TIDMPRIM

RNS Number : 0793L

Primorus Investments PLC

03 September 2019

Primorus Investments plc

("Primorus" or the "Company")

Interim Results for the six months ended 30 June 2019

Primorus Investments plc announces its interim results for the

six months ended 30 June 2019.

Overview

Primorus Investments plc ("Primorus") has a strong balance sheet

with no debt and with total assets (including cash of GBP121,000)

as at 30 June 2019 amounting to GBP4.85 million. (30 June 2018:

GBP4.94 million).

2019 has been a successful period for the Company as detailed

below.

Highlights for the period were as follows:

- Fresho completed a heavily backed A$2.25 million capital raise

and attracted a A$1.5 million investment from high-profile,

technology and senior banking investors. Undertook widespread

external press coverage that "lifts the veil" on the business to

industry for the first time. Currently pressing ahead on global

expansion plans that may include the UK.

- Post-period end, topped up our investment in Engage Technology

Partners ("Engage") by GBP50,000 to GBP1.45 million. Recently

received an Engage update which highlights outstanding growth in

monthly recurring revenues and billable transactions on the back of

the first Self-Serve, truly scalable, SaaS products.

- Greatland Gold (GGP.L) signed a Farm-in Agreement with

Newcrest Mining (NCZ.AX) ("Newcrest") over the Havieron Project.

Newcrest has the right to acquire up to a 70% interest in 12 blocks

within E45/4701 that cover the Havieron target by spending up to

US$65 million (circa GBP50 million or AUD$90 million) and completed

a series of exploration and development milestones in a four-stage

farm-in over six years.

- WeShop completed an Amazon license agreement to pay WeShop for

user purchases facilitated by WeShop and to enable Amazon inventory

to be available on the WeShop platform. Instagram integration

license: functionality to enable WeShop users to import existing

content from Instagram to post on WeShop. Apple iTunes (Apple

Services) partner agreement to pay WeShop for user purchases

facilitated by WeShop and to enable iTunes inventory of all music,

video, books and other media to be available on the WeShop

platform.

- SOA Energy ("SOA") executed a Farm-in Agreement with Delek

Drilling ("Delek"), one of Israel's largest Oil and Gas companies

with a market capitalisation of circa US$3.5 billion. According to

the agreement, Delek will invest up to US$8.3 million, in return

Delek will assume a 25%, non-operated stake in each of the Ofek and

Yahel licences, leaving SOA with a 45% stake in each permit. Drill

programme is estimated to commence in late 2019.

- Post-period end, Primorus agreed pricing on a sale of its

A$500,000 in Series B loan notes by a known third party. Expecting

final execution of sale documents to occur in next 8 weeks. If

completed as contemplated, this sale would result in a significant

return above investment earlier than previously contemplated.

Financial Results

The operating loss was GBP418,000 (30 June 2018: GBP48,000

loss). The net loss after tax was GBP418,000 (30 June 2018:

GBP48,000).

Total assets including cash at 30 June 2019 amounted to GBP4.85

million (30 June 2018: GBP4.94 million).

Outlook

The Board remains confident that the private and pre-IPO markets

remain significantly under-served and as such significant

opportunities exist for the Company going forward. We look forward

to the remainder of 2019 being a period in which we can further

demonstrate our business model by exiting some more of our

investment positions, thereby realising tangible value for all

shareholders.

We will continue to seek out further investments in line with

the Company's investing strategy.

The Directors would like to take this opportunity to thank our

shareholders, staff and consultants for their continued

support.

Jeremy Taylor-Firth

Chairman

3 September 2019

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information please contact:

Primorus Investments plc

Alastair Clayton, Executive

Director +44 (0) 20 7440 0640

Nominated Advisor

Cairn Financial Advisers

LLP

James Caithie / Sandy Jamieson +44 (0) 20 7213 0880

Broker

Turner Pope Investments

Limited

Andy Thacker +44 (0) 20 3621 4120

Unaudited Condensed Company Statement of Comprehensive

Income

for the six months ended 30 June 2019

6 months 6 months Year to

to to

30 June 2019 30 June 2018 31 December

2018

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

Continuing operations

Revenue

Investment income - - 7

Realised gain on disposal of

AFS investments (136) 267 985

Unrealised (loss)/gain on market

value movement of AFS investments (18) (57) (79)

------------- ------------- ------------

Total gains on AFS investments (154) 210 913

------------- ------------- ------------

Impairment provision on AFS

investments - - (100)

Share based payments - - (212)

Administrative costs (264) (258) (605)

------------- ------------- ------------

Operating (loss) (418) (48) (4)

------------- ------------- ------------

Provision on associate loan - - -

Share of (loss) of associate - - -

Net (loss) on disposal of associate - - -

------------- ------------- ------------

(Loss) before tax (418) (48) (4)

Taxation - - -

------------- ------------- ------------

(Loss) for the period (418) (48) (4)

------------- ------------- ------------

Other comprehensive income

Transfer to income statement - - -

of available for sale reserve

Total Comprehensive Income for

the year attributable to the

owners of the parent company (418) (48) (4)

------------- ------------- ------------

(Loss) per share:

Basic and diluted (loss) per

share (pence) 2 (0.015) (0.002) (0.0001)

Unaudited Condensed Company Statement of Financial Position

as at 30 June 2019

30 June 2019 30 June 2018 31 December

2018

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Available for sale assets 4,674 4,023 4,779

------------- ------------- ------------

4,674 4,023 4,779

------------- ------------- ------------

Current assets

Trade and other receivables 57 642 89

Cash and cash equivalents 121 274 408

------------- ------------- ------------

178 916 497

Total assets 4,852 4,939 5,276

------------- ------------- ------------

EQUITY

Equity attributable to equity

holders of the parent

Share capital 15,391 15,391 15,391

Share premium account 35,296 35,296 35,296

Share based payment reserve 683 471 683

Retained earnings (46,630) (46,256) (46,212)

------------- ------------- ------------

Total equity 4,740 4,902 5,158

LIABILITIES

Current liabilities

Trade and other payables 112 37 118

------------- ------------- ------------

Total liabilities 112 37 118

Total equity and liabilities 4,852 4,939 5,276

------------- ------------- ------------

Unaudited Condensed Company Statement of Changes in Equity

for the six months ended 30 June 2019

Share Share Share based payment reserve Retained Total

capital premium earnings attributable

to owners

of parent

Unaudited GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 December 2017 15,391 35,296 471 (46,208) 4,950

========= ========= ============================ ========== ==============

Loss for the period - - - (4) (4)

Total comprehensive income for the

period - - - (4) (4)

Share options issued - - 212 - 212

Transactions with owners of the

company - - 212 - 212

Balance at 31 December 2018 15,391 35,296 683 (46,212) 5,158

========= ========= ============================ ========== ==============

Loss for the period - - - (418) (418)

Total comprehensive income for the

period - - - (418) (418)

Shares issued - - - - -

Share Issue costs - - - - -

Share options issued - - - - -

Transactions with owners of the - - - - -

company

Balance at 30 June 2019 15,391 35,296 683 (46,630) 4,740

========= ========= ============================ ========== ==============

Unaudited Condensed Company Statement of Cash Flows

for the six months ended 30 June 2019

6 months to 6 months to Year to

30-Jun-19 30-Jun-18 31-Dec-18

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Operating (loss) (418) (48) (4)

Adjustments for:

Share based payment charge - - 212

Impairment provision - - 100

Decrease/(increase) in trade and other receivables 32 83 (47)

Increase/(decrease) in trade and other payables (6) (60) 21

Decrease/(increase) in AFS Investments 147 (262) (175)

Taxation (paid) - - -

Net cash used in operating activities (245) (287) 107

Cash flows from investing activities

Purchase of available for sale assets (334) - -

Proceeds from sales of available for sale assets 292 - -

Loan advanced to related party - - (260)

Net cash (used in) investing activities (42) - (260)

Cash flows from financing activities

Proceeds from share issues - - -

Share issue costs - - -

Net cash from financing activities - - -

Net change in cash and cash equivalents (287) (287) (153)

------------ ------------ ----------

Cash and cash equivalents at beginning of period 408 561 561

Cash and cash equivalents at end of period 121 274 408

------------ ------------ ----------

Notes to the condensed interim financial statements

1. General Information

The condensed interim financial information for the 6 months to

30 June 2019 does not constitute statutory accounts for the

purposes of Section 434 of the Companies Act 2006 and has not been

audited or reviewed. No statutory accounts for the period have been

delivered to the Registrar of Companies.

The condensed interim financial information in respect of the

year ended 31 December 2018 has been produced using extracts from

the statutory accounts for that period. Consequently, this does not

constitute the statutory information (as defined in section 434 of

the Companies Act 2006) for the year ended 31 December 2018, which

was audited. The statutory accounts for this period have been filed

with the Registrar of Companies. The auditors' report was

unqualified and did not contain a statement under Sections 498 (2)

or 498 (3) of the Companies Act 2006.

The Report was approved by the Directors on 3 September 2019 and

is available on the Company's website at

www.primorusinvestments.com .

Basis of preparation and accounting

The financial information has been prepared on the historical

cost basis. The Company's business activities, together with the

factors likely to affect its future development, performance and

position are set out in the Chairman's Statement. This statement

also includes a summary of the Company's financial position and its

cash flows.

These condensed interim financial statements have been prepared

in accordance with International Financial Reporting Standards

(IFRS) as adopted by the European Union with the exception of

International Accounting Standard ('IAS') 34 - Interim Financial

Reporting. Accordingly the interim financial statements do not

include all of the information or disclosures required in the

annual financial statements and should be read in conjunction with

the Company's 2018 annual financial statements.

2. Earnings per share

The calculation of the basic earnings per share is based on the

earnings attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the year. The

calculation of diluted earnings per share is based on the basic

earnings per share, adjusted to allow for the issue of shares and

the post-tax effect of dividends and/or interest, on the assumed

conversion of all dilutive options and other dilutive potential

ordinary shares.

Reconciliations of the earnings and weighted average number of

shares used are set out below.

Six months Six months Year ended

to to

30 June 2019 30 June 2018 31 December

2018

(Unaudited) (Unaudited) (Audited)

(GBP'000) (GBP'000) (GBP'000)

Net loss attributable to equity

holders of the company (418) (47) (4)

----------------------------------- -------------- -------------- --------------

Weighted average number of shares 2,796,619,344 2,796,619,344 2,796,619,344

Basic and diluted loss per share

(pence) (0.015) (0.002) (0.0001)

----------------------------------- -------------- -------------- --------------

3. Events after the reporting date

None

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BDGDCXBGBGCX

(END) Dow Jones Newswires

September 03, 2019 08:17 ET (12:17 GMT)

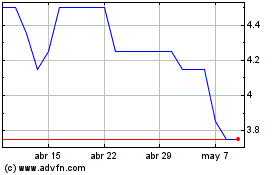

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024