TIDMPETS

RNS Number : 6476H

Pets At Home Group Plc

02 August 2019

FOR IMMEDIATE RELEASE, 2 AUGUST 2019

Pets at Home Group Plc: Q1 FY20 Trading Statement

A strong start to the year, delivering our pet care strategy

Pets at Home Group Plc, the UK's leading pet care business,

today announces a scheduled trading update for the 16 week period

from 29 March to 18 July 2019, compared with the 16 week period

from 30 March to 19 July 2018.

Financial summary

-- Group revenue(1) growth of 9.9% to GBP303.4m

o Retail revenue up 8.7% to GBP266.4m, including omnichannel(2)

revenue up 36.0% to GBP26.0m

o Vet Group revenue(1) up 18.8% to GBP37.0m. First Opinion

customer sales growth across all vet practices was 11.4%, with

mature practices growing ahead of the market

-- Group like-for-like(3) revenue growth of 8.0%

o Retail like-for-like revenue growth of 8.2%

o Vet Group like-for-like revenue growth(4) of 6.2%, with

like-for-like Joint Venture fee income up 1.1% to GBP16.2m,

reflecting the planned impact of our fee remediation measures

-- We now expect underlying profit for the year, before IFRS16

impacts(5) , to be slightly above current market expectations(6) ,

reflecting:

o Good transaction and cash growth in Retail, particularly in

food and omnichannel where strong growth has more than offset

adverse margin mix

o Vet Group underlying performance in line with our plans, with

the financial impact of buying out a number of Joint Venture vet

practices comfortably within expectations

-- All other FY20 financial guidance components(7) are maintained

Strategic highlights

We are introducing more customers to our complete pet care

offer, allowing us to take a greater share of their overall

spend:

o Number of VIPs who purchase products and a service has grown

23% y/y, driven by increased use of both the Groom Room and our

First Opinion vets

o Number of subscription customers(8) across the Group is now

over 765,000

-- In Retail, our investment in convenient, competitive and

innovative shopping has brought success across categories, in

particular with acquiring new customers and their food shop

-- Vet Group recalibration on track, with the buy out and closure of practices largely complete

-- Formed a strategic partnership through an investment in

Tailster.com, a leading online marketplace in the UK for pet

walking, sitting and boarding services, which will enhance our pet

care services to customers

Peter Pritchard, Group Chief Executive Officer, commented:

"The momentum with which we exited FY19 has continued into the

first quarter of FY20. We have seen a strong sales performance

across the business, particularly in Retail where like-for-like

sales were 8.2% - an impressive 14% on a two year basis. We are

also making good progress in our Vet Group. Our plans to buy out a

number of Joint Venture vet practices have been carefully executed,

whilst performance in the ongoing estate remains strong. We have

the right foundations in place to accelerate the maturity of our

vet practices in a sustainable way, delivering cashflow benefits to

both Joint Venture Partners and Pets at Home.

At this early stage in the year, and with ongoing uncertainty

across the wider retail sector, we remain cautiously optimistic and

focused on delivering our pet care strategy."

Conference call

A conference call for analysts and investors will be held at

8.30am today. To join the call, please dial +44 (0)330 336 9125 and

use the participant access code 9026449. A recording will be

available at http://investors.petsathome

Strategic Key Performance Indicators

Q1 FY20 Q1 FY19 YoY change

Number of customer transactions (m) 18.0 17.0 5.8%

----------------------------------------- -----------------------

Customer sales(9) from services(10) 35.5% 34.7% 84 bps

----------------------------------------- -----------------------

VIP customer sales(11) (GBPm) 646.6 535.8 20.7%

----------------------------------------- -------- -------- -----------------------

Customer sales(9) per colleague (GBPk) 54.2 49.9 8.6%

----------------------------------------- -------- -------- -----------------------

Number of stores 452 449 3

-----------------------

Number of grooming salons 312 310 2

-----------------------

Number of Joint Venture First Opinion

vet practices 401 449 (48)

----------------------------------------- -------- -------- -----------------------

Number of company managed First Opinion

vet practices 43 19 24

----------------------------------------- -------- -------- -----------------------

1. The fee income for practices which we have already bought

out, or intend to buy out in the future, has not been recognised

within Vet Group, and Group, revenue in Q1 FY19 at GBP1.2m, despite

this de-recognition taking place during Q2 FY19

2. Defined as orders placed online at petsathome.com and

in-store using our order-in-store service, plus subscriptions

3. Like-for-like growth comprises total revenue in a financial

period compared to revenue achieved in a prior period, for stores,

omnichannel operations, grooming salons, vet practices and referral

centres that have been trading for 52 weeks or more

4. The fee income for practices which we have already bought

out, or intend to buy out in the future, has not been recognised in

either Q1 FY20 or Q1 FY19 like-for-like revenue

5. The impact of IFRS16 is expected to reduce Group underlying

profit before tax by cGBP3-4m in H1 FY20, and cGBP6-7m in FY20

6. Current consensus estimates for FY20 Group underlying profit

before tax have a mean of GBP85m,with a range between GBP79m and

GBP90m

7. Refers to financial guidance as disclosed during FY19

preliminary results on 22 May 2019, which was provided on a pre

IFRS16 basis

8. Defined as customers signed up to a Vet Group health plan,

omnichannel subscription platforms Easy Repeat and Subscribe &

Save, or Bubble Bundle

9. Includes gross customer sales made by JV vet practices,

rather than fee income recognised within Vet Group revenue

10. Defined as gross customer sales made by JV vet practices,

revenue from our Specialist Referral centres and company managed

vet practices, grooming services, subscriptions, pet sales and pet

insurance commissions

11. VIP customer sales are shown on a rolling 12 month basis rather than a year-to-date basis

Investor Relations Enquiries

Pets at Home Group Plc:

Amie Gramlick, Director of Investor Relations & Corporate

Affairs

+44 (0)161 486 6688

Media Enquiries

Pets at Home Group Plc:

Gillian Hammond, Head of Media & Public Affairs

+44 (0)161 486 6688

Maitland/AMO:

Clinton Manning, Joanna Davidson

+44 (0)20 7379 5151

About Pets at Home

Pets at Home Group Plc is the UK's leading pet care business;

our commitment is to make sure pets and their owners get the very

best advice, products and care. Pet products are available online

or from our 452 stores, many of which also have vet practices and

grooming salons. Pets at Home also operates a UK leading small

animal veterinary business, with 444 First Opinion practices

located both in our stores and in standalone locations, as well as

four Specialist Referral centres. For more information visit:

http://investors.petsathome.com/

Disclaimer

This trading statement does not constitute an invitation to

underwrite, subscribe for, or otherwise acquire or dispose of any

Pets at Home Group Plc shares or other securities nor should it

form the basis of or be relied on in connection with any contract

or commitment whatsoever. It does not constitute a recommendation

regarding any securities. Past performance, including the price at

which the Company's securities have been bought or sold in the

past, is no guide to future performance and persons needing advice

should consult an independent financial adviser.

Certain statements in this trading statement constitute

forward-looking statements. Any statement in this document that is

not a statement of historical fact including, without limitation,

those regarding the Company's future plans and expectations,

operations, financial performance, financial condition and business

is a forward-looking statement. Such forward-looking statements are

subject to risks and uncertainties that may cause actual results to

differ materially. These risks and uncertainties include, among

other factors, changing economic, financial, business or other

market conditions. These and other factors could adversely affect

the outcome and financial effects of the plans and events described

in this statement. As a result you are cautioned not to place

reliance on such forward-looking statements. Nothing in this

statement should be construed as a profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTSSSFMFFUSEIA

(END) Dow Jones Newswires

August 02, 2019 02:00 ET (06:00 GMT)

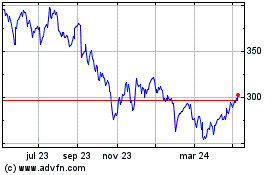

Pets At Home (LSE:PETS)

Gráfica de Acción Histórica

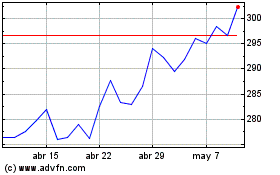

De Mar 2024 a Abr 2024

Pets At Home (LSE:PETS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024