TIDMNCYT

RNS Number : 4745X

Novacyt S.A.

30 April 2019

NOVACYT FULL YEAR 2018 RESULTS

Paris, France and Camberley, UK - 30 April 2019 - Novacyt

(EURONEXT GROWTH: ALNOV; AIM: NCYT), an international specialist in

clinical diagnostics, today announces its audited financial results

for the year ended 31 December 2018 and restated financial results

for the year ended 31 December 2017 following the impact of the

discontinuing operations of NOVAprep(R).

In 2018, Novacyt delivered material financial and operational

progress as it focused on integrating the Omega Infectious Diseases

business unit ("Omega ID") acquired in June 2018 and undertook a

strategic review resulting in the decision to sell the NOVAprep(R)

business unit. Novacyt took the decision to focus on its core and

more profitable reagent diagnostic product development

manufacturing units of Primerdesign and Lab21. This core continuing

business of Novacyt delivered sales growth of 9% at CER, improved

gross margin 63% (FY17: 62%) and adjusted EBITDA profitability for

both FY2017 and FY2018, with the NOVAprep(R) business unit

eliminated from the operating results for continuing operations,

under the provisions of IFRS 5.

Financial and recent highlights

-- Decision taken during the year to exit the NOVAprep(R)

business unit to allow the Group to focus on diagnostic reagent

product development, commercialisation, contract design and

manufacturing

-- Delivered full year adjusted EBITDA for FY18 of EUR0.6

million with adjusted EBITDA of EUR0.9 million in 2017(1) ,

demonstrating the underlying financial strength of the continuing

operations of Novacyt

o The reduction in adjusted EBITDA reflects investment in

commercial and manufacturing capacity, including two new

manufacturing facilities, as well as the additional costs of being

dual listed on Euronext and AIM markets

-- Group consolidated revenue increased by 8% (9% at CER) to

EUR13.7m (GBP12.1m) compared with EUR12.7m (GBP11.2m) in 2017

o Sales momentum continued in H2 2018, up 7% year-on-year to

EUR7.3m and up 13% on H1 2018

o Excluding the acquisition of Omega ID, pro forma growth for

the year was 1% CER

-- Group gross margin increased to 63% in 2018 from 62% in 2017

driven by product mix, sales volumes and cost of sales improvements

within Primerdesign

o Primerdesign's gross margin grew 3% year-on-year to 84%

-- Following the successful acquisition in late June 2018 of

Omega ID, Novacyt has almost tripled Omega ID's adjusted EBITDA

margin to 28%

-- Novacyt ended the year with EUR1.1m (GBP1.0m) in cash

Note: 1) All references to 2017 results within this release are

to the restated position under IFRS 5, unless otherwise stated

EUR'000 2018 2017 2016

Consol Consol* Consol

Revenue 13,721 12,749 11,076

Gross profit 8,604 7,909 6,080

Gross margin % 63% 62% 55%

Adjusted EBITDA ** 579 902 (2,295)

Recurring operating (loss)/profit

*** (425) 62 (3,074)

Operating loss (1,385) (2,119) (4,461)

Loss after tax (2,112) (3,491) (5,710)

Loss from discontinued operations (2,626) (1,951) -

Loss after tax attributable to

the owners (4,738) (5,442) (5,710)

---------

* 2017 Consolidated results have been restated as per IFRS 5

rules, with the discontinuing operations results now below the

operating result

** Adjusted EBITDA is the recurring operating result adjusted

for amortisation, depreciation and long-term employee incentive

plan (LTIP)

*** Recurring operating result is stated before EUR1.0m of

exceptional charges as follows:

-- Acquisition & Business sale related expenses of EUR0.5m charged to the income statement

-- Other non-recurring costs totalling EUR0.3m, including IPO

listing costs & French legal costs

-- Group employee restructuring costs of EUR0.2m

The loss after tax attributable to the owners is stated after

the loss attributable to the discontinuing operations of

NOVAprep(R). While NOVAprep(R) is being held for sale, it is

expected to remain loss making, but materially reduced compared to

2018 due to careful management of operational costs with a view to

keeping cash outflows to a minimum.

Divisional revenues

-- Primerdesign sales increased to EUR6.2m (GBP5.5m), up 2% (3% CER) in 2018

o Revenue growth in the core molecular business was strong at

over EUR0.5m (GBP0.5m) or 11%, which was offset by reduced business

to business ("B2B") sales as a result of a large one-off sale to

China in late 2017 of over $1m (GBP0.9m)

-- Lab21 revenues were EUR7.5m (GBP6.6m), up 14% on 2017 at CER,

mainly reflecting the acquisition of Omega ID which accounted for

13% of the 14% year-on-year growth. Lab21 has EUR1.0m of confirmed

tender orders received at the end of 2018 which will now be

completed in 2019.

-- On 2 August 2018 the Board announced that it had placed the

NOVAprep(R) business under a strategic review. Subsequently, on 11

December 2018 the Board announced the decision to sell the

NOVAprep(R) business unit due the material investment required in

this early stage business at odds with the other more mature

businesses within the Group. The planned divestment for the

NOVAprep(R) business unit continues to make progress and a further

update is expected later in the quarter or as soon as a binding

position has been established with a buyer

-- As part of the strategic review of Novacyt it was also

decided to sell the Clinical Lab business based in Cambridge as it

is now considered non-core. Solid progress is being made in the

sale of this business and management expect to update the market by

the end of Q2 2019

Operational highlights

-- Primerdesign completed a substantial q16 molecular instrument

order, expanding the Group's clinical diagnostic reach in the

fast-growing Chinese market

-- New molecular CE Mark genesig(R) BKV Kit and genesig(R) EBV

Kit assays were developed expanding the Group's clinical diagnostic

menu

-- Exclusive supply agreement signed by Primerdesign with

US-based full-service diagnostic laboratory Genesis Diagnostics

worth a minimum $3.0m over five years

-- Recently completed the rapid development of an African Swine

Flu assay to help address the current swine flu food supply-chain

limitations in China, Vietnam and certain European countries

Post Balance Sheet Funding Event

On the 23 April 2019, the Company entered into a Convertible

Bond Financing, for up to EUR5.0 million (net of expenses) (the

"Agreement") with Park Partners GP and Negma Group LTD (together

the "Investment Managers"). Under the terms of the Agreement, the

Company will be able to access capital in seven tranches which

oblige the Investment Managers to immediately subscribe for an

initial tranche of EUR2.0 million, followed by six further

tranches, each of an aggregate nominal value of EUR500,000,

drawable at the Company's option subject to certain terms and

conditions. The Company has immediately exercised its right to the

initial tranche of funding giving rise to the subscription of

EUR2.0 million of convertible bonds with warrants by the Investment

Managers. The remaining EUR3.0 million of convertible bonds can be

issued by the Company over the next 36 months following the signing

of the Agreement.

The EUR5.0m convertible bond financing facility with the

immediate draw down of EUR2.0m was a factor in preparing the

audited financial statements on a going concern basis, while

emphasising that certain conditions attached to the draw down of

further tranches could place uncertainty on this principal as

discussed later in this release.

Current Trading and Outlook

The first quarter of 2019 has started well operationally, with

sales meeting management expectations and continuing strong

double-digit growth from 2018.

However, sales are expected to temporarily slow during Q2 due to

the availability of stock, which has been directly impacted by lack

of working capital prior to execution of the Agreement and

associated capital draw down. Nonetheless, the outlook for the full

year continues to be very encouraging, with the full impact of the

acquisition of Omega ID and the visibility from the current sales

pipeline also looking strong. Overall, the Company's financial

performance is meeting management expectations.

Following completion of the Convertible Bond Financing, the

Company has cash and cash equivalents of approximately EUR2.4

million as at 29 April 2019, being the latest practicable date

ahead of this announcement.

Graham Mullis, Group CEO of Novacyt, commented:

"The Group made good operational progress over the course of

2018, continuing its growth trajectory and R&D development.

During this period we took the difficult decision to exit the

NOVAprep(R) business unit as we believe greater long-term value for

our shareholders can be realised by focusing our resources on

reagent development and manufacturing.

We remain committed to our three strategic growth pillars with

the delivery of strong organic sales growth from Primerdesign and

Lab21 and the recent launch of our CE-Mark approved molecular

products, the genesig(R) BKV Kit and genesig(R) EBV Kit.

"We have begun to see the full benefit from the acquisition of

the Infectious Disease Business from Omega Diagnostics Plc., which,

has contributed to EBITDA profitability in the first six months of

ownership and further significant synergies in respect of sales

channels, overheads and direct costs are anticipated.

"The Group, on a continued operations basis, is now EBITDA

profitable and we aim to build on the operational progress made in

2018 to continue to deliver double-digit revenue growth from this

base, further increase margins with the medium target to become

self-sustainable on a free cash-flow basis and look at the

potential for further acquisitions.

"On 23 April 2019 we announced the completion of an up to

EUR5.0m financing facility which will enable management to drive

the business forward knowing there is sufficient working capital to

support growth. The business has started well operationally in 2019

and, with the new financing now in place, management can fully

focus on the business which we expect to see the benefit of in the

second half of the year."

The information included in this announcement is extracted from

the Annual Report. Defined terms used in the announcement refer to

terms as defined in the Annual Report unless the context otherwise

requires. This announcement should be read in conjunction with, and

is not a substitute for, the full Annual Report. The information

contained within this announcement is deemed to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014. Upon the publication of this announcement, this

inside information is now considered to be in the public domain

- End -

Contacts

Novacyt SA

Graham Mullis, Chief Executive Officer

Anthony Dyer, Chief Financial Officer

+44 (0)1223 395472

Stifel Nicolaus Europe Limited (Nominated Advisor and Joint

Broker)

Jonathan Senior / Fred Walsh / Ben Maddison

+44 (0)20 7610 7600

WG Partners (Joint Broker)

Nigel Birks / Chris Lee / Claes Spång

+44 (0)203 705 9330

FTI Consulting (International)

Brett Pollard / Victoria Foster Mitchell / Mary Whittow

+44 (0)20 3727 1000

brett.pollard@fticonsulting.com/victoria.fostermitchell@fticonsulting.com/

Mary.whittow@fticonsulting.com

FTI Consulting (France)

Arnaud de Cheffontaines / Astrid Villette

+33 (0)147 03 69 47 / +33 (0)147 03 69 51

arnaud.decheffontaines@fticonsulting.com /

astrid.villette@fticonsulting.com

About Novacyt Group

The Novacyt Group is a rapidly growing, international

diagnostics business generating an increasing portfolio of in vitro

and molecular diagnostic tests. Its core strengths lie in

diagnostics product development, commercialisation, contract design

and manufacturing. The Company's lead business units comprise of

Primerdesign and Lab21 Products, supplying an extensive range of

high quality assays and reagents worldwide. The Group directly

serves oncology, microbiology, haematology and serology markets as

do its global partners, which include major corporates.

For more information please refer to the website:

www.novacyt.com

CHIEF EXECUTIVE OFFICER'S REVIEW

Overview

Novacyt has achieved the major milestone of adjusted EBITDA

profitability within its continuing operations for both FY2018 and

the restated results of FY2017, following its announced intention

to divest the non-core NOVAprep(R) business unit. This reinforces

the financial strength of its core, continuing reagent

manufacturing businesses: Primerdesign (molecular diagnostics) and

Lab21 Products (protein diagnostics). In the current challenging

financial markets, we believe this places Novacyt into a strong

competitive position as an adjusted EBITDA profitable, technology

focused, high growth diagnostics company.

During 2018, Novacyt commenced a strategic review to explore

ways to maximise the future value of certain non-core assets within

the Group. A decision was reached to sell the NOVAprep(R) and Lab21

Clinical Lab businesses: processes which remain ongoing. The

continuing businesses within the Group are, therefore, focused on

the development, manufacture, sales and distribution of diagnostic

reagents used in infectious disease markets. The decision to move

away from large instrumentation means Novacyt can capitalise on its

core expertise in reagents and continue to drive stronger, premium

margins.

The Group has been reorganised internally from a divisional to a

centralised structure, enabling us to align the organisation to

create greater integration and synergies across each of the core

business units during 2019 and beyond, to further enhance financial

performance. I would like to extend my thanks and appreciation to

colleagues involved in these changes who have shown continued

commitment and support for the Novacyt business with some

outstanding leadership from the executive management team.

Novacyt remains committed to its growth strategy based on the

three strategic pillars of organic growth, acquisitive growth and

growth from new product development.

Organic Growth

The core reagent products are based on molecular and protein

diagnostic technologies and the Group's extensive product menu

generates sales from clinical testing, food testing and animal

testing diagnostics. The Group will continue to invest in

commercial infrastructure for its clinical and food sales channels

and will look for a strategic partner in the animal testing

market.

The molecular products business provides the Group's most

significant growth opportunity which continues to develop following

the successful acquisition of Primerdesign. In 2018, molecular

sales increased to EUR6.2m (GBP5.5m), up 3% (CER) year-on-year,

with revenue growth in the core international business strong at

over EUR0.5m (GBP0.5m) or 11%. Total molecular sales growth in 2017

was positively impacted by a large one-off sale to China in excess

of $1m (GBP0.9m). Excluding this one off sale in 2017 would have

resulted in a year-on-year growth of over 20% for the Primerdesign

business in 2018. In 2019, further investment is planned to expand

the Group's direct sales channel.

Lab21 revenues in the year were EUR7.5m (GBP6.6m), an increase

of 14% on 2017 at CER, with growth being driven by the acquisition

of Omega ID.

Acquisitive Growth

The Company has always been clear that significant opportunities

exist in the diagnostics market to acquire new high growth products

and accelerate financial performance with attractive and accretive

M&A. The Company has been able to demonstrate this during the

past five years through the acquisitions of Lab21, Primerdesign and

Omega ID as it has significantly increased sales from EUR1.2m to

EUR13.7m and turned losses into EBITDA profitability. With

attractive buying multiples and the Group's demonstrated ability to

integrate assets successfully, acquisitions are expected to

continue be significantly accretive to sales growth, gross margins

and earnings.

In May 2018, the Company successfully raised EUR4.0 million

through bonds to fund the acquisition of the profitable Omega ID

business which helped the Group accelerate its EBITDA profitability

during the second half of 2018 and give the Group greater access to

certain key markets to help create operational synergies. During

the first six months of integrating the business assets, Novacyt

was able to generate an EBITDA margin of 28% from this acquisition,

which has almost tripled its underlying EBITDA margin due to

manufacturing and overhead cost savings. This level of performance

is expected to continue into 2019 where the full year benefit of

the acquisition will be seen.

While the financial markets remain uncertain, Novacyt has no

current immediate plans for further acquisitions but will continue

to monitor and assess opportunities that have the potential to

benefit the Group.

R&D

During 2018, a number of significant B2B opportunities were

secured and new products and further CE-IVD marked molecular

diagnostic kits were launched. This reflects the Group's commitment

to our core strengths of in-vitro diagnostics product development,

commercialisation and contract manufacturing as we focus on our

molecular and protein reagent manufacturing business units

Primerdesign and Lab21 Products.

A key target is to expand our clinical molecular menu following

the launch in 2018 of two new molecular CE Mark assays (BKV and

EBV), with three additional complementary molecular assays for

immunosuppressed patients set to be launched in 2019.

During the year, significant operational development of the qPCR

instrument, the q16 was made, allowing Novacyt to reduce test cycle

times further from 120 minutes to for some assays down to 45

minutes which the Company believes is class-leading. Further

developments are planned in 2019 with the launch of the

next-generation and larger qPCR instrument: the q32. In addition,

Primerdesign has just launched the newly developed African Swine

Flu assay where significant demand is currently experienced in

China, Vietnam and some Eastern European countries, again showing

how responsive its development capabilities are to market

demands.

Graham Mullis

Chief Executive Officer

Novacyt S.A.

FINANCIAL REVIEW

Overview

During the year, Novacyt continued to grow revenue and gross

margin and the steps we took to refocus the business helped us

deliver EBITDA profitability. It has also been an important year in

which the Group has completed its first full year as a dual-listed

AIM and Euronext Growth Paris company. We have set ourselves an

objective of continuing to drive high sales growth, improve the

gross margin whilst balancing ongoing investment with sustained

EBITDA profitability goals and ultimately deliver free cash flow

generation.

Following the issuance of a bond to finance the acquisition of

the Infectious Disease business of Omega Diagnostics, which has

increased Group borrowings, Novacyt has continued to reduce the

level of indebtedness of the Company through debt repayments of

EUR3.2m during the year including EUR0.6m of interest.

On 23 April 2019, Novacyt entered into the convertible bond

Agreement with an immediate investment of EUR2.0 million. The

initial EUR2.0 million of funding, will be used primarily for

general working capital purposes and support the planned growth of

the business in the short and medium term. The full facility

funding, if drawn down would also be used to further service

outstanding debt and earn out obligations. Ultimately, the

Directors believe that the full facility funding would support

Novacyt in becoming cash flow self-sufficient in the longer

term.

Financial performance

Revenue growth of 8% (9% CER) compared to 2017 was underpinned

by improvements in the two continuing operating divisions:

-- Primerdesign FY18: EUR6.2m (GBP5.5m), FY17: EUR6.1m (GBP5.3m), +3% at CER

-- Lab21 Group FY18: EUR7.5m (GBP6.6m), FY17: EUR6.7m (GBP5.8m), +14% at CER

Primerdesign sales growth was driven by a strong core business

delivering over 11% or EUR0.5m of growth, offset by reduced B2B

revenues as a result of a large one-off sale in late 2017 for over

$1m. Removing this one-off sale in 2017 would have resulted in a

year-on-year growth of over 20% for the Primerdesign business.

During 2018 Primerdesign signed a multi-year exclusive B2B supply

agreement worth a minimum in excess of $3m over five years with a

US customer with material revenue streams expected to commence in

2019. As sales have increased, the impact of high margin genesig(R)

testing reagent kits have ensured the divisional gross margin

remains above 80% and have increased by three percentage points to

84%.

Lab21 sales grew by 14% (CER) for the full year, primarily due

to the accretive effect of the Omega ID business, which drove 13%

of the 14% year-on-year growth. Revenue growth was achieved while

maintaining the divisional gross margin, which at 45%, is good for

a mature products business.

Group operating costs have increased year-on-year to support the

continued growth of the business following a profitable 2017

adjusted EBITDA position for the continuing operations of the

Group. A number of new staff have been hired across different

functions in 2018 to ensure the business is structured to build on

historical growth.

The Group's underlying adjusted EBITDA remains positive in 2018

at EUR0.6m, EUR0.3m lower than the restated 2017 position, due

primarily to the EUR0.3m of additional costs associated with being

dual listed on AIM and Euronext from November 2017. Improvements to

EBITDA from the acquisition of Omega ID were broadly offset by

increased investment in commercial and manufacturing capacity. The

decision to dispose of the NOVAprep(R) business has a significant

impact on the financial results of the Group for 2018 and on an

ongoing basis.

The recurring operating result has decreased to a loss of

EUR0.4m during 2018 from a profit of EUR0.1m in 2017. The reduction

is due to two main factors: i) the EUR0.3m reduction in EBITDA as

explained above, and ii) an annual increase in amortisation and

depreciation of EUR0.2m following the Omega ID business and asset

purchase, primarily customer relationships and brands. Total

depreciation charges of EUR317k (2017: EUR248k) and amortisation

charges of EUR685k (2017: EUR574k) are higher than in 2017 due to

the impact of the Omega ID acquisition and the full year effect of

significant capital expenditure investment in the second half of

2017.

The operating loss in 2018 was reduced to EUR1.4m from EUR2.1m

in 2017 and is stated after non-recurring charges amounting to

EUR1.0m. The 2018 charges comprise EUR0.5m of acquisition and

business sale related expenses, EUR0.2m of Group restructuring

costs and EUR0.3m of other non-recurring charges, including delayed

IPO listing costs and French employee litigation costs. Significant

listing costs in 2017 were not repeated in 2018, helping drive the

improved EBIT in 2018.

The total net loss was EUR4.7m in 2018, reduced from EUR5.4m in

2017, and is stated after EUR0.7m of gross borrowing costs (2017:

EUR1.2m), other financial expenses and tax of EUR0.05m (2017:

EUR0.2m) and the loss from discontinued operations of EUR2.6m (2017

EUR2.0m). The discontinued operations loss represents the

financials of the NOVAprep(R) business that is available for sale

and is accounted for under IFRS 5 - non-current assets held for

sale and discontinued operations. Other financial expenses in 2017

comprised items such as exchange gains and losses, change in fair

value of the Primerdesign warrants and the Primerdesign contingent

consideration.

The loss per share significantly improved during 2018 to

-EUR0.13 (2017: -EUR0.24) due to increased revenue and reduced net

loss.

Financial position

Goodwill has reduced to EUR16.1m in 2018 from EUR16.5m in the

previous year. This reflects a EUR316k increase in the year as a

result of the residual goodwill attributed to the Omega ID

acquisition following the Purchase Price Allocation process and

fair valuing of the assets, and a EUR648k reduction in Goodwill as

a result of allocating a portion of the overall Lab21 Goodwill to

the Cambridge Clinical Labs (asset held for sale) as part of the

accounting requirements of IFRS 5.

Trade and other receivables have increased slightly in the year

by EUR0.1m (3%) to EUR3.9m in line with revenue growth.

Inventory has increased by EUR0.4m (21%) year-on-year.

predominantly following the acquisition of the Omega ID business

resulting in an additional circa EUR0.5m of stock compared with

2017. Additionally, the underlying inventory holding for the group

has increased by EUR0.4m to meet the greater sales demand of the

growing business. Partially offsetting these increases, EUR0.5m of

inventory has been transferred to the assets of discontinued

operations.

The assets of discontinued operations consist of:

-- Clinical Lab goodwill of EUR648k - representing the portion

of Lab21 Goodwill that has been allocated to the Clinical lab

(approximately 7%),

-- EUR825k of other intangibles in relation to NOVAprep(R) patents,

-- EUR281k of tangible fixed assets in relation to NOVAprep(R)

comprising instrument development, moulds and instrument equipment,

and

-- EUR459k of inventories and WIP in relation to NOVAprep(R),

instrument stock (EUR256k) and vials (EUR154k).

Borrowings have increased from EUR3.9m to EUR5.4m during the

year due to issuing a new three year EUR4.0m bond, offset by

capital repayments of EUR2.6m against outstanding borrowings. Total

borrowings in 2018 include two main items: Kreos bonds totalling

EUR1.1m (two bonds originally valued at EUR3.5m and EUR3.0m

amortising monthly) and Vatel convertible bonds totalling EUR4.2m

(two bonds originally valued at EUR1.5m and EUR4.0m, amortising

monthly until March 2020 and May 2021 respectively.

The final Primerdesign earn out milestone of GBP1.0m (disclosed

under Contingent Considerations in the financial statements) will

be paid over the next 12 months. The increase of EUR0.4m in

contingent consideration compared to 2017 is caused by the two earn

out milestones associated with the Omega ID acquisition.

Cash reduced by EUR3.2m to EUR1.1m during 2018. Net cash used in

operating activities decreased from EUR4.6m to EUR1.2m due to one

off 2017 costs relating to the IPO of EUR1.8m not repeating in

2018, a large aged debtor receipt of EUR0.4 in 2018 received from a

single customer and improved terms with suppliers.

Net cash outflow from investing activities reduced slightly to

EUR2.7m in 2018 from EUR2.8m in 2017. This movement was caused by a

EUR1.7m earn out payment made in relation to the Primerdesign

acquisition, offset by the EUR2m cash consideration paid for the

Omega ID assets offset by a EUR0.4m reduction in capital

expenditure due significant investment in 2017 on leasehold

improvements as part of the move to new upgraded headquarters in

Camberley.

Novacyt raised EUR4.0m in 2018 through the issuance of

convertible bonds. There were no equity capital increases in 2018

and as a result year-on-year cash inflows from financing activities

have reduced between 2017 and 2018 by EUR8.2m as Novacyt moves

towards being cash self-sustaining. The significant reduction in

2018 is largely explained by the equity financing of EUR9.7m before

expenses (EUR7.9m net of expenses) upon the Group's successful

listing on AIM and the issuance of EUR2.7m in convertible bonds

(net of fees), both of which took place in 2017.

Repayments of capital and interest for all borrowings have

decreased in 2018 by EUR1.6m to EUR3.2m, consisting of repayments

on Kreos bonds totalling EUR1.9m, Vatel repayments totalling

EUR1.2m and other small loan repayments of EUR0.1m.

Audited financial statements will be released on 30 April

2019.

Anthony Dyer

Chief Financial Officer

Novacyt S.A.

Consolidated statement of comprehensive income

Figures in EUR'000 Year ended Year ended

31 December 31 December

Notes 2018 2017 *

Revenue 3 13,721 12,749

Cost of sales -5,116 -4,840

Gross profit 8,604 7,909

Sales, marketing and distribution

expenses -2,454 -1,974

Research and development expenses -406 -626

General and administrative expenses -6,119 -5,492

Government subsidies -51 245

Operating loss/profit before exceptional

items -425 62

Costs related to acquisitions 4,5 -201 -

Other operating income 5 - 16

Other operating expenses 5 -759 -2,197

Operating loss after exceptional

items -1,385 -2,119

Financial income 6 225 466

Financial expense 6 -919 -1,839

Loss before tax -2,080 -3,492

Tax income/(expense) -32 2

Loss after tax -2,112 -3,491

------------------------------------------ ------- ------------ -------------------------

Loss from discontinued operations 13 -2,626 -1,951

Loss after tax attributable to owners

of the company -4,738 -5,442

--------------------------------------------------- ------------ -------------------------

Loss per share (EUR) 7 -0.13 -0.24

Diluted loss per share (EUR) 7 -0.13 -0.24

Loss per share from the continuing

operations (EUR) 7 -0.06 -0.15

Diluted loss per share from the

continuing operations (EUR) 7 -0.06 -0.15

Loss per share from the discontinued

operations (EUR) 7 -0.07 0.09

Diluted loss per share from the

discontinued operations (EUR) 7 -0.07 -0.09

* 2017 financials are restated as per IFRS 5 - Non-current

Assets held for sale and discontinued operations.

Statement of financial position

Figures in EUR'000 Year ended Year ended

31 December 31 December

Notes 2018 2017

Goodwill 2.4 16,134 16,466

Other intangible assets 4,944 4,840

Property, plant and equipment 1,191 1,573

Non-current financial assets 234 238

------------------------------------------- ------- ------------ ------------

Non-current assets 22,503 23,116

Inventories and work-in-progress 2,347 1,942

Trade and other receivables 3,900 3,804

Tax receivables 94 271

Prepayments 233 537

Short-term investments 10 10

Cash & Cash equivalents 1,132 4,345

------------------------------------------- ------- ------------ ------------

Current assets 7,716 10,908

Assets of discontinued operations 13 2,294 -

Total assets 32,513 34,024

------------------------------------------- ------- ------------ ------------

Bank overdrafts and current portion of long-term

borrowings 9 3,115 2,778

Contingent consideration (current

portion) 10 1,569 1,126

Short-term provisions 100 50

Trade and other liabilities 4,647 3,692

Other current liabilities 379 137

------------------------------------------- ------- ------------ ------------

Total current liabilities 9,809 7,783

Liabilites of discontinued operations 13 85 -

Net current assets/(liabilities) -2,008 3,125

------------------------------------------- ------- ------------ ------------

Borrowings and convertible bond

notes 9 2,259 1,115

Retirement benefit obligations - 14

Long-term provisions 168 158

Deferred tax liabilities 54 41

------------------------------------------- ------- ------------ ------------

Total non-current liabilities 2,481 1,327

Total liabilities 12,375 9,111

------------------------------------------- ------- ------------ ------------

Net assets 20,138 24,914

------------------------------------------- ------- ------------ ------------

Share capital 11a 2,511 2,511

Share premium account 11b 58,249 58,281

Own shares -178 -176

Other reserves 11c -2,819 -2,815

Equity reserve 11d 422 422

Retained losses 11e -38,047 -33,309

Total equity 20,138 24,914

------------------------------------------- ------- ------------ ------------

Statement of changes in equity

Other group reserves

======= ======= ====== ------------ ---------------------------------- ======== ======

Acquisition Other

of the comprehensive

shares income on

Figures in Share Share Own Equity of Translation retirement Retained Total

EUR '000 Notes capital premium shares reserves Primerdesign reserve benefits Total loss equity

======= ======= ======= ====== ======== ============ =========== ============= ====== ======== ======

Balance at

1 January

2017 1,161 47,120 -165 345 -2,948 135 -12 -2,825 -27,867 17,768

============== ======= ======= ======= ====== ======== ============ =========== ============= ====== ======== ======

Actuarial

gains

on retirement

benefits - - - - - - 2 2 - 2

Translation

differences - - - - - 8 - 8 - 8

Loss for the

period 11e - - - - - - - - -5,442 -5,442

Total

comprehensive

income /

(loss)

for the

period - - - - 8 2 10 -5,442 -5,432

Issue of share 11a,

capital 11b 1,218 9,685 - - - - - - - 10,903

Own shares

acquired/sold

in the period - - -11 - - - - - - -11

Other changes 132 1,476 - 77 - - - - - 1,685

Balance at

31 December

2017 2,511 58,281 -176 422 -2,948 143 -11 -2,815 -33,309 24,914

============== ======= ======= ======= ====== ======== ============ =========== ============= ====== ======== ======

Actuarial

gains

on retirement

benefits - - - - - - - - - -

Translation

differences - - - - - - 4 - -4 - -4

Loss for the

period 11e - - - - - - - - -4,738 -4,738

Total

comprehensive

income /

(loss)

for the

period - - - - - - 4 - -4 -4,738 -4,738

Issue of share

capital 11a,11b - - - - - - - - - -

Own shares

acquired/sold

in the period - - -2 - - - - - - -2

Other changes - -32 - - - - - - - -32

Balance at

31 December

2018 2,511 58,249 -178 422 -2,948 139 -11 -2,819 -38,047 20,138

============== ======= ======= ======= ====== ======== ============ =========== ============= ====== ======== ======

Statement of cash flows

Figures in EUR'000 Year ended Year ended

31 December 31 December

Notes 2018 2017

Net cash used in operating activities -1,246 -4,646

Investing activities

Purchases of patents and trademarks -307 -64

Purchases of property, plant and

equipment -377 -914

Purchases of trading investments 3 -101

Acquisition of subsidiary net of

cash acquired 12 -2,034 -1,747

----------------------------------------- ---------- ------------ ------------

Net cash used in investing activities -2,716 -2,826

----------------------------------------- ---------- ------------ ------------

Investing cash flows from discontinued

activities -130 -97

Investing cash flows from continuing

operations -2,586 -2,729

Repayment of borrowings -2,561 -3,296

Proceeds on issue of borrowings and

bond notes 3,960 2,722

Proceeds on issue of shares 11a,11b - 11,080

Purchase of own shares -2 -11

Paid interest expenses -632 -1,506

----------------------------------------- ---------- ------------ ------------

Net cash generated from financing

activities 765 8,989

----------------------------------------- ---------- ------------ ------------

Financing cash flows from discontinued

activities - -3

Financing cash flows from continuing

operations 765 8,992

Net increase/decrease in cash and

cash equivalents -3,197 1,517

----------------------------------------- ---------- ------------ ------------

Cash and cash equivalents at beginning

of year 4,345 2,856

Effect of foreign exchange rate changes -16 -27

Cash and cash equivalents at end

of year 1,132 4,345

----------------------------------------- ---------- ------------ ------------

Anthony Dyer

Chief Financial Officer

Novacyt S.A.

Notes

1. Corporate Information

Novacyt S.A is incorporated in France and its principal

activities are specialising in cancer and infectious disease

diagnostics. Its registered office is located at 13 Avenue Morane

Saulnier, 78140 Vélizy Villacoublay.

2. Basis of announcement

2.1 Basis of Preparation

The consolidated financial statements for the fiscal year ended

December 31, 2018 were prepared in accordance with the

international accounting standards and interpretations (IAS / IFRS)

adopted by the European Union and applicable on December 31, 2018.

They are prepared and presented in '000s of Euros.

2.2 Key accounting policies

- IFRS 5: Non-current Assets Held for Sale and Discontinued Operations

Discontinued operations and assets held for sale are restated in

accordance with IFRS 5.

A discontinued operation is a component of an entity that has

been disposed of or is classified as held for sale, and:

-- Represents a separate major line of business or geographical area of operations,

-- Is part of a plan to dispose of, or

-- Is a subsidiary acquired solely with a view to resale.

As per IFRS 5 we have presented discontinued operations as

follows:

In the statement of profit and loss and other comprehensive

income: a single amount comprising the total of:

- The post-tax profit or loss of the discontinued operation,

- The post-tax gain or loss recognised on the measurement to

fair value less costs to sell, and

- The post-tax gain or loss recognised on the disposal of assets

or the disposal group making up the discontinued operation.

The analysis of the single amount is presented in the note.

This restatement, which concerns only the NOVAprep activity, is

made for both years to ensure comparability.

In the statement of cash flows: the net cash flow attributable

to the operating, investing and financing activities of

discontinued operations have been disclosed separately.

In the statement of financial position: the assets and

liabilities of a disposal group have been presented separately from

other assets. The same applies for liabilities of a disposal group

classified as held for sale.

This restatement is made in the accounts 2018 to reflect the

intention to dispose of the NOVAprep activity (held by Novacyt

S.A.) and of the Clinical Lab business (held by Lab21 Ltd.).

- Standards, interpretations and amendments to standards with

mandatory application for periods beginning on or after 1 January

2018

- IFRS 15: "Revenues from contracts with customers". This

standard came into effect on 1(st) January 2018. Its application

had no impact on the way revenues are recognized by the companies

of the group.

2.3 Going concern

The directors have, at the time of approving the financial

statements, a reasonable expectation that the Company has adequate

resources to continue in operational existence for the foreseeable

future. Thus they adopt the going concern basis of accounting in

preparing the financial statements.

The going concern model covers the period up to and including

April 2020. In making this assessment the Directors have considered

the following elements:

- the working capital requirements of the business;

- a positive cash balance at 31 December 2018 of EUR1,132,000;

- the repayment of the current bond borrowings according to the agreed repayment schedules;

- earn out payments in respect of previous acquisitions

- draw down of funds from time to time from the EUR5,000,000

convertible bond facility including the initial EUR2,000,000

received upon completion.

Further bond issuances beyond the initial EUR2,000,000 upon

signing are dependent on certain conditions, such as a cool down

period, average daily volume and minimum share price prior to each

draw down request. The Company anticipates being able to draw

sufficient funds to support its working capital requirements, but

as they are outside of the Company's direct control, complete

certainty cannot be given and waivers may be used where

necessary.

Additional capital receipts from the disposals of the Clinical

labs and NOVAprep businesses and the potential strategic partnering

of the Primerdesign animal health business have not been factored

into the Group's cash flow forecast. Any such funds received would

help reduce the need and mitigate the risk of further bond

issuances.

Failure to meet the conditions within the convertible bond

facility could place uncertainty on the going concern principle

applied in preparing the financial statements insofar as the

company may in this case not be able to repay its debts and dispose

of its assets in the ordinary course of its business. The going

concern principle applied for the period ended 31 December 2018

could in that case prove inappropriate.

2.4 Critical accounting judgements and key sources of estimate

uncertainty

The preparation of the financial information in accordance with

IFRS requires management to exercise judgement on the application

of accounting policies, and to make estimates and assumptions that

affect the amounts of assets and liabilities, and income and

expenses. The underlying estimates and assumptions, made in

accordance with the going concern principle, are based on past

experience and other factors deemed reasonable in the

circumstances. They serve as the basis for the exercise of

judgement required in determining the carrying amounts of assets

and liabilities that cannot be obtained directly from other

sources. Actual amounts may differ from these estimates. The

underlying estimates and assumptions are reviewed continuously. The

impact of changes in accounting estimates is recognised in the

period of the change if it affects only that period, or in the

period of the change and subsequent periods if such periods are

also affected.

- Measurement of goodwill

Goodwill is tested for impairment on an annual basis. The

recoverable amount of goodwill is determined mainly on the basis of

forecasts of future cash flows.

The total amount of anticipated cash flows reflects management's

best estimate of the future benefits and liabilities expected for

the relevant cash-generating unit (CGU).

The assumptions used and the resulting estimates sometimes cover

very long periods, taking into account the technological,

commercial and contractual constraints associated with each

CGU.

These estimates are mainly subject to assumptions in terms of

volumes, selling prices and related production costs, and the

exchange rates of the currencies in which sales and purchases are

denominated. They are also subject to the discount rate used for

each CGU.

The value of the goodwill is tested whenever there are

indications of impairment and reviewed at each annual closing date

or more frequently should this be justified by internal or external

events.

The carrying amount of goodwill at the balance sheet and related

impairment loss over the periods are shown below:

Year ended Year ended

31 December 31 December

Amounts in '000 EUR 2018 2017

Goodwill Lab21 17,709 19,042

Impairment of goodwill - 9,101 - 9,786

=========================== =========================== ===========================

Net value 8,608 9,256

=========================== =========================== ===========================

Goodwill Primerdesign 7,210 7,210

Impairment of goodwill - -

========================== =========================== ===========================

Net value 7,210 7,210

=========================== =========================== ===========================

Goodwill Omega ID 316 -

Impairment of goodwill - -

========================== =========================== ===========================

Net value 316 -

========================== =========================== ===========================

Total Goodwill 16,134 16,466

=========================== =========================== ===========================

3. Operating Segments

Segment reporting

Pursuant to IFRS 8, an operating segment is a component of an

entity:

- that engages in business activities from which it may earn

revenues and incur expenses (including revenues and expenses

relating to transactions with other components of the same

entity);

- whose operating results are regularly reviewed by the Group's

chief executive and the managers of the various entities to make

decisions regarding the allocation of resources to the segment and

to assess its performance;

- for which discrete financial information is available.

The Group has identified three operating segments, whose

performances and resources are monitored separately:

o Corporate and Cytology

Previously, this segment represented the NOVAprep and French

Group central costs. Following the announcement of the sale

proceedings for NOVAprep, this segment now only shows the French

Group central costs and the results of NOVAprep are shown in a

single line - Discontinued Operations.

o Corporate and Diagnostics

This segment corresponds to diagnostic activities in

laboratories, and the manufacturing and distribution of reagents

and kits for bacterial and blood tests. This is the activity

conducted by Lab21 and its subsidiaries. This segment also includes

UK Group central costs.

o Molecular testing

This segment represents the activities of recently acquired

Primerdesign, which designs, manufactures and distributes test kits

for certain diseases in humans, animals and food products. These

kits are intended for laboratory use and rely on "polymerase chain

reaction" technology.

Reliance on major customers

The Group is not dependent on a particular customer, there are

no customers generating sales accounting for over 10% of

revenue.

Breakdown of revenue by operating segment and geographic

area

o At 31 December 2018

Corporate Corporate Molecular

Amounts in '000 EUR & Cytology & Diagnostics Products Total

Geographical area

Africa 715 285 1,000

Europe 3,304 2,811 6,115

Asia-Pacific 1,738 1,282 3,020

America 795 1,578 2,372

Middle East 951 262 1,213

Revenue 7,502 6,218 13,721

===================================== =============== ========== =======

o At 31 December 2017

Corporate Corporate Molecular

Amounts in '000 EUR & Cytology & Diagnostics Products Total

Geographical area

Africa 299 363 662

Europe 3,347 2,531 5,878

Asia-Pacific 1,608 1,656 3,265

America 661 1,192 1,853

Middle East 739 352 1,091

Revenue 6,655 6,095 12,749

==================================== =============== ========== ======

Breakdown of result by operating segment

o Year ended 31 December 2018

Corporate Corporate Molecular Total

& & Diagnostics Products

Amounts in '000 EUR Cytology

Revenue - 7,503 6,219 13,721

Cost of sales - -4,147 -969 -5,116

Sales and marketing costs - -1,152 -1,302 -2,454

Research and development - -162 -244 -406

General & administrative expenses -959 -2,635 -2,525 -6,119

Governmental subsidies - 75 -125 -51

==================================== =========== =============== =========== =========

Operating profit/(loss) before

exceptional items -959 -519 1,054 -425

Other operating income - - - -

Other operating expenses -526 -337 -97 -960

Operating profit/(loss) -1,486 -856 957 -1,385

==================================== =========== =============== =========== =========

Financial income 290 -144 79 225

Financial expense -736 -180 -4 -919

Profit/(Loss) before tax -1,931 -1,181 1,032 -2,080

==================================== =========== =============== =========== =========

Tax (expense) / credit - - -32 -32

Loss from discontinued activities -2,626 - - -2,626

Profit/(Loss) after tax -4,557 -1,181 1,001 -4,738

==================================== =========== =============== =========== =========

Attributable to owners of

the company -4,557 -1,181 1,001 -4,738

==================================== =========== =============== =========== =========

Attributable to non-controlling - - - -

interests

o Year ended 31 December 2017

Corporate Corporate Molecular Total

& & Diagnostics Products

Amounts in '000 EUR Cytology

Revenue - 6 654 6 095 12 749

Cost of sales - -3 671 -1 170 -4 840

Sales and marketing costs - -1 015 -959 -1 974

Research and development - -113 -513 -626

General & administrative expenses -849 -2 364 -2 279 -5 492

Governmental subsidies - 119 127 245

==================================== ========== ================ =========== =========

Operating profit/(loss) before

exceptional items -849 -391 1 301 62

Other operating income 16 - - 16

Other operating expenses -1 661 -503 -33 -2 197

Operating profit/(loss) -2 494 -894 1 268 -2 119

==================================== ========== ================ =========== =========

Financial income 556 -99 9 466

Financial expense -1 564 -257 -18 -1 839

Profit/(Loss) before tax -3 502 -1 249 1 259 -3 492

==================================== ========== ================ =========== =========

Tax (expense) / credit -2 - 3 2

Loss from discontinued activities -1 951 - - -1 951

Profit/(Loss) after tax -5 455 -1 249 1 262 -5 442

==================================== ========== ================ =========== =========

Attributable to owners of

the company -5 455 -1 249 1 262 -5 442

==================================== ========== ================ =========== =========

The 2017 consolidated income statement is presented to reflect

the impacts of the application of IFRS 5 relative to discontinued

operations, by restating the NOVAprep activity on a single line

"Loss from discontinued operations".

4. Costs related to acquisitions

On 28 June 2018, the UK Company Lab21 Healthcare Ltd completed

an asset purchase agreement for the Infection Diseases business of

the company called Omega Diagnostics Ltd. The acquisition was

accounted for as a business combination under IFRS, accordingly,

the costs related to the acquisition of EUR201,000 was expensed

5. Other operating income and expenses

Year ended Year ended

31 December 31 December

Amounts in '000 EUR 2018 2017

Other operating income - 16

Other operating income - 16

=========================================== ========================= ========================

Provision for litigation with employees - 46 - 171

Restructuring expenses - 183 - 78

Business sale expenses -104 -

Acquisition related expenses - 379 -

IPO preparation - 87 - 1,631

Relocation expenses - - 176

Other expenses - 161 - 141

Other operating expenses - 960 - 2,197

=========================================== ========================= ========================

The restructuring expenses of EUR78,000 in the year ended 31

December 2017 and EUR183,000 in the period ended 31 December 2018

relate to redundancy payments made to employees in relation to

restructuring taken place during this period.

The IPO preparation expenses of EUR1,631,000 in the year ended

31 December 2017 and EUR87,000 in the period ended 31 December 2018

relate to the fees incurred in preparation for the company's AIM

listing in late 2017.

6. Financial income and expense

Year ended Year ended

31 December 31 December

Amounts in '000 EUR 2018 2017

Exchange gains 102 287

Change in fair value of options 122 140

Other financial income - 39

Financial income 225 466

=================================== =========================== ===========================

Interest on loans - 682 - 1,202

Exchange losses - 190 - 251

Contingent consideration - - 386

Other financial expense - 47 -

Financial expense - 919 - 1,839

=================================== =========================== ===========================

Financial Income:

Exchange gains

Exchange gains resulted from recurring operations and from

variations in sterling on the contingent consideration liability

related to the Primerdesign acquisition.

Change in fair value of options

The December 2017 balance relates to the revaluation of the

Primerdesign warrants liability from EUR266,000 to EUR126,000.

The December 2018 balance relates to the revaluation of the

Primerdesign warrants liability from EUR126,000 to EUR5,000.

Financial Expense:

Interest on loans

The interest charge is mainly related to the Kreos and Vatel

bond notes.

Exchange Losses

Exchange losses in 2017 and 2018 were mainly those recorded by

the British company Lab21 Ltd on its operations and relate to the

monthly revaluation of the Novacyt loan in Lab21 Ltd's books.

Contingent consideration:

The contingent consideration in 2017 relates to the discounting

of the contingent consideration liability in favour of Primerdesign

shareholders.

7. Loss per share

Loss per share is calculated based on the weighted average

number of shares outstanding during the period. Diluted loss per

share is calculated based on the weighted average number of shares

outstanding and the number of shares issuable as a result of the

conversion of dilutive financial instruments.

Year ended Year ended

31 December 31 December

Amounts in 000' EUR 2018 2017

Net loss attributable to owners of the company - 4,738 - 5,442

Impact of dilutive instruments - -

Net loss attributable to owners of the company - 4,738 - 5,442

=================================================== ========================== ==========================

Weighted average number of shares 37,664,342 23,075,634

Impact of dilutive instruments - -

Weighted average number of diluted shares 37,664,342 23,075,634

=================================================== ========================== ==========================

Earnings per share (in Euros) - 0.13 - 0.24

=================================================== ========================== ==========================

Diluted earnings per share (in Euros) - 0.13 - 0.24

=================================================== ========================== ==========================

Loss per share from the continuing operations

(in Euros) - 0.06 - 0.15

=================================================== ========================== ==========================

Diluted loss per share from the continuing

operations (in Euros) - 0.06 - 0.15

=================================================== ========================== ==========================

Loss per share from the discontinued operations

(in Euros) - 0.07 - 0.09

=================================================== ========================== ==========================

Diluted Loss per share from the discontinued

operations (in Euros) - 0.07 - 0.09

=================================================== ========================== ==========================

Pursuant to IAS 33, options whose exercise price is higher than

the value of the Company's security were not taken into account in

determining the effect of dilutive instruments.

8. Group companies

The consolidated financial statements of the Group include:

Closing Opening

============== =============== ============== ============== =============== ==============

Companies Interest Control Consolidation Interest Control Consolidation

percentage percentage method percentage percentage method

=============== ============== =============== ============== ============== =============== ==============

Biotec

laboratories

Ltd 100.00 % 100.00 % FC 100.00 % 100.00 % FC

Lab21

Healthcare Ltd 100.00 % 100.00 % FC 100.00 % 100.00 % FC

Lab21 Ltd 100.00 % 100.00 % FC 100.00 % 100.00 % FC

Microgen

Bioproducts

Ltd 100.00 % 100.00 % FC 100.00 % 100.00 % FC

Novacyt SA 100.00 % 100.00 % FC 100.00 % 100.00 % FC

Novacyt Asia 100.00 % 100.00 % FC 100.00 % 100.00 % FC

Novacyt China 100.00 % 100.00 % FC 100.00 % 100.00 % FC

Primerdesign

Ltd 100.00 % 100.00 % FC 100.00 % 100.00 % FC

9. Borrowings

The following tables show borrowings and financial liabilities

carried at amortised cost.

o Maturities as of 31 December 2018

Amount due Amount due Total

for settlement for settlement

within 12 after 12 months

Amounts in '000 EUR months

Bond notes 2,976 2,239 5,216

Bank borrowings 67 20 87

Accrued interest on borrowings 72 - 72

Total financial liabilities 3,115 2,259 5,374

================================== ========================= ========================= =========================

o Maturities as of 31 December 2017

Amount due Amount due Total

for settlement for settlement

within 12 after 12 months

Amounts in '000 EUR months

Bond notes 2,664 1,028 3,692

Bank borrowings 66 87 153

Accrued interest on borrowings 49 - 49

Total financial liabilities 2,778 1,115 3,894

=============================== =============== ================ =====

o Change in borrowings and financial liabilities in 2018

At At

31 December 31 December

Amounts in 000' EUR 2017 Increase Repayment Renegotiation 2018

Bond notes 3,692 4,019 - 2,554 59 5,216

Bank borrowings 153 - - 66 - 87

Accrued interest on

borrowings 49 72 - 49 - 72

Total financial liabilities 3,894 4,091 - 2,669 59 5,374

=============================== ============= ========= ============= ============== =============

o Change in borrowings and financial liabilities in 2017

At

31 December

Amounts in '000 EUR At 31 December 2016 Increase Repayment Conversion 2017

Bond notes 5,620 2,664 - 3,227 -1,365 3,692

Bank borrowings 220 - - 67 - 153

Accrued interest on borrowings 414 49 -414 - 49

Total financial liabilities 6,254 2,713 - 3,708 -1,365 3,894

=============================== =================== ======== ========= ========== ============

10. Contingent Consideration

The contingent consideration related to the acquisition of the

Primerdesign shares and the Asset Purchase Agreement of the

Infectious Diseases business from Omega Diagnostics Ltd.

Year ended Year ended

31 December 31 December

Amounts in '000 EUR 2018 2017

Contingent consideration (current portion) 1,569 1,126

1,569 1,126

============================================== ================ ================

The movement in the liability between the 31 December 2017 and

31 December 2018 is due to the variance of the foreign exchange

rate (contingent liability is denominated in Pounds Sterling), by

the interest accrued on this debt in the amount of GBP40,000, and

by the deferred consideration related to the acquisition of the

Omega infectious diseases business for GBP375,000 comprising:

-- GBP175,000 paid after twelve months upon completion of technology transfer and,

-- GBP200,000 paid upon the successful accreditation of the

Axminster, UK production facility to certain standards (expected to

be achieved inside 12 months of acquisition date)

11. Issued capital and reserves

a. Share capital

As of 1 January 2017, the Company's share capital of

EUR1,161,134 was divided into 17,417,014 shares with a par value of

1/15th of a Euro each.

Amounts in '000 EUR Amount of share capital Unit value per share Number of shares issued

========================================== ======================== ===================== ========================

At 1 January 2017 1,161 0.07 17,417,014

Capital increases 1,218 0.07 18,269,258

Capital increase by conversion of OCABSA 132 0.07 1,978,070

At 31 December 2017 2,511 0.07 37,664,342

At 31 December 2018 2,511 0.07 37,664,342

As of 31 December 2018, the Company's share capital of

EUR2,510,956.06 was divided into 37,664,342 shares with a par value

of 1/15th of a Euro each.

The Company's share capital consists of one class of share. All

outstanding shares have been subscribed, called and paid.

b. Share premium

Amounts in '000 EUR

Balance at 1 January 2017 47,120

Premium arising on issue of equity shares 12,987

Expenses of issue of equity shares - 1,826

Balance at 31 December 2017 58,281

Premium arising on issue of equity shares -

Expenses of issue of equity shares - 32

Balance at 31 December 2018 58,249

c. Other reserves

Amounts in '000 EUR

Balance at 1 January 2017 - 2,826

Translation differences 8

Other variations 3

Balance at 31 December 2017 - 2,815

Translation differences - 4

Other variations -

Balance at 31 December 2018 - 2,819

d. Equity reserve

Amounts in '000 EUR

Balance at 1 January 2017 345

Conversion of the OCABSA Yorkville 77

Balance at 31 December 2017 422

Conversion of the OCABSA Yorkville -

Balance at 31 December 2018 422

e. Retained losses

Amounts in '000 EUR

Balance at 1 January 2017 - 27,867

Net loss for the year - 5,442

Other variations -

Balance at 31 December 2017 - 33,309

Net loss for the year - 4,738

Other variations -

Balance at 31 December 2018 - 38,047

12. Business Combinations

- Acquisition of Omega ID

On 28 June 2018, the UK Company Lab21 Healthcare Ltd completed

an asset purchase agreement for the Infection Diseases business of

the company called Omega Diagnostics Ltd. The Infectious Diseases

business specialises in the manufacture of a range of diagnostic

kits, in particular for syphilis and febrile antigens, as well as a

range of latex serology tests for rheumatoid factor, C-reactive

protein, anti-streptolysin and systemic lupus erythematosus.

It includes various assets, such as equipment, stock, trademarks

and patents. It also includes two employees, whose employment

contracts were transferred to Lab21 Healthcare Ltd via the TUPE

process under which employees in the UK transfer with the activity

on the same employment term.

The purchase price was GBP2,175,000 (EUR2,456,000) broken down

as follows:

Cash disbursed EUR2,032,000

Deferred consideration for successfully supporting

and handling over manufacturing EUR198,000

Deferred consideration for successfully achieving

a Category 3 facility accreditation EUR226,000

Total purchase price EUR2,456,000

The assets acquired and the liabilities assumed are as

follows:

Net property, plant and equipment and intangible assets EUR46,000

Inventories EUR523,000

Customer relationship EUR1,314,000

Trademark EUR251,000

Fair value of assets acquired and liabilities assumed EUR2,134,000

Goodwill EUR322,000

The table above shows how the goodwill figure of EUR322,000 is

arrived at after allocating the purchase price accordingly. The

residual goodwill arising from the acquisition reflects the future

growth expected to be driven by new customers, the value of the

workforce, technical files and know-how.

The value of "customer relationships" was determined by

discounting the additional margin generated by customers after

remuneration of the contributing assets.

The value of the trademark was determined by discounting the

cash flows that could be generated by licensing the Omega

trademark, estimated as a percentage of revenue derived from

information available on comparable assets.

IFRS 3 provides for a period of 12 months from the takeover to

complete the identification and measurement of the fair value of

assets acquired and liabilities assumed. Therefore, until May 2019,

the gross amount of goodwill is subject to adjustment.

Goodwill is a residual component calculated as the difference

between the purchase price for the acquisition of control and the

fair value of the assets acquired and liabilities assumed. It

includes unrecognised assets such as the value of the personnel and

know-how of the acquiree.

The acquisition costs amounted to EUR201,000. They are included

on the statement of comprehensive income in the year ended 31

December 2018 as "Costs related to acquisitions".

Omega contributed EUR1,030,000 to consolidated revenue in the

year ended 31 December 2018 and EUR45,000 to net profit or loss

attributable to owners of the company between its consolidation on

1 July 2018 and 31 December 2018.

If the acquisition of the Omega business were deemed to have

been completed on 1 January 2018, the opening date of the Group's

2018 financial year, consolidated revenue would have amounted to

EUR14,751,000 and net profit or loss attributable to owners of the

company to a loss of EUR4,695,000.

The table below presents the group income statement for the 12

months period ended on 31 December 2018 as if the acquisition of

Omega had been completed on 1st January 2018.

31 December

2018

Amounts in 000' EUR Pro forma

Revenue 2,455

Cost of sales -1,612

====================================== ============

Gross profit 843

Sales and marketing costs -70

General & administrative costs -532

====================================== ============

Recurring operating profit 242

Costs related to acquisitions -

Other operating expenses -131

Operating profit 111

====================================== ============

Financial expenses -1

Loss before tax 110

====================================== ============

Tax expense -

Loss after tax 110

====================================== ============

Total net loss 110

====================================== ============

Attributable to owners of the company 110

====================================== ============

13. Discontinued operations

Novacyt has begun the formal sale process for the NOVAprep

(Cytology businesses) and Cambridge Clinical Labs businesses. The

Clinical Lab business is a non-core service business and does not

fit in with the long-term high margin growth strategy for the

Group. NOVAprep is being sold as it continues to be loss making and

is a drain on working capital while it is non-profit making and as

such the decision was made to dispose of the business in late

2018.

It is expected that NOVAprep and the Clinical Labs will be sold

or disposed of by December 2019 at the latest.

The assets and liabilities available for sale are transferred on

the lines "Assets of the discontinued activities" and "Liabilities

of the discontinued activities". The nature of these assets and

liabilities are presented in the table below:

Amounts in '000 EUR Clinical Lab NOVAprep Total

Goodwill 648 - 648

Other intangible assets - 829 829

Property, plant and equipment 3 281 284

============= ========= ======

Non-current assets 651 1,110 1,761

Inventories and work in progress 24 459 483

Trade and other receivables 49 - 49

Current assets 73 459 532

Total assets held for sale 725 1,569 2,294

================================== ============= ========= ======

Trade and other liabilities 43 18 61

Total current liabilities 43 18 61

Long term provisions 7 17 24

Total non-current liabilities 7 17 24

Total liabilities held for sale 50 35 85

================================== ============= ========= ======

In accordance with the IFRS 5, the net result of the NOVAprep

business was transferred on the line "Loss from the discontinued

activities".

The table below presents the detail of the loss generated by

this business in 2017 and 2018.

Year ended Year ended

31 December 31 December

Amounts in '000 EUR 2018 2017

Revenue 974 2,204

Cost of sales -719 -1,190

============================================== ============= =============

Gross profit 255 1,014

Sales, marketing and distribution expenses -1,169 -1,274

Research and development expenses -189 -194

General and administrative expenses -1,563 -1,622

Governmental subsidies 88 123

Operating loss before exceptional items -2,578 -1,952

Other operating expenses -48 -

Operating loss after exceptional items -2,626 -1,952

============================================== ============= =============

Financial expense - -

Loss before tax -2,626 -1,952

============================================== ============= =============

Tax (expense) / income - 1

Loss after tax from discontinued operations -2,626 -1,951

============================================== ============= =============

14. Subsequent Events

On the 23rd April 2019, Novacyt entered into a Convertible Bonds

with Warrants Funding Programme, for up to EUR5,000,000 (net of

expenses). Under the terms of the Agreement, the Company will be

able to access capital in seven tranches which oblige the

Investment Managers to immediately subscribe for an initial tranche

of EUR2,000,000, followed by six further tranches, each of an

aggregate nominal value of EUR500,000 (together the "Tranches"),

drawable at the Company's option subject to certain terms and

conditions. The Company has immediately exercised its right to the

initial tranche of funding giving rise to the subscription of

EUR2,000,000 of convertible bonds with warrants by the Investment

Managers. The remaining EUR3,000,000 of convertible bonds can be

issued by the Company over the next 36 months following the closing

of the Agreement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR KKLFLKZFEBBZ

(END) Dow Jones Newswires

April 30, 2019 02:01 ET (06:01 GMT)

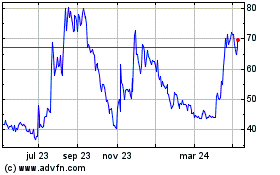

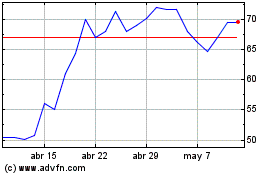

Novacyt (LSE:NCYT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Novacyt (LSE:NCYT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024