EQT in $2.26 Billion Takeover Bid for Australia's Vocus

26 Mayo 2019 - 7:57PM

Noticias Dow Jones

By Robb M. Stewart

MELBOURNE, Australia--Asset manager EQT has secured access to

Vocus Group Ltd.'s (VOC.AU) books after pitching a non-binding

takeover offer that values the Australian telecommunications

provider at about 3.27 billion Australian dollars (US$2.26

billion).

In a statement Monday, Vocus said EQT Infrastructure is offering

A$5.25 a share in cash, a 35% premium to the last closing price on

Friday.

The indicative bid is subject to a number of conditions,

including securing committed financing and the unanimous approval

of Vocus's board, plus the usual shareholder and regulatory

approvals.

Vocus's board said it had decided to allow EQT non-exclusive due

diligence access to allow it to potentially make a formal binding

offer for the Australian company, a process expected to take a

number of weeks. Vocus has hired UBS as its financial adviser.

A takeover of Vocus would further shake up Australia's telecom

industry, which has struggled in recent years with heightened

competition and the ongoing rollout by the federal government of a

nationwide broadband network that sells wholesale access to telecom

operators. TPG Telecom Ltd. (TPM.AU) and Vodafone Hutchison

Australia have proposed merging their respective fixed-line and

mobile operations, but are seeking approval in court after the deal

was earlier this month blocked by Australia's antitrust

regulator.

In late 2017, competing private equity firms KKR & Co. and

Affinity Equity Partners ended talks with Vocus after finding they

couldn't support a takeover offer on terms that were acceptable to

the telecom company's board. The company had attracted an

indicative offer from KKR months earlier worth about A$2.18

billion, and a month later Affinity made a bid at a matching

price.

Vocus owns telecommunications networks in capital and regional

cities in Australia and New Zealand, with a portfolio of brands

focused on a range of corporate, small business, government and

residential customers. Over the last couple of years, the company

has shifted from a concentration on fiber-networks on Australia's

east coast to a broader range of telecom operations across the two

countries, other products including television and insurance

services and retailing electricity and natural gas.

In February, Vocus parted ways with Geoff Horth, who had been

chief executive since February 2016 when the company completed the

acquisition of another telecom company, M2 Group. The departure of

Mr. Horth came a week after Vocus scaled back earnings guidance due

to higher expense charges and lower-than-anticipated subscribers

for the telecommunications company's retail energy offering.

Following media reports in March, the company denied it had

current plans for a capital raising with the issue of equity and

said the board was comfortable with the debt position. And in

April, the company said it had opted against selling its New

Zealand business after failing to land an offer it could

accept.

EQT, a global alternative asset manager supported in part by

Investor AB, last week said its EQT Infrastructure IV had signed an

agreement to acquire Melita, a telecom operator in Malta. In March,

closed its largest infrastructure fund yet, after it EQT

Infrastructure IV held a one-and-done close at EUR9 billion

(US$10.7 billion) after an about six-month fundraising process.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

May 26, 2019 20:42 ET (00:42 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

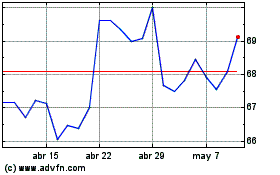

Vodafone (LSE:VOD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

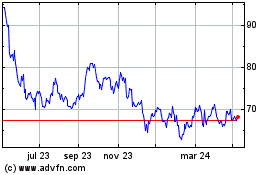

Vodafone (LSE:VOD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024