TIDMNTBR

RNS Number : 4541F

Northern Bear Plc

15 July 2019

15 July 2019

Northern Bear PLC

("Northern Bear" or the "Company")

Preliminary results for the year ended 31 March 2019

The board of directors of Northern Bear (the "Board") is pleased

to announce its unaudited preliminary results for the year ended 31

March 2019.

Highlights

-- Revenue of GBP56.6m (2018: GBP53.6m)

-- Operating profit of GBP3.3m (2018: GBP2.8m)

-- Adjusted operating profit* of GBP3.2m (2018: GBP3.1m)

-- Basic earnings per share of 14.0p (2018: 10.9p)

-- Adjusted basic earnings per share* of 13.5p (2018: 12.5p)

-- Cash generated from operations of GBP5.1m (2018: GBP1.4m)

-- Net cash position at year end of GBP2.0m (2018: net bank debt of GBP0.8m)

-- Increase in proposed final dividend to 3.25p per share (2018: 3.0p)

-- Proposed special dividend of 0.75p per share (2018: 1.0p per share)

* stated prior to the impact of amortisation and other

acquisition related adjustments

Steve Roberts, Executive Chairman of Northern Bear,

commented:

"I am delighted to be reporting another strong set of results

for the year. We are hopeful of another good year despite ongoing

challenging market conditions and political uncertainty. "

For further information contact:

+44 (0) 166

Northern Bear PLC 182 0369

Steve Roberts - Executive Chairman +44 (0) 166

Tom Hayes - Finance Director 182 0369

Strand Hanson Limited (Nominated Adviser

and Broker)

James Harris

James Spinney +44 (0) 20 7409

James Bellman 3494

Chairman's Statement

Introduction

I am pleased to report the results for the year to 31 March 2019

for Northern Bear and its subsidiaries (together, the "Group").

The Group's companies have delivered another excellent set of

trading results, with turnover and earnings per share ahead of what

we had considered to be very strong prior year results.

Trading

The Group reported an outstanding set of results for the six

months ended 30 September 2018 ("H1 FY19") with particularly strong

trading in our Roofing and Specialist Building Services

divisions.

Trading was more mixed over the winter period and we released a

trading update in March 2019 stating that we expected operating

profit for the year (stated prior to amortisation and other

adjustments) to be broadly in line with the prior year. I am

pleased to say that, in fact, we had a strong finish to the year,

particularly in our Roofing division, where a number of contracts

completed in March. This has contributed to trading for the six

months to 31 March 2019 ("H2 FY19") being in line with trading for

the six months ended 31 March 2018. We are, hence, reporting

adjusted operating profit slightly ahead of our already very strong

prior year results.

We received a number of comments following our March 2019

trading update. As such, I thought it worthwhile to expand a little

on the fact that levels of profitability within the Group are very

difficult to predict.

Trading for the companies in our Group is impacted by seasonal,

cyclical, political and other factors, sometimes in an unexpected

manner. This means that like-for-like company results will vary on

a monthly, semi-annual, and annual basis. Having a portfolio of

eleven businesses does help balance, to some extent, this

variability in profits but it will always be a factor in our

overall performance in any given period.

By way of example, we had a very mild winter in 2018/19 and the

natural assumption would be that profitability in our divisions

should increase. Unfortunately, this is not always the case in our

business. Several clients insisted on longer than usual close-down

periods in December 2018 and January 2019. This had a significant

effect on the Roofing division in those months.

To further emphasise the point regarding the timing of

contracts, whilst continuing to have a strong order book across the

entire Group, we experienced a slow first quarter in the new

financial year due to a number of contract delays arising from

matters which were beyond our control. The majority of these

contracts have now commenced and trading should be much stronger in

the second quarter.

Roofing

Our Roofing division performed ahead of our expectations and of

prior year results, during the year and particularly in H2 FY19,

with a number of major contracts delivered. During the year we made

enforced major changes to our roofing supply base in order to

improve both consistency of supply and contract pricing. I am

pleased to say that there was a seamless transition, which

supported the excellent results for this division. It did, however,

have a negative impact on working capital, although cash generation

has remained strong.

Specialist Building Services

Our Specialist Building Services division traded ahead of prior

year results during H1 FY19, but behind prior year in H2 FY19.

Isoler Limited ("Isoler"), our fire protection business, has had

an exceptional year on the back of some significant contracts being

secured and generally increased industry activity levels. The

strong performance should continue into future years as this niche

sector remains buoyant.

By contrast H Peel & Sons Limited ("H Peel"), which we

acquired in July 2017, traded well in H1 FY19 but had a very

disappointing H2 FY19 with a number of contract delays and what we

perceive to be reduced industry activity impacted by uncertainty

over the Brexit process. We were aware that H Peel's results can

vary year to year and the acquisition was structured such that an

element of consideration was contingent on future trading.

Accordingly, GBP0.3m of the consideration due in July 2019 will not

be payable and has been adjusted via the Consolidated Statement of

Comprehensive Income.

We remain confident that H Peel is a high quality business and

expect that it will continue to make positive contributions to the

Group's results in future years.

Materials Handling

We have previously reported on the retirements of the original

Joint Managing Directors of A1 Industrial Trucks Limited ("A1").

Following a transitionary period with an interim appointment, we

appointed Stuart Dawson as Managing Director in December 2018. We

are pleased to report an improvement in profitability in H2 FY19

relative to the performance in H2 FY18.

Overall Trading

Overall turnover increased to GBP56.6 million (2018: GBP53.6

million) and gross profit increased to GBP11.9 million (2018:

GBP10.5 million). I am pleased to say that gross margin increased

to 21.1% from 19.6% in the prior year, due to sales mix, in

particular growth in higher margin specialist building works.

Administrative expenses increased to GBP8.7 million (2018:

GBP7.5 million). This was due to a number of factors, including

both increased activity levels and a full year's trading for H

Peel, which was acquired during the prior period.

The main factor impacting administrative expenses was

remuneration across our trading companies. All of our subsidiary

Managing Directors are paid via a combination of salary and bonus

payments. The bonus is payable based on a percentage of profits

achieved in excess of targets, set some years ago, which increase

annually. This was, and still is, intended to incentivise our key

people to be entrepreneurial and to grow their companies over time,

while providing some downside protection for the Group in the event

of a bad year. The higher trading levels at certain companies

within the Group, particularly in the Roofing division and at

Isoler, resulted in increased bonus payments relative to the prior

year. Total remuneration for main board directors was in line with

the prior year.

As in the prior year, we presented amortisation and certain

other adjustments separately within the Consolidated Statement of

Comprehensive Income, in addition to an adjusted earnings per share

calculation in the notes to the accounts, in order to provide an

indication of underlying trading performance.

Operating profit before amortisation and other adjustments was

GBP3.2 million (2018: GBP3.1 million). After taking these

adjustments into account, operating profit was GBP3.3 million

(2018: GBP2.8 million). This is largely due to the write-back of

deferred consideration, in the current year, and transaction costs

incurred in the prior year.

We have also presented adjusted earnings per share for the year,

the calculation for which is included later in this document.

Adjusted basic earnings per share was 13.5p (2018: 12.5p). Reported

basic earnings per share was 14.0p (2018: 10.9p).

Cash flow and bank facilities

The Group had a net cash position (defined as cash balances less

revolving credit facility) of GBP2.0 million at 31 March 2019

(2018: GBP0.8 million net bank debt). Cash generated from

operations during the year was GBP5.1 million (2018: GBP1.4

million).

As I reported in the interim results, it must be stressed that

while operating cash generation in the year was outstanding, this

represents a snapshot at a particular point in time and our net

cash/bank debt position can move by up to GBP1.5 million in a

matter of days, given the nature, size and variety of contracts

that we work on and the related working capital balances.

The lowest position during the period was GBP1.8 million net

bank debt, the highest was GBP2.0 million net cash, and the average

was GBP0.3 million net bank debt. Hence, the year end position

reflected some favourable working capital swings and to an extent

would be expected to reverse post year-end.

The Group's working capital requirements will continue to vary

depending on the ongoing customer and contract mix. I believe that

the Group's results, when considered over periods of more than one

year, have demonstrated a strong ratio of profit to operating cash

generation.

We retain a GBP3.5 million revolving credit facility and GBP1.0

million overdraft facility with Yorkshire Bank. These facilities

provide us with the flexibility to accommodate the above working

capital swings, as well as to support a wider range of options for

capital allocation and the ability to move quickly should a

suitable acquisition opportunity present itself.

Dividend policy

In view of the continued strong trading performance of the

Group, I am pleased to announce that the Board proposes the payment

of an increased final dividend of 3.25p per share (2018: 3.0p per

share) for the year ended 31 March 2019. This is subject to

shareholder approval at the Annual General Meeting to be held on 19

August 2019. If approved, it will be payable on 30 August 2019 to

shareholders on the register at 9 August 2019.

Due to the fact that financial performance in the year exceeded

prior year results, we have also decided to distribute funds which

are surplus to our strategic requirements. Accordingly, we are

announcing a proposed special dividend of 0.75p per share (2018:

1.0p per share), which is also subject to shareholder approval and

payable as above.

The Board will continue to assess the dividend levels and our

intention remains to adjust future dividends in line with the

Group's relative performance, after taking into account the Group's

available cash, working capital requirements, corporate

opportunities, debt obligations and the macro-economic environment

at the relevant time. However, I would point out that, having spent

many years of paying down bank debt, our flexible bank facilities

and in the absence of not using the cash for other strategic

purposes, we are well placed to continue with our policy of paying

dividends in years even in the event that profitability falls below

current and prior year levels.

We do not intend to pay further special dividends if trading

continues at current levels, and would only consider doing so

should profitability increase further.

Outlook

The Group continues to hold a high level of committed orders

although, as stated in the Trading section, we have limited short

term visibility as to when these orders will be realised.

Despite the slower first quarter referred to above, the medium

and longer term outlook for the financial year remain good and we

are hopeful of another strong set of full year results. We will

provide a further update on trading and outlook via the interim

report for the six months to September 2019.

Strategy

We continue to seek acquisitions of established specialist

building services businesses, either in the same or complementary

sectors to our current operations. Our main criteria are that a

business is well-established in its sector, has a consistent track

record of profitability and cash generation and has a strong

management team who are committed to remaining with the business.

Any potential acquisition would, in addition, need to be earnings

accretive and provide an acceptable return on investment.

We have recently engaged an advisor to support us in identifying

business owners looking to realise equity while securing the long

term future of the business and employees. This has resulted in a

significant improvement in the quality of our acquisition pipeline

as we have sought to avoid companies being sold via an auction

process. We will continue to exercise caution in this area and, as

with H Peel, any acquisitions will be structured to protect our

downside in the event that trading is below expectations.

People

We have recently included a news feed on our website, in order

to provide updates on operational progress that would not need to

be released via RNS. This would include details of ongoing projects

and any changes to subsidiary management teams. Succession planning

remains an ongoing focus for us and a programme of succession

planning is in place for all of our subsidiary businesses.

As always, our loyal, dedicated and skilled workforce is a key

part of our success and we make every effort to support them

through continued training and health and safety compliance.

Conclusion

I am delighted to be able to report another excellent set of

results and I would, once more, like to thank all our employees for

their hard work and contribution.

Steve Roberts

Executive Chairman

15 July 2019

Consolidated statement of comprehensive income

for the year ended 31 March 2019

2019 2018

GBP000 GBP000

Revenue 56,575 53,573

Cost of sales (44,659) (43,067)

--------- ---------

Gross profit 11,916 10,506

Other operating income 24 23

Administrative expenses (8,725) (7,459)

------------------------------------------------ --------- ---------

Operating profit (before amortisation

and other adjustments) 3,215 3,070

Transaction costs - (158)

Deferred consideration adjustments 265 -

Amortisation of intangible assets arising

on acquisitions (152) (102)

------------------------------------------------ --------- ---------

Operating profit 3,328 2,810

Finance costs (197) (213)

--------- ---------

Profit before income tax 3,131 2,597

Income tax expense (540) (613)

--------- ---------

Profit for the year 2,591 1,984

--------- ---------

Total comprehensive income attributable

to equity holders of the parent 2,591 1,984

========= =========

Earnings per share from continuing operations

Basic earnings per share 14.0p 10.9p

Diluted earnings per share 13.9p 10.8p

--------- ---------

Consolidated statement of changes in equity

for the year ended 31 March 2019

Share Capital Share Merger Retained Total

capital redemption premium reserve earnings equity

reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 April 2017 184 6 5,169 9,231 5,102 19,692

Total comprehensive income

for the year

Profit for the year - - - - 1,984 1,984

Transactions with owners,

recorded directly in equity

Issue of shares 5 - - - - 5

Exercise of share options - - - - 65 65

Equity dividends paid - - - - (742) (742)

Merger reserve arising on

acquisition - - - 374 - 374

At 31 March 2018 189 6 5,169 9,605 6,409 21,378

======== =========== ======== ======== ========= ========

At 1 April 2018 189 6 5,169 9,605 6,409 21,378

Total comprehensive income

for the year

Profit for the year - - - - 2,591 2,591

Transactions with owners,

recorded directly in equity

Exercise of share options - - - - 17 17

Equity dividends paid - - - - (740) (740)

At 31 March 2019 189 6 5,169 9,605 8,277 23,246

======== =========== ======== ======== ========= ========

Consolidated balance sheet

at 31 March 2019

2019 2018

GBP000 GBP000

Assets

Property, plant and equipment 3,033 3,050

Intangible assets 20,476 20,628

Trade and other receivables 1,057 -

Total non-current assets 24,566 23,678

-------- --------

Inventories 652 952

Trade and other receivables 8,450 9,833

Prepayments 259 265

Cash and cash equivalents 3,038 1,731

-------- --------

Total current assets 12,399 12,781

-------- --------

Total assets 36,965 36,459

======== ========

Equity

Share capital 189 189

Capital redemption reserve 6 6

Share premium 5,169 5,169

Merger reserve 9,605 9,605

Retained earnings 8,277 6,409

-------- --------

Total equity attributable to equity holders

of the Company 23,246 21,378

-------- --------

Liabilities

Loans and borrowings 1,236 2,672

Deferred consideration 217 510

Deferred tax liabilities 295 316

-------- --------

Total non-current liabilities 1,748 3,498

-------- --------

Loans and borrowings 232 227

Deferred consideration 97 425

Trade and other payables 11,152 10,333

Current tax payable 490 598

-------- --------

Total current liabilities 11,971 11,583

-------- --------

Total liabilities 13,719 15,081

-------- --------

Total equity and liabilities 36,965 36,459

======== ========

Consolidated statement of cash flows

for the year ended 31 March 2019

2019 2018

GBP000 GBP000

Cash flows from operating activities

Operating profit for the year 3,328 2,810

Adjustments for:

Depreciation 538 559

Amortisation 152 103

Loss/(profit) on sale of property, plant

and equipment 17 (7)

Deferred consideration adjustments (265) -

------- -------

3,770 3,465

Change in inventories 163 11

Change in trade and other receivables 326 (1,004)

Change in prepayments 6 33

Change in trade and other payables 819 (1,103)

------- -------

Cash generated from operations 5,084 1,402

Interest paid (127) (139)

Tax paid (669) (483)

------- -------

Net cash flow from operating activities 4,288 780

------- -------

Cash flows from investing activities

Proceeds from sale of property, plant

and equipment 518 186

Acquisition of property, plant and equipment (581) (569)

Acquisition of subsidiary (net of cash

acquired) (426) (866)

-------

Net cash from investing activities (489) (1,249)

------- -------

Cash flows from financing activities

(Repayment)/issue of borrowings (1,498) 511

Repayment of finance lease liabilities (271) (216)

Proceeds from the exercise of share options 17 64

Equity dividends paid (740) (742)

------- -------

Net cash from financing activities (2,492) (383)

------- -------

Net increase/(decrease) in cash and cash

equivalents 1,307 (852)

Cash and cash equivalents at start of

year 1,731 2,583

------- -------

Cash and cash equivalents at end of year 3,038 1,731

======= =======

Notes

1 Basis of preparation

This announcement has been prepared in accordance with the

Company's accounting policies, which in turn are in accordance with

International Financial Reporting Standards ("IFRS") as adopted by

the European Union ("EU") applied in accordance with the provisions

of the Companies Act 2006. IFRS is subject to amendment and

interpretation by the International Accounting Standards Board

("IASB") and the IFRS Interpretations Committee and there is an

on-going process of review and endorsement by the European

Commission. The accounting policies comply with each IFRS that is

mandatory for accounting periods ended 31 March 2019.

The following standards, amendments and interpretations, which

became effective for the first time, were adopted by the Group for

the accounting period ended 31 March 2019:

-- IFRS 15 Revenue from Contracts with Customers;

-- IFRS 9 Financial Instruments;

-- IAS 40 Investment Property: Amendment in relation to transfers of investment property;

-- IFRS 2 Share-based Payment: Amendment in relation to

classification and measurement of share-based payment

transactions;

-- IFRS 4 Insurance Contracts: Amendment in relation to applying

IFRS 9 Financial Instruments with IFRS 4 Insurance Contracts;

-- IFRIC 22 Foreign Currency Transactions and Advance Consideration; and

-- Annual Improvements to IFRSs (2014 - 2016 cycle in respect of IAS 1 and IAS 28).

The adoption of the above standards and interpretations has not

had a significant impact on the Group's results for the year or

equity.

For the purposes of their assessment of the appropriateness of

the preparation of the Group's accounts on a going concern basis,

the directors have considered the current cash position and

forecasts of future trading including working capital and

investment requirements. The Group's forecasts and projections,

taking account of reasonable possible changes in trading

performance, show that the Group and the Company should have

sufficient cash resources to meet its requirements for at least the

next 12 months. Accordingly, the adoption of the going concern

basis in preparing the financial statements remains

appropriate.

2 Status of financial information

The financial information set out above does not constitute the

Company's financial statements for the years ended 31 March 2019 or

31 March 2018.

The financial information for the year ended 31 March 2018 is

derived from the financial statements for that year, which have

been delivered to the Registrar of Companies. The auditor has

reported on the 2018 financial statements; their report was i)

unqualified, ii) did not include references to any matters to which

the auditors drew attention by way of emphasis, without qualifying

their report, and iii) did not contain a statement under section

498(2) or (3) of the Companies Act 2006.

The financial statements for 2019 will be finalised on the basis

of the financial information presented by the Directors in this

preliminary announcement and will be delivered to the Registrar of

Companies following the Company's Annual General Meeting. The

results are unaudited; however, we do not expect there to be any

difference between the numbers presented and those within the

annual report.

3 Earnings per share

Basic earnings per share is the profit or loss for the year

divided by the weighted average number of ordinary shares

outstanding, excluding those in treasury, calculated as

follows:

2019 2018

Profit for the year (GBP000) 2,591 1,984

Weighted average number of ordinary shares

excluding shares held in treasury for the proportion

of the year held in treasury ('000) 18,515 18,270

-------- --------

Basic earnings per share 14.0p 10.9p

The calculation of diluted earnings per share is the profit or

loss for the year divided by the weighted average number of

ordinary shares outstanding, after adjustment for the effects of

all potential dilutive ordinary shares, excluding those in

treasury, calculated as follows:

2019 2018

Profit for the year (GBP000) 2,591 1,984

-------- --------

Weighted average number of ordinary shares

excluding shares held in treasury for the proportion

of the year held in treasury ('000) 18,515 18,270

Effect of potential dilutive ordinary shares

('000) 63 113

-------- --------

Diluted weighted average number of ordinary

shares excluding shares held in treasury for

the proportion of the year held in treasury

('000) 18,577 18,383

-------- --------

Diluted earnings per share 13.9p 10.8p

-------- --------

The following additional earnings per share figures are

presented as the directors believe they provide a better

understanding of the trading performance of the Group.

Adjusted basic and diluted earnings per share is the profit for

the year, adjusted for acquisition related costs, divided by the

weighted average number of ordinary shares outstanding as presented

above.

Adjusted earnings per share is calculated as follows:

2019 2019

Profit for the year (GBP000) 2,591 1,984

Transaction costs - 158

Deferred consideration adjustments (265)

Amortisation of intangible assets arising on

acquisitions 152 102

Unwinding of discount on deferred consideration

liabilities 70 74

Corporation tax effect of above items (43) (30)

-------- --------

Adjusted profit for the year (GBP000) 2,505 2,288

Weighted average number of ordinary shares

excluding shares held in treasury for the proportion

of the year held in treasury ('000) 18,515 18,270

-------- --------

Adjusted basic earnings per share 13.5p 12.5p

Adjusted diluted earnings per share 13.5p 12.4p

-------- --------

4 Finance costs

2019 2018

GBP'000 GBP'000

On bank loans and overdrafts 106 128

Finance charges payable in respect of finance

leases and hire purchase contracts 21 11

Unwinding of discount on deferred consideration

liabilities 70 74

-------- --------

197 213

-------- --------

5 Trade and other receivables

2019 2018

GBP'000 GBP'000

Non-current assets

Contract retentions 1,057 -

Current assets

Trade receivables 7,094 6,878

Contract work in progress 277 994

Contract retentions 1,079 1,961

-------- --------

8,450 9,833

-------- --------

On application of IFRS 15 the Group has changed the presentation

of its consolidated balance sheet such that contract retentions due

in more than one year are shown in non-current assets. The amount

due in more than one year is presented on an undiscounted basis as

the impact of discounting is not considered to be material. The

Group has not restated the consolidated balance sheet at 31 March

2018 in this Report as there is no material impact on net

assets.

6 Loans and borrowings

2019 2018

GBP'000 GBP'000

Non-current liabilities

Secured bank loans 1,000 2,500

Finance lease liabilities 236 172

-------- --------

1,236 2,672

-------- --------

Current liabilities

Current portion of finance lease liabilities 214 211

Other loans 18 16

-------- --------

232 227

-------- --------

At 31 March 2019 a total of GBP1.0 million (2018: GBP2.5

million) was drawn down on the Group's revolving credit facility,

which is committed until 31 May 2020, providing a net cash figure

at 31 March 2019 of GBP2.0 million (2018: net bank debt of GBP0.8

million) after allowing for cash and cash equivalents of GBP3.0

million (2018: GBP1.7 million).

The Group also retains a GBP1 million overdraft facility for

working capital purposes. This facility was renewed on 31 May 2019

and is next due for routine review and renewal on 31 May 2020.

7 Availability of financial statements

The Group's Annual Report and Financial Statements for the year

ended 31 March 2019 are expected to be approved by 22 July 2019 and

will be posted to shareholders during the week commencing 22 July

2019. Further copies will be available to download on the Company's

website at: http://www.northernbearplc.com/. It is intended that

the Annual General Meeting will take place at the Company's

registered office, A1 Grainger, Prestwick Park, Prestwick,

Newcastle upon Tyne, NE20 9SJ, at 11:00am on 19 August 2019.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR BIGDRGXBBGCS

(END) Dow Jones Newswires

July 15, 2019 02:00 ET (06:00 GMT)

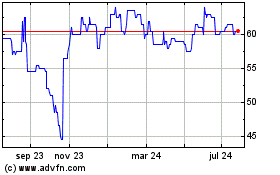

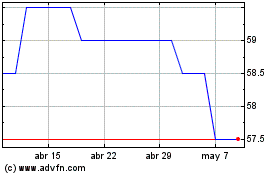

Northern Bear (LSE:NTBR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Northern Bear (LSE:NTBR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024