TIDMPRD

RNS Number : 4776X

Predator Oil & Gas Holdings PLC

30 April 2019

Predator Oil and Gas Holdings Plc

('Predator' or 'the Company' or 'the Group')

Annual Report and Financial Statements for the Year Ended 31

December 2018

Predator Oil and Gas Holdings Plc, the Jersey-based Oil and Gas

Company, with a portfolio of attractive upstream gas assets

adjacent to European gas infrastructure entry points is pleased to

announce its audited annual report and financial statements for the

year ended 31 December 2018 ("2018 Report"), extracts of which are

set out below.

The Company's 2018 Report is being posted to shareholders.

Copies of the Annual Financial Report will shortly be available to

download from the Company's website at

www.predatoroilandgas.com.

The financial information set out below does not constitute the

Company's statutory accounts for the year ending 31 December

2018.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014

Key Activities in 2018

-- Developed a portfolio of high impact oil and gas assets in

the Republic of Trinidad and Ireland

-- Negotiated Petroleum Agreement for onshore Morocco

-- Established potential for production and cash flow from

Trinidad in the near and medium term

-- Developed Pilot C02 EOR operational plan in Trinidad, put

together by the Company. with Heritage, FRAM, Environmental

Monitoring Authority, Ministry and Massy Gas Products which

potentially forms the template for all future onshore C02 EOR

operations

-- Progressed offshore Ireland and Morocco to maintain exposure

to high potential, transformational gas acreage by initiating the

acquisition of assets at low cost prior to rising gas prices and

renewed concerns over security of gas supply

-- Generated project economic models to support the strategy for

early monetisation in a success case of the Company's strategic

focus on gas assets around existing mature infrastructure offshore

Ireland and onshore Morocco

-- Equity funds raised on IPO ensured the Company was

fully-funded for near-term operations with the medium-term strategy

of completing farmouts and M & A transactions being progressed

through technical studies to de-risk future capital requirements

using the Company's material licence positions and proprietary

knowledge to secure acceptable financial terms

-- Group structure established suitable for potential M & A

and farmout transactions to reflect the diversified portfolio of

near-term production; exploration and appraisal, and exploration in

different geographic regions with different fiscal terms

Share Price Performance and Capital Raising

At the time of listing in May 2018 the Company's share price was

2.8p, but by the end of the year it had increased by 190% to 8.13p.

On Listing a placing of 46,428,600 shares at 2.8p raised gross

proceeds of GBP1.3 million. The funds raised have been or will be

used in support of the Company's 2018/19 work programmes, primarily

in Trinidad. We are very grateful for the support shown to the

Company in the fundraising by our existing shareholders and of

course subsequently by our new shareholders who we welcome to the

Company.

Highlights of Financial Results for 2018

-- Loss from operations of GBP0.792 million (2017: Loss of GBP0.448 million).

-- Cash balance at period end of 2018 GBP0.973 million (2017: GBP0.521 million).

For further information please contact:

Predator Oil & Gas Holdings Plc +44 (0)1534 834 600

Sarah Cope, Chairman Info@predatoroilandgas.com

Paul Griffiths, Chief Executive Officer

Novum Securities Ltd (Broker)

Jon Bellis +44 (0)207 399 9425

CHAIRMAN'S STATEMENT

I am pleased to present the 2018 financial results for the year

and a detailed summary of our activities during the year and into

the early months of 2019.

Following four very difficult years for the oil and gas sector,

arising from the sharp decline in oil prices in particular, there

had been a subsequent reduction in exploration activity,

availability of capital and a severe contraction in the size of the

potential farmout market.

More significantly, there is also a growing sector awareness

that the Fossil Fuel Industry must adapt quickly to address growing

global concerns regarding C02 emissions and climate change that

result from an over-reliance on fossil fuels as a source of primary

energy to support economic development.

In developing the Company's asset portfolio during 2018 the

strategic focus has been on building a responsible fossil fuel

exploration and production business.

Predator's focus on gas reflects the fact that gas has lower C02

emissions than oil and is a relatively flexible fossil fuel, being

more widely available and affordable and with multiple potential

roles in the energy transition towards a greater dependence on

renewable energy.

Cash flows have increased in the industry during 2018 and the

sharp decline in operating costs attributed to the fall in the

price of oil has now allowed the industry to focus on replacing

reserves and identifying new business growth opportunities through

exploration, appraisal and near-term development. Gas assets with

credible technical merits and a clear pathway to monetisation close

to existing infrastructure are potentially an attractive

proposition and compatible with the sector backdrop outlined

above.

The global energy consumption mix is still dominated by fossil

fuel energy and to reduce this reliance requires a considerable

period of time and large amounts of capital investment in renewable

energy projects whilst sustaining economic development to pay for

such investments.

Natural gas continues to play a key role in Ireland's energy

system providing approximately 30% of the country's primary energy

needs. In 2018 50% of Ireland's electricity was powered by natural

gas, and despite significant investment in and contributions from

renewable energy Ireland presently remains one of the worst C02

polluters per capita within the European Union.

In Morocco 80.4% of thermal electricity generating capacity is

based on coal with minor fuel oil, which results in high levels of

C02 emissions.

By seeking to explore for and develop indigenous gas in Ireland

and Morocco Predator seeks to make a small but practical

contribution to the role gas has in decarbonising the living

environment, whilst still maintaining the security and cost

effectiveness of energy supply, which is critical to sustaining

economic development.

In Trinidad Predator, through its Pilot C02 Enhanced Oil

Recovery project, is seeking to utilise some C02 emissions from one

of Trinidad's ammonia plants which would otherwise be vented into

the atmosphere. A significant proportion of the C02 utilised in the

Pilot will be sequestrated in the ground. The potential for

upscaling enhanced oil production using C02 injection within

Trinidad's large inventory of mature oil fields may potentially

provide further business development opportunities.

Predator was formed during the year to consolidate the

acquisition of an existing non-operated, potentially

revenue-generating, business opportunity in Trinidad and an

operated exploration and appraisal portfolio offshore Ireland.

During the year progress was made on adding an exploration project

onshore Morocco. A successful public listing raised GBP1.3 million

of capital primarily to develop the Trinidad project. Predator's

public listing was the first by a junior oil and gas company in

2018.

Trinidad is a core asset in the Predator portfolio as it offers

the potential for early cash flow from production revenues with

which to provide medium-term contributions to Predator's balance

sheet. During the year the emphasis has been on prudently moving

the project scope from infill drilling to enhancing oil recoveries

and production rates using C02 injection, a process widely used to

good effect in the United States. Commercial rationale for this was

based upon reducing the quantum of capital investment per barrel of

oil

produced and the payback time on investment, whilst increasing

forecast production rates per well. Securing exclusivity to the C02

supply was an important primary objective in order to have the

opportunity to be in the prime position to upscale C02 EOR

operations after a potentially successful Pilot.

During the year Predator has applied for Successor

Authorisations in Ireland, one of which has subsequently been

granted in 2019, and developed its business model for these gas

assets. Ireland has proved to be a challenging environment over the

recent years for executing projects in a timely manner. The

completion of the sale of the Corrib gas field combined with a new

drive to reduce C02 emissions to avoid EU fines and to improve

security of gas supply has potentially created the conditions to

re-energise the gas sector to possibly create a changed environment

for potentially substantive transactions for gas assets proximal to

existing infrastructure with rapidly developing capacity ullage.

Predator is well-placed to exploit such an opportunity for business

development using our management team, which has considerable

transaction experience in Ireland.

Morocco is becoming an exciting addition to the portfolio of gas

projects and offers a high-quality opportunity for low capital

investment in drilling close to existing under-utilised gas

infrastructure. The level of general interest already shown in this

asset, which was screened and selected based on our management's

long history of involvement in operations and farm-out activity in

Morocco, is very encouraging. Morocco is set to become an

additional pillar supporting Predator's business growth potential

during 2019 and is consistent with current sector sentiments in

relation to gas and the environment.

Recognising the changing environment in which we operate, your

Board and management's most recent strategic review has concluded

that Predator must focus the majority of its cash resources on

executing and developing its short-term production capability in

Trinidad whilst maintaining in good standing an attractive

portfolio of material high quality gas assets to facilitate

de-risking the financing thereof through farmouts and potential M

& A transactions.

Predator will continue to operate with a very small management

team with specialist knowledge and experience and a track record in

executing and delivering projects to the highest possible standards

and for the benefit of the Company and its shareholders.

We have a robust Board experienced in many diverse aspects of

the corporate business of a public company and all of whom make

important contributions to the Board's deliberations to provide

diligent oversight of Predator's business. Collectively we strive

to meet the best corporate governance standards and maintain a

strong commitment to judiciously developing the business of the

Company in line with shareholder expectations.

The outcome to Brexit in 2019 may pose significant new

challenges in terms of creating instability in the financial

markets and currency exchange rate fluctuations, reducing access to

UK-based oil field services, and in creating conditions liable to

weaken investor sentiment and decision-making processes. The

Company has some protection in that it does not operate in the

United Kingdom and is intending to generate revenues in United

States dollars from production in Trinidad. However, whilst Brexit

remains unresolved uncertainty will persist and possible outcomes

cannot be predicted with confidence.

In conclusion I am encouraged by our achievements to date over a

short period of time in developing a portfolio of material assets,

each of which could potentially transform the Company in its own

right. Predator has performed well on the Standard Listing segment

of the Official List on the Main Market of the London Stock

Exchange during 2018. At year end our share price was 190% higher

than our IPO price without shareholder dilution, out-performing the

AIM All-Share Chart for 2018. I look forward to reporting on our

progress in the coming year.

Finally, I would like to thank our management team for their

diligence and hard work during the year. The commitment and support

of my fellow Board members is also very much appreciated.

Sarah Cope

Chairman

30 April 2019

Events Since Year End

Operational

Near-Term Production Projects

Inniss-Trinity C02 EOR Pilot Project, Onshore Trinidad

- Approval received from Heritage Petroleum Ltd for the Pilot

CO2 EOR Project conditional on EMA and Ministry permits and

consents

- Option to purchase FRAM extended to 31 December 2019

- Exclusivity period for CO2 gas supply from Massy Gas Products

Ltd extended to 31 May 2019, subject to finalising C02 Gas Sales

Contract

- New CPR specific to C02 EOR operations commissioned

Near-Term Exploration Projects

Guercif Petroleum Agreement ("PA") Onshore Morocco

- Bank Guarantee arranged

- Guercif PA formally signed on 19 March 2019

- Rig selection discussions ongoing

- Planning for Environmental Impact Assessment commenced

- CPR for Guercif commissioned

Medium Term Exploration and Appraisal Projects

Corrib South Licensing Option 16/26 Slyne Basin, Atlantic Margin

Ireland

- Farmout and M & A activity progressing whilst waiting on

award of Frontier Exploration Licence

Ram Head Licensing Option 16/30 Celtic Sea Basin, Ireland

- New CPR incorporating new reservoir engineering data commissioned

- Potential synergies with the decommissioning of the Kinsale

facilities being investigated with other interested parties

- Award of 12-month extension to the Ram Head Licensing Option

16/30 received and accepted on 10 April 2019

Financial

On 15 February 2019 GBP1,500,000 was raised in the form of

convertible loan notes. The loan notes carry no coupon, are

repayable at a premium of 5% and a fee of 10% of the principal

amount. The loan notes are convertible at the election of the

lender at 90% of the volume weighted average share price. The term

of the loan notes is two years. The lender Arato Global

Opportunities Limited, also agreed to make available an additional

GBP250,000 on the same terms. The lender was issued with 2,083,333

warrants at an exercise price of 12p with a vesting period of two

years. Novum Securities Limited, the arranger of the convertible

loan notes, was issued with 2,000,000 in warrants on the same

terms.

On 12 April,2019 following the receipt of notice from Arato

Global Opportunities Limited for the conversion of GBP150,000 of

the Loan Note, issued on 15 February 2019, 1,966,888 New Ordinary

Shares were allotted and issued. Following the issue of such

1,966,888 New Ordinary Shares, the Company's issued share capital

was 102,104,038 shares of no par value, each with one vote per

share (and no such shares are held in treasury). The total number

of voting rights was therefore 102,104,038 following said issue of

shares.

Cash balance of GBP0.922 million in the Group as at 30April 2019

annual report date

Consolidated statement of comprehensive

income

For the year ended 31 December 2018

01.01.2018 01.01.2017

to 31.12.2018 to 31.12.2017

(audited) (unaudited)

Continuing operations Notes GBP GBP

-------------------------------------------- ------ --------------- ---------------

Administrative expenses (761,302) (414,370)

Loan impairment/write off (32,171) (34,276)

Operating loss (793,473) (448,646)

Finance income 1,012 492

Loss for the year before taxation (792,461) (448,154)

Taxation - -

Loss for the year after taxation (792,461) (448,154)

-------------------------------------------- ------ --------------- ---------------

Other comprehensive income - -

Total comprehensive loss for the year attributable

to the owners of the parent (792,461) (448,154)

---------------------------------------------------- --------------- ---------------

Earnings per share (in pence) 6 (1.0) (0.8)

Consolidated statement of financial position

As at 31 December 2018

31.12.2018 31.12.2017

(audited) (unaudited)

Notes GBP GBP

---------------------------------------------- ------ ------------ ------------

Non-current assets

Tangible fixed assets 8 3,622 -

---------------------------------------------- ------ ------------ ------------

3,622 -

Current assets

Trade and other receivables 10 12,250 68,804

Cash and cash equivalents 973,600 520,939

---------------------------------------------- ------ ------------ ------------

985,850 589,743

Total assets 989,472 589,743

---------------------------------------------- ------ ------------ ------------

Equity attributable to the owner of the

parent

Share capital 13 1,584,795 537,085

Reconstruction reserve 3,547,190 3,547,190

Other reserves 81,570 -

Retained deficit (4,294,352) (3,501,891)

---------------------------------------------- ------ ------------ ------------

Total equity 919,202 582,384

Current liabilities

Trade and other payables 11 70,270 7,359

---------------------------------------------- ------ ------------ ------------

Total liabilities 70,270 7,359

---------------------------------------------- ------ ------------ ------------

Total liabilities and equity 989,472 589,743

---------------------------------------------- ------ ------------ ------------

The accounting policies as shown in the annual report and the notes

below form an integral part of these financial statements

The Company has adopted the exemption in terms of Companies (Jersey)

law 1991 and has not presented its own income statement in these

financial statements. The Group reported a loss after taxation for

the year of GBP0.8million (2017: GBP0.4million loss). The financial

statements on pages 5 to 8 were approved and authorised for issue

by the Board of Directors on 30 April2019 and were signed on its

behalf by:

Paul Griffiths

Director

30 April 2019

Company Registered number: 125419

Consolidated statement of changes

in equity

For the year ended 31 December

2018

Attributable to owners of the

parent

Share Reconstruction Other Retained Total

Capital Reserve Reserves deficit

GBP GBP GBP GBP GBP

--------------------------------- ---------- --------------- ---------- ------------ ----------

Balance at 31 December 2016 375,000 3,375,000 - (3,053,737) 696,263

Issue of ordinary share capital 162,085 172,190 - - 334,275

Total contributions by and

distributions to owners of

the parent recognised directly

in equity 537,085 3,547,190 - (3,053,737) 1,030,538

--------------------------------- ---------- --------------- ---------- ------------ ----------

Loss for the year - - - (448,154) (448,154)

Other comprehensive income - - - - -

Total comprehensive income

for the year - - - (448,154) (448,154)

--------------------------------- ---------- --------------- ---------- ------------ ----------

Balance at 31 December 2017 537,085 3,547,190 - (3,501,891) 582,384

--------------------------------- ---------- --------------- ---------- ------------ ----------

Issue of ordinary share capital 1,300,001 - - 1,300,001

Issue of warrants - - 27,051 - 27,051

Issue of share options - - 54,519 - 54,519

Listing costs capitalised (252,292) - - - (252,292)

Total contributions by and

distributions to owners of

the parent recognised directly

in equity 1,047,709 - 81,570 - 1,129,279

--------------------------------- ---------- --------------- ---------- ------------ ----------

Loss for the year - - - (792,461) (792,461)

Other comprehensive income - - - - -

Total comprehensive income

for the year - - - (792,461) (792,461)

--------------------------------- ---------- --------------- ---------- ------------ ----------

Balance at 31 December 2018 1,584,794 3,547,190 81,570 (4,294,352) 919,202

--------------------------------- ---------- --------------- ---------- ------------ ----------

Consolidated statement of cash flows

For the year ended 31 December 2018

01.01.2018 01.01.2017

to 31.12.2018 to 31.12.2017

(audited) (unaudited)

Notes GBP GBP

---------------------------------------------- ------- --------------- ---------------

Cash flows from operating activities

Loss for the period before taxation (792,461) (448,154)

Adjustments for:

Consultancy fees - 300,000

Loans waived 32,171 34,276

Issue of share options 54,519 -

Finance income (1,012) (492)

Depreciation 392 -

Decrease/(Increase) in trade and other

receivables 24,383 (36,293)

Increase in trade and other payables 62,911 3,238

Net cash used in operating activities (619,097) (147,425)

----------------------------------------------- ------- --------------- ---------------

Cash flow from investing activities

Purchase of computer equipment (4,014) -

Net cash generated from investing activities (4,014) -

----------------------------------------------- ------- --------------- ---------------

Cash flows from financing activities

Proceeds from issuance of shares, net

of issue costs 1,074,760 -

Finance income received 1,012 -

Net cash generated from financing activities 1,075,772 -

----------------------------------------------- ------- --------------- ---------------

Net increase/(decrease) in cash and cash

equivalents 452,661 (147,425)

Cash and cash equivalents at the beginning

of the year 520,939 668,364

Cash and cash equivalents at the end of

the year 973,600 520,939

----------------------------------------------- ------- --------------- ---------------

Notes to the financial statements

For the year ended 31 December 2018

1. Segmental analysis

The Group operates in one business segment, the exploration,

appraisal and development of oil and gas assets. The Group has

interests in three geographical segments being Africa (Morocco),

Europe (Ireland) and the Caribbean (Trinidad and Tobago)

The Group's operations are reviewed by the Board (which is

considered to be the Chief Operating Decision Maker ('CODM')) and

split between oil and gas exploration and development and

administration and corporate costs.

Exploration and development is reported to the CODM only on the

basis of those costs incurred directly on projects..

Administration and corporate costs are further reviewed on the

basis of spend across the Group.

Decisions are made about where to allocate cash resources based

on the status of each project and according to the Group's strategy

to develop the projects. Each project, if taken into commercial

development, has the potential to be a separate operating segment.

Operating segments are disclosed below on the basis of the split

between exploration and development and administration and

corporate.

Europe Caribbean Africa Corporate

GBP'000 GBP'000 GBP'000 GBP'000

Year to 31 December 2018

Gross profit (loss) (71) (123) (30) (483)

Depreciation -

Other administrative and

overhead expenses (32)

Share option and warrant

expense (55)

Finance income - - 1

Finance expense

Taxation (charge) - -

Profit (loss) for the year

from continuing

operations (71) (123) (30) (569)

Total assets 255 - - 966

Total non-current assets - - - -

Additions to non-current - - - -

assets

Total current assets 255 - - 966

Total liabilities (4) (137) (30) (61)

There are no non-current assets held in the Group's country of

domicile, being the Jersey Isles (2017: GBPnil).

2. Group loss from operations

2018 2017

Group Group

GBP'000 GBP'000

Operating loss is stated after charging/

(crediting):

Auditors' remuneration (note 3) 67.5 -

Depreciation - -

Share option expense - -

Foreign exchange (gain) (19) 0.8

3. Auditor's remuneration

2018 2017

Group Group

GBP'000 GBP'000

Fees payable to the Group's auditor

for the audit of the Group's annual

accounts -

Fees payable to the Group's auditor

for other services: -

- Audit of the accounts of the Group 20 -

- Other services 48 -

68 -

---------------- -----------------

4 Taxation

2018 2017

Factors affecting the tax charge Group Group

for the year

GBP'000 GBP'000

Loss on ordinary activities before

tax : (792) (448)

Loss on ordinary activities at Jersey

standard 0% tax (2017: 0%) 0 0

Tax charge (credit) for the year: 0 0

-------- ----------------

No deferred tax asset or liability has been recognised as the

Standard Jersey corporate tax rate is 0%

5 Personnel

2018 2017

Group Group

GBP'000 GBP'000

Personnel costs (including directors)

consist of:

Consultancy fees 242 300

Share based payments 55 -

Healthcare costs - -

Pension costs - -

297 300

-------- ------------------

The average number of personnel (including

directors) during the year was as

follows:

Management 5 2

Other operations - -

5 2

---------------- ---

Four Directors at the end of the period have share options

receivable under long term incentive schemes. The highest paid

Director received an amount of GBP98,200 (2017: nil). The Group

does not have employees. All personnel are engaged under

consultancy contracts as service providers

6 Earnings per share

31 Dec 2018 31 Dec 2017

Group Group

Loss per ordinary share has been calculated

using the weighted average number

of ordinary shares in issue during

the relevant financial year.

The weighted average number of ordinary

shares in issue for the period is: 82,201,718 53,708,550

Losses for the period: (GBP'000) (GBP792) (GBP448)

Earnings per share basic and diluted

(pence) (1.0p) (0.8p)

Dilutive loss per Ordinary Share equals

basic loss per Ordinary Share as,

due to the losses incurred in 2018

and 2017, there is no dilutive effect

from the subsisting share options

7 Loss for the financial year

The Group has adopted the exemption in terms of Companies

(Jersey) law 1991 and has not presented its own income statement in

these financial statements.

8 Property, plant and equipment

Fixed Assets

Computer

equipment

GBP

--------------------- -----------

Cost

At 31 December 2017 -

Additions 4,014

--------------------------- -----------

At 31 December 2018 4,014

--------------------------- -----------

Amortisation

At 31 December 2017 -

Charge for the year 392

--------------------------- -----------

At 31 December 2018 392

--------------------------- -----------

Carrying amount

At 31 December 2017 -

At 31 December 2018 3,622

--------------------------- -----------

9 Investments in subsidiaries

2018 2017

Group Group

GBP'000 GBP'000

Cost at the beginning of the year - -

Additions during the year 537 -

Cost at the end of the year 537 -

-------- --------

The principal subsidiaries of Predator Oil and Gas Holdings Plc,

all of which are included in these consolidated Annual Financial

Statements, are as follows:

Country Proportion

Group of registration Class held by Group Nature of business

2018 2017

------------------ ---------- ----- ---------- ----------------------

Jersey

Predator Oil and , Channel Licence options

Gas Ventures Limited Islands Ordinary 100% 100% offshore Ireland

------------------ ---------- ----- ---------- ----------------------

Predator Gas Ventures Jersey Ordinary 100% - Exploitation licence

Limited , Channel onshore Morocco

Islands

------------------ ---------- ----- ---------- ----------------------

Jersey Drilling rights

Predator Oil and , Channel for a CO2 pilot

Gas Trinidad Limited Islands Ordinary 100% 100% oil recovery project

------------------ ---------- ----- ---------- ----------------------

The registered address of all of the Group's companies is at 3rd

Floor, Standard Bank House, 47-49 La Motte Street, Jersey, JE2 4SZ,

Channel Islands.

10 Trade and other receivables

Dec 2018 Dec 2017

Group Group

GBP'000 GBP'000

Loan receivable 32 32

Provision for impairment (32)

Prepayments 12 37

12 69

--------- ---------

Prepayments in 2018 are in respect of an insurance premium paid

in advance and are expensed within 60 days. There are no material

differences between the fair value of trade and other receivables

and their carrying value at the year end.

11 Trade and other payables

Dec 2018 Dec 2017

Group Group

GBP'000 GBP'000

Trade payables 3 -

Accrued expenses 67 7

70 7

--------- ---------

All payables are required to be settled within 30days.

12 Financial instruments - risk management

Significant accounting policies

Details of the significant accounting policies in respect of

financial instruments are disclosed on pages 51 to 56 of the annual

report. The Group's financial instruments comprise cash and items

arising directly from its operations such as other receivables,

trade payables and loans.

Financial risk management

The Board seeks to minimise its exposure to financial risk by

reviewing and agreeing policies for managing each financial risk

and monitoring them on a regular basis. No formal policies have

been put in place in order to hedge the Group's activities to the

exposure to currency risk or interest risk; however, the Board will

consider this periodically. A foreign exchange hedge was entered

into during the year whereby Sterling GBP was converted to United

States $.

The Group is exposed through its operations to the following

financial risks:

-- Credit risk

-- Market risk (includes cash flow interest rate risk and foreign currency risk)

-- Liquidity risk

The policy for each of the above risks is described in more

detail below.

The principal financial instruments used by the Group, from

which financial instruments risk arises are as follow:

-- Receivables

-- Cash and cash equivalents

-- Trade and other payables (excluding other taxes and social security) and loans

The table below sets out the carrying value of all financial

instruments by category and where applicable shows the valuation

level used to determine the fair value at each reporting date. The

fair value of all financial assets and financial liabilities is not

materially different to the book value.

2018 2017

Group Group

GBP'000 GBP'000

Loans and receivables

Cash and cash

equivalents 973 521

Receivables 12 69

Available for

sale financial

assets

Available for - -

sale investments

(valuation level

1)

Other liabilities

Trade and other

payables (excl

short term loans) 70 7

Loans and borrowings - -

Credit risk

Financial assets, which potentially subject the Group to

concentrations of credit risk, consist principally of cash,

short-term deposits and other receivables. Cash balances are all

held at recognised financial institutions. Other receivables are

presented net of allowances for doubtful receivables. Other

receivables currently form an insignificant part of the Group's

business and therefore the credit risks associated with them are

also insignificant to the Group as a whole.

The Group has a credit risk in respect of inter-company loans to

subsidiaries. The Company is owed GBP196,830 by its subsidiaries.

The recoverability of these balances is dependent on the commercial

viability of the exploration activities undertaken by the

respective subsidiary companies. The credit risk of these loans is

managed as the directors constantly monitor and assess the

viability and quality of the respective subsidiary's investments in

intangible oil & gas assets.

Maximum exposure to credit risk

The Group's maximum exposure to credit risk by category of

financial instrument is shown in the table below:

2018 2018 2017 2017

Carrying Maximum Carrying Maximum

value exposure value exposure

GBP'000 GBP'000 GBP'000 GBP'000

Cash and cash equivalents 973 1034 521 521

Receivables 12 12 69 69

Loans and borrowings - - - -

The holding company's maximum exposure to credit risk by class

of financial instrument is shown in the table below:

2018 2018 2017 2017

Carrying Maximum Carrying Maximum

value exposure value exposure

GBP'000 GBP'000 GBP'000 GBP'000

Cash and cash equivalents 973 1034 521 521

Receivables 12 12 69 69

Loans to Group Companies 197 197 - -

Market risk

Cash flow interest rate risk

The Group has adopted a non-speculative policy on managing

interest rate risk. Only approved financial institutions with sound

capital bases are used to borrow funds and for the investments of

surplus funds.

The Group seeks to obtain a favourable interest rate on its cash

balances through the use of bank deposits. The Group's bank ceased

paying interest on cash balances during the year, therefore the

Group is not currently affected by interest rate changes. At

31December,2018, the Group had a cash balance of GBP0.973 million

(2017: GBP0.521 million) which was made up as follows:

2018 2017

Group Group

GBP'000 GBP'000

Sterling 455 521

United States Dollar 518 -

973 521

--------- ------------------

At the reporting date, the Group had a cash balance of

GBP0.922million

The Group had no interest bearing debts at the current year

end

Foreign currency risk

Foreign exchange risk is inherent in the Group's activities and

is accepted as such. The majority of the Group's expenses are

denominated in Sterling and therefore foreign currency exchange

risk arises where any balance is held, or costs incurred, in

currencies other than Sterling. At 31 December 2018 and 31 December

2017, the currency exposure of the Group was as follows:

Sterling US Dollar Euro Other Total

At 31 December 2018 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cash and cash equivalents 455 518 - - 973

Trade and other receivables 12 - - - 12

Trade and other payables 70 - = - 70

At 31 December 2017

Cash and cash equivalents 521 - - - 521

Trade and other receivables 69 - - - 69

Trade and other payables 7 - - - 7

The effect of a 10% strengthening of Sterling against the US

dollar at the reporting date, all other variables held constant,

would have resulted in increasing post tax losses by GBP51,800

(2017:GBPnil ). Conversely the effect of a 10% weakening of

Sterling against the US dollar at the reporting date, all other

variables held constant, would have resulted in decreasing post tax

losses by GBP51,800 (2017:GBPnil)

Liquidity risk

Any borrowing facilities are negotiated with approved financial

institutions at acceptable interest rates. All assets and

liabilities are at fixed and floating interest rate. The Group

seeks to manage its financial risk to ensure that sufficient

liquidity is available to meet the foreseeable needs both in the

short and long term. See also references to Going Concern

disclosures in the Strategic Report on pages 6 and 10.

Capital

The objective of the directors is to maximise shareholder

returns and minimise risks by keeping a reasonable balance between

debt and equity. At 31December 2018 the Group had no debt

13 Share Capital

Ordinary

Nominal

No of shares value

As at 31 December 53,708,550 GBP537,085

2017

Issued during 46,428,600 GBP1,300,001

the year *

Less listing costs (GBP252,292)

------------- -----------------

As at 31 December 100,137,150 GBP1,584,794

2018

------------- -----------------

* Details of the shares issued during the year are as shown in

the table below and in the Statement of Changes of Equity on shown

above

Date of No of shares Issue Purpose of issue

issue price

21March 53,708,550 GBP0.01 Acquire Predator Oil & Gas Ventures

2018 Limited

21 May 46,428,600 GBP0.028 Fund operations

2018

14 Share based payments

Equity - settled share based payments

Warrant and Share option expense

2018 Group 2017 Group

GBP'000 GBP'000

Warrant and share option expense:

- In respect of remuneration contracts 55 -

- In respect of financing arrangements 27 -

----------- -----------

Total expense / (credit) 82 -

----------- -----------

The Group operates a share option plan for directors. Details of

share options granted in the year to 31 December 2018 are noted

below.

On 24 May 2018 both Paul Griffiths and Ron Pilbeam were granted

share options each of 4,005,486 exercisable at GBP0.028 each and

Steve Staley and Sarah Cope were granted share options each of

1,001,370 exercisable at GBP0.028 each

The options are subject to the following vesting conditions:

1/3 of the option shares 3,337,904 on gross production from the

wells drilled under the Well Participation Agreement Predator Oil

and Gas Ventures Limited and FRAM Exploration Trinidad Limited

of 50 BOPD (measured over a consecutive 30 day period)

1/3 of the option shares 3,337,904 on incremental gross production

from a Pilot C02 test of 300 BOPD (measured over a consecutive

30 day period)

1/3 of the option shares 3,337,904 on incremental total gross production

from wells for which the Company receives revenues of 1,000 BOPD

(measured over a consecutive 30 day period)

Each option shall lapse 5 years after the date on which it vests,

assuming it is not exercised before then and no event occurs to

cause it to lapse early.

Each option shall lapse 5 years after the date on which it

vests, assuming it is not exercised before then and no event occurs

to cause it to lapse early. The Black Scholes model has been used

to fair value the options, the inputs into the model were as

follows

Grant date 24 May, 2018

Share price

GBP0.028

Exercise price

GBP0.028

Term

5 years

Expected volatility 400%

Expected dividend yield 0%

Risk free rate

0.80%

Fair value per option

GBP0.028

The total fair value of the options: GBP54,519

Expected volatility was determined by reference to the Company's

share price since admission to the Standard List of the London

Stock Exchange and the year end. The risk free rate is based on the

UK three year bond yield.

On 24 May 2018 the Company's granted 2,231,248 warrants to Novum

Securities Limited and 160,714 warrants to Optiva Securities

Limited in consideration of services provided to the Company

pursuant to the terms of the Placing Agreement and conditional upon

admission becoming effective. The warrants may be exercised at

GBP0.028 each in whole or in part at any time and from time to time

from the date of their grant until the third anniversary of

admission.

The Black Scholes model has been used to fair value the

warrants, the inputs into the model were as follows

Grant date 24 May, 2018

Share price GBP0.028

Exercise price

GBP0.028

Term

3 years

Expected volatility

60%

Expected dividend yield

0%

Risk free rate

0.80%

Fair value per warrant

GBP0.0113

Total fair value of warrants GBP27,051

15 Reserves

Details of the nature and purpose of each reserve within owners'

equity are provided below:

-- Share capital represents the nominal value each of the shares in issue.

-- The Other Reserves are included in the Consolidated Statement

of Changes in Equity and in the Consolidated Statement of Financial

Position and represent the accumulated balance of share benefit

charges recognised in respect of share options and warrants granted

by the Company, less transfers to retained losses in respect of

options exercised or lapsed.

-- The Retained Deficit Reserve represents the cumulative net

gains and losses recognised in the Group's statement of

comprehensive income.

-- The Reconstruction Reserve arose through the acquisition of

Predator Oil & Gas Ventures Limited. This entity was under

common control and therefore merger accounting was adopted.

16 Related party transactions

Directors and key management emoluments are disclosed note 5 and

in the Remuneration report.

Paul Griffiths holds 44,773,293 ordinary shares, 44.7% (43.8% as

at the reporting date) of the issued share capital in the Company,

and is the Group's controlling shareholder

17 Acquisition of Predator Oil & Gas Ventures Limited

On 21 March 2018 the Predator Oil and Gas Holdings Plc acquired the

entire issued share capital of Predator Oil and Gas Ventures Limited

for a consideration of GBP537,085. The consideration was satisfied

by the issue of the 53,708,550 new Ordinary shares of No Par Value.

GBP

------------------------------------------------------------------- ---------

Consideration

Issue of 53,708,550 Ordinary

NPV shares 537,085

Total consideration 537,085

------------------------------------------------------------------------- ---------

The assets and liabilities recognised as a result of the

acquisition are as follows:

Cash 387,444

Loans receivable 43,458

Total net assets acquired 430,902

------------------------------------------------------------------------- ---------

The acquisition of Predator Oil & Gas Ventures Limited does not constitute

a business combination under IFRS3 because the entity was under common

control and therefore merger accounting has been adopted.

18 Contingent liabilities and capital commitments

The Group had at the reporting date no capital commitments or

contingent liabilities

19 Litigation

The Group is not involved in any litigation

20 Events after the reporting date

1. A licence was awarded to Predator Gas Ventures Limited by

ONHYM on 20March 2019 for the exploitation of Guercif Moulouya

Tortonian Prospect in Northern Morocco

2. On 15 February, 2019 GBP1,500,000 gross, was raised in the

form of convertible loan notes to progress inter alia the Guercif

licence. The loan notes carry no coupon, are repayable at a premium

of 5% and a fee of 10% of the principal amount. The loan notes are

convertible at the election of the lender at 90% of the volume

weighted average share price ruling on the preceding two trading

days. The term of the loan notes is two years. The lender, Arato

Global Opportunities Limited, also agreed to make available an

additional GBP250,000 on the same terms. The lender was issued with

2,083,333 warrants at an exercise price of 12p with a vesting

period of two years. Novum Securities Limited, the arranger of the

convertible loan notes, was issued with 2,000,000 in warrants on

the same terms.

3. On 12 April,2019 following the receipt of notice from Arato

Global Opportunities limited for the conversion of GBP150,000 of

the Loan Note, issued on 15 February 2019, 1,966,888 New Ordinary

Shares were allotted and issued. Following the issue of such

1,966,888 New Ordinary Shares, the Company's issued share capital

was 102,104,038 shares of no par value, each with one vote per

share (and no such shares are held in treasury). The total number

of voting rights was therefore 102,104,038 following said issue of

shares.

4. On 10 April 2019 the Company announced its acceptance of a

one year extension of the term of the Licensing Option 16/30 ("LO

16/30")('Ram Head') to 30 November 2019 subject to the carrying out

of the work programme agreed with the Department of Communications,

Climate Action and Environment, the conditions that are attached to

Licensing Option 16/30 and the Licensing Terms for Offshore Oil and

Gas Exploration and Development and Production 2007

respectively.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR UKUARKOASUUR

(END) Dow Jones Newswires

April 30, 2019 02:01 ET (06:01 GMT)

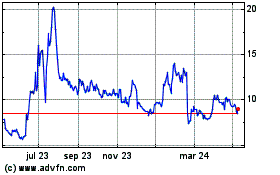

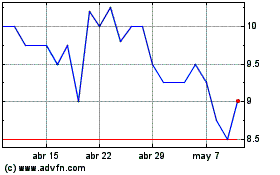

Predator Oil & Gas (LSE:PRD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Predator Oil & Gas (LSE:PRD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024