TIDMLSE

RNS Number : 6531X

London Stock Exchange Group PLC

01 May 2019

1 May 2019

LONDON STOCK EXCHANGE GROUP plc

TRADING STATEMENT

INCLUDING REVENUES AND KPIs FOR THE THREE MONTHSED 31 MARCH 2019

(Q1)

-- Good overall Q1 income performance against challenging market backdrop

-- Q1 total income up 5% year-on-year to GBP546 million

-- Group continues to develop and invest for growth, with the

acquisition of minority stake in Euroclear and launch of new

services in Post Trade and Information Services

Q1 summary:

-- Information Services: revenues up 6% to GBP214 million - with

7% growth at FTSE Russell. Growth in index subscriptions remained

strong while FTSE Russell asset-based revenues reduced due to

reduction in AuM at the end of 2018 (which impacted on revenue in

the first part of Q1 2019); asset-based revenue in Q2 is expected

to be stronger

-- Post Trade - LCH: income up 17% to GBP182 million, with 16%

revenue growth in OTC following record volumes at SwapClear and no

discernible change to customers' use of the service as equivalence

secured in event of hard Brexit; LCH benefited from an updated

SwapClear agreement with partner banks, with effect from the start

of the year, estimated to deliver c.GBP30 million savings to cost

of sales in 2019

-- Post Trade - Italy: income down 4% to GBP36 million as equity

markets experienced a slow first quarter; after adjusting for the

treatment of T2S costs, gross profit increased 3%

-- Capital Markets: revenues down 9% to GBP97 million, mostly

reflecting lower equity trading volumes

-- Technology Services: revenues up 9% to GBP14 million

David Schwimmer, CEO said:

"We continue to execute our strategy across our core businesses

of Information Services, Post Trade and Capital Markets. In Post

Trade, we acquired a stake in Euroclear, which shares our open

access approach, and we updated our SwapClear agreement, which will

deliver significant savings as we further develop the service.

"We are investing in and growing our Information Services

business, including developing our multi-asset and data and

analytics offering. While equity markets were slower due to

macroeconomic uncertainty, we have seen an improved listing

environment in Q2.

"The Group is strategically well positioned to develop its

growth opportunities further in the evolving macroeconomic

landscape."

New product development and investment in opportunities

continued across the business:

- Group acquired a 4.9% stake in Euroclear with a seat on the

Board, which will help strengthen the existing commercial

relationships between the businesses

- LCH RepoClear members successfully consolidated European debt

clearing activity in LCH SA, benefitting from T2S efficiencies

- SwapClear Non-Deliverable IRS Clearing expanded to include 5

new LatAm and Asia-Pacific currencies

- Dutch pension fund Pensioenfonds Detailhandel selected a

custom FTSE Russell ESG benchmark as the basis of a new EUR6bn

developed market passive equity mandate managed by BlackRock

- FTSE Russell launched a new Multi-Asset Composite Index Series

- a wide range of indexes across major asset classes covering

global, regional and emerging markets

- In early April, Network International, a Middle Eastern

payments company, raised GBP1.1 billlion on London Stock Exchange

plc; and Nexi, a major Italian payments company listed on Borsa

Italiana, raising $2.6 billion, the largest IPO year to date

globally

- Acquisition of minority stake in Nivaura, partnering with them

to support capital markets innovation through use of emerging

technologies

Financial Position

The Group's financial position remains strong and is broadly

unchanged from that reported for 31 December 2018. As at 31 March

2019, having funded the purchase of a 4.9% stake in Euroclear, the

Group had committed facility headroom of over GBP750 million

available for general corporate purposes.

S&P maintains a positive outlook over its A- long term

rating of LSEG, while Moody's rates LSEG A3 with a stable

outlook.

The euro weakened by 2% and the US dollar strengthened by 6%

against sterling compared with the same period last year. To

illustrate our exposure to movements in exchange rates, a EUR0.05

change up or down in the average euro:sterling rate would have

resulted in a corresponding change to continuing operations total

income of c.GBP7 million for Q1, while a US$0.05 move would have

resulted in a c.GBP6 million change.

Further information is available from:

Gavin Sullivan/Lucie Holloway

London Stock Exchange - Media +44 (0) 20 7797 1222

Group plc Paul Froud - Investor Relations +44 (0) 20 7797 3322

A conference call for analysts and investors will be held at

8:00 (UK time) on Wednesday 1 May. On the call will be David Warren

(Group CFO) and Paul Froud (Group Head of Investor Relations).

To access the telephone conference call dial 0800 376 7922 or

+44 (0) 20 7192 8000

Conference ID: 506 6297

Q1 Revenue Summary

Revenues for three months ended 31 March 2019 refer to

continuing operations, with comparatives against performance for

the same period last year, are provided below. Growth rates for Q1

performance are also expressed on an organic and constant currency

basis. All figures are unaudited.

Three months ended Constant

31 March currency

---------------------

2019 2018 Variance variance

Continuing operations: GBPm GBPm % %

Revenue

Information Services 214 201 6% 3%

Post Trade Services - LCH 134 118 14% 14%

Post Trade Services - CC&G

and Monte Titoli 25 28 (10%) (9%)

Capital Markets 97 107 (9%) (9%)

Technology 14 13 9% 9%

Other 2 3 (31%) (31%)

----------------------------- ---------- --------- --------- ---------

Total revenue 486 470 3% 2%

Net treasury income through

CCP businesses 59 48 23% 22%

Other income 1 2 (53%) (53%)

----------

Total income 546 520 5% 4%

----------------------------- ---------- --------- --------- ---------

Cost of sales (56) (56) - (1%)

---------- ---------

Gross profit 490 464 6% 4%

----------------------------- ---------- --------- --------- ---------

The Group's principal foreign exchange exposure arises from

translating and revaluing its foreign currency earnings, assets and

liabilities into LSEG's reporting currency of Sterling.

More detailed revenues by segment are provided in tables

below:

Information Services

Revised reporting format:

Three months ended Constant

31 March currency

---------------------

2019 2018 Variance variance

GBPm GBPm % %

Revenue

Index - Subscription 99 89 11% 7%

Index - Asset based 52 52 - (6%)

FTSE Russell 151 141 7% 2%

---------------------------- ---------- --------- --------- ---------

Real time data 24 24 (1%) (1%)

Other information services 39 36 8% 7%

Total revenue 214 201 6% 3%

---------------------------- ---------- --------- --------- ---------

Cost of sales (17) (18) (2%) (7%)

---------- ---------

Gross profit 197 183 7% 3%

---------------------------- ---------- --------- --------- ---------

Note:

Mergent and some other minor items (previously reported in FTSE

Russell subscriptions), are now included in Other information

services

Previous reporting format:

Three months ended Constant

31 March currency

---------------------

2019 2018 Variance variance

GBPm GBPm % %

Revenue

FTSE Russell 161 150 7% 2%

Real time data 24 24 (1%) (1%)

Other information services 29 27 7% 7%

Total revenue 214 201 6% 3%

---------------------------- ---------- --------- --------- ---------

Cost of sales (17) (18) (2%) (7%)

---------- ---------

Gross profit 197 183 7% 3%

---------------------------- ---------- --------- --------- ---------

Post Trade Services - LCH

Three months ended Constant

31 March currency

---------------------

2019 2018 Variance variance

GBPm GBPm % %

Revenue

OTC - SwapClear, ForexClear

& CDSClear 76 66 16% 14%

Non OTC - Fixed income,

Cash equities & Listed derivatives 34 33 2% 3%

Other 24 19 26% 27%

---------- ---------

Total revenue 134 118 14% 14%

------------------------------------- ---------- --------- --------- ---------

Net treasury income 48 38 26% 24%

Other income - - - -

Total income 182 156 17% 16%

------------------------------------- ---------- --------- --------- ---------

Cost of sales (32) (25) 26% 28%

---------- ---------

Gross profit 150 131 15% 14%

------------------------------------- ---------- --------- --------- ---------

Post Trade Services - CC&G and Monte Titoli

Three months ended Constant

31 March currency

---------------------

2019 2018 Variance variance

GBPm GBPm % %

Revenue

Clearing 11 10 3% 4%

Settlement, Custody & other 14 18 (18%) (16%)

Total revenue 25 28 (10%) (9%)

----------------------------- ---------- --------- --------- ---------

Net treasury income 11 10 13% 15%

Total income 36 38 (4%) (3%)

----------------------------- ---------- --------- --------- ---------

Cost of sales (1) (2) (4) (61%) (61%)

---------- ---------

Gross profit 34 34 3% 5%

----------------------------- ---------- --------- --------- ---------

1 Pass through of T2S costs, Cost of sales have now been netted

off against Settlement, Custody & other, 2019 Q1 impact

GBP3m

Capital Markets

Three months ended Constant

31 March currency

---------------------

2019 2018 Variance variance

GBPm GBPm % %

Revenue

Primary Markets 28 29 (2%) (1%)

Secondary Markets - Equities 37 45 (18%) (18%)

Secondary Markets - Fixed

income, derivatives and

other 32 33 (4%) (3%)

Total revenue 97 107 (9%) (9%)

------------------------------ ---------- --------- --------- ---------

Cost of sales (1) (5) (67%) (67%)

---------- ---------

Gross profit 96 102 (6%) (6%)

------------------------------ ---------- --------- --------- ---------

Technology Services

Three months ended Constant

31 March currency

---------------------

2019 2018 Variance variance

Revenue GBPm GBPm % %

MillenniumIT & other technology 14 13 9% 9%

--------------------------------- ---------- --------- --------- ---------

Cost of sales (2) (3) (16%) (16%)

---------- --------- --------- ---------

Gross profit 12 10 16% 16%

--------------------------------- ---------- --------- --------- ---------

Basis of Preparation

Results for the period ended 31 March 2019 have been translated

into sterling using the average exchange rates for the period.

Constant currency growth rates have been calculated by translating

prior period results at the average exchange rate for the current

period.

Average rate Average rate

Closing rate Closing rate

3 months ended at 3 months ended at

31 March 2019 31 March 2019 31 March 2018 31 March 2018

GBP : EUR 1.15 1.16 1.13 1.14

GBP : USD 1.30 1.30 1.39 1.40

--------------- -------------- --------------- --------------

Appendix - Key performance indicators

Information Services

As at

31 March Variance

------------------

2019 2018 %

ETF assets under management

benchmarked ($bn)

FTSE 413 399 4%

Russell Indexes 256 240 7%

----------------------------- ---------

Total 669 639 5%

----------------------------- -------- -------- ---------

Terminals

UK 67,000 68,000 (1%)

Borsa Italiana Professional

Terminals 105,000 109,000 (4%)

Post Trade Services -

LCH

Three months ended

31 March Variance

---------------------

2019 2018 %

OTC derivatives

SwapClear

IRS notional cleared

($tn) 318 291 9%

SwapClear members 119 105 13%

Client trades ('000) 411 407 1%

CDSClear

Notional cleared (EURbn) 176 162 9%

CDSClear members 26 13 100%

ForexClear

Notional value cleared

($bn) 4,311 4,286 1%

ForexClear members 34 30 13%

------------------------------- ---------- --------- ---------

Non-OTC

Fixed income - Nominal

value (EURtn) 26.2 23.9 10%

Listed derivatives (contracts

m) 36.4 38.5 (5%)

Cash equities trades

(m) 180.8 221 (18%)

------------------------------- ---------- --------- ---------

Average cash collateral

(EURbn) 91.1 83.0 10%

Post Trade Services - CC&G and

Monte Titoli

Three months ended

31 March Variance

---------------------

2019 2018 %

CC&G Clearing

Contracts (m) 25.0 29.7 (16%)

Initial margin held (average

EURbn) 13.7 9.0 52%

Monte Titoli

Settlement instructions

(trades m) 10.7 11.7 (9%)

Custody assets under

management (average EURtn) 3.31 3.30 -

Capital Markets - Primary

Markets

Three months ended

31 March Variance

---------------------

2019 2018 %

New Issues

UK Main Market, PSM &

SFM 11 19 (42%)

UK AIM 5 12 (58%)

Borsa Italiana 7 6 17%

----------

Total 23 37 (38%)

--------------------------- ---------- --------- ---------

Money Raised (GBPbn)

UK New 0.5 1.0 (50%)

UK Further 3.0 5.5 (45%)

Borsa Italiana new and

further 0.0 1.5 (100%)

Total (GBPbn) 3.5 8.0 (56%)

--------------------------- ---------- --------- ---------

Capital Markets - Secondary Markets

Three months ended

31 March Variance

---------------------

Equity 2019 2018 %

Totals for period

UK value traded (GBPbn) 294 388 (24%)

Borsa Italiana (no of

trades m) 15.6 19.2 (19%)

Turquoise value traded

(EURbn) 163 254 (36%)

SETS Yield (basis points) 0.68 0.61 11%

Average daily

UK value traded (GBPbn) 4.7 6.2 (24%)

Borsa Italiana (no of

trades '000) 248 305 (19%)

Turquoise value traded

(EURbn) 2.6 4.0 (35%)

Derivatives (contracts

m)

LSE Derivatives 0.8 1.8 (56%)

IDEM 8.3 9.2 (10%)

Total 9.1 11.0 (17%)

------------------------------ ---------- --------- ---------

Fixed Income

MTS cash and BondVision

(EURbn) 836 1,030 (19%)

MTS money markets (EURbn

term adjusted) 28,809 19,588 47%

Total Income - Quarterly

2018 2019

GBP millions Q1 Q2 Q3 Q4 2018 Q1

---------------- ---------------- ---------------- ---------------- ----------------

Index -

Subscription 89 96 94 94 373 99

Index - Asset

based 52 53 59 55 219 52

FTSE Russell 141 149 153 149 592 151

Real time

data 24 23 23 24 94 24

Other

information 36 39 36 44 155 39

-------------

Information

Services 201 211 212 217 841 214

OTC -

SwapClear,

ForexClear &

CDSClear 66 64 65 73 268 76

Non OTC -

Fixed

income, Cash

equities

& Listed

derivatives 33 34 34 35 136 34

Other 19 21 21 22 83 24

------------- ---------------- ---------------- ---------------- ---------------- --------------- ----------------

Post Trade

Services -

LCH 118 119 120 130 487 134

Clearing 10 12 10 9 41 11

Settlement,

Custody &

other 18 12 15 16 61 14

------------- ---------------- ---------------- ---------------- ---------------- --------------- ----------------

Post Trade

Services -

CC&G and

Monte Titoli 28 24 25 25 102 25

Primary

Markets 29 33 20 31 113 28

Secondary

Markets -

Equities 45 44 39 41 169 37

Secondary

Markets -

Fixed

income,

derivatives

& other 33 31 30 31 125 32

------------- ---------------- ---------------- ---------------- ---------------- --------------- ----------------

Capital

Markets 107 108 89 103 407 97

Technology 13 19 16 17 65 14

Other 3 2 2 2 9 2

Total Revenue 470 483 464 494 1,911 486

Net treasury

income

through CCP:

CC&G 10 11 11 11 43 11

LCH 38 45 46 46 175 48

Other income 2 1 1 2 6 1

Total income 520 540 522 553 2,135 546

------------- ---------------- ---------------- ---------------- ---------------- --------------- ----------------

Cost of sales (56) (50) (57) (64) (227) (56)

Gross profit 464 490 465 489 1,908 490

------------- ---------------- ---------------- ---------------- ---------------- --------------- ----------------

Note Information Services:

Mergent and some other minor items (previously reported in FTSE

Russell subscriptions), are now included in Other information

services

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTVBLFXKZFXBBZ

(END) Dow Jones Newswires

May 01, 2019 02:00 ET (06:00 GMT)

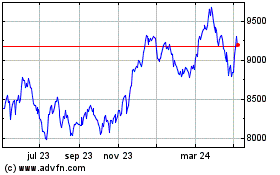

London Stock Exchange (LSE:LSEG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

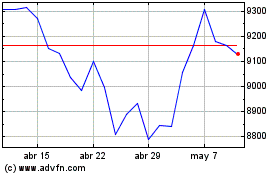

London Stock Exchange (LSE:LSEG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024