TIDMCTEA

CATENAE INNOVATION PLC

("Catenae" or the "Company")

HALF YEARLY REPORT

Catenae Innovation Plc ("Catenae" or the "Company"), the AIM quoted

(AIM: CTEA) provider of digital media and technology, announces its half

yearly report for the six months ended 31 March 2019.

HIGHLIGHTS

-- OnSuite Proof of Concept agreements converted into Contracts

-- Sequestrum (Blockchain) product launched as both standalone product and

integrated into existing product ranges

-- Expansion to business sectors outside of Football, including Buildings

and Facilities Management, Charities and Rugby

-- Post period end, a Head of Sales appointed along side a lead generating

marketing partner

Tony Sanders, Chief Executive, said:

"The six months under review have seen further progress of the cost

reduction exercise combined with growth in the sales of the OnSuite

products (i.e. OnSite, OnGuard and OnSide). The Company is now in a

position where it is taking advantage of the existing product suite as

well as continuing to look at opportunities to expand into new sectors

and diversify its revenue streams."

This announcement contains inside information for the purposes of

Article 7 of EU Regulation 596/2014.

For further information:

Catenae Innovation Plc

Tony Sanders Tel: 020 7929 7826

Cairn Financial Advisers LLP, Nominated Adviser

Liam Murray / Jo Turner / Ludovico Lazzaretti

Tel: 020 7213 0880

Alexander David Securities Limited, Joint Broker

David Scott / James Dewhurst

Tel: 020 7448 9820

Turner Pope Investments Limited, Joint Broker

Andrew Thacker

Tel: 020 3621 4120

CHIEF EXECUTIVE'S STATEMENT

This period has seen further progress of the cost reduction exercise

combined with year-on-year growth in the sales for the same H1 period of

the OnSuite products (i.e. OnSite, OnGuard and OnSide). The team is now

in place to take the revenue generating sections of the business forward

to create positive value.

Contracts

In December 2018, STM Security UK Ltd signed a contract for OnGuard Plus

(OnGuard incorporating Sequestrum), which provides increased visibility

and proof of work for their man-guarding sector. This was followed in

January 2019 with the launch of OnSite (incorporating Sequestrum, the

Company's proprietary distributed ledger technology), an inspection and

auditing tool that utilises blockchain to provide immutable records and

proof of work for digital inspections. The first such contract was

signed in January 2019 with Firedoor Guardian Ltd for use in their fire

door inspection service. The value of this contract proved that the

market will pay for 'best in class' products.

As previously announced, we have also seen an increasing number of

contracts being signed following successful proof of concept agreements.

The Company has continued to target the football sector with its OnSide

product and has signed a number of contracts as well as continuing to

carry out proof of concept agreements with new clubs. In January 2019,

the first non-football proof of concept agreement for OnSide was signed

with the Harlequins Foundation the community arm of Harlequins Rugby,

taking the product into the Rugby sector, and post year-end agreed a

contract with a Charity organisation that has no link to football or

sport in general.

In addition, the Company has integrated Sequestrum, Catenae's

distributed ledger technology (blockchain), into its core product suite,

providing clients with the ability to store critical and regulatory

reports in an immutable form within the Sequestrum repository, providing

auditable proof of both the existence of the report as well as its

original content.

Sales Team

Post period end, in May 2019, the Board announced the appointment of a

Head of Sales. One of his first actions has been the appointment of a

leading marketing partner to engage targeted organisations focused upon

the core sectors for the OnSuite products. Although in its early stages,

we are already seeing an increase in pipeline activity and appointments

with potential new customers.

Trust in Media Joint Venture

As announceed on 26 March 2018, the Company entered into a Joint

Venture ("JV") with Martin Heath and that JV would trade as Trust in

Media Ltd. The board has now taken steps to place Trust in Media Ltd

into liquidation as that venture has not performed as expected. The

purpose of the JV was to produce payment processing, copyright and

intellectual property solutions, initially within the Media industry,

utilising a combination of private and public blockchain technologies

including Catenae's Sequestrum.

Funding

The Board has continued to review the expenditure of the business to

ensure that the appropriate resources are in place to allow the Company

to focus on marketing and selling the products that are now developed.

In addition, the Board has continued to manage the balance sheet with

net liabilities reduced to GBP399,980 (30 Sept 2018: GBP891,929).

During the period, the Company raised funds through the issue of shares

to support the development of the business. The Company raised

GBP995,000 cash and settled GBP95,055 of services through the issue of

shares. The Company continues to carefully manage its working capital

position and is currently considering a number of funding opportunities.

Further announcements will be made in due course.

Outlook

The board is also looking to further strengthen its capabilities and

expects to announce changes in due course.

The Company is now in a position where it is taking advantage of the

existing product suite and is seeing growth in terms of potential

pipeline and converted sales. The Company continues to look at

opportunities that enable it to expand its reach into new sectors and to

significantly increase its growth.

Tony Sanders

Chief Executive Officer

STATEMENT OF COMPREHENSIVE INCOME

Unaudited Unaudited Audited year

six months ended six months ended ended

31 March 31 March 30 Sept

2019 2018 2018

GBP GBP GBP

Revenue 68,857 10,372 157,218

Cost of sales - - -

----------------- ----------------- -------------

Gross profit 68,857 10,372 157,218

Administrative expenses (572,134) (562,451) (1,282,027)

(572,134) (562,451) (1,282,027)

----------------- ----------------- -------------

Loss from operations (503,277) (552,079) (1,124,809)

Net Finance income/(expense) 44 11 (2,460)

Loss before taxation (503,233) (552,068) (1,127,269)

Taxation credit - - 20,481

----------------- ----------------- -------------

Total comprehensive loss for the year (503,233) (552,068) (1,106,788)

================= ================= =============

Attributable to equity shareholders of

the parent (503,233) (552,068) (1,106,788)

================= ================= =============

Total basic and diluted loss per share (0.04) (0.05) (0.06)

There were no comprehensive income and expense items (2018: nil) other

than those reflected in the above income statement. All results relate

to continuing activities.

STATEMENT OF FINANCIAL POSITION

Unaudited Unaudited Audited

six months six months year

ended ended ended

31 March 31 March 30 Sept

2019 2018 2018

Note GBP GBP GBP

Non-current assets

Intangible assets 11 11 11

11 11 11

Current assets

Trade and other receivables 101,394 42,439 48,864

Cash and cash equivalents 319,146 125,846 49,105

------------ ------------ ------------

420,540 168,285 97,969

Current liabilities

Trade and other payables (651,530) (741,025) (674,247)

Interest-bearing loans (169,001) (158,300) (315,662)

------------ ------------ ------------

(820,531) (899,325) (989,909)

Net Liabilities (399,980) (731,029) (891,929)

------------ ------------ ------------

Capital and reserves attributable to equity holders

of the company

Share capital 4 3,173,601 1,925,435 2,078,601

Share premium account 17,068,371 18,124,709 16,999,644

Shares to be issued 18,700 50,000 187,245

Share reserve (83,333) (1,250,000) (83,333)

Merger reserve 11,119,585 11,119,585 11,119,585

Capital Redemption Reserve 2,732,904 2,732,904 2,732,904

Retained losses (34,429,808) (33,433,662) (33,926,575)

------------ ------------ ------------

Total Equity (399,980) (731,029) (891,929)

------------ ------------ ------------

STATEMENT OF CASH FLOWS

Unaudited Unaudited Audited

six months six months year

ended ended ended

31 March 2019 31 March 2018 30 Sept 2018

GBP GBP GBP

Loss for the period (503,233) (552,068) (1,106,788)

Adjustments for:

Net bank and other interest (income) / charges (44) 2,121 2,460

Issue of share options / warrant charge - 6,318 68,126

Services settled by the issue of shares 63,782 38,000 317,513

Net (loss) before changes in working capital (439,495) (505,629) (718,689)

(Increase) / decrease in trade and other

receivables (52,530) 34,699 28,272

(Decrease) / increase in trade and other

payables (22,720) (321,816) (411,961)

-------------- -------------- -------------

Cash from operations (514,745) (792,746) (1,102,378)

Interest received 44 11 15

Interest paid - - (2,475)

Net cash flows from operating activities (514,701) (792,735) (1,104,838)

-------------- -------------- -------------

Investing activities

Investment in joint venture - (10) (10)

-------------- -------------- -------------

Net cash flows from investing activities - (10) (10)

-------------- -------------- -------------

Financing Activities

Issue of ordinary share capital 931,403 305,000 381,500

Repayment of loan (210,842) (241,227) (375,090)

New loans raised 64,181 105,000 397,725

-------------- -------------- -------------

Net cash flows from financing activities 784,742 168,773 404,135

-------------- -------------- -------------

Net increase / (decrease) in cash 270,041 (623,972) (700,713)

Cash and cash equivalents at beginning of

period 49,105 749,818 749,818

Cash and cash equivalents at end of period 319,146 125,846 49,105

-------------- -------------- -------------

STATEMENT OF CHANGES IN EQUITY

Share Share Shares to Other Retained Total

Capital Premium be issued reserves losses Equity

GBP GBP GBP GBP GBP GBP

---------- ------------ ---------- ----------- ------------- ----------

Balance at

31 March

2018 1,925,435 18,124,709 50,000 12,602,489 (33,433,662) (731,029)

---------- ------------ ---------- ----------- ------------- ----------

Loss for

the

period - - - - (554,720) (554,720)

Conclusion

of

defaulting

shares

issue - (1,166,667) - 1,166,667 - -

Share issue

agreed in

advance - - 137,245 - - 137,245

Share

capital

issued 153,166 41,602 - - - 194,768

Share

options

charge - - - - 61,807 61,807

---------- ------------ ---------- ----------- ------------- ----------

Balance at

30 Sept

2018 2,078,601 16,999,644 187,245 13,769,156 (33,926,575) (891,929)

---------- ------------ ---------- ----------- ------------- ----------

Loss for

the

period - - - - (503,233) (503,233)

Share issue

agreed in

advance - - (168,545) - - (168,545)

Share

capital

issued 1,095,000 68,727 - - - 1,163,727

Share

options

charge - - - - - -

---------- ------------ ---------- ----------- ------------- ----------

Balance at

31 March

2019 3,173,601 17,068,371 18,700 13,769,156 (34,429,808) (399,980)

---------- ------------ ---------- ----------- ------------- ----------

NOTES TO THE HALF YEARLY REPORT

1. General information

The principal activity of Catenae Innovation Plc ("Catenae" or "the

Company") is the provision of digital media and technology.

Catenae is incorporated in the United Kingdom with registration number

4689130. Catenae is domiciled in the United Kingdom and has its

registered office at 27 Old Gloucester Street, London WC1N 3AX, and this

is its principal place of business for the Company is 199 Bishopsgate,

London

EC2M 3TY.

Catenae's shares are quoted on the AIM market of the London Stock

Exchange.

Catenae's financial statements are presented in Pounds Sterling (GBP).

This financial information has been approved for issue by the Board of

Directors on 27 June 2019.

2. Basis of preparation

The financial information in the half yearly report has been prepared

using the recognition and measurement principles of International

Accounting Standards, International Financial Reporting Standards and

Interpretations adopted for use in the European Union (collectively

Adopted IFRSs). The principal accounting policies used in preparing the

half yearly report are those the Company expects to apply in its

financial statements for the year ending 30 September 2019 and are

unchanged from those disclosed in the Directors' Report and financial

statements for the year ended 30 September 2018.

The financial information for the six months ended 31 March 2019 and the

six months ended 31 March 2018 is unaudited and does not constitute the

Company's statutory financial statements for those periods. The

comparative financial information for the full year ended 30 September

2018 has, however, been derived from the audited statutory financial

statements for that period. A copy of those statutory financial

statements has been delivered to the Registrar of Companies.

While the financial figures included in this half-yearly report have

been computed in accordance with IFRSs applicable to interim periods,

this half-yearly report does not contain sufficient information to

constitute an interim financial report as that term is defined in IAS

34.

Going concern

As stated in the accounts for the year to 30 September 2018, the future

business model of the Company is based around the generation of

sustainable revenues and profits through strategic partnerships and

internal projects. As described in the Chief Executive's statement,

progress has been and continues to be made to develop the Company's

activities and associated revenues. However, as also noted in the 30

September 2018 accounts, the Company needs to raise further funds from

the placing of shares or through other means, whilst the revenues and

profits from these solutions are fully developed.

During the period the Company has raised funds of GBP995,000 through the

issuing of shares for cash and settled GBP95,055 of services through the

issue of shares.

In line with the plans and projections prepared by the Board, the

Company's activities continue to build, however in accordance with those

plans, in the short term the Company needs to continue to raise funds

from a combination of trading and placement of shares to fund its

activities.

3. Loss per share

The calculation of the basic loss per share is based on the loss

attributable to ordinary shareholders divided by the average weighted

number of shares in issue during the period. The calculation of diluted

loss per share is based on the basic loss per share, adjusted to allow

for the issue of shares and the post tax effect of dividends and

interest, on the assumed conversion of all other dilutive options and

other potential ordinary shares.

There were 162,702,116 share options and 110,931,460 share warrants

outstanding at 31 March 2019 (2018: 163,213,116 and 385,098,130),

however the figures have not been adjusted to reflect conversion of

these share options as the effects would be anti-dilutive.

Weighted Weighted

Loss for 6 months to average Loss for 6 months to average

31 March 2019 number of Per share amount 31 March 2018 number of Per share amount

GBP shares (pence) GBP shares (pence)

(503,233) 1,321,073,786 (0.04) (552,068) 1,120,104,463 (0.05)

4. Share Capital

31 March 30 Sept

2019 2018

Number GBP Number GBP

Allotted, called up and

fully paid

Ordinary shares of 0.1p 3,173,601,652 3,173,601 2,078,601,652 2,078,601

3,173,601,652 3,173,601 2,078,601,652 2,078,601

------------- --------- ------------- ----------

On 7 November 2018, the Company issued 500,000,000 ordinary shares at a

price of 0.12 pence per share for a cash consideration of GBP524,945 and

for settlement of outstanding trade payables of GBP75,055.

On 5 March 2019, the Company issued 595,000,000 ordinary shares at a

price of 0.10 pence per share for a cash consideration of GBP575,000 and

for the settlement of outstanding trade payables of GBP20,000.

5. Availability of the Half Yearly Report

Copies of the half yearly report are available to shareholders on the

Company's website at www.catenaeinnovation.com and from the Company's

trading address: 199 Bishopsgate, London EC2M 3TY.

(END) Dow Jones Newswires

June 28, 2019 02:00 ET (06:00 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

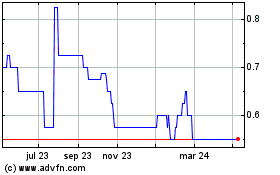

Catenae Innovation (LSE:CTEA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Catenae Innovation (LSE:CTEA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024