Premier African Minerals Limited Zulu Lithium Drilling Programme Update (0387Z)

15 Mayo 2019 - 1:01AM

UK Regulatory

TIDMPREM

RNS Number : 0387Z

Premier African Minerals Limited

15 May 2019

For immediate release

15 May 2019

Premier African Minerals Limited

Zulu Lithium Drilling Programme Update

Premier African Minerals Limited ("Premier" or the "Company")

previously announced on 26 February 2019 that it would recommence

drilling at the Company's wholly-owned Zulu Lithium and Tantalum

Project ("Zulu") in Zimbabwe, and that KME Plant Hire Proprietary

Limited ("KME") would be the drilling contractor to carry out these

drilling works. Drilling was expected to commence as soon as

mobilisation was complete and seasonal rains permitted.

The budget for the initial drilling programme (as described

above), including mobilisation, was estimated at approximately

US$400,000 and the Company issued within the Company's existing

share authorities 212,413,793 new Ordinary Shares of nil par value

at an issue price of 0.145p per share ("KME Payment Shares") to KME

as pre-payment for mobilisation and drilling. The KME Payment

Shares were admitted to trading on AIM on 4 March 2019.

The KME Payment Shares, while issued, have not to date been

released by Premier to the control of KME, pending execution of the

long form drilling contract, which is not currently in a final form

that is acceptable to both parties reflecting their current

relationship. On the basis that the long form drilling contract is

mutually agreed between the parties, and as the rainy season has

now largely subsided, drilling will then proceed on Zulu and the

KME Payment Shares released by Premier to KME's control. If

agreement, however, cannot be reached with KME on the final

outstanding terms of the long form drilling contract, then KME's

appointment will end, the KME Payment Shares will be cancelled and

Premier will in due course appoint a new contractor to undertake

the drilling programme at Zulu.

A further announcement will be made in due course.

Enquiries:

Premier African Minerals Tel: +44 (0)7734

Fuad Sillem Limited 922074

Michael Cornish / Beaumont Cornish Limited Tel: +44 (0) 20 7628

Roland Cornish (Nominated Adviser) 3396

--------------------------- ---------------------

Jerry Keen/Edward Shore Capital Stockbrokers Tel: +44 (0) 20 7408

Mansfield Limited 4090

--------------------------- ---------------------

Tom Curran/Elliot Tel: +44 (0) 20 3700

Hance SVS Securities Limited 0100

--------------------------- ---------------------

Forward Looking Statements:

Certain statements in this announcement are or may be deemed to

be forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe"

"could" "should" "envisage" "estimate" "intend" "may" "plan" "will"

or the negative of those variations or comparable expressions

including references to assumptions. These forward-looking

statements are not based on historical facts but rather on the

Directors' current expectations and assumptions regarding the

Company's future growth results of operations performance future

capital and other expenditures (including the amount. nature and

sources of funding thereof) competitive advantages business

prospects and opportunities. Such forward looking statements re ect

the Directors' current beliefs and assumptions and are based on

information currently available to the Directors. Many factors

could cause actual results to differ materially from the results

discussed in the forward-looking statements including risks

associated with vulnerability to general economic and business

conditions competition environmental and other regulatory changes

actions by governmental authorities the availability of capital

markets reliance on key personnel uninsured and underinsured losses

and other factors many of which are beyond the control of the

Company. Although any forward-looking statements contained in this

announcement are based upon what the Directors believe to be

reasonable assumptions. The Company cannot assure investors that

actual results will be consistent with such forward looking

statements.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014. The person who arranged the

release of this announcement on behalf of the Company was George

Roach.

Notes to Editors:

Premier African Minerals Limited (AIM: PREM) is a

multi-commodity mining and natural resource development company

focused on Southern Africa with its RHA and Zulu projects in

Zimbabwe.

The Company has a diverse portfolio of projects, which include

tungsten, rare earth elements, lithium and tantalum in Zimbabwe,

encompassing brownfield projects with near-term production

potential to grass-roots exploration. In addition, the Company

holds 5,010,333 shares in Circum Minerals Limited ("Circum"), the

owners of the Danakil Potash Project in Ethiopia.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DRLKMGMKMDDGLZZ

(END) Dow Jones Newswires

May 15, 2019 02:01 ET (06:01 GMT)

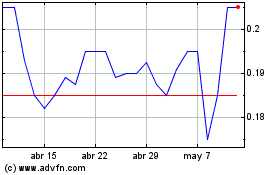

Premier African Minerals (LSE:PREM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

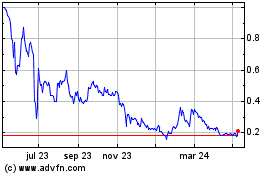

Premier African Minerals (LSE:PREM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024