Oil Buoyed by Tightening Global Supplies

10 Mayo 2019 - 9:02AM

Noticias Dow Jones

By Dan Molinski

--Oil prices edged higher Friday as investors shrugged off a

Trump administration decision to impose higher tariffs on Chinese

imports, and instead focused on continuing supply concerns in

Venezuela, Iran and Libya.

--West Texas Intermediate futures, the U.S. oil benchmark,

recently rose 0.2% to $61.81 a barrel on the New York Mercantile

Exchange.

--Brent crude, the global oil benchmark, was up 0.5% at $70.74 a

barrel on London's Intercontinental Exchange.

HIGHLIGHTS

U.S.-China Trade: Oil prices have been on a bumpy road this week

amid shifts in sentiment over trade negotiations between the U.S.

and China, the world's two largest economies. On Friday morning,

President Trump made good on a threat to raise tariffs on Chinese

goods, but investors were nonetheless encouraged that he didn't

signal any derailment to the overall trade talks.

"Talks with China continue in a very congenial manner -- there

is absolutely no need to rush -- as Tariffs are NOW being paid to

the United States by China of 25% on 250 Billion Dollars worth of

goods & products. These massive payments go directly to the

Treasury of the U.S.," Mr. Trump said in a Twitter post.

Analysts said oil investors also aren't overlooking the

price-supportive, ongoing risks to global crude supplies. Tough

U.S. sanctions against Venezuela and Iran have significantly curbed

oil exports from those two countries -- both members of the

Organization of the Petroleum Exporting Countries -- while

crisis-torn Libya, also an OPEC member, is on investors' radar.

"With U.S.-China trade deal hopes revived, we could be on the

verge of another oil rally," Phil Flynn, senior market analyst at

Price Futures in Chicago, said in a note to clients Friday. "On top

of that we still have supply risks and threats. Can't forget

Venezuela, Iran, and Libya."

Iran, Venezuela: Sanctions on Iran that began last year have

already pushed Iranian exports to below 1 million barrels a day

from 2.5 million previously, while Venezuelan exports are slowing

to a trickle as Washington tries to force embattled President

Nicolas Maduro from power.

"Venezuelan exports may also fall further too, as the U.S. is

likely to squeeze the country economically, implying further

sanctions, following the failed uprising against the Maduro regime

last week," said analysts at Energy Aspects in a note.

INSIGHT

Chevron Exits: Oil markets were also focused this week on a

potential bidding war between Chevron Corp. and Occidental

Petroleum, both of which wanted to buy shale-rich Anadarko

Petroleum. But after Occidental made an offer higher than Chevron's

initially accepted offer of $33 billion, Chevron decided to make no

counteroffers, and instead will walk away with a $1 billion breakup

fee.

"Chevron wields an enviable growth profile among the Majors. It

is already a leader in U.S. tight oil, underpinned by its

low-royalty, contiguous acreage position throughout the Permian,"

said Greig Aitken, director of M&A Research at Wood Mackenzie.

"We thought Chevron had room to up its offer without destroying

value -- and in oil and gas M&A, that's generally an

achievement for any buyer. But it looks like Chevron wasn't content

with just breaking even."

AHEAD

-- Baker Hughes releases its rig-count report on Friday at 1

p.m. ET.

--The EIA's monthly Drilling Productivity Report, which details

oil production from the U.S.'s main shale regions, is due for

release Monday.

--OPEC's monthly oil market report is due Tuesday.

Write to Dan Molinski at dan.molinski@wsj.com

(END) Dow Jones Newswires

May 10, 2019 09:47 ET (13:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

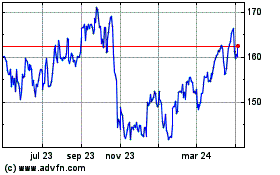

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

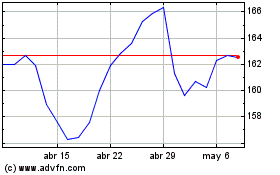

Chevron (NYSE:CVX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024