TIDMNAH

RNS Number : 5091M

NAHL Group PLC

17 September 2019

17 September 2019

NAHL Group plc

("NAHL" or the "Group")

Interim Results

Performance in line with expectations; Continued strategic

progress

NAHL (AIM: NAH), the leading UK marketing and services business

focused on the UK consumer legal market, announces its Interim

Results for the six months ended 30 June 2019.

Financial Highlights

-- Revenue up 3.9% to GBP25.8m (2018 H1: GBP24.9m)

-- Underlying operating profit(1) up 1.7% to GBP6.5m (2018 H1:

GBP6.4m) including GBP0.5m of planned start-up losses of new ABS

law firm, National Accident Law ("NAL"). Before these losses, up

10.6% to GBP7.0m

-- Cash generation from operations(1) ahead at GBP3.5m (2018 H1: GBP1.3m)

-- Exceptional costs of GBP0.8m (2018 H1: GBP0.1m) incurred in

preparing for small claims reforms

-- Profit before tax of GBP4.6m after exceptional costs (2018 H1: GBP5.3m)

-- Basic earnings per share of 3.4p (2018 H1: 8.2p), in line

with the Board's expectations, reflecting

o Shifting balance of case allocation between panel law firms

and Legal Services business unit, in line with strategy; and

o Continued development of ABS structures, highlighted by profit

attributable to JV partners of GBP2.6m (2018 H1: GBP0.6m)

-- Interim dividend of 2.6p per share (2018 H1: 3.2p)

-- Net debt(1) flat at GBP17.6m (2018 H1: GBP17.4m)

Operational Highlights

-- Strategic transformation of Personal Injury ("PI") division yielding positive results

-- Successful launch of wholly owned law firm, NAL, which is scaling and performing well

-- National Accident Helpline ("NAH") marketing and placement

tactics adapted to respond to continuing competitive pressures

-- Continued strong progress from Critical Care, with double digit revenue and profit growth

-- Residential Property performance reflective of continuing difficult wider market conditions

Post-Period End

-- Announced the launch of a new ABS law firm, Law Together LLP,

operated in partnership with panel law firm

Russell Atkinson, CEO of NAHL, commented:

"As a Group, we are pleased with the overall progress made in

the first half of the year. The strategic transformation of our

Personal Injury (PI) business continues and the changes put in

place are now yielding positive results.

"Our wholly owned law firm, National Accident Law, has made

encouraging progress since its launch in April 2019 and we are

continuing to grow the number of enquiries being placed through our

Legal Services business unit. Our focus remains on taking an

economic interest in the success of the whole claim and capturing

more value over the long-term. To this end, we are pleased to

announce the launch of a new law firm, Law Together LLP, to help

take advantage of the opportunities ahead.

"In our Critical Care division, we saw another strong

performance, growing operating profit by 12.6% in the period as we

begin the process of investing in the technology platform to

position it for further growth. Conditions within the residential

property market have been well documented and remain challenging.

The leadership team in our Residential Property division are

focused on a range of initiatives to grow market share.

"We are encouraged by the progress made in the year so far, and

although fully cognisant of the challenges ahead, we remain

confident of achieving a full year result in line with our

underlying EPS(1) expectations."

For further information please call:

NAHL Group PLC via FTI Consulting

Russell Atkinson (CEO) Tel: +44 (0) 20

James Saralis (CFO) 3727 1000

finnCap Ltd (NOMAD & Broker) Tel: +44 (0) 207

Julian Blunt / James Thompson 220 0500

(Corporate Finance)

Andrew Burdis (Corporate Broking)

FTI Consulting (Financial PR) Tel: +44 (0) 20

Alex Beagley 3727 1000

James Styles

Sam Macpherson

Notes to Editors

NAHL Group plc (AIM: NAH) is a leader in the Consumer Legal

Services ("CLS") market. The Group provides services and products

to individuals and businesses in the CLS market through its three

divisions:

-- Personal Injury provides outsourced marketing services to law

firms through National Accident Helpline and claims processing

services to individuals through its Legal Services business unit,

which includes the law firms Your Law, National Law Partners, Law

Together and National Accident Law.

-- Critical Care provides a range of specialist services in the

catastrophic and serious injury market to both claimants and

defendants through Bush and Company Rehabilitation.

-- Residential Property provides marketing services to law firms

and conveyancers as well as surveys to individuals through Fitzalan

Partners. It also provides property searches through Searches

UK.

More information is available at www.nahlgroupplc.co.uk

(1) The Interim Results include alternative performance measures

(APMs) because the Directors believe they provide useful

information for shareholders on underlying business trends and

performance. Details of APMs are provided in Note 1.

Interim Management Statement

I am pleased to report the Group's results for the six months

ended 30 June 2019.

Summary of Financial Performance

During the first half of 2019, the Group has performed in line

with the Board's underlying EPS expectations. Revenue grew by 3.9%

to GBP25.8m (H1 2018: GBP24.9m) and underlying operating profit

increased by 1.7% to GBP6.5m (H1 2018: GBP6.4m).

Unaudited Unaudited

H1 2019 H1 2018 Growth Growth

GBPm GBPm GBPm %

Personal Injury 16.2 15.5 0.7 5.1

Critical Care 6.6 6.0 0.6 10.4

Residential Property 3.0 3.4 (0.4) (12.8)

------------------------------------------------------------------------ ---------- ---------- ------- -------

Revenue 25.8 24.9 0.9 3.9

Personal Injury 4.8 4.6 0.2 2.8

Critical Care 2.3 2.1 0.2 12.6

Residential Property 0.1 0.6 (0.5) (83.7)

Group Costs (0.7) (0.9) 0.2 (21.9)

------------------------------------------------------------------------ ---------- ---------- ------- -------

Underlying operating profit 6.5 6.4 0.1 1.7

Start -up losses associated with NAL 0.5 - 0.5 n/a

------------------------------------------------------------------------ ---------- ---------- ------- -------

Underlying operating profit before start-up losses associated with NAL 7.0 6.4 0.6 10.6

------------------------------------------------------------------------ ---------- ---------- ------- -------

Underlying operating profit was net of GBP0.5m of planned

start-up losses associated with the Group's new law firm, National

Accident Law ("NAL"). Whilst they don't conform to the Group's

definition of exceptional costs, these start-up losses comprise the

operating loss for the first six months after launch, as the

business is scaling up and still refining its processes. The

underlying operating profit before start-up losses associated with

NAL was GBP7.0m, which represents growth of 10.6% on last year.

The Group also incurred GBP0.8m (H1 2018: GBP0.1m) of

exceptional costs associated with our business transformation. We

continue to carefully manage these costs and are pleased that they

remain in line with plan.

After deducting minority interest payments associated with the

Group's ABS law firms, which are rising as a result of increased

volumes, underlying earnings per share was 7.4p (H1 2018: 9.9p),

which was consistent with the Board's expectation.

Trading Review - Personal Injury ("PI")

The PI division performed in line with plan in the first half.

Revenue increased 5.1% to GBP16.3m and underlying operating profit

increased 2.8% to GBP4.8m.

The strategic transformation of PI continues and, pleasingly,

the contribution from our Legal Services business unit is slightly

ahead of expectations during the period. This includes the Group's

wholly owned law firm, NAL, which has made encouraging progress

since its launch in April 2019, and we are now turning our

attention to finalising our small claims proposition, albeit we

still require Government confirmation of some important elements of

the small claims process.

We are encouraged that panel demand has remained stable during

the period and we have agreed a number of deals with panel firms

that extend beyond the reform implementation date, currently

planned for April 2020. We continue to grow the proportion of our

enquiries placed into our Legal Services business unit, in support

of our chosen strategy.

National Accident Helpline ("NAH") continues to operate in

challenging market conditions, driven by competitive pressures. The

Board expects these to persist until the implementation date of the

legal reforms. NAH management continue to adapt the business'

marketing and placement tactics to respond and optimise its

performance. As part of this, we are investing in re-platforming

the NAH website in early 2020 which will keep us at the forefront

of digital marketing performance.

Our largest ABS venture, Your Law LLP, performed ahead of

expectations in the first half and continues to grow. It has

achieved damages to date of over GBP16m. Together with our partner

in this venture, NewLaw LLP, we are pleased with the progress made

and look forward to further developing this relationship.

I am pleased to announce that on 16 September we entered into a

contract to launch a new law firm, called Law Together LLP. This

venture, which is operated in partnership with Horwich Cohen

Coghlan Solicitors, is consistent with the ongoing evolution of our

ABS strategy, enabling us to maintain our placement strategy and

manage the working capital demands of running personal injury

claims. Law Together is the third joint venture law firm to have

been established by NAH following the launch of Your Law and

National Law Partners in 2017 and is scheduled to launch in October

2019.

Trading Review - Critical Care

Our Critical Care division has had a good H1, driven largely by

organic growth from its case management business. Revenue increased

10.4% to GBP6.6m, and underlying operating profit was up 12.6% to

GBP2.3m.

The business is progressing a number of initiatives aimed at

maintaining this growth and intends to upgrade its technology

platform in 2020, which will create efficiencies and deliver

further process improvements.

Trading Review - Residential Property

The residential property market has deteriorated further in H1

and this has impacted our results. First half revenue was down

12.8% to GBP3.0m and underlying operating profit was down 83.7% at

GBP0.1m. Whilst leadership changes made last year are starting to

have a positive effect, the market remains very challenging.

Cash Conversion, Balance Sheet and Interim Dividend

The Group generated free cash flow(1) of GBP0.8m in the first

half (H1 2018: GBP(0.5)m) and underlying cash conversion increased

on the same period last year to 66.5% (H1 2018: 20.3%). Our ABS law

firms made a positive contribution towards a total of GBP4.3m

underlying operating cash flow(1) .

As at 30 June 2019 we had net debt of bank borrowings of

GBP17.6m (H1 2018: GBP17.4m), which was in line with our

expectations.

The Board is declaring an interim dividend of 2.6p per share

payable on 31 October 2019 to ordinary shareholders registered on

27 September 2019. Our policy is to have a dividend cover of twice

underlying EPS, before exceptional costs and non-cash charges.

Current Year Outlook

As a Board, we are pleased with the tangible results achieved

within the PI division in the first half of the year and expect the

Group to continue to make progress with its strategic

transformation in H2. Whilst we do not expect a noticeable

improvement in the market conditions experienced by our Residential

Property or PI divisions, our underlying earnings expectations for

the full year remain unchanged.

Russell Atkinson

Chief Executive Officer

17 September 2019

(1) The Interim Results include alternative performance measures

(APMs) because the Directors believe they provide useful

information for shareholders on underlying business trends and

performance. Details of APMs are provided in Note 1.

Consolidated statement of comprehensive income

for the 6 months ended 30 June 2019

Audited

Unaudited Unaudited 12 months

6 months 6 months ended 31

Note ended 30 ended 30 December 2018

June 2019 June 2018 GBP000

GBP000 GBP000

Total revenue 2 25,839 24,865 48,957

Cost of sales (12,589) (12,217) (24,254)

Gross profit 13,250 12,648 24,703

Administrative expenses (8,500) (7,269) (14,683)

---------------------------------------------------------------- ------- ----------- ------------ ----------------

Underlying operating profit 6,465 6,360 12,132

Share-based payments (426) (191) (457)

Amortisation of intangible assets acquired on business

combinations (484) (648) (1,270)

Exceptional items 3 (805) (142) (385)

Total operating profit 2 4,750 5,379 10,020

Financial income 104 98 222

Financial expense (296) (206) (470)

---------------------------------------------------------------- ------- ----------- ------------ ----------------

Profit before tax 4,558 5,271 9,772

Taxation 4 (424) (953) (1,389)

---------------------------------------------------------------- ------- ----------- ------------ ----------------

Profit for the period and total comprehensive income 4,134 4,318 8,383

---------------------------------------------------------------- ------- ----------- ------------ ----------------

Profit and total comprehensive income is attributable to:

Owners of the company 1,561 3,758 6,674

Non-controlling interests 2,573 560 1,709

---------------------------------------------------------------- ------- ----------- ------------ ----------------

4,134 4,318 8,383

---------------------------------------------------------------- ------- ----------- ------------ ----------------

Unaudited 6 months ended Unaudited 6 months Audited 12 months

30 June 2019 ended ended

30 June 31 December 2018

2018

-------------------------------- ------------------------- ------------------- ------------------

Basic earnings per share (p) 7 3.4 8.2 14.5

-------------------------------- ------------------------- ------------------- ------------------

Diluted earnings per share (p) 7 3.3 8.0 14.3

-------------------------------- ------------------------- ------------------- ------------------

Consolidated statement of financial position

At 30 June 2019

Unaudited 6 months ended Unaudited 6 months ended Audited 12 months ended

30 June 2019 30 June 2018 31 December 2018

Note GBP000 GBP000 GBP000

--------------------------- ----- -------------------------- -------------------------- --------------------------

Non-current assets

Goodwill 60,362 60,362 60,362

Intangibles 5,906 6,647 6,400

Property, plant and

equipment 842 225 195

Deferred tax asset 152 34 177

--------------------------- ----- -------------------------- -------------------------- --------------------------

67,262 67,268 67,134

--------------------------- ----- -------------------------- -------------------------- --------------------------

Current assets

Trade and other

receivables (including

GBP4,955,000 (June 2018:

GBP9,538,000, December

2018:

GBP6,603,000) due in

greater than one year) 5 33,027 29,978 28,806

Cash and cash equivalents 2,026 939 1,598

35,053 30,917 30,404

--------------------------- ----- -------------------------- -------------------------- --------------------------

Total assets 102,315 98,185 97,538

--------------------------- ----- -------------------------- -------------------------- --------------------------

Current liabilities

Trade and other payables 6 (17,495) (14,770) (15,111)

Other payables relating to

legacy pre-LASPO ATE

product - (865) (301)

Tax payable (726) (1,290) (975)

(18,221) (16,925) (16,387)

--------------------------- ----- -------------------------- -------------------------- --------------------------

Non-current liabilities

Other interest-bearing

loans and borrowings (19,659) (18,334) (17,122)

Deferred tax liability (1,188) (1,500) (1,342)

--------------------------- ----- -------------------------- -------------------------- --------------------------

(20,847) (19,834) (18,464)

--------------------------- ----- -------------------------- -------------------------- --------------------------

Total liabilities (39,068) (36,759) (34,851)

--------------------------- ----- -------------------------- -------------------------- --------------------------

Net assets 63,247 61,426 62,687

--------------------------- ----- -------------------------- -------------------------- --------------------------

Equity

Share capital 115 115 115

Share option reserve 3,004 2,312 2,578

Share premium 14,595 14,595 14,595

Merger reserve (66,928) (66,928) (66,928)

Retained earnings 110,313 110,756 111,380

--------------------------- ----- -------------------------- -------------------------- --------------------------

Capital and reserves

attributable to the

owners of NAHL Group plc 61,099 60,850 61,740

Non-controlling interests 2,148 576 947

--------------------------- ----- -------------------------- -------------------------- --------------------------

Total equity 63,247 61,426 62,687

--------------------------- ----- -------------------------- -------------------------- --------------------------

Consolidated statement of changes in equity

for the 6 months ended 30 June 2019

Capital and

reserves

Share attributa-ble

Share option Share Merger Retained to the owners Non-controlling Total

capital reserve premium reserve earnings of NAHL Group interest equity

GBP000 GBP000 GBP000 GBP000 GBP000 plc GBP000 GBP000 GBP000

---------------- --------- --------- --------- --------- ---------- --------------- ----------------- --------

Balance at 1

January 2019 115 2,578 14,595 (66,928) 111,380 61,740 947 62,687

Adjustment on

initial

application of

IFRS 16 - - - - 4 4 - 4

Adjusted

balance at 1

January 2019 115 2,578 14,595 (66,928) 111,384 61,744 947 62,691

Total

comprehensive

income for the

period

Profit for the

period - - - - 1,561 1,561 2,573 4,134

---------------- --------- --------- --------- --------- ---------- --------------- ----------------- --------

Total

comprehensive

income - - - - 1,561 1,561 2,573 4,134

---------------- --------- --------- --------- --------- ---------- --------------- ----------------- --------

Transactions with owners,

recorded directly in

equity

Share-based

payments - 426 - - - 426 - 426

Dividends paid - - - - (2,632) (2,632) - (2,632)

Non-

controlling

interest

member

drawings - - - - - - (1,372) (1,372)

Balance at 30

June 2019 115 3,004 14,595 (66,928) 110,313 61,099 2,148 63,247

---------------- --------- --------- --------- --------- ---------- --------------- ----------------- --------

Balance at 1

January 2018 115 2,121 14,507 (66,928) 111,893 61,708 103 61,811

Total

comprehensive

income for the

period

Profit for the

period - - - - 3,758 3,758 560 4,318

---------------- --------- --------- --------- --------- ---------- --------------- ----------------- --------

Total

comprehensive

income - - - - 3,758 3,758 560 4,318

---------------- --------- --------- --------- --------- ---------- --------------- ----------------- --------

Transactions

with owners,

recorded

directly in

equity

Issue of new

Ordinary

shares - - 88 - - 88 - 88

Share-based

payments - 191 - - - 191 - 191

Dividends paid - - - - (4,895) (4,895) - (4,895)

Non-

controlling

interest

member

drawings - - - - - - (87) (87)

Balance at 30

June 2018 115 2,312 14,595 (66,928) 110,756 60,850 576 61,426

---------------- --------- --------- --------- --------- ---------- --------------- ----------------- --------

Balance at 1

January 2018 115 2,121 14,507 (66,928) 111,893 61,708 103 61,811

Adjustment on

initial

application of

IFRS 9 net of

tax - - - - (814) (814) - (814)

Adjusted

balance at 1

January 2018 115 2,121 14,507 (66,928) 111,079 60,894 103 60,997

Total

comprehensive

income for the

year

Profit for the

year - - - - 6,674 6,674 1,709 8,383

---------------- --------- --------- --------- --------- ---------- --------------- ----------------- --------

Total

comprehensive

income - - - - 6,674 6,674 1,709 8,383

---------------- --------- --------- --------- --------- ---------- --------------- ----------------- --------

Transactions

with owners,

recorded

directly in

equity

Issue of new

Ordinary

Shares - - 88 - - 88 - 88

Member drawings - - - - - - (865) (865)

Share-based

payments - 457 - - - 457 - 457

Dividends paid - - - - (6,373) (6,373) - (6,373)

Balance at 31

December 2018 115 2,578 14,595 (66,928) 111,380 61,740 947 62,687

---------------- --------- --------- --------- --------- ---------- --------------- ----------------- --------

Consolidated cash flow statement

for the 6 months ended 30 June 2019

Audited

Unaudited 6 months ended Unaudited 12 months ended 31

30 June 2019 6 months ended 30 June December 2018

Note GBP000 2018 GBP000 GBP000

-------------------------- ------ -------------------------- -------------------------- --------------------------

Cash flows from operating

activities

Profit for the period 4,134 4,318 8,383

Adjustments for:

Depreciation and amortisation 913 810 1,630

IFRS 9 provision movements 130 - 206

Financial income (104) (98) (222)

Financial expense 296 206 470

Share-based payments 426 191 457

Taxation 424 953 1,389

---------------------------------- -------------------------- -------------------------- --------------------------

6,219 6,380 12,313

Increase in trade and other

receivables (4,253) (7,621) (7,564)

Increase in trade and other

payables 1,530 2,340 2,775

Increase/(decrease) in other

payables relating to legacy

pre-LASPO ATE product - 189 (375)

---------------------------------- -------------------------- -------------------------- --------------------------

Cash generation from operations 3,496 1,288 7,149

Interest paid (240) (154) (474)

Tax paid (803) (1,338) (2,202)

---------------------------------- -------------------------- -------------------------- --------------------------

Net cash from operating

activities 2,453 (204) 4,473

---------------------------------- -------------------------- -------------------------- --------------------------

Cash flows from

investing activities

Acquisition of property, plant

and equipment (118) (42) (145)

Acquisition of intangible assets (190) (156) (640)

Disposal of property, plant and

equipment - - 42

Interest received 6 2 35

Net cash used in investing

activities (302) (196) (708)

---------------------------------- -------------------------- -------------------------- --------------------------

Cash flows from

financing activities

New share issue - 88 88

New borrowings acquired 2,500 5,375 4,125

Finance leases (219) - -

Dividends paid (2,632) (4,895) (6,373)

Non- controlling interest member

drawings (1,372) (87) (865)

---------------------------------- -------------------------- -------------------------- --------------------------

Net cash (used in)/from financing

activities (1,723) 481 (3,025)

---------------------------------- -------------------------- -------------------------- --------------------------

Net increase in cash and cash

equivalents 428 81 740

Cash and cash equivalents at

beginning of period 1,598 858 858

---------------------------------- -------------------------- -------------------------- --------------------------

Cash and cash equivalents at end

of period 2,026 939 1,598

---------------------------------- -------------------------- -------------------------- --------------------------

Notes to the financial statements

1. Accounting policies

General Information

The half year results for the current and comparative period to

30 June have not been audited or reviewed by auditors pursuant to

the Auditing Practices Board guidance of Review of Interim

Financial Information.

These half year results do not comprise statutory accounts

within the meaning of Section 434 of the Companies Act 2006.

Statutory accounts for the year ended 31 December 2018 were

approved by the Board of Directors on 18 March 2019 and delivered

to the Registrar of Companies. The report of the auditors on those

accounts was unqualified, did not contain an emphasis of matter

paragraph and did not contain any statement under Section 498 of

the Companies Act 2006.

Having made due enquiries the Directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. For this reason,

they continue to adopt the going concern basis in preparing the

condensed set of financial statements.

The condensed set of financial statements was approved by the

Board of Directors on 16 September 2019.

Basis of preparation

Statement of compliance

The half year results for the current and comparative period to

30 June have been prepared in accordance with IAS 34 Interim

Financial Reporting as adopted by the EU and the AIM Rules of UK

companies. They do not include all of the information required for

full annual financial statements and should be read in conjunction

with the financial statements of the Group for the year ended 31

December 2018, which have been prepared in accordance with IFRSs as

adopted by the European Union.

New and amended standards adopted by the Group

The following new or amended standards became applicable for the

current reporting period:

IFRS 16 - Leases

The Group has adopted IFRS 16 'Leases' from 1 January 2019 which

has changed lease accounting for lessees under operating leases.

Such agreements now require recognition of an asset, representing

the right to use the leased item, and a liability, representing

future lease payments. Lease costs (such as property rent) are

recognised in the form of depreciation and interest, rather than as

an operating cost. Further information on the impact of IFRS 16 is

given in Note 10.

Use of judgements and estimates

The preparation of financial statements in conformity with IFRSs

requires management to make judgements and estimates that affect

the application of accounting policies and the reported amounts of

assets, liabilities, income and expenses. Actual results may differ

from these estimates. Estimates and underlying assumptions are

reviewed on an ongoing basis. Revisions to accounting estimates are

recognised in the year in which the estimates are revised and in

any future years affected.

The preparation of the condensed set of financial statements

requires management to make judgements, estimates and assumptions

that affect the application of accounting policies and reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates.

In preparing the condensed set of financial statements, the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were of the same type as those that applied to the financial

statements for the year ended 31 December 2018.

Significant accounting policies

The accounting policies used in the preparation of these interim

financial statements for the 6 months ended 30 June 2019 are the

accounting policies as applied to the Group's financial statements

for the year ended 31 December 2018 with the addition of IFRS 16

which is discussed in further detail in Note 10.

Statutory and non-statutory measures

The Directors have presented these alternative performance

measures (APMs) in the Interim Results because they believe they

provide additional useful information for shareholders on

underlying business trends and performance. As these APMs are not

defined by IFRS, they may not be directly comparable to other

companies' APMs. They are not intended to be a substitute for, or

superior to, IFRS measurements and the Directors recommend that the

IFRS measures should also be used when users of this document

assess the performance of the Group.

The APMs used in the Interim Results are as defined in the 2018

Annual Report and the principles to identify adjusting items have

been applied on a basis consistent with previous years with the

exception of exceptional revenues arising from the release of the

pre-LASPO ATE liability. Given the magnitude of the pre-LASPO ATE

liability, it is no longer considered to be a material item and

therefore from 1 January 2019 the Directors have made the decision

to no longer include revenues related to the release of this

liability as an exceptional item. The key adjusting items in

arriving at the APMs are as follows:

IFRS 2 Share-based Payments - This is the charge for share-based

payments calculated in line with IFRS 2. IFRS 2 requires the

fair

value of equity instruments measured at grant date to be spread

over the period during which the employees become

unconditionally

entitled to the options. The calculation behind the charge can

fluctuate year-on-year as new grants are made depending on inputs

such

as the expected volatility, the share price, exercise price etc.

and therefore the charge can vary with little correlation to the

underlying

trading activities. For example, in the five years since the

Group's flotation on AIM, the IFRS 2 charge has been as low as

GBP182,000 and

as high as GBP1,052,000. Management therefore believe it is

appropriate to exclude this charge from the underlying operating

profit to

allow for greater comparability of the underlying core trading

performance of the Group year-on-year.

IFRS 3 (Revised) Business Combinations - This is the

amortisation charge for intangible assets arising on acquisitions

and expenditure

arising from acquisition activity. Under IFRS 3 all acquisition

costs are required to be expensed in the Group Income Statement

and

intangible assets arising on acquisition are required to be

amortised over their useful economic life. Management believes that

it is

useful to separately identify these costs due to their

materiality to the Group results and due to the fact that the

amortisation is

calculated on a straight-line basis, it therefore has little

correlation to the trading activities of the acquired entity in any

particular year.

To allow for greater comparability of the trading results

year-on-year, this charge is therefore excluded from underlying

operating profit.

Exceptional items - These are non-recurring items that are

material by nature and separately identified to allow for greater

comparability of underlying Group operating results year on year.

Examples of exceptional items in the current and/or previous years

include

reorganisation and restructuring costs; revaluation of liability

associated with legacy ATE products; and acquisition related

costs.

Exceptional costs are separately identified to allow for greater

comparability of underlying Group operating results

year-on-year.

The APMS presented in the Interim Results are defined as

follows:

Nature Related Related

of IFRS IFRS

measure measure source Definition Use/relevance

Underlying Operating Consolidated Based on the related Allows management and users

operating profit income IFRS measure of the financial statements

profit statement but excluding exceptional to assess the underlying

items, IFRS trading results after removing

2 share-based payment material, non-recurring

charges and items that are not reflective

amortisation of intangible of the core trading activities

assets and allows comparability

acquired on business of core trading performance

combinations. year-on-year.

----------- ----------------- --------------- --------------------------------- ----------------------------------

Underlying Cash flow Consolidated Based on the related Provides management with

operating from cash flow IFRS measure an indication of the amount

cash operating statement but excluding cash flows of cash available for

flow activities in respect of discretionary

the items excluded from investing or financing

underlying after removing material

operating profit as described non-recurring expenditure

above. that does not reflect the

underlying trading operations

and allows management to

monitor the conversion

of underlying profit into

cash.

Underlying Not defined n/a Calculated as underlying

cash by IFRS operating

conversion cash flow divided by

underlying

operating profit.

Free Not defined n/a Calculated as net cash

cash by IFRS generated

flow from operating activities

less net cash

used in investing activities

less

payments made to non-controlling

interests.

----------- ----------------- --------------- ---------------------------------

Underlying Basic Consolidated Based on the related Allows management and users

EPS income IFRS measure of the financial statements

EPS statement but calculated using to assess the underlying

underlying trading results after removing

Profit after tax. material, non-recurring

items that are not reflective

of the core trading activities.

It also allows comparability

of core trading performance

year-on-year.

---------------------------- ----------------- --------------------------------- ----------------------------------

Working Movement Consolidated Working capital is not Allows management to assess

Capital in receivables statement defined by IFRS. This the short-term cash flows

and movement of cashflows is defined by management from movements in the more

in payables as being the cash movement liquid assets.

in trade and other receivables

less the cash movement

in trade and other payables.

Net debt Not defined Consolidated Net debt is defined as Allows management to monitor

by IFRS cash flow cash and cash the overall level of debt

statement equivalents less interest-bearing in the business. As stated

borrowings net of loan in the strategic report,

arrangement loan funding is key to

fees. the Group's future strategy

as an increasing proportion

of profits and cash flows

are deferred until case

settlement.

A reconciliation of each measure is provided as follows:

Underlying operating profit:

Unaudited 6 months ended 30 Unaudited 6 months ended 30 Audited 12 months ended 31

June 2019 June 2018 December 2018

GBP000 GBP000 GBP000

---------------------------- ---------------------------- ---------------------------- ----------------------------

IFRS measure - operating

profit 4,750 5,379 10,020

Exceptional items 805 142 385

IFRS 2 share-based payment

charge 426 191 457

Amortisation of intangible

assets acquired on

business combinations 484 648 1,270

Underlying operating profit 6,465 6,360 12,132

---------------------------- ---------------------------- ---------------------------- ----------------------------

Underlying operating cash flow, underlying cash conversion and

free cash flow:

Unaudited 6 months ended 30 Unaudited 6 months ended 30 Audited 12 months ended 31

June 2019 June 2018 December 2018

GBP000 GBP000 GBP000

---------------------------- ---------------------------- ---------------------------- ----------------------------

IFRS measure - cash

generation from operations 3,496 1,288 7,149

Exceptional items 805 142 385

Working capital movements

in respect of exceptional

items - 50 50

Decrease/(increase) in

liabilities relating to

Pre-LASPO ATE - (189) 375

---------------------------- ---------------------------- ---------------------------- ----------------------------

Underlying operating cash

flow 4,301 1,291 7,959

Underlying operating profit

(as above) 6,465 6,360 12,132

Underlying cash conversion 66.5% 20.3% 65.6%

Cash generation from

operations 3,496 1,288 7,149

Interest paid (240) (154) (474)

Tax paid (803) (1,338) (2,202)

---------------------------- ---------------------------- ---------------------------- ----------------------------

Net cash generated from

operating activities 2,453 (204) 4,473

Net cash used in investing

activities (302) (196) (708)

Payments to non-controlling

interests (1,372) (87) (865)

---------------------------- ---------------------------- ---------------------------- ----------------------------

Free cash flow 779 (487) 2,900

---------------------------- ---------------------------- ---------------------------- ----------------------------

Underlying EPS:

Unaudited 6 months ended 30 Unaudited 6 months ended 30 Audited 12 months ended 31

June 2019 June 2018 December 2018

GBP000 GBP000 GBP000

---------------------------- ---------------------------- ---------------------------- ----------------------------

IFRS measure - profit for

the year attributable to

shareholders 1,561 3,758 6,674

Exceptional items net of

tax 652 115 312

Start-up losses associated 458 - -

with NAL net of tax

IFRS 2 share-based payment

charge 426 191 457

Amortisation of intangible

assets acquired on

business combinations net

of deferred tax 334 486 950

Underlying profit for the

year attributable to

shareholders 3,431 4,550 8,393

Weighted average number of

shares 46,178,716 46,100,876 46,160,172

Underlying EPS 7.4 9.9 18.2

---------------------------- ---------------------------- ---------------------------- ----------------------------

Working capital:

Unaudited 6 months ended 30 Unaudited 6 months ended 30 Audited 12 months ended 31

June 2019 June 2018 December 2018

GBP000 GBP000 GBP000

---------------------------- ---------------------------- ---------------------------- ----------------------------

Movement in trade and other

receivables (4,253) (7,621) (7,564)

IFRS 9 provision movement 130 - 206

Movement in trade and other

payables 1,530 2,340 2,775

Working capital (2,593) (5,281) (4,583)

Pre-LASPO ATE movement (101) - -

IFRS 9 opening balance

adjustment - - 1,002

IFRS 16 adjustments to 676 - -

payables

Movement in interest

accruals (120) (81) (268)

---------------------------- ---------------------------- ---------------------------- ----------------------------

IFRS measure - movement in

trade and other

receivables less movement

in trade and other

payables

(including Pre-LASPO ATE

liability) (2,138) (5,362) (3,849)

---------------------------- ---------------------------- ---------------------------- ----------------------------

Financial assets and liabilities

The Group's principal financial instruments comprise cash and

cash equivalents, trade and other receivables, trade and other

payables

and interest-bearing borrowings.

Trade and other receivables

Trade and other receivables are recognised initially at fair

value. Subsequent to initial recognition, trade and other

receivables are stated at amortised cost using the effective

interest method, less any impairment losses calculated in line with

IFRS 9.

Trade and other payables

Trade and other payables are recognised initially at fair value.

Subsequent to initial recognition, trade and other payables are

stated at

amortised cost using the effective interest method.

Cash and cash equivalents

Cash and cash equivalents comprise cash balances. Cash and cash

equivalents are repayable on demand and are recognised at their

carrying amount.

Interest-bearing borrowings

Interest-bearing borrowings are recognised initially at fair

value less attributable transaction costs. Subsequent to initial

recognition,

interest-bearing borrowings are stated at amortised cost using

the effective interest method, less any impairment losses.

2. Operating segments

Personal Critical Residential Group Underlying Pre-LAPSO Other Eliminati-ons Total

Injury Care Property GBP000 operations ATE items GBP000 GBP000

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

6 months ended 30 June

2019

Revenue 16,279 6,591 2,969 - 25,839 - - - 25,839

Depreciation and

amortisation (185) (71) (172) (1) (429) - (484) - (913)

Operating profit/(loss)

(1) 4,751 2,349 96 (731) 6,465 - (1,715) - 4,750

Financial income 103 - - 1 104 - - - 104

Financial expenses (1) (1) (2) (292) (296) - - - (296)

Profit/(loss) before tax 4,853 2,348 94 (1,022) 6,273 - (1,715) - 4,558

Trade receivables 8,673 5,106 770 - 14,549 - - - 14,549

Total assets(3) 29,289 5,753 1,666 78,332 115,040 - - (12,725) 102,315

Segment liabilities(3) (15,457) (1,027) (704) (307) (17,495) - (2) - - (17,495)

Capital expenditure

(including intangibles) (192) (93) (7) (16) (308) - - - (308)

------------------------- --------- --------- ------------ -------- ----------- ---------- --------- -------------- ---------

6 months ended 30 June

2018

Revenue 15,489 5,970 3,406 - 24,865 - - 24,865

Depreciation and

amortisation (94) (18) (50) - (162) - (648) (810)

Operating profit/(loss)

(1) 4,622 2,087 588 (937) 6,360 - (981) 5,379

Financial income 97 - - 1 98 - - 98

Financial expenses - - - (206) (206) - - (206)

Profit/(loss) before tax 4,719 2,087 588 (1,142) 6,252 - (981) 5,271

Trade receivables 14,572 4,655 795 - 20,022 - - 20,022

Total Assets(3) 25,132 4,970 1,604 78,917 110,623 (12,438) 98,185

Segment liabilities(3) (12,492) (1,003) (569) (706) (14,770) (865)(2) - 15,635

Capital expenditure

(including intangibles) 21 20 157 - 198 - - 198

------------------------- --------- --------- ------------ -------- ----------- ---------- --------- -------------- ---------

12 months ended 31

December 2018

Revenue 29,522 12,383 6,388 - 48,293 664 - - 48,957

Depreciation and

amortisation (195) (48) (117) - (360) - (1,270) - (1,630)

Operating profit/(loss)

(1) 8,424 4,520 728 (1,540) 12,132 589 (2,701) - 10,020

Financial income 191 30 - 1 222 - - - 222

Financial expenses - (5) - (465) (470) - - - (470)

Profit/(loss) before tax 8,615 4,545 728 (2,004) 11,884 589 (2,701) - 9,772

Trade receivables 10,200 5,036 598 - 15,834 - - - 15,834

Total assets(3) 24,528 5,800 1,269 78,574 110,171 - - (12,633) 97,538

Segment liabilities(3) (13,254) (1,137) (364) (356) (15,111) (301)(2) - - (15,412)

Capital expenditure

(including intangibles) 245 188 352 - 785 - - - 785

------------------------- --------- --------- ------------ -------- ----------- ---------- --------- -------------- ---------

1. These are the respective underlying profits of the division.

2. Pre-LASPO ATE liabilities include the balance of commissions

received in advance that are due to be paid back to the

insurance

provider of GBP200,000 (June 2018: GBP865,000, December 2018:

GBP301,000). From January 2019 this balance was no longer

considered to be material and going forward will now be presented

as part of Personal Injury.

3. Total assets and segment liabilities exclude intercompany

loan balances as these do not form part of the operating activities

of the segment.

Geographic information

All revenue and assets of the Group are based in the UK.

Operating segments

The activities of the Group are managed by the Board, which is

deemed to be the chief operating decision maker (CODM). The CODM

has identified the following segments for the purpose of

performance assessment and resource allocation decisions. These

segments are split along product lines and are consistent with

those reported last year.

Personal Injury - Revenue from the provision of enquiries to the

Panel Law Firms, based on a cost plus margin model, plus

commissions received from providers for the sale of additional

products by them to the Panel Law Firms and in the case of the

ABSs, revenue receivable from clients for the provision of legal

services.

Critical Care - Revenue from the provision of expert witness

reports and case management support within the medico-legal

framework for multi-track cases.

Residential Property - Revenue from the provision of online

marketing services to target homebuyers and sellers in England and

Wales, offering lead generation services to Panel Law Firms and

surveyors in the conveyancing sector and the provision of

conveyancing searches for solicitors and licensed conveyancers.

Group - Costs that are incurred in managing Group activities or

not specifically related to a product.

Pre-LASPO ATE - Revenue is commissions received from the

insurance provider for the use of after the event policies by Panel

Law Firms. From 1 April 2013, this product was no longer available

as a result of LASPO regulatory changes. Included in the balance

sheet is a liability relating to commissions received in advance

that are due to be paid back to the insurance provider. No interest

is due on this liability.

Other items - Costs associated with the acquisition of

subsidiary undertakings, reorganisation costs associated with

exceptional projects that are not related to the core operations of

the business, share-based payments and amortisation charges on

intangible assets recognised as part of business combinations.

3. Exceptional items

Unaudited 6 months ended 30 Unaudited 6 months ended 30 Audited 12 months ended 31

June 2019 June 2018 December 2018

GBP000 GBP000 GBP000

---------------------------- ---------------------------- ---------------------------- ----------------------------

Release of pre-LASPO ATE

liability and associated

costs(1) - - 589

Personal Injury

reorganisation costs(2) (805) (142) (816)

Residential Property

reorganisation costs(3) - - (158)

Total (805) (142) (385)

---------------------------- ---------------------------- ---------------------------- ----------------------------

1. Previously recognised liabilities for pre-LASPO ATE

commissions received in advance of GBP664,000 were released in 2018

as a result of more favourable settlements. These have been offset

by associated costs of GBP75,000.

2. Personal Injury reorganisation costs relate to costs

associated with exceptional projects that are not related to the

core operations

of the business.

3. Costs of management reorganisation in the Residential Property division.

4. Taxation

Unaudited 6 months ended 30 Unaudited 6 months ended 30 Audited 12 months ended 31

June 2019 June 2018 December 2018

GBP000 GBP000 GBP000

Current tax expense

Current tax on income for

the year 552 1,115 1,824

Adjustments in respect of

prior years - - (160)

Total current tax 552 1,115 1,664

Deferred tax credit

Origination and reversal of

timing differences (128) (162) (275)

---------------------------- ---------------------------- ---------------------------- ----------------------------

Total deferred tax (128) (162) (275)

---------------------------- ---------------------------- ---------------------------- ----------------------------

Total expense in statement

of comprehensive income 424 953 1,389

---------------------------- ---------------------------- ---------------------------- ----------------------------

Total tax charge 424 953 1,389

---------------------------- ---------------------------- ---------------------------- ----------------------------

Reconciliation of effective tax rate:

Unaudited 6 months ended 30 Unaudited 6 months ended 30 Audited 12 months ended 31

June 2019 June 2018 December 2018

GBP000 GBP000 GBP000

Profit for the period 4,134 4,318 8,383

Total tax expense 424 953 1,389

Profit before taxation 4,558 5,271 9,772

Tax using the UK

corporation tax rate of

19.00% (June 2018: 19.00%,

December 2018:19.00%) 866 1,001 1,856

Income disallowable for tax

purposes - - (6)

Non-deductible expenses 81 36 100

Adjustments in respect of

prior years - - (160)

Share scheme deductions - (18) (18)

Non-controlling interest

share of tax (489) (106) (324)

Short term timing

differences for which no

deferred tax is recognised (34) 40 (59)

---------------------------- ---------------------------- ---------------------------- ----------------------------

Total tax charge 424 953 1,389

---------------------------- ---------------------------- ---------------------------- ----------------------------

The Group's tax charge of GBP424,000 (June 2018: GBP953,000,

December 2018: GBP1,389,000) represents an effective tax rate of

9.3% (June 2018: 18.1%, December 2018: 14.2%). The effective tax

rate is lower than the standard corporation tax rate of 19.0% for

the reasons as set out above. The most significant of these is that

the Group does not account for the non-controlling interests' share

of tax. This results in a reduction in effective tax rate of 10.7%

(June 2018: 2.0%, December 2018: 3.3%).

Changes in tax rates and factors affecting the future tax

charge

A reduction in the UK corporation tax rate from 19.0% to 18.0%

(effective from 1 April 2020) was substantively enacted on 26

October 2015 and an additional reduction to 17.0% (effective from 1

April 2020) were substantively enacted on 6 September 2017. This

will reduce the Group's future current tax charge accordingly. The

deferred tax assets and liabilities at 30 June 2019have been

calculated based on these rates.

5. Trade and other receivables

Unaudited 6 months ended 30 Unaudited 6 months ended 30 Audited 12 months ended 31

June 2019 June 2018 December 2018

GBP000 GBP000 GBP000

Trade receivables:

receivable in less than

one year 13,444 12,082 13,234

Trade receivables:

receivable in more than

one year 1,105 7,940 2,600

Accrued income: receivable

in less than one year 8,346 5,215 4,359

Accrued income: receivable

in more than one year 3,850 1,597 4,003

Other receivables 208 259 308

---------------------------- ---------------------------- ---------------------------- ----------------------------

26,953 27,093 24,504

Prepayments 990 594 673

Recoverable disbursements 5,084 2,291 3,629

---------------------------- ---------------------------- ---------------------------- ----------------------------

Total 33,027 29,978 28,806

---------------------------- ---------------------------- ---------------------------- ----------------------------

A provision against trade receivables of GBP779,000 (June 2018:

GBP171,000, December 2018 GBP909,000) is included in the figures

above.

6. Trade and other payables

Unaudited 6 months ended 30 Unaudited 6 months ended 30 Audited 12 months ended 31

June 2019 June 2018 December 2018

GBP000 GBP000 GBP000

Trade payables 3,642 2,360 2,493

Disbursements payable 5,359 2,320 3,712

Other taxation and social

security 941 975 1,028

Other payables, accruals

and deferred revenue 6,849 8,311 6,907

Customer deposits 704 804 971

---------------------------- ---------------------------- ---------------------------- ----------------------------

Total 17,495 14,770 15,111

---------------------------- ---------------------------- ---------------------------- ----------------------------

7. Earnings per share

The calculation of basic earnings per share at 30 June 2019 is

based on profit attributable to ordinary shareholders and a

weighted average number of Ordinary Shares outstanding at the end

of the period as follows:

Profit attributable to ordinary shareholders (basic)

Unaudited 6 months ended Unaudited 6 months ended

30 June 30 June Audited 12 months ended 31

2019 2018 December 2018

GBP000 GBP000 GBP000

---------------------------- ---------------------------- ---------------------------- ----------------------------

Profit for the period

attributable to the

shareholders 1,561 3,758 6,674

---------------------------- ---------------------------- ---------------------------- ----------------------------

Weighted average number of Ordinary Shares (basic)

Unaudited 6 months ended Unaudited 6 months ended Audited 12 months ended

Number 30 June 2019 30 June 2018 31 December 2018

---------------------------- --------------------------- --------------------------- ---------------------------

Issued Ordinary Shares at

start of period 46,178,716 46,061,090 46,061,090

----------------------------- --------------------------- --------------------------- ---------------------------

Weighted average number of

Ordinary Shares at end of

period 46,178,716 46,100,876 46,160,172

----------------------------- --------------------------- --------------------------- ---------------------------

Basic earnings per share (p)

Unaudited 6 months ended 30 June Unaudited 6 months ended 30 June Audited 12 months ended 31

2019 2018 December 2019

----------- ---------------------------------- ---------------------------------- ---------------------------------

Group (p) 3.4 8.2 14.5

----------- ---------------------------------- ---------------------------------- ---------------------------------

The Company has in place share-based payment schemes to reward

employees. The incremental shares available for these schemes

included in the diluted earnings per share calculation are 405,859

(June 2018: 958,388; December 2018: 454,169). There are no other

diluting items.

Diluted earnings per share (p)

Unaudited 6 months ended 30 June Unaudited 6 months ended 30 June Audited 12 months ended 31

2019 2018 December

2018

----------- --------------------------------- ---------------------------------- ----------------------------------

Group (p) 3.3 8.0 14.3

----------- --------------------------------- ---------------------------------- ----------------------------------

8. Dividends

On 31 May 2019 the Group paid final dividends in respect of 2018

of GBP2,632,000 (2018: final dividends in respect of 2017 of

GBP4,895,000) which represented a dividend per share of 5.7p (2018:

10.6p). The Directors have recommended an interim dividend in

respect of 2019 of 2.6p (2018: interim dividend of 3.2p).

9. Net debt

Net debt comprises cash and cash equivalents, secured bank

loans, loan notes and preference shares.

30 June 2019 30 June 31 December 2018

GBP000 2018 GBP000

GBP000

------------------------------------------------ -------------- --------- -----------------

Cash and cash equivalents 2,026 939 1,598

Other interest-bearing loans and loan notes(1) (19,659) (18,334) (17,122)

Net debt (17,633) (17,395) (15,524)

------------------------------------------------ -------------- --------- -----------------

1. Other interest-bearing loans and loan notes are stated after

deducting facility arrangement fees of GBP91,000 (June 2018:

GBP166,000; December 2018: GBP128,000). These fees are being

amortised over the term of the facility.

Set out below is a reconciliation of movements in net debt

during the period.

30 June 2019 30 June 31 December 2018

GBP000 2018 GBP000

GBP000

------------------------------------------------------------------------- ------------- --------- -----------------

Net increase in cash and cash equivalents 428 81 740

Cash and cash equivalents net inflow from increase in debt and debt

financing (2,500) (5,375) (4,125)

------------------------------------------------------------------------- ------------- --------- -----------------

Movement in net borrowings resulting from cash flows (2,072) (5,294) (3,385)

Non-cash release of prepaid loan arrangement fees (37) (37) (75)

Net debt at beginning of period (15,524) (12,064) (12,064)

------------------------------------------------------------------------- ------------- --------- -----------------

Net debt at end of period (17,633) (17,395) (15,524)

------------------------------------------------------------------------- ------------- --------- -----------------

It is the Group's intention to repay the balance on the

revolving credit facility in more than 12 months time and hence the

gross balance of GBP19,750,000 is deemed to be a non-current

liability.

10. Changes in accounting policies

The Group has adopted the modified retrospective approach with

the right of use asset measured as if IFRS 16 had been applied

since the commencement date of a lease using a discount rate based

on the Group's incremental borrowing rate at the date of initial

application and the lease liability at transition date as the

present value of the remaining lease payments, discounted using the

Group's

incremental borrowing rate at the date of initial application,

adjusted by any prepayments or lease incentives recognised

immediately before the date of initial application. Under the

modified retrospective transition approach, the comparative

information is not restated.

The Group has elected to apply a single discount rate to assets

with similar characteristics. The Group has also elected not to

recognise right of use assets and lease liabilities for short-term

leases or low-value assets. The Group will continue to expense the

lease payments associated with these leases on a straight-line

basis over the lease term.

Leases

The Group leases property and certain items of office

equipment.

Property Office equipment Total

GBP000 GBP000 GBP000

-------------------------------------- --------- ----------------- --------

Right of use asset at 1 January 2019 531 109 640

-------------------------------------- --------- ----------------- --------

Right of use asset at 30 June 2019 473 97 570

-------------------------------------- --------- ----------------- --------

Impact on Financial Statements

1) Impact on transition

On transition to IFRS 16, the Group recognised additional right

of use assets and lease liabilities recognising the difference in

retained earnings. This impact on transition is summarised

below.

Total

GBP000

Right of use assets presented in property, plant and equipment 640

Lease liabilities presented in other payables, accruals and deferred revenue (673)

Release of rent-free period adjustments 37

------------------------------------------------------------------------------ --------

Impact on retained earnings 4

------------------------------------------------------------------------------ --------

2) Impacts for the period

As a result of applying IFRS 16, in relation to the leases that

were previously classified as operating leases, the Group

recognised GBP570,000 of right of use assets and GBP640,000 of

lease liabilities as at 30 June 2019 (including new leases taken

out after 1 January 2019). The right of use assets of GBP570,000

have been included in property, plant and equipment on the balance

sheet and the lease liabilities of GBP640,000 have been included

within other payables, accruals and deferred revenue.

Also, in relation to those leases under IFRS 16, the Group has

recognised depreciation and interest costs, instead of operating

lease expense. During the six months ended 30 June 2019, the Group

recognised GBP187,000 of depreciation charges and GBP4,000 of

interest costs from those leases.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR EASNKFSANEFF

(END) Dow Jones Newswires

September 17, 2019 02:00 ET (06:00 GMT)

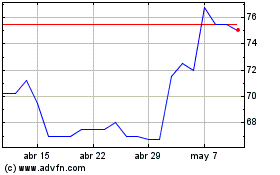

Nahl (LSE:NAH)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Nahl (LSE:NAH)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024