TIDMNTG

RNS Number : 2647D

Northgate PLC

25 June 2019

NORTHGATE PLC

PRELIMINARY RESULTS FOR THE 12 MONTHSED 30 APRIL 2019

Financial performance in line with guidance, continuing progress

in the delivery of operational and strategic initiatives across the

Group

Reported results

Year ended 30 April 2019 2018 Change

GBPm GBPm %

----------------------------------------- -------- -------- --------

Revenue - vehicle hire 517.6 471.2 +9.9%

Revenue - vehicle sales 227.8 230.5 (1.1%)

Total revenue 745.5 701.7 +6.2%

Operating Profit 75.5 64.1 +17.8%

Profit before Tax 60.4 52.7 +14.5%

Earnings per Share 38.6p 32.4p +19.1%

Dividend per Share 18.3p 17.7p +3.4%

Adjusted results

Year ended 30 April 2019 2018 Growth

GBPm GBPm %

----------------------------------------- -------- -------- --------

Rental profit 64.3 52.5 +22.6%

EBITDA 268.4 248.5 +8.0%

Underlying(1) Operating

Profit 76.2 68.3 +11.5%

Underlying(1) Profit before

Tax 61.1 57.0 +7.2%

Underlying(1) Earnings

per Share 38.7p 34.8p +11.2%

----------------------------------------- -------- -------- --------

Total net capex(1) (243.9) (311.0) +21.6%

Net Replacement Capex(1) (201.3) (185.9) (8.3%)

Growth Capex(1) (incl.

acquisition) (42.6) (125.1) +65.9%

EBITDA less Net Replacement

Capex 67.1 62.6 +7.3%

Free cash flow / (outflow) 20.4 (96.0)

Net Debt 436.9 439.3 +0.6%

Return on Capital Employed

% 7.7% 7.5% +20 bps

----------------------------------------- -------- -------- --------

Highlights:

-- Hire revenue growth(3) driven by double digit vehicles on hire (VOH(2) ) growth(3) ;

-- Rental profit of GBP64.3m grew(2) 22.6%, delivering a Group

rental margin of 12.4% (2018: 11.1%);

-- UK & Ireland rental margin of 7.8% grew steadily

throughout the year, reflecting the strong momentum from our

self-help agenda;

-- Rental margin in Spain increased significantly to 19.7%, as

we took steps to protect our strong market position in response to

increasing pricing competition in the market;

-- Group rental profit growth(3) benefit of GBP20.2m following

the depreciation rate changes effective 1 May 2018;

-- Underlying(1) profit before tax of GBP61.1m benefitted

GBP15.3m from the net impact of depreciation rate changes, offset

by the unwind of disposals;

-- Final dividend proposed of 12.1p per share (2018: 11.6p),

taking the total dividend payable for the year to 18.3p per share,

an increase of 3.4% (2018: 17.7p);

-- Free cash inflow of GBP20.4m benefitted from significantly

lower total net capex of GBP243.9m (2018: GBP311.0m) driven by

lower fleet growth and the fleet optimisation policy. Steady state

cash generation(5) remained strong at GBP67.1m (2018:

GBP62.6m);

-- Net debt of GBP436.9m gave year end leverage of 1.64x, within the 1.5 - 2.5x target range.

Outlook for FY 2020 and the medium-term(4)

The Group exited FY 2019 with good operational momentum and

clear execution plans to continue the delivery of profitable growth

and strong cash generation in the coming year. Guidance for FY 2020

is as follows:

-- Group rental revenue expected to grow(3) low to mid

single-digit %, driven by low single digit VOH(2) growth(3) in the

UK & Ireland, and low to mid single digit VOH(2) growth(3) in

Spain;

-- Group rental profit margin to be approximately 50 basis

points above FY 2019 rental margin of 12.4%;

-- Group disposal profits will remain broadly flat with FY 2019;

-- Total capex is expected to increase 15-20%, driven by growth capex.

In the medium-term(4) , the Group expects to deliver a rental

profit margin of at least 15%, supported by the substantial margin

opportunity ahead for the UK & Ireland, and a continued strong

margin in Spain.

Kevin Bradshaw, Chief Executive of Northgate, commented:

"We continue to make good progress executing our rental strategy

to address the compelling growth opportunity in our markets.

"In the UK, our self-help turnaround programme is delivering. We

have successfully introduced regular price increases during the

year, and applied greater commercial focus to increase the

efficiency of our operations. We turned a pricing corner in the

second half of the year with our average hire rates returning to

year-on-year growth after a three-year period of decline. Combined

with our VOH(2) growth(3) driven by selective expansion of our

minimum-term product, we delivered both rental income and average

VOH growth(3) of 11.3% in 2019. Our disposal channel has also

performed well, achieving firm sales prices for the vehicles we

sell.

"In Spain we continue to leverage the strength of our flexible

hire business to provide a comprehensive range of fleet hire

solutions to our customers. We are pursuing minimum-term growth

opportunities with increasing selectivity as we take steps to

protect the strong and attractive returns of the business against

increasing price competition in the market. Lower disposal profits

primarily reflect lower disposal volumes driven by the transition

to longer holding periods following the previously announced

strategic decision to increase the ageing of our fleet.

"Steady state cash generation for the Group remains strong, and

has enabled us to increase the dividend and fund attractive

minimum-term growth opportunities. Our progressive dividend

reflects the confidence of the Board in the future prospects of the

Group. Through continued performance improvement in our core rental

business and extending our penetration into complementary services

to broaden the fleet solutions we provide, I am confident that our

strategy will deliver our medium-term objectives of further

profitable growth, strong cash generation and attractive returns

for shareholders.

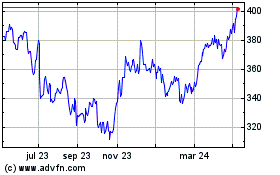

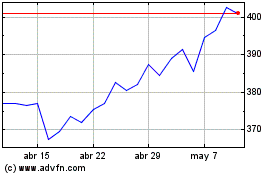

"We are disappointed with the share price performance and remain

focussed on addressing the undervaluation of the Group. The search

for our new Chairman is well advanced with an exceptionally strong

shortlist. The Board and management look forward to working

alongside a new Chair appointment to maximise value for

shareholders".

(1) Refer to GAAP reconciliation and Glossary of terms note

(2) Vehicles on Hire is average unless otherwise stated

(3) Growth is year-on-year unless otherwise stated

(4) Medium-term is 3-5 years

(5) Steady state cash generation is EBITDA less net replacement

capex

GAAP reconciliation and glossary of terms

Throughout this document we refer to underlying results and

measures; the underlying measures allow management and other

stakeholders to better compare the performance of the Group between

the current and prior period without the effects of one-off or

non-operational items. Underlying measures exclude certain one-off

items such as those arising from restructuring activities and

recurring non-operational items. Specifically we refer to disposal

profit. This is a non-GAAP measure used to describe the adjustment

in depreciation charge made in the year for vehicles sold at an

amount different to their net book value at the date of sale (net

of attributable selling costs).

A reconciliation of GAAP to Non-GAAP underlying measures and a

glossary of terms used in this document are outlined below the

financial review.

Next Results

Northgate will provide a First Quarter Trading Update on the day

of its Annual General Meeting on 23 September 2019.

Contact details

There will be a presentation for investors and analysts at 9.00

a.m. today at Numis, 5(th) Floor, London Stock Exchange Building,

10 Paternoster Square, London EC4M 7LT. If you have not already

registered to attend, please contact MHP Communications on the

number below.

A live webcast of this presentation will be available via a link

on the Company's web-site www.northgateplc.com

There will also be a listen-only dial-in facility on +44 (0)330

336 9411, confirmation code 6599335.

For further information please contact:

Northgate plc +44 (0)118 207 3535

Kirsty Law, Investor Relations +44 (0)7808 212 964

MHP

Andrew Jaques, Simon Hockridge,

Ollie Hoare +44 (0)203 128 8771

Notes to Editors:

Northgate plc is the leading light commercial vehicle hire

business in the UK, Spain and Ireland by fleet size and has been

operating in the sector since 1981.

Northgate's core business is the hire of light commercial

vehicles to businesses on a flexible or minimum-term basis, giving

customers the ability to manage their fleet requirements in a way

which can adapt best to changing business needs.

Further information regarding Northgate plc can be found on the

Company's website www.northgateplc.com

CHIEF EXECUTIVE REVIEW

MARKET AND OPPORTUNITIES

There are approximately 8 million Light Commercial Vehicles

(LCVs) on the roads in Northgate's two territories. The rental and

term hire segments present the greatest opportunities for future

growth within the LCV sector, driven by the major structural shift

in the market from vehicle ownership to 'usership'.

Customers are increasingly attracted to a rental proposition

that avoids the high initial capital outlay of vehicle ownership

and brings them certainty of future cash outflows. In addition, the

benefit of third party vehicle supply and management delivers lower

total ownership costs to customers versus direct ownership.

Northgate is evolving its fleet solutions to offer customers a

comprehensive range of complementary services including fleet

management, telematics and accident management. This evolution

increases the attractiveness of LCV rental solutions to our

customers, and in return will allow Northgate to participate in the

higher returns these technology-led services offer.

GROUP PERFORMANCE

During 2019 we continued to strengthen the Group's foundations

and execute on our strategy to deliver long-term sustainable growth

in revenues, profits and shareholder returns.

Total revenues grew 6.2% to GBP745.5m (2018: GBP701.7m) driven

by our selective penetration into the rental markets through our

attractive minimum-term proposition. Group statutory operating

profit of GBP75.5m grew 17.8%, with underlying operating profit

growth of 11.5% to GBP76.2m (2018: GBP68.3m), driven by growth in

rental profits partially offset by lower disposal profits

reflecting the transition to longer vehicle holding periods

following implementation of the fleet optimisation policy.

Operating profit growth included a net GBP15.3m benefit following

the changes to depreciation rates at the start of the year, being a

GBP20.2m benefit in rental profit offset by a GBP4.9m unwind

through disposal profits. Underlying earnings per share grew 11.2%

to 38.7p (2018: 34.8p), with the net benefit of the depreciation

changes representing 9.7p of the earnings per share increase.

Statutory earning per share of 38.6p increased from 32.4p in the

prior year.

Free cash flow improvement was delivered from growth in the

business and significantly lower total capex, reflecting lower

growth in our fleet alongside the benefits of our fleet

optimisation policy. Steady state cash generation(1) grew 7.3% to

GBP67.1m, reflecting improved cash generation from our rental

operations alongside investment in attractive minimum-term growth

opportunities. Year end net debt of GBP436.9m is flat versus the

prior year, giving leverage of 1.64x at the year end, within our

target range of 1.5 - 2.5x.

ROCE in FY 2019 improved 20 bps to 7.7%, reflecting the

strategic progress made during the year and was impacted by reduced

disposal profits following the transition to a more aged fleet, by

strong minimum-term growth in VOH(2) , and from capital employed

increasing ahead of the profit from those growth vehicles.

For the year ended 30 April 2019, we are proposing a final

dividend of 12.1p (2018: 11.6p) which, together with the interim

dividend of 6.2p (2018: 6.1p), gives a full year dividend of 18.3p

(2018:17.7p), an increase of 0.6p or 3.4% on 2018. If approved by

Shareholders, the final dividend will be paid on 27 September 2019

to Shareholders on the register on 16 August 2019. The proposed

dividend increase reflects the strong performance of FY 2019 and

the Board's confidence in the strategy initiatives in place to

deliver increasing profits and distributions to shareholders going

forward.

Our capital management framework remains consistent, delivering

attractive returns to shareholders via our progressive dividend

policy whilst maintaining a dividend cover of 2.0x - 3.0x. We

continue to invest in the business and explore core bolt-ons,

supported by established facilities and free cash flow. All of this

done whilst maintaining balance sheet leverage within our stated

range of 1.5x - 2.5x.

(1) Defined as EBITDA less Net replacement capex. Steady state

cash generation is stated before cash flows for interest, taxation

and other financing costs.

(2) Vehicles on Hire is average unless otherwise stated

FOUR PART STRATEGY

Northgate exists to provide expert, easy and responsible vehicle

rental. Behind this purpose are four principal market objectives

through which we will leverage our strong market positions and

competitive advantages to deliver strong growth and attractive

returns:

1. Defend and grow our share of flexible rental markets;

2. Selectively gain share in minimum-term markets;

3. Broaden our provision of capital-light fleet solutions;

4. Optimise and increase participation in the disposals market.

The strategy above has evolved to include the broadening of

Northgate's provision of fleet solutions through the development of

capital-light services in attractive and complementary markets.

Northgate already provides a number of complementary services in

the wider B2B vehicle rental landscape such as fleet and accident

management solutions, and we expect to grow our participation in

these attractive areas to support and drive future growth in our

core business operations.

Delivery of the above market objectives draws on Northgate's

many competitive strengths, which include:

-- Our strong brand, reputation and relationships in the LCV market;

-- The breadth and depth of our operational experience and expertise;

-- Our strong coverage capability in both territories, we offer

national coverage capability as well as a presence in local markets

through our nation-wide network of rental depots, service workshops

and sales;

-- Our purchasing scale and strong relationships with vehicle manufacturers;

-- Our strong balance sheet and cashflows and our disciplined approach to capital deployment.

Management of the vehicle fleet

In the prior year we made the decision to increase vehicle

holding periods in all territories, to give a more efficient

capital base and drive stronger cash returns and higher ROCE. The

transition to this fleet optimisation policy continued during this

year, which led to a lower number of vehicle sales with a

corresponding reduction in replacement vehicles purchased.

Consequently, the revenue and profits from disposals, capex, and

net debt levels were all lower than they would have been under the

previous policy whilst the fleet was transitioning to this older

ageing.

Attractive growth in minimum-term

Average VOH(1) growth in the year was driven by growth in our

minimum-term product across both our markets, this will provide

increasing visibility of our rental revenue and earnings. We have

applied increased selectivity to minimum-term growth as the year

progressed, seeing good opportunities for attractive growth in the

UK & Ireland, and strong benefits of providing a bundled fleet

solution to our customers in Spain.

GROUP OUTLOOK AND GUIDANCE

We have done much work in the past year to further strengthen

the foundations of the Group. We have a clear strategy to grow our

revenues, profits and returns, supported by clear execution plans.

We will continue to enhance our capabilities and leverage our

competitive advantages, to deliver the growth opportunities

identified.

We expect Group revenue from vehicle hire to grow(2) by low to

mid single digit % in FY 2020, driven by low single digit VOH(1)

growth(2) in the UK & Ireland, and low to mid single digit

VOH(1) growth(2) in Spain.

The Group rental profit margin is expected to increase by

approximately 50 basis points in FY 2020, driven by VOH(1) growth

and the opportunity for rental margin expansion in the UK &

Ireland, together with our efforts to protect our strong market

position in Spain through selective VOH(1) growth.

-- In the UK & Ireland, despite uncertainty in the market

driven by Brexit, we remain confident in the strength of our

proposition and our ability to win business. Rental revenues will

continue to be supported by our established price discipline, and

we expect operational efficiency improvements driven by our

self-help agenda and the application of technology, to support a

growing rental profit margin in FY 2020 and beyond.

-- In Spain, whilst the market is increasingly competitive,

particularly from a pricing perspective, we have a strategy in

place to protect our strong market position and to continue to

deliver attractive returns. This will be delivered through

selective VOH(1) growth, further market segmentation, a continued

focus on innovating our operating model and customer propositions,

and the execution of a cost management programme.

Group disposal profits will remain broadly flat with FY 2019,

and will be adversely impacted by approximately GBP5m depreciation

unwind, offset by strong profit per unit.

Total net capex for the Group is expected to increase by 15% -

20% in FY 2020, driven by growth capex. Steady state cash

generation(3) is expected to grow in FY 2020, as ageing benefits

from fleet optimisation drive lower net replacement capex(4) . We

have flexibility in our balance sheet to enable us to finance our

growth plans, provide long-term returns to shareholders, and

safeguards the Group's financial position through economic cycles.

In the event of an economic downturn, our robust cash generation

will benefit from reduced new vehicle purchases. We will continue

to target a leverage range of 1.5 to 2.5 times net debt to

EBITDA.

In the medium-term(5) , the Group expects to deliver a rental

margin of at least 15%, supported by the substantial margin

opportunity ahead for the UK & Ireland, and by a continued

strong margin in Spain in the context of a highly competitive

landscape. I am confident we will continue to progress and deliver

improved performance for the benefit of all our shareholders.

(1) Vehicles on Hire is average unless otherwise stated

(2) Growth is year-on-year unless otherwise stated

(3) Defined as EBITDA less Net replacement capex. Steady state

cash generation is stated before cash flows for interest, taxation

and other financing costs.

(4) Net replacement capex is total capex less growth capex.

(5) Medium-term is 3-5 years.

People

As announced previously, Fernando Cogollos Ubeda will retire

from his role as the General Manager of Northgate Spain in August

2019 and upon retirement is expected to join the main Board of

Northgate plc as a Non-Executive Director.

Jorge Alarcon will join Northgate as the new General Manager in

Northgate Spain effective 22 August 2019. Jorge is a proven and

strong leader who brings with him a wealth of experience of the

industrials and services markets in Spain. Jorge joins us from GAM

where he has held the position of Managing Director since July

2016.

Impact of the UK leaving the European Union

The Company has undertaken a thorough review of the potential

impact on its business of the UK leaving the European Union. The

greatest risks identified would be a disruption to the supply of

new vehicles and vehicle components imported into the UK from the

EU, including additional import costs which may be imposed:

-- Around 90% of vehicles purchased by Northgate UK from UK OEMs

are imported from the EU, valued at approximately GBP220 million

per annum. Assurances have been sought from these OEMs, who are

confident that there will be no material long-term disruption. Any

potential short-term supply disruption can also be mitigated by

Northgate itself, by slowing the rate of vehicle de-fleets in order

to maintain vehicle availability for customers.

-- Components for vehicles manufactured in the UK are also

imported from the EU. However, normal OEM stock levels are

considered to be sufficient to address any potential short-term

supply issues.

-- The introduction of import costs could potentially create

some margin pressure in the short-term. However, the Company

believes that in the longer-term, it will be able to pass through

to end-users any significant additional costs that might be imposed

on imported vehicles.

A potential upside for Northgate in the event of supply

disruptions or higher purchase costs, would be the likely increase

in rental demand and stronger residual values that would

result.

Less than 5% of Northgate's UK employees do not possess a UK

passport, so any change to the status of EU citizens in the UK will

not have a material effect on the company's operations.

No material impacts on Northgate's business in Ireland have been

identified.

OUR 2019 PERFORMANCE

UK & Ireland

Year ended 30 April 2019 2018 Change

KPI ('000) ('000) %

--------------------------- ------- ------- --------

Average VOH 48.4 43.5 +11.3%

Closing VOH 47.1 45.5 +3.4%

Vehicles purchased (incl.

acquired) 15.7 23.4 (32.9%)

Vehicles sold 21.0 21.0 -

Profit per Unit (PPU)

GBP 512 457 +12.0%

Closing fleet size (incl.

acquired) 54.6 56.7 (3.7%)

Average utilisation % 88% 87% +1 ppt

Average fleet age at

year-end (mo.) 21 21 -

--------------------------- ------- ------- --------

Year ended 30 April 2019 2018 Change

PROFIT & LOSS (Underlying) GBPm GBPm %

---------------------------- ------ ------ ----------

Revenue - Vehicle hire 315.6 283.5 +11.3%

Revenue - Vehicle sales 166.5 156.9 +6.1%

Total Revenue 482.0 440.5 +9.4%

Rental profit 24.6 23.5 +4.8%

Rental Margin % 7.8% 8.3% (0.5 ppt)

Disposals profit 10.8 9.6 +12.0%

Operating profit 35.4 33.1 +6.9%

ROCE % 6.4% 6.4% -

---------------------------- ------ ------ ----------

Rental business

Rental revenue in the UK & Ireland in 2019 increased by

11.3% over the prior year to GBP315.6m (2018: GBP283.5m), driven by

average VOH growth of 11.3%. Following the return to growth of

year-on-year VOH in late 2018, momentum has remained strong

throughout 2019, resulting in VOH of 47,100 at the end of the year,

3.4% higher than the prior year.

This strength in UK & Ireland rental revenues was driven by

successful execution of the rental strategy, supported by the

self-help actions identified through our strategic review. Lead

generation from our marketing function has increased substantially

during the year, particularly from our telesales capabilities and

new digital marketing programme. In addition, Northgate

successfully integrated 1,600 ex-TOM vehicles into VOH(1) during

the first quarter of 2019.

Price rises introduced to certain flexible hire products at the

beginning of the year paved the way for further regular rate

increases across our full range of rental products. These price

adjustments have been very well planned, communicated and executed,

and we have not seen an apparent adverse customer churn resulting

from these changes. Year-on-year average hire rates returned to

growth in the final quarter of the year, following a more proactive

approach to managing revenues during the year. We are confident we

will be able to continue to reflect the structural cost increases

faced by the business through regular adjustments to our hire rates

going forward.

At the year end, Northgate's compelling minimum-term proposition

accounted for around 24% of average VOH, compared to 11% at the

start of the year. The average term of these contracts is

approximately three years, representing a significant improvement

in the visibility of rental revenue and earnings, as well as lower

transactional costs.

The 2019 UK & Ireland rental margin benefitted by

approximately GBP4.8m from the changes in depreciation rates

introduced on 1 May 2018. The rental margin has delivered

sequential improvement for the past three half year periods,

increasing from 6.0% in H2 2018, to 7.1% in H1 2019 and 8.5% in H2

2019. This improvement reflects the more competitive pricing

introduced to the market as well as the execution of our strategic

priorities. The overall 2019 rental margin of 7.8% decreased by 0.5

ppts versus the prior year.

The net impact of the higher VOH(1) and lower rental margins was

a 4.8% increase in UK & Ireland rental profits to GBP24.6m

(2018: GBP23.5m).

(1) Vehicles on Hire is average unless otherwise stated

Management of fleet and vehicle sales

The total UK & Ireland year end fleet size of 54,600

vehicles decreased from 56,700 in the prior year. 15,700 vehicles

were purchased during the year and approximately 17,800 vehicles

were de-fleeted, including 1,800 ex-TOM vehicles.

A total of 21,000 vehicles were sold in UK & Ireland during

the year, including third-party vehicles purchased for resale and

sales from stock. Our Van Monster operations achieved strong sales,

especially in the retail channel, in addition to robust residual

values in the market.

Disposal profits of GBP10.8m (FY 2018: GBP9.6m) increased 12.0%

over the prior year, driven by a c.12% increase in the average

profit per unit (PPU) on disposals to GBP512 (2018: GBP457).

Disposal profits were reduced by approximately GBP0.7m relating to

the unwind of the depreciation rate changes.

Operating profit and ROCE

Underlying operating profit of GBP35.4m grew 6.9% over the prior

year (2018: GBP33.1m) including a GBP4.1m net benefit from lower

depreciation and the associated unwind through disposal

profits.

The return on capital employed in the UK & Ireland was 6.4%

(2018: 6.4%) reflecting both the increase in operating profit and

the increase in capital employed resulting from attractive growth

in minimum-term VOH.

Capex and cashflow

Year ended 30 April 2019 2018 Change

GBPm GBPm %

-------------------------------- -------- -------- --------

EBITDA 151.8 135.8 11.8%

Net Replacement Capex (122.8) (105.4) (16.5%)

EBITDA less Net Replacement

Capex 29.0 30.4 (4.5%)

Growth Capex (incl. inorganic) (21.0) (53.1) (60.5%)

-------------------------------- -------- -------- --------

EBITDA increased by 11.8% to GBP151.8m (2018: GBP135.8m) due to

higher rental and disposal profits.

Net replacement capex(2) in the year was GBP122.8m, 16.5% higher

than in 2018, driven by OEM price inflation, strong VOH(1) growth

and expansion of our minimum-term product, offset by the benefit of

vehicle ageing.

EBITDA less net replacement capex(2) reduced by 4.5% in 2019 to

GBP29.0m (2018: GBP30.4 million) reflecting higher EBITDA more than

offsetting higher replacement capex in the year. Investment to grow

the fleet was GBP21.0m, including approximately GBP1.6m partial

cost of the TOM acquired vehicles.

(1) Vehicles on Hire is average unless otherwise stated

(2) Net replacement capex is total capex less growth capex.

Growth capex represents the cash consumed in order to grow the

fleet or the cash generated if the fleet size is reduced in periods

of contraction.

SPAIN

Year ended 30 April 2019 2018 Change

KPI ('000) ('000) %

----------------------- ------- ------- --------

Average VOH 44.8 40.3 +10.9%

Closing VOH 46.0 42.7 +7.5%

Vehicles purchased 13.9 18.9 (26.5%)

Vehicles sold 11.6 13.0 (10.8%)

PPU EUR 626 871 (28.1%)

Closing fleet size 51.1 48.0 +6.5%

Average utilisation % 91% 91% -

Average fleet age at

year-end (mo.) 20 19 1 mo.

----------------------- ------- ------- --------

Year ended 30 April 2019 2018 Change

PROFIT & LOSS (Underlying) GBPm GBPm %

---------------------------- ------ ------ ----------

Revenue - Vehicle hire 202.1 187.6 +7.7%

Revenue - Vehicle sales 61.4 73.5 (16.6%)

Total Revenue 263.4 261.2 +0.9%

Rental profit 39.7 29.0 +37.1%

Rental margin % 19.7% 15.4% +4.3 ppts

Disposals profit 6.4 10.0 (36.3%)

Operating Profit 46.1 39.0 +18.3%

ROCE % 10.7% 10.0% +70 bps

---------------------------- ------ ------ ----------

Rental business

Rental revenue in Spain grew 7.7% to GBP202.1m (2018: GBP187.6m)

driven by average VOH growth of 10.9% in FY 2019. At constant

exchange rates, removing the headwind of foreign exchange, the

reported growth in rental revenue was 7.9%.

Strong VOH(1) growth throughout the year was underpinned by

stable macro-economic conditions, strong growth in the Spanish

rental fleet and the continuing structural shift away from LCV

ownership to 'usership', most notably into minimum-term hire.

Northgate leveraged its leading position in the flexible rental

market to support ongoing expansion into minimum-term during the

year. Customers have welcomed Northgate's successful bundling of

minimum-term and flexible products and cross-selling achievements

have been strong.

VOH growth was also supported by ongoing vehicle diversification

of flexible hire vehicles allowing us to serve new markets, with

niche vehicles including refrigerated vehicles for food

distribution now representing c.1.5% of Northgate's fleet. In

addition, we have also increased our base of green vehicles in

response to increasing anti-pollution measures and trends in

sustainable mobility.

VOH(1) growth softened in the final quarter to 8.6%, principally

reflecting the strong VOH growth in the prior year. This led to

closing VOH of 46,000 at the end of the year, 7.5% higher

year-on-year. At the end of the year around 31% of average VOH were

being supplied on minimum-term contracts.

The 2019 rental margin of 19.7% (2018: 15.4%) increased

significantly year-on-year driven primarily by the 3% reduction in

depreciation rates in Spain, effective 1 May 2018. Rental profits

in 2019 grew 37.1% to GBP39.7m (2018: GBP29.0m) including a

GBP15.4m benefit from the changes in depreciation rates. Alongside

the depreciation benefit, the delivery of operational leverage and

efficiency improvements more than offset the impacts of vehicle

price inflation and the greater proportion of minimum-term

contracts. Vehicle utilisation in the year remained consistent with

the prior year at 91%.

Rental profits grew by 37.7% at constant exchange rates.

Management of fleet and vehicle sales

The total fleet size in Spain increased by 6.5% to 51,100

vehicles, driven by the strong growth in VOH during the year. This

net increase of 3,100 vehicles comprised 13,900 vehicles purchased

for the fleet less approximately 10,800 de-fleeted vehicles. The

average age of the fleet at the end of the year was around one

month higher than at the same time last year.

A total of 11,600 vehicles were sold in the Spain during the

year, 10.8% less than in the previous year. The average profit per

unit (PPU) on disposals in Spain fell by more than 28% to EUR626

(2018: EUR871), reflecting the impacts of the fleet optimisation

policy. As a result of the lower disposal volumes and PPU, profits

from vehicle sales fell by 36.3% to GBP6.4m (2018: GBP10.0m).

Operating profit and ROCE

The growth of rental profit of GBP10.7m was partially offset by

the GBP3.6m fall in disposal profits, with total operating profit

increasing by GBP7.1m (18.3%) to GBP46.1m (2018: GBP39.0m). At

constant currencies, operating profits in Spain grew 18.8%.

The return on capital employed in Spain was 10.7% (2018: 10.0%)

reflecting improved operating profit and the increase in capital

employed driven by the growth and mix of the fleet.

Capex and cashflow

Year ended 30 April 2019 2018 Change

CASHFLOW GBPm GBPm %

----------------------------- ------- ------- -------

EBITDA 115.1 109.4 +5.2%

Net Replacement Capex (78.5) (80.5) +2.5%

EBITDA less Net Replacement

Capex 36.6 28.9 +26.6%

Growth Capex (21.7) (72.0) +69.9%

----------------------------- ------- ------- -------

EBITDA increased by 5.2% to GBP115.1m (2018: GBP109.4m)

reflecting higher rental profits partially offset by lower disposal

profits.

Net replacement capex(2) in Spain in the year was GBP78.5m, 2.5%

lower than in 2018, mainly due to OEM price inflation, with growth

in minimum-term being offset by vehicle ageing. EBITDA less net

replacement capex grew by 26.6%, to GBP36.6m (2018: GBP28.9m),

reflecting the benefit of ageing. Growth capex was GBP21.7m,

GBP50.3m lower than the prior year due to lower growth in the

fleet.

Kevin Bradshaw, Chief Executive Officer

(1) Vehicles on Hire is average unless otherwise stated

(2) Net replacement capex is total capex less growth capex.

FINANCIAL REVIEW

Group summary

A summary of the Group's financial performance is as

follows:

Year ended 30 April 2019 2018 Change Change

GBPm GBPm GBPm %

----------------------------- ----- ------ ------ ------

Revenue 745.5 701.7 43.8 6.2%

Operating Profit 75.5 64.1 11.4 17.8%

Profit before tax 60.4 52.7 7.7 14.5%

EPS 38.6 32.4 6.2 19.1%

Underlying operating profit 76.2 68.3 7.9 11.5%

Underlying profit before tax 61.1 57.0 4.1 7.2%

Underlying EPS 38.7p 34.8p 3.9p 11.2%

Dividend per share 18.3p 17.7p 0.6p 3.4%

Underlying free cash flow 63.1 29.1 34.0 116.9%

----------------------------- ----- ------ ------ ------

Revenue

Group revenue increased by 6.2% to GBP745.5m, 6.4% at constant

exchange rates.

Group revenue comprised:

Year ended 30 April 2019 2018 Change Change

GBPm GBPm GBPm %

-------------------- ----- ----- ------ ------

Vehicle hire 517.6 471.2 46.4 9.9%

Vehicle sales 227.8 230.5 (2.7) (1.1%)

-------------------- ----- ----- ------ ------

Vehicle hire revenue grew to GBP517.6m from GBP471.2m in 2018,

mainly driven by the 11.1% increase in Group average VOH.

Group vehicle sales revenue declined by 1.1% reflecting vehicle

ageing due to the fleet optimisation strategy and slowing of the

disposals cycle. This decline was partly offset by Group-wide sales

channel optimisation in particular by improved retail penetration

in the UK & Ireland resulting higher average proceeds per

vehicle.

Underlying operating profit

Underlying Group operating profit increased 11.5% (11.7% at

constant exchange rates) to GBP76.2m and is stated before certain

intangible amortisation (GBP0.7m).

Underlying Group operating profit comprised:

2019 2018 Change Change

Year ended 30 April GBPm GBPm GBPm %

-------------------- ----- ----- ------ -------

Rental profit 64.3 52.5 11.8 22.6%

Disposals profit 17.1 19.6 (2.5) (12.6%)

Corporate costs (5.3) (3.7) (1.6) (41.6%)

Total 76.2 68.3 7.9 11.6%

-------------------- ----- ----- ------ -------

Group vehicle rental profit increased GBP11.8m including the

impact of depreciation rate changes and reflecting strong VOH

growth in the UK & Ireland and Spain.

The reduction in Group disposals profits resulted primarily from

fewer vehicle sales (-GBP1.0m) and the impact of previous changes

to depreciation rates (-GBP4.9m). This was partially offset by

other impacts including sales channel optimisation and the impact

of vehicle ageing (+GBP3.4m)

Underlying corporate costs increased to GBP5.3m (2018: GBP3.7m)

with 2018 benefiting from certain one-off reversals in costs.

Depreciation rate changes

The accounting requirements to adjust depreciation rates due to

changes in expectations of future residual values of used vehicles

make it more difficult to identify the underlying profit trends in

the business. When a vehicle is acquired it is recognised as a

fixed asset at its cost net of any discount or rebate receivable.

The cost is then depreciated evenly over its rental life, matching

its pattern of usage.

Matching of future market values to net book value on the

disposal date requires significant judgement for the following key

reasons:

1. Used vehicle prices are subject to short term volatility

which makes it challenging to estimate future residual values;

2. The exact disposal age is not known at the point at which

rates are set and therefore the book value at disposal date is not

certain; and

3. Mileage and condition are the key factors in influencing the

market value of a vehicle. This can vary significantly through a

vehicle's life depending upon how the vehicle is used.

Inevitably, a difference arises between the net book value of a

vehicle and its market value at the date of disposal. Where

differences arising are within an acceptable range these are

adjusted against depreciation. Where these differences are outside

of the range Northgate changes the depreciation rate estimate to

better reflect the pattern of usage of the vehicle.

The impact of previous rate changes on 2019 operating profit,

and the estimated impact on future years of the previous changes,

is set out below:

Cumulative

impact Year on year impact

--------------- ---------- -----------------------

UK &

Group Group Ireland Spain

Year: GBPm GBPm GBPm GBPm

--------------- ---------- ------ -------- -----

30 April 2013 5.3 5.3 5.3 -

30 April 2014 4.3 (1.0) (1.0) -

30 April 2015 15.7 11.4 8.4 3.0

30 April 2016 12.0 (3.7) (5.9) 2.2

30 April 2017 6.3 (5.7) (4.1) (1.6)

30 April 2018 2.1 (4.2) (2.7) (1.5)

30 April 2019 17.4 15.3 4.1 11.2

30 April 2020* 12.0 (5.4) (1.4) (4.0)

30 April 2021* 6.6 (5.4) (1.4) (4.0)

30 April 2022* 1.2 (5.4) (1.4) (4.0)

30 April 2023* - (1.2) - (1.2)

*These are management estimates based on indicative fleet size

and assuming an equalised level of defleeting in each year.

Interest

Net underlying finance charges for the year increased by 33.0%

to GBP15.1m (2018: GBP11.3m) as a result of higher net debt. The

net cash interest charge for the year was GBP14.1m (2018: GBP10.7m)

as a result of higher borrowings. Non-cash interest was GBP1.0m

(2018: GBP0.6m).

Underlying profit before tax

Underlying profit before tax was GBP61.1m (GBP61.3m at constant

exchange rates), GBP4.1m higher than in 2018 (2018: GBP57.0m).

Taxation

The Group's underlying tax charge was GBP9.5m (2018: GBP10.7m)

and the underlying effective tax rate was 16% (2018: 19%). The

statutory effective tax rate was 15% (2018: 18%).

Earnings per share

Underlying EPS was 38.7p compared to 34.8p in the prior year.

Statutory earnings per share was 38.6p compared to 32.4p in the

prior year.

Underlying earnings for the purpose of calculating EPS were

GBP51.6m (2018: GBP46.4m). The weighted average number of shares

for the purposes of calculating EPS was 133.2m, in line with the

prior year.

Exceptional items

During the year there were no exceptional costs incurred (2018:

GBP2.5m).

Dividend and capital allocation

The Group's dividend policy is to ensure that the underlying

basic earnings per share will cover the total annual dividend

within a range of 2.0× to 3.0×.

Subject to approval, the final dividend proposed of 12.1p per

share (2018: 11.6p) will be paid on 27 September 2019 to

shareholders on the register as at close of business on 16 August

2019.

Including the interim dividend paid of 6.2p (2018: 6.1p), the

total dividend relating to the year would be 18.3p (2018: 17.7p).

The dividend is covered 2.1× by underlying earnings, in line with

stated policy.

The Group's objective is to build shareholder value by

generating returns above the cost of capital. Capital will be

allocated within the business in accordance with the framework

outlined below, with the first priority being to allocate capital

to support the Group's growth ambitions:

1. Core business: maximise profitability and capital efficiency, organic growth opportunities

2. Dividend: maintain progressive dividend policy

3. Growth: Core bolt-ons, capital light opportunities, diversification into service solutions.

The Group plans to maintain a balance sheet within a target

leverage range of 1.5× to 2.5× net debt to EBITDA, and during

periods of significant growth net debt would be expected to be

towards the higher end of this range. This is consistent with the

Group's objective of maintaining a balance sheet that is efficient

in terms of providing long term returns to shareholders and

safeguards the Group's financial position through economic

cycles.

Cash flow

A summary of the Group's cash is as follows:

Year ended 30 April 2019 2018

GBPm GBPm

--------------------------------------- ------- -------

Underlying operational cash generation 283.2 240.5

Net capital expenditure (243.9) (311.0)

Net taxation and interest payments (15.7) (22.2)

Share purchases and refinancing costs (3.2) (3.3)

Free cash flow 20.4 (96.0)

--------------------------------------- ------- -------

Dividends (23.4) (23.4)

Net cash consumed (3.0) (119.4)

--------------------------------------- ------- -------

A total of GBP403.5m was invested in new vehicles compared to

GBP486.9m in the prior year. The Group's new vehicle capital

expenditure was partially funded by GBP174.5m generated from the

sale of used vehicles (2018: GBP186.9m). Other net capital

expenditure amounted to GBP14.9m (2018: GBP11.0m).

All vehicles required for the Group's operations are paid for in

cash upfront. The cash flow generation of the Group in any year is

therefore influenced by the capital expenditure to grow the

business or cash generated by adjusting the fleet size downwards if

VOH reduce. If the impact of increasing or reducing the fleet size

in the year is removed from net capital expenditure, the underlying

free cash generation of the Group was as follows:

Year ended 30 April 2019 2018

GBPm GBPm

-------------------------- ----- ------

Free cash flow 20.4 (96.0)

Add back: Growth capex 42.6 125.2

Underlying free cash flow 63.1 29.2

-------------------------- ----- ------

Net debt reconciles as follows:

Year ended 30 April 2019 2018

GBPm GBPm

--------------------- ----- -----

Opening net debt 439.3 309.9

Net cash consumed 3.0 119.4

Other non-cash items 0.6 (0.8)

Exchange differences (6.0) 10.8

Closing net debt 436.9 439.3

--------------------- ----- -----

Free cash inflow was GBP20.4m (2018: GBP96.0m outflow) after net

capital expenditure of GBP243.9m (2018 GBP311.0m). If the impact of

growth capex in the year is removed from net capital expenditure in

each year, the underlying free cash flow of the Group was GBP63.1m

(2018: GBP29.2m).

Net cash consumption was GBP3.0m (2018: GBP119.4m). After an

adverse exchange rate impact of GBP6.0m (2018: GBP10.8m

favourable), closing net debt was GBP436.9m (2018: GBP439.3m).

Borrowing facilities

As at 30 April 2019 the Group had GBP439m drawn against total

committed facilities of GBP604m, giving headroom of GBP165m, as

detailed below:

Facility Drawn Headroom Borrowing

GBPm GBPm GBPm Maturity Cost

----------------- -------- ----- -------- --------- ---------

UK bank facility 504 343 161 July 2021 2.6%

Loan notes 86 86 - Aug 2022 2.4%

Other loans 14 10 4 Nov 2019 1.0%

----------------- -------- ----- -------- --------- ---------

604 439 165 2.5%

----------------- -------- ----- -------- --------- ---------

The overall cost of borrowings at 30 April 2019 is 2.5% (2018:

2.3%).

The margin charged on bank debt is dependent upon the Group's

net debt to EBITDA ratio, ranging from a minimum of 1.5% to a

maximum of 3%. The net debt to EBITDA ratio at 30 April 2019

corresponds to a margin of 2% (2018: 2.25%).

Interest rate swap contracts have been taken out which fix a

proportion of bank debt at 2.6% (2018: 2.4%) giving an overall cost

of borrowings (gross of cash balances) at 30 April 2019 of 2.6%

(2018: 2.3%).

During the year UK bank facilities were increased by GBP50m.

The other loans consist of GBP13.5m of local borrowings in Spain

and GBP0.5m of preference shares.

The split of borrowings (gross of cash balances and excluding

overdrafts) by currency is as follows:

2019 2018

----------------------------------------------- ---- ----

GBPm GBPm

Euro 297 328

Sterling 143 128

----------------------------------------------- ---- ----

Borrowings before unamortised arrangement fees 440 456

Unamortised arrangement fees (2) (3)

Borrowings (excluding cash and overdrafts) 438 453

----------------------------------------------- ---- ----

There are three financial covenants under the Group's facilities

as follows:

Threshold April 2019 Headroom April 2018

--------------- ---------- ---------- ---------------- ----------

Interest cover 3× 5.34× GBP33m (EBIT) 6.22×

GBP284m (Net

Loan to value 70% 43% debt) 43%

Debt leverage 2.75× 1.64× GBP108m (EBITDA) 1.76×

--------------- ---------- ---------- ---------------- ----------

Balance sheet

Net tangible assets at 30 April 2019 were GBP548.5m (2018:

GBP530.3m), equivalent to a net tangible asset value of 412p per

share (2018: 398p per share).

Gearing at 30 April 2019 was 79.6% (2018: 82.8%).

Return on capital employed was 7.7% (2018: 7.5%).

Treasury

The function of Group Treasury is to mitigate financial risk, to

ensure sufficient liquidity is available to meet foreseeable

requirements, to secure finance at minimum cost and to invest cash

assets securely and profitably. Treasury operations manage the

Group's funding, liquidity and exposure to interest rate risks

within a framework of policies and guidelines authorised by the

Board of Directors.

The Group uses derivative financial instruments for risk

management purposes only. Consistent with Group policy, Group

treasury does not engage in speculative activity and it is Group

policy to avoid using more complex financial instruments.

Credit risk

The policy followed in managing credit risk permits only minimal

exposures, with banks and other institutions meeting required

standards as assessed normally by reference to major credit

agencies. Group credit exposure for material deposits is limited to

banks which maintain an A rating. Individual aggregate credit

exposures are also limited accordingly.

Liquidity and funding

The Group has sufficient funding facilities to meet its normal

funding requirements in the medium term as discussed above.

Covenants attached to those facilities as outlined above are not

restrictive to the Group's operations.

Capital management

The Group's objective is to maintain a balance sheet structure

that is efficient in terms of providing long term returns to

shareholders and safeguards the Group's financial position through

economic cycles.

Operating subsidiaries are financed by a combination of retained

earnings and borrowings.

The Group can choose to adjust its capital structure by varying

the amount of dividends paid to shareholders, by issuing new shares

or by adjusting the level of capital expenditure.

Interest rate management

The Group's bank facilities and other loan agreements

incorporate variable interest rates. The Group seeks to manage the

risks associated with fluctuating interest rates by having in place

a number of financial instruments covering at least 50% of its

borrowings at any time. The proportion of gross borrowings hedged

into fixed rates was 68% at 30 April 2019 (2018: 73%).

Foreign exchange risk

The Group's reporting currency is, and 65% of its revenue is

generated in, Sterling (2018: 59%). The Group's principal currency

translation exposure is to the Euro, as the results of operations,

assets and liabilities of its Spanish and Irish businesses must be

translated into Sterling to produce the Group's consolidated

financial statements.

The average and year end exchange rates used to translate the

Group's overseas operations were as follows:

2019 2018

GBP : EUR GBP : EUR

--------- ---------- ----------

Average 1.14 1.13

Year end 1.16 1.14

--------- ---------- ----------

The Group manages its exposure to currency fluctuations on

retranslation of the balance sheets of those subsidiaries whose

functional currency is in Euros by maintaining a proportion of its

borrowings in the same currency. The exchange differences arising

on these borrowings have been recognised directly within equity

along with the exchange differences on retranslation of the net

assets of the Euro subsidiaries. At 30 April 2019 62% of Euro net

assets were hedged against Euro borrowings (2018: 71%).

Going concern

Having considered the Group's current trading, cash flow

generation and debt maturity including severe but plausible stress

testing scenarios, the Directors have concluded that it is

appropriate to prepare the Group financial statements on a going

concern basis.

Philip Vincent

Chief Financial Officer

Principal Risks and Uncertainties

Economic environment

The demand for our products and services could be affected by a

downturn in economic activity in the countries in which the Group

operates.

Economic activity in the territories we operate could be

adversely impacted by the UK decision to leave the EU.

The high level of operational gearing in our business model

means that changes in demand can lead to higher levels of

variability in profits.

An adverse change in macroeconomic conditions could also

increase the risk of customer failure and therefore incidences of

bad debts.

Flexibility is ingrained in the Group's business model and

allows any vehicles returned to be placed with different customers.

Alternatively, the group can generate cash and reduce debt by

reducing purchases and increasing vehicle disposals.

The Group is not materially exposed to a single customer sector

and no individual customer contributes more than 5% of total

revenue generated.

The Group's current hedging arrangements protect it from

material foreign exchange risks on retranslation of results.

Transactional FX exposure is minimised through sourcing supplies in

the same currency as revenue is generated.

The impact of the UK's decision to leave the EU is still

uncertain, as is the current Spanish political situation. However,

there have been no material impacts on the group to date.

Market risk

The markets in which the Group operates are fragmented with low

barriers to entry meaning that price competition is high.

There is a risk that the Group fails to attract and retain

customers based on pricing. This could either be because of

uncompetitive pricing or failing to communicate the inherent value

of our offering successfully.

There is also a risk that demand for our products could

materially diminish due to other structural or technical changes in

the market that are not responded to.

Competition influences how we create value for our customers and

investors, either by enhancing our service offering or investing in

pricing.

If our pricing is perceived to be higher than our competitors

for the same level of service, then we will lose market share or be

forced to reduce prices to remain competitive. Without any

adjustment to the cost base, this will result in lower returns.

Our pricing is based upon target levels of return, with discount

authority levels allowing flexibility to ensure that we remain

competitive on pricing.

Focus on margins will continue into the subsequent year, to

ensure returns are not eroded in the long-term.

We have continued to invest in marketing to ensure we

communicate the value proposition underpinning pricing.

Northgate continues to expand its service offering to maintain

its competitive advantage in the market.

Vehicle Holding Costs

The Group's profitability depends upon minimising vehicle

holding costs, which are affected by the pricing levels of new

vehicles purchased and the disposal value of vehicles sold.

An increase in holding costs, if not recovered through hire rate

increases or other operational efficiencies, would adversely affect

profitability, shareholder returns and cash generation.

Pricing is negotiated with manufacturers on an annual basis in

advance of purchases being made. We manage the number and mix of

suppliers and model variants, to optimise buying terms. We review

the holding period of vehicles continuously, to ensure we make

disposals at the optimal time in a vehicle's life cycle, so

ensuring we recycle capital in the most efficient way.

While the Group is exposed to fluctuations in the used vehicle

market, we seek to optimise the sales route for each vehicle.

Should the market experience a short-term decline in residual

values, we can age our existing fleet until the market

improves.

The employee environment

Inadequate maintenance of a working environment where

individuals do not receive appropriate training and support could

harm relationships with stakeholders.

Failure to attract, develop and retain individuals with the

appropriate skills will inhibit the successful delivery of our

strategy.

Failure to invest in our workforce and high levels of staff

turnover will impact upon customer service and delivery of the

Group's strategic objectives.

We compare salaries to the market and provide a range of

incentives to attract and retain staff. We conduct personal

development plans and tailored training for all employees.

Succession plans are in place for senior positions.

Regular communication and engagement with everyone across the

business is vital to our success.

Legal compliance

Failure to comply with laws and regulations would put the

reputation of the business at risk, both attracting fines and

penalties, and in maintaining good customer and supplier

relationships.

If our systems to monitor compliance are not adequate the Group

could be exposed to material fines and penalties.

Complying with Laws and regulations is ultimately the

responsibility of the Board. Management of compliance is delegated

to the relevant business unit leaders. Group Internal Audit

monitors and reports on non-compliance to the Board.

IT Systems

IT systems are integral to the Group's operations. Failure to

appropriately invest in the Group's systems appropriately, and the

security and continuity of systems, could result in loss of

commercial agility, loss or theft of sensitive data, and an

inability to effectively carry out the Group's business activities

effectively.

Failure of existing systems or a lack of investment in new

systems could inhibit the commercial agility of the business and

the efficient continuity of our operations.

Incorrectly handling sensitive data or unsuccessfully defending

against malicious cyber-attacks would cause significant

reputational harm and affect relationships with all stakeholders

negatively.

The UK business is currently undertaking a material systems

change, and has implemented an appropriate governance structure to

ensure the project is completed successfully.

The Group has an appropriate business continuity plan in the

event of disruption arising from an IT systems failure.

We make the appropriate level of investment in ensuring

sensitive data is held securely and is adequately protected from

cyber-attacks or other breaches.

Access to Capital

The group operates a capital-intensive business model and

requires sufficient access to capital in order to maintain and grow

the fleet.

As such, an inefficient capital cycle or failure to access or

service credit represents a significant risk to the delivery of

strategy and continuation of the business.

Failure to maintain or extend access to credit facilities could

impact on the Group's ability to deliver its strategic objectives

or continue as a going concern.

The Group's main facilities mature in 2021 and 2022 and the

Group believes that these facilities provide adequate resources for

present requirements.

The Group reports against covenants twice a year and monitors

cash flow forecasts continually, to ensure it complies with

covenants and there is headroom in the facilities.

GLOSSARY OF TERMS

The following defined terms have been used throughout this

document:

Term Definition

B2B Business to business

-------------------------------------------------------

Disposals profits This is a non-GAAP measure used to describe

the adjustment in the depreciation charge made

in the year for vehicles sold at an amount

different to their net book value at the date

of sale (net of attributable selling costs)

-------------------------------------------------------

EBIT Earnings before interest and taxation

-------------------------------------------------------

EBITDA Earnings before interest, taxation, depreciation

and amortisation

-------------------------------------------------------

EU European Union

-------------------------------------------------------

EPS Underlying basic earnings per share

-------------------------------------------------------

Facility headroom Calculated as facilities of GBP604m less net

borrowings of GBP439m. Net borrowings represent

net debt of GBP437m excluding unamortised arrangement

fees of GBP2m and are stated after the deduction

of GBP1m of net cash and overdraft balances

which are available to offset against borrowings

-------------------------------------------------------

FY 2018 The year ended 30 April 2018

-------------------------------------------------------

FY 2019 The year ended 30 April 2019

-------------------------------------------------------

GAAP Generally Accepted Accounting Practice: meaning

compliance with International Financial Reporting

Standards

-------------------------------------------------------

Gearing Calculated as net debt divided by net tangible

assets (as defined below)

-------------------------------------------------------

Growth Capex Growth capex represents the cash consumed in

order to grow the fleet or the cash generated

if the fleet size is reduced in periods of

contraction

-------------------------------------------------------

LCV Light commercial vehicle: the official term

used within the European Union for a commercial

carrier vehicle with a gross vehicle weight

of not more than 3.5 tonnes

-------------------------------------------------------

Net replacement Net capital expenditure other than that defined

capex as growth capex

-------------------------------------------------------

Net tangible assets Net assets less goodwill and other intangible

assets

-------------------------------------------------------

OEM Original Equipment Manufacturer: a reference

to our vehicle suppliers

-------------------------------------------------------

PPU Profit per unit/loss per unit - this is a non-GAAP

measure used to describe disposals profits

(as defined), divided by the number of vehicles

sold

-------------------------------------------------------

ROCE Underlying return on capital employed: calculated

as underlying operating profit (see non-GAAP

reconciliation) divided by average capital

employed

-------------------------------------------------------

Steady state cash EBITDA less net replacement capex

generation

-------------------------------------------------------

The Company Northgate plc

-------------------------------------------------------

The Group The Company and its subsidiaries

-------------------------------------------------------

GAAP Reconciliation

A reconciliation of GAAP to non-GAAP underlying measures is as

follows:

Group Group

2019 2018

GBP000 GBP000

-------------------------------- ------- -------

Operating profit 75,491 64,077

Add back:

Restructuring costs - 2,499

Certain intangible amortisation 709 1,767

Underlying operating profit 76,200 68,343

-------------------------------- ------- -------

Group Group

2019 2018

GBP000 GBP000

-------------------------------- ------- -------

Profit before tax 60,406 52,738

Add back:

Restructuring costs - 2,499

Certain intangible amortisation 709 1,767

Underlying profit before tax 61,115 57,004

-------------------------------- ------- -------

Group Group

2019 2018

GBP000 GBP000

------------------------------------------------ ----------- -----------

Profit for the year 51,418 43,232

Add back:

Restructuring costs - 2,499

Certain intangible amortisation 709 1,767

Tax on exceptional items and certain intangible

amortisation (545) (1,145)

------------------------------------------------ ----------- -----------

Underlying profit for the year 51,582 46,353

------------------------------------------------ ----------- -----------

Weighted average number of Ordinary shares 133,232,518 133,232,518

------------------------------------------------ ----------- -----------

Underlying basic earnings per share 38.7p 34.8p

------------------------------------------------ ----------- -----------

Group Group

2019 2018

GBP000 GBP000

----------------------------- --------- ---------

Operating profit 75,491 64,077

Add back:

Fleet depreciation 185,794 176,600

Other depreciation 5,522 5,585

Net impairment - (380)

Loss on disposal of assets 274 415

Intangible amortisation 1,366 2,171

----------------------------- --------- ---------

EBITDA 268,447 248,468

----------------------------- --------- ---------

Net replacement capex (201,304) (185,886)

Steady state cash generation 67,143 62,582

----------------------------- --------- ---------

UK&I Spain Corporate Group

2019 2019 2019 2019

GBP000 GBP000 GBP000 GBP000

-------------------------------------- -------- ------- --------- --------

Underlying operating profit (loss) 35,396 46,086 (5,282) 76,200

Exclude:

Adjustments to depreciation charge

in relation to vehicles sold in the

period (10,762) (6,374) - (17,136)

Corporate costs - - 5,282 5,282

Rental profit 24,634 39,712 - 64,346

Divided by: Revenue: hire of vehicles 315,559 202,065 - 517,624

-------------------------------------- -------- ------- --------- --------

Rental margin 7.8% 19.7% - 12.4%

-------------------------------------- -------- ------- --------- --------

UK&I Spain Corporate Group

2018 2018 2018 2018

GBP000 GBP000 GBP000 GBP000

-------------------------------------- ------- -------- --------- --------

Underlying operating profit (loss) 33,114 38,960 (3,731) 68,343

Exclude:

Adjustments to depreciation charge

in relation to vehicles sold in the

period (9,608) (10,002) - (19,610)

Corporate costs - - 3,731 3,731

Rental profit 23,506 28,958 - 52,464

Divided by: Revenue: hire of vehicles 283,543 187,644 - 471,187

-------------------------------------- ------- -------- --------- --------

Rental margin 8.3% 15.4% - 11.1%

-------------------------------------- ------- -------- --------- --------

Group Group

2019 2018

GBP000 GBP000

---------------------------------------------- -------- ---------

Net decrease in cash and cash equivalents (13,616) (5,507)

Add back:

Receipt of bank loans and other borrowings - (113,902)

Repayments of bank loans and other borrowings 10,651 -

---------------------------------------------- -------- ---------

Net cash generated (2,965) (119,409)

---------------------------------------------- -------- ---------

Add back: Dividends paid 23,431 23,365

---------------------------------------------- -------- ---------

Free cash flow 20,466 (96,044)

---------------------------------------------- -------- ---------

Add back: Growth capex 42,641 125,145

---------------------------------------------- -------- ---------

Underlying free cash flow 63,107 29,101

---------------------------------------------- -------- ---------

CONSOLIDATED INCOME STATEMENT

FOR THE YEARED 30 APRIL 2019

------------------------------------------------ ------------ ------------ ----------- -------------------

Underlying Statutory Underlying Statutory

2019 2019 2018 2018

Note GBP000 GBP000 GBP000 GBP000

------------------------------------------------ ---- ------------ ----------- ------------ -----------

Revenue: hire of vehicles 517,624 517,624 471,187 471,187

Revenue: sale of vehicles 227,846 227,846 230,485 230,485

------------------------------------------------ ---- ------------ ----------- ------------ -----------

Total revenue 1 745,470 745,470 701,672 701,672

Cost of sales (592,598) (592,598) (563,232) (563,232)

------------------------------------------------ ---- ------------ ----------- ------------ -----------

Gross profit 152,872 152,872 138,440 138,440

Administrative expenses (excluding exceptional

items and certain intangible amortisation) (76,672) (76,672) (70,097) (70,097)

Exceptional administrative expenses 6 - - - (2,499)

Certain intangible amortisation - (709) - (1,767)

------------------------------------------------ ---- ------------ ----------- ------------ -----------

Total administrative expenses (76,672) (77,381) (70,097) (74,363)

------------------------------------------------ ---- ------------ ----------- ------------ -----------

Operating profit 1 76,200 75,491 68,343 64,077

Interest income 39 39 1 1

Finance costs (15,124) (15,124) (11,340) (11,340)

Profit before taxation 61,115 60,406 57,004 52,738

Taxation (9,533) (8,988) (10,651) (9,506)

------------------------------------------------ ---- ------------ ----------- ------------ -----------

Profit for the year 51,582 51,418 46,353 43,232

------------------------------------------------ ---- ------------ ----------- ------------ -----------

Profit for the year is wholly attributable to owners of the

Parent Company. All results arise from continuing operations.

Underlying profit excludes exceptional items as set out in Note

6, as well as certain intangible amortisation and the taxation

thereon, in order to provide a better indication of the Group's

underlying business performance.

Earnings per share

Basic 238.7p 38.6p 34.8p 32.4p

------------------- ----- ----- ----- -----

Diluted 238.0p 37.8p 34.3p 32.0p

------------------- ----- ----- ----- -----

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 30 APRIL 2019

----------------------------------------------------------------------------------------- --------- --------

2019 2018

GBP000 GBP000

----------------------------------------------------------------------------------------- --------- --------

Amounts attributable to owners of the Parent Company

Profit attributable to the owners 51,418 43,232

Other comprehensive (expense) income

Foreign exchange differences on retranslation of net assets of subsidiary undertakings (9,366) 15,488

Net foreign exchange differences on long term borrowings held as hedges 5,687 (11,393)

Foreign exchange difference on revaluation reserve (23) 46

Net fair value gains on cash flow hedges 398 1,105

Deferred tax charge recognised directly in equity relating to cash flow hedges (76) (210)

Total other comprehensive (expense) income (3,380) 5,036

------------------------------------------------------------------------------------------ --------- --------

Total comprehensive income for the year 48,038 48,268

------------------------------------------------------------------------------------------ --------- --------

All items will subsequently be reclassified to the consolidated

income statement.

CONSOLIDATED BALANCE SHEET

AS AT 30 APRIL 2019

2019 2018

GBP000 GBP000

------------------------------------------------- --------- ----------

Non-current assets

Goodwill 3,589 3,589

Other intangible assets 11,495 5,205

Property, plant and equipment: vehicles for hire 900,335 897,323

Other property, plant and equipment 68,843 67,979

Total property, plant and equipment 969,178 965,302

--------------------------------------------------- --------- ----------

Deferred tax assets 6,620 10,791

--------------------------------------------------- --------- ----------

Total non-current assets 990,882 984,887

--------------------------------------------------- --------- ----------

Current assets

Inventories 29,826 31,828

Trade and other receivables 71,802 76,091

Current tax assets 116 4,745

Cash and bank balances 35,742 21,382

Total current assets 137,486 134,046

--------------------------------------------------- --------- ----------

Total assets 1,128,368 1,118,933

--------------------------------------------------- --------- ----------

Current liabilities

Trade and other payables 72,487 97,671

Derivative financial instrument liabilities 77 112

Current tax liabilities 13,425 15,246

Short term borrowings 44,190 17,952

--------------------------------------------------- --------- ----------

Total current liabilities 130,179 130,981

--------------------------------------------------- --------- ----------

Net current assets 7,307 3,065

--------------------------------------------------- --------- ----------

Non-current liabilities

Derivative financial instrument liabilities 914 1,277

Long term borrowings 428,409 442,751

Deferred tax liabilities 5,250 4,796

--------------------------------------------------- --------- ----------

Total non-current liabilities 434,573 448,824

--------------------------------------------------- --------- ----------

Total liabilities 564,752 579,805

--------------------------------------------------- --------- ----------

NET ASSETS 563,616 539,128

--------------------------------------------------- --------- ----------

Equity

Share capital 66,616 66,616

Share premium account 113,508 113,508

Own shares reserve (3,359) (3,238)

Hedging reserve (803) (1,125)

Translation reserve (4,825) (1,146)

Other reserves 68,637 68,660

Retained earnings 323,842 295,853

TOTAL EQUITY 563,616 539,128

--------------------------------------------------- --------- ----------

Total equity is wholly attributable to owners of the Parent

Company.

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEARED 30 APRIL 2019

-------------------------------------------------------- ------ -------- --------

2019 2018

Note GBP000 GBP000

Net cash generated from (used in) operations 4 38,528 (81,797)

-------------------------------------------------------- ------ -------- --------

Investing activities

Interest received 39 1

Proceeds from disposal of other property, plant and equipment 1,128 2,374

Purchases of other property, plant and equipment (8,370) (9,292)

Purchases of intangible assets (7,684) (4,073)

-------------------------------------------------------- ------ -------- --------

Net cash used in investing activities (14,887) (10,990)

-------------------------------------------------------- ------ -------- --------

Financing activities

Dividends paid (23,431) (23,365)

Receipts of bank loans and other borrowings - 113,902

Repayments of bank loans and other borrowings (10,651) -

Debt issue costs (1,737) -

Net payments to acquire own shares for share schemes (1,438) (3,257)

Net cash (used in) generated from financing activities (37,257) 87,280

-------------------------------------------------------- ------ -------- --------

Net decrease in cash and cash equivalents (13,616) (5,507)

Cash and cash equivalents at 1 May 14,127 19,637

Effect of foreign exchange movements 294 (3)

-------------------------------------------------------- ------ -------- --------

Cash and cash equivalents at 30 April 805 14,127

-------------------------------------------------------- ------ -------- --------

Cash and cash equivalents comprise:

Cash and bank balances 35,742 21,382

Bank overdrafts (34,937) (7,255)

------------------------------------- -------- -------

805 14,127

------------------------------------ -------- -------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 30 APRIL 2019

Share

capital

and share Own shares Hedging Translation Other Retained

premium reserve reserve reserve reserves earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------------------- ----------- ------------- --------- ------------ ---------- ---------- ---------

Total equity at 1

May 2017 180,124 (1,659) (2,020) (5,241) 68,614 276,799 516,617

Share options fair

value charge - - - - - 865 865

Share options exercised - - - - - (1,678) (1,678)

Profit attributable

to owners of the

Parent Company - - - - - 43,232 43,232

Dividends paid - - - - - (23,365) (23,365)

Net purchase of own

shares - (3,257) - - - - (3,257)

Transfer of shares

on vesting of share

options - 1,678 - - - - 1,678