordinary Shares

rights

Bracebridge Capital,

LLC 12.2% 12,288,503

--------------------- -----------------------

Thames River Capital 8.0% 8,088,096

--------------------- -----------------------

Invesco 6.8% 6,872,314

--------------------- -----------------------

Requirements of the Listing Rules

The following table provides references to where the information

required by the Listing Rule 9.8.4R is disclosed.

Listing Rule requirement

A statement of the amount of interest capitalised by the group Not applicable

during the period under review

with an indication of the amount and treatment of any related tax

relief.

-----------------------------------------------

Any information required by LR 9.2.18 R (Publication of unaudited Not applicable

financial information).

-----------------------------------------------

Details of any long-term incentive schemes as required by LR 9.4.3 Not applicable

R.

-----------------------------------------------

Details of any arrangements under which a director of the company No such waivers

has waived or agreed to

waive any emoluments from the company or any subsidiary undertaking.

Where a director has

agreed to waive future emoluments, details of such waiver together

with those relating to

emoluments which were waived during the period under review.

-----------------------------------------------

Details required in the case of any allotment for cash of equity No such share allotments

securities made during the

period under review otherwise than to the holders of the company's

equity shares in proportion

to their holdings of such equity shares and which has not been

specifically authorised by

the company's shareholders. This information must also be given for

any major unlisted subsidiary.

-----------------------------------------------

Where a listed company has listed shares in issue and is a Not applicable

subsidiary undertaking of another

company, details of the participation by the parent undertaking in

any placing made during

the period under review.

-----------------------------------------------

Details of any contract of significance subsisting during the period a) Notes 27,33 to the accounts

under review: b) No controlling shareholder, not applicable

(a) to which the listed company, or one of its subsidiary

undertakings, is a party and in

which a director of the listed company is or was materially

interested; and

(b) between the listed company, or one of its subsidiary

undertakings, and a controlling

shareholder.

-----------------------------------------------

Details of contracts for the provision of services to the listed No controlling shareholder, not applicable

company or any of its subsidiary

undertakings by the controlling shareholder.

-----------------------------------------------

Details of any arrangement under which a shareholder has waived or No such agreements

agreed to waive any dividends,

where a shareholder has agreed to waive future dividends, details of

such waiver together

with those relating to dividends which are payable during the period

under review.

-----------------------------------------------

Board statement in respect of relationship agreement with the No controlling shareholder, not applicable

controlling shareholder.

-----------------------------------------------

Corporate Governance

The Directors have prepared a statement on how the UK Corporate

Governance Code has been applied, which is set out on pages 35 to

44.

Financial instruments

Details of the financial risk management objectives and policies

followed by the Directors can be found in note 3 to the

consolidated financial statements.

Events after the reporting date

-- In April 2019, the Company exchanged contracts for the

acquisition of one individual property in Berlin for the purchase

price of EUR2.4 million. The property is still awaiting

completion.

-- The Company had exchanged contracts for the acquisition of

one property in Berlin with a purchase price of EUR2.2 million

prior to the balance sheet date, which as at balance sheet date had

not yet completed. The purchase completed in January 2019.

-- In Q1 2019, the Company exchanged contracts for the sale of

one commercial unit and one residential unit in BoxhagenerStraße

with an aggregated purchase price of EUR1.9 million. The sale of

these units subsequently completed in April 2019.

-- The Company had exchanged contracts for the sale of three

condominiums in Berlin with aggregated consideration of EUR1.1

million prior to the reporting date. The sale of these units

subsequently completed in Q1 2019.

-- The Company exchanged contracts for the disposal of the last

non-Berlin property for the sale price of EUR3.9 million prior to

the reporting date, the sale of this property subsequently

completed in January 2019.

-- In February 2019, the Company drew down the final EUR0.9

million portion of the EUR7.5 million loan with Berliner Sparkasse.

EUR6.6 million of the debt was drawn down in December 2018.

Auditor

Each of the Directors at the date of approval of this Annual

Report has taken all the steps that he or she ought to have taken

as a Director in order to make him or herself aware of any relevant

audit information and to establish that the Group's auditor is

aware of that information. The Directors are not aware of any

relevant audit information which has not been disclosed to the

auditor.

RSM UK Audit LLP has expressed its willingness to continue in

office as auditor and a resolution to reappoint them will be

proposed at the forthcoming Annual General Meeting.

Viability Statement

The Directors have assessed the viability of the Group over a

three-year period. The Directors have chosen three years because

that is the period over which the Group has sufficiently robust

forecasts as part of its business plan. The Viability Statement is

based on a robust assessment of those risks that would threaten the

business model, future performance, solvency or liquidity of the

Group. For the purposes of the Viability Statement the Directors

have considered, in particular, the impact of the following factors

affecting the projections of cash flows for the three-year period

ending 31 December 2021:

a) the potential operating cash flow requirement of the

Group;

b) seasonal fluctuations in working capital requirements;

c) property vacancy rates;

d) rent arrears and bad debts;

e) capital and administration expenditure (excluding potential

acquisitions as set out below) during the period; and

f) condominium sales proceeds.

The Directors recognise that the projections of cash flows do

not include the impact of further potential property acquisitions

over the three-year period, as these acquisitions are ad hoc and

discretionary in nature. In this respect, the Directors complete a

formal review of the working capital headroom of the Group for each

potential acquisition.

On the basis of the above, and assuming the principal risks are

managed or mitigated as expected, the Directors have a reasonable

expectation that the Group will be able to continue in operation

and meet its liabilities as they fall due over the three-year

period of their assessment.

Registered office

13-14 Esplanade

St Helier

Jersey

JE1 1EE

Channel Islands

Corporate Governance Statement

This Corporate Governance Statement comprises pages 35 to 44 and

forms part of the Directors' Report.

To comply with the UK Listing Regime, the Company must comply

with Listing Rule 9.8.6(5) R which requires the Company to apply

the main principles of the UK Corporate Governance Code ('the

Code') most recently published in July 2018 and report to

shareholders how the Company has applied these principles or

explain any departures therefrom.