German 5G Auction Ends With Companies Pledging EUR6.5 Billion for Spectrum

13 Junio 2019 - 6:14AM

Noticias Dow Jones

By Patrick Costello

--Germany's 5G spectrum auction ended late Wednesday with

telecom companies pledging over EUR6.5 billion for frequencies

--Deutsche Telekom spent more than its peers for spectrum

--The auction costs exceeded companies' and analysts' initial

expectations

Germany's 5G spectrum auction ended late Wednesday with the

country's main telecoms operators pledging to pay over 6.5 billion

euros ($7.36 billion) for frequencies on the 5G mobile

spectrum.

Deutsche Telekom AG (DTE.XE), Telefonica Deutschland AG

(O2D.XE), Vodafone Germany and 1&1 Drillisch AG (DRI.XE)

pledged a total of EUR6.55 billion in 497 rounds of bidding for

licenses to 41 blocks of spectrum, said the Federal Network Agency,

Germany's telecoms regulator and the auction organizer.

The auction kicked off on March 19 and lasted nearly three

months, ending last night only when operators ceased submitting new

bids. Companies bid for frequencies to build up 5G networks that

will be used by consumers and industry.

Deutsche Telekom outspent its rivals, securing 13 blocks of

frequencies for EUR2.17 billion. Vodafone Germany spent EUR1.88

billion on 12 frequency blocks, while Telefonica Deutschland spent

EUR1.42 billion on nine frequency blocks.

1&1 Drillisch pledged EUR1.07 billion for seven frequency

blocks. The company is aiming to become Germany's fourth mobile

network operator having now won spectrum.

Still, companies criticized that the final costs for 5G spectrum

were too high, saying this deprives them of funds to build up their

next-generation mobile networks.

"Once again, the spectrum in Germany is much more expensive than

in other countries," Deutsche Telekom board member Dirk Woessner

said. "Network operators now lack the money to expand their

networks."

Analysts likewise said the auction costs exceeded initial

expectations and came in too high.

"The high cost at which the German 5G spectrum auction settled

is a setback for the industry," Jefferies said, calling the auction

an "unexpectedly drawn-out process."

Deutsche Bank's Nizla Naizer said the final price tag came in

EUR1.5 billion ahead of the bank's initial estimate of EUR5

billion, adding that "all eyes" would now turn to 1&1's plans

for rolling out its new network.

Write to Patrick Costello at patrick.costello@dowjones.com.

(END) Dow Jones Newswires

June 13, 2019 06:59 ET (10:59 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

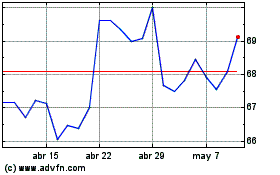

Vodafone (LSE:VOD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

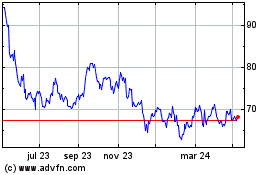

Vodafone (LSE:VOD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024