Immedia Group PLC Trading Update (2761G)

22 Julio 2019 - 4:27AM

UK Regulatory

TIDMIME

RNS Number : 2761G

Immedia Group PLC

22 July 2019

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014. Upon the publication of

this announcement via the Regulatory Information Service, this

inside information is now considered to be in the public

domain.

Monday, 22 July 2019

For immediate release

Immedia Group Plc

("Immedia" or "the Company" or "the Group")

Trading Update

Immedia (AIM: symbol: IME), a supplier of multi-media content

and digital solutions for leading brands and global businesses,

provides the following unaudited update on its performance covering

the six month period ended 30 June 2019 and up to the date of this

announcement.

Trading

The Group set about 2019 with a solid base coupled with multiple

new business opportunities, with both existing and new clients, and

continued excellent relationships with customers.

We have also been encouraged by growth in our Aberdeen business,

exemplified by the announcement of a major AV installation contract

released on 23 May 2019. We expect the positive performance of our

Aberdeen division to continue throughout the year.

As a Board we anticipated that several of the business

opportunities referred to above would materialise into contracts

during Q2. However, contract conversions are taking longer than

first anticipated, therefore impacting the budgeted performance of

the first half of the year. Whilst we remain confident that the

expected proportion of new business opportunities will occur, we

cannot be certain of the timing, or that a substantive level of

this business will come on stream in the current financial

year.

As a result of these uncertainties, combined with a number of

challenging factors impacting the economy generally and our market

sector in particular, the Board considers it prudent to revise

market estimates for the year ending 31 December 2019 as a

whole.

Given the weaker than expected trading result in HY1, the

Company expects that the results for the financial year ending 31

December 2019 will now be below market estimates. The Company

currently anticipates that the revised revenue for the financial

year will be not less than GBP4.1m resulting in EBITDA in the

region of cGBP(0.3m), however the Board anticipates the outturn to

be better given the current pipeline.

Financial position

The Group continues to have a healthy balance sheet and working

capital after making necessary adjustments to its cost base.

Summary

The Board remains positive despite a cautious trading

environment. The business will continue to focus on tightly

managing its operating costs and driving efficiencies to ensure

that the trading of the business remains secure. We are also

leveraging client engagement whilst our pipeline of opportunity

continues to be healthy across our key targets including the

development of Omni-channel. We remain optimistic that some of

these will be delivered over the short to medium term and will keep

shareholders abreast of developments as appropriate.

For further information please contact:

Immedia Group Plc Tel: +44 (0) 1635 556200

Tim Hipperson, Non-executive Chairman

Bruno Brookes, Chief Executive

SPARK Advisory Partners Limited (Nomad) Tel: +44 (0) 203 368 3550

Mark Brady

Neil Baldwin

SP Angel Corporate Finance LLP (Stockbroker) Tel: +44 (0) 207 470 0470

Abigail Wayne

TooleyStreet Communications (IR & Media Tel: +44 (0) 7785 703523

Relations)

Fiona Tooley

About Immedia Group Plc

Immedia Group Plc is a multi-media content and digital solutions

provider to global businesses and organisations, who are investing

in internal and/or brand communications.

Our business provides a wide range of 'live' branded channels

specifically to retail locations across the UK and Europe with an

estimated listening audience of 8.5 million listeners per week.

Immedia's interactive audio channels deliver original and relevant

content, via its own DreamStream-X platform with encrypted

Dreamstream technology deployed in each location. Dreamstream-X

provides a mix of 'on brand' national and localised content to a

client's workforce and customer base. Each channel is supported

with powerful data analytics tools that monitor audience activity

and provide data to enable us to further enhance audience

engagement.

Immedia Group also creates original video content, 3D animation,

app and web development, as well as supplying and installing Audio

Visual equipment.

Immedia clients include, HSBC, Shell, Subway, BP, Nationwide

Building Society, JD Sports, O2, BMW, IKEA and FIFA.

To read more about our business, visit www.immediaplc.com or

email us on enquiries@immediaplc.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTCKBDBCBKKQOB

(END) Dow Jones Newswires

July 22, 2019 05:27 ET (09:27 GMT)

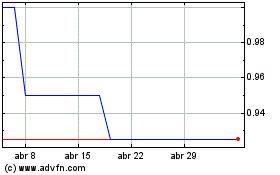

Fiinu (LSE:BANK)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

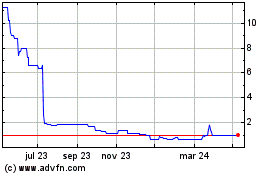

Fiinu (LSE:BANK)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024