Westmount Energy Limited Investment in Cataleya Energy Corporation (6337K)

30 Agosto 2019 - 1:04AM

UK Regulatory

TIDMWTE

RNS Number : 6337K

Westmount Energy Limited

30 August 2019

The information contained within this announcement (the

"Announcement") is deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014. Upon the publication of this Announcement via

Regulatory Information Service ("RIS"), this inside information is

now considered to be in the public domain.

30(th) August 2019

WESTMOUNT ENERGY LIMITED

("Westmount" or the "Company")

Additional Investment in Cataleya Energy Corporation

Further to the Susbcription announcement dated 23(rd) August

2019, the Board of Westmount is pleased to announce that it has

entered into unconditional agreements to acquire an additional

313,500 common shares in Cateleya Energy Corporation ("CEC") at a

price of USD $10 per share, for total consideration of US$3,135,000

million (equivalent to GBP GBP2,582,372) including transaction

costs.

CEC is a private, Canadian-registered, company established in

2015 and focused on oil exploration opportunities in the emerging

Guyana-Suriname Basin. CEC's main asset is a 25% participating

interest in the Kaieteur Block, which it holds through its

wholly-owned subsidiary Cataleya Energy Limited ("CEL"). The 13,500

km(2) Kaieteur Block is located outboard of, and adjacent to, the

Ranger Oil Discovery which is located on the Stabroek Block,

offshore Guyana.

The Kaieteur Block was awarded in early 2015 to CEL (formerly

Ratio Energy Limited) and Ratio Guyana Limited, a subsidiary of

Ratio Petroleum Energy Limited Partnership ("Ratio Petroleum").

Subsequent to the Upper Cretaceous play-opening Liza-1 discovery in

May 2015, a farm-in agreement ("ExxonMobil FIA") executed with

ExxonMobil and various other arrangements, the effective date of

the Kaieteur Petroleum Agreement was amended to February 2017. The

Kaieteur Block is currently operated by an ExxonMobil subsidiary,

Esso Production & Exploration Guyana Limited (35%), with CEL

(25%), Ratio Guyana Limited (25%) and a subsidiary of Hess

Corporation (15%) as partners.

A Competent Person's Report ("CPR") on the Kaieteur Block, which

has been carried out by Netherland, Sewell & Associates Inc.

("NSAI") and published by Ratio Petroleum on 14 May 2019, provides

estimates of the unrisked prospective oil resources in 9 prospects

located on the 5,750 km(2) 3D seismic survey acquired in the

southern part of the Kaieteur Block in 2017. This 3D survey covers

circa 42% of the total area of the Kaieteur Block. 'Best Estimate'

of Unrisked Gross Prospective Oil Resources for individual

prospects ranges from 76.1 MMBBLs (Towa-Towa Prospect) to 702.7

MMBBLs (Toucan Prospect). Aggregate 'Best Estimate' Gross Unrisked

Prospective Resources for these 9 prospects is 2.1 BnBBLs

(Aggregate Low to High Estimates 694 MMBBLs to 5.85 BnBBLs)

implying Aggregate Net Best Estimate 525 MMBBLs (Aggregate Net Low

to High Estimate 174 MMbbls to 1.46 BnBBLs) to CEC (25%) across the

area of the Kaieteur 3D seismic survey. The CPR can be viewed on,

or downloaded from, the Tel Aviv Stock Exchange website here.

On 14th May 2019, Ratio Petroleum also announced that ExxonMobil

and partners are planning to spud the first well in the Kaieteur

Block on the Tanager Prospect in the first half of 2020 - subject

to the standard permitting and regulatory approvals. The NSAI

report describes the Tanager Prospect as a stacked reservoir

prospect (Maastrichtian to Turonian reservoir intervals) and

assigns a 'Best Estimate' Unrisked Gross (100%) Prospective Oil

Resource of 256.2 MMBBLs to the prospect (Low to High Estimates

135.6 MMBBLs to 451.6 MMBBLs), with an aggregate Probability of

Geologic Success (POSg) of 72%.

The investment has been funded from Westmount's existing cash

resources, including the net proceeds of the Subscription announced

by the Company on 23(rd) August 2019. At cost, Westmount's holding

in CEC equates to approximately 109% of the value of Westmount's

gross assets as of 31(st) December 2018. Westmount reported a

profit for the interim period ended 31(st) December 2018 of

GBP0.259 million (unaudited), whereas CEC reported a net loss of

USD $44,481 (draft, unaudited) for the year ended 31(st) December

2018. As a result of this share purchase, Westmount's holds a total

of 567,185 common shares in CEC, representing approximately 5.4% of

the fully diluted share capital of CEC as of 29(th) August

2019.

Westmount's strategy continues to be to seek exposure to

opportunities in the prolific Guyana-Suriname Basin, a major

emerging hydrocarbon province where, since 2015, ExxonMobil and its

Stabroek Block partners have reported discovered recoverable

resources in excess of 6 billion oil-equivalent barrels and 13

successes out of 15 exploration wells. Through the Company's

existing portfolio of investments in this basin, the Board believes

that the Company will have exposure to between four and seven

funded wells during 2019-2020, including the recently announced

Jethro-1 Oil Discovery well, the currently drilling Joe-1 well

(both located on the Orinduik Block) and the Tanager-1 well

(located on the Kaieteur block) which is scheduled to be spudded in

the first half of 2020.

Gerard Walsh, Chairman of Westmount Energy Ltd. commented:

"Our investment in CEC is consistent with Westmount's strategy

of seeking exposure to opportunities in the prolific

Guyana-Suriname Basin and it compliments Westmount's existing

portfolio of investments which, in the view of the Board, offers

shareholders exposure to up to 7 fully funded wells during

2019-2020.

The recent announcement, by the Orinduik partners, of the

Jethro-1 Oil Discovery, the first well in Westmount's drilling

portfolio, confirms the potential for additional substantial

discoveries outside of the Stabroek Block and we look forwards to

the outcome of the other potentially 6 wells in Westmount's

drilling portfolio over the coming months, including the Tanager-1

well in 2020."

For further information, please contact:

Westmount Energy Limited www.westmountenergy.com

David King, Director Tel: +44 (0) 1534 823133

Jane Vlahopoulou

Cenkos Securities plc (Nomad and Broker) Tel: +44 (0) 20 7397 8900

Nicholas Wells/Harry Hargreaves (Corporate Finance)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQPLMTTMBBTTLL

(END) Dow Jones Newswires

August 30, 2019 02:00 ET (06:00 GMT)

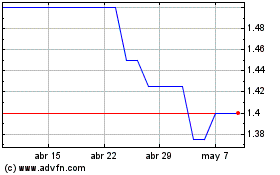

Westmount Energy (LSE:WTE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

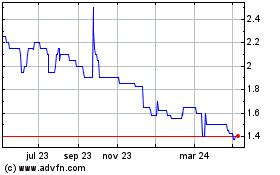

Westmount Energy (LSE:WTE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024