TIDMXLM

RNS Number : 6499F

XLMedia PLC

16 July 2019

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014.

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, DISTRIBUTION, PUBLICATION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO OR FROM

CANADA, AUSTRALIA, OR JAPAN OR ANY OTHER JURISDICTION WHERE TO DO

SO MIGHT CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS

OF SUCH JURISDICTION. PLEASE SEE THE IMPORTANT INFORMATION AT THE

OF THIS ANNOUNCEMENT.

FOR IMMEDIATE RELEASE

16 July 2019

XLMEDIA PLC

Tender Offer for up to 19,675,000 Ordinary Shares

Notice of extraordinary general meeting

TRADING UPDATE

XLMedia PLC ("XLMedia", the "Company" or the "Group") (AIM:

XLM), a leading provider of digital performance marketing, is today

posting a circular to its shareholders containing full details of a

proposed tender offer at 80 pence per Share and a notice of

Extraordinary General Meeting convened for 10.00 a.m. on 16 August

2019.

Unless otherwise stated, terms used in this announcement have

the same meanings as given to them in the Circular.

Summary

-- The Tender Price represents a premium of approximately 10 per

cent. to the mid-market price of a Share at the close of business

on 15 July 2019;

-- The Tender Offer will be restricted to 19,675,000 Shares,

representing approximately 9.51 per cent. of the Shares in issue

(excluding any Shares held in treasury) at the close of business on

15 July 2019;

-- Shareholders (other than Restricted Shareholders) will be

able to tender up to 9.51 per cent. of their holding (rounded down

to the nearest whole number of Shares) under the Basic Entitlement

of the Tender Offer;

-- Each Shareholder (other than Restricted Shareholders) will

also be able to tender Shares in excess of their Basic Entitlement,

but such excess tenders will only be satisfied on a pro rata basis

to the extent that other Shareholders tender less than (or none of)

their Basic Entitlement;

-- Successfully tendered Shares will be held in treasury by the

Company and the number of Shares in issue carrying voting rights

reduced accordingly;

-- The Tender Offer will open at 8.00 a.m. on 17 July 2019 and

will close at 1.00 p.m. on 14 August 2019;

-- The implementation of the Tender Offer is conditional upon

the passing of the Tender Offer Resolution at the General

Meeting;

-- On the date of this announcement, the existing buyback programme shall cease; and

-- While XLMedia has continued to implement its strategy of

focussing on higher margin publishing activities and growing its

finance business during the first half of 2019, the business has

remained stable and overall performance has been in line with the

Board's expectations.

Chris Bell, Non-executive Chairman of XLMedia, commented:

"The Board is of the opinion that the full potential of the

Company is not reflected in the current share price and this Tender

Offer accelerates our current share buyback programme, further

capitalising on our current share price."

This summary should be read in conjunction with the full text of

the Circular.

The Circular is expected to be posted to Shareholders and made

available on the Company's website www.xlmedia.com, later

today.

Trading update

XLMedia provides an update on trading for the six months ended

30 June 2019.

During the first half of 2019, the Group's business has remained

stable and overall performance has been in line with the Board's

expectations.

Pleasingly, the Company has seen a strong performance from its

personal finance publishing assets in North America and Canada,

which continue to gain momentum.

As anticipated, new gambling legislation in Sweden has had an

impact on revenues for many gambling operators; however, the Group

believes this to be a short-term issue with XLMedia's publishing

assets continuing to rank well in the region. Elsewhere, the

Company continues to invest in creating new publishing assets,

including in North America.

The Company has a positive material cash balance and generates

strong cash flows from operations. The Company's current cash

balance will support the proposed Tender Offer, ongoing organic

investment initiatives and current working capital commitments.

XLMedia remains a highly cash generative business and as such will

continue to maintain a progressive dividend policy, distributing at

least 50 per cent. of retained earnings.

The Company will publish its half year results for the six

months ended 30 June 2019 in September 2019.

Information on the Company

XLMedia is a performance marketing company operating a large

portfolio of informational and content rich websites globally. Its

websites act as a conduit to channel users to its clients, the

majority of which address two key products - gambling and personal

finance. The Group also uses in-house media buying capabilities

which it deploys to support its core publishing division.

The Group's publishing activities comprise of numerous

informational websites and mobile sites which attract millions of

users across numerous countries in their local language. These

sites attract paying users and direct them to online businesses in

return for performance-based payments, which are predominantly

based on revenue share and cost per acquisition.

The Company is currently focused on further building its

publishing business within the established gambling sector, as well

as growing its presence in the personal finance space, where the

Directors believe that there exists a significant market

opportunity in North America. In order to establish its footprint,

XLMedia has undertaken a number of acquisitions in this space, most

notably greedyrates.ca and moneyunder30.com, and the Directors

remain focused on broadening the Group's exposure to this growing

sector.

In addition, the Company is closely monitoring the US gambling

market, which continues to benefit from the potential introduction

of legislation and regulation across various States. XLMedia is now

actively investing in building and developing a more comprehensive

portfolio of publishing assets to support its entry into this

market alongside investigating potential strategic acquisitions. As

previously announced, in order to capitalise on this potential

market opportunity, the Company has committed to spend $7 million

over the next three years on targeting the US gambling market in

particular.

The Company is therefore focused on the following key growth

initiatives:

-- A strengthened focus on publishing activities as a core

profit driver with an emphasis on gambling and personal

finance;

-- Further expanding the Company's footprint in the nascent US

gambling sector, which offers significant growth potential; and

-- Ongoing investment in technology whilst continuing to

evaluate selective earnings accretive acquisitions.

Update on share buyback programme

On 18 December 2018, the Board announced a $10 million share

buyback programme for the Company's Shares. As part of its broader

strategy to deliver shareholder value, coupled with the recent

weakness in the Company's share price, the Board concluded that it

was an opportune moment to undertake such an initiative, alongside

maintaining its progressive dividend policy. At the Company's

Annual general Meeting on 29 May 2019, authority to continue the

share buyback programme was given and on 4 June 2019, the Company

announced it would be commencing a further $10 million

programme.

Through these programmes, to date the Company has acquired

13,548,743 Shares at an aggregate cost of approximately $10.8

million. These Shares have been acquired and held in treasury.

On the date of this announcement, the existing buyback programme

shall cease and no additional purchases shall be made pursuant to

it.

Background to and reasons for the Tender Offer

On 26 February 2019, the Company announced its intention to

reduce activity in non-core, low margin media activities, with a

view to focusing on the higher margin publishing activity, leading

to an expected $30 million reduction in revenues in 2019. The

reduction alongside investment in development of new publishing

assets have led to an adjusted EBITDA reduction of between $6-7

million for 2019. This decision was made proactively by the Board

with a view to delivering higher profit margins and better quality

of earnings for Shareholders.

Despite some recent share price momentum, the Directors believe

that the full potential of the Company, as highlighted in the

'Information on the Company' section above, is not reflected in the

price of 72.75 pence per Share (as at close of business on 15 July

2019), and that the Shares continue to trade at a significant

discount to quoted peers.

The Company has been built on the success of its publishing

assets and the Directors firmly believe in the growth potential for

the business by focusing on such assets in both the gambling and

personal finance verticals going forward.

In light of these considerations, the Board has concluded that,

in the interests of both effective capital management and utilising

the Company's strong net cash position alongside ongoing working

capital expenditure and the Company's future investment plans, a

tender offer offers the most efficient use of the Company's excess

cash at this point in time. A tender offer is therefore being

proposed to Shareholders on the Company's Register on the Record

Date (being close of business on 14 August 2019).

The Board intends to continue its commitment to maintaining a

dividend policy of paying out at least 50 per cent. of net profit

and will continue to evaluate selective publishing acquisition

opportunities, which the Board considers could accelerate earnings

growth.

The Tender Offer

The key points of the Tender Offer are as follows:

-- the Tender Offer will be restricted to 19,675,000 Shares,

representing approximately 9.51 per cent. of the Shares in issue

(excluding any Shares held in treasury) on the Record Date;

-- each Shareholder (other than Restricted Shareholders) will be

able to tender up to 9.51 per cent. of his or her holding (rounded

down to the nearest whole number of Shares), with such tenders

being satisfied in full ("Basic Entitlement");

-- each Shareholder will also be able to tender Shares in excess

of his or her Basic Entitlement, but such excess tenders will only

be satisfied on a pro rata basis to the extent that other

Shareholders tender less than (or none of) their Basic Entitlement;

and

-- the Tender Price will be fixed at 80 pence per Share which

represents a premium of approximately 10 per cent. to the

mid-market price of a Share at the close of business on 15 July

2019, the latest practicable day before the printing of the

Circular.

The Tender Offer will be implemented by means of on-market

purchases by Berenberg, which will, as principal, purchase the

Shares tendered (subject to the overall limit of the Tender Offer)

at the Tender Price and, on the completion of those purchases and

in accordance with the Repurchase Agreement, sell them on to the

Company at the Tender Price by way of an on-market transaction. The

Shares that the Company purchases from Berenberg will be held in

treasury and the number of Shares in issue carrying voting rights

reduced accordingly. The Company will fund the purchase from its

existing cash resources.

The Tender Offer is conditional on the Tender Offer Resolution

being passed at the Extraordinary General Meeting. It is also

subject to certain further conditions, which are set out in the

Circular. In addition, the Tender Offer may be terminated in

certain circumstances as set out in paragraph 3 of Part 3 of the

Circular.

Your attention is drawn to the letter from Berenberg in Part 2

of the Circular and to Part 3 of the Circular, which constitute the

terms and conditions of the Tender Offer.

Extraordinary General Meeting

The implementation of the Tender Offer is conditional upon the

passing of the Tender Offer Resolution at the Extraordinary General

Meeting. A notice convening the General Meeting is set out in Part

7 of the Circular.

The Tender Offer Resolution will be proposed at the General

Meeting as a special resolution to seek Shareholder approval for

the Company to make an on-market purchase of up to a maximum of

19,675,000 Shares from Berenberg in connection with the Tender

Offer. Shareholders' tendered shares will be purchased at the

Tender Price pursuant to the Tender Offer. The authority sought by

way of the Tender Offer Resolution will expire on the earlier of:

(1) the completion of the Tender Offer or (2) the date falling 18

months from the date of the passing of the Tender Offer

Resolution.

EXPECTED TIMETABLE

Publication of the Circular 16 July 2019

Tender Offer opens 8.00 a.m. on 17 July 2019

Latest time for receipt of proxy 10.00 a.m. on 14 August

forms and CREST proxy instructions 2019

Latest time and date for receipt 1.00 p.m. on 14 August 2019

of Tender Forms and TTE Instructions

in CREST for Tender Offer

Record Date for Tender Offer close of business on 14

August 2019

Result of Tender Offer announced 15 August 2019

General Meeting 10.00 a.m. on 16 August

2019

Payments through CREST made in respect 23 August 2019

of Shares held in uncertificated

form successfully tendered

CREST accounts settled in respect 23 August 2019

of unsold tendered Shares held in

uncertificated form

Cheques despatched in respect of 23 August 2019

Shares held in certificated form

successfully tendered

Balancing certificates despatched by 29 August 2019

in respect of unsold tendered Shares

held in certificated form

Notes to expected timetable:

1. Each of the times and dates referred to in the expected

timetable above and elsewhere in this announcement may be extended

or brought forward at the discretion of the Company. If any of the

above times and/or dates change, the revised time(s) and/or date(s)

will be notified to Shareholders by an announcement through a

Regulatory Information Service.

2. All times referred to in this announcement are, unless

otherwise stated, references to London time.

Recommendation

The Directors believe that the implementation of the Tender

Offer is in the best interests of the Company and the Shareholders

as a whole. Therefore, the Directors unanimously recommend that you

vote in favour of the Tender Offer Resolution as they intend to do

so in respect of their own interests in 6,181,222 Shares in

aggregate, representing approximately 2.98 per cent. of the Shares

currently in issue. Each of the Directors who holds Shares has

stated that he will not tender any Shares equating to his Basic

Entitlement.

The Board makes no recommendation to Shareholders as to whether

or not to tender their Shares pursuant to the Tender Offer. Whether

or not Shareholders decide to tender their Shares will depend on,

among other things, their view of the Company's prospects and their

own individual circumstances, including their tax position, on

which they should seek their own independent advice.

For further enquiries, please contact:

XLMedia plc via Vigo Communications

Chris Bell, Non-executive Chairman

Ory Weihs, Chief Executive Officer

www.xlmedia.com

Vigo Communications Tel: 020 7390 0233

Jeremy Garcia / Fiona Henson / Simon

Woods

www.vigocomms.com

Cenkos Securities plc (Nomad and Joint Tel: 020 7397 8900

Broker)

Giles Balleny / Callum Davidson

www.cenkos.com

Berenberg (Joint Broker) Tel: 020 3207 7800

Chris Bowman / Mark Whitmore / Simon

Cardron

www.berenberg.com

IMPORTANT INFORMATION

The Directors and the Company accept responsibility, both

collectively and individually, for the information contained in

this announcement and compliance with the AIM Rules.

Joh. Berenberg, Gossler & Co. KG, London Branch

("Berenberg"), which is authorised and regulated in Germany by the

German Federal Financial Supervisory Authority (BaFin) and subject

to limited regulation by the FCA, is acting solely in its capacity

as joint broker to XLMedia PLC and for no one else, including any

recipient of the Circular, in connection with the Tender Offer and

other matters referred to in the Circular and will not be

responsible to anyone other than XLMedia PLC for providing the

protections afforded to clients of Berenberg or for affording

advice in relation to the Tender Offer or any other matter referred

to in this announcement or the Circular.

This announcement does not constitute an offer to purchase, or

solicitation of an offer to sell, Shares in any jurisdiction in

which, or to or from any person to or from whom, it is unlawful to

make such offer or solicitation under applicable securities

laws.

This announcement and the information contained herein is for

background purposes only and does not purport to be full or

complete. It does not constitute or form part of, and should not be

construed as, any offer, invitation or recommendation to purchase,

sell or subscribe for any securities in any jurisdiction and

neither the issue of the information nor anything contained herein

shall form the basis of or be relied upon in connection with, or

act as an inducement to enter into, any investment activity.

No reliance may be placed for any purpose on the information

contained in this announcement or its accuracy or completeness. The

information in this announcement is subject to change. Nothing in

this announcement should be interpreted as a term or condition of

the Tender Offer. Shareholders should not participate in the Tender

Offer except on the basis of information in the Circular which

gives further details of the Tender Offer.

Forward-looking statements

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"projects", "anticipates", "expects", "intends", "may", "will", or

"should" or, in each case, their negative or other variations or

comparable terminology. These forward-looking statements include

matters that are not historical facts. They appear in a number of

places throughout this announcement and include statements

regarding the Directors' current intentions, beliefs or

expectations concerning, among other things, the Group's results of

operations, financial condition, liquidity, prospects, growth,

strategies and the Group's markets. By their nature,

forward-looking statements involve risk and uncertainty because

they relate to future events and circumstances. Actual results and

developments could differ materially from those expressed or

implied by the forward-looking statements. Forward-looking

statements may and often do differ materially from actual results.

Any forward-looking statements in this announcement are based on

certain factors and assumptions, including the Directors' current

view with respect to future events and are subject to risks

relating to future events and other risks, uncertainties and

assumptions relating to the Group's operations, results of

operations, growth strategy and liquidity. Whilst the Directors

consider these assumptions to be reasonable based upon information

currently available, they may prove to be incorrect. Save as

required by law or by the AIM Rules, none of the Company, its

nominated adviser, Berenberg nor their respective directors,

partners,

officers or employees undertakes any obligation to publicly

release the results of any revisions to any forward-looking

statements in this announcement that may occur due to any change in

the Directors' expectations or to reflect events or circumstances

after the date of this announcement.

Overseas Shareholders

The making of the Tender Offer to persons outside the United

Kingdom may be prohibited or affected by the relevant laws of the

overseas jurisdiction. Shareholders with registered or mailing

addresses outside the United Kingdom or who are citizens or

nationals of, or resident in, a jurisdiction other than the United

Kingdom should read paragraph 7 of Part 3 of the Circular. It is

the responsibility of all Overseas Shareholders to satisfy

themselves as to the observance of any legal requirements in their

jurisdiction, including, without limitation, any relevant

requirements in relation to the ability of such persons to complete

and return a Tender Form.

Notice for US Shareholders

The Tender Offer relates to securities of a non-US company that

is incorporated in Jersey and is subject to the disclosure

requirements, rules and practices applicable to companies listed in

the United Kingdom, which differ from those of the United States in

certain material respects.

The Circular has been prepared in accordance with UK style and

practice for the purpose of complying with English law, Jersey law

and the AIM Rules for Companies of the London Stock Exchange, and

US Shareholders should read the entire Circular, including Part 4

(Taxation) of the Circular. The financial information relating to

the Company included in the Circular has not been prepared in

accordance with generally accepted accounting principles in the

United States and thus may not be comparable to financial

information relating to US companies. The Tender Offer is not

subject to the disclosure and other procedural requirements of

Regulation 14D under the United States Securities Exchange Act of

1934, as amended (the "US Exchange Act"). The Tender Offer will be

made in the United States in accordance with the requirements of

Regulation 14E under the US Exchange Act to the extent applicable.

Certain provisions of Regulation 14E under the US Exchange Act are

not applicable to the Tender Offer by virtue of Rule 14d-1(d) under

the US Exchange Act. US Shareholders should note that the Shares

are not listed on a US securities exchange and the Company is not

subject to the periodic reporting requirements of the US Exchange

Act and is not required to, and does not, file any reports with the

SEC thereunder.

It may be difficult for US Shareholders to enforce certain

rights and claims arising in connection with the Tender Offer under

US federal securities laws since the Company is located outside the

United States and most of its officers and directors reside outside

the United States. It may not be possible to sue a non-US company

or its officers or directors in a non-US court for violations of US

securities laws. It also may not be possible to compel a non-US

company or its affiliates to subject themselves to a US court's

judgment.

To the extent permitted by applicable law and in accordance with

normal UK practice, the Company, Berenberg or any of their

respective affiliates, may make certain purchases of, or

arrangements to purchase, Shares outside the United States during

the period in which the Tender Offer remains open for acceptance,

including sales and purchases of Shares effected by Berenberg

acting as market maker in the Shares. These purchases, or other

arrangements, may occur either in the open market at prevailing

prices or in private transactions at negotiated prices. In order to

be excepted from the requirements of Rule 14e-5 under the US

Exchange Act by virtue of Rule 14e-5(b)(12) thereunder, such

purchases, or arrangements to purchase, must comply with applicable

English law and regulation, including the AIM Rules for Companies

of the London Stock Exchange, and the relevant provisions of the US

Exchange Act. Any information about such purchases will be

disclosed as required in the UK and the United States and, if

required, will be reported via the Regulatory News Service of the

London Stock Exchange and will be available on the London Stock

Exchange website at http://www.londonstockexchange.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TENGUGDRBUBBGCL

(END) Dow Jones Newswires

July 16, 2019 02:00 ET (06:00 GMT)

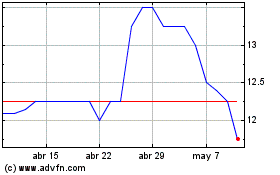

Xlmedia (LSE:XLM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Xlmedia (LSE:XLM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024