TIDMPET

RNS Number : 6649C

Petrel Resources PLC

19 June 2019

19(th) June 2019

Petrel Resources plc

("Petrel" or "the Company")

Preliminary Results for the Year Ended 31(st) December 2018

Petrel announces its results for the year ended 31(st) December

2018.

Highlights

-- The Iolar well, being drilled by CNOOC / ExxonMobil during

mid-2019, is a key test of ultra-deep-rock (6,310 metres below

sea-bed), deep-water plays in the Irish Atlantic Porcupine.

-- Petrel has applied to assume operatorship and extend the 1st

phase of FEL 3/14, and to convert LO 16/24 to a Frontier

Exploration Licence.

-- The reforming Ghanaian NPP Government is expediting Petroleum

development. A systematic review of historic Petroleum Agreements

is underway, which includes Tano 2A Block.

-- Revised coordinates for Tano offshore acreage, submitted by

Clontarf, are under consideration by the Ghanaian authorities. Most

of the original 1,532km2 is immediately available, though part

awaits relinquishment.

-- Riadh Hameed has joined Petrel Resources plc as a

Non-Executive Director, and is helping re-establish Petrel's

Baghdad operations.

A copy of the Company's Annual Report and Accounts for 2018 will

be mailed shortly only to those shareholders who have elected to

receive it. Otherwise shareholders will be notified that the Annual

Report will be available on the website at www.petrelresources.com.

Copies of the Annual Report will also be available for collection

from the Company's registered office, 162 Clontarf Road, Dublin 3,

Ireland.

The Company's Annual General Meeting will be held on 24(th) July

2019 in the Gresham Hotel, 23 O'Connell Street Upper, Dublin 1, D01

C3W7 at 10:30 am.

S

For further information please visit

http://www.petrelresources.com/ or contact:

Enquiries:

Petrel Resources PLC

John Teeling, Chairman

David Horgan, Director +353 1 833 2833

Beaumont Cornish - Nominated Adviser

Felicity Geidt

Roland Cornish +44 (0) 020 7628 3396

Novum Securities Limited - Broker

Colin Rowbury +44 (0) 20 399 9400

Blytheweigh - PR +44 (0) 20 7138 3206

Julia Tilley +44 (0) 207 138 3553

Fergus Cowan +44 (0) 207 138 3208

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). The person

who arranged for the release of this announcement on behalf of the

Company was Jim Finn, Director.

CHAIRMANS STATEMENT

Petrel is a grassroots exploration company. That means we pursue

high risk high potential projects. But high risk means there is a

high risk of total loss. The only true lie detector in exploration

is a drill hole. The most sophisticated and best informed analyses

and evaluation of a prospect comes with high risk. No better

example that the well currently being drilled in the Atlantic

Porcupine offshore Ireland. From surface to target depth is over

8,000 metres - 8 kilometres! 2,162 metres of water and 6,310 metre

of rock. And there is a good probability of finding nothing of

value.

Petrel was first founded in the early 1980's to participate in

offshore Irish exploration. It failed. Revived in the 1990's with

new management and new risk capital we entered Iraq, then offshore

Ireland and offshore Ghana.

When choosing places to explore there are three overriding

considerations - the probability of finding something, the

potential size of the discovery and can we develop and profit from.

There are two main risks, Geological and Political. Our strategy

has been to go where the best chances are of finding something.

Often this is in areas where the political rules change. So we

accept higher political risk for lower geological risk.

How has this worked out? Not well. The big surprise is that

Ireland where we assumed low political risk and higher geological

risk and turning out to have high political risk while the

geological has not improved.

Petrel and the partners it attracted to Ireland saw a stable

environment, clear terms and rights to develop. This is not what

has happened.

- The Corrib debacle lasting 20 years has done serious damage to

our international reputation. It now is taken for granted that

there will be objections to any natural resource developments.

Delays of years are common thus destroying the present value of the

project.

- The state changed the taxation laws applying to petroleum

projects. There is absolutely no logic for doing this. Exploration

has found almost nothing. There are no profits to tax. Ireland has

one of the highest failure rates in oil exploration in the world.

We should be increasing incentives not diminishing them.

- There is an active political movement to outlaw all offshore

exploration. This in a country which is dependent on Siberian

gas!!! What began as a fanciful proposition from a tiny left wing

party got support from mainstream parties. The recent proposition

before parliament has lapsed but damage has been done and a

precedent established. Foreign investors can spend their money in

over 200 countries, it does not have to be Ireland.

- Finally, companies who obtained exploration licences are being

frustrated in getting drilling permits and are having permits

overturned on technicalities. The state has allowed explorers to

spend tens of millions on early stage prospecting only to frustrate

and delay the granting of drilling licences.

Trying to be positive. Should the current well be a hit and

should the long delayed work commence on the Barryroe prospect then

sentiment may change.

Where is Petrel in all of this? We have applied to assume 100%

operatorship of Frontier Exploration License 3/14 and to extend the

first phase by one year. It has taken almost the full year to get

approval. We have worked up the extensive data on the block and

believe that we have a good package with which to attract a major

but we have no time.

We have applied to transfer our 100% owned Licence Option 16 /

24 to a Frontier Exploration Licence. Here again we believe the

geology holds potential. We will pitch the opportunities to

majors.

Finally we hold a 10% working interest in Frontier Exploration

Licence 11 / 18, Woodside holds the remaining 90%. We have met

commitments until now. When we receive proposed budgets for the

coming year we will evaluate whether to stay in or not.

Overall the Irish offshore is a sorry scene.

Ghana

After ten years in Ghana, Petrel (30%) and partners Clontarf

(60%) local Ghanaian interests (10%) await ratification of the Tano

2A Petroleum Agreement negotiated with the Ghana National Petroleum

Corporation. It needs cabinet and parliamentary approval.

Relationships in Ghana have improved in the last two years,

particularly with the Ghana National Petroleum Corporation, but

there is little evidence that political promises are being

delivered on.

In the ten years we have been waiting for ratification Ghana has

become a significant oil producer, not without difficulty with both

the geology and with government. The change in government has

renewed a focus on oil development. This should assist Petrel and

partners. I hesitate to give any guidance.

Iraq

We had high hopes of commercial success in Iraq. It has the best

oil geology on the planet with drilling success over 90% and a $2

to 4 a barrel production cost. But the political risk offsets all

of this.

Petrel first entered Iraq in 1997 and had initial success in

obtaining a large exploration block in the Western Desert between

Baghdad and Amman Jordan. We were seeking development rights to any

one of the many proven but undeveloped oil fields but we needed to

establish our credentials. We undertook exploration work but were

frustrated by sanctions which stopped us from drilling.

We continued involvement with the Iraqi Oil Ministry and

undertook extensive technical work, with Itochu of Japan on the

Merjan oil field.

Post 2003 we were awarded a development contract on the Subba

and Luhais oil fields. Bureaucratic interference and payment

problems forced Petrel to sell out in 2010.

We maintained our interest and appointed an Iraqi Arman

Kayablian to work in Iraq. We purchased a 20% stake in Amira

Hydrocarbon which had joint operations with Oryx Petroleum, in the

Wasit province. The joint venture failed to obtain a licence. In

2018 the agreement was dissolved and some 20 million Petrel shares

returned to the company.

We have recently appointed Riadh Mahmoud Hameed to the Petrel

board. Riadh worked as project co-ordinator for six years for

Petrel in Iraq.

Activities are normalising in Iraq. There are many oil projects

in Iraq which need to be developed. Petrel will be making a case to

be part of the development.

Future

Oil and gas grassroots exploration has proven to be an expensive

experience for Petrel shareholders. There is little interest in the

sector.

Petrel has had a loyal following for decades but as the downward

cycle in exploration share prices continues and intensifies even

the loyalists lose hope. We continue to press of ratification in

Ghana and continue to seek farm in partners for our offshore

Ireland interests.

Interest is reviving in Iraq. We now have the people to seek out

operations on the ground.

As a board we are awake to other opportunities both in our

sector and in different industries. Because we are a small, tightly

held company with a big shareholder base we are an attractive

vehicle for a new project. Nothing presented to the board has yet

been deemed good enough for shareholders.

John Teeling

Chairman

18(th) June 2019

PETREL RESOURCES PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE FINANCIAL YEARED 31 DECEMBER 2018

2018 2017

EUR EUR

CONTINUING OPERATIONS

Administrative expenses (239,042) (297,381)

Impairment of investments - (4,094,804)

OPERATING LOSS (239,042) (4,392,185)

LOSS BEFORE TAXATION (239,042) (4,392,185)

Income tax expense - -

LOSS FOR THE FINANCIAL YEAR: all attributable to equity holders of the parent (239,042) (4,392,185)

Other comprehensive income - -

Items that are or may be reclassified subsequently to profit or loss - -

Exchange differences 95,741 (321,858)

TOTAL COMPREHENSIVE LOSS FOR THE FINANCIAL YEAR (143,301) (4,714,043)

Loss per share - basic and diluted (0.27c) (4.40c)

PETREL RESOURCES PLC

CONSOLIDATED BALANCE SHEET AS AT 31 DECEMBER 2018

2018 2017

EUR EUR

Assets

Non-Current Assets

Intangible assets 2,523,279 2,179,283

2,523,279 2,179,283

Current Assets

Trade and other receivables 58,016 27,573

Cash and cash equivalents 329,503 371,380

387,519 398,953

Total Assets 2,910,798 2,578,236

Current Liabilities

Trade and other payables (632,615) (584,693)

Net Current Liabilities (245,096) (185,740)

NET ASSETS 2,278,183 1,993,543

Equity

Called-up share capital 1,306,966 1,246,025

Capital conversion reserve fund 7,694 7,694

Capital redemption reserve 209,342 -

Share premium 21,601,057 21,416,085

Share based payment reserve 26,871 26,871

Translation reserve 495,202 399,461

Retained deficit (21,368,949) (21,102,593)

TOTAL EQUITY 2,278,183 1,993,543

PETREL RESOURCES PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE FINANCIAL YEARED 31 DECEMBER 2018

Capital Capital Share

Redemption Conversion Based

Share Share Reserve Reserve Payment Translation Retained

Capital Premium fund Reserve Reserve Deficit Total

EUR EUR EUR EUR EUR EUR EUR EUR

At 1 January

2017 1,246,025 21,416,085 - 7,694 26,871 721,319 (16,710,408) 6,707,586

Total

comprehensive

income for

the financial

year - - - - - (321,858) (4,392,185) (4,714,043)

---------- ----------- ----------- ----------- -------- ------------ ------------- ------------

At 31 December

2017 1,246,025 21,416,085 - 7,694 26,871 399,461 (21,102,593) 1,993,543

Shares issued 270,283 184,972 455,255

Share issue

expenses - - - - - (27,314) (27,314)

Shares

cancelled (209,342) - 209,342 - - - - -

Total

comprehensive

income for

the financial

year - - - - - 95,741 (239,042) (143,301)

---------- ----------- ----------- ----------- -------- ------------ ------------- ------------

At 31 December

2018 1,306,966 21,601,057 209,342 7,694 26,871 495,202 (21,368,949) 2,278,183

========== =========== =========== =========== ======== ============ ============= ============

Share premium

Share premium comprises of the excess of monies received in

respect of the issue of share capital over the nominal value of

shares issued.

Capital redemption reserve

On 25 July 2018 the shareholders approved the buy back and

cancellation of 16,747,368 shares for nominal consideration from

Amira Petroleum N.V., Amira International Holdings Limited and

their advisors. These shares were immediately cancelled upon their

repurchase and the cost of these shares were transferred into the

Capital redemption reserve.

Capital conversion reserve fund

The ordinary shares of the company were renominalised from

EUR0.0126774 each to EUR0.0125 each in 2001 and the amount by which

the issued share capital of the company was reduced was transferred

to the capital conversion reserve fund.

Share based payment reserve

The share based payment reserve represents share options granted

which are not yet exercised and issued as shares.

Translation Reserve

The translation reserve comprises of foreign exchange movement

on translation from US Dollars (functional currency) to Euro

(presentation currency).

Retained deficit

Retained deficit comprises accumulated losses in the current and

prior financial years.

PETREL RESOURCES PLC

CONSOLIDATED CASH FLOW STATEMENT

FOR THE FINANCIAL YEARED 31 DECEMBER 2018

2018 2017

EUR EUR

CASH FLOW FROM OPERATING ACTIVITIES

Loss for the financial year (239,042) (4,392,185)

Write of financial asset - 4,094,804

OPERATING CASHFLOW BEFORE

MOVEMENTS IN WORKING CAPITAL (239,042) (297,381)

Movements in working capital:

Increase in trade and other payables 2,922 129,799

Increase in trade and other receivables (30,443) (4,570)

CASH USED IN OPERATIONS (266,563) (172,152)

NET CASH USED IN OPERATING ACTIVITIES (266,563) (172,152)

INVESTING ACTIVITIES

Payments for exploration and evaluation assets (195,671) (259,161)

Funds on disposal of financial assets - 116,319

NET CASH USED IN INVESTING ACTIVITIES (195,671) (142,842)

FINANCING ACTIVITIES

Shares issued 455,255 -

Share issue expenses (27,314) -

NET CASH GENERATED FROM FINANCING ACTIVITIES 427,941 -

NET DECREASE IN CASH AND CASH EQUIVALENTS (34,293) (314,994)

Cash and cash equivalents at beginning of financial year 371,380 745,195

Effect of exchange rate changes on cash held in

foreign currencies (7,584) (58,821)

Cash and cash equivalents at end of financial year 329,503 371,380

NOTES:

1. ACCOUNTING POLICIES

There were no changes in accounting policies from those used to

prepare the Group's Annual Report for financial year ended 31

December 2017. The financial statements have been prepared in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the European Union.

2. LOSS PER SHARE

2018 2017

EUR EUR

Loss per share - basic and diluted (0.27c) (4.40c)

Basic loss per share

The earnings and weighted average number of ordinary shares used

in the calculation of basic loss per share are as follows:

2018 2017

EUR EUR

Loss for the financial year attributable to

equity holders (239,042) (4,392,185)

2018 2017

Number Number

Weighted average number of ordinary shares

for the

purpose of basic earnings per share 87,733,283 99,681,992

Basic and diluted loss per share are the same as the effect of

the outstanding share options is anti-dilutive.

3. GOING CONCERN

The Group and Company incurred a loss for the financial year of

EUR239,042 (2017: loss of EUR4,392,185) and had a retained earnings

deficit of EUR21,341,635 (2017 deficit of EUR21,102,593), at the

balance sheet date leading to doubt about the Group and Company's

ability to continue as a going concern.

Cashflow projections prepared by the directors indicate that the

funds available are sufficient to meet the obligations of the group

and company for at least 12 months from the date of approval of the

financial statements.

The Group and Company had a cash balance of EUR329,503 (2017:

EUR371,380) at the balance sheet date. Accordingly the directors

are satisfied that it is appropriate to continue to prepare the

financial statements of the Group and Company on the going concern

basis, as the group has sufficient cash resources that can be used

to develop exploration projects along with funding the day to day

running of the Group. The financial statements do not include any

adjustment to the carrying amount, or classification of assets and

liabilities, which would be required if the Group or Company was

unable to continue as a going concern.

4. FINANCIAL ASSET

2018 2017

Investment EUR EUR

At the beginning of the financial year - 4,211,123

Disposal - (116,319)

Impairment - (4,094,804)

At the end of the financial year - -

The Company's investment in financial assets, through its wholly

owned subsidiary Petrel Resources (TCI) Limited, consisted of a 20

per cent shareholding in Amira Hydrocarbons Wasit B.V.("Amira")

which was acquired from Amira Petroleum N.V. on 14 August 2013.

Amira is a special purpose vehicle which holds a 25 per cent

carried to production interest in an early stage oil opportunity in

the large, underexplored and underdeveloped province of Wasit.

The consideration for the acquisition included the issue of

18,947,368 shares in Petrel. The Initial Consideration Shares were

agreed to be locked-in until the date of spudding the first

conventional oil well in respect of Amira's interest in the Wasit

province but that, if the Spudding Date had not occurred by 19

August 2018, Petrel could, amongst other things, elect to

re-acquire the Initial Consideration Shares for a nominal amount.

As part of the agreement with Amira Petroleum, 2.8 million of the

Initial Consideration Shares were, at the direction of Amira

Petroleum, issued to its advisers in satisfaction of fees payable

by Amira Petroleum and were subject to a lock in agreement as

detailed above.

During December 2017, the Directors learnt that 2.2 million of

the Adviser Shares had been sold between March and July 2017,

notwithstanding the lock-in agreement. The parties reached a

settlement and agreed that the vendors of the 2.2 million Adviser

Shares make a payment of GBP100,000 to the Company which has been

received pre year end (representing approximately 4.5p per Adviser

Share sold).

The Spudding Date did not occur. Accordingly, the directors

decided to write off the investment in Amira Hydrocarbons Wasit

B.V. and an impairment charge of EUR4,094,804 was recorded in 2017.

No further shares were issued to Amira and the 16,747,368 shares

already issued were re-acquired for nominal consideration on 25

July 2018 after shareholder approval and the shares were

immediately cancelled.

5. INTANGIBLE ASSETS

Exploration and evaluation assets: 2018 2017

EUR EUR

Cost:

Opening balance 2,179,283 2,138,159

Additions 240,67 304,159

Exchange translation adjustment 103,325 (263,035)

Closing balance 2,523,279 2,179,283

Segmental Analysis 2018 2017

EUR EUR

Ghana 911,631 843,988

Ireland 1,611,648 1,335,295

2,523,279 2,179,283

Exploration and evaluation assets at 31 December 2018 represent

exploration and related expenditure in respect of projects in

Ireland and Ghana. The directors are aware that by its nature there

is an inherent uncertainty in relation to the recoverability of

amounts capitalised on the exploration projects.

Relating to the remaining exploration and evaluation assets at

the financial year end, the directors believe there were no facts

or circumstances indicating that the carrying value of the

intangible assets may exceed their recoverable amount and thus no

impairment review was deemed necessary by the directors. The

realisation of these intangible assets is dependent on the

successful discovery and development of economic reserves and is

subject to a number of significant potential risks, as set out

below:

The Group's exploration activities are subject to a number of

significant and potential risks including:

-- Licence obligations;

-- Funding requirements;

-- Political and legal risks, including title to licence, profit sharing and taxation;

-- Geological and development risks;

-- Exchange rate risk;

-- Political risk; and

-- Financial risk management.

Directors' remuneration of EUR30,000 (2017: EUR30,000) and

salaries of EUR15,000 (2017: EUR15,000) were capitalised as

exploration and evaluation expenditure during the financial

year.

6. SHARE CAPITAL

2018 2017

EUR EUR

Authorised:

200,000,000 ordinary shares of EUR0.0125 2,500,000 2,500,000

Allotted, called-up and fully

paid:

Number Share Share

Capital Premium

EUR EUR

At 1 January 2017 99,681,992 1,246,025 21,416,085

Issued during the financial - - -

year

At 31 December 2017 99,681,992 1,246,025 21,416,085

At 1 January 2018 99,681,992 1,246,025 21,416,085

Issued during the financial

year 21,622,622 270,283 184,972

Shares cancelled (16,747,368) (209,342) -

At 31 December 2018 104,557,246 1,306,966 21,601,057

Movements in share capital

On 25 July 2018 the company received shareholder approval for

the following transaction:

(i) the contract between Amira Petroleum N.V., Amira

International Holding Limited and the Company for the purchase of

16,147,368 ordinary shares of EUR0.0125 each in the capital of the

Company for nominal consideration; and

(ii) the contract between Hannam & Partners (Advisory) Group

Services Ltd and the Company for the purchase of 600,000 ordinary

shares of 0.0125 each in the capital of the Company for nominal

consideration.

The aggregate 16,747,368 ordinary shares of EUR0.0125 each were

immediately cancelled upon their repurchase by the Company.

The purchase consideration of GBP20 was funded by the issue of

1000 Ordinary shares of EUR0.0125 at 2p per share.

Further details are outlined in note 4 above.

On 11 October 2018 a total of 21,621,622 shares were placed at a

price of 1.85 pence per share. Proceeds were used to provide

additional working capital and fund development costs.

7. POST BALANCE SHEET EVENTS

There were no material post balance sheet events affecting the

company or group.

8. ANNUAL GENERAL MEETING

The Company's Annual General Meeting will be held on 24(th) July

2019 in the Gresham Hotel, 23 O'Connell Street Upper, Dublin 1 ,

D01 C3W7 at 10:30 am.

9. GENERAL INFORMATION

The financial information set out above does not constitute the

Company's financial statements for the year ended 31 December 2018.

The financial information for 2017 is derived from the financial

statements for 2017 which have been delivered to the Companies

Registration Office. The auditors have reported on 2017 statements;

their report was unqualified with an emphasis of matter in respect

of considering the adequacy of the disclosures made in the

financial statements concerning the valuation of intangible assets,

investment in subsidiaries and amounts due by group undertakings.

The financial statements for 2018 will be delivered to the

Companies Registration Office.

A copy of the Company's Annual Report and Accounts for 2018 will

be mailed shortly only to those shareholders who have elected to

receive it. Otherwise shareholders will be notified that the Annual

Report will be available on the website at www.petrelresources.com.

Copies of the Annual Report will also be available for collection

from the Company's registered office, 162 Clontarf Road, Dublin 3,

Ireland.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR GGUQUQUPBGAR

(END) Dow Jones Newswires

June 19, 2019 02:00 ET (06:00 GMT)

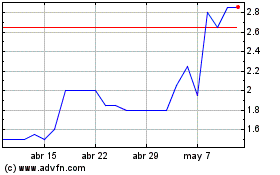

Petrel Resources (LSE:PET)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Petrel Resources (LSE:PET)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024