Plaza Centers N.V. PRE-SALE AGREEMENT FOR THE SALE OF CASA RADIO (4768E)

04 Julio 2019 - 1:18AM

UK Regulatory

TIDMPLAZ

RNS Number : 4768E

Plaza Centers N.V.

04 July 2019

July 4, 2019

PLAZA CENTERS N.V.

PRE-SALE AGREEMENT FOR THE SALE OF THE COMPANY'S INDIRECT

SHAREHOLDINGS IN THE DAMBOVITA CENTER PROJECT ("CASA RADIO")

Plaza Centers N.V. ("Plaza" or the "Company") announced today,

further to its announcements dated February 11, 2019 and June 14,

2019, that it has signed a pre-sale agreement (the "Agreement")

with AFI Europe N.V. (the "Purchaser", and together with the

Company, the "Parties"), an indirectly wholly-owned subsidiary of

Africa Israel Properties Ltd., an Israeli Company listed on TA-90

Index (the top 90 companies traded on the Tel Aviv Stock Exchange),

for the sale of its subsidiary (the "SPV") which holds 75% in the

Casa Radio Project (the "Project"), for a maximum consideration of

EUR 60 million, subject to the fulfilment of certain conditions

(the "Transaction").

Below are the principal changes made in the Agreement compared

to the non-binding Letter of Intent, as detailed in the Company

announcement dated February 11, 2019:

1. The Purchaser's due diligence review period was extended to

no later than September 5, 2019, following which, subject to the

satisfaction of the conditions precedent, the Parties will have 15

months to execute a share purchase agreement (the "SPA").

2. The payment schedule was changed as follows:

3.

Stage Payment Amount Comments

Down Payment EUR 200,000 The down payment is refundable

(upon satisfactory completion upon the occurrence of any

of due diligence) of the following (i) cancellation

of the PPP Agreement; (ii)

initiation of SPV's dissolution

due to negative equity requirements;

or (iii) the existence of

elements of criminal investigation

against the SPV beyond the

information disclosed to

the Purchaser as of this

date; or, if against the

SPV's directors or employees,

in case such elements would

trigger a significant impact

on the Project.

-------------------- --------------------------------------

Execution of the SPA EUR 20,000,000

-------------------- --------------------------------------

Issuance of Building EUR 22,000,000 "Phase 1" was defined as

Permit for Phase 1. the development of any of

the elements of Component

A under the PPP Agreement,

i.e., a shopping mall and/or

an office park, excluding

the development of the Public

Authority building.

-------------------- --------------------------------------

Obtaining of all permits The balance between The Purchase Price is defined

required for the operation the Purchase Price in the Agreement as Euro

of any of the components and the payments 60 million minus 75% of the

(buildings) of Phase made by that time SPV's liabilities computed

I, namely for the office (see above). based on the closing accounts

building or for the shopping (as defined in the Agreement)

mall, including the fire and excluding the inter-company

permit and the operation loan granted to the SPV;

permit. plus 75% of the SPV's available

cash and other current assets

as shown in the closing accounts

(as defined in the Agreement)

and minus, if applicable,

the amount agreed upon by

the Parties to be reduced

from the Purchase Price if

the 49-year lease period

shall commence before 2012.

-------------------- --------------------------------------

4. The conditions precedent for the consummation of the

Transaction were broadened to include also the receipt of the

Company's shareholders' and bondholders' approval for the

Transaction as well as no material adverse change, as defined in

the Agreement.

5. The Company undertook to indemnify the Purchaser against all

losses, charges, costs and expenses (including reasonable attorney

fees) which the Purchaser sustained or incurred by reason of breach

of the warranties set forth in the Agreement.

There can be no certainty that the SPA will eventually be

executed and/or that the Transaction will be consummated as

presented above or at all.

Ends

For further details, please contact:

Plaza

Avi Hakhamov, Executive Director +36 1 6104523

Forward-looking statements

This press release may contain forward-looking statements with

respect to the possibility of completing the Transaction with the

Purchaser. Such statements are based on current expectations,

estimates and projections of Plaza Centers N.V. and information

currently available to the company. Plaza Centers N.V. cautions

readers that such statements involve certain risks and

uncertainties that are difficult to predict and therefore it should

be understood that many factors can cause actual performance and

position to differ materially from these statements. Plaza Centers

N.V. has no obligation to update the statements contained in this

press release, unless required by law.

Notes to Editors

Plaza Centers N.V. (www.plazacenters.com) is listed on the Main

Board of the London Stock Exchange, as of 19 October 2007, on the

Warsaw Stock Exchange (LSE: "PLAZ", WSE: "PLZ/PLAZACNTR") and, on

the Tel Aviv Stock Exchange. Plaza Centers has been active in real

estate development in emerging markets for over 23 years.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DISLIFLRDSISIIA

(END) Dow Jones Newswires

July 04, 2019 02:18 ET (06:18 GMT)

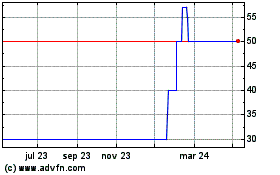

Plaza Centers N.v (LSE:PLAZ)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

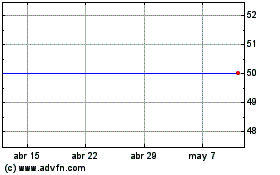

Plaza Centers N.v (LSE:PLAZ)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024