Hargreaves Lansdown PLC Trading Statement (0236Z)

15 Mayo 2019 - 1:00AM

UK Regulatory

TIDMHL.

RNS Number : 0236Z

Hargreaves Lansdown PLC

15 May 2019

Trading update

15 May 2019

Hargreaves Lansdown plc ("Hargreaves Lansdown" or the "Company"

or the "Group") today publishes a trading update in respect of the

four month period to 30 April 2019 ("the period").

Highlights

-- Net new business of GBP2.9 billion in the period

-- Year to date net new business of GBP5.4 billion

-- Assets under administration ("AUA") of GBP97.8 billion as at 30 April 2019

-- 1,188,000 active clients, with net new clients of 53,000 in the period

-- Year-to-date total net revenue of GBP395.9 million, up 8%

Chris Hill, Chief Executive Officer, commented:

"We are pleased with the strong tax year end, delivering net new

business of GBP2.9 billion and welcoming another 53,000 net new

clients despite the market backdrop. It is also pleasing to see the

benefit of our investment coming through with Active Savings

continuing to gather momentum and the announced transfers of

clients and assets from Witan Investment Services, JP Morgan and

Baillie Gifford.

Whilst political and macro-economic uncertainty remains, we are

confident that our continued focus on the needs of UK investors and

savers means that we are well positioned to deliver attractive

growth."

Assets under administration and net new business

GBP billion Four months Ten months

to 30 April to 30 April

2019 2019

Opening AUA 85.9 91.6

Net new business 2.9 5.4

Market movements 9.0 0.8

Closing AUA 97.8 97.8

Net new business was GBP2.9 billion during the period (2018:

GBP3.3bn), taking year to date net inflows to GBP5.4 billion (2018:

GBP6.6bn). The period started slowly but built momentum,

particularly across the tax year-end. New business was driven by

organic new clients, ongoing wealth consolidation onto our platform

from existing clients, flows into our cash management service

"Active Savings" (GBP399m) and a direct back book transfer from

Witan Investment Services (GBP267m). In addition, the rebranded

Wealth 50 list of funds, the HL Select Global Growth fund launch

and the introduction of an "Easy Access" account in Active Savings

have all helped to attract new clients and inflows.

Rising stock markets have led to a positive market movement of

GBP9.0bn, which combined with net new business has driven AUA to a

record GBP97.8 billion as at 30 April 2019.

Transfers from Witan Investment Services are expected to

complete before our year-end and while we will start the transfer

process of clients from J.P. Morgan and Baillie Gifford, most of

the clients and their respective assets are expected to arrive in

the early months of the next financial year. We look forward to

welcoming these new clients and delivering them an exceptional

client experience. Year to date we have added 97,000 net new

clients, taking total active client numbers to 1,188,000.

Net revenues

Net revenue for the period was GBP159.5 million (2018:

GBP150.6m), benefitting from a greater level of AUA and a higher

cash revenue margin, which have more than offset a fall in stock

broking revenues driven by reduced dealing volumes as a consequence

of low investor confidence and lower charges on overseas dealing.

This has resulted in year to date net revenue of GBP395.9 million

(2018: GBP366.6m), 8% higher than last year.

Contacts:

Investors Media

James Found, Head of Investor Danny Cox, Head of Communications

Relations Chris Hill, Chief Executive

Philip Johnson, Chief Financial Officer

Officer +44(0)117 317 1638

+44(0)117 988 9898

Forward looking statements

This announcement contains forward-looking statements with

respect to the financial condition, results and business of the

Group. By their nature, forward-looking statements involve risk and

uncertainty because they relate to events, and depend on

circumstances, that will occur in the future. The Group's actual

results may differ materially from the results expressed or implied

in these forward-looking statements. Nothing in this announcement

should be construed as a profit forecast. This announcement is

unaudited. This statement should not be seen as a promotion or

solicitation to buy Hargreaves Lansdown plc shares. It should be

remembered that the value of shares can fall as well as rise and

therefore you could get back less than you invested.

LEI Number: 2138008ZCE93ZDSESG90

Assets Under Administration

Average AUA 4 months 3 months 3 months 2 months 4 months

(GBPbillion) to 30 April to 31 December to 30 September to 30 June to 30 April

2019 2018 2018 2018 2018

Funds 50.2 48.1 52.0 50.9 48.5

------------- ---------------- ----------------- ------------ -------------

Shares 31.4 29.5 32.0 30.8 28.6

------------- ---------------- ----------------- ------------ -------------

Cash 10.5 10.2 9.7 9.6 9.0

------------- ---------------- ----------------- ------------ -------------

HL Funds 9.1 8.9 9.6 9.6 9.1

------------- ---------------- ----------------- ------------ -------------

Active Savings 0.6 0.3

------------- ---------------- ----------------- ------------ -------------

Double count(1) (9.0) (8.9) (9.5) (9.5) (9.0)

------------- ---------------- ----------------- ------------ -------------

Total 92.8 88.1 93.8 91.4 86.2

------------- ---------------- ----------------- ------------ -------------

AUA (GBPbillion) As at 30 As at 31 As at 30 As at 30 As at 30

April 2019 December September June 2018 April 2018

2018 2018

Funds 52.7 46.6 52.0 51.0 49.6

------------ ---------- ----------- ----------- ------------

Shares 33.4 28.5 32.2 31.0 29.6

------------ ---------- ----------- ----------- ------------

Cash 10.9 10.4 9.7 9.6 9.5

------------ ---------- ----------- ----------- ------------

HL Funds 9.4 8.6 9.6 9.6 9.4

------------ ---------- ----------- ----------- ------------

Active Savings 0.8 0.4 0.1 - -

------------ ---------- ----------- ----------- ------------

Double count(1) (9.4) (8.6) (9.5) (9.5) (9.3)

------------ ---------- ----------- ----------- ------------

Total 97.8 85.9 94.1 91.6 88.8

------------ ---------- ----------- ----------- ------------

Average AUA 10 months 10 months

(GBPbillion) to 30 April to 30 April

2019 2018

Funds 50.1 47.8

------------- -------------

Shares 31.0 27.8

------------- -------------

Cash 10.1 8.6

------------- -------------

HL Funds 9.2 9.1

------------- -------------

Active Savings 0.4 -

------------- -------------

Double count(1) (9.1) (9.0)

------------- -------------

Total 91.7 84.3

------------- -------------

(1) All HL Funds are held in Vantage or the Portfolio Management

Service (PMS) and are included in the Funds category of the table

with the exception of a small balance held off platform by third

parties. To avoid double counting the amount held in Vantage or PMS

has been deducted.

AUA (GBPbillion) 4 months 3 months 3 months 2 months 4 months

to 30 April to 31 December to 30 September to 30 June to 30 April

2019 2018 2018 2018 2018

Opening AUA 85.9 94.1 91.6 88.8 86.1

------------- ---------------- ----------------- ------------ -------------

Net new business(1) 2.9 1.2 1.3 1.0 3.3

------------- ---------------- ----------------- ------------ -------------

Market movements 9.0 (9.4) 1.2 1.9 (0.6)

------------- ---------------- ----------------- ------------ -------------

Founder transfer(2) - - - (0.1) -

------------- ---------------- ----------------- ------------ -------------

Closing AUA 97.8 85.9 94.1 91.6 88.8

------------- ---------------- ----------------- ------------ -------------

(1) Net new business in the 4 months to 30 April 2019 includes

GBP267m of flows acquired from Witan Investment Services.

(2) Net new business excludes the withdrawal of GBP110 million

of Hargreaves Lansdown plc placing proceeds during the period that

were held by a founder.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTBLGDUGGBBGCS

(END) Dow Jones Newswires

May 15, 2019 02:00 ET (06:00 GMT)

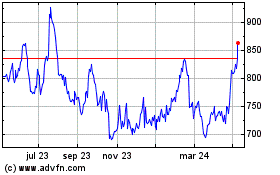

Hargreaves Lansdown (LSE:HL.)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

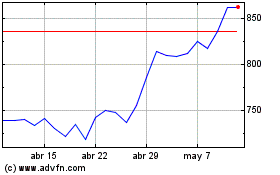

Hargreaves Lansdown (LSE:HL.)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024