TIDMPFD TIDMIRSH

RNS Number : 7508F

Premier Foods plc

17 July 2019

17 July 2019

Premier Foods plc (the "Company" or the "Group")

Trading update for the 13 weeks ended 29 June 2019

-- Q1 Group sales up +1.1%, Q1 Branded sales up +2.9%

-- Q1 UK sales up +2.6%, Q1 Branded UK sales up +4.9%

-- Market share gains in 7 out of 8 top brands

-- Increased marketing investment this year; Mr Kipling and

Batchelors already aired - more to come

-- Sales of Mr Kipling, Group's largest brand, up +10%

-- Expectations for the full year remain unchanged

Alastair Murray, Acting Chief Executive Officer

"I am pleased to report an encouraging start to the year with

Group sales up +1.1% and ahead +2.6% in the UK. As we previously

noted, we are increasing our consumer marketing investment this

year and both Mr Kipling and Batchelors have already benefitted

from TV advertising campaigns in the first quarter. Many of our

largest brands have built on strong category positions and grown

market share, and we achieved branded growth in the quarter of

nearly 3%. These figures provide evidence that the Company's

strategy is delivering results. Our expectations for the full year

remain unchanged."

Q1 Sales % change Grocery Sweet Treats Group

Branded +1.1% +7.1% +2.9%

Non-branded +2.2% (37.2%) (8.3%)

-------- ------------- -------

Total +1.3% +0.6% +1.1%

-------- ------------- -------

Trading update

===============

In the first quarter of the year, Group sales increased +1.1%

compared to the prior year, with branded sales up +2.9%. In the UK,

total sales grew +2.6% and branded sales advanced +4.9%. Both

Grocery and Sweet Treats have delivered market share gains during

the quarter, with notably good performances seen from Ambrosia,

Sharwood's, Bisto and Cadbury cake.

Grocery reported sales of GBP123.1m in the quarter, +1.3% up on

the prior year. The Flavourings & Seasonings category was

strong, growing over 10% compared to the prior year due to a softer

comparative period in 2018 when the UK experienced exceptionally

warm weather. Accordingly, Bisto and Paxo both delivered strong

revenue growth and market share gains in the quarter. Looking

forward to the second quarter, Bisto will be launching a new range

of convenient ready to use Gravy pots. Ambrosia also benefitted

from relatively cooler weather in June, gaining share in a growing

category.

In cooking sauces, Sharwood's and Loyd Grossman saw double-digit

growth reflecting improved promotional plans, distribution gains

and range expansion of curry pastes. The Group saw growth in the

Quick Meals, Snacks & Soups category as Nissin Soba noodles

continued their very strong trajectory from last year, more than

doubling sales and volumes, while Batchelors sales were slightly

lower due to the phasing of promotional activity.

Non-branded Grocery sales grew +2.2% as contract wins in cooking

sauces and stuffing were partly offset by Knighton Foods which saw

some contract exits and customer de-stocking.

In Sweet Treats, sales increased by +0.6% against the same

period a year ago with branded sales up +7.1%. Mr Kipling continued

to deliver strong growth, with Group sales up 10% and benefitting

from the brand relaunch it received during 2018 but also further TV

advertising in the first quarter this year. A new premium range of

'Signature' cakes is set to be launched In the second quarter to

support Mr Kipling growth through the remainder of the year.

Cadbury cake sales grew in the UK, due to both the later timing

of Easter compared to 2018 and also due to improved seasonal ranges

for the Easter period. The Group also launched a range of new

Cadbury Dairy Milk slices in the quarter. Non-branded Sweet Treats,

(representing 9% of Sweet Treats sales value) were (37.2%) down in

the period due to the exit of lower margin cake contracts.

International sales were, as expected, held back primarily due

to slower sales in Ireland and were (18%) down compared to the

prior year. This was due to the unwind of Brexit related stock in

Irish customers' supply chains. The International business is,

however, expected to return to sales growth in subsequent

quarters.

IFRS 16 - Leases

=================

The Group is adopting the modified retrospective approach for

the new accounting standard, IFRS 16 - Leases, as previously

stated. The first accounting period which the Group will adopt this

change is its Interim results for the 26 weeks ending 28 September

2019. The main changes to the Company's financial statements are

with respect to Net debt and EBITDA, which would have been

approximately GBP20m and GBP3m higher respectively than reported as

at 30 March 2019.

Board update

=============

As previously announced, Keith Hamill, Non-executive Chairman,

will be retiring from the Board at the Company's AGM being held

today. Richard Hodgson, Senior Independent Non-Executive Director

is leading the search for a new Non-executive Chairman, a further

Independent Non-executive Director and a permanent CEO, and the

Company will provide further updates in due course.

Outlook

========

The Group's strategy remains to improve operating performance

through driving profitable revenue growth and delivering cost

efficiencies to generate cash. Its expectations for progress in the

full year remains unchanged, and as previously communicated,

weighted to the second half of the year.

The Group's previously announced strategic review remains

ongoing; the outcome of which will be communicated in due

course.

Ends

For further information, please contact:

Institutional investors and analysts:

Alastair Murray, Acting CEO & Chief Financial +44 (0) 1727 815

Officer 850

Richard Godden, Director of Investor Relations +44 (0) 1727 815

& Treasury 850

Media enquiries:

Maitland/AMO

Neil Bennett

Joanna Davidson +44 (0) 20 7379 5151

Conference Call

A conference call for investors and analysts will take place on

17 July 2019 at 9.00am, details of which are outlined below. A

replay of the conference call will be available on the Company's

website later in the day.

Telephone number: +44 20 7192 8000

Telephone number (UK Toll free) 0800 376 7922

Conference ID: 1963129

http://www.premierfoods.co.uk/investors/results-centre

A Premier Foods image gallery is available using the following

link:

http://www.premierfoods.co.uk/media/image-gallery

Certain statements in this trading update are forward looking

statements. By their nature, forward looking statements involve a

number of risks, uncertainties or assumptions that could cause

actual results or events to differ materially from those expressed

or implied by those statements. Forward looking statements

regarding past trends or activities should not be taken as

representation that such trends or activities will continue in the

future. Accordingly, undue reliance should not be placed on forward

looking statements.

Notes to editors:

1. Sales data is for the thirteen weeks to 29 June 2019 or 30 June 2018 as appropriate.

Q1 Sales (GBPm) FY19/20 FY18/19 % Change

Grocery

Branded 101.8 100.8 +1.1%

Non-branded 21.3 20.8 +2.2%

-------- -------- ---------

Total 123.1 121.6 +1.3%

Sweet Treats

Branded 47.0 43.9 +7.1%

Non-branded 4.7 7.5 (37.2%)

-------- -------- ---------

Total 51.7 51.4 +0.6%

-------- -------- ---------

Group

Branded 148.8 144.6 +2.9%

Non-branded 26.0 28.4 (8.3%)

-------- -------- ---------

Total 174.8 173.0 +1.1%

-------- -------- ---------

2. Market share data is sourced from IRI, 13 weeks ended 29 June 2019.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTUNRBRKUABAAR

(END) Dow Jones Newswires

July 17, 2019 02:00 ET (06:00 GMT)

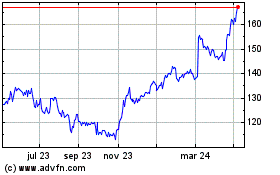

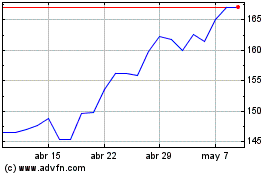

Premier Foods (LSE:PFD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Premier Foods (LSE:PFD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024