TIDMPPH

RNS Number : 4673X

PPHE Hotel Group Limited

30 April 2019

PPHE Hotel Group Limited

Trading update (unaudited)

for the three months ended 31 March 2019

-- Strong start to 2019 with 8.1% like-for-like(1) revenue increase

-- Continued good progress with hospitality real estate investments

PPHE Hotel Group Limited (the "Group"), the international

hospitality real estate group which owns, co-owns and develops

hotels, resorts and campsites, is pleased to announce its trading

update for the three months ended 31 March 2019.

Key Financial Statistics for the three months ended 31 March

2019

Reported Like-for-like(1)

----------------------------------------- ------------ ---------------- ----------

Three months Three months Three months

ended ended ended Three months

31 March 31 March % 31 March ended %

2019 2018 change(2) 2019 31 March 2018 change(2)

-------------- ------------- ------------- ----------- ------------ ---------------- ----------

GBP 62.5 GBP 59.4 GBP 62.4

Total revenue million million 5.2% million GBP 57.8 million 8.1%

-------------- ------------- ------------- ----------- ------------ ---------------- ----------

Occupancy 76.4% 73.7% 270 bps 76.4% 73.8% 260 bps

-------------- ------------- ------------- ----------- ------------ ---------------- ----------

Average room

rate GBP115.5 GBP108.7 6.2% GBP115.4 GBP110.6 4.3%

-------------- ------------- ------------- ----------- ------------ ---------------- ----------

RevPAR GBP88.2 GBP80.1 10.1% GBP88.2 GBP81.7 7.9%

-------------- ------------- ------------- ----------- ------------ ---------------- ----------

1 The like-for-like numbers for 31 March 2018 exclude the first

three months of operation from art'otel dresden due to termination

of the lease. Furthermore, the like-for-like numbers for both 31

March 2019 and 31 March 2018 exclude the first three months of

operation from Park Plaza Vondelpark, Amsterdam (temporarily closed

for repositioning).

2 Percentage change figures are calculated from actual figures

as opposed to the rounded figures included in the above table.

Unless otherwise indicated, all figures in this report compare

three months ended 31 March 2019 with three months ended 31 March

2018.

Commenting on the results, Boris Ivesha, President & Chief

Executive Officer said:

"We are pleased to report a strong first quarter performance,

with like-for-like revenue for the Group increasing by 8.1%

reflecting good increases in occupancy and average room rate and

the appeal of our portfolio and our rigorous focus on inspirational

service delivery to delight our guests.

We are continuing to make good progress in extending our

property pipeline with the acquisition of an interest in a property

in Manhattan, New York, and we look forward to progressing our

pre-construction timetable with our partner in this new market for

our art'otel(R) brand. Our broader pipeline is strong with an

approximate GBP240m committed investment programme including

several repositioning projects and the developments of our art'otel

london hoxton and art'otel london battersea power station which are

both progressing well.

PPHE's proven development strategy is to target real estate in

prime locations and attractive geographies where we believe there

is significant upside potential to drive growth and long-term value

through both the property portfolio and operations. The Group

intends to continue with its mission to bring art'otel(R) to major

cities, building on the success of the brand in Amsterdam, Berlin,

Cologne and Budapest.

We take an integrated and entrepreneurial approach and have a

strong 30-year track record in creating value through owning,

developing and operating prime hospitality real estate, a robust

financial position and an attractive pipeline to deliver future

growth in profits and real estate assets. We look forward to

progressing these new opportunities along with our committed

repositioning and renovation projects through 2019 and expect to

deliver full year results in line with expectations."

Performance during the three months ended 31 March 2019

-- Like-for-like(1) , revenue increased by 8.1% to GBP62.4

million (three months ended 31 March 2018: GBP57.8 million) driven

by strong growth in the United Kingdom, with positive performances

across the Netherlands, Germany, Hungary. Reported total revenue

increased by 5.2% to GBP62.5 million (three months ended 31 March

2018: GBP59.4 million) reflecting hotel closures in the period.

-- Like-for-like(1) RevPAR increased by 7.9% to GBP88.2 (three

months ended 31 March 2018: GBP81.7). Reported RevPAR increased by

10.1% to GBP88.2 (three months ended 31 March 2018: GBP80.1).

-- Like-for-like(1) average room rate increased by 4.3% to

GBP115.4 (three months ended 31 March 2018: GBP110.6). On a

reported basis, average room rate increased by 6.2% to GBP115.5

(three months ended 31 March 2018: GBP108.7).

-- Like-for-like(1) occupancy increased by 260 bps to 76.4%

(three months ended 31 March 2018: 73.8%). Reported occupancy

increased by 270 bps to 76.4% (three months ended 31 March 2018:

73.7%).

Corporate activities and highlights

-- Entry into the United States for art'otel with a joint

venture agreement with a New York based real estate development and

investment firm to develop a prime site located in Manhattan, New

York;

-- Site works started at the Group's 100% owned art'otel london

hoxton, with approved improved planning consent. Works are also

underway at art'otel london battersea power station, which will be

managed by the Group on completion of the construction;

-- Announced 22 May 2019 as the launch date for the Group's

premium boutique Holmes Hotel London, with excellent progress made

with repositioning projects at Park Plaza Vondelpark, Amsterdam,

Park Plaza Utrecht and Arena Kazela Campsite in Croatia. Completion

dates for these projects expected end of H1 2019; and

-- Successful GBP149m placing by the Group's three largest

shareholders of approximately 22% of the issued share capital,

which should allow for greater liquidity for investors by expanding

the shareholder base. As at the next FTSE review date of June 2019

the Company expects to meet the free float level and such other

criteria required to qualify for potential inclusion in the FTSE UK

series of indices.

Portfolio investments

The Group has an approximate GBP240.0 million committed

investment programme in place for the development of art'otel

london hoxton and several repositioning projects. 22 May 2019 will

see the launch of the Group's first completed repositioning project

for 2019, Holmes Hotel London. This will follow by the completion

of repositioning projects at Park Plaza Vondelpark, Amsterdam, Park

Plaza Utrecht and Arena Kazela Campsite in Croatia.

After the 2019 summer season, Arena is expected to commence the

repositioning programmes of Verudela Beach Resort Pula and Hotel

Brioni Pula, with anticipated completion timings of 2020 and 2022

respectively.

Works are ongoing on plans and pre-work for the planning and

preliminary works on site for the Group's recent acquisition of a

development site in New York.

A translation of Arena Hospitality Group d.d.'s (Arena)

unaudited results for the three months ended 31 March 2019 will

shortly be available on Arena's website

www.arenahospitalitygroup.com.

Post period end event

On 26 April 2019, Arena announced that it had entered into a

framework agreement to acquire the four-star 88 Rooms Hotel in

Belgrade, Serbia, for a total consideration of HRK 47 million. The

completion of this acquisition is subject to certain steps and

conditions having been fulfilled, which the Group expects to happen

by the end of 2019. This latest acquisition is in line with Arena's

strategy to further expand its property portfolio within the CEE

region.

Enquiries:

PPHE Hotel Group Limited

Daniel Kos

Chief Financial Officer & Executive Director

Robert Henke

Executive Vice President of Commercial & Corporate

Affairs

Tel: +31 (0)20 717 8600

Tulchan

David Allchurch / Jessica Reid

Tel: +44 (0)20 7353 4200

Email: pphe@tulchangroup.com

Notes to editors

PPHE Hotel Group is an international hospitality real estate

company, with a GBP1.6 billion portfolio of primarily prime

freehold and long leasehold assets in Europe.

The Group's guiding principle is to generate attractive returns

from operations and long-term capital appreciation.

Through its subsidiaries, jointly controlled entities and

associates it owns, co-owns, develops, leases, operates and

franchises hospitality real estate. Its primary focus is

full-service upscale, upper upscale and lifestyle hotels in major

gateway cities and regional centres, as well as hotel, resort and

campsite properties in select resort destinations.

The Group benefits from having an exclusive and perpetual

licence from the Radisson Hotel Group, one of the world's largest

hotel groups, to develop and operate Park Plaza(R) branded hotels

and resorts in Europe, the Middle East and Africa. In addition, the

Group wholly owns, and operates under, the art'otel(R) brand and

its Croatian subsidiary owns, and operates under, the Arena Hotels

& Apartments(R) and Arena Campsites(R) brands. This multi-brand

approach enables the Group to develop and operate properties across

several segments of the hospitality market.

The Group is one of the largest owner/operators of hotels in

central London and its property portfolio comprises of 38 hotels

and resorts in operation, offering a total of approximately 8,800

rooms and 8 campsites, offering approximately 6,000 units. The

Group's development pipeline includes two new hotels in London and

one in New York City which are expected to add an additional 600

rooms by the end of 2022/2023.

PPHE Hotel Group is a Guernsey registered company and its shares

are listed on the Premium Listing segment of the Main Market of the

London Stock Exchange. PPHE Hotel Group also holds a controlling

ownership interest (51.97% of the share capital) in Arena

Hospitality Group, whose shares are listed on the Zagreb Stock

Exchange.

Company websites

www.pphe.com

www.arenahospitalitygroup.com

For reservations

www.parkplaza.com

www.artotels.com

www.arenahotels.com

www.arenacampsites.com

For images and logos visit

www.vfmii.com/parkplaza

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTLLFSRSTIAFIA

(END) Dow Jones Newswires

April 30, 2019 02:00 ET (06:00 GMT)

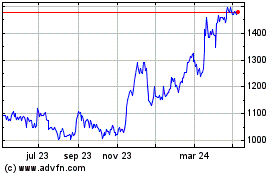

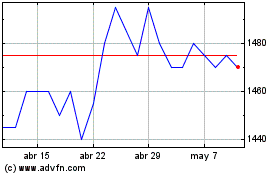

Pphe Hotel (LSE:PPH)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Pphe Hotel (LSE:PPH)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024