By Andrew Scurria

In the decade since R. Allen Stanford's international financial

empire was exposed as a fiction, investors in his Ponzi scheme have

recouped just a tiny fraction of the life savings many of them

lost.

Now a small group of individuals, backed by hedge funds, is

making a last-ditch effort to recover money from five banks that

they contend turned a blind eye to Mr. Stanford's fraud. In a

lawsuit filed in Dallas federal court on Friday, these investors

alleged that the banks "aided, abetted and conspired" with Mr.

Stanford to steal from investors and that "their close profitable

relationship with such a wealthy, high-profile customer led them to

callously ignore R.A. Stanford's fraud."

The five banks they sued on Friday are HSBC Bank PLC,

Toronto-Dominion Bank, Bank of Houston, Trustmark National Bank,

and Societe Generale Private Banking. Most of these institutions

had long-term relationships with Mr. Stanford and his entities, and

those ties gave them insights into the fraud as it was happening,

the investors allege.

In addition to filing the new lawsuit, investors in Stanford

have lobbied lawmakers in recent months, met with Securities and

Exchange Commission Chairman Jay Clayton and pressed for the return

of frozen overseas assets, according to people familiar with the

matter.

Since Mr. Stanford's arrest and the collapse of Stanford

International Bank Ltd. in 2009, what remains of his far-flung

financial operation has been wound down by lawyers and consultants

in Antigua and Dallas, where court-appointed liquidators have sold

assets, sued alleged beneficiaries of the fraud and distributed

proceeds across roughly 18,000 victims.

But unlike account holders at Bernard Madoff's phantom

investment firm, Mr. Stanford's U.S. victims stand out for how

little they have recovered. The judge overseeing the receivership

has authorized $272 million in distributions, compared with the

more than $5 billion lost by depositors.

That comes out to roughly 4.5 cents on every dollar in losses.

By contrast Mr. Madoff's customers have gotten back roughly

two-thirds of the $17.5 billion they lost, with individual claims

up to $1.5 million satisfied in full. The schemes imploded two

months apart as the global financial crisis peaked.

Blaine Smith, of Baton Rouge, La. was enjoying early retirement

in 2009 from a career working for Exxon Mobil Corp., building

houses and running a TCBY franchise on the side. He lost more than

$1 million on IRAs, certificates of deposit and other Stanford

group investments that evaporated when the institutions collapsed,

costing him his home, boat and motorcycle and all but $150,000 of

his life savings. His wife worked for the state a decade longer

than they planned; he went back to work as a construction

superintendent.

"It ruined our lives," Mr. Smith said. "I literally cried for

the first 365 days. I would cry going to work and going back, and

pretty much all day long."

Mr. Smith, 61, never sold his claim to an outside investor. The

best offer -- 14 cents on the dollar -- was too low for him to

bite. Instead, he has spent the past decade hoping lawsuits would

eventually dig up enough money to pay him more. Mr. Smith isn't

part of the lawsuit.

Kevin Sadler, a lawyer for the receiver, acknowledged that the

pace of recoveries have been "frustratingly slow," in part because

U.S. government prosecutors didn't generate recoveries for victims

to the extent it did for those who invested with Mr. Madoff.

Mr. Madoff's account holders were deemed eligible for insurance

coverage from the Securities Investor Protection Corp., an industry

association created by Congress that maintains a special fund to

cover the first $500,000 of losses for customers of failed

brokerages. SIPC also bankrolled a legal campaign by Madoff

liquidating trustee that dug up more than $13 billion for

creditors.

No such coverage was available to Mr. Stanford's victims, which

also meant the legal fees for cleaning up his fraud had to be paid

out of money that would otherwise go to victims. As of October 31,

those fees and expenses totaled $224.2 million, according to court

records.

"When you're not able to be outspent, that improves your ability

to resolve cases successfully," said Mark Kornfeld, a lawyer who

worked for years with the Madoff trustee.

More money is expected to come in for Stanford investors. The

receiver is seeking court approval to distribute an additional $200

million in settlements he reached last year, while a pending

judgment against Colorado billionaire Gary Magness could bring in

another $125 million, Mr. Sadler said.

But the banks that moved money in and out of Mr. Stanford's

companies are disputing they owe anything. The receiver has already

sued them.

SocGen also holds roughly $160 million in assets linked to Mr.

Stanford in Switzerland, claiming in Swiss court that it has the

right to use the funds to protect itself against potential claims.

Senator Bill Cassidy (R, La.) demanded that the money be returned

in a meeting last month with SocGen's attorneys, alleging it "aided

and abetted Stanford's banking outside the United States." A SocGen

spokesman said it was "carefully reviewing" the senators'

concerns.

The other banks either declined to comment about Friday's

lawsuit or didn't immediately respond to queries.

Backing the investors in the lawsuit are hedge funds that bought

out some of the victims' claims in the hope of turning a profit

themselves.

Plaintiffs include Contrarian Capital LLC, CarVal Investors LLC,

Whitebox Advisors LLC and Foxhill Capital Partners LLC --

investment funds that purchased victims' claims -- betting the

receiver would return additional proceeds from Mr. Stanford's

crimes over time.

Mr. Stanford is serving a 110-year prison sentence in central

Florida, 50 miles northwest of Orlando, after his 2012 conviction

on 13 felony counts. He has remained unrepentant, petitioning

several courts from prison to free him and publishing a 789-page

book that is available on Amazon, claiming he was made a scapegoat

by prosecutors.

--Gretchen Morgenson and Dave Michaels contributed to this

article.

Write to Andrew Scurria at Andrew.Scurria@wsj.com

(END) Dow Jones Newswires

May 04, 2019 08:14 ET (12:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

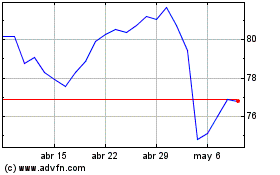

Toronto Dominion Bank (TSX:TD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Toronto Dominion Bank (TSX:TD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024