TIDMPRIM

RNS Number : 4055K

Primorus Investments PLC

28 August 2019

Primorus Investments plc

("Primorus" or the "Company")

Quarterly Investor Update

Primorus Investments plc (AIM: PRIM, NEX: PRIM) is pleased to

provide the quarter ending 30 June 2019 ("Q2" or the "Quarter")

investor update regarding its current holdings and activities

acquired and managed as per its investing policy.

Executive Director's Quarterly Comment - Alastair Clayton

Compared to previous Quarters there is no doubt that Q2 has been

a relatively quiet one with news focussed around several key

investments such as Fresho, WeShop and Greatland Gold.

As we discussed in our Q1 Report, the IPO market for growth

companies in London is still very weak. This however does not mean

we cannot generate profitable investment exits. As such I am

pleased to report that we have recently agreed pricing regarding

the potential sale of our A$500,000 Series B Zuuse loan note that,

subject to final agreement and execution, would result in a

significant gain above investment price. We look forward to

advancing this sale process and will keep shareholders updated as

to pricing and timing.

Fresho grabbed a lot of the headlines during this quarter. The

participation of several high-profile investors in an equity

investment round at a significant premium to our investment cost

was fantastic news. This brings a wealth of global technology

scaling and banking experience to Fresho as it embarks upon its

global expansion in 2019/2020.

Those who follow our @priminvestments twitter page will have

seen the extensive national press this generated in Australia.

Given the long period in which we have been subject to commercial

in confidence it was personally pleasing for our shareholders to be

able to read about Fresho for themselves from external sources.

Elsewhere WeShop reported significant progress and Greatland

Gold ("GGP.L") reported significant news from its Havieron JV with

Newcrest Mining ("NCM.AX"). In the last few days we have received

updates from Engage Technology Partners ("Engage") and SOA Energy

("SOA") that we shall discuss in detail below.

So once again (share price aside) it has been another successful

quarter for the Company and we hope to sustain any future share

price rises as further exits and portfolio growth become more

compelling to existing and new investors.

We currently see no short to medium term requirement to raise

capital thereby reducing the risk of any potential dilution to

existing shareholders.

Highlights

-- As announced on 17 June 2019, Fresho attracts high-profile

technology and senior banking investors and undertakes widespread

external press that "lifts the veil" on the business to industry

for the first time. Pressing ahead on global expansion plans

including the UK.

-- First assays since the Greatland Gold (GGP.L) Farm-in

Agreement with Newcrest Mining (NCZ.AX) ('Newcrest") over the

Havieron Project released. Excellent Gold and Copper results

reported from first batch of holes. Newcrest add a third and fourth

drill rig to the Havieron project.

-- Post-period Primorus agrees pricing on a sale of its

A$500,000 in Series B loan notes by a known third party. Expecting

final execution of sale documents to occur in next 8 weeks. If

completed as contemplated this sale would result in a significant

return above investment earlier than previously contemplated.

-- Post-period we topped up our investment in Engage Technology

Partners ("Engage") by GBP50,000 to GBP1.45m. Recently received

Engage update highlights outstanding growth in monthly recurring

revenues and billable transactions on the back of the first

Self-Serve truly scalable SaaS products.

-- WeShop completes Amazon license agreement to pay WeShop for

user purchases facilitated by WeShop, and to enable Amazon

inventory to be available on the WeShop platform. Instagram

integration license: functionality to enable WeShop users to import

existing content from Instagram to post on WeShop. Apple iTunes

(Apple Services) partner agreement to pay WeShop for user purchases

facilitated by WeShop, and to enable iTunes inventory of all music,

video, books and other media to be available on the WeShop

platform.

-- SOA Energy ("SOA") expect drilling and appraisal work on the

farm-in with Delek Drilling ("Delek"), one of Israel's largest Oil

& Gas companies, to commence at the Ofek and Yahel licences in

Q3/Q4, later than previously anticipated.

-- Company finishes the quarter debt-free and the Board still

foresees no short to medium term need or intention to raise

capital.

Update on Investments

It truly was an enlightening quarter for Fresho and what the

future may hold for our investment. The Australian Financial Review

("AFR") ran an exclusive interview with Fresho management in which

Mr Leigh Jasper, Mr Robert Philpott and Mr Geoffrey Tarrant were

revealed as new, significant investors in Fresho. In late 2017 Mr

Jasper and Mr Phillpot sold Aconex, a global cloud-based

construction software business, to Oracle for US$1.2B. Mr Tarrant

is an investment banker and the Chairman of Zuuse Ltd, in which the

Company owns A$500,000 in high yielding notes as well as some stock

options.

The news in the AFR, as well as numerous follow up press items,

for the first time revealed to Primorus shareholders and the

broader investment community details about the growth and strategy

of Fresho which we were hitherto unable to report due to commercial

sensitivities so this was a particularly pleasing moment as Fresho

is one of our longest standing investments.

With Fresho pressing the button on a rapid expansion of growth,

sales and product development, we took time to meet company

executives in London to discuss the future. We introduced Fresho to

two large UK food suppliers and sat in on those discussions. We

were extremely pleased to hear their feedback from these large

suppliers on the Fresho offering and how it may be applicable to

the UK market.

This direct intervention may seem a little unorthodox to many

large funds however given Primorus's small size we do sometimes

take a slightly more hands-on approach to understanding the

trajectory of our investments. Clearly it will be very satisfying

to see Fresho begin to roll out in the UK and make our investment

all the more tangible for our UK shareholder-base.

Following this additional fund-raising, Fresho is now very

well-funded and we look forward to reporting back with more news

over the rest of the year. We understand that sales at Fresho have

jumped dramatically since the national press articles and we expect

to see this flow through to the bottom line over the remainder of

2019.

In terms of exiting this position, recent events have

significantly raised our expectations on value and as such any

secondary exit price would have to be very compelling indeed.

Engage Technology Partners is our largest investment, now with a

total of GBP1.45m invested across three funding rounds. We invested

in Engage because we believe it has great potential in the SME

market for temporary and also permanent recruitment, agency back

office and pay and bill if it is able to develop and release a pure

SaaS, mass-market scalable platform.

Following on from last quarter's report the recently received

update from Engage makes excellent reading. Key metrics since the

beginning of the year including Revenue (+69% for the year), live

Corporate Customers (+410% to >250) and importantly Cash Burn

(-60%) are all going very much in the right direction.

What is really important, and I am pleased to report we believe

Engage are well on the path to delivering, is the transition from

software start-up to a pure SaaS platform with significant

potential. Selling great business solutions is all well and good

however if Engage can truly become a zero-customer-touch, pure SaaS

company then we feel our GBP1.45m investment to date has the

potential to become an investment capable of achieving our stated

balance sheet growth target on its own.

To achieve this Engage has to continue to execute its business

transition strategy that has involved several key tenants;

automating the product suite from take on to user support,

delivering a SaaS sales model and shrinking the size of the

headcount of the business to reflect the SaaS model, thereby

driving the business to break-even and profitability on SaaS

(>90%) margins.

I am delighted that this journey to a pure SaaS play, sometimes

referred to in industry as "The Valley of Death", is well underway

and as evidenced by the key data points on revenue, sales and cash

burn are, in our view, well past the point of maximum danger and

moving towards a break-even position by the end of 2019/2020. This

is no mean feat and has in part been achieved by the introduction

of several SaaS experts to the company and we welcome the

incredible focus and discipline this has injected into what was

already great team.

As flagged in our last report Engage recently undertook a modest

fund-raising of circa GBP1m in equity (and debt) at GBP24 per

share. We took a small amount of the equity, GBP50,000, and may

look to take another small amount in the coming months. Engage has

estimated that it will not need significant further funding until

it hits breakeven which is very pleasing and the GBP24 per share

paid compares well to our previous investments at GBP15 and GBP22

respectively.

As investors we want Engage to drive towards breakeven and

profitability because upon achieving this, the world of exits

available to us will open up substantially. With the IPO market

still so soft we do consider a trade sale the likeliest of outcomes

or perhaps an early secondary exit should price be compelling.

In the quarter Greatland Gold PLC ("Greatland") and Farm-in

partner Newcrest Mining (NCZ.AX) ('Newcrest") announced several

excellent drilling results at the Havieron Project in Western

Australia. Newcrest has the right to acquire up to a 70% interest

in 12 blocks within E45/4701 that cover the Havieron target by

spending up to US$65m (circa GBP50m or AUD$90m) and completing a

series of exploration and development milestones in a four-stage

Farm-in over six years.

With the release of the first joint venture drilling at Havieron

that yielded outstanding results and exploration results due

imminently across several other high-alpha gold projects, our

investment in Greatland is beginning what we believe will be a very

interesting phase.

Reiterating what we said last quarter, we believe recent share

price softness in Greatland was simply a function of market

impatience and short-sightedness. Whilst at the time of writing we

are ahead on our investment, we consider the current share price to

not be in any way a reflection of the value we see in the company.

With the recent appointment of Numis Securities as joint broker we

are hopeful the company may reach a more patient, institutional

investor class.

We spoke to the CEO of SOA Energy recently as he prepares his

company to commence activities with their farm-in partner Delek

towards the end of 2019. This will comprise the Ofek

re-entry/appraisal well drilling programme and associated test

works. This is probably running a little behind our earlier

estimates in terms of timing however this is relatively unimportant

in the scheme of things. Upon successful conclusion this will then

allow long-held plans to list the company in London to

commence.

Zuuse is an international construction payments and lifecycle

software vendor with significant operations in the UK, United

States and Australia.

We hold A$500,000 in loan notes due December 2019 at an

attractive rolled up coupon of 12% as well as some options.

Post-period we have been approached by a credible investor to

purchase these notes of us for face value plus rolled up interest.

We have also been asked to consider selling the 1m options we hold

however the Board are still considering this approach.

We have agreed pricing on both scenarios and have begun

documentation of the proposed deal on agreed terms. Whilst there is

no guarantee any deal will be completed, we are confident that this

proposal will represent the next, profitable investment exit for

Primorus.

In the quarter under review StreamTV bolstered its board with

the appointment of two new directors to assist with the financial

and capital management side of the business. Whilst chip

manufacture and product commercialisation activities are moving

ahead and many millions of dollars of investment have been secured

over the quarter, the large cornerstone investor it has been

seeking has still not closed. Clearly it is in the interests of all

shareholders for this matter to be finalised so we eagerly await

news on this front.

WeShop had a very significant update to all shareholders during

the quarter. Primorus has invested a total of GBP875,000 in WeShop

representing approximately 3.5 per cent. of the issued share

capital of WeShop.

WeShop gained considerable momentum in finalising the product

and proposition for user acquisition later this summer. Some

significant commercial and product agreements, and integration,

have also been achieved. These included:

1. the Amazon license agreement to pay WeShop for user purchases

facilitated by WeShop, and to enable Amazon inventory to be

available on the WeShop platform.

2. An Instagram integration license: functionality to enable

WeShop users to import existing content from Instagram to post on

WeShop.

3. Apple iTunes (Apple Services) partner agreement to pay WeShop

for user purchases facilitated by WeShop, and to enable iTunes

inventory of all music, video, books and other media to be

available on the WeShop platform.

Additionally, WeShop has completed the implementation of

functionality that strengthens its user proposition through an

enhanced product and merchant inventory. This is a key milestone in

delivering the best possible experience and proposition to its

users. The commercial agreement with Apple Services ensures that

users can share and recommend products and media across the full

range of their interests and lifestyle, and not just fashion, like

most social commerce platforms. WeShop will look to expand its

product offering even further with hotel and travel inventory later

this year.

Elsewhere in the portfolio we had little material news from

TruSpine where a commercial funding route is in train however not

yet complete as far as we are aware.

We are awaiting the sign off of Sport:80's financial performance

before we make further comment save to say that the business is

growing nicely and we are happy for now to let the company get on

with business and not be distracted by external matters such as an

IPO in a very unreceptive market.

NOMAD and its partner VITOL are still in discussions finalising

the commercialisation of its gas assets in the Ivory Coast and we

await the outcome of those discussions.

Summary

Share price aside, we are pleased with the Quarter as

demonstrating solid growth within the portfolio whilst embarking

upon our next potential investment exit. As evidenced at Fresho and

WeShop, Primorus shareholders can now, in many cases, read about

our investee companies from a range of external media sources and

shareholder groups. I am hopeful that in reading other peoples'

opinions of our investee companies, shareholders might conclude

that the Primorus actually takes a relatively conservative approach

to assessing progress and valuing its investments. It has always

been the aim of Primorus to be judged on its ability to invest

wisely and successfully exit for cash or other tradable

instruments. We see terminal value recognition as the arbiter of

business progress and believe, over time, this goes hand in glove

with shareholder wealth creation.

We would reiterate that estimating timings for exists can be

tricky and in the current global macro environment probably even

more so. The guidance we give changes often and is usually a

reflection of many factors, many or all of which are outside our

direct influence. Indeed, the purpose of these Quarterly Reports is

to provide a running commentary of our views on the investee

companies and what the route to exit is at any given time. These

can change as the facts change.

That being said we believe that many of our core investments

have matured to where, in the absence of IPO demand, secondary

market sales are very possible outcomes. We thank our shareholders

once again for their support and look forward to the second half of

2019 with some optimism.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

Forward Looking Statements

This announcement contains forward-looking statements relating

to expected or anticipated future events and anticipated results

that are forward-looking in nature and, as a result, are subject to

certain risks and uncertainties, such as general economic, market

and business conditions, competition for qualified staff, the

regulatory process and actions, technical issues, new legislation,

uncertainties resulting from potential delays or changes in plans,

uncertainties resulting from working in a new political

jurisdiction, uncertainties regarding the results of exploration,

uncertainties regarding the timing and granting of prospecting

rights, uncertainties regarding the Company's ability to execute

and implement future plans, and the occurrence of unexpected

events. Actual results achieved may vary from the information

provided herein as a result of numerous known and unknown risks and

uncertainties and other factors.

For further information, please contact:

Primorus Investments plc: +44 (0) 20 7440 0640

Alastair Clayton

Nominated Adviser: +44 (0) 20 7213 0880

Cairn Financial Advisers LLP

James Caithie / Sandy Jamieson

Broker: +44 (0) 20 3621 4120

Turner Pope Investments

Andy Thacker

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDGMGZRLRLGLZG

(END) Dow Jones Newswires

August 28, 2019 05:13 ET (09:13 GMT)

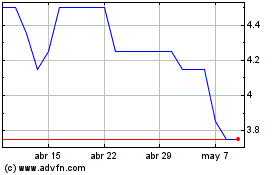

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024