TIDMPIRI

RNS Number : 4704X

Pires Investments PLC

30 April 2019

Pires Investments plc

("Pires" or the "Company")

Results for the year to 31 October 2018

The Board is pleased to announce the audited results of Pires

for the year ended 31 October 2018.

Chairman's Statement

The Board is pleased to announce improved results for the

financial year ended 31 October 2018 as compared with the previous

year. The Company achieved a profit before taxation of GBP322,069

compared to a loss before taxation of GBP142,916 for 2017.

Operating costs were significantly reduced during the year to

GBP252,929.

The principal factor behind the improved results was the

increase in the value of our investments which almost doubled to

GBP1,029,526, after allowing for share disposals during the period

amounting to GBP264,881 which includes realised gains of GBP89,192.

Since the period end, the value of the investment portfolio has

increased by a further 45% to GBP1,490,000 after further profitable

share disposals.

The main factor behind the improved performance was the increase

in the value of our holding in ECO (Atlantic) Oil and Gas Limited

although our other investments, principally SalvaRx plc

("SalvaRx"), also made significant advances. Since the year end,

there have been significant changes in SalvaRx which are described

in the Directors' Report in the section 'Events after the Reporting

Period'.

In February 2019, the Board raised additional equity funds by

way of a placing to raise GBP781,720 at a price of 2.4p per share,

a modest discount to the then market price of the shares. As

markets continue to be uncertain, the Board believed that it was

prudent to raise some additional funds at this stage to ensure that

the Company is well placed for the future and better able to take

advantage of opportunities as they arise.

Taking account of this placing and the increased value of the

Company's investments, the Company's net assets have now risen to

around GBP2.35 million and comprise virtually wholly of cash and

tradeable quoted shares. As previously stated, the Board considers

that the Company not only represents a much more attractive

investment partner but also has the resources to diversify its

portfolio and to make investments from time to time on a scale

which could significantly enhance shareholder value.

The Board will continue to seek value enhancing investments

whether by taking minority holdings or by direct acquisition.

Peter Redmond

Chairman

STATEMENT OF COMPREHENSIVE INCOME

2018 2017

GBP GBP

------------------------------------------- ---------- ----------

CONTINUING ACTIVITIES

Income

Investment income - -

Other Income 11 8

-------------------------------------------- ---------- ----------

Total income 11 8

Gain on investments held at fair

value through profit or loss 574,987 196,049

Operating expenses (252,929) (338,973)

Operating profit / (loss) from continuing

activities 322,069 (142,916)

Profit / (loss) before taxation

from continuing activities 322,069 (142,916)

Tax - -

------------------------------------------- ---------- ----------

Profit / (loss) for the year from

continuing activities 322,069 (142,916)

Profit / (loss) for the year and

attributable to equity holders of

the Company 322,069 (142,916)

============================================ ========== ==========

Earnings per share

Equity holders

Basic and diluted 0.95p (0.43)p

============================================ ========== ==========

STATEMENT OF CHANGES IN EQUITY

Capital

Share Share Redemption Retained

Capital Premium Reserve Earnings Total

GBP GBP GBP GBP GBP

------------------------------ ----------- ---------- ------------ ------------- ----------

Balance at 1 November

2016 11,858,477 2,997,555 164,667 (14,889,985) 130,714

Issue of shares 56,250 583,500 - - 639,750

Loss and total comprehensive

Income for the year - - - (142,916) (142,916)

As at 31 October

2017 11,914,727 3,581,055 164,667 (15,032,901) 627,548

Profit and total

comprehensive profit

for the year - - - 322,069 322,069

As at 31 October

2018 11,914,727 3,581,055 164,667 (14,710,832) 949,617

============================== =========== ========== ============ ============= ==========

STATEMENT OF FINANCIAL POSITION

2018 2017

GBP GBP

------------------------------------------- ------------- -------------

Non-current assets

Property, plant and equipment - -

Investment in subsidiaries 1 1

Total non-current assets 1 1

Current assets

Investments 1,029,526 543,421

Trade and other receivables 11,357 9,875

Cash and cash equivalents 48,028 241,142

-------------------------------------------- ------------- -------------

Total current assets 1,088,911 794,438

-------------------------------------------- ------------- -------------

Total assets 1,088,912 794,439

============================================ ============= =============

Equity

Issued share capital 11,914,727 11,914,727

Share premium 3,581,055 3,581,055

Retained earnings (14,710,832) (15,032,901)

Capital redemption reserve 164,667 164,667

-------------------------------------------- ------------- -------------

Total equity 949,617 627,548

Liabilities

Current liabilities

Trade and other payables 139,295 166,891

Total liabilities and current liabilities 139,295 166,891

-------------------------------------------- ------------- -------------

Total equity and liabilities 1,088,912 794,439

============================================ ============= =============

1. OPERATING PROFIT / (LOSS)

2018 2017

GBP GBP

------------------------------------------------ ------ -------

Operating profit / (loss) from continuing

activities is stated after charging:

Depreciation of property, plant and equipment - 230

Provision against VAT receivable - 68,157

2. PROFIT / (LOSS) PER SHARE

2018 2017

GBP GBP

Profit / (loss) attributable to the owners

of the Company

Continuing Operations 322,069 (142,916)

---------------------------------------------------- ----------- -----------

2018 2017

No. of No. of

Shares shares

---------------------------------------------------- ----------- -----------

Weighted average number of shares for calculating

basic loss per share 33,900,805 33,521,353

---------------------------------------------------- ----------- -----------

2018 2017

Pence Pence

---------------------------------------------------- ----------- -----------

Basic and diluted profit /(loss) per share

Continuing Operations - basic and diluted 0.95 (0.43)

==================================================== =========== ===========

Copies of the accounts will be posted to shareholders and will

be available on the Company's website at

www.piresinvestments.com

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

Enquiries:

Pires Investments plc: +44 (0) 20 7580 7576

Peter Redmond, Director

Nominated Adviser: +44 (0) 20 7213 0880

Cairn Financial Advisers LLP

Liam Murray

Tony Rawlinson

Ludovico Lazzaretti

Broker: +44 (0) 20 7562 3351

Peterhouse Capital Limited

Duncan Vasey / Lucy Williams

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR ILMRTMBJTBTL

(END) Dow Jones Newswires

April 30, 2019 02:00 ET (06:00 GMT)

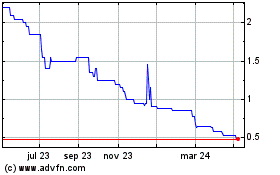

Mindflair (LSE:MFAI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

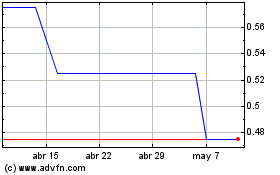

Mindflair (LSE:MFAI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024