BHP More Bullish on Electric-Vehicle Revolution

20 Mayo 2019 - 9:29PM

Noticias Dow Jones

By Rhiannon Hoyle

SYDNEY--BHP Group Ltd. (BHP.AU) sounded an increasingly

confident tone on the electric-vehicle revolution, a forecast that

will help to shape the miner's investment in commodities including

copper and oil.

The world's biggest miner by market value on Tuesday raised its

expectations for the number of electric vehicles that it expects on

the roads in coming decades, citing declining battery costs and

rising interest among automakers, particularly in China.

"Globally established automakers and China's up-and-coming

indigenous firms are embracing EVs, with model availability

increasing steadily and many self-imposed sales targets

instituted," said BHP's chief economist, Huw McKay.

BHP said it now expects electric vehicles to account for at

least 7% of the light-vehicle market come 2035, up from a forecast

of at least 5% two years ago. That is equal to 132 million electric

vehicles on the road at that time, it said.

The miner thinks market share could swell as high as 36% should

more governments invest in infrastructure to support charging and

ban the sale of cars powered by traditional internal-combustion

engines. BHP said its forecasts include wholly battery powered and

plug-in hybrid vehicles, but not traditional hybrids such as the

Toyota Prius.

Electric vehicles have faced some speed bumps recently as China,

the world's largest car market, has cut subsidies. Umicore--which

makes cathodes used in electric-car batteries--issued a profit

warning and pushed back targets for sales and plant investments,

citing slowing Chinese demand.

Still, countries and cities elsewhere--particularly in

Europe--are pressing for change by announcing bans or restrictions

on diesel and gasoline vehicles.

Mr. McKay called electric vehicles "one of the mega-trends

expected to shape our long run operating environment."

BHP's electric-vehicle forecasts are "essential to establishing

the plausibility of our long run copper, nickel, oil and power

demand ranges" and consequently making decisions on future

investments, said Mr. McKay.

Last week, the mining company said it no longer plans to sell a

large nickel-mining and processing business in Australia because of

growing optimism over the use of nickel in batteries for electric

vehicles.

A strong electric-vehicle boom would be particularly positive

for BHP's copper business. Electric vehicles use up to four times

as much copper as other cars.

BHP has in recent years shifted its focus to producing more

copper, away from steelmaking materials iron ore and coal, because

of expectations demand for consumer products, including electric

vehicles, would lead the next commodity boom.

It has also focused on investments in petroleum, which could be

hurt by stronger-than-expected electric vehicle sales. The first

100 million electric vehicles on the road will likely reduce global

oil demand by 1.3 million barrels per day, said Mr. McKay. World

demand currently stands around 100 million barrels a day.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

May 20, 2019 22:14 ET (02:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

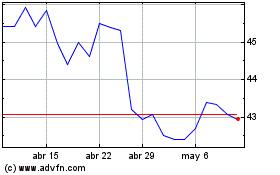

BHP (ASX:BHP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

BHP (ASX:BHP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024