U.S. Approves T-Mobile, Sprint Merger -- Update

26 Julio 2019 - 11:29AM

Noticias Dow Jones

By Drew FitzGerald and Sarah Krouse

The Justice Department approved T-Mobile US Inc.'s merger with

Sprint Corp. after the companies agreed to create a new wireless

carrier by selling assets to satellite-TV provider Dish Network

Corp.

The landmark antitrust agreement seeks to address concerns that

the combination of T-Mobile, the nation's No. 3 carrier by

subscribers, and No. 4 Sprint will drive up prices for consumers.

It would leave more than 95% of American cellphone customers with

the top three U.S. operators.

A deal brokered by the Justice Department will require Dish,

which has been sitting on valuable airwaves, to build a 5G network

for cellphone customers. To help it get started, T-Mobile will sell

Sprint's prepaid brands to Dish and give access to the combined

carrier's network for seven years.

"The remedies set up Dish as a disruptive force in wireless"

with the pieces needed for the company to have a network that is

ready to go, Makan Delrahim, the Justice Department's antitrust

chief, said in a news conference.

Critics of the arrangement include a group of state attorneys

general that broke with the Justice Department and have filed an

antitrust lawsuit seeking to block the more than $26 billion

merger. Five states that weren't part of the lawsuit joined the

federal government in the settlement announced Friday.

"Why scramble so much to create a fourth competitor when you

already have one?" said Samuel Weinstein, an assistant law

professor at the Cardozo School of Law at Yeshiva University who

worked previously in the Justice Department's antitrust unit.

The deal gives Dish, a satellite-TV provider, about 9 million

Sprint prepaid cellphone customers and additional wireless

spectrum. Those subscribers represent about a fifth of Sprint's

customer base.

T-Mobile and Sprint must also give Dish access to at least

20,000 cell sites and hundreds of retail locations. The new

T-Mobile must provide "robust access" to its network, the Justice

Department said.

The union of T-Mobile and Sprint, years in the making, would

create a wireless company with more than 80 million U.S. customers,

closing the gap with Verizon Communications Inc. and AT&T Inc.,

which each have roughly 100 million wireless customers. It also

would fulfill a long-held goal of Japan's SoftBank Group Corp.,

which owns most of Sprint, and Deutsche Telekom AG, which controls

T-Mobile.

Shares of T-Mobile rose on the news and are trading near

all-time highs. Sprint shares also were higher. Dish, whose stock

price has slumped this week on news of the arrangement, were up

Friday.

Federal Communications Commission Chairman Ajit Pai, who had

previously backed the deal, said Friday the Justice Department

settlement, coupled with T-Mobile and Sprint's earlier commitments

to deploy a nationwide 5G network, will preserve competition and

advance U.S. leadership in rolling out next-generation

networks.

U.S. carriers have been battling for customers in the $180

billion voice-and-data market, where growth has slowed now that the

companies have rolled out unlimited data plans and most Americans

have upgraded to smartphones.

The federal approval for T-Mobile and Sprint caps a more than

yearlong review of a combination that fell apart twice in the past

five years over terms of the deal or fears that the Justice

Department would object.

The Justice Department, under the Obama administration, told the

companies that shrinking from four to three national providers was

anticompetitive. The companies tried again under Trump appointees

to push the deal through, ultimately agreeing to divest assets to

Dish to win approval.

In its agreement with the government, T-Mobile promised not to

raise prices for three years and cover 97% of the U.S. population

with 5G service in three years.

T-Mobile has been adding millions of customers at the expense of

its rivals, pushing unlimited data plans and lower prices than the

incumbents. Sprint, despite owning valuable airwaves, has been

shedding millions of subscribers and has struggled to be

profitable.

T-Mobile surpassed Sprint to become the No. 3 player by

subscribers and argued the acquisition of the smaller carrier's

airwaves would help speed its deployment of a 5G network so that it

could better compete with Verizon and AT&T.

Dish, which generated $13.6 billion in annual revenue last year,

had about $13 billion of net debt before the deal. It will need to

shell out billions of dollars in the coming years to absorb the

wireless carriers' cast-off assets, build its own network and vie

for customers.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com and Sarah

Krouse at sarah.krouse@wsj.com

(END) Dow Jones Newswires

July 26, 2019 12:14 ET (16:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

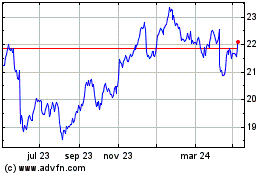

Deutsche Telekom (TG:DTE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

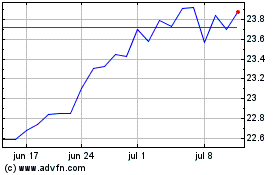

Deutsche Telekom (TG:DTE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024