Woodbois Limited Preference Share Restructure (1766N)

20 Septiembre 2019 - 9:38AM

UK Regulatory

TIDMWBI

RNS Number : 1766N

Woodbois Limited

20 September 2019

20 September 2019

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014.

Woodbois Limited

("Woodbois", the "Group" or the "Company")

(AIM: WBI)

Preference Share Restructure into 4% Convertible Bond

Woodbois, the African focused forestry and timber trading

company, is pleased to provide an update to the announcement of the

11(th) July on the proposed restructure of the perpetual preference

shares in its subsidiary Argento Ltd ("Preference Shares") into a

4% convertible bond 2024 ("Bonds") to be issued by the Company.

The Company has now received irrevocable undertakings from 100%

of the holders of the Preference Shares ("Preference Shareholders")

to accept the terms offered by the Company to purchase the

Preference Shares in exchange for the issue of Bonds by the

Company, at a ratio of US$400 in nominal value of Bonds for every

one Preference Share. The issue of the Bonds has been authorised by

a resolution of the board. The Bonds are constituted by a trust

deed between the Company and Woodside Corporate Services Limited

acting as trustee for the Bonds. Neville Registrars Limited has

been appointed by the Company to act as transfer agent for the

Bonds.

CEO Paul Dolan commented "I'm delighted to report that this

transaction marks another important milestone in the transformation

of the Company's capital structure. The resulting improvement of

transparency within the balance sheet will leave the Company much

more strongly positioned to take advantage of the many

opportunities ahead."

Convertible Bond Terms

The Bonds will be issued in registered form with a nominal value

of US$1 each. The Bonds bear interest at the rate of 4% per annum

calculated by reference to the principal amount thereof and payable

annually in arrears within ten business days following 30 December

in each year with the exception of 30 December 2019. The Bonds are

redeemable on 30 June 2024 (unless converted or redeemed earlier)

and may be converted into ordinary shares in the capital of the

Company ("Ordinary Shares") on notice at any time prior to

redemption at a conversion ratio of 8p per Ordinary Share and an

exchange rate of GBP1/US$1.25.

The Bonds are freely transferable and will rank as senior debt

of the Company but will not be secured.

The Company may redeem all but not some only of the Bonds at

their principal amount, together with accrued but unpaid interest

in the following circumstances: (i) if after 30 January 2020, the

Volume Weighted Average Price of an Ordinary Share on 10 Dealing

Days in any period of 30 consecutive Dealing Days is greater than

GBP0.12; or (ii) not less than 90% by principal amount of Bonds

have been redeemed or converted.

Full details of the Bond Terms and Conditions are available on

our website at www.woodbois.com.

Concert Party

The Takeover Panel deems the holders of the Preference

Shares/Bonds to be a 'concert party' for the purposes of the

Takeover Code. Upon conversion of all of the Bonds, the new

Ordinary Shares so issued would account for 39.2% of the enlarged

issued Ordinary Share capital.

Under Rule 9 of the Takeover Code, where any person acquires,

whether by a single transaction or a series of transactions over a

period of time, interests in securities which (taken together with

securities in which persons acting in concert with him are

interested) carry 30 per cent. or more of the voting rights of the

Company, that person is normally required by the Takeover Panel to

make a general offer to the shareholders of the Company to acquire

their shares. Further, when any person individually, or a group of

persons acting in concert, already holds interests in securities

which carry between 30 and 50 per cent. of the voting rights of the

Company, that person may not normally acquire further securities

without making a general offer to the shareholders of the Company

to acquire their shares.

In order to avoid an inadvertent breach of Rule 9 of the

Takeover Code, Pelham Limited (a company controlled by Miles

Pelham, the former chairman of the Company), the owner of 73.3% of

the Preference Shares, has undertaken to the Company that its

aggregate interest (as defined in the Takeover Code) in Ordinary

Shares, when aggregated with all Ordinary Shares which have been

issued to (and are still held by) any other Preference Shareholders

on conversion of the Bond; and all other Ordinary Shares in which

the other Preference Shareholders are interested (as defined in the

Takeover Code) and in respect of which the Company is aware (having

made all reasonable enquiries), will not at any time exceed 28.0%

of the enlarged issued Ordinary Share capital of the Company.

Purchase of Convertible Bonds

The Company will now proceed to exchange contracts with each of

the Preference Shareholders.

The transaction is deemed to be a 'related party transaction'

for the purposes of the AIM Rules for Companies. Accordingly, the

Board, apart from Paul Dolan (who has an interest in the Preference

Shares and so is precluded from taking part in the deliberations),

having consulted with Arden Partners as its nominated adviser,

consider the terms of the transaction are fair and reasonable

insofar as shareholders are concerned.

Woodbois Limited

Paul Dolan - CEO

Kevin Milne - Interim Chairman

www.woodbois.com +44 (0)20 7099 1940

Arden Partners Plc (Nominated adviser and broker)

Tom Price +44 (0)20 7614 5900

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCZBLFLKKFXBBZ

(END) Dow Jones Newswires

September 20, 2019 10:38 ET (14:38 GMT)

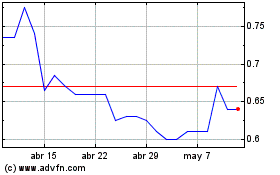

Woodbois (LSE:WBI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Woodbois (LSE:WBI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024