Portmeirion Group PLC Acquisition of Namb LC (4501F)

15 Julio 2019 - 1:00AM

UK Regulatory

TIDMPMP

RNS Number : 4501F

Portmeirion Group PLC

15 July 2019

15 July 2019

Portmeirion Group PLC

("Portmeirion" or the "Company")

Acquisition of Nambé LLC

Portmeirion Group PLC (AIM: PMP), the manufacturer and worldwide

distributor of high-quality homewares under the Portmeirion, Spode,

Royal Worcester, Pimpernel and Wax Lyrical brands, is pleased to

announce the acquisition of Nambé LLC ("Nambé"), a US based premium

homewares business.

Highlights

-- The Company has agreed to purchase Nambé, for a cash consideration of $12m.

-- Nambé is a premium, branded US homewares business with

reported sales of $18.0m and adjusted EBITDA of $1.1m in 2018.

-- The acquisition provides additional scale in the key US

market and the Board expects to achieve both sales and cost

synergies.

-- The acquisition is expected to be earnings enhancing in the first full year of ownership.

Information on Nambé

Nambé designs, sources, markets, and retails Nambé branded

products in homewares. Nambé was founded in 1951 and its range now

includes cutlery, glassware, dinnerware, kitchenware and home

décor. Nambé's sales are largely concentrated in the US through

wholesale channels, online and through eight retail stores across

New Mexico and Arizona.

Strategic Rationale for the Acquisition

The acquisition provides the Company with additional scale in

its key US market and strategically complements its existing US

subsidiary while continuing to diversify the company into new

homeware product categories. Portmeirion intends to leverage the

Nambé product ranges through its existing US sales channels and

global sales infrastructure. The Company also expects to benefit

from the expertise of Nambé's contemporary design consultants

across the Portmeirion brands and ranges. Further cost saving and

production synergies are also expected. The acquisition is expected

to be earnings enhancing in the first full financial year. The

Company is also delighted that Nambé's key management team will

continue in their roles and believe they will further strengthen

our existing US based team.

Summary Financials

In the year to 31 December 2018, Nambé recorded sales of $18.0m,

adjusted EBITDA of $1.1m, a reported loss before tax of $0.4m with

a normalised adjusted profit before tax of $0.6m. As at 31 December

2018, Nambé reported total assets of $12.9m and net liabilities of

$3.8m. The estimated net assets of the business at the date of

acquisition, on a debt free, cash free basis, are $9.6m. The

acquisition constitutes a substantial transaction pursuant to the

AIM Rules for Companies.

Bank Facilities

The Company has agreed to purchase 100 per cent of the issued

and outstanding membership interests of Nambé for a consideration

of $12m on a cash free, debt free basis. The acquisition will be

financed entirely through a new debt facility of GBP10m with Lloyds

Banking Group repayable over a five-year period. Additionally, the

Company has agreed terms to extend its existing overdraft by

GBP3m.

Lawrence Bryan, Chief Executive, said:

"Having been working with Nambé for nearly a year on potential

synergistic opportunities, we are delighted to acquire this

historic US brand together with a strong management team. Nambé is

synonymous with market leading design in homewares and we are

hugely excited to take the brand on the next part of its journey.

Portmeirion has a great track record of adding value through

acquiring quality brands that can then be leveraged through our

global sales infrastructure. We are looking forward to working with

the Nambé team on growing the business."

Dick Steele, Non-Executive Chairman, said:

"We are excited to have acquired Nambé, the acquisition is

highly complementary to our existing business and provides further

access to the key US market. We see the acquisition as an exciting

milestone for Portmeirion. The Board expects the acquisition to be

earnings enhancing in the first full year of consolidation through

top line growth along with sales and cost saving synergies."

The company will announce its interim results for the first half

of 2019 on 1 August.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014 (MAR).

ENQUIRIES:

Portmeirion Group PLC:

Dick Steele +44 (0) 1782 744 steele_clan@msn.com

721

Non-executive Chairman

Mike Raybould +44 (0) 1782 744 mraybould@portmeiriongroup.com

721

Group Finance Director

Hudson Sandler:

Dan de Belder +44 (0) 207 796 ddebelder@hudsonsandler.com

4133

Nick Moore nmoore@hudsonsandler.com

Oenone Potter opotter@hudsonsandler.com

Panmure Gordon

(Nominated Adviser and +44 (0) 207 886

Broker): 2500

Freddy Crossley / Joanna Corporate Finance

Langley

James Stearns Corporate Broking

Cantor Fitzgerald Europe

+44 (0) 207 894

(Joint Broker): 7000

Phil Davies / Rick Thompson Corporate Finance

Caspar Shand Kydd Sales

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQUUVARKRABAUR

(END) Dow Jones Newswires

July 15, 2019 02:00 ET (06:00 GMT)

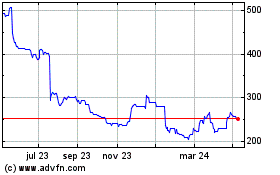

Portmeirion (LSE:PMP)

Gráfica de Acción Histórica

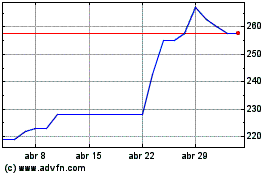

De Mar 2024 a Abr 2024

Portmeirion (LSE:PMP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024