TIDMMDZ

MediaZest Plc

("MediaZest",the "Company" or the "Group"; AIM: MDZ)

Final Results for the Year Ended 31 March 2019

MediaZest, the creative audio-visual company, is pleased to provide

shareholders with final results for the year ended 31 March 2019.

This announcement contains inside information for the purposes of Article 7 of

Regulation (EU) 596/2014

CHAIRMAN'S STATEMENT

Introduction

The results for MediaZest plc for the year ended 31 March 2019 incorporate the

results of its wholly owned subsidiary, MediaZest International Limited.

Results for the year and Key Performance Indicators

* Revenue for the period was GBP3,303,000 up 17% (2018: GBP2,819,000).

* Gross profit was GBP1,675,000 up 23% (2018: GBP1,361,000)

* Gross margins improved by 3% to 51% (2018: 48%).

* EBITDA was a profit of GBP129,000 (2018: loss of GBP113,000).

* Profit after tax was GBP6,000 (2018: loss of GBP256,000).

* The basic and fully diluted earnings per share was 0.0004 pence (2018 loss

per share: 0.02 pence).

* Cash in hand at period end GBP24,000 (2018: GBP38,000).

Business overview

The Board is pleased to announce that the Group has reached profitability at

both EBITDA and Profit after tax for the first time, with considerable year on

year improvement in financial performance, beating market expectations

comfortably.

The results include the beneficial profit impact of GBP117,000 resulting from the

adoption of IFRS15, which is analysed in note 4. The impact of this is

additional revenue of GBP317,000 and costs of GBP200,000 which are consequentially

recognised in profit or loss for the year ended 31 March 2019.

Significant projects for HP (Hewlett Packard), Lululemon Athletica, Ford Motor

Company, Mitsubishi Motors, Opel, and Tiffany & Co. as well as the European

Bank for Reconstruction and Development have complemented ongoing contracts

with long term clients such as Ted Baker, Diesel, Kuoni and Hyundai. During the

year the Group has also successfully completed projects in Europe, the Middle

East, Africa, Asia (including China), the Americas and Australasia making the

Group a global provider of audio-visual solutions for our client base.

MediaZest International Limited turned over GBP3,303,000, generating EBITDA of GBP

434,000 and a Profit after Tax of GBP350,000. It has annual ongoing recurring

contractual revenues in excess of GBP700,000, a number of which are multi-year

deals.

The first six months of the Financial Year 2019 were particularly pleasing as

activity in the retail sector provided opportunities for growth and new client

acquisition, in line with the Group's strategy. The second half of the

financial year, however, was markedly more difficult. This was due, in part, to

the deterioration in macroeconomic trading conditions that has been evident

since November 2018 as a consequence, initially, of uncertainty surrounding

Brexit and then latterly, an overall slowdown in the sector as a whole.

In light of these circumstances, the achievement in reaching profitability this

year has been particularly encouraging although the Board recognises that there

is much work still to be done.

Markets Served and Project Highlights

The Group services, primarily, the Retail sector, particularly the Automotive,

Fashion, Electronic goods and Financial Services sectors. In addition, it also

provides audio visual solutions for the Corporate and Education markets.

Below we set out some of the project highlights for the year in traditional

retail.

The Company continued to provide innovative in-store solutions for HP's

concessions within host retailers across Europe, the Middle East and Africa. In

aggregate over 200 screens were deployed in twelve countries and eight

different languages, all via a centrally managed content management solution

provided by MediaZest.

In the follow-up to a successful deployment at Lululemon's flagship store in

London's Regent Street two years ago, MediaZest has been working with Lululemon

in providing digital signage solutions for multiple stores across Europe as

part of their ongoing growth programme.

Business continued steadily with Ted Baker, for whom the company now provides

content management and audio-visual support globally in twenty countries.

In 2018, the Group was delighted to be appointed to install a large LED screen

at the Tiffany new concept store in Covent Garden and is currently working on

their New Bond Street flagship store refresh programme.

MediaZest added Pets at Home as a client in the year, providing audio-visual

solutions for their new store concepts in Stockport and Chesterfield. Following

the year end the Company has also completed a further store in

Stratford-Upon-Avon with two more awarded and another two in the pipeline.

The automotive sector remained fruitful, as the Group continued to work with

Hyundai and VW but also delivered new concept stores for Ford, Mitsubishi and

Opel. In respect of Ford, the Company provided a range of solutions including

projection, LED and data measurement. This "Ford Store" concept in Manchester

is located within the Next store in the city's Arndale Shopping Centre.

Mitsubishi opened their first store in the Lakeside shopping centre, again

featuring a wide range of audio-visual solutions. For Opel, it provided content

management and content build services for a proof of concept dealership in

Germany, all in the local language. MediaZest, in respect of the latter,

partnered with Snap On Business Solutions in much the same way as it works with

Retail Interior Design agencies and the likes of Samsung to jointly deliver

best-in-class projects for end clients.

In the corporate arena, the Group undertook a large project for the European

Bank for Reconstruction and Development (EBRD), a new headquarters for both

Kuoni and its sister company, Carrier. Along with the aforementioned client

business the completion of an audio installation at BMW's Mini factory in

Oxfordshire, were some of the more notable highlights.

Following the collapse into administration of HMV, a long-standing client, the

Company wrote off bad debts of GBP16,000 against outstanding invoices

representing amounts due no more than 30 days at the time of administration.

Revenue from project work for the new owner of these stores has generated

income of a similar level.

Strategy

The Board's strategy continues to be one of growing both the quantum and

quality of revenues with an emphasis upon clients where there is a long-term

opportunity to deploy solutions across multiple sites, and sometimes countries,

over a period of time.

The Group focus is on providing a high-quality Managed Service offering wrapped

around hardware and software delivery that generates ongoing contractual

revenues from the customer base over several years and this is a major

objective. This strategy has been effective over the last 24 months, in

particular, which has enabled the Group to create an annual recurring

contractual revenue base of in excess of GBP700,000. In the longer-term, the aim

is to cover the Group's costs with recurring contractual revenues to achieve

consistent profitability, supplemented by one or more 'game changing' large

scale roll-out projects.

In the context of the above narrative, the Board has recognised the current

period of economic slowdown and the negative impact thereof on the retail

sector. It has, therefore, taken the following steps in late 2018/early 2019 to

help mitigate this:

* Reduced annual costs by c. GBP200,000

* Increased marketing activity in the Education and Corporate sectors. This

is already showing signs of success as noted below; and

* Undertook a small placing to improve working capital, also as detailed

below.

Fund Raising During the Period

The Company raised GBP110,000 (before expenses) to strengthen the balance sheet

from existing investors in February 2019 by way of a placing of 110,000,000 new

ordinary shares at a placing price of 0.1p per share. The shares were admitted

to trading on AIM in February 2019.

Outlook

Following the progress made during Financial Year 2019, it is prudent to

assume that for the new Financial Year ending 31 March 2020, the macro-economic

and business environment will continue to be challenging.

However, as already noted, many customers continue to work with the Company on

an ongoing basis, rolling out solutions to their stores as refresh or new store

programmes continue. Lululemon, Pets at Home, Ted Baker, Kuoni, Hyundai and

several others fit into this category with multiple projects for each already

won for the new financial year.

A large project in the Education sector has also been won, as announced in the

Trading Update of 25 March 2019. This is expected to be deployed in the second

half of the new financial year.

Retail markets in which the Company operates are increasingly adopting digital

signage solutions, which bodes well for the future. "Big Data" services,

including measuring return on investment and improving the relevancy of content

to the consumer, represent opportunities in the sector in which the Group is in

the vanguard.

Despite the business environment, renewal rates on recurring revenue contracts

for "already-deployed" stores continue to be strong. This, coupled with both

anticipated revenue and other new business wins, along with the reduction in

the cost base means the Board believes the Group has an opportunity to build on

this maiden profit during the coming year.

Lance O'Neill

Chairman

Date: 28 August 2019

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 MARCH 2019

2019 2018

GBP'000 GBP'000

Continuing operations

Revenue 3,303 2,819

Cost of sales (1,628) (1,458)

Gross profit 1,675 1,361

Administrative expenses - excluding depreciation & (1,546) (1,474)

amortisation

EBITDA 129 (113)

Administrative expenses - depreciation & amortisation (40) (41)

Operating profit/(loss) 89 (154)

Finance costs (83) (102)

Profit/(loss) on ordinary activities before taxation 6 (256)

Tax on profit/(loss) on ordinary activities - -

Profit/(loss) for the year and total comprehensive income/ 6 (256)

(loss) for the year attributable to the owners of the

parent

Earnings/(loss) per ordinary 0.1p share

Basic 0.0004p (0.02p)

Diluted 0.0004p (0.02p)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 MARCH 2019

(Company No. 05151799)

2019 2018

GBP'000 GBP'000

Non-current assets

Goodwill 2,772 2,772

Property, plant & equipment 62 51

Intangible fixed assets 1 3

Total non-current assets 2,835 2,826

Current assets

Inventories 69 217

Trade and other receivables 481 897

Cash and cash equivalents 24 38

Total current assets 574 1,152

Current liabilities

Trade and other payables (1,017) (1,664)

Financial liabilities (548) (471)

Total current liabilities (1,565) (2,135)

Net current liabilities (991) (983)

Non-current liabilities

Financial liabilities (25) (22)

Total non-current liabilities (25) (22)

Net assets 1,819 1,821

Equity

Share capital 3,656 3,546

Share premium account 5,244 5,244

Share options reserve 146 146

Retained earnings (7,227) (7,115)

Total equity 1,819 1,821

The financial statements were approved and authorised for issue by the Board of

Directors on 28 August 2019 and were signed on its behalf by:

Geoffrey Robertson

CEO

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 MARCH 2019

Share

Share Share Options Retained Total

Capital Premium Reserve Earnings Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 April 2017 3,499 5,221 146 (6,859) 2,007

Loss for the year - - - (256) (256)

Total comprehensive loss for the year - - - (256) (256)

Issue of share capital 47 24 - - 71

Share issue costs - (1) - - (1)

Balance at 31 March 2018 3,546 5,244 146 (7,115) 1,821

Adjustment for adoption of IFRS 15 - - - (117) (117)

Balance at 1 April 2018 restated 3,546 5,244 146 (7,232) 1,704

Profit for the year - - - 6 6

Total comprehensive income for the - - - 6 6

year

Issue of share capital 110 - - - 110

Share issue costs - - - (1) (1)

Balance at 31 March 2019 3,656 5,244 146 (7,227) 1,819

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEARED 31 MARCH 2019

2019 2018

GBP'000 GBP'000

Net cash generated from/(used in) operating activities before 117 (434)

tax

Taxation - -

Net cash generated from/(used in) operating activities 117 (434)

Cash flows used in investing activities

Purchase of property, plant and equipment (30) (5)

Purchase of intellectual property - (2)

Net cash used in investing activities (30) (7)

Cash flow from financing activities

Other loans (19) (40)

Shareholder loan receipts 385 233

Shareholder loan repayments (330) (213)

Interest paid (58) (54)

Proceeds of share issue 110 70

Share issue costs (1) -

Net cash generated from/(used in) financing activities 87 (4)

Net increase / (decrease) in cash and cash equivalents 174 (445)

Cash and cash equivalents at beginning of year (353) 92

Cash and cash equivalents at end of the year (179) (353)

NOTES TO THE FINANCIAL STATEMENTS

The financial information set out in this announcement does not constitute the

Group's financial statements for the years ended 31 March 2019 or 2018, but is

derived from those financial statements. Statutory financial statements for

2018 have been delivered to the Registrar of Companies and those for 2019 will

be delivered following the Group's annual general meeting. The auditors have

reported on the 2018 and 2019 financial statements which carried an unqualified

audit report, did not include a reference to any matters to which the auditor

drew attention by way of emphasis and did not contain a statement under section

498(2) or 498(3) of the Companies Act 2006.

Whilst the financial information included in this announcement has been

computed in accordance with International Financial Reporting Standards (IFRS),

this announcement does not in itself contain sufficient information to comply

with IFRS. The accounting policies used in preparation of this announcement are

consistent with those in the full financial statements that have yet to be

published.

The Report and Consolidated Financial Statements for the year ended 31 March

2019 will be posted to shareholders shortly and will also be available to

download from the Company's website: www.mediazest.com

1. SEGMENTAL INFORMATION

Revenue for the year can be analysed by customer location as follows:

2019 2018

GBP'000 GBP'000

UK and Channel Islands 2,549 2,381

Netherlands 292 281

Switzerland 157 -

Italy 59 -

Germany 53 70

North America 29 54

Other 164 33

3,303 2,819

An analysis of revenue by type is shown below:

2019 2018

GBP'000 GBP'000

Hardware and installation 2,008 2,016

Support and maintenance - recurring revenue 645 524

Other services (including software solutions) 650 279

3,303 2,819

GBP65,000 of revenue has been recognised at a point in time and GBP3,238,000 of

revenue has been recognised over a period of time. Transitional exemptions

have been taken from restating the comparative disclosure.

Segmental information and results

The Chief Operating Decision Maker ('CODM'), who is responsible for the

allocation of resources and assessing performance of the operating segments,

has been identified as the Board. IFRS 8 requires operating segments to be

identified on the basis of internal reports that are regularly reviewed by the

Board. The Board have reviewed segmental information and concluded that there

is only one operating segment.

The Group does not rely on any individual client - the following revenues arose

from sales to the Group's largest client.

2019 2018

GBP'000 GBP'000

Goods and services 155 94

Service and maintenance 181 169

336 263

2. EARNINGS/(LOSS) PER ORDINARY SHARE

2019 2018

Profit/(Loss) GBP'000 GBP'000

Profit/(Loss) for the purposes of basic and diluted 6 (256)

earnings per share being net loss attributable to

equity shareholders

2019 2018

Number of shares Number Number

Weighted average number of ordinary shares for the 1,296,370,979 1,245,639,221

purposes of basic earnings per share

Number of dilutive shares under option or warrant - -

2019 2018

GBP'000 GBP'000

Weighted average number of ordinary shares for the 1,296,370,979 1,245,639,221

purposes of dilutive loss per share

Basic earnings per share is calculated by dividing the profit after tax

attributed to ordinary shareholders of GBP6,000 (2018 loss: GBP256,000) by the

weighted average number of shares during the year of 1,296,370,979 (2018:

1,245,639,221).

The diluted loss per share is identical to that used for basic loss per share

as the options are "out of the money" and therefore anti-dilutive.

3. CASH AND CASH EQUIVALENTS

The Group The Group The Company The Company

2019 2018 2019 2018

GBP'000 GBP'000 GBP'000 GBP'000

Cash held at bank 24 38 2 -

Invoice discounting facility (203) (391) - -

(179) (353) 2 -

4. ADOPTION OF IRFS 9 AND IFRS 15

IFRS 9 "Financial Instruments" and IFRS 15 "Revenue from contracts with

customers were both adopted with effect from 1 April 2018 in line with the

transitional provisions provided in the new standards.

For IFRS 9 there is not deemed to be any material impact as the impact of any

increased loss allowance is deemed immaterial.

For IFRS 15, Management have reviewed the nature of their contracts in line

with the new standard. In prior years the Group had unbundled the sale of goods

and service works, recognising each element separately, when providing

solutions to customers. However, Management now believe this solution

constitutes the provision of a single performance obligation, where contract

revenue should be recognised over time in line with the criteria of IFRS 15. As

a result, Management have reviewed contracts in progress at the start of the

financial year and aligned the accounting treatment to the new policy.

As disclosed in the Statement of Changes in Equity, this results in a reduction

of equity of GBP117,000 relating to profit which cannot be recognised in line

with the new accounting policy at the start of the year. The impact of this, is

additional revenue of GBP317,000 and costs of GBP200,000 which are consequentially

recognised in profit or loss for the year ended 31 March 2019 as this

adjustment reverses in the current year.

For the remaining income streams of the business is there is no change in

accounting policy from adopting IFRS 15.

END

(END) Dow Jones Newswires

August 28, 2019 08:00 ET (12:00 GMT)

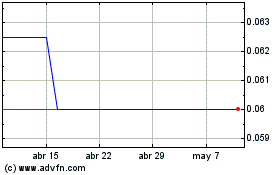

Mediazest (LSE:MDZ)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Mediazest (LSE:MDZ)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024